Canada And Us Point Of Care Testing Market

Market Size in USD Billion

CAGR :

%

USD

15.25 Billion

USD

31.72 Billion

2024

2032

USD

15.25 Billion

USD

31.72 Billion

2024

2032

| 2025 –2032 | |

| USD 15.25 Billion | |

| USD 31.72 Billion | |

|

|

|

|

Canada and U.S. Point of Care Testing Market Size

- The Canada and U.S. point of care testing market was valued at USD 15.25 billion in 2024 and is expected to reach USD 31.72 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.6%, primarily driven by the rising prevalence of chronic and infectious diseases

- This growth is driven by factors such as the increasing demand for rapid diagnosis in emergency and outpatient settings

Canada and U.S. Point of Care Testing Market Analysis

- Canada and U.S. point of care testing market is driven by the rising prevalence of chronic conditions such as diabetes and cardiovascular diseases, along with the growing burden of infectious diseases that demand rapid and accurate diagnostic solutions. The COVID-19 pandemic significantly accelerated adoption of both molecular and rapid POC tests, while ongoing demand for respiratory, gastrointestinal, sexually transmitted, and bloodstream infection panels continues to expand the market. Increasing preference for decentralized and home-based healthcare, supported by the widespread availability of self-testing kits and retail pharmacy-based diagnostics, further fuels growth

- Technological advancements in molecular assays, microfluidics, and smartphone-connected POCT devices are enhancing test accuracy and accessibility, while healthcare systems adopt these solutions to reduce costs and improve patient turnaround times. Additionally, supportive government policies, regulatory approvals, and reimbursement frameworks in Canada and U.S. are encouraging broader adoption of POCT across clinical, retail, and homecare settings

- Healthcare providers and policymakers in both Canada and U.S. are increasingly recognizing the value of POCT in addressing the growing disease burden, especially in community health centers, urgent care settings, and remote regions where access to centralized labs is limited. This rising demand is driving public and private investments in advanced diagnostic platforms that support rapid clinical decision-making

- The COVID-19 pandemic catalyzed widespread adoption of decentralized testing solutions, accelerating the deployment of POCT technologies across hospitals, pharmacies, and other healthcare facilities throughout North America. As health systems continue to focus on accessibility, early detection, and value-based care, the need for efficient, near-patient diagnostics is expected to remain a key growth driver in the market

- U.S. is expected to dominate the Canada and U.S. point of care testing market with the market share of 88.56% due to the presence of advanced healthcare infrastructure, high adoption of rapid diagnostic technologies, strong government support, and a large patient population driving demand for efficient and accurate testing solutions

Report Scope and Canada and U.S. Point of Care Testing Market Segmentation

|

Attributes |

Canada and U.S. Point of Care Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Canada and U.S. Point of Care Testing Market Trends

Rising prevalence of chronic and infectious diseases increasing demand for rapid, decentralized diagnostics

- The rising prevalence of chronic and infectious diseases in Canada and U.S. is creating an urgent need for rapid, decentralized diagnostic solutions that enable timely detection and effective disease management

- Healthcare providers and policymakers in both Canada and U.S. are increasingly recognizing the value of POCT in addressing the growing disease burden, especially in community health centers, urgent care settings, and remote regions where access to centralized labs is limited

- For instance, in May 2025, Renyun (Hunan) Busbar Co., Ltd. recently hosted a valued customer at its headquarters, marking another milestone in the company’s commitment to building strong, long-term partnerships. The visit included a guided tour of Renyun’s state-of-the-art manufacturing facilities, where the customer observed advanced production processes, rigorous quality testing, and innovative product designs

- Data centers, where uptime is non-negotiable, Canada and U.S. point of care testing are being integrated to provide streamlined and reconfigurable power delivery, allowing operators to scale infrastructure without extended downtime. Their plug-and-play nature has been valued for enabling quick rack power connections and supporting dynamic load shifts—needs that have become common in both hyperscale and edge computing scenarios

- The World Bank’s energy development programs further highlight how electrification is being linked with sustainable industrial growth in emerging economies. In smart industrial zones and government-led infrastructure corridors, Canada and U.S. point of care testing are being considered as part of low-voltage distribution strategies—particularly where speed, flexibility, and long-term safety are required

