Colombia Apparel And Jeans Market

Market Size in USD Billion

CAGR :

%

USD

9.48 Billion

USD

14.73 Billion

2024

2032

USD

9.48 Billion

USD

14.73 Billion

2024

2032

| 2025 –2032 | |

| USD 9.48 Billion | |

| USD 14.73 Billion | |

|

|

|

Colombia Apparel and Jeans Market Analysis

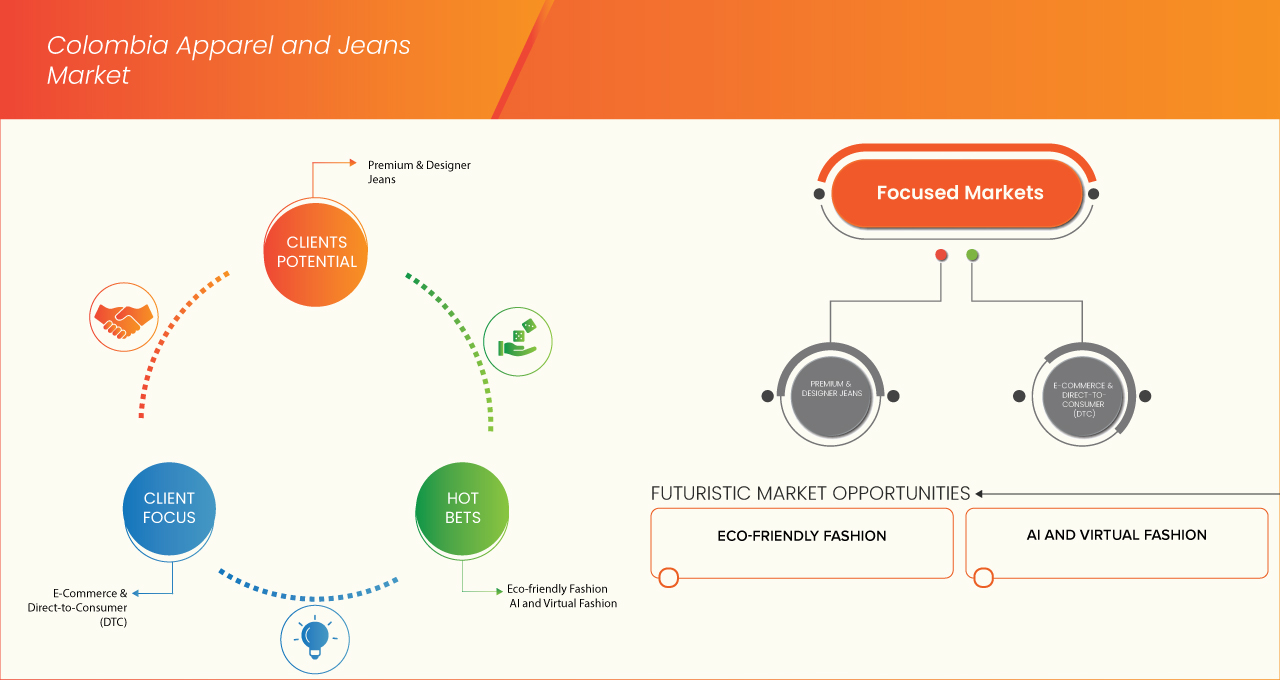

The Colombia apparel and jeans market is experiencing significant growth, fueled by increasing consumer demand for stylish, high-quality, and affordable clothing. The rise of e-commerce platforms has made shopping more accessible, expanding the market reach to urban and rural areas alike. Colombian consumers are increasingly drawn to trendy and durable jeans, with a particular preference for sustainable and eco-friendly options. The market is further driven by advancements in manufacturing technologies, allowing companies to streamline production processes, reduce costs, and improve product quality. In addition, international brands are tapping into Colombia’s growing middle class, further intensifying competition and innovation in the apparel sector. The shift towards sustainable fashion, coupled with rising disposable incomes, is expected to propel the market forward in the coming years.

Colombia Apparel and Jeans Market Size

The Colombia apparel and jeans market size was valued at USD 9.48 billion in 2024 and is projected to reach USD 14.73 billion by 2032, with a CAGR of 5.7% forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Colombia apparel and jeans market Trends

“Increased Focus on Sustainable Fashion"

The Colombian apparel and jeans market is witnessing a significant shift towards sustainability, as consumers and brands alike are prioritizing eco-friendly practices. There is an increasing demand for jeans made from organic cotton, recycled materials, and environmentally friendly production methods. This trend is being driven by rising awareness of environmental issues, particularly the impact of the fashion industry on water usage and waste. Brands are adapting by introducing more sustainable product lines and adopting ethical manufacturing practices, such as fair trade certifications and reducing carbon footprints. The growing consumer preference for sustainable products is prompting companies to invest in green technologies and eco-conscious sourcing to meet this demand. This trend reflects a broader movement within the Colombian market towards environmentally responsible fashion, aiming to reduce the environmental impact while appealing to a more socially-conscious consumer base.

