Dominican Republic Anesthesia Market

Market Size in USD Million

CAGR :

%

USD

91.16 Million

USD

133.98 Million

2024

2032

USD

91.16 Million

USD

133.98 Million

2024

2032

| 2025 –2032 | |

| USD 91.16 Million | |

| USD 133.98 Million | |

|

|

|

|

Dominican Republic Anesthesia Market Size

- The Dominican Republic anesthesia market size was valued at USD 91.16 million in 2024 and is expected to reach USD 133.98 million by 2032, at a CAGR of 5.1% during the forecast period

- The Dominican Republic anesthesia market involves the supply of anesthetic drugs, equipment, and services used to manage pain and ensure patient comfort during medical and surgical procedures. It includes general, regional, and local anesthesia, along with sedation. Key components of the market are inhalation and intravenous anesthetics, anesthesia machines, monitors, ventilators, and related consumables. The market also covers services delivered by anesthesiologists and nurse anesthetists in hospitals, surgical centers, and clinics.

Dominican Republic Anesthesia Market Analysis

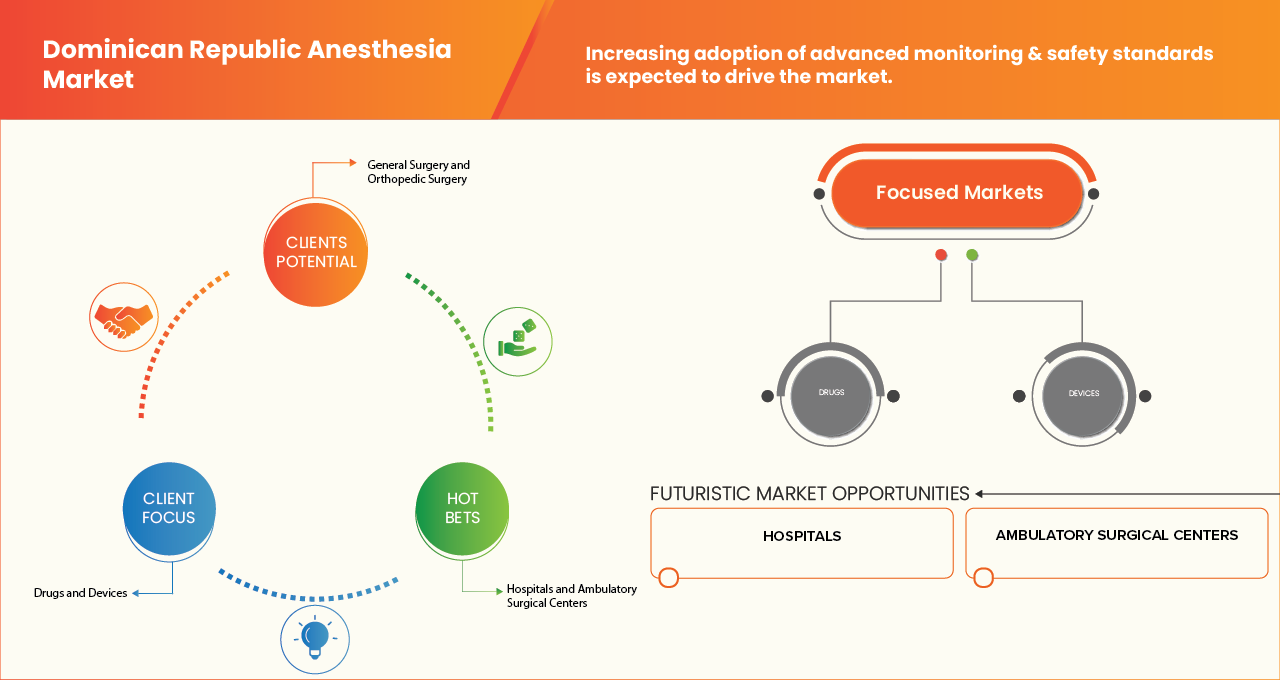

- The Dominican Republic anesthesia market is witnessing steady growth, driven by rising demand for surgical procedures, expanding healthcare infrastructure, and increasing adoption of advanced anesthetic techniques. The country’s healthcare sector is undergoing significant modernization, with investments from both public and private players aimed at improving surgical capacity and quality of care. As chronic diseases such as cardiovascular disorders, cancer, and diabetes become more prevalent, the number of surgeries requiring anesthesia support has increased, creating consistent market opportunities. Furthermore, the growing popularity of cosmetic and elective surgeries among medical tourists in the Dominican Republic is contributing to the heightened demand for anesthesia products and services

