China Immunoassay Reagents And Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.88 Billion

USD

3.04 Billion

2024

2032

USD

1.88 Billion

USD

3.04 Billion

2024

2032

| 2025 –2032 | |

| USD 1.88 Billion | |

| USD 3.04 Billion | |

|

|

|

|

China Immunoassay Reagents and Devices Market Size

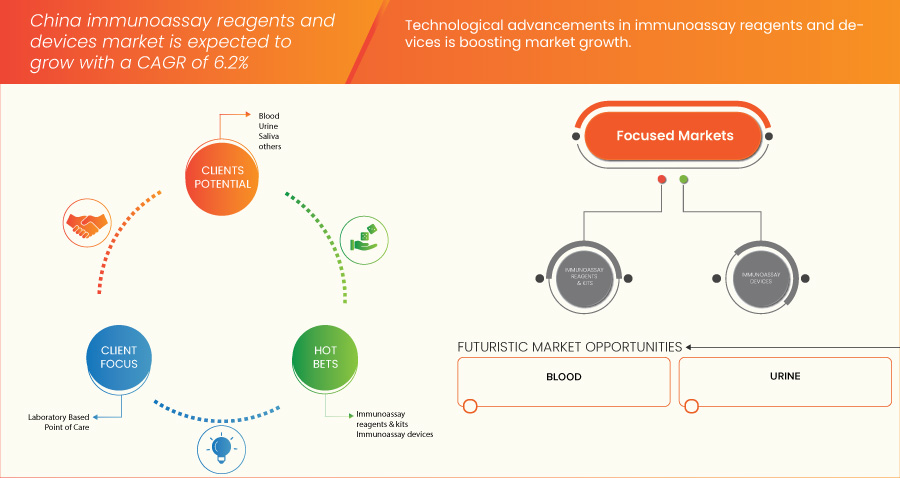

- The China Immunoassay Reagents and Devices Market size was valued at USD 1.88 billion in 2024 and is expected to reach USD 3.04 billion by 2032, at a CAGR of 6.2% during the forecast period

- The market growth is primarily driven by increasing demand for early disease detection, the prevalence of chronic and infectious diseases, and advancements in immunoassay technologies, which have enhanced the accuracy, speed, and sensitivity of diagnostic testing.

- Additionally, expanding healthcare infrastructure, rising healthcare expenditure, and the adoption of automated and point-of-care testing solutions are contributing significantly to the market’s expansion across hospitals, diagnostic centers, and research laboratories.

China Immunoassay Reagents and Devices Market Analysis

- Immunoassay reagents and devices, essential tools for detecting and quantifying biological markers, are becoming increasingly vital in China's healthcare system due to their high sensitivity, accuracy, and ability to support early disease diagnosis in both clinical and research settings.

- The escalating demand for immunoassay solutions in China is primarily fueled by the rising prevalence of chronic and infectious diseases, growing awareness of preventive healthcare, and the increasing integration of automated and point-of-care diagnostic technologies.

- Immunoassay reagents & kits segment is expected to dominate the China Immunoassay Reagents and Devices Market with a market share of 67.75% in 2025, driven by their widespread use in hospitals, diagnostic laboratories, and academic research, as well as their ease of implementation across various testing platforms.

Report Scope and China Immunoassay Reagents and Devices Market Segmentation

|

Attributes |

Immunoassay Reagents and Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

China Immunoassay Reagents and Devices Market Trends

Growing Government Support for Domestic Diagnostic Manufacturing

- The Chinese government’s increasing focus on strengthening domestic production of medical diagnostics and reducing dependence on foreign imports is a key trend shaping the China Immunoassay Reagents and Devices Market.

- For instance, in 2023, China’s National Health Commission emphasized the importance of accelerating the localization of key diagnostic technologies under its “Healthy China 2030” initiative, which aims to improve healthcare accessibility and innovation.

- This policy shift is driving increased funding, favorable regulations, and public-private partnerships to support the development and commercialization of homegrown immunoassay solutions.

- The government is also encouraging local companies to upgrade manufacturing capabilities and adopt international quality standards, further boosting the competitiveness of Chinese immunoassay product manufacturers.

- As a result, several domestic firms are entering the immunoassay space with affordable, high-performance devices and reagents tailored to local healthcare needs.

- This trend not only fosters innovation but also enhances supply chain resilience, improves access to diagnostics in rural and underserved regions, and positions China as a potential global hub for diagnostic exports in the future.