Report Scope and Colombia Apparel and Jeans Market Segmentation

|

Report Metric |

Colombia Apparel and Jeans Market Insights |

|

Segments Covered |

|

|

Key Market Players |

INDITEX (Spain), LEVI STRAUSS & CO. (U.S.), LVMH (France), Nike Inc. (U.S.), DECATHLON UK LIMITED (France), Adidas Colombia Ltda.(adidas) (Germany), PVH Corp. (U.S.), CHRISTIAN DIOR SE (France), SHEIN (Singapore), and HANESBRANDS INC. (U.S.). among others |

|

Market Opportunities |

|

|

Value Added Data |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Colombia Apparel and Jeans Market Definition

Apparel and Jeans refer to clothing and garments designed for various purposes, with jeans being a specific category of durable, casual wear made primarily from denim fabric. Apparel includes a broad range of clothing items such as shirts, dresses, jackets, and activewear, catering to different occasions, styles, and climates. Jeans, originally designed as workwear, have evolved into a fashion staple available in various fits, washes, and designs. Both apparel and jeans are influenced by trends, cultural shifts, and technological advancements in textiles, making them essential components of the global fashion industry.

Colombia Apparel and Jeans Market Dynamics

Drivers

- Increasing Demand for Fashion-Forward, Sustainable Apparel and Jeans

The increasing demand for fashion-forward, sustainable apparel and jeans is transforming the Colombia apparel market. Consumers, particularly millennials and Gen Z, are seeking stylish, versatile clothing that aligns with global fashion trends. Social media, influencers, and e-commerce platforms play a pivotal role in shaping these preferences, as they provide exposure to the latest styles and enable easy access to trendy products. Colombian brands are capitalizing on this shift by offering modern, fashion-driven jeans that cater to both casual and semi-formal occasions, reflecting a blend of comfort and style that resonates with contemporary consumers.

Simultaneously, sustainability is becoming a critical factor influencing purchasing decisions. With growing environmental awareness, consumers are favoring brands that prioritize eco-friendly production methods, such as the use of organic or recycled materials, reduced water usage, and ethical labor practices. This trend has encouraged Colombian apparel manufacturers to adopt more sustainable practices, enabling them to attract environmentally conscious buyers while staying competitive in the global market. The dual focus on fashion-forward designs and sustainability not only meets evolving consumer expectations but also drives innovation and growth in the Colombian apparel and jeans industry.

For Instance,

- In February 2022, according to the article published by Fashion United, At MAGIC 2022, Colombia highlighted its sustainable and fashion-forward apparel, showcasing innovative designs and eco-friendly practices. Ten Colombian companies presented high-value products like jeans, swimwear, and jewelry to global buyers, reinforcing Colombia’s reputation as a reliable fashion supplier. Participation in such global platforms boosts the country's appeal to eco-conscious consumers and retailers, promoting sustainable sourcing and ethical production. This aligns with the increasing demand for sustainable and stylish apparel, helping to position Colombia as a key player in the global fashion market.

Rising Disposable Income and Changing Lifestyle Trends

Rising disposable income and shifting lifestyle trends are significantly influencing the Colombian apparel and jeans market. As consumers in Colombia experience higher disposable incomes, there is an increased demand for premium and fashion-forward apparel, including high-quality denim products. This economic growth allows consumers to prioritize fashion choices that align with their evolving preferences, with many opting for trendy, stylish, and durable jeans over basic, lower-priced alternatives. This trend is also fueled by the growing influence of social media, where younger generations seek to showcase their style, leading to a rise in demand for fashion brands that offer a balance of quality and innovation.

Alongside this, changing lifestyle trends, including a greater focus on comfort, versatility, and sustainability, are reshaping the apparel market. Consumers are increasingly looking for jeans that can be worn in a variety of settings, from casual outings to semi-formal occasions. The demand for eco-friendly and sustainable fashion options is also on the rise, driven by growing awareness of environmental issues and the desire to make more responsible purchasing decisions. As a result, Colombian denim brands that prioritize comfort, sustainability, and trend-conscious designs are well-positioned to capitalize on these shifts in consumer behavior.

For Instance,

- In October 2024, according to an article published by Fashion Dive, Columbia Sportswear has unveiled its "Accelerate" strategy to attract younger, more active consumers by updating its product offerings, marketing approach, and boosting its brand presence, especially in the U.S. Despite a 5% drop in net sales for Q3, the company remains optimistic about future growth, expecting visible changes by 2025. This strategic shift aligns with rising disposable incomes and evolving lifestyle trends, as consumers increasingly favor versatile, outdoor-inspired apparel. Columbia's focus on activewear caters to the growing demand for eco-conscious, durable fashion, positioning the brand to capitalize on the expanding Colombian apparel and jeans market.

Opportunities

- Customizable Apparel Offerings Help Brands Stand Out in the Competitive Market

Offerings of customizable clothing provide firms a big chance in Colombia's cutthroat industry. Brands may provide individualized experiences that encourage loyalty and repeat business by customizing items to each customer's preferences. Customization increases a brand's attractiveness by differentiating it from rivals selling mass-produced goods. Additionally, by targeting niche markets, this strategy enables companies to meet the specific needs of their clientele. Customized goods can also be promoted as high-end products, which raises their perceived worth. By using this tactic, brands can improve their market standing and cultivate enduring relationships with consumers.

For Instance,

- In April 2024, according to the article published by Elle, Silvia Tcherassi launched her third bridal capsule collection featuring 16 pieces that blended Victorian and avant-garde styles. The collection was available online and in-store at her boutique in Miami and Colombia. The designs incorporated florals, pearls, and modern minimalist silhouettes. This launch reinforced Tcherassi's long-standing reputation in bridal fashion, benefiting her brand by attracting attention from bridal shoppers looking for elegant and unique designs. The collection’s popularity bolstered the visibility of Tcherassi's brand, especially within the luxury bridal market.

