Brazil Machine Control System Market

Market Size in USD Million

CAGR :

%

USD

189.19 Million

USD

262.21 Million

2024

2032

USD

189.19 Million

USD

262.21 Million

2024

2032

| 2025 –2032 | |

| USD 189.19 Million | |

| USD 262.21 Million | |

|

|

|

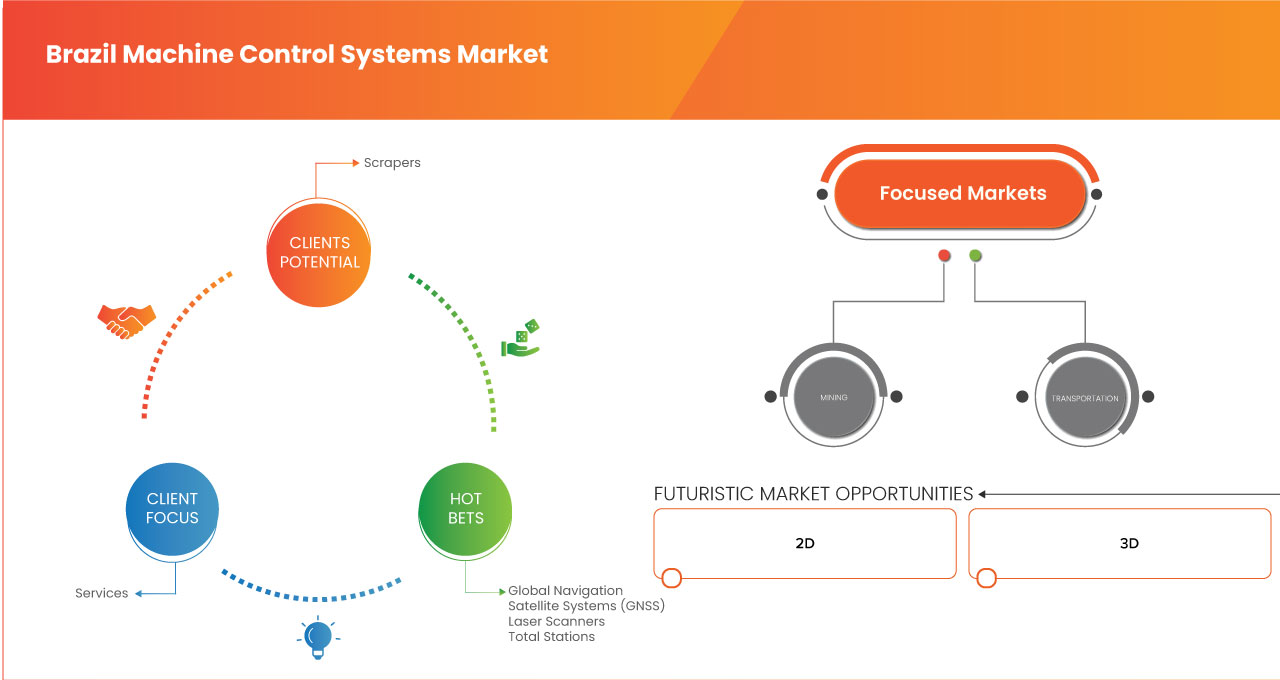

Machine Control Systems Market Analysis

The Brazil machine control systems market encompasses technologies and solutions designed to enhance the precision, efficiency, and automation of heavy machinery and equipment across various industries such as construction, agriculture, and mining. These systems integrate advanced technologies such as GPS, GNSS, laser scanning, and robotic total stations to control and monitor machine operations in real-time, ensuring optimal performance. Driven by the growing need for accuracy and productivity, the market caters to diverse applications including grading, excavation, paving, and material handling. The adoption of cordless and advanced machine control systems is rising, reflecting the industry’s shift towards modern, wireless solutions. However, the market faces challenges such as high initial investments, data security concerns, and compatibility issues with existing equipment. Opportunities lie in government infrastructure initiatives, technological collaborations, and localized service support to drive growth. The market represents a critical component of Brazil's efforts to modernize its industrial and infrastructure sectors.

Machine Control Systems Market Size

Brazil machine control systems market size was valued at USD 189.19 million in 2024 and is projected to reach USD 262.21 million by 2032, with a CAGR of 5.6% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Machine Control Systems Market Trends

“Advancements in Construction Automation"

Advancements in construction automation are a key driver for the Machine Control Systems market. As construction projects grow in scale and complexity, the demand for precise and efficient equipment management has surged. Machine control systems, equipped with technologies such as GPS, GNSS, and laser-guided systems, enable accurate grading, excavation, and paving operations, reducing errors and optimizing resource usage. The adoption of automated solutions helps construction firms meet tight deadlines, minimize labor costs, and ensure compliance with stringent quality standards. Additionally, the growing emphasis on sustainable construction practices and smart infrastructure development further fuels the demand for these systems. As construction automation evolves, the Machine Control Systems market is set to witness robust growth.