- Anesthesia in the Dominican Republic is utilized across diverse applications, including general surgery, orthopedics, gynecology, trauma and emergency care, dental procedures, and cardiovascular surgeries. The market encompasses a wide range of products, such as anesthetic drugs, delivery systems, and monitoring devices. Hospitals and specialty clinics remain the primary end-users, although ambulatory surgical centers are gaining importance due to the rise in minimally invasive procedures. In addition, the country’s strong positioning as a hub for affordable medical tourism across Latin America and the Caribbean further supports growth, as international patients seek high-quality surgical services at competitive costs

- In 2025, drugs segment is expected to dominate the market with 65.84% share and it is anticipated to show the fastest growth during the forecast period, due to the rising demand for safe and effective medications to support complex surgeries. Growing incidences of chronic illnesses, coupled with the country’s medical tourism expansion, fuel the need for reliable anesthetic drug availability.

- Dominican Republic is expected to dominate the anesthesia market and it is anticipated to show the fastest growth during the forecast period. driven by rising prevalence of chronic diseases such as cancer, Crohn’s disease, and gastrointestinal disorders, which significantly increase the demand for clinical nutrition support. Expanding healthcare infrastructure, higher hospital admissions, and greater awareness of nutrition therapy among healthcare providers are further boosting adoption. Additionally, increasing investments by global players, coupled with government initiatives to improve patient care and access to advanced nutritional solutions, will strengthen market growth.

Report Scope and Dominican Republic Anesthesia Market Segmentation

|

Attributes |

Dominican Republic Anesthesia Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Dominican Republic |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dominican Republic Anesthesia Market Trends

“Integration of Advanced Anesthesia Delivery Systems and Rising Focus on Outpatient Surgeries”

- The Dominican Republic anesthesia market is evolving with increasing adoption of modern anesthesia machines, monitoring systems, and drug delivery devices to improve patient safety and surgical efficiency.

- Outpatient and minimally invasive procedures are rising in demand, requiring shorter-acting anesthetics and advanced monitoring solutions to support fast recovery.

- Hospitals and surgical centers are shifting towards Target-Controlled Infusion (TCI) systems, depth-of-anesthesia monitors, and inhalation agents with improved pharmacological profiles.

- For instance, regional healthcare providers are partnering with global manufacturers to procure portable anesthesia workstations that are well-suited for both urban hospitals and mid-sized clinics.

- This trend reflects the growing recognition of anesthesia as a critical enabler of surgical innovation and healthcare modernization in the Dominican Republic.

Dominican Republic Anesthesia Market Dynamics

Driver

“Increasing Adoption of Advanced Monitoring & Safety Standards”

- The Dominican Republic is experiencing a clear shift toward stronger perioperative safety and modern physiologic monitoring, driven by national quality programs, multilateral financing for health system strengthening, and technical support from regional health bodies.

- Hospitals and health networks are prioritizing maternal neonatal safety, patient safety campaigns, and primary care integration, which translates directly into procurement and use of capnography, continuous pulse oximetry, integrated anesthesia workstations, and improved perioperative protocols. These changes raise baseline clinical expectations for monitoring during anesthesia and create demand not only for devices but for training, maintenance and consumables, all core growth levers for the anesthesia market in the country.

- In December 2023, World Bank reported that it approved a USD 190 million project to strengthen capacity to deliver quality health services in the Dominican Republic, with a particular emphasis on improving maternal and neonatal care and strengthening Ministry stewardship.

- In September 2024, the Pan American Health Organization reported that the Dominican Republic officially launched its collaboration with the Alliance for Primary Health Care in the Americas to strengthen primary care, coordination and investments that support quality and safety in health services.