China Immunoassay Reagents and Devices Market Dynamics

Driver

Increasing Prevalence of Chronic Diseases

- The increasing prevalence of chronic diseases such as diabetes, cardiovascular conditions, cancer, and respiratory illnesses has emerged as a significant driver of growth in the China Immunoassay Reagents and Devices Market.

- For instance, In Dec 2024, according to the World Health Organization (WHO), non-communicable diseases (NCDs) such as cardiovascular diseases, cancers, chronic respiratory diseases, and diabetes account for 71% of all global deaths. The WHO also stresses the need for early detection and effective management strategies to combat these rising health threats.

- The global rise in chronic disease cases is largely attributed to factors such as aging populations, unhealthy lifestyles, poor dietary habits, and lack of physical activity.

- As these diseases require continuous monitoring and early diagnosis, there is an escalating need for advanced diagnostic tools, including immunoassay devices that can provide accurate, quick, and minimally invasive results.

- Immunoassays are essential in detecting specific biomarkers associated with chronic conditions like diabetes (e.g., HbA1c), heart disease (e.g., troponin), and cancer (e.g., CA-125). These tests not only help in early diagnosis but also in tracking disease progression and assessing the efficacy of treatments. Consequently, healthcare systems and patients are increasingly relying on these diagnostic technologies, driving demand for immunoassay reagents and devices.

- This trend is expected to continue as the burden of chronic diseases grows globally, especially in emerging markets with expanding healthcare infrastructure.

Restraint/Challenge

Fragmented Market with Intense Low-Cost Competition Causing Pricing Pressure

- The Chinese immunoassay market includes a large number of small- to mid-sized domestic manufacturers offering low-cost reagents and devices. These players compete aggressively on price rather than innovation or quality.

- For instance, In 2024, China's centralized procurement policies significantly impacted the immunoassay market. Domestic brands, such as Mindray Medical, Antu Biotech, New Industry, and Wanfu Biotech, have increasingly dominated the biochemical diagnosis, blood diagnosis, and enzyme-linked immunoassay sectors, which are characterized by lower technical content. These sectors have largely completed domestic substitution, leading to a competitive landscape where domestic manufacturers offer more affordable options, thereby exerting downward pressure on prices

- The absence of significant mergers and acquisitions has prevented consolidation, resulting in a crowded marketplace with overlapping product portfolios and minimal differentiation.

- Fragmentation reduces the space for premium and specialized offerings, as customers (especially in public hospitals) are often driven by procurement cost rather than diagnostic accuracy or automation. The Chinese government’s national and provincial bidding systems prioritize lowest-cost bids in public hospitals, which account for a significant portion of healthcare delivery.

- This institutionalizes price wars and further compresses margins for all players.