Report Scope and Machine Control Systems Market Segmentation

|

Attributes |

Machine Control Systems Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Trimble Inc., (U.S.), Leica Geosystems AG - Part of Hexagon (Switzerland), Komatsu (Japan), TOPCON CORPORATION, (Japan), Liebherr (Germany), Schneider Electric (Singapore), Rockwell Automation, (U.S.), Hemisphere GNSS, Inc. (U.S.), MOBA MOBILE AUTOMATION AG (Germany), and Eos Positioning Systems, Inc. (Eos) (Canada) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Machine Control Systems Market Definition

The machine control systems refers to the industries focused on the production and sale of safety-related devices such as controllers, relays, switches, and various sensors. It is driven by increasing demand for automation, stricter safety regulations, and the need for efficient worker protection across industries like automotive, oil & gas, food & beverage, and manufacturing. Safety sensors are devices used to monitor, detect, and respond to unsafe conditions in industrial environments to protect equipment, personnel, and processes. Safety controllers coordinate multiple safety inputs and outputs to trigger shutdowns or corrective actions. Safety relays isolate and switch circuits when risks are detected, ensuring systems operate safely. Safety switches monitor access points, stopping machinery when guards or doors are opened. Analog sensors provide continuous signals to measure variables like pressure or temperature, while digital sensors offer discrete on/off signals. Smart sensors incorporate real-time monitoring, diagnostics, and predictive maintenance capabilities, enhancing automation and operational safety.

Machine Control Systems Market Dynamics

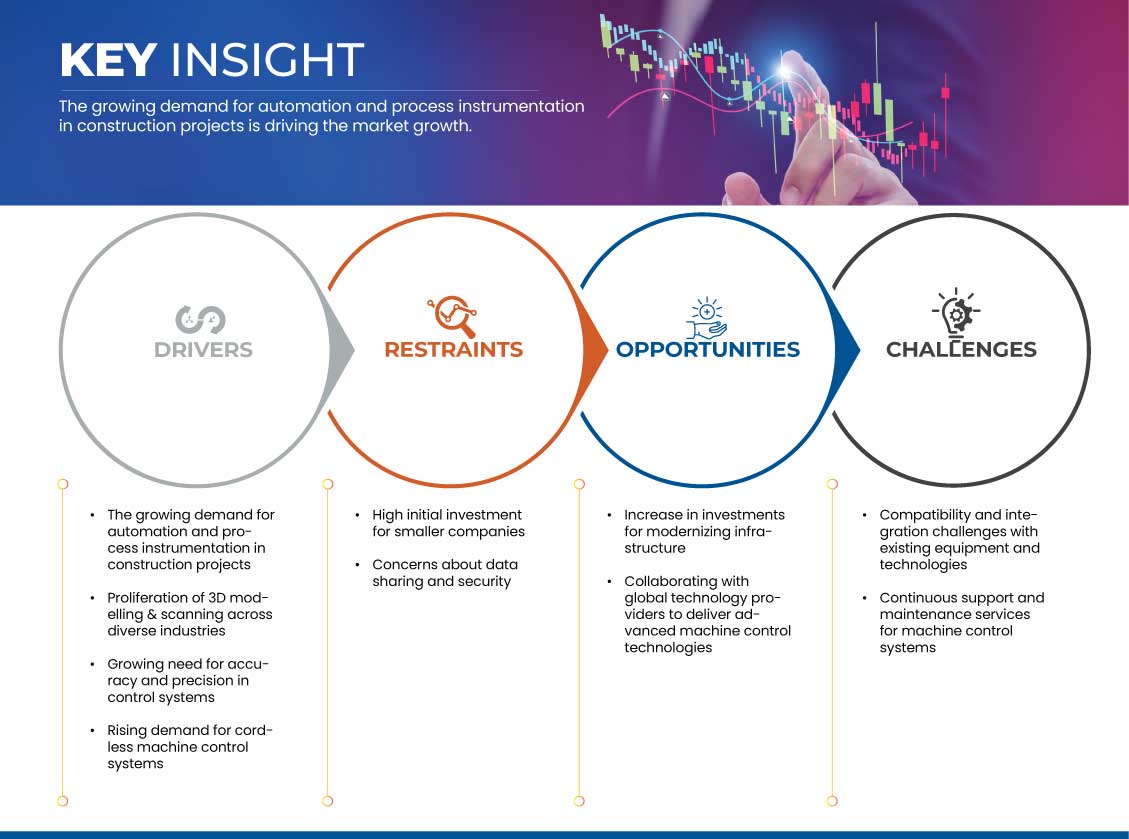

Drivers

- Growing Demand for Automation and Process Instrumentation In Construction Projects

The Brazil machine control systems market is witnessing significant growth, primarily driven by the increasing demand for automation and process instrumentation in construction projects. As the construction industry in Brazil expands, with large-scale infrastructure projects and urbanization efforts, the need for efficient, precise, and cost-effective operations has become paramount. Automation technologies, coupled with advanced machine control systems, are transforming traditional construction practices, enabling enhanced productivity and reduced errors.