Canada and U.S. Point of Care Testing Market Dynamics

Driver

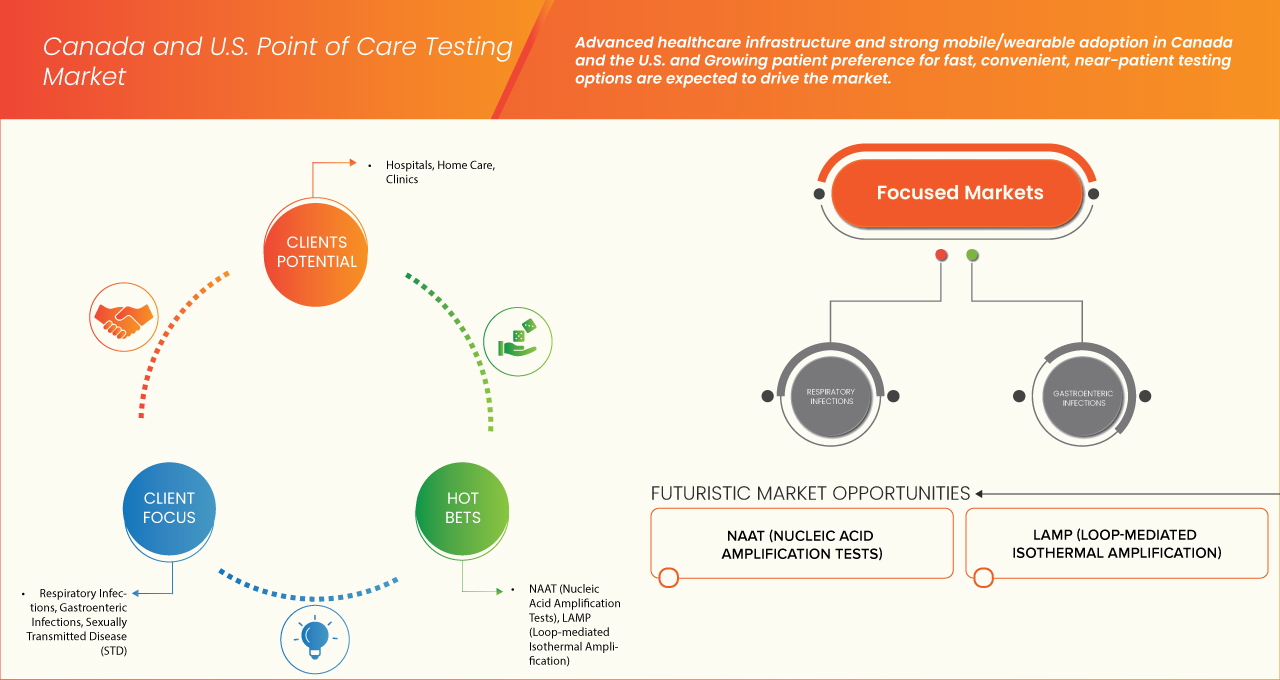

Advanced Healthcare Infrastructure and Strong Mobile/Wearable Adoption in Canada and U.S.

- One of the key trends propelling the Canada and U.S. point of care testing market is the rapid diagnostic workflows, real-time data sharing, and streamlined clinical decision-making, which together enhance patient outcomes

- Alongside this infrastructure, strong consumer adoption of mobile and wearable health technologies in Canada and U.S. is driving the demand for connected and user-friendly POCT devices

- For instance, in August 2025, Canada Health Infoway launched the Connected Care Clinical Student Scholarship, offering up to USD 3,000 per student to support clinical learners pursuing digital health education programs at accredited Canadian post-secondary institutions

- This initiative, part of the Centre for Clinical Innovation in Digital Health (CIDH), aims to advance interoperability and connected care by empowering students with knowledge in areas such as electronic health records, AI in healthcare, and healthcare data analytics. The scholarship aligns with Infoway’s Shared Pan-Canadian Interoperability Roadmap and supports the development of decentralized diagnostic capabilities and digital health solutions

- Wearables and mobile health apps empower patients to monitor their health continuously, creating a data-rich environment that POCT solutions can leverage to provide timely and personalized diagnostics

- The convergence of these technologies facilitates remote patient monitoring, chronic disease management, and preventive care, reducing hospital visits and easing the burden on healthcare systems. As mobile and wearable adoption continues to grow, it will increasingly support the expansion and acceptance of POCT as a key component of modern healthcare delivery

Opportunity

Increasing Use in Drug Abuse, Infectious Disease, and Oncology Screening, Driving Market Diversification

- The landscape of healthcare in Canada and U.S. is undergoing a significant transformation, driven by the increasing adoption of Point-of-Care Testing (POCT). This shift is particularly evident in the diversification of its applications, moving beyond traditional diagnostics into new, high-growth areas

- The expansion of POCT into fields like drug abuse, infectious disease, and oncology screening is creating a new paradigm for timely and accessible patient care. This evolution is driven by the demand for faster results, which can lead to more rapid treatment decisions and improved patient outcomes

- For instance, in August 2025, according to Canada and U.S.'s Drug Agency, the onset of the COVID-19 pandemic spurred substantial uptake of POCT, leading to greater awareness of how these tests can be applied across different aspects of medicine, with examples including HIV rapid diagnostic tests and biomarker-based tests for mild traumatic brain injuries

- The ability to perform these tests outside of a centralized laboratory setting, such as in clinics, pharmacies, and even remote locations, is a key enabler of this trend. As technology becomes more sophisticated and user-friendly, the range of conditions that can be screened for at the point of care continues to grow, offering new opportunities for healthcare providers and patients alike. This diversification not only addresses long-standing challenges in healthcare access but also promises to streamline clinical workflows and reduce the burden on traditional laboratory infrastructure

- The U.S. POCT landscape is increasingly embracing diverse screening applications from drug-of-abuse panels to infectious disease detection and oncology biomarkers, broadening its impact across healthcare domains. For instance, home-based infectious disease tests such as SARS-CoV-2 antigen kits have demonstrated substantial cost savings of approximately USD 12.5 million over 60 days—highlighting demand for decentralized testing. Concurrently, advances in oncology diagnostics, for instance, machine learning enhanced blood tests capable of detecting early-stage ovarian cancer with around 92% accuracy, portend a similar expansion in cancer screening via POCT

Restraint/Challenge

High Costs for Advanced POCT Devices and Reagents

- The adoption of advanced Point of Care Testing (POCT) devices in Canada and U.S. is often hindered by the substantial costs involved. These technologies typically feature sophisticated components and require specialized reagents, leading to higher manufacturing and purchase expenses

- The recurring expenses related to consumables, maintenance, and device calibration further increase the overall financial burden. In many cases, healthcare organizations must carefully evaluate the cost-benefit ratio before investing in advanced POCT systems, which may lead to delayed adoption or selective usage of these technologies

- For instance, in June, 2025, a study published in Applied Sciences explored the integration of point-of-care testing (POCT) for cancer and chronic disease management in workplace settings. The study highlighted that the variability in performance and quality among different POCT devices from various manufacturers poses significant challenges to standardization efforts

- This inconsistency complicates the establishment of uniform testing protocols and quality assurance measures, leading to difficulties in clinical adoption and integration into routine healthcare practices. The lack of standardized devices and procedures can result in discrepancies in test results, impacting patient care and hindering the widespread implementation of POCT solutions

- Addressing this cost-related restraint will be critical for market growth. It may require innovations to reduce production costs, economies of scale, and potential financial support from the government or private sectors to improve affordability and accessibility across diverse healthcare settings