- Taken together, these official instances from PAHO, the World Bank, WHO, the Dominican Ministry of Public Health and implementation partners demonstrate a coordinated, system level push financial, technical and programmatic toward improving clinical quality, maternal neonatal outcomes and patient safety in the Dominican Republic.

Opportunity

“Government Healthcare Investments Expanding Surgical Capacity”

- Government-led investments in healthcare infrastructure and surgical capacity are a pivotal growth driver for the Dominican Republic’s anesthesia market. By channeling funds into expanding and modernizing public health facilities, training personnel, and enhancing maternal-neonatal services, the government is elevating surgical throughput, procedural complexity, and overall demand for anesthesia drugs, devices, and perioperative services

- In February 2025, an article published in FDI Latin America stated that government and health officials, in collaboration with ProDominicana and DIGEMAPS, convened to bolster the Dominican Republic’s medical device manufacturing sector. Through improved regulatory frameworks and investment incentives, the government advanced the country’s position as a biomedical hub enabling greater local access to anesthesia-related equipment and supporting surgical capacity

- In April 2024, the University of Alabama at Birmingham’s Department of Anesthesiology announced plans to continue its partnership and educational collaboration with Hospital Ricardo Limardo in the Dominican Republic in February 2025. This international technical cooperation brings anesthesia training and perioperative care advancements to support local surgical capacity

- Government healthcare investments are proving to be a cornerstone in shaping the future of the Dominican Republic’s anesthesia market. By expanding hospital infrastructure, strengthening maternal and surgical care, modernizing equipment, and enhancing workforce capacity, these initiatives are directly increasing the volume and complexity of surgical procedures nationwide

- As public health reforms and international collaborations continue to strengthen perioperative care, the demand for anesthesia drugs, delivery systems, and monitoring equipment is set to accelerate. This positions government-driven healthcare modernization as not only a policy priority but also a critical growth driver for stakeholders across the anesthesia value chain

Restraint/Challenge

“High Out-of-Pocket Spending and Public-Sector Limitations”

- One of the most significant restraints on the Dominican Republic anesthesia market is the structure of health financing. A large portion of healthcare costs are borne directly by households, while the public system is chronically underfunded and uneven in quality. This combination reduces hospitals’ ability to invest steadily in high-cost anesthesia equipment and creates barriers to universal access for patients needing surgery

- Despite reforms and social security coverage expansion, financial protection gaps persist, especially for catastrophic surgical interventions. For anesthesia vendors, this translates into restricted public procurement volumes, heavy reliance on private facilities, and pressure to provide low-cost or refurbished solutions rather than premium monitoring and delivery systems

- In June 2021, Pan American Health Organization reported that more than 45 percent of total health expenditure in the Dominican Republic was financed out-of-pocket by households, among the highest shares in the region

- In October 2021, PAHO (Health in the Americas) reported that public health expenditure was 3.29% of GDP, while out-of-pocket spending comprised 23.59% of total health expenditure in the Dominican Republic

- These official reports consistently point to the same structural challenge: health financing in the Dominican Republic depends excessively on household out-of-pocket payments while the public system operates under severe budgetary constraints