Automation and process instrumentation offers several benefits that align with the evolving requirements of Brazil's construction sector. These systems provide real-time data, ensuring precision in operations such as excavation, grading, and paving. For instance, machine control systems equipped with GPS and sensors allow for accurate measurement and control of construction machinery, reducing material waste and labor costs. This level of precision is especially critical for large infrastructure projects such as highways, bridges, and urban developments, where efficiency and adherence to strict timelines are crucial. Moreover, as construction companies strive to meet environmental and safety regulations, the adoption of automated systems helps in reducing carbon footprints and ensuring worker safety.

For instance,

In 2024, as per the OECD Economics Department report, total investment in Brazil was 19% of GDP. Increased public and private investment in infrastructure will improve market opportunities for machine control systems, especially in agriculture and construction. Addressing climate risks and social inclusion in these projects will further drive demand in the machine control systems market

- Proliferation Of 3D Modelling & Scanning Across Diverse Industries

The Brazil machine control systems market is experiencing robust growth, driven by the increasing adoption of 3D modeling and scanning technologies across various industries. These advanced tools are revolutionizing how industries such as construction, mining, and agriculture approach project planning, design, and execution. By enabling enhanced accuracy and visualization, 3D modeling and scanning have become indispensable in ensuring efficient and cost-effective operations, fostering a growing demand for machine control systems integrated with these technologies.

3D modeling and scanning provide detailed, precise digital representations of physical environments, which are essential for industries that rely on heavy machinery. In construction, for instance, these technologies allow engineers to create highly accurate project blueprints, enabling machine control systems to execute tasks with pinpoint accuracy. This minimizes errors in grading, excavation, and alignment, reducing material wastage and labor costs. Similarly, in mining and agriculture, 3D scanning helps map terrains and optimize the deployment of machinery, ensuring maximum efficiency and safety. The seamless integration of these technologies with machine control systems enhances decision-making processes and operational outcomes, making them a vital component of modern industrial practices.

For instance,

- In 2023, according to the article published in American Institute of Architects, the rise in 3D modeling use in architecture has significantly boosted the demand for machine control systems. In 2023, 60% of U.S. architects utilized 3D modeling to visualize designs and enhance client communication, representing a 50% increase over the past five years. This growing adoption of 3D modeling in architecture is driving the demand for machine control systems, as construction projects increasingly rely on accurate, efficient, and automated processes for earthworks and site preparation. The integration of 3D modeling technology into machine control systems is becoming essential for meeting the heightened requirements of modern construction projects

Opportunities

- Increase in Investments for Modernizing Infrastructure

The Brazil machine control systems market is poised to benefit significantly from the increasing investments in modernizing infrastructure across the country. With government and private sector initiatives focusing on upgrading transportation networks, urban development, and industrial facilities, there is a growing demand for advanced technologies that can enhance efficiency, precision, and project management. This surge in infrastructure investment presents a substantial opportunity for the adoption of machine control systems, which are critical for executing large-scale projects with accuracy and cost-effectiveness.

Modernizing infrastructure projects, such as building highways, railways, airports, and urban housing, requires machinery capable of performing intricate tasks with precision. Machine control systems equipped with GPS, GNSS, and other advanced technologies enable operators to automate processes such as grading, excavation, and paving. This not only reduces errors and material wastage but also ensures adherence to strict timelines and quality standards. With Brazil investing heavily in projects like new transportation corridors and urban renewal programs, the demand for these systems is expected to rise sharply as they align with the goals of maximizing productivity and minimizing costs.

For instance,

In June 2023, according to the article published in MDPI report, Brazil’s ongoing urban development programs, such as the Revitaliza Brazil initiative, are promoting the adoption of advanced machine control systems by investing heavily in smart city technologies. These projects bring substantial financial commitments, which may limit access for smaller contractors and companies due to the high upfront costs associated with machine control systems. This could act as a restraint on the demand for the Brazil machine control systems market

- Collaborating With Global Technology Providers to Deliver Advanced Machine Control Technologies

Collaborating with global technology providers to deliver advanced machine control technologies offers a significant growth opportunity for the Brazil machine control systems market. As industries in Brazil, such as construction, mining, and agriculture, increasingly adopt innovative technologies, partnerships with international leaders in machine control solutions can accelerate the deployment of state-of-the-art systems. These collaborations enable local companies to access cutting-edge tools and expertise, enhancing their competitiveness in a rapidly evolving market.