Government Incentives and Support Enhance Local Apparel Industry Development and Growth

The Colombian government has introduced initiatives to support the growth of its domestic apparel sector, offering tax incentives and other benefits to manufacturers. These incentives are particularly important for small and medium-sized enterprises looking to scale and expand. The support helps reduce operational costs, encourages innovation, and increases competitiveness within the region. Government backing also promotes sustainable production practices and job creation within the apparel sector, driving growth and positioning Colombia as a key player in the Latin American fashion industry.

For Instance,

In December 2012, according to an article published by fibre2fashion, the Colombian apparel sector praised the government’s new policy measures aimed at boosting the textile industry. These included raising tariffs on imports, creating a task force to tackle illegal apparel imports, and launching the Buy Colombian Program. The sector hoped these efforts would improve performance, create jobs, and protect local businesses. However, the measures did not address technological upgrades for manufacturers. These policies were expected to level the playing field for domestic businesses, especially against competitors like China.

Restraints/Challenges

- Economic Fluctuations Impacting Production Costs and Consumer’s Spending Patterns

The economy's swings, which affect both production costs and consumer purchasing habits, present serious obstacles for Colombia's clothing and denim industry. Inflation, currency depreciation, and interest rate swings are examples of economic instability that can raise the price of labor, energy, and raw materials. This puts pressure on regional producers, who can find it difficult to stay profitable in the face of growing production costs. Economic downturns also frequently result in fewer consumer purchasing power, which leads to a move toward lesser-quality, less expensive alternatives. For instance, the cost of imported fabrics and components may rise due to the devaluation of the Colombian peso, while the cost of domestic manufacture may rise due to inflation. Brands must therefore carefully handle these difficulties by modifying their pricing plans, looking into economical manufacturing options, and

For Instance,

- In March 2023, according to an article published by Textile Today, Colombia removed import tariffs on 165 goods, including textiles, to combat inflation and reduce production costs. The decision aimed to lower consumer prices and support the economy. This opportunity to boost textile exports to Colombia. From April 2021 to March 2022, Colombia imported significant amounts of textiles, showcasing potential market growth. The move benefits businesses by reducing costs, enhancing trade opportunities, and supporting local industry through increased exports and domestic production growth.

Increasing Sustainability Regulations and Environmental Standards Add Complexity to Colombia's Market

Sustainability regulations and environmental standards pose significant challenges for Colombia's apparel and jeans manufacturers. These require companies to adopt eco-friendly practices, reduce chemical usage, and incorporate sustainable materials, often leading to increased production costs. Smaller manufacturers, in particular, face difficulties due to the limited financial and technical resources needed to implement such changes. Compliance with these standards is critical for maintaining export opportunities, as international buyers increasingly demand sustainable products. However, the transition can disrupt existing operations, requiring significant investment and adaptation across the industry.

For Instance,

- In July 2024, according to an article published by Anthesis Group Ltd, the European Union introduced the Ecodesign for Sustainable Products Regulation (ESPR), targeting apparel brands to adopt sustainability standards. The regulation required companies to create durable, repairable, and recyclable products, with transparency on environmental impacts through Digital Product Passports. Brands that complied could improve their reputation and trust with consumers, but the transition presented challenges like increased operational costs and the need for new technologies. Manufacturers faced pressure to manage supply chains effectively and reduce waste. Despite challenges, the regulation encouraged innovation in sustainable fashion and opened new market opportunities

Colombia Apparel and Jeans Market Scope

The Colombia apparel and jeans market is segmented six notable segments on the basis of offering, tax type, deployment mode, organization size, revenue model, and industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Category

- Top Wear

- Tops

- T-Shirts

- Tank Tops

- Polo Shirts

- Blouses

- Crop Tops

- Henley Shirts

- Tunics

- Kaftans

- Kurtas

- Sherwanis

- Others

- Shirts

- Short Sleeve Shirt

- Dress Shirt

- Linen Shirt

- Striped Pattern Shirt

- Oxford Button-Down Shirt

- Cuban Collar Shirt

- Flannel Shirt

- Mandarin Collar Shirt

- Others

- Tops

- Sweater And Knits

- Sweaters

- Full Arm

- Half Arm

- Cardigans

- Pullovers

- Turtlenecks

- Vests

- Sweaters

- Outerwear

- Jackets

- Full Arm

- Half Arm

- Hoddies

- Sweatshirts

- Coats

- Blazers

- Others

- Jackets

- Bottom Wear

- Jeans

- Jeans, By Style

- Skinny Jeans

- Straight-Leg Jeans

- Tapered Jeans

- Boot Cut Jeans

- Flare Jeans

- Baggy Jeans

- Mom Jeans

- Boyfriend Jeans

- Girlfriend Jeans

- Stovepipe Jeans

- Cigarette Jeans

- Kick Flare Jeans

- Bell Bottom Jeans

- Brancusi Jeans

- Jeans Overalls

- Jogger Jeans

- Jeans, By Body Type

- Apple Shape

- Pear Shape

- Hourglass Shape

- Rectangle Shape

- Jeans, By Fit

- Relaxed Fit

- Slim Fit

- Classic Fit (Regular)

