Brazil Corrugated Board Packaging Market

Market Size in USD Billion

CAGR :

%

USD

9.22 Billion

USD

12.54 Billion

2025

2033

USD

9.22 Billion

USD

12.54 Billion

2025

2033

| 2026 –2033 | |

| USD 9.22 Billion | |

| USD 12.54 Billion | |

|

|

|

|

Brazil Corrugated Board Packaging Market Size

- The Brazil Corrugated Board Packaging was valued at USD 9.22 Billion in 2025 and is expected to reach USD 12.54 Billion by 2033

- During the forecast period of 2026 to 2033 the market is likely to grow at a CAGR of 3.8%, primarily driven by growing inclination toward lightweight corrugated boxes

- This growth is driven by factors such continued industrialization demanding unique cartons & materials, rising demand for sustainable & aesthetic packaging, and others.

Brazil Corrugated Board Packaging Market Analysis

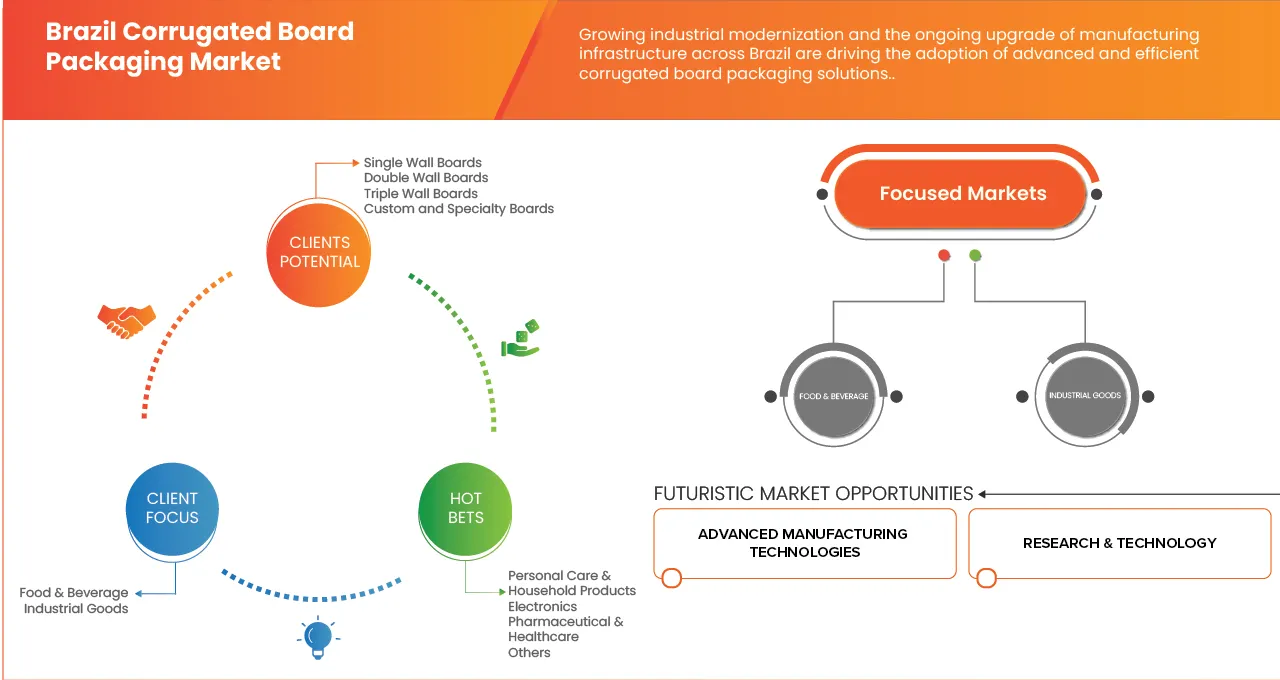

- The Board Packaging Market refers to the global industry involved in the manufacturing, processing, and distribution of packaging solutions made from paperboard, containerboard, corrugated board, folding boxboard, solid bleached sulfate, and other fiber-based board materials.