Moreover, these collaborations open opportunities for knowledge transfer and skill development, helping the Brazilian workforce stay abreast of global trends in machine control technologies. Partnerships with international players also create avenues for co-developing new solutions, ensuring that local companies remain innovative and relevant. In addition, by aligning with globally recognized brands, Brazilian firms can build trust and credibility among clients, facilitating adoption across industries. This synergy fosters technological advancement while creating a competitive edge in the market.

For instance,

- In November 2023, according to the article published in Brazilian news, the collaboration between Brazilian companies and John Deere is driving the adoption of advanced machine control technologies in agriculture. Deere’s GPS-guided systems are becoming more accessible in Brazil, enhancing efficiency and productivity on farms. This partnership creates significant growth opportunities for the Brazil machine control systems market, as more farmers leverage these technologies for better land management and operational optimization.

Restraints/Challenges

- Compatibility and integration challenges with existing equipment and technologies

Compatibility and integration challenges with existing equipment and technologies represent a significant hurdle for the Brazil machine control systems market. As industries increasingly adopt advanced machine control systems, the need to integrate these systems seamlessly with existing machinery, software, and technologies becomes crucial. However, the heterogeneity of equipment and varying technology standards across industries pose obstacles to achieving smooth integration, which can delay project timelines and increase costs.

One of the primary challenges is the varying degrees of compatibility between older equipment and modern machine control systems. Many construction, mining, and agricultural machines in Brazil are still equipped with outdated technologies, making it difficult to retrofit them with newer control systems. This lack of standardization necessitates costly upgrades or replacements, which can be prohibitive for many companies, especially smaller ones. Moreover, integrating machine control systems into existing software platforms, such as fleet management systems or Enterprise Resource Planning (ERP) tools, requires additional effort to ensure data interoperability. The lack of standardized interfaces and communication protocols between these systems can lead to data silos, inefficient workflows, and reduced return on investment.

For instances,

- In December 2023, according to the article published in ITA article, Brazilian companies frequently faced challenges in integrating new machine control systems with outdated legacy equipment that operated on older technologies. A 2023 survey highlighted that 40% of Brazilian construction firms encounter difficulties in merging new GPS-based machine control systems with their existing non-GPS-enabled machinery. This integration challenge acts as a significant barrier to fully realizing the potential of advanced machine control technologies in Brazil. It limits the adoption and widespread use of these systems, creating a constraint for the growth of the Brazil machine control systems market. Addressing these integration issues will be crucial for overcoming this challenge and unlocking new opportunities for the market

Continuous Support And Maintenance Services For Machine Control Systems

Continuous support and maintenance services for machine control systems present a significant challenge for the Brazil machine control systems market. While these systems offer enhanced efficiency and precision, their complex nature requires ongoing support to ensure they function optimally throughout their lifecycle. The absence of reliable and accessible maintenance services can lead to costly downtimes and operational disruptions, particularly for industries heavily reliant on machinery, such as construction, mining, and agriculture.

One of the primary challenges is the availability and cost of qualified technicians and service providers who can offer timely support for machine control systems. Many companies in Brazil face difficulties finding professionals with the necessary skills to troubleshoot, repair, and maintain these advanced systems. This gap is more pronounced in remote or less urbanized areas, where skilled technicians may not be readily available. The dependency on manufacturers or international providers for service can also create delays, as logistical issues and language barriers may hinder quick resolutions to technical problems. The lack of localized support can result in extended downtime for critical equipment, impacting productivity and profitability.

Furthermore, the rapid pace of technological advancement in machine control systems presents another challenge for continuous support. As systems evolve, they may require regular updates and upgrades to ensure compatibility with new software versions and emerging technologies. This requires ongoing training for service personnel to stay up-to-date with the latest developments. However, the cost and complexity of providing such training can be prohibitive for some companies, particularly smaller ones, leading to inconsistencies in the level of service provided across the market. Ensuring continuous support and maintenance services requires a coordinated effort among technology providers, equipment manufacturers, and service networks to establish comprehensive and cost-effective support systems.

For instance,

- In May 2023, according to the article published in TMF Group, many Brazilian companies operating machine control systems face significant challenges due to the lack of local service centers for timely repairs and maintenance. A 2023 report from the Brazilian Equipment Manufacturers Association highlighted that 55% of companies experience long wait times for service support, which can severely delay critical projects. This issue not only impacts operational efficiency but also poses a challenge for the Brazil machine control systems market by creating uncertainty and risk for companies relying on these technologies. Improving service availability and support is essential to mitigate these challenges and enhance market adoption

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Machine Control Systems Market Scope