- Straight Fit

- Loose Fit

- Cargo Fit

- Trouser Fit

- Jeans, By Category

- Stretch

- Non-Stretch

- Jeans, By Waist Level

- Midrise Jeans

- High Waist Jeans

- Regular Rise

- Lowrise Jeans

- Brazilian Low Rise / Ultra Low Rise

- Jeans, By Length

- Ankle Length Jeans

- Cropped Jeans (Crops)

- Capri

- Skimmer

- Retro Jeans

- Gaucho

- Jeans, By Embellishments

- Ripped Jeans

- Distressed Jeans

- Sand Blasted Jeans

- Whisker Washed Jeans

- Tinted / Colored Jeans

- Frayed Jeans

- Carpenter Jeans

- Corded Jeans

- Lace-Up Jeans

- Pintuck Jeans

- Skimmer

- Cropped Jeans (Crops)

- Gaucho

- Jeans, By Color

- Medium Wash Denim

- Dark Wash Denim

- Light Wash Denim

- Black Denim

- Gray Denim

- White Denim

- Others

- Jeans, By Price

- Luxury / Designer

- Premium

- Mid-Range

- Budget

- Jeans, By Material/Fabric

- Organic Cotton

- Recycled Fabrics

- Blended Materials

- Jeans, By Style

- Pants/Trousers

- Shorts

- Leggings

- Chinos

- Joggers

- Track Pants

- Cargo Pants

- Sweat Pants

- Bermuda Shorts

- Skirts

- Mini

- Midi

- Maxi

- Capris

- Boxer Shorts

- Lounge Pants

- Jeggings

- Others

- Jeans

- Accessories

- Caps And Hats

- Headbands

- Head Tie / Scarves

- Scarves And Shawls

- Gloves

- Socks

Product Type

- Casual Wear

- Sports Wear

- Formal Wear

- Party Wear

- Ethnic Wear

- Night Wear

- Gym Wear

- Occasionally Wear

- Others

Nature

- Traditional Wear

- Modern Wear

Fabric

- Cotton

- Polyester

- Denim

- Linen

- Wool

- Nylon

- Leather & Suede

- Velvet

- Tweed

- Chiffon

- Georgette

- Taffeta

- Fleece

- Other

Fabrics Type

- Wovens

- Non-Wovens

Distribution Channel

- Offline

- Shopping Malls

- Depatmenatl Store

- Brand Outlets

- Multibrand Fashion Stores

- Supermarket/Hypermarket

- Specialty Store

- Discounted Stores

- Convenience Stores

- High Street Chain Stores

- Boutiques

- Designer Boutiques

- High End Fashion Boutiques

- Sport Clothing Stores

- Kids Clothing Stores

- Wedding Dresses Clothing

- Lingerie Store

- Travel Clothing Store

- Maternity Stores

- Others

- Online

- 3rd Party Company Website

- Company Own Website

End-User

- Women

- Women, By Category

- Top Wear

- Bottom Wear

- Accessories

- Women, By Age

- Adult (Up To 50)

- Seniors (After 50)

- Women, By Category

- Men

- Men, By Category

- Top Wear

- Bottom Wear

- Accessories

- Men, By Age

- Adult (Up To 50)

- Seniors (After 50)

- Men, By Category

- Children

- Children, By Category

- Top Wear

- Bottom Wear

- Accessories

- Children, By Category

Colombia Apparel and Jeans Market Share

Apparel and jeans market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Colombia apparel and jeans market .

Colombia Apparel and Jeans Market Leaders Operating in the Market are:

- INDITEX (Spain),

- LEVI STRAUSS & CO. (U.S.)

- LVMH (France)

- Nike Inc. (U.S.)

- DECATHLON UK LIMITED (France)

- Adidas Colombia Ltda.(adidas) (Germany)

- PVH Corp (U.S.)

- CHRISTIAN DIOR SE (France)

- SHEIN (Singapore)

- HANESBRANDS INC. (U.S.)

Latest Developments in Colombia Apparel and Jeans Market

- In December 2024, Levi’s is enhancing its premium presence in Canada by collaborating with HAVEN, a luxury menswear retailer, to introduce exclusive denim collections in Vancouver and Toronto. This strategic partnership boosts Levi’s® brand visibility, caters to the rising demand for high-quality denim, and strengthens its positioning in the premium apparel and jeans market by blending heritage craftsmanship with modern fashion trends

- In September 2024, Levi’s has introduced the "REIIMAGINE" campaign featuring Beyoncé, modernizing its classic ads to merge tradition with contemporary culture. This collaboration elevates Levi’s® brand prestige, strengthens its presence in the women’s denim market, and boosts global recognition through a partnership with a cultural icon, reinforcing its position as a top denim lifestyle brand

- In January 2025, LVMH’s acquisition of Kapital strengthens its position in high-end denim by incorporating the brand’s artisanal craftsmanship and Americana-inspired aesthetic. This move expands LVMH’s reach into niche fashion communities, enhances its credibility in heritage denim, and aligns with the growing demand for authenticity in luxury apparel. However, concerns remain about maintaining Kapital’s independent identity and craftsmanship under corporate ownership