China Immunoassay Reagents and Devices Market Scope

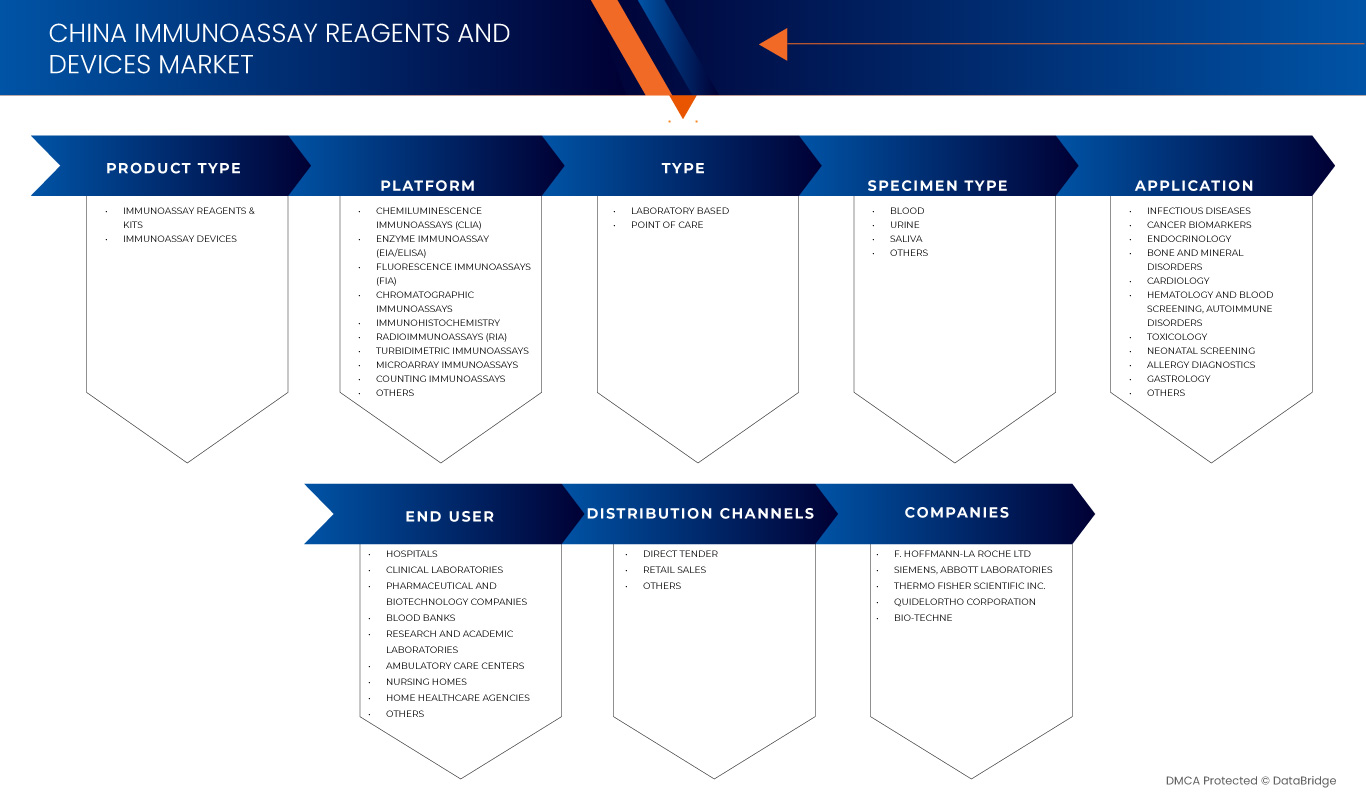

China Immunoassay Reagents and Devices Market is categorized into seven notable segments which are based on the product type, platform, type, specimen type, application, end user, and distribution channel.

- By Product Type

On the basis of product type, China Immunoassay Reagents and Devices Market is segmented into immunoassay reagents & kits and immunoassay devices. In 2025, the immunoassay reagents & kits segment is expected to dominate the China Immunoassay Reagents and Devices Market with a market share of 67.75%, driven by the increasing demand for early and accurate disease diagnosis, widespread adoption in hospitals and diagnostic laboratories, and the ease of use and high reliability of these kits in detecting a wide range of infectious and chronic conditions. Additionally, advancements in reagent formulation and automation-friendly designs are further enhancing their uptake across the healthcare sector.

The immunoassay reagents & kits segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising prevalence of chronic and infectious diseases, increasing demand for point-of-care testing, and ongoing innovations in assay sensitivity and specificity. Additionally, growing investments in healthcare infrastructure and the expanding use of immunoassays in personalized medicine and routine health screenings are expected to further accelerate segment growth.

- By Platform

On the basis of platform, China Immunoassay Reagents and Devices Market is segmented into chemiluminescence immunoassays (CLIA), enzyme immunoassay (EIA/ELISA), fluorescence immunoassays (FIA), chromatographic immunoassays, immunohistochemistry, radioimmunoassays (RIA), turbidimetric immunoassays, microarray immunoassays, counting immunoassays, and others. In 2025, the chemiluminescence immunoassays (CLIA) segment is expected to dominate and witness the fastest CAGR the China Immunoassay Reagents and Devices Market, driven by its high sensitivity, wide dynamic range, and ability to deliver rapid and accurate results. The increasing adoption of automated CLIA systems in hospitals and laboratories, along with their suitability for large-scale testing and chronic disease monitoring, is further propelling the segment’s growth.

- By Type

On the basis of type, China Immunoassay Reagents and Devices Market is segmented into Laboratory Based, Point of Care. In 2025, the blood segment is expected to dominate and witness the fastest CAGR from 2025 to 2032 in the China Immunoassay Reagents and Devices Market, driven by its high reliability in detecting a wide range of biomarkers, including those related to infectious diseases, hormonal imbalances, and chronic conditions. The ease of sample collection, compatibility with various immunoassay platforms, and growing use in routine health checkups and disease screening are further contributing to the segment’s dominance.