- In 2025, the Single Wall Boards segment is expected to dominate the market by 40.01% due to Brazil’s rising online retail shipments create large volumes of single-use/returnable transit packaging. Slotted boxes (RSCs) are the default parcel/transit format because they’re fast to make, easy to assemble and protect goods in transit.

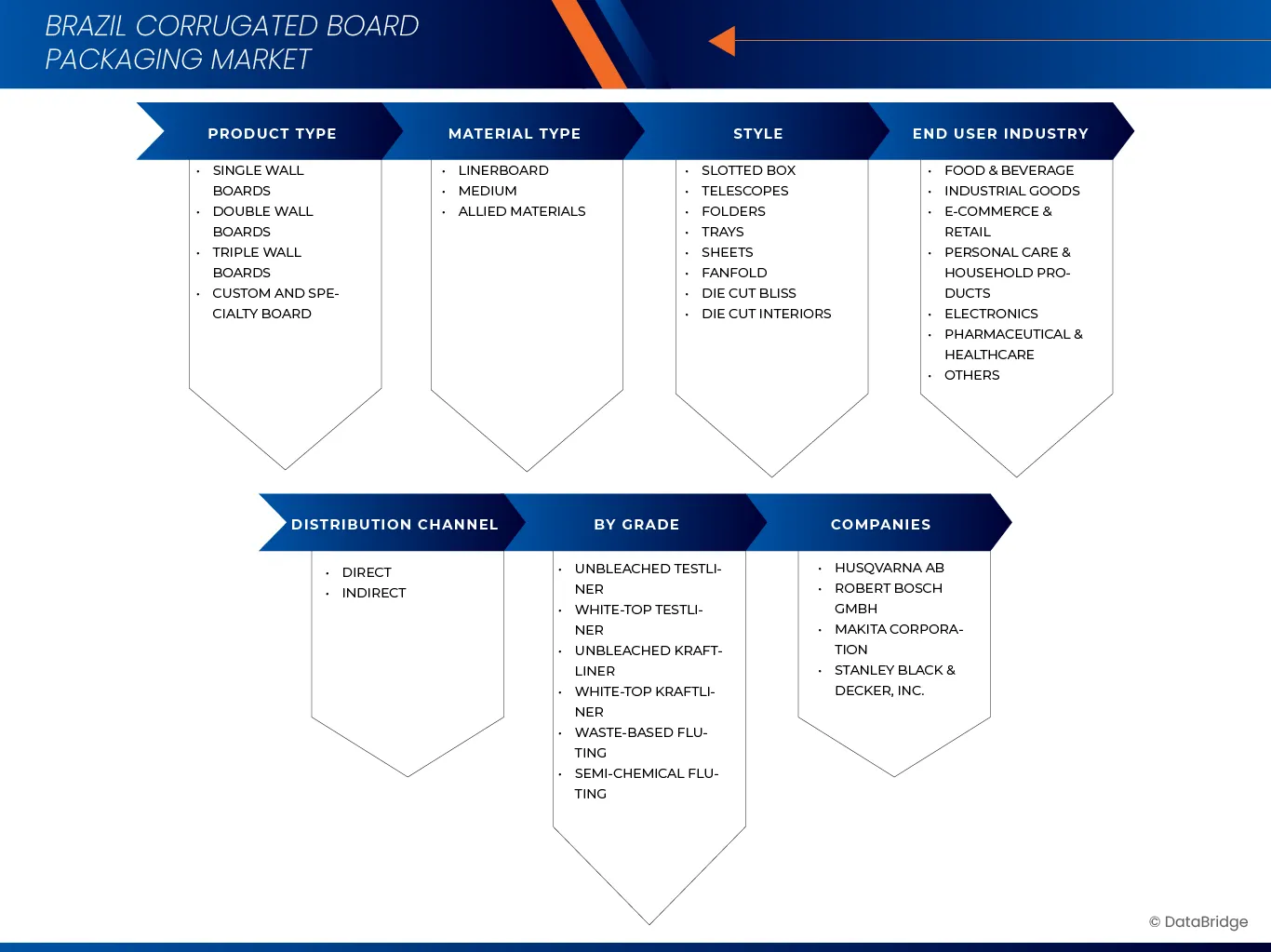

Report Scope and Brazil Corrugated Board Packaging Market Segmentation

|

Attributes |

Brazil Corrugated Board Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Brazil Corrugated Board Packaging Market Trends