- In January 2025, Nike has introduced the 24.7 Apparel Collection, a fusion of sport and lifestyle wear, launching online on January 25 and in stores on January 30. This move strengthens Nike’s foothold in the athleisure market by incorporating innovative fabrics like ImpossiblySoft and PerfectStretch. The collection enhances customer engagement, appeals to lifestyle-conscious consumers, and drives growth in both activewear and casual wear segments, reinforcing Nike’s brand presence in the evolving apparel industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF COLOMBIA APPAREL AND JEANS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MARKET END USER COVERAGE GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MULTIVARIATE MODELING

2.1 CATEGORY TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’E FIVE FORCES

4.2 CONSUMER BUYING BEHAVIOUR

4.3 FACTORS AFFECTING BUYING DECISION

4.4 PRODUCT ADOPTION SCENARIO

4.5 RAW MATERIAL SOURCING ANALYSIS

4.6 IMPORT EXPORT SCENARIO

4.7 PRODUCTION CAPACITY OUTLOOK

4.8 PRICING ANALYSIS

4.9 BRAND OUTLOOK

4.9.1 PRODUCT VS BRAND OVERVIEW

4.1 IMPACT OF ECONOMIC SLOWDOWN

4.10.1 IMPACT ON PRICES

4.10.2 IMPACT ON SUPPLY CHAIN

4.10.3 IMPACT ON SHIPMENT (COLOMBIA FASHION SA TRADE DATA ANALYSIS)

4.10.4 IMPACT ON DEMAND

4.10.5 IMPACT ON STRATEGIC DECISIONS

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 LOGISTIC COST SCENARIO

4.11.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR FASHION-FORWARD, SUSTAINABLE APPAREL AND JEANS

6.1.2 RISING DISPOSABLE INCOME AND CHANGING LIFESTYLE TRENDS

6.1.3 GROWTH OF ONLINE RETAIL CHANNELS AND E-COMMERCE PLATFORMS

6.1.4 STRONG INFLUENCE OF SOCIAL MEDIA AND INFLUENCER MARKETING ON FASHION TRENDS

6.2 RESTRAINT

6.2.1 FLUCTUATIONS IN RAW MATERIAL COSTS AFFECTING PRICING STABILITY

6.2.2 INTENSE COMPETITION FROM INTERNATIONAL BRANDS AND LOW-COST IMPORTS

6.3 OPPORTUNITIES

6.3.1 CUSTOMIZABLE APPAREL OFFERINGS HELP BRANDS STAND OUT IN THE COMPETITIVE MARKET

6.3.2 STRATEGIC PARTNERSHIPS WITH GLOBAL BRANDS EXPAND MARKET REACH AND GROWTH POTENTIAL

6.3.3 GOVERNMENT INCENTIVES AND SUPPORT ENHANCE LOCAL APPAREL INDUSTRY DEVELOPMENT AND GROWTH

6.4 CHALLENGES

6.4.1 ECONOMIC FLUCTUATIONS IMPACTING PRODUCTION COSTS AND CONSUMER’S SPENDING PATTERNS

6.4.2 INCREASING SUSTAINABILITY REGULATIONS AND ENVIRONMENTAL STANDARDS ADD COMPLEXITY TO COLOMBIA'S MARKET

7 COLOMBIA APPAREL AND JEANS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CASUAL WEAR

7.3 SPORTS WEAR

7.4 FORMAL WEAR

7.5 PARTY WEAR

7.6 ETHNIC WEAR

7.7 NIGHT WEAR

7.8 GYM WEAR

7.9 OCCASIONALLY WEAR

7.1 OTHERS

8 COLOMBIA APPAREL AND JEANS MARKET, BY NATURE TYPE

8.1 OVERVIEW

8.2 MODERN WEAR

8.3 TRADITIONAL WEAR

9 COLOMBIA APPAREL AND JEANS MARKET, BY FABRIC

9.1 OVERVIEW

9.2 COTTON

9.3 POLYESTER

9.4 DENIM

9.5 LINEN

9.6 WOOL

9.7 NYLON

9.8 LEATHER & SUEDE

9.9 VELVET

9.1 TWEED

9.11 CHIFFON

9.12 GEORGETTE

9.13 TAFFETA

9.14 FLEECE

9.15 OTHER

10 COLOMBIA APPAREL AND JEANS MARKET, BY FABRIC TYPE

10.1 OVERVIEW

10.2 WOVENS

10.3 NON-WOVENS

11 COLOMBIA APPAREL AND JEANS MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 TOP WEAR

11.2.1 TOPS

11.2.1.1 T-SHIRTS

11.2.1.2 TANK TOPS

11.2.1.3 POLO SHIRTS

11.2.1.4 BLOUSES

11.2.1.5 CROP TOPS

11.2.1.6 HENLEY SHIRTS

11.2.1.7 TUNICS

11.2.1.8 KAFTANS

11.2.1.9 KURTAS

11.2.1.10 SHERWANIS

11.2.1.11 OTHERS

11.2.2 SHIRTS

11.2.2.1 SHORT SLEEVE SHIRT

11.2.2.2 DRESS SHIRT

11.2.2.3 LINEN SHIRT

11.2.2.4 STRIPED PATTERN SHIRT

11.2.2.5 OXFORD BUTTON-DOWN SHIRT