- By Specimen Type

On the basis of specimen type, China Immunoassay Reagents and Devices Market is segmented into blood, urine, saliva, and others. In 2025, the blood segment is expected to dominate market and expected to witness the fastest CAGR from 2025 to 2032, driven by the widespread use of blood-based immunoassays for early disease detection, ongoing advancements in assay technologies, and increasing demand for minimally invasive, accurate diagnostic testing. Additionally, the rising prevalence of chronic and infectious diseases requiring regular monitoring through blood tests is fueling sustained growth in this segment.

- By Application

On the basis of application, China Immunoassay Reagents and Devices Market is segmented into infectious diseases, cancer biomarkers, endocrinology, bone and mineral disorders, cardiology, hematology and blood screening, autoimmune disorders, toxicology, neonatal screening, allergy diagnostics, gastrology, and others. In 2025, the infectious diseases segment is expected to dominate market and expected to witness the fastest CAGR from 2025 to 2032, driven by the rising prevalence of infectious diseases, increased public health initiatives for early detection and control, and growing demand for rapid and accurate diagnostic tools. Advances in immunoassay technologies enabling timely identification of pathogens and the need for efficient outbreak management further accelerate growth in this segment.

- By End User

On the basis of end user, China Immunoassay Reagents and Devices Market is segmented into hospitals, clinical laboratories, pharmaceutical and biotechnology companies, blood banks, research and academic laboratories, ambulatory care centers, nursing homes, home healthcare agencies, and others. The hospitals segment is further segmented into public and private, and by level into tier 3, tier 2, and tier 1 hospitals. In 2025, the hospitals segment is expected to dominate the market and expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing number of hospital admissions, growing demand for advanced diagnostic services, and the expansion of healthcare infrastructure across China. Additionally, hospitals’ preference for automated and high-throughput immunoassay devices to support timely and accurate patient diagnosis is fueling growth in this segment.

- By Distribution Channel

On the basis of distribution channel, China Immunoassay Reagents and Devices Market is segmented into direct tender, retail sales, and others. The retail sales segment is further segmented into online and offline. In 2025, the direct tender segment is expected to dominate market and expected to witness the fastest CAGR from 2025 to 2032, driven by increasing government and institutional procurement of immunoassay reagents and devices to ensure cost-effective and large-scale supply. Additionally, streamlined purchasing processes, long-term contracts, and rising investments in public healthcare infrastructure are accelerating growth in this segment.

China Immunoassay Reagents and Devices Market Regional Analysis

- North America dominates the China Immunoassay Reagents and Devices Market with the largest revenue share of 40.01% in 2024, driven by a growing demand for home automation and security, as well as increased awareness of smart home technology

- Consumers in the region highly value the convenience, advanced security features, and seamless integration offered by Immunoassay Reagents and Devicess with other smart devices such as thermostats and lighting systems.

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and the growing preference for remote monitoring and control, establishing Immunoassay Reagents and Devicess as a favored solution for both residential and commercial properties.

China Immunoassay Reagents and Devices Market Insight

The China Immunoassay Reagents and Devices Market is fueled by the increasing prevalence of chronic and infectious diseases, which drive the demand for early and accurate diagnostic solutions. Rapid advancements in immunoassay technologies, including automation and enhanced sensitivity, have improved testing efficiency and reliability, further boosting market growth. Additionally, growing healthcare infrastructure, supportive government initiatives aimed at promoting domestic manufacturing, and rising awareness about preventive healthcare are key factors contributing to the expanding adoption of immunoassay reagents and devices across hospitals, diagnostic laboratories, and research institutions throughout China.

China Immunoassay Reagents and Devices Market Share

The Immunoassay Reagents and Devices industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens (Germany)

- Abbott Laboratories (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- QuidelOrtho Corporation (U.S.)

- Bio-Techne (U.S.)

- BIOMRIEUX (France)

- DIASORIN S.P.A (Italy)

- Danaher (U.S.)

- Tosoh Bioscience LLC (Japan)

- Hipro Biotechnology Co., Ltd. (China)

- Agilent Technologies, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Sysmex (Japan)

- BD (U.S.)

- QIAGEN (Germany)

- Revvity (U.S.)

- SD Biosensor, INC (South Korea)

Latest Developments in China Immunoassay Reagents and Devices Market

- In June 2025, Early results from the Phase I/II NXTAGE trial show promising outcomes for NXT007, Roche’s next-generation bispecific antibody for hemophilia A. The data indicate that NXT007 may achieve hemostatic normalization in patients without factor VIII inhibitors. These findings were presented by Chugai Pharmaceutical at the 2025 International Society on Thrombosis and Hemostasis (ISTH) Congress. NXT007 is designed to build on the clinical success of Hemlibra, another bispecific antibody therapy.