“Rising acquisitions & collaborations among packaging companies”

- Brazil’s corrugated packaging market is undergoing consolidation, with leading companies acquiring regional players and forming strategic alliances to expand capacity, enter new geographies, and improve operational efficiency.

- These collaborations also promote innovation in lightweight materials, digital printing, and supply chain optimization. Such strategic movements not only strengthen the competitive position of major packaging manufacturers but also accelerate technology adoption across the industry, creating new opportunities for product differentiation and service expansion.

Brazil Corrugated Board Packaging Market Dynamics

Driver

“Growing Inclination Toward Lightweight Corrugated Boxes”

- Brazil is experiencing a strong and accelerating shift toward lightweight corrugated boxes as companies prioritize logistics efficiency, cost optimization, and sustainability across packaging operations. With rising fuel prices, growing domestic consumption, and rapidly expanding e-commerce, businesses are increasingly adopting lighter corrugated materials to reduce transportation costs, increase pallet utilization, and improve handling efficiency.

- This preference is further supported by Brazil’s push toward a circular economy, where recyclable and low-impact packaging materials are becoming essential for regulatory compliance and brand positioning. As major industries—such as FMCG, agribusiness, electronics, and retail—expand their distribution networks, the need for lightweight, durable, and high-performance corrugated solutions is becoming a critical component of modern supply chains.

- In April 2024, ABPO reported strong growth in lightweight corrugated packaging consumption in São Paulo and Minas Gerais as FMCG and e-commerce companies sought shipping cost reduction.

- In October 2023, Klabin expanded lightweight kraftliner production at its Ortigueira mill to serve rising demand from the food and retail sectors.

- In February 2024, WestRock Brazil introduced lightweight corrugated solutions tailored for large e-commerce fulfillment centers operating in Rio de Janeiro and Belo Horizonte.

Restraint/Challenge

“Higher Cost Of Corrugated Board Due To Increased Raw Material & Logistics Cost”

- The Brazilian corrugated packaging industry faces ongoing cost pressures due to volatility in pulp prices, kraft paper inputs, and fuel-driven logistics expenses. Frequent fluctuations in the price of recovered paper and energy add to the production cost, making corrugated packaging comparatively more expensive for SMEs and local retailers.

- Transportation costs are especially significant in Brazil due to long distances, dependence on road freight, and high diesel prices, which raise the overall cost of delivering corrugated products to distributors and end users. These rising cost components directly impact profit margins and limit the adoption of corrugated materials in price-sensitive markets.

- For Instance, In in July 2024, ABPO reported a 12% rise in kraft paper prices due to pulp cost volatility and higher fuel prices, increasing corrugated board production costs across Southern Brazil.

- In February 2023, Irani Papel e Embalagem confirmed that logistics expenses surged by nearly 15% due to diesel price hikes, raising transportation costs for corrugated packaging shipments nationwide.

Brazil Corrugated Board Packaging Market Scope

The Brazil Corrugated Board Packaging Market is categorized into Six notable segments which are product type, Material type, Style, Grade, End Use, distribution channel.

- By Product Type

On the basis of product type, the Brazil Corrugated Board Packaging Market is segmented Single Wall Boards, Double Wall Boards, Triple Wall Boards, and Custom and Specialty Boards. In 2025, the Single Wall Boards segment is expected to dominate the Brazil Corrugated Board Packaging Market with share of 40.01% and is estimated to growing at a CAGR of 3.8% due to Single wall boards are cheaper to produce compared with double or triple wall structures. In a price-sensitive market like the Dominican Republic, most FMCG, retail, and food producers prefer the most economical board option for packaging their products. Most domestic packaging needs—food items, beverages, personal care, household goods, textiles, and e-commerce parcels—require light to medium protection strength. Single wall boards offer adequate durability for these common applications.