11.2.2.6 CUBAN COLLAR SHIRT

11.2.2.7 FLANNEL SHIRT

11.2.2.8 MANDARIN COLLAR SHIRT

11.2.2.9 OTHERS

11.2.3 SWEATER AND KNITS

11.2.3.1 SWEATERS

11.2.3.1.1 FULL ARM

11.2.3.1.2 HALF ARM

11.2.3.2 CARDIGANS

11.2.3.3 PULLOVERS

11.2.3.4 TURTLENECKS

11.2.3.5 VESTS

11.2.4 OUTERWEAR

11.2.4.1 JACKETS

11.2.4.1.1 FULL ARM

11.2.4.1.2 HALF ARM

11.2.4.2 HOODIES

11.2.4.3 SWEATSHIRTS

11.2.4.4 COATS

11.2.4.5 BLAZERS

11.2.4.6 OTHERS

11.3 BOTTOM WEAR

11.3.1 JEANS

11.3.1.1 STRAIGHT-LEG JEANS

11.3.1.2 SKINNY JEANS

11.3.1.3 TAPERED JEANS

11.3.1.4 BOOT CUT JEANS

11.3.1.5 FLARE JEANS

11.3.1.6 BAGGY JEANS

11.3.1.7 MOM JEANS

11.3.1.8 BOYFRIEND JEANS

11.3.1.9 GIRLFRIEND JEANS

11.3.1.10 STOVEPIPE JEANS

11.3.1.11 CIGARETTE JEANS

11.3.1.12 KICK FLARE JEANS

11.3.1.13 BELL BOTTOM JEANS

11.3.1.14 BRANCUSI JEANS

11.3.1.15 JEANS OVERALLS

11.3.1.16 JOGGER JEANS

11.3.1.16.1 BODY TYPE

11.3.1.16.1.1 PEAR SHAPE

11.3.1.16.1.2 APPLE SHAPE

11.3.1.16.1.3 HOURGLASS SHAPE

11.3.1.16.1.4 RECTANGLE SHAPE

11.3.1.16.2 BY FIT

11.3.1.16.2.1 RELAXED FIT

11.3.1.16.2.2 SLIM FIT

11.3.1.16.2.3 CLASSIC FIT (REGULAR)

11.3.1.16.2.4 STRAIGHT FIT

11.3.1.16.2.5 LOOSE FIT

11.3.1.16.2.6 CARGO FIT

11.3.1.16.2.7 TROUSER FIT

11.3.1.16.3 BY CATEGORY

11.3.1.16.3.1 STRETCH

11.3.1.16.3.2 NON-STRETCH

11.3.1.16.4 BY WAIST LEVEL

11.3.1.16.4.1 MIDRISE JEANS

11.3.1.16.4.2 HIGH WAIST JEANS

11.3.1.16.4.3 REGULAR RISE

11.3.1.16.4.4 LOWRISE JEANS

11.3.1.16.4.5 BRAZILIAN LOW RISE / ULTRA LOW RISE

11.3.1.16.5 BY LENGTH

11.3.1.16.5.1 ANKLE LENGTH JEANS

11.3.1.16.5.2 CROPPED JEANS (CROPS)

11.3.1.16.5.3 CAPRI

11.3.1.16.5.4 SKIMMER

11.3.1.16.5.5 RETRO JEANS

11.3.1.16.5.6 GAUCHO

11.3.1.16.6 BY EMBELLISHMENTS

11.3.1.16.6.1 RIPPED JEANS

11.3.1.16.6.2 DISTRESSED JEANS

11.3.1.16.6.3 SAND BLASTED JEANS

11.3.1.16.6.4 WHISKER WASHED JEANS

11.3.1.16.6.5 TINTED / COLORED JEANS

11.3.1.16.6.6 FRAYED JEANS

11.3.1.16.6.7 CARPENTER JEANS

11.3.1.16.6.8 CORDED JEANS

11.3.1.16.6.9 LACE-UP JEANS

11.3.1.16.6.10 PINTUCK JEANS

11.3.1.16.6.11 SKIMMER

11.3.1.16.6.12 CROPPED JEANS (CROPS)

11.3.1.16.6.13 GAUCHO

11.3.1.16.7 BY COLOR

11.3.1.16.7.1 MEDIUM WASH DENIM

11.3.1.16.7.2 DARK WASH DENIM

11.3.1.16.7.3 LIGHT WASH DENIM

11.3.1.16.7.4 BLACK DENIM

11.3.1.16.7.5 GRAY DENIM

11.3.1.16.7.6 WHITE DENIM

11.3.1.16.7.7 OTHERS

11.3.1.16.8 BY PRICE

11.3.1.16.8.1 MID-RANGE

11.3.1.16.8.2 PREMIUM

11.3.1.16.8.3 BUDGET

11.3.1.16.8.4 LUXURY / DESIGNER

11.3.1.16.9 BY MATERIAL/FABRIC

11.3.1.16.9.1 BLENDED MATERIALS

11.3.1.16.9.2 ORGANIC COTTON

11.3.1.16.9.3 RECYCLED FABRICS

11.3.2 PANTS/TROUSERS

11.3.3 SHORTS

11.3.4 LEGGINGS

11.3.5 CHINOS

11.3.6 JOGGERS

11.3.7 TRACK PANTS

11.3.8 CARGO PANTS

11.3.9 SWEAT PANTS

11.3.10 BERMUDA SHORTS

11.3.11 SKIRTS

11.3.11.1 MIDI

11.3.11.2 MAXI

11.3.11.3 MINI

11.3.12 CAPRIS

11.3.13 BOXER SHORTS

11.3.14 LOUNGE PANTS

11.3.15 JEGGINGS

11.3.16 OTHERS

11.4 ACCESSORIES

11.4.1 CAPS AND HATS

11.4.2 SCARVES AND SHAWLS

11.4.3 HEADBANDS

11.4.4 SOCKS

11.4.5 HEAD TIE / SCARVES

11.4.6 GLOVES

12 COLOMBIA APPAREL AND JEANS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 OFFLINE

12.2.1 OFFLINE, BY TYPE

12.2.1.1 SHOPPING MALLS

12.2.1.2 DEPARTMENTAL STORE

12.2.1.3 BRAND OUTLETS

12.2.1.4 MULTIBRAND FASHION STORES

12.2.1.5 SUPERMARKET/HYPERMARKET

12.2.1.6 SPECIALTY STORE

12.2.1.7 DISCOUNTED STORES

12.2.1.8 CONVENIENCE STORES

12.2.1.9 HIGH STREET CHAIN STORES

12.2.1.10 BOUTIQUES

12.2.1.10.1 BOUTIQUES, BY TYPE

12.2.1.10.1.1 DESIGNER BOUTIQUES