- The high costs associated with advanced POCT devices and reagents remain a significant barrier to their widespread adoption in Canada and U.S.. Overcoming this financial challenge through cost reduction strategies, increased production efficiencies, and supportive funding mechanisms will be essential to making these technologies more accessible across diverse healthcare settings and driving market growth

Canada and U.S. Point of Care Testing Market Scope

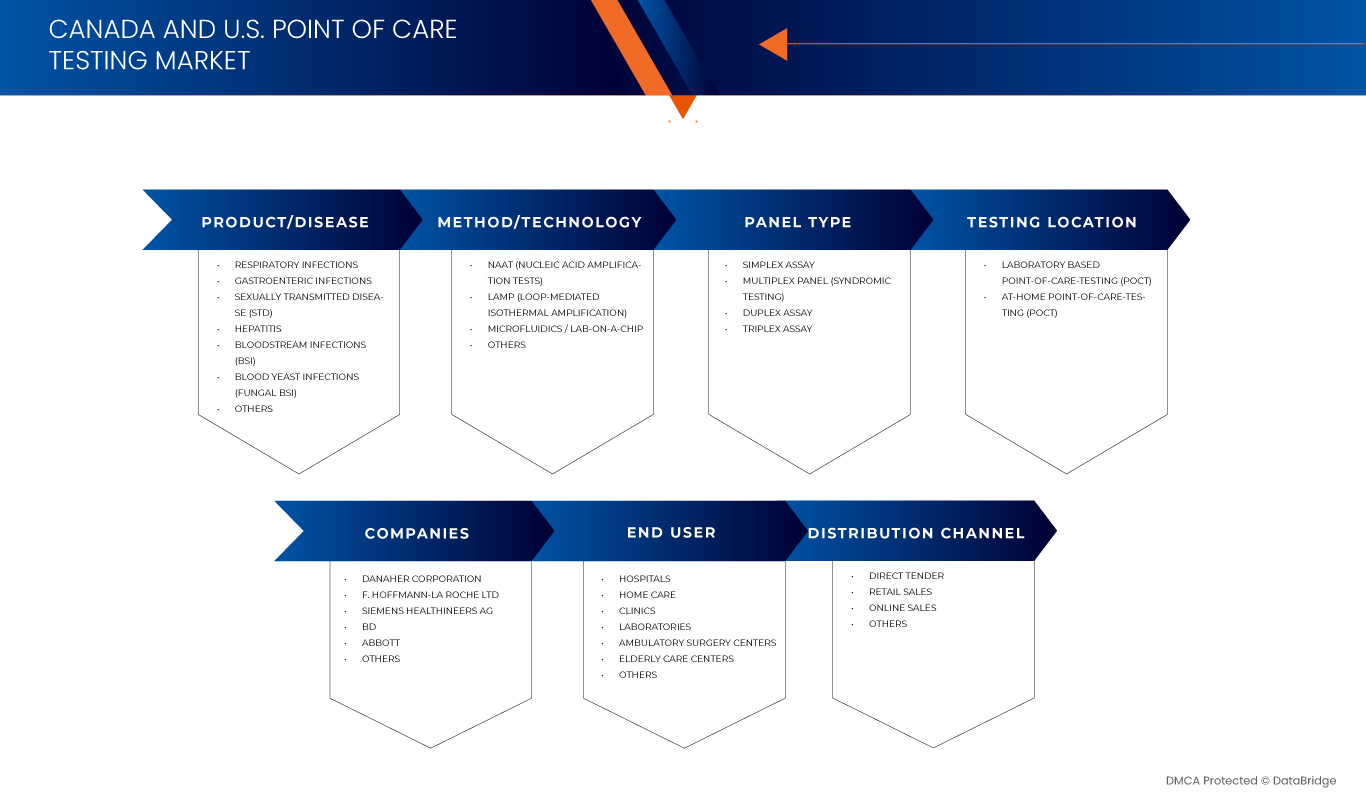

The Canada and U.S. point of care testing market is segmented into six segments based on product/disease, method/technology, panel type, testing location, end user and distribution channel

- By Product/Disease

On the basis of product/disease, the Canada and U.S. point of care testing market is segmented into respiratory infections, gastroenteric infections, Sexually Transmitted Disease (STD), hepatitis, Bloodstream Infections (BSI), Blood Yeast Infections (Fungal BSI), and others. In 2025, the respiratory infections segment is expected to dominate the market with a market share of 48.15% and 34.50% in U.S. and Canada respectively, due to their high prevalence, rapid transmission, and the clinical need for timely diagnosis. The COVID-19 pandemic demonstrated the critical importance of decentralized and rapid molecular testing, significantly accelerating investment in point-of-care platforms.

The Sexually Transmitted Disease (STD) segment is anticipated to gain traction with a CAGR of 10.1% in the U.S. and 9.4% in Canada during the forecast period of 2025 to 2032, driven by the rising prevalence of STDs, growing demand for rapid and confidential testing, continuous product innovations, and increasing adoption of at-home and clinic-based point-of-care diagnostic solutions.

- By Method/Technology

On the basis of method/technology, the Canada and U.S. point of care testing market is segmented into NAAT (Nucleic Acid Amplification Tests), LAMP (Loop-Mediated Isothermal Amplification), microfluidics / lab-on-a-chip, and others. In 2025, the NAAT (Nucleic Acid Amplification Tests) segment is expected to dominate the market with a market share of 55.27% and 55.58% in U.S. and Canada respectively, owing to PCR-based rapid tests became essential for large-scale screening and rapid clinical decision-making. Beyond COVID-19, NAATs are increasingly applied in detecting respiratory pathogens, Sexually Transmitted Infections (STIs), gastrointestinal infections, and bloodstream infections, supporting faster diagnosis compared to conventional laboratory PCR tests.

The LAMP (Loop-Mediated Isothermal Amplification) segment is anticipated to gain traction with a CAGR of 10.2% in the U.S. and 9.5% in Canada during the forecast period of 2025 to 2032, driven by its high sensitivity and rapid detection capabilities, increasing adoption in infectious disease diagnostics, continuous product innovations, and growing demand for cost-effective molecular testing solutions in both clinical and home care settings.