- By Material Type

On the basis of Material Type, the Brazil Corrugated Board Packaging Market is segmented into Linerboard, Medium, and Allied Materials.. In 2025, the Linerboard segment is expected to in the Brazil Corrugated Board Packaging Market with the largest market share of 55.65%, growing at the CAGR of 3.9% due to its Linerboard forms the outer facing layers of corrugated board and provides critical strength, printability, and protection. Brazil’s major demand centers—food & beverage, industrial goods, agriculture exports, and e-commerce—require packaging that can withstand moisture, compression, and long-distance logistics. Linerboard meets these performance needs better than other material types.

- By Style

On the basis of Style, the Brazil Corrugated Board Packaging Market is segmented into Slotted Box, Telescopes, Folders, Trays, Sheets, Fanfold, Die Cut Bliss, Die Cut Interiors. In 2025, Slotted Box segment is projected to dominate in the Brazil Corrugated Board Packaging Market with the largest market share of 38.08%, growing at the CAGR of 4.7% owing to Brazil is witnessing strong growth in e-commerce shipments. Slotted boxes are the standard shipping container for parcels due to their durability, ease of assembly, and cost-efficiency. This high-volume demand positions them as the leading packaging format. Slotted boxes use minimal board material, require no complex die-cutting, and have high manufacturing throughput, making them cheaper than telescopic, die-cut, or folder-style boxes. In price-sensitive markets like Brazil, this drives their dominance.

- By End User

On the basis of End User Industry, the Brazil Corrugated Board Packaging Market is segmented into Food & Beverage, Industrial Goods, E-Commerce & Retail, Personal Care & Household Products, Electronics, Pharmaceutical & Healthcare, Others. In 2025, Food & Beverage segment is projected to dominate in the Brazil Corrugated Board Packaging Market with the largest market share of 35.10%, growing at the CAGR of 4.1% due to Food & beverage is one of the largest manufacturing sectors in Brazil, covering processed foods, fresh produce, meat, dairy, bakery, beverages, and frozen goods. High production volume directly translates into the highest packaging consumption, especially in corrugated formats used for secondary and tertiary packaging.

- By GRADE

On the basis of Grade, the Brazil Corrugated Board Packaging Market is segmented Unbleached testliner, white-top testliner, unbleached kraftliner, white-top kraftliner, waste-based fluting, and semi-chemical fluting. In 2025, Unbleached testliner segment is projected to dominate in the Brazil Corrugated Board Packaging Market with the largest market share of 38.08% and is expected to reach USD 4,966.63 thousand by 2033, growing at the CAGR of 4.4% owing to Unbleached testliner uses a high percentage of recycled fiber, making it significantly cheaper than kraftliner or coated white-top grades. In Brazil’s cost-sensitive packaging environment—impacted by logistics costs, commodity price fluctuations, and high-volume shipping—manufacturers prioritize testliner to keep prices competitive.

- By Distribution Channel

On the basis of Distribution Channel, the Brazil Corrugated Board Packaging Market is segmented into Direct, Indirect. In 2025, Direct segment is projected to dominate in the Brazil Corrugated Board Packaging Market with the largest market share of 59.89%, growing at the CAGR of 4.0%, owing to the strong preference of large FMCG, food & beverage, industrial, and e-commerce players to procure corrugated packaging directly from manufacturers. This purchasing pattern ensures better price control, high-volume supply reliability, customized packaging solutions, and faster delivery cycles, which are critical in Brazil’s fast-growing logistics and retail sectors.

Brazil Corrugated Board Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Dominican Republic presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Klabin S.A. (Brazil)

- Smurfit Westrock (Ireland)

- International Paper (U.S.)