Dominican Republic Anesthesia Market Scope

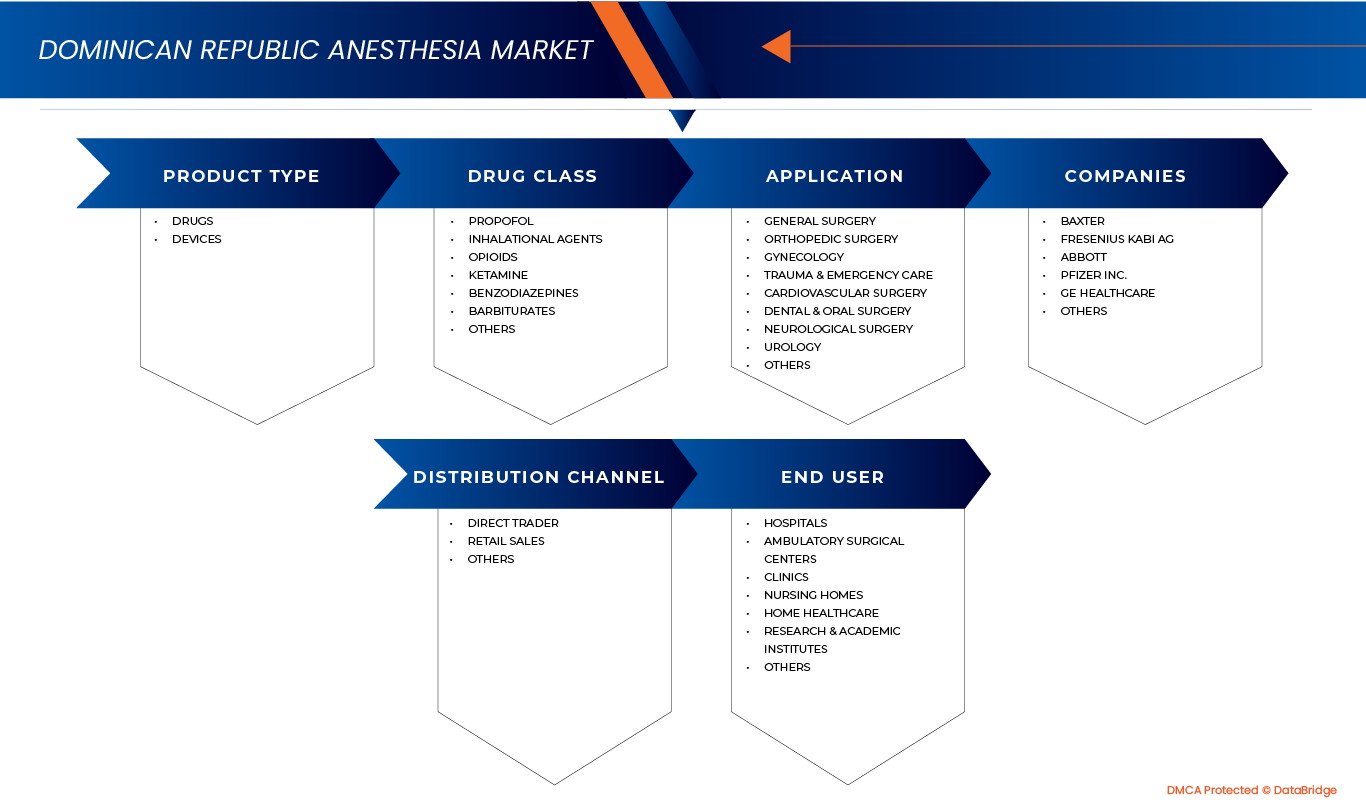

The Dominican Republic anesthesia market is categorized into five notable segments which are product type, drug class, application, end user, distribution channel.

- By Product Type

On the basis of product type, the market is segmented into drugs and devices. In 2025, the drugs segment is expected to dominate the market with 65.84% share due to growing incidences of chronic illnesses, coupled with the country’s medical tourism expansion, fuel the need for reliable anesthetic drug availability.

Drugs segment is anticipated to show the fastest CAGR with 5.8% during the forecast period due to the rising demand for safe and effective medications to support complex surgeries.

- By Drug Class

On the basis of drug class, the market is segmented into Propofol, Inhalational Agents, Opioids, Ketamine, Benzodiazepines, Barbiturates, and others. In 2025, Propofol segment is expected to dominate the market with 34.01% share due to its widespread use in general anesthesia induction and sedation for surgeries and intensive care. Its rapid onset, safety profile, and preference in outpatient and short-duration procedures enhance its adoption across Dominican healthcare facilities.

Propofol segment is anticipated to show the fastest growth CAGR with 5.7% during the forecast period due to its increasing adoption in outpatient procedures, shorter recovery times, and rising preference for intravenous anesthesia over inhalational agents.