- By Panel Type

On the basis of panel type, the Canada and U.S. point of care testing market is segmented into simplex assay, multiplex panel (syndromic testing), duplex assay, and triplex assay. In 2025, the simplex assay segment is projected to dominate the market with a market share of 52.50% and 52.38% in U.S. and Canada respectively, because they are cost-effective, easy to use, and widely adopted across routine diagnostic applications. These assays are designed to detect a single analyte or pathogen per test, making them particularly suitable for high-volume needs such as blood glucose monitoring, pregnancy and fertility testing, infectious disease screening (like HIV and COVID-19 rapid antigen tests), and cardiac markers.

The multiplex panel (syndromic testing) segment is anticipated to gain traction with a CAGR of 10.1% in the U.S. and 9.3% in Canada during the forecast period of 2025 to 2032, driven by rising demand for rapid and comprehensive diagnostic solutions, continuous product innovations, growing adoption in clinical and near-patient settings, and the need for accurate detection of multiple pathogens in a single test.

- By Testing Location

On the basis of testing location, the Canada and U.S. point of care testing market is segmented into Laboratory based Point-of-Care-Testing (POCT) and At-Home Point-of-Care-Testing (POCT). In 2025, the Laboratory based Point-of-Care-Testing (POCT) segment is expected to dominate the market with a market share of 60.13% and 59.87% in U.S. and Canada respectively, due to higher accuracy, reliability, and integration into hospital and clinical workflows compared to at-home testing. These tests are typically conducted within healthcare facilities such as hospitals, diagnostic laboratories, and urgent care centers, where trained professionals can ensure proper sample handling, quality control, and interpretation of results.

The At-Home Point-of-Care Testing (POCT) segment is anticipated to gain traction with a CAGR of 9.9% in the U.S. and 9.2% in Canada during the forecast period of 2025 to 2032, driven by increasing adoption of self-testing kits, growing product innovations, wider availability through online and retail channels, and rising patient preference for convenient and rapid diagnostic solutions.

- By End User

On the basis of end user, the Canada and U.S. point of care testing market is segmented into hospitals, home care, clinics, laboratories, ambulatory surgery centers, elderly care centers, and others. In 2025, the hospitals segment is expected to hold the largest share of 42.86% and 43.28% in U.S. and Canada respectively owing to high patient volumes, advanced infrastructure, and strong integration of rapid diagnostics into clinical workflows. POCT is widely adopted in hospital settings for emergency care, intensive care units, operating rooms, and inpatient monitoring, where timely results are critical for treatment decisions. Hospitals also utilize a broad range of POCT applications, including blood glucose monitoring, cardiac marker testing, coagulation tests, and infectious disease diagnostics, particularly syndromic panels for respiratory and bloodstream infections.

The home care segment is anticipated to gain traction with a CAGR of 10.1% in the U.S., while the hospital segment is expected to grow at a CAGR of 9.6% in Canada during the forecast period of 2025 to 2032, driven by rising demand for rapid diagnostics, increasing availability of innovative POCT devices, patient preference for at-home monitoring, and the growing need for faster decision-making in clinical settings.

- By Distribution Channel

On the basis of distribution channel, the Canada and U.S. point of care testing market is segmented into direct tender, retail sales, online sales, and others. In 2025, the direct tender segment is expected to dominate the market with a market share of 44.13% and 43.74% in U.S. and Canada respectively, owing to the primary procurement method for large-scale healthcare institutions such as hospitals, diagnostic laboratories, and government-funded healthcare facilities. Through direct tenders, bulk purchasing agreements are established between healthcare providers and manufacturers or authorized distributors, ensuring lower costs per unit, stable supply, and standardized product availability.

The online sales segment in the POCT market is anticipated to gain traction with a CAGR of 10.3% in the U.S. and 9.6% in Canada during the forecast period of 2025 to 2032, driven by increasing adoption of digital health platforms, growing availability of diagnostic devices through e-commerce channels, rising patient preference for at-home testing, and the convenience of direct-to-consumer delivery models.

The Major Market Leaders Operating in the Market Are:

- Danaher Corporation (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthineers AG (Germany)

- BD (Becton, Dickinson and Company) (U.S.)

- Abbott Laboratories (U.S.)

- Cardinal Health (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Medline Industries, LP (U.S.)

- Trinity Biotech (Ireland)

- OraSure Technologies Inc (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- BIOMÉRIEUX (France)

- QIAGEN (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- QuidelOrtho Corporation (U.S.)

- Trimedic Inc (Canada)

- Abaxis, Inc. (U.S.)

- Sysmex Corporation (Japan)

- NIPRO (Japan)

- SEKISUI Diagnostics (U.S.)

- SANNER (Germany)

- PTS Diagnostics (U.S.)

- The Stevens Company Limited (Canada)

- QuantuMDx Group Ltd. (U.K.)

- EKF Diagnostics Holdings plc (U.K.)

- Creative Diagnostics (U.S.)

- Hipro Biotechnology Co., Ltd. (China)

- Canadian Hospital Specialties Limited (Canada)

- Radiometer Medical ApS (Denmark)

- Meridian Bioscience, Inc. (U.S.)

- Henry Schein, Inc. (U.S.)

- Nova Biomedical (U.S.)

- binx health, inc. (U.S.)

- Sanguina (U.S.)