12.2.1.10.1.2 HIGH END FASHION BOUTIQUES

12.2.1.11 SPORT CLOTHING STORES

12.2.1.12 KIDS CLOTHING STORES

12.2.1.13 WEDDING DRESSES CLOTHING

12.2.1.14 LINGERIE STORE

12.2.1.15 TRAVEL CLOTHING STORE

12.2.1.16 MATERNITY STORES

12.2.1.17 OTHERS

12.3 ONLINE

12.3.1 ONLINE, BY TYPE

12.3.1.1 3RD PARTY COMPANY WEBSITE

12.3.1.2 COMPANY OWN WEBSITE

13 COLOMBIA APPAREL AND JEANS MARKET, BY END USER

13.1 OVERVIEW

13.2 WOMEN

13.2.1 TOP WEAR

13.2.2 BOTTOM WEAR

13.2.3 ACCESSORIES

13.2.3.1 ADULTS (UPTO 50)

13.2.3.2 SENIORS (AFTER 50)

13.3 MEN

13.3.1 TOP WEAR

13.3.2 BOTTOM WEAR

13.3.3 ACCESSORIES

13.3.3.1 ADULTS (UPTO 50)

13.3.3.2 SENIORS (AFTER 50)

13.4 CHILDREN

13.4.1 TOP WEAR

13.4.2 BOTTOM WEAR

13.4.3 ACCESSORIES

14 COLOMBIA APPAREL AND JEANS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: COLOMBIA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 INDITEX

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 LEVI STRAUSS & CO.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 LVMH

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 NIKE INC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 DECATHLON UK LIMITED

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 ADIDAS

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 CHRISTIAN DIOR SE

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 HANESBRANDS INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 PVH CORP

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 SHEIN

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

1.1.4. RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 COLOMBIA IMPORTS FROM INDIA OF COTTON AND FABRICS

TABLE 2 COLOMBIA'S TOP 10 TEXTILES EXPORTS BY COUNTRIES

TABLE 3 COLOMBIA'S TOP 10 TEXTILES IMPORTS BY COUNTRIES

TABLE 4 TOP 5 COMPANIES PRICING ANALYSIS

TABLE 5 TOP EXPORT COMPETITORS

TABLE 6 TOP EXPORT BUYERS

TABLE 7 REGULATORY REQUIREMENTS IN COLOMBIA

TABLE 8 COLOMBIA APPAREL AND JEANS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 COLOMBIA APPAREL AND JEANS MARKET, BY NATURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 COLOMBIA APPAREL AND JEAN MARKET, BY FABRIC, 2018-2032 (USD THOUSAND)

TABLE 11 COLOMBIA APPAREL AND JEANS MARKET, BY FABRIC TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 COLOMBIA APPAREL AND JEANS MARKET, BY CATEGORY 2018-2032 (USD THOUSAND)

TABLE 13 COLOMBIA TOP WEAR IN APPAREL AND JEANS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 COLOMBIA TOPS IN APPAREL AND JEANS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 COLOMBIA SHIRTS IN APPAREL AND JEANS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 COLOMBIA SWEATER AND KNITS IN APPAREL AND JEANS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 COLOMBIA SWEATER IN APPAREL AND JEANS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 COLOMBIA OUTERWEAR IN APPAREL AND JEANS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 COLOMBIA JACKETS IN APPAREL AND JEANS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 COLOMBIA BOTTOM WEAR IN APPAREL AND JEANS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 COLOMBIA JEANS IN APPAREL AND JEANS MARKET, BY STYLE, 2018-2032 (USD THOUSAND)

TABLE 22 COLOMBIA JEANS IN APPAREL AND JEANS MARKET, BY BODY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 COLOMBIA JEANS IN APPAREL AND JEANS MARKET, BY FIT, 2018-2032 (USD THOUSAND)

TABLE 24 COLOMBIA JEANS IN APPAREL AND JEANS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 25 COLOMBIA JEANS IN APPAREL AND JEANS MARKET, BY WAIST LEVEL, 2018-2032 (USD THOUSAND)