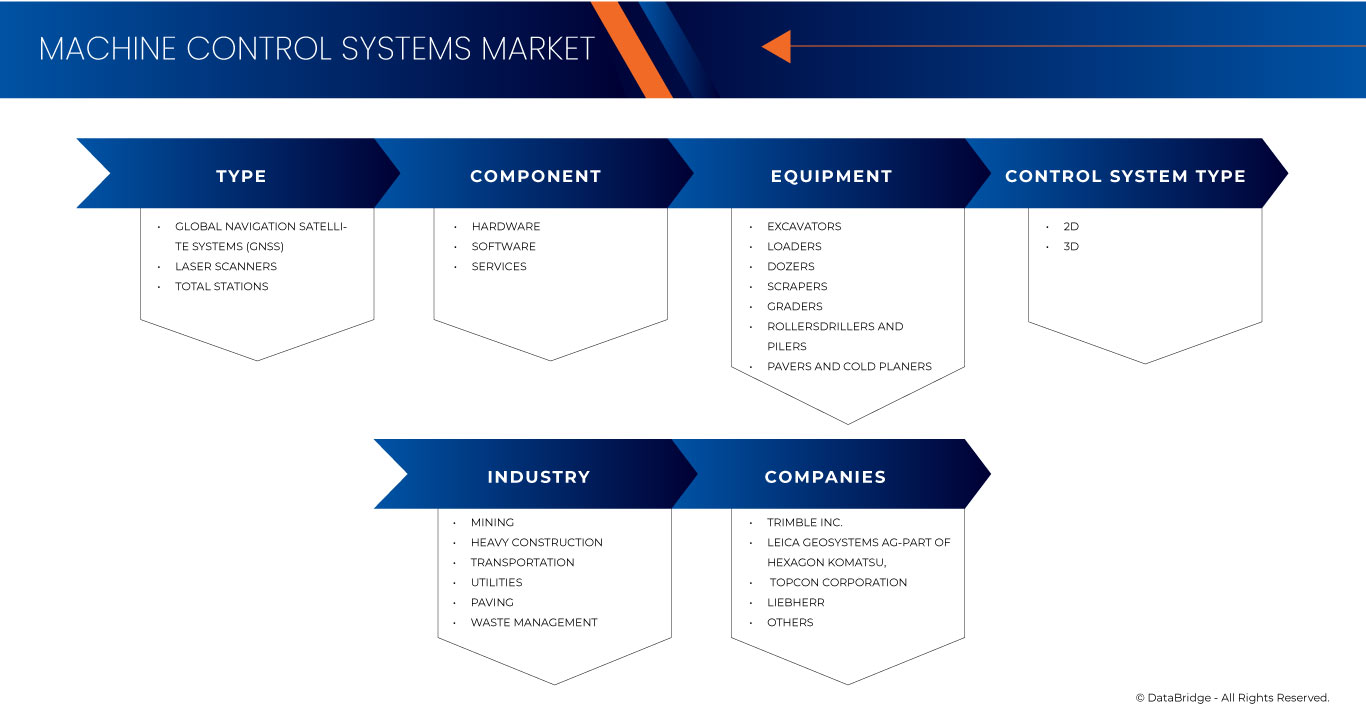

The Brazil Machine Control Systems Market is segmented into seven notable segments based on the offering, equipment type, depth, survey type, deployment, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Global Navigation Satellite System (Gnss)

- By Type

- Integrated

- Modular

- By Component

- Receiver

- Antenna

- Data Radios

- Others

- By Type

- Laser Scanners

- Total Stations

- By Type

- Mechanical

- Robotic

- Others

- By Type

- Others

Brazil Machine Control Systems Market, By Component

- Hardware

- Control Box

- Receiver

- Antenna

- Gateway

- Radios

- Tracer

- Others

- Software

- Services

- Testing

- Implemenatation And Integration

- Support And Maintenance

Equipment

- Excavators

- Loaders

- Dozers

- Scrapers

- Graders

- Rollers

- Drillers And Pilers

- Pavers And Cold Planers

- Others

Control System Type

- 2d

- 3d

Industry

- Mining

- By Mining Type

- Surface

- Underground

- In-Situ Mining

- By Type

- Global Navigation Satellite System (Gnss)

- Total Station

- Laser Scanners

- Others

- By Mining Type

- Heavy Construction

- By Type

- Roads And Higways

- Bridges And Tunnels

- Large Commercial Buildings

- Others

- By Type

- Global Navigation Satellite System (Gnss)

- Total Station

- Laser Scanners

- Others

- By Type

- Transportation

- By Application

- Rail

- Roads And Highways

- Ports And Maritimewater

- By Type

- Global Navigation Satellite System (Gnss)

- Total Station

- Laser Scanners

- Others

- By Application

- Utilities

- By Application

- Electric Utilities

- Water

- Gas

- Renewable Energy

- By Type

- Global Navigation Satellite System (Gnss)

- Total Station

- Laser Scanners

- Others

- By Application

- Paving

- By Type

- Global Navigation Satellite System (Gnss)

- Total Station

- Laser Scanners

- Others

- By Type

- Waste Management

- By Type

- Global Navigation Satellite System (Gnss)

- Total Station

- Laser Scanners

- By Type

- Others

Machine Control Systems Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, South America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Machine Control Systems Market Leaders Operating in the Market Are:

- Trimble Inc., (U.S.)