Latest Developments in Canada and U.S. Point of Care Testing Market

- In February 2025, Thermo Fisher Scientific acquired Solventum’s Purification and Filtration business for USD 4.1 billion, strengthening its bioprocessing capabilities. The acquisition enhances Thermo Fisher's portfolio of filtration and purification technologies, which utilize advanced surface analysis techniques to optimize material interactions in both biologics and industrial applications

- In July 2025, OraSure, through its subsidiary DNA Genotek, launched the HEMAcollect PROTEIN blood collection tube, a new device for proteomic research. The product is an evacuated tube with a proprietary stabilizing liquid designed to preserve and stabilize plasma proteins in whole blood for up to seven days at ambient temperatures. This eliminates the need for immediate processing or cold-chain shipping, making sample collection and transport more efficient and cost-effective. Powered by ProteoPrecision technology, it minimizes hemolysis and platelet activation, ensuring the collected sample accurately reflects the body's in vivo state, leading to higher-quality research data for applications in oncology, neurology, and cardiology

- In July 2025, according to Time Magazine, Microsoft's MAI DxO system demonstrated significantly higher diagnostic accuracy than human doctors-around 85% vs 20%-and reduced patient testing costs by 20%

- In August 2025, according to Reuters, a U.S.-based team developed an AI-enabled blood test that detects early-stage ovarian cancer with over 90% accuracy, opening new avenues for POC diagnostics in oncology

- In August 2025, according to a report by the National Collaborating Centre for Infectious Diseases, POCT can provide accessible testing for individuals facing barriers to conventional services, improving access in remote or resource-limited areas

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 ENVIRONMENTAL FACTORS

4.2.6 LEGAL FACTORS

4.3 R&D ANALYSIS

4.3.1 COMPARATIVE ANALYSIS

4.3.2 DRUG DEVELOPMENTAL LANDSCAPE

4.3.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

4.3.4 THERAPEUTIC ASSESSMENT

4.3.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

4.4 HEALTHCARE TARIFFS IMPACT ANALYSIS

4.4.1 OVERVIEW

4.4.2 TARIFF STRUCTURES

4.4.2.1 GLOBAL VS. REGIONAL TARIFF STRUCTURES

4.4.3 PHARMACEUTICAL TARIFFS AND TRADE BARRIERS

4.4.3.1 IMPORT DUTIES ON PRESCRIPTION DRUGS VS. GENERICS

4.4.3.2 IMPACT ON DRUG AFFORDABILITY AND ACCESS

4.4.3.3 KEY TRADE AGREEMENTS AFFECTING TARIFFS

4.4.4 IMPACT OF TARIFFS ON PROVIDERS AND PATIENTS

4.4.4.1 COST BURDEN ON HOSPITALS AND HEALTHCARE FACILITIES

4.4.4.2 EFFECT ON PATIENT AFFORDABILITY AND INSURANCE COVERAGE

4.4.4.3 TARIFFS AND MEDICAL TOURISM

4.4.5 TRADE AGREEMENTS AND HEALTHCARE TARIFFS

4.4.5.1 WTO REGULATIONS

4.4.5.2 IMPACT OF TRADE WARS ON THE HEALTHCARE SUPPLY CHAIN

4.4.5.3 ROLE OF FREE TRADE AGREEMENTS (FTAS) IN REDUCING TARIFFS

4.4.6 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

4.4.7 IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

4.5 PATENT ANALYSIS-

4.6 MARKETED DRUG ANALYSIS

4.6.1 10-YEAR MARKET FORECAST

4.6.2 DRUGS

4.6.3 BRANDED DRUGS

4.6.4 GENERIC DRUGS

4.6.5 THERAPEUTIC INDICATION

4.6.6 PHARMACOLOGICAL CLASS OF THE DRUG

4.6.7 DRUG PRIMARY INDICATION

4.6.8 MARKET STATUS

4.6.9 MEDICATION TYPE

4.6.10 DRUG DOSAGE FORM

4.6.11 DOSAGE AVAILABILITY

4.6.12 PACKAGING TYPE

4.6.13 DRUG ROUTE OF ADMINISTRATION

4.6.14 DOSING FREQUENCY

4.6.15 DRUG INSIGHT

4.6.16 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES

4.6.17 REGULATORY MILESTONE, SAFETY DATA, AND EFFICACY DATA

4.6.18 MARKET EXCLUSIVITY DATA

4.6.19 FORECAST MARKET OUTLOOK

4.6.20 CROSS COMPETITION

4.6.21 THERAPEUTIC PORTFOLIO

4.6.22 CURRENT DEVELOPMENT SCENARIO

4.7 MARKET ACCESS

4.7.1 10-YEAR MARKET FORECAST

4.7.2 CLINICAL TRIAL RECENT UPDATES

4.7.3 ANNUAL NEW FDA-APPROVED DRUGS

4.7.4 DRUG MANUFACTURER AND DEALS

4.7.5 MAJOR DRUG UPTAKE

4.7.6 CURRENT TREATMENT PRACTICES

4.7.7 IMPACT OF UPCOMING THERAPY

4.8 EPIDEMOLOGY

4.8.1 INCIDENCE BY GENDER: POCT-RELEVANT CONDITIONS

4.8.2 TREATMENT RATE: IMPACT ON POCT

4.8.3 MORTALITY RATE: THE NEED FOR TIMELY DIAGNOSIS

4.8.4 DRUG ADHERENCE AND THERAPY SWITCH: POCT'S ROLE IN MANAGEMENT

4.8.5 PATIENT TREATMENT SUCCESS RATES: THE POCT ADVANTAGE

4.9 SUPPLY CHAIN ECOSYSTEM

4.9.1 PROMINENT COMPANIES

4.9.2 KEY COMPONENTS OF THE ECOSYSTEM:

4.9.3 SMALL & MEDIUM SIZE COMPANIES (INNOVATORS)

4.9.4 END USERS

4.1 INNOVATION TRACKER & STRATEGIC ANALYSIS

4.10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.10.1.1 JOINT VENTURES

4.10.1.2 MERGERS & ACQUISITIONS

4.10.1.3 LICENSING & PARTNERSHIPS

4.10.1.4 TECHNOLOGY COLLABORATIONS

4.10.1.5 STRATEGIC DIVESTMENTS

4.10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.10.3 STAGE OF DEVELOPMENT