TABLE 26 COLOMBIA JEANS IN APPAREL AND JEANS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 27 COLOMBIA JEANS IN APPAREL AND JEANS MARKET, BY EMBELLISHMENTS, 2018-2032 (USD THOUSAND)

TABLE 28 COLOMBIA JEANS IN APPAREL AND JEANS MARKET, BY COLOR, 2018-2032 (USD THOUSAND)

TABLE 29 COLOMBIA JEANS IN APPAREL AND JEANS MARKET, BY PRICE, 2018-2032 (USD THOUSAND)

TABLE 30 COLOMBIA JEANS IN APPAREL AND JEANS MARKET, BY MATERIAL/FABRIC, 2018-2032 (USD THOUSAND)

TABLE 31 COLOMBIA SKIRTS IN APPAREL AND JEANS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 COLOMBIA ACCESSORIES IN APPAREL AND JEANS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 COLOMBIA APPAREL AND JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 34 COLOMBIA OFFLINE APPAREL AND JEANS MARKET, BY TYPE 2018-2032 (USD THOUSAND)

TABLE 35 COLOMBIA OFFLINE APPAREL AND JEANS MARKET, BY TYPE 2018-2032 (USD THOUSAND)

TABLE 36 COLOMBIA ONLINE APPAREL AND JEANS MARKET, BY TYPE 2018-2032 (USD THOUSAND)

TABLE 37 COLOMBIA APPAREL AND JEANS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 38 COLOMBIA WOMEN IN APPAREL AND JEANS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 39 COLOMBIA WOMEN IN APPAREL AND JEANS MARKET, BY AGE, 2018-2032 (USD THOUSAND)

TABLE 40 COLOMBIA MEN IN APPAREL AND JEANS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 41 COLOMBIA MEN IN APPAREL AND JEANS MARKET, BY AGE, 2018-2032 (USD THOUSAND)

TABLE 42 COLOMBIA CHILDREN IN APPAREL AND JEANS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 COLOMBIA APPAREL AND JEANS MARKET: SEGMENTATION

FIGURE 2 COLOMBIA APPAREL AND JEANS MARKET: DATA TRIANGULATION

FIGURE 3 COLOMBIA APPAREL AND JEANS MARKET: DROC ANALYSIS

FIGURE 4 COLOMBIA APPAREL AND JEANS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 COLOMBIA APPAREL AND JEANS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 COLOMBIA APPAREL AND JEANS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 COLOMBIA APPAREL AND JEANS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 COLOMBIA APPAREL AND JEANS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 COLOMBIA APPAREL AND JEANS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 COLOMBIA APPAREL AND JEANS MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE COLOMBIA APPAREL AND JEANS MARKET, BY CATEGORY (2024)

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING DISPOSABLE INCOME AND CHANGING LIFESTYLE TRENDS IS EXPECTED TO DRIVE THE COLOMBIA APPAREL AND JEANS MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 15 CATEGORY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE COLOMBIA APPAREL AND JEANS MARKET IN 2025 & 2032

FIGURE 16 CONSUMER CLOTHING PURCHASE FEATURES

FIGURE 17 SUSTAINABILITY CLOTHING

FIGURE 18 COLOMBIA CONSUMER BUYING PATTERN

FIGURE 19 FASHION REVENUE BY APP 2023 ( USD BN)

FIGURE 20 COLOMBIA IMPORTS FROM INDIAN COTTON

FIGURE 21 BRAND COMPARATIVE ANALYSIS

FIGURE 22 COLOMBIA ANNUAL CONSUMER PRICE INFLATION

FIGURE 23 FASHION SPENDING IN THE LOCAL MARKET

FIGURE 24 EXPORTS IN THE TEXTILES AND APPAREL INDUSTRY

FIGURE 25 SUPPLY CHAIN OF APPAREL AND JEANS

FIGURE 26 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE COLOMBIA APPAREL AND JEANS MARKET

FIGURE 27 GROWTH IN COLOMBIAN FASHION EXPORTS ACROSS KEY SUB-SECTORS IN 2021

FIGURE 28 APPAREL SPENDING OUTLOOK: 2013 VS. PROJECTED SPENDING IN 2020

FIGURE 29 SOCIAL NETWORK USERS BY COUNTRY IN JANUARY 2024

FIGURE 30 TEXTILE FIBRE PRICES

FIGURE 31 DENIM FABRICS EXPORTS TO THE TOP 5 DESTINATIONS FROM INDIA IN THE YEAR 2022

FIGURE 32 COLOMBIA APPAREL AND JEANS MARKET, BY PRODUCT TYPE, 2024

FIGURE 33 COLOMBIA APPAREL AND JEANS MARKET: BY NATURE TYPE, 2024

FIGURE 34 COLOMBIA APPAREL AND JEAN MARKET: BY FABRIC, 2024

FIGURE 35 COLOMBIA APPAREL AND JEANS MARKET: BY FABRIC TYPE, 2024

FIGURE 36 COLOMBIA APPAREL AND JEANS MARKET: BY CATEGORY, 2024

FIGURE 37 COLOMBIA APPAREL AND JEANS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 38 COLOMBIA APPAREL AND JEANS MARKET: BY END USER, 2024

FIGURE 39 COLOMBIA APPAREL AND JEANS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.