- In March 2025, The company initiated a new clinical trial focused on intravascular lithotripsy (IVL) to enhance treatment outcomes for patients with coronary artery disease. This innovative procedure uses sonic pressure waves to fracture calcium deposits in the coronary arteries, aiming to improve stent placement and blood flow. The trial highlights Abbott’s commitment to advancing minimally invasive cardiovascular technologies and addressing complex arterial conditions.

- In March 2025, The company received CE Mark approval in Europe for its Volt Pulsed Field Ablation (PFA) System, offering a new therapy option for treating abnormal heart rhythms such as atrial fibrillation. The single-catheter system delivers precise, high-energy electrical pulses to safely ablate targeted cardiac tissue, achieving pulmonary vein isolation in 99.1% of veins during clinical trials. Abbott has already commenced commercial PFA procedures in several EU countries and plans to expand deployment later this year.

- In February 2025, The Company is acquiring Solventum’s Purification and Filtration business for USD 4.1 billion, strengthening its bioprocessing capabilities. The acquisition enhances its portfolio of filtration and purification technologies, which involve key surface analysis techniques to optimize material interactions in biologics and industrial applications.

- In February 2025, The Company new EVOS S1000 Spatial Imaging System allows researchers to generate high-quality data for spatial tissue proteomics, enabling detailed analysis of tissue microenvironments. The system utilizes advanced imaging techniques that involve surface analysis to study protein distribution and interactions within tissue samples.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 PREMIUM INSIGHTS

5.1 PESTAL ANALYSIS

5.2 PORTER'S FIVE FORCES ANALYSIS

5.3 TECHNOLOGICAL ADVANCEMENTS IN THE TECHNOLOGICAL ADVANCEMENTS IN THE GLOBAL NATURAL TERPENE MARKET

5.4 MICRO AND MACRO ECONOMIC FACTORS

5.5 PENETRATION AND GROWTH PROSPECT MAPPING

5.6 KEY PRICING STRATEGIES

5.7 INTELLECTUAL PROPERTY (IP) PORTFOLIO ANALYSIS

5.7.1 PATENT QUALITY AND STRENGTH

5.7.2 AND COLLABORATIONS

5.8 COST STRUCTURE BREAKDOWN

5.8.1 IMMUNOASSAY REAGENTS

5.8.2 IMMUNOASSAY DEVICES (ANALYZERS):

5.9 REGULATORY COMPLIANCE

5.9.1 REGULATORY AUTHORITIES

5.9.2 REGULATORY CLASSIFICATIONS

5.9.2.1 CLASS I (LOW RISK)

5.9.2.2 CLASS II (MODERATE RISK)

5.9.2.3 CLASS III (HIGH RISK)

5.9.3 REGULATORY SUBMISSIONS

5.9.4 INTERNATIONAL HARMONIZATION

5.9.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

5.9.6 REGULATORY CHALLENGES AND STRATEGIES

5.1 OPPORTUNITY MAP ANALYSIS

5.11 VALUE CHAIN ANALYSIS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF CHRONIC DISEASES

6.1.2 RISING HEALTHCARE INVESTMENTS IN DIAGNOSTIC TECHNOLOGIES

6.1.3 GROWING DEMAND FOR PERSONALIZED MEDICINE AND TREATMENTS

6.1.4 TECHNOLOGICAL ADVANCEMENTS IN IMMUNOASSAY REAGENTS AND DEVICES

6.2 RESTRAINTS

6.2.1 FRAGMENTED MARKET WITH INTENSE LOW-COST COMPETITION CAUSING PRICING PRESSURE

6.2.2 STRINGENT REGULATORY APPROVAL PROCESSES FOR NEW PRODUCTS

6.3 OPPORTUNITIES

6.3.1 GROWTH IN RESEARCH AND DEVELOPMENT OF IMMUNOASSAYS

6.3.2 EXPANSION OF POINT-OF-CARE IMMUNOASSAY TESTING

6.3.3 INDUSTRY COLLABORATIONS ADVANCING IMMUNOASSAY CAPABILITIES

6.4 CHALLENGES

6.4.1 HIGH COST OF ADVANCED IMMUNOASSAY SYSTEMS AND IMPLEMENTATION

6.4.2 SHORTAGE OF SKILLED WORKFORCE AND TECHNICAL EXPERTISE

7 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 IMMUNOASSAY REAGENTS & KITS