- Leica Geosystems AG - Part of Hexagon (Switzerland)

- Komatsu (Japan)

- TOPCON CORPORATION, (Japan)

- Liebherr (Germany)

- Schneider Electric (Singapore)

- Rockwell Automation, (U.S.)

- Hemisphere GNSS, Inc. (U.S.)

- MOBA MOBILE AUTOMATION AG (Germany)

- Eos Positioning Systems, Inc. (Eos) (Canada)

Latest Developments in Brazil Machine Control Systems Market

- In December 2024, Trimble and GroundProbe have partnered to provide a unified slope stability monitoring portfolio, combining their technologies and services to streamline workflows for geotechnical and geospatial mining professionals. This collaboration simplifies sourcing, enhances data integration, and improves decision-making for slope stability and site safety. Both companies benefit by expanding their customer base, delivering superior solutions, and leveraging a global support network to drive operational efficiency and risk management in the mining industry..

- In November 2024, Trimble expands collaboration with The HALO Trust to enhance landmine clearance efforts worldwide. The technology allows The HALO Trust to equip more field teams with precise mapping capabilities, accelerating their mission to clear minefields and improve safety in conflict-affected areas. This collaboration not only reinforces its commitment to humanitarian efforts but also enhances its reputation as a leader in providing advanced, reliable technology solutions.

- In November 2024, Leica Geosystems and Develon have partnered to introduce a new 3D machine control solution for Develon’s DD100 and DD130 dozers, enhancing precision and operational efficiency. The Leica MC1 3D system integrates seamlessly with Develon’s advanced hydraulic controls, enabling precise grading and improved site productivity. This collaboration benefits Develon customers by reducing rework and operator fatigue, ultimately leading to more efficient and sustainable earthmoving projects..

- In October 2024, Leica Geosystems has announced a new partnership with Dimanor, making them the official distributor for Leica Geosystems' construction portfolio in Mexico. This collaboration enhances Dimanor's offerings in heavy construction, expanding their coverage to key states across the country. Dimanor's extensive network and commitment to customer service align well with Leica Geosystems' mission to deliver cutting-edge machine control solutions, ensuring enhanced efficiency and precision for construction projects throughout Mexico.

- In December 2023, Komatsu Ltd. announced its participation in CES 2025 to showcase innovative technologies for extreme applications, including lunar construction and underwater automation for disaster relief. The event highlighted Komatsu’s focus on remote operation and advanced product design, attracting global talent and partners. This initiative aimed to enhance Komatsu’s industry leadership and expand opportunities in construction, mining, and forestry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF BRAZIL MACHINE CONTROL SYSTEMS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE GROWING DEMAND FOR AUTOMATION AND PROCESS INSTRUMENTATION IN CONSTRUCTION PROJECTS