- EMBANOR EMBALAGENS (Brazil)

- Fastpack Embalagens (Brazil)

- GLOBOKRAFT INDÚSTRIA DE EMBALAGENS (Brazil)

- Fabricart Embalagens (Brazil)

- Best Papel (Brazil)

- MS Packaging (Brazil)

- SIMAPPEL (Brazil)

- Poapel (Brazil)

- Agile Cardboard Tubes (Brazil)

- FURNAX (Brazil)

Latest Developments in Brazil Corrugated Board Packaging Market

- In April 2024, ABPO reported strong growth in lightweight corrugated packaging consumption in São Paulo and Minas Gerais as FMCG and e-commerce companies sought shipping cost reduction.

- In December 2023, WestRock Brazil partnered with manufacturers in São Paulo’s industrial belt to deliver heavy-duty and customized corrugated packaging for electronic appliances.

- In March 2024, Klabin collaborated with agribusiness exporters in Mato Grosso to supply moisture-resistant corrugated cartons for fruits and grains.

- In September 2023, Gualapack Brazil expanded its industrial packaging line to cater to chemical and pharmaceutical companies requiring high-strength corrugated solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF BRAZIL CORRUGATED BOARD PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES

4.2 PRICING ANALYSIS

4.3 BRAND OUTLOOK

4.4 SUPPLY CHAIN ANALYSIS – BRAZIL CORRUGATED BOARD PACKAGING MARKET

4.4.1 RAW MATERIALS SUPPLIERS

4.4.2 MANUFACTURERS

4.4.3 DISTRIBUTORS

4.4.4 BUYERS

4.4.5 CONCLUSION

4.5 COMPANY EVALUATION

4.5.1 LEADERS (HIGH SCALE, HIGH DIFFERENTIATION)

4.5.2 CHALLENGERS (HIGH SCALE, LOWER DIFFERENTIATION)

4.5.3 NICHE / INNOVATION SPECIALISTS (LOW SCALE, HIGH DIFFERENTIATION)

4.5.4 LOCAL / EMERGING PLAYERS (LOW SCALE, LOW DIFFERENTIATION)

4.6 CONSUMER BUYING BEHAVIOUR

4.6.1 GROUP 1 PREMIUM FMCG & ELECTRONICS BRANDS

4.6.2 GROUP 2 ORGANIZED RETAILERS & MID-SCALE CONSUMER GOODS MANUFACTURERS

4.6.3 GROUP 3 GENERAL INDUSTRIAL BUYERS

4.6.4 GROUP 4 PRICE-SENSITIVE COMMODITY & BULK BUYERS

4.6.5 GROUP 5 PREMIUM FOOD, COSMETICS & E-COMMERCE SELLERS

4.6.6 GROUP 6 SPECIALIZED INDUSTRIAL

4.7 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.7.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.7.1.1 JOINT VENTURES

4.7.1.2 MERGERS AND ACQUISITIONS

4.7.1.3 LICENSING AND PARTNERSHIP

4.7.1.4 TECHNOLOGY COLLABORATIONS

4.7.1.5 STRATEGIC DIVESTMENTS

4.7.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.7.3 STAGE OF DEVELOPMENT

4.7.4 TIMELINES AND MILESTONES

4.7.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.7.6 RISK ASSESSMENT AND MITIGATION

4.7.7 FUTURE OUTLOOK

4.8 RAW MATERIAL COVERAGE

4.8.1 VIRGIN PULP

4.8.2 RECOVERED FIBRE (RECYCLED PAPER / OCC)

4.8.3 CHEMICALS, STARCH, AND ADDITIVES

4.8.4 POLICY AND ENVIRONMENTAL FRAMEWORK

4.8.5 CONCLUSION

4.9 TECHNOLOGICAL ADVANCEMENTS

4.1 VALUE CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 RAW MATERIAL SUPPLY

4.10.3 OMPONENT MANUFACTURING AND PROCESSING

4.10.4 EQUIPMENT & TECHNOLOGY PROVIDERS

4.10.5 DISTRIBUTION AND LOGISTICS

4.10.6 END-USERS (BRANDS & INDUSTRY SECTORS)

4.10.7 CONCLUSION

4.11 VENDOR SELECTION CRITERIA

4.11.1 REGULATORY COMPLIANCE

4.11.2 SUSTAINABILITY AND ENVIRONMENTAL RESPONSIBILITY

4.11.3 QUALITY AND INNOVATION

4.11.4 COST COMPETITIVENESS AND SUPPLY RELIABILITY

4.11.5 EXPERIENCE AND MARKET REPUTATION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VERSUS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS STATUS