7.2.1 CHEMILUMINESCENCE IMMUNOASSAYS KITS AND REAGENTS

7.2.2 ELISA KITS AND REAGENTS

7.2.3 RAPID TEST KITS AND REAGENTS

7.2.4 IMMUNOHISTOCHEMISTRY ASSAYS KITS AND REAGENTS

7.2.5 BEAD-BASED IMMUNOASSAYS KITS AND REAGENTS

7.2.6 WESTERN BLOT KITS AND REAGENTS

7.2.7 ELISPOT KITS AND REAGENTS

7.2.8 RADIOIMMUNOASSAY KITS AND REAGENTS

7.2.9 MICROARRAY IMMUNOASSAYS KITS AND REAGENTS

7.2.10 MULTIPLEX MICROARRAY ASSAYS KITS AND REAGENTS

7.2.11 OTHER IMMUNOASSAY KITS AND REAGENTS

7.3 IMMUNOASSAY DEVICES

7.3.1 ANALYZERS

7.3.1.1 AUTOMATIC ANALYZERS

7.3.1.1.1 CLOSED-ENDED SYSTEMS

7.3.1.1.1.1 MODULAR

7.3.1.1.1.2 FLOOR-STANDING

7.3.1.1.1.3 BENCH-TOP

7.3.1.1.1.4 OTHERS

7.3.1.1.2 OPEN-ENDED SYSTEMS

7.3.1.1.2.1 BENCH-TOP

7.3.1.1.2.2 FLOOR-STANDING

7.3.1.1.2.3 MODULAR

7.3.1.1.2.4 OTHERS

7.3.1.2 SEMI-AUTOMATIC ANALYZERS

7.3.1.2.1 BENCH-TOP

7.3.1.2.2 FLOOR-STANDING

7.3.1.2.3 MODULAR

7.3.1.2.4 OTHERS

7.3.1.1 RENTAL PURCHASE

7.3.1.2 OUTRIGHT PURCHASE

7.3.1.1 BENCH-TOP

7.3.1.2 FLOOR-STANDING

7.3.1.3 MODULAR

7.3.1.4 OTHERS

7.3.2 ACCESSORIES AND CONSUMABLES

7.3.2.1 THERMAL PRINTER

7.3.2.2 BARCODE SCANNER

7.3.2.3 OTHERS

7.3.3 POCT DEVICES

7.3.3.1 BENCH-TOP

7.3.3.2 HANDHELD

8 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY PLATFORM

8.1 OVERVIEW

8.2 CHEMILUMINESCENCE IMMUNOASSAYS (CLIA)

8.3 ENZYME IMMUNOASSAY (EIA/ELISA)

8.3.1 ENZYME LINKED IMMUNOSORBENT ASSAY (ELISA)

8.3.1.1 THIRD-GENERATION ELISA

8.3.1.2 FOURTH-GENERATION ELISA

8.3.1.3 SECOND-GENERATION ELISA

8.3.1.4 FIRST-GENERATION ELISA

8.3.2 ENZYME LINKED FLUORESCENT IMMUNOASSAY (ELFA)

8.4 FLUORESCENCE IMMUNOASSAYS (FIA)

8.5 CHROMATOGRAPHIC IMMUNOASSAYS

8.6 IMMUNOHISTOCHEMISTRY

8.7 RADIOIMMUNOASSAYS (RIA)

8.8 TURBIDIMETRIC IMMUNOASSAYS

8.9 MICROARRAY IMMUNOASSAYS

8.1 COUNTING IMMUNOASSAYS

8.11 OTHERS

9 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE

9.1 OVERVIEW

9.2 LABORATORY BASED

9.3 POINT OF CARE

10 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY SPECIMEN TYPE

10.1 OVERVIEW

10.2 BLOOD

10.3 URINE

10.4 SALIVA

10.5 OTHERS

11 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 INFECTIOUS DISEASES

11.2.1 IMMUNOASSAY REAGENTS & KITS

11.2.2 IMMUNOASSAY DEVICES

11.3 CANCER BIOMARKERS

11.3.1 CARCINO EMBRYONIC ANTIGEN (CEA)

11.3.1.1 IMMUNOASSAY REAGENTS & KITS

11.3.1.2 IMMUNOASSAY DEVICES

11.3.2 ALPHA-FETOPROTEIN (AFP)

11.3.2.1 IMMUNOASSAY REAGENTS & KITS

11.3.2.2 IMMUNOASSAY DEVICES

11.3.3 CARBOHYDRATE ANTIGEN 19-9 (CA 19-9)

11.3.3.1 IMMUNOASSAY REAGENTS & KITS

11.3.3.2 IMMUNOASSAY DEVICES

11.3.4 CARBOHYDRATE ANTIGEN 125 (CA 125)

11.3.4.1 IMMUNOASSAY REAGENTS & KITS

11.3.4.2 IMMUNOASSAY DEVICES

11.3.5 OTHERS

11.3.5.1 IMMUNOASSAY REAGENTS & KITS

11.3.5.2 IMMUNOASSAY DEVICES

11.4 ENDOCRINOLOGY

11.4.1 IMMUNOASSAY REAGENTS & KITS

11.4.2 IMMUNOASSAY DEVICES