4.10.4 TIMELINES & MILESTONES

4.10.5 INNOVATION STRATEGIES & METHODOLOGIES

4.10.6 RISK ASSESSMENT & MITIGATION

4.10.7 FUTURE OUTLOOK

4.11 PIPELINE ANALYSIS – CANADA AND USA POINT OF CARE TESTING MARKET

4.11.1 CLINICAL TRIALS AND PHASE ANALYSIS

4.11.2 TECHNOLOGY PIPELINE

4.11.3 PHASE III CANDIDATES

4.11.4 PHASE II CANDIDATES

4.11.5 PHASE I CANDIDATES

4.11.6 OTHERS (PRE-CLINICAL AND RESEARCH)

4.11.7 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC AND INFECTIOUS DISEASES INCREASING DEMAND FOR RAPID, DECENTRALIZED DIAGNOSTICS

6.1.2 ADVANCED HEALTHCARE INFRASTRUCTURE AND STRONG MOBILE/WEARABLE ADOPTION IN CANADA AND THE U.S.

6.1.3 GROWING PATIENT PREFERENCE FOR FAST, CONVENIENT, NEAR-PATIENT TESTING OPTIONS

6.1.4 INCREASING GOVERNMENT INITIATIVES AND FUNDING TO SUPPORT DIGITAL HEALTH AND DECENTRALIZED DIAGNOSTICS

6.2 RESTRAINTS

6.2.1 HIGH COSTS FOR ADVANCED POCT DEVICES AND REAGENTS

6.2.2 VARIABILITY IN DEVICE PERFORMANCE AND QUALITY ACROSS BRANDS, COMPLICATING STANDARDIZATION AND CLINICAL ADOPTION

6.3 OPPORTUNITIES

6.3.1 INCREASING USE IN DRUG ABUSE, INFECTIOUS DISEASE, AND ONCOLOGY SCREENING, DRIVING MARKET DIVERSIFICATION

6.3.2 EXPANDING USE OF MOLECULAR POCT AND LATERAL FLOW IMMUNOASSAYS, INCLUDING PHARMACIES AND REMOTE/RURAL CARE

6.3.3 INTEGRATION OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING FOR ENHANCED DIAGNOSTIC ACCURACY AND CLINICAL DECISION SUPPORT

6.4 CHALLENGES

6.4.1 MAINTAINING ACCURACY, RELIABILITY, AND REGULATION COMPLIANCE ACROSS DECENTRALIZED TESTING ENVIRONMENTS

6.4.2 ADDRESSING DATA PRIVACY AND CYBERSECURITY RISKS AS MORE POCT DEVICES CONNECT TO HEALTH NETWORKS

7 CANADA AND U.S. POINT OF CARE TESTING MARKET, BY PRODUCT/DISEASE

7.1 OVERVIEW

7.2 RESPIRATORY INFECTION

7.2.1 SARS-COV-2

7.2.2 INFLUENZA A/B

7.2.3 RESPIRATORY SYNCYTIAL VIRUS (RSV)

7.2.4 BORDETELLA PERTUSSIS

7.2.5 OTHERS

7.3 GASTROENTERIC INFECTIONS

7.3.1 CLOSTRIDIOIDES DIFFICILE

7.3.2 NOROVIRUS

7.3.3 ROTAVIRUS

7.3.4 SALMONELLA, SHIGELLA, CAMPYLOBACTER, E. COLI (STEC)

7.3.5 GIARDIA

7.4 SEXUALLY TRANSMITTED DISEASE (STD)

7.5 HEPATITIS

7.6 BLOODSTREAM INFECTIONS (BSI)

7.7 BLOOD YEAST INFECTIONS (FUNGAL BSI)

7.8 OTHERS

8 CANADA AND U.S. OF CARE TESTING MARKET, BY METHOD/TECHNOLOGY

8.1 OVERVIEW

8.2 NAAT (NUCLEIC ACID AMPLIFICATION TESTS)

8.3 LAMP (LOOP-MEDIATED ISOTHERMAL AMPLIFICATION)

8.4 MICROFLUIDICS / LAB-ON-A-CHIP

8.5 OTHERS

9 CANADA AND U.S. POINT OF CARE TESTING MARKET, BY PANEL TYPE

9.1 OVERVIEW

9.2 SIMPLEX ASSAY

9.3 MULTIPLEX PANEL (SYNDROMIC TESTING)

9.4 DUPLEX ASSAY

9.5 TRIPLEX ASSAY

10 CANADA AND U.S. POINT OF CARE TESTING MARKET, BY TESTING LOCATION

10.1 OVERVIEW

10.2 LABORATORY BASED POINT-OF-CARE-TESTING (POCT)

10.3 AT-HOME POINT-OF-CARE-TESTING (POCT)

11 CANADA AND U.S. POINT OF CARE TESTING MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 HOME CARE

11.4 CLINICS

11.5 LABORATORIES

11.6 AMBULATORY SURGERY CENTERS

11.7 ELDERLY CARE CENTERS

11.8 OTHERS

12 CANADA AND U.S. POINT OF CARE TESTING MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 ONLINE SALES

12.5 OTHERS

13 CANADA AND U.S. POINT OF CARE TESTING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

13.2 COMPANY SHARE ANALYSIS: CANADA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 DANAHER CORPORATION.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 F. HOFFMANN-LA ROCHE LTD

15.2.1 COMPANY SNAPSHOT

15.2.2 RECENT FINANCIALS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 SIEMENS HEALTHINEERS AG

15.3.1 COMPANY SNAPSHOT

15.3.2 RECENT FINANCIALS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 BD

15.4.1 COMPANY SNAPSHOT

15.4.2 RECENT FINANCIALS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 ABBOTT

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AGILENT TECHNOLOGIES INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 RECENT FINANCIALS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ABAXIS, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BINX HEALTH, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 BIOMERIEUX

15.9.1 COMPANY SNAPSHOT

15.9.2 RECENT FINANCIALS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 BIO-RAD LABORATORIES, INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 CREATIVE DIAGNOSTICS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 CARDINAL HEALTH

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 CANADIAN HOSPITAL SPECIALTIES LIMITED

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 EKF DIAGNOSTICS HOLDINGS PLC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 HENRY SCHEIN, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 HIPRO BIOTECHNOLOGY CO.,LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 MEDLINE INDUSTRIES, LP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 MERIDIAN BIOSCIENCE, INC

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 NIPRO

15.19.1 COMPANY SNAPSHOT

15.19.2 RECENT FINANCIALS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENTS

15.2 NOVA BIOMEDICAL

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 ORASURE TECHNOLOGIES INC

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 PTS DIAGNOSTICS

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 QIAGEN

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 PRODUCT PORTFOLIO

15.23.4 RECENT DEVELOPMENT

15.24 QUANTUMDX GROUP LTD.

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 QUIDELORTHO CORPORATION.