5.1.2 PROLIFERATION OF 3D MODELLING & SCANNING ACROSS DIVERSE INDUSTRIES

5.1.3 GROWING NEED FOR ACCURACY AND PRECISION IN CONTROL SYSTEMS

5.1.4 RISING DEMAND FOR CORDLESS MACHINE CONTROL SYSTEMS

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENT FOR SMALLER COMPANIES

5.2.2 CONCERNS ABOUT DATA SHARING AND SECURITY

5.3 OPPORTUNITIES

5.3.1 INCREASE IN INVESTMENTS FOR MODERNIZING INFRASTRUCTURE

5.3.2 COLLABORATING WITH GLOBAL TECHNOLOGY PROVIDERS TO DELIVER ADVANCED MACHINE CONTROL TECHNOLOGIES

5.4 CHALLENGES

5.4.1 COMPATIBILITY AND INTEGRATION CHALLENGES WITH EXISTING EQUIPMENT AND TECHNOLOGIES

5.4.2 CONTINUOUS SUPPORT AND MAINTENANCE SERVICES FOR MACHINE CONTROL SYSTEMS

6 BRAZIL MACHINE CONTROL SYSTEMS MARKET, BY TYPE

6.1 OVERVIEW

6.2 GLOBAL NAVIGATIONS SATELLITE SYSTEMS (GNSS)

6.2.1 GLOBAL NAVIGATIONS SATELLITE SYSTEMS (GNSS), BY TYPE

6.2.1.1 INTEGRATED

6.2.1.2 MODULAR

6.2.2 GLOBAL NAVIGATIONS SATELLITE SYSTEMS (GNSS), BY COMPONENT

6.2.2.1 RECEIVER

6.2.2.2 ANTENNA

6.2.2.3 DATA RADIOS

6.2.2.4 OTHERS

6.3 LASER SCANNERS

6.4 TOTAL STATIONS

6.4.1 TOTAL STATION, BY TYPE

6.4.1.1 MECHANICAL

6.4.1.2 ROBOTIC

6.4.1.3 OTHERS

6.5 OTHERS

7 BRAZIL MACHINE CONTROL SYSTEMS MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 HARDWARE, BY TYPE

7.2.1.1 CONTROL BOX

7.2.1.2 RECEIVER

7.2.1.3 ANTENNA

7.2.1.4 GATEWAY

7.2.1.5 RADIOS

7.2.1.6 TRACER

7.2.1.7 OTHERS

7.3 SOFTWARE

7.4 SERVICES

7.4.1 SERVICES, BY TYPE

7.4.1.1 SUPPORT AND MAINTENANCE

7.4.1.2 IMPLEMENTATION AND INTEGRATION

7.4.1.3 TESTING

8 BRAZIL MACHINE CONTROL SYSTEMS MARKET, BY INDUSTRY

8.1 OVERVIEW

8.2 MINING

8.2.1 MINING, BY MINING TYPE

8.2.1.1 SURFACE

8.2.1.2 UNDERGROUND

8.2.1.3 IN-SITU

8.2.2 MINING, BY TYPE

8.2.2.1 GLOBAL NAVIGATIONS SATELLITE SYSTEMS (GNSS)

8.2.2.2 LASER SCANNERS

8.2.2.3 TOTAL STATIONS

8.2.2.4 OTHERS

8.3 HEAVY CONSTRUCTION

8.3.1 HEAVY CONSTRUCTION, BY HEAVY CONSTRUCTION TYPE

8.3.1.1 ROADS AND HIGHWAYS

8.3.1.2 BRIDGES AND TUNNELS

8.3.1.3 LARGE COMMERCIAL BUILDINGS

8.3.1.4 OTHERS

8.3.2 HEAVY CONSTRUCTION, BY TYPE

8.3.2.1 GLOBAL NAVIGATIONS SATELLITE SYSTEMS (GNSS)

8.3.2.2 LASER SCANNERS

8.3.2.3 TOTAL STATIONS

8.3.2.4 OTHERS

8.4 TRANSPORTATION

8.4.1 TRANSPORTATION, BY APPLICATION

8.4.1.1 RAIL

8.4.1.2 ROADS AND HIGHWAYS

8.4.1.3 PORTS AND MARITIME WATER

8.4.2 TRANSPORTATION, BY TYPE

8.4.2.1 GLOBAL NAVIGATIONS SATELLITE SYSTEMS (GNSS)

8.4.2.2 LASER SCANNERS

8.4.2.3 TOTAL STATIONS

8.4.2.4 OTHERS

8.5 UTILITIES

8.5.1 UTILITIES, BY APPLICATION

8.5.1.1 ELECTRIC UTILITIES

8.5.1.2 RENEWABLE ENERGY

8.5.1.3 WATER

8.5.1.4 GAS

8.5.2 UTILITIES, BY TYPE

8.5.2.1 GLOBAL NAVIGATIONS SATELLITE SYSTEMS (GNSS)

8.5.2.2 LASER SCANNERS

8.5.2.3 TOTAL STATIONS

8.5.2.4 OTHERS

8.6 PAVING

8.6.1 PAVING, BY TYPE

8.6.1.1 GLOBAL NAVIGATIONS SATELLITE SYSTEMS (GNSS)

8.6.1.2 LASER SCANNERS

8.6.1.3 TOTAL STATIONS

8.6.1.4 OTHERS

8.7 WASTE MANAGEMENT

8.7.1 WASTE MANAGEMENT, BY TYPE

8.7.1.1 GLOBAL NAVIGATIONS SATELLITE SYSTEMS (GNSS)

8.7.1.2 LASER SCANNERS

8.7.1.3 TOTAL STATIONS

8.7.1.4 OTHERS

9 BRAZIL MACHINE CONTROL SYSTEMS MARKET, BY EQUIPMENT

9.1 OVERVIEW

9.2 EXCAVATORS

9.3 LOADERS

9.4 DOZERS

9.5 SCRAPERS

9.6 GRADERS

9.7 ROLLERS

9.8 DRILLERS AND PILERS

9.9 PAVERS AND COLD PLANERS

9.1 OTHERS

10 BRAZIL MACHINE CONTROL SYSTEMS MARKET, BY CONTROL SYSTEM TYPE

10.1 OVERVIEW

10.2 2D

10.3 3D

11 BRAZIL MACHINE CONTROL SYSTEMS MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: BRAZIL

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 TRIMBLE INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 LEICA GEOSYSTEMS AG – PART OF HEXAGON

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENTS

13.3 KOMATSU

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 SOLUTION T PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 TOPCON CORPORATION

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 LIEBHERR

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENTS

13.6 EOS POSITIONING SYSTEMS, INC. (EOS)

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 HEMISPHERE GNSS, INC.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 MOBA MOBILE AUTOMATIONA AG

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 ROCKWELL AUTOMATION

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 SOLUTION PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 SCHNEIDER ELECTRIC