11.5 BONE AND MINERAL DISORDERS

11.5.1 IMMUNOASSAY REAGENTS & KITS

11.5.2 IMMUNOASSAY DEVICES

11.6 CARDIOLOGY

11.6.1 IMMUNOASSAY REAGENTS & KITS

11.6.2 IMMUNOASSAY DEVICES

11.7 HEMATOLOGY AND BLOOD SCREENING

11.7.1 IMMUNOASSAY REAGENTS & KITS

11.7.2 IMMUNOASSAY DEVICES

11.8 AUTOIMMUNE DISORDERS

11.8.1 IMMUNOASSAY REAGENTS & KITS

11.8.2 IMMUNOASSAY DEVICES

11.9 TOXICOLOGY

11.9.1 IMMUNOASSAY REAGENTS & KITS

11.9.2 IMMUNOASSAY DEVICES

11.1 NEONATAL SCREENING

11.10.1 IMMUNOASSAY REAGENTS & KITS

11.10.2 IMMUNOASSAY DEVICES

11.11 ALLERGY DIAGNOSTICS

11.11.1 IMMUNOASSAY REAGENTS & KITS

11.11.2 IMMUNOASSAY DEVICES

11.12 GASTROLOGY

11.12.1 IMMUNOASSAY REAGENTS & KITS

11.12.2 IMMUNOASSAY DEVICES

11.13 OTHERS

11.13.1 IMMUNOASSAY REAGENTS & KITS

11.13.2 IMMUNOASSAY DEVICES

12 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 PUBLIC

12.2.2 PRIVATE

12.2.3 TIER 3

12.2.4 TIER 2

12.2.5 TIER 1

12.3 CLINICAL LABORATORIES

12.4 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

12.5 BLOOD BANKS

12.6 RESEARCH AND ACADEMIC LABORATORIES

12.7 AMBULATORY CARE CENTERS

12.8 NURSING HOMES

12.9 HOME HEALTHCARE AGENCIES

12.1 OTHERS

13 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: CHINA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 F. HOFFMANN-LA ROCHE LTD

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT/NEWS

15.2 SIEMENS

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 ABBOTT

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT/NEWS

15.4 THERMO FISHER SCIENTIFIC INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 QUIDELORTHO CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT/NEWS

15.6 AGILENT TECHNOLOGIES, INC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BD

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT/NEWS

15.8 BIO RAD LABORATORIES INC

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BIO-TECHNE

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 BIOMERIEUX

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 DANAHER CORPORATION

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 DIASORIN

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT/NEWS

15.13 HIPRO BIOTECHNOLOGY CO.LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 QIAGEN

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 REVVITY

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 SD BIOSENSOR, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 SYSMEX CORPORATION

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 TOSOH BIOSCIENCE, INC

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 PENETRATION AND GROWTH PROSPECT MAPPING ANALYSIS

TABLE 2 IMMUNOASSAY REAGENTS COST STRUCTURE BREAKDOWN

TABLE 3 IMMUNOASSAY DEVICES (ANALYZERS)

TABLE 4 OPPORTUNITY MAP ANALYSIS (TECHNOLOGY)

TABLE 5 OPPORTUNITY MAP ANALYSIS (APPLICATION AREA)