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 PRODUCT PORTFOLIO

15.25.4 RECENT DEVELOPMENTS

15.26 RADIOMETER MEDICAL APS

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT UPDATES

15.27 SANNER

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENT

15.28 SEKISUI DIAGNOSTICS

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 SYSMEX CORPORATION

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 PRODUCT PORTFOLIO

15.29.4 RECENT DEVELOPMENT

15.3 SANGUNIA

15.30.1 COMPANY SNAPSHOT

15.30.2 PRODUCT PORTFOLIO

15.30.3 RECENT DEVELOPMENTS

15.31 THE STEVENS COMPANY LIMITED

15.31.1 COMPANY SNAPSHOT

15.31.2 PRODUCT PORTFOLIO

15.31.3 RECENT DEVELOPMENT

15.32 THERMO FISHER SCIENTIFIC INC.

15.32.1 COMPANY SNAPSHOT

15.32.2 REVENUE ANALYSIS

15.32.3 PRODUCT PORTFOLIO

15.32.4 RECENT DEVELOPMENT

15.33 TRIMEDIC INC

15.33.1 COMPANY SNAPSHOT

15.33.2 PRODUCT PORTFOLIO

15.33.3 RECENT DEVELOPMENT

15.34 TRINITY BIOTECH

15.34.1 COMPANY SNAPSHOT

15.34.2 REVENUE ANALYSIS

15.34.3 PRODUCT PORTFOLIO

15.34.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

List of Table

TABLE 1 PHASE-WISE DISTRIBUTION

TABLE 2 REGULATORY COVERAGE

TABLE 3 U.S. POINT OF CARE TESTING MARKET, BY PRODUCT/DISEASE, 2018-2032 (USD THOUSAND)

TABLE 4 CANADA POINT OF CARE TESTING MARKET, BY PRODUCT/DISEASE, 2018-2032 (USD THOUSAND)

TABLE 5 U.S. RESPIRATORY INFECTIONS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 CANADA RESPIRATORY INFECTIONS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 U.S. GASTROENTERIC INFECTIONS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 CANADA GASTROENTERIC INFECTIONS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 U.S. SEXUALLY TRANSMITTED DISEASE (STD) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 CANADA SEXUALLY TRANSMITTED DISEASE (STD) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 U.S. HEPATITIS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 CANADA HEPATITIS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 U.S. BLOODSTREAM INFECTIONS (BSI) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 CANADA BLOODSTREAM INFECTIONS (BSI) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 U.S. BLOOD YEAST INFECTIONS (FUNGAL BSI) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 CANADA BLOOD YEAST INFECTIONS (FUNGAL BSI) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 U.S. OTHERS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 CANADA OTHERS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 U.S. POINT OF CARE TESTING MARKET, BY METHOD/TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 20 CANADA POINT OF CARE TESTING MARKET, BY METHOD/TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 21 U.S. NAAT (NUCLEIC ACID AMPLIFICATION TESTS) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 CANADA NAAT (NUCLEIC ACID AMPLIFICATION TESTS) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 U.S. POINT OF CARE TESTING MARKET, BY PANEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 CANADA POINT OF CARE TESTING MARKET, BY PANEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 U.S. MULTIPLEX PANEL (SYNDROMIC TESTING) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 CANADA MULTIPLEX PANEL (SYNDROMIC TESTING) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 U.S. POINT OF CARE TESTING MARKET, BY TESTING LOCATION, 2018-2032 (USD THOUSAND)

TABLE 28 CANADA POINT OF CARE TESTING MARKET, BY TESTING LOCATION, 2018-2032 (USD THOUSAND)

TABLE 29 U.S. POINT OF CARE TESTING MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 30 CANADA POINT OF CARE TESTING MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 31 U.S. POINT OF CARE TESTING MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 32 CANADA POINT OF CARE TESTING MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 CANADA AND U.S. POINT OF CARE TESTING MARKET: SEGMENTATION

FIGURE 2 GEOGRAPHICAL SCOPE

FIGURE 3 CANADA AND U.S. POINT OF CARE TESTING MARKET: DATA TRIANGULATION

FIGURE 4 CANADA AND U.S. POINT OF CARE TESTING MARKET: DROC ANALYSIS

FIGURE 5 U.S. POINT OF CARE TESTING MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 6 CANADA POINT OF CARE TESTING MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 7 CANADA AND U.S. POINT OF CARE TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 8 CANADA AND U.S. POINT OF CARE TESTING MARKET: MULTIVARIATE MODELING

FIGURE 9 U.S. POINT OF CARE TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 CANADA POINT OF CARE TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 11 CANADA AND U.S. POINT OF CARE TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 12 U.S. POINT OF CARE TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 CANADA POINT OF CARE TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 14 U.S. POINT OF CARE TESTING MARKET: END USER COVERAGE GRID

FIGURE 15 CANADA POINT OF CARE TESTING MARKET: END USER COVERAGE GRID

FIGURE 16 CANADA AND U.S. POINT OF CARE TESTING MARKET: SEGMENTATION

FIGURE 17 CANADA POINT OF CARE TESTING MARKET: EXECUTIVE SUMMARY

FIGURE 18 U.S. POINT OF CARE TESTING MARKET: EXECUTIVE SUMMARY

FIGURE 19 SEVEN SEGMENTS COMPRISE THE U.S. POINT OF CARE TESTING MARKET, BY PRODUCT/DISEASE (2024)