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 PRICE FOR SYSTEM INSTALLATION

TABLE 2 BRAZIL MACHINE CONTROL SYSTEMS MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 3 BRAZIL GLOBAL NAVIGATIONS SATELLITE SYSTEMS (GNSS) IN MACHINE CONTROL SYSTEMS MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 4 BRAZIL GLOBAL NAVIGATIONS SATELLITE SYSTEMS (GNSS) IN MACHINE CONTROL SYSTEMS MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 5 BRAZIL TOTAL STATIONS IN MACHINE CONTROL SYSTEMS MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 6 BRAZIL MACHINE CONTROL SYSTEMS MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 7 BRAZIL HARDWARE IN MACHINE CONTROL SYSTEMS MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 8 BRAZIL SERVICES IN MACHINE CONTROL SYSTEMS MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 9 BRAZIL MACHINE CONTROL SYSTEMS MARKET, BY INDUSTRY, 2022-2032 (USD THOUSAND)

TABLE 10 BRAZIL MINING IN MACHINE CONTROL SYSTEMS MARKET, BY MINING TYPE, 2022-2032 (USD THOUSAND)

TABLE 11 BRAZIL MINING IN MACHINE CONTROL SYSTEMS MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 12 BRAZIL HEAVY CONSTRUCTION IN MACHINE CONTROL SYSTEMS MARKET, BY HEAVY CONSTRUCTION TYPE, 2022-2032 (USD THOUSAND)

TABLE 13 BRAZIL HEAVY CONSTRUCTION IN MACHINE CONTROL SYSTEMS MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 14 BRAZIL TRANSPORTATION IN MACHINE CONTROL SYSTEMS MARKET, BY APPLICATION, 2022-2032 (USD THOUSAND)

TABLE 15 BRAZIL TRANSPORTATION IN MACHINE CONTROL SYSTEMS MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 16 BRAZIL UTILITIES IN MACHINE CONTROL SYSTEMS MARKET, BY APPLICATION, 2022-2032 (USD THOUSAND)

TABLE 17 BRAZIL UTILITIES IN MACHINE CONTROL SYSTEMS MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 18 BRAZIL PAVING IN MACHINE CONTROL SYSTEMS MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 19 BRAZIL WASTE MANAGEMENT IN MACHINE CONTROL SYSTEMS MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 20 BRAZIL MACHINE CONTROL SYSTEMS MARKET, BY EQUIPMENT, 2022-2032 (USD THOUSAND)

TABLE 21 BRAZIL MACHINE CONTROL SYSTEMS MARKET, BY CONTROL SYSTEM TYPE, 2022-2032 (USD THOUSAND)

List of Figure

FIGURE 1 BRAZIL MACHINE CONTROL SYSTEMS MARKET: SEGMENTATION

FIGURE 2 BRAZIL MACHINE CONTROL SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 BRAZIL MACHINE CONTROL SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 BRAZIL MACHINE CONTROL SYSTEMS MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 BRAZIL MACHINE CONTROL SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BRAZIL MACHINE CONTROL SYSTEMS MARKET: TYPE TIMELINE CURVE

FIGURE 7 BRAZIL MACHINE CONTROL SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 BRAZIL MACHINE CONTROL SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 BRAZIL MACHINE CONTROL SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 BRAZIL MACHINE CONTROL SYSTEMS MARKET: SEGMENTATION

FIGURE 11 FOUR SEGMENTS COMPRISE THE BRAZIL MACHINE CONTROL SYSTEMS MARKET, BY TYPE (2024)

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 THE GROWING DEMAND FOR AUTOMATION AND PROCESS INSTRUMENTATION IN CONSTRUCTION PROJECTS IS EXPECTED TO DRIVE BRAZIL MACHINE CONTROL SYSTEMS MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 GLOBAL NAVIGATIONS SATELLITE SYSTEMS (GNSS) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF BRAZIL MACHINE CONTROL SYSTEMS MARKET IN 2025 & 2032

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE BRAZIL MACHINE CONTROL SYSTEMS MARKET

FIGURE 17 GROWING DEMAND FOR AUTOMATION AND PROCESS INSTRUMENTATION IN BRAZIL

FIGURE 18 BRAZIL MACHINE CONTROL SYSTEMS MARKET, BY TYPE, 2024

FIGURE 19 BRAZIL MACHINE CONTROL SYSTEMS MARKET, BY COMPONENT, 2024

FIGURE 20 BRAZIL MACHINE CONTROL SYSTEMS MARKET, BY INDUSTRY, 2024

FIGURE 21 BRAZIL MACHINE CONTROL SYSTEMS MARKET: BY EQUIPMENT, 2024

FIGURE 22 BRAZIL MACHINE CONTROL SYSTEMS MARKET: BY CONTROL SYSTEM TYPE, 2024

FIGURE 23 BRAZIL MACHINE CONTROL SYSTEMS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.