TABLE 6 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 CHINA IMMUNOASSAY REAGENTS & KITS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 CHINA IMMUNOASSAY REAGENTS & KITS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 9 CHINA IMMUNOASSAY REAGENTS & KITS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 10 CHINA IMMUNOASSAY DEVICES IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 CHINA ANALYZERS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 CHINA AUTOMATIC ANALYZERS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 CHINA CLOSED-ENDED SYSTEMS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 CHINA CLOSED-ENDED SYSTEMS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 15 CHINA CLOSED-ENDED SYSTEMS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 16 CHINA OPEN-ENDED SYSTEMS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 CHINA OPEN-ENDED SYSTEMS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 18 CHINA OPEN-ENDED SYSTEMS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 19 CHINA SEMI-AUTOMATIC ANALYZERS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 CHINA SEMI-AUTOMATIC ANALYZERS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 21 CHINA SEMI-AUTOMATIC ANALYZERS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 22 CHINA ANALYZERS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY PURCHASE MODE, 2018-2032 (USD THOUSAND)

TABLE 23 CHINA ANALYZERS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 24 CHINA ACCESSORIES AND CONSUMABLES IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 CHINA POCT DEVICES IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY PLATFORM, 2018-2032 (USD THOUSAND)

TABLE 27 CHINA ENZYME IMMUNOASSAY IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 CHINA ENZYME LINKED IMMUNOSORBENT ASSAY (ELISA) IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 30 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 32 CHINA INFECTIOUS DISEASES IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 CHINA CANCER BIOMARKERS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 CHINA CARCINO EMBRYONIC ANTIGEN (CEA) IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 CHINA ALPHA-FETOPROTEIN (AFP) IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 CHINA CARBOHYDRATE ANTIGEN 19-9 (CA 19-9) IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 CHINA CARBOHYDRATE ANTIGEN 125 (CA 125) IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 CHINA OTHERS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 CHINA ENDOCRINOLOGY IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 CHINA BONE AND MINERAL DISORDERS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 CHINA CARDIOLOGY IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 CHINA HEMATOLOGY AND BLOOD SCREENING IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 CHINA AUTOIMMUNE DISORDERS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 CHINA TOXICOLOGY IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 CHINA NEONATAL SCREENING IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 CHINA ALLERGY DIAGNOSTICS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 CHINA GASTROLOGY IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 CHINA OTHERS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 50 CHINA HOSPITALS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 CHINA HOSPITALS IN IMMUNOASSAY REAGENTS AND DEVICES MARKET, BY LEVEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET: SEGMENTATION

FIGURE 2 CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET: DATA TRIANGULATION

FIGURE 3 CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET: DROC ANALYSIS

FIGURE 4 CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET: CHINA VS REGIONAL MARKET ANALYSIS

FIGURE 5 CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET: MULTIVARIATE MODELLING

FIGURE 7 CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET: MARKET END USER COVERAGE GRID

FIGURE 11 CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE THE CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET, BY PRODUCT TYPE (2024)

FIGURE 13 CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET: EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 LINE CHART, BY ISOTOPE (2024)

FIGURE 16 RISING HEALTHCARE INVESTMENTS IN DIAGNOSTIC TECHNOLOGIES IS EXPECTED TO DRIVE THE CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 17 IMMUNOASSAY REAGENTS & KITS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE CHINA IMMUNOASSAY REAGENTS AND DEVICE MARKET IN 2025 & 2032

FIGURE 18 DROC ANALYSIS

FIGURE 19 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY PRODUCT TYPE, 2024

FIGURE 20 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 21 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY PRODUCT TYPE, CAGR (2025- 2032)

FIGURE 22 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 23 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY PLATFORM, 2024

FIGURE 24 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY PLATFORM, 2025 TO 2032 (USD THOUSAND)

FIGURE 25 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY PLATFORM, CAGR (2025- 2032)

FIGURE 26 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY PLATFORM, LIFELINE CURVE

FIGURE 27 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY TYPE, 2024

FIGURE 28 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 29 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY TYPE, CAGR (2025- 2032)

FIGURE 30 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 31 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY SPECIMEN TYPE, 2024

FIGURE 32 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY SPECIMEN TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 33 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY SPECIMEN TYPE, CAGR (2025- 2032)

FIGURE 34 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY SPECIMEN TYPE, LIFELINE CURVE

FIGURE 35 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY APPLICATION, 2024

FIGURE 36 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 37 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY APPLICATION, CAGR (2025- 2032)

FIGURE 38 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 39 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY END USER, 2024

FIGURE 40 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 41 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 42 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 43 CHINA IMMUNOASSAY REAGENTS AND DEVICES MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.