5.7.3 ACCREDITATION (INCLUDING MFTN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

6.4 CIRCULARITY, REVERSE-LOGISTICS & SUSTAINABILITY REQUIREMENTS

6.5 COMPLIANCE & ENFORCEMENT

6.6 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING INCLINATION TOWARD LIGHTWEIGHT CORRUGATED BOXES

7.1.2 CONTINUED INDUSTRIALIZATION DEMANDING UNIQUE CARTONS & MATERIALS

7.1.3 RISING DEMAND FOR SUSTAINABLE & AESTHETIC PACKAGING

7.2 RESTRAINTS

7.2.1 HIGHER COST OF CORRUGATED BOARD DUE TO INCREASED RAW MATERIAL & LOGISTICS COST

7.2.2 STRINGENT GOVERNMENT REGULATIONS FOR PACKAGING STANDARDS & COMPLIANCE

7.3 OPPORTUNITIES

7.3.1 RISING ACQUISITIONS & COLLABORATIONS AMONG PACKAGING COMPANIES

7.3.2 GLOBAL BAN ON SINGLE-USE PLASTIC BOOSTING CORRUGATED PACKAGING DEMAND

7.3.3 SURGING E-COMMERCE & COURIER SECTOR ACCELERATING CORRUGATED BOX CONSUMPTION

7.4 CHALLENGES

7.4.1 LACK OF CONSUMER AWARENESS ABOUT SUSTAINABLE PACKAGING

7.4.2 IMPACT OF HUMID AND MOIST WEATHER ON THE FIRMNESS OF CORRUGATED BOXES

8 BRAZIL CORRUGATED BOARD PACKAGING MARKET: BY PRODUCT TYPE

8.1 OVERVIEW

8.2 SINGLE WALL BOARDS

8.3 DOUBLE WALL BOARDS

8.4 TRIPLE WALL BOARDS

8.5 CUSTOM AND SPECIALTY BOARDS

9 BRAZIL CORRUGATED BOARD PACKAGING MARKET: BY MATERIAL TYPE,

9.1 OVERVIEW

9.2 LINERBOARD

9.3 MEDIUM

9.4 ALLIED MATERIALS

10 BRAZIL CORRUGATED BOARD PACKAGING MARKET: BY STYLE

10.1 OVERVIEW

10.2 SLOTTED BOX

10.3 TELESCOPES

10.4 FOLDERS

10.5 TRAYS

10.6 SHEETS

10.7 FANFOLD

10.8 DIE CUT BLISS

10.9 DIE CUT INTERIORS

11 BRAZIL CORRUGATED BOARD PACKAGING MARKET: BY END USER INDUSTRY

11.1 OVERVIEW

11.2 FOOD & BEVERAGE

11.3 INDUSTRIAL GOODS

11.4 E-COMMERCE & RETAIL

11.5 PERSONAL CARE & HOUSEHOLD PRODUCTS

11.6 ELECTRONICS

11.7 PHARMACEUTICAL & HEALTHCARE

11.8 OTHERS

12 BRAZIL CORRUGATED BOARD PACKAGING MARKET, BY GRADE

12.1 OVERVIEW

12.2 UNBLEACHED TESTLINER

12.3 WHITE-TOP TESTLINER

12.4 UNBLEACHED KRAFTLINER

12.5 WHITE-TOP KRAFTLINER

12.6 WASTE-BASED FLUTING

12.7 SEMI-CHEMICAL FLUTING

13 BRAZIL CORRUGATED BOARD PACKAGING MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT

13.3 INDIRECT

14 BRAZIL CORRUGATED BOARD PACKAGING MARKET: COMPANY LANDSCAPE

14.1 MANUFACTURER COMPANY SHARE ANALYSIS: BRAZIL

15 COMPANY PROFILE

15.1 KLABIN S.A.

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 SMURFIT WESTROCK

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 INTERNATIONAL PAPER.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 EMBANOR EMBALAGENS