FIGURE 20 SEVEN SEGMENTS COMPRISE THE CANADA POINT OF CARE TESTING MARKET, BY PRODUCT/DISEASE (2024)

FIGURE 21 STRATEGIC DECISIONS

FIGURE 22 RISING PREVALENCE OF CHRONIC AND INFECTIOUS DISEASES INCREASING DEMAND FOR RAPID, DECENTRALIZED DIAGNOSTICS IS DRIVING THE GROWTH OF CANADA POINT OF CARE TESTING MARKET FROM 2025 TO 2032

FIGURE 23 GROWING PATIENT PREFERENCE FOR FAST, CONVENIENT, NEAR-PATIENT TESTING OPTIONS IS DRIVING THE GROWTH OF U.S. POINT OF CARE TESTING MARKET FROM 2025 TO 2032

FIGURE 24 THE RESPIRATORY INFECTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE CANADA POINT OF CARE TESTING MARKET IN 2025 AND 2032

FIGURE 25 THE RESPIRATORY INFECTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. POINT OF CARE TESTING MARKET IN 2025 AND 2032

FIGURE 26 PESTEL ANALYSIS

FIGURE 27 PATENT FILINGS ACROSS SEVERAL KEY JURISDICTIONS:

FIGURE 28 U.S.: KEY APPLICANTS V/S NUMBER OF PATENTS.

FIGURE 29 CANADA: KEY APPLICANTS V/S NUMBER OF PATENTS

FIGURE 30 U.S.: IPC CODES V/S PATENT COUNT

FIGURE 31 CANADA: IPC CODES V/S PATENT COUNT.

FIGURE 32 U.S.: YEAR V/S NUMBER OF PATENT PUBLISHED

FIGURE 33 CANADA: YEAR V/S NUMBER OF PATENT PUBLISHED

FIGURE 34 DROC ANALYSIS

FIGURE 35 U.S. POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, 2024

FIGURE 36 U.S. POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, 2025 TO 2032 (USD THOUSAND)

FIGURE 37 U.S. POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, CAGR (2025- 2032)

FIGURE 38 U.S. POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, LIFELINE CURVE

FIGURE 39 CANADA POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, 2024

FIGURE 40 CANADA POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, 2025 TO 2032 (USD THOUSAND)

FIGURE 41 CANADA POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, CAGR (2025- 2032)

FIGURE 42 CANADA POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, LIFELINE CURVE

FIGURE 43 U.S. POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, 2024

FIGURE 44 U.S. POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, 2025 TO 2032 (USD THOUSAND)

FIGURE 45 U.S. POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, CAGR (2025- 2032)

FIGURE 46 U.S. POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, LIFELINE CURVE

FIGURE 47 CANADA POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, 2024

FIGURE 48 CANADA POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, 2025 TO 2032 (USD THOUSAND)

FIGURE 49 CANADA POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, CAGR (2025- 2032)

FIGURE 50 CANADA POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, LIFELINE CURVE

FIGURE 51 U.S. POINT OF CARE TESTING MARKET: BY PANEL TYPE, 2024

FIGURE 52 U.S. POINT OF CARE TESTING MARKET: BY PANEL TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 53 U.S. POINT OF CARE TESTING MARKET: BY PANEL TYPE, CAGR (2025- 2032)

FIGURE 54 U.S. POINT OF CARE TESTING MARKET: BY PANEL TYPE, LIFELINE CURVE

FIGURE 55 CANADA POINT OF CARE TESTING MARKET: BY PANEL TYPE, 2024

FIGURE 56 CANADA POINT OF CARE TESTING MARKET: BY PANEL TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 57 CANADA POINT OF CARE TESTING MARKET: BY PANEL TYPE, CAGR (2025- 2032)

FIGURE 58 CANADA POINT OF CARE TESTING MARKET: BY PANEL TYPE, LIFELINE CURVE

FIGURE 59 U.S. POINT OF CARE TESTING MARKET: BY TESTING LOCATION, 2024

FIGURE 60 U.S. POINT OF CARE TESTING MARKET: BY TESTING LOCATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 61 U.S. POINT OF CARE TESTING MARKET: BY TESTING LOCATION, CAGR (2025- 2032)

FIGURE 62 U.S. POINT OF CARE TESTING MARKET: BY TESTING LOCATION, LIFELINE CURVE

FIGURE 63 CANADA POINT OF CARE TESTING MARKET: BY TESTING LOCATION, 2024

FIGURE 64 CANADA POINT OF CARE TESTING MARKET: BY TESTING LOCATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 65 CANADA POINT OF CARE TESTING MARKET: BY TESTING LOCATION, CAGR (2025- 2032)

FIGURE 66 CANADA POINT OF CARE TESTING MARKET: BY TESTING LOCATION, LIFELINE CURVE

FIGURE 67 U.S. POINT OF CARE TESTING MARKET: BY END USER, 2024

FIGURE 68 U.S. POINT OF CARE TESTING MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 69 U.S. POINT OF CARE TESTING MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 70 U.S. POINT OF CARE TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 71 CANADA POINT OF CARE TESTING MARKET: BY END USER, 2024

FIGURE 72 CANADA POINT OF CARE TESTING MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 73 CANADA POINT OF CARE TESTING MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 74 CANADA POINT OF CARE TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 75 U.S. POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 76 U.S. POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 77 U.S. POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 78 U.S. POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 79 CANADA POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 80 CANADA POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 81 CANADA POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 82 CANADA POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 83 U.S. POINT OF CARE TESTING MARKET: COMPANY SHARE 2024 (%)

FIGURE 84 CANADA POINT OF CARE TESTING MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.