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 FASTPACK EMBALAGENS

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 AGILE CARDBOARD TUBES.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BEST PAPEL

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 FABRICART EMBALAGENS.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 FURNAX.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 GLOBOKRAFT INDÚSTRIA DE EMBALAGENS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 MS PACKAGING

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 POAPEL

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 SIMAPPEL.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 BRAZIL CORRUGATED BOARD PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD MILLION)

TABLE 2 BRAZIL CORRUGATED BOARD PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (KILO TONS)

TABLE 3 BRAZIL CORRUGATED BOARD PACKAGING MARKET, BY MATERIAL TYPE, 2018-2033 (USD MILLION)

TABLE 4 BRAZIL CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2018-2033 (USD MILLION)

TABLE 5 BRAZIL CORRUGATED BOARD PACKAGING MARKET, BY END USER INDUSTRY, 2018-2033 (USD MILLION)

TABLE 6 BRAZIL CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2018-2033 (USD MILLION)

TABLE 7 BRAZIL CORRUGATED BOARD PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

List of Figure

FIGURE 1 BRAZIL CORRUGATED BOARD PACKAGING MARKET: SEGMENTATION

FIGURE 2 BRAZIL CORRUGATED BOARD PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 BRAZIL CORRUGATED BOARD PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 BRAZIL CORRUGATED BOARD PACKAGING MARKET: BRAZIL VS. REGIONAL ANALYSIS

FIGURE 5 BRAZIL CORRUGATED BOARD PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BRAZIL CORRUGATED BOARD PACKAGING MARKET: INTERVIEW DEMOGRAPHICSSSS

FIGURE 7 BRAZIL CORRUGATED BOARD PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 BRAZIL CORRUGATED BOARD PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 BRAZIL CORRUGATED BOARD PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 BRAZIL CORRUGATED BOARD PACKAGING MARKET: SEGMENTATION

FIGURE 11 FOUR SEGMENTS COMPRISE THE BRAZIL CORRUGATED BOARD PACKAGING MARKET, BY PRODUCT TYPE

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 GROWTH IN E-COMMERCE FUELING PACKAGING DEMAND IS EXPECTED TO DRIVE THE BRAZIL CORRUGATED BOARD PACKAGING MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 14 SINGLE WALL BOARDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE BRAZIL CORRUGATED BOARD PACKAGING MARKET IN 2026 & 2033

FIGURE 15 BRAZIL CORRUGATED BOARD PACKAGING MARKET, 2025-2033, AVERAGE SELLING PRICE (USD/KG)

FIGURE 16 VENDOR SELECTION CRITERIA

FIGURE 17 DROC

FIGURE 18 BRAZIL CORRUGATED BOARD PACKAGING MARKET: BY PRODUCT TYPE, 2025

FIGURE 19 BRAZIL CORRUGATED BOARD PACKAGING MARKET: BY MATERIAL TYPE, 2025

FIGURE 20 BRAZIL CORRUGATED BOARD PACKAGING MARKET: BY STYLE, 2025

FIGURE 21 BRAZIL CORRUGATED BOARD PACKAGING MARKET: BY END USER INDUSTRY, 2025

FIGURE 22 BRAZIL CORRUGATED BOARD PACKAGING MARKET: BY GRADE, 2025

FIGURE 23 BRAZIL CORRUGATED BOARD PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 24 BRAZIL CORRUGATED BOARD PACKAGING MARKET: COMPANY SHARE 2024 (%)

Brazil Corrugated Board Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Brazil Corrugated Board Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Brazil Corrugated Board Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.