- By Application

On the basis of application, the market is segmented into general surgery, orthopedic surgery, gynecology, trauma & emergency care, cardiovascular surgery, dental & oral surgery, neurological surgery, urology, and others. In 2025, the general surgery segment is expected to dominate the market with 23.40% share due to rising cases of gastrointestinal, hernia, and appendectomy procedures. Increased access to surgical care, urban healthcare expansion, and the need for anesthesia in routine interventions are fueling the consistent demand for anesthetic solutions.

General surgery segment is anticipated to show the fastest growth CAGR of 6.3% during the forecast period due to increasing demand for surgical procedures and advancements in minimally invasive techniques.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers, clinics, nursing homes, home healthcare, research & academic institutes, and others. In 2025, the hospitals segment is expected to dominate the market with 36.32% share due to the capability to handle a high volume of surgical procedures, emergencies, and critical care cases.

Hospitals segment is anticipated to show the fastest growth CAGR of 5.7% during the forecast period due to government healthcare investments, better-equipped surgical departments, and availability of skilled anesthesiologists drive anesthesia product demand in this setting.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct trader, retail sales, and others. In 2025, the direct trader segment is expected to dominate the market with 61.91% share as hospitals and clinics prefer reliable, immediate supply channels to reduce procurement delays. Direct sourcing ensures cost-efficiency, quality assurance, and quick accessibility, supporting uninterrupted surgical services across both urban and semi-urban Dominican regions.

Direct trader segment is anticipated to show the fastest growth CAGR of 5.4% during the forecast period as it benefits from increasing demand for direct procurement channels and cost-efficient supply chain solutions.

Dominican Republic Anesthesia Market Share

The Dominican Republic anesthesia industry is primarily led by well-established companies, including:

- Baxter (U.S.)

- Fresenius Kabi AG (Germany)

- Abbott Laboratories (U.S.)

- Pfizer Inc. (U.S.)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Medline Industries, LP (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- AstraZeneca (United Kingdom)

- Medtronic (Ireland)

- inCAVMedical (U.S.)

- Avante Health Solutions (U.S.)

- Aetos Pharma Private Limited (India)

- MEDICA (Italy)

- Mercury Medical (U.S.)

- ASCO (Apothecaries Sundries Mfg. Pvt. Ltd.) (India)

- EPSIMED (U.S.)

- IndoSurgicals Private Limited (India)

- Naugra Medical (India)

Latest Developments in Dominican Republic Anesthesia Market

- In September 2024, Baxter International introduced the Vest Advanced Pulmonary Experience (APX) System, its next-generation airway clearance device launched at the North American Cystic Fibrosis Conference. The system enhances comfort and U.S.bility while maintaining proven airflow technology for managing chronic lung conditions with retained secretions. This development represents a product launch, expanding Baxter’s respiratory care portfolio and supporting improved adherence, patient outcomes, and quality of life in cystic fibrosis and related pulmonary disorders

- In August 2025, Pfizer and BioNTech received U.S. FDA approval for Comirnaty, their mRNA-based COVID-19 vaccine, for use in adults aged 65 and older as well as individuals aged 5 to 64 at increased risk of severe disease. This approval expands the vaccine’s eligible population, addressing vulnerable groups with higher risk profiles and reinforcing its role in ongoing COVID-19 prevention strategies within the U.S. healthcare system

- In August 2025, Medline introduced Pack 360 Analysis as part of its perioperative management program. The solution provides detailed analysis of workflow and supply utilization, identifying opportunities to optimize surgical packs and procedure supplies. By improving efficiency and reducing waste, the program supports surgical teams in enhancing operational performance and resource management within perioperative environments.

- In April 2024, Medtronic received FDA approval for the Inceptive closed-loop spinal cord stimulator. The system features real-time sensing that automatically adjusts therapy, offering a more personalized approach to managing chronic pain. This development strengthens Medtronic’s neuromodulation portfolio, improves patient comfort, and supports broader adoption of closed-loop technologies in pain management

- In July 2025, GE HealthCare launched a new advanced digital X-ray system designed to improve access and operational efficiency in high-throughput clinical settings. The system integrates enhanced imaging capabilities with streamlined workflow features, enabling faster patient processing and supporting clinicians in delivering accurate diagnostics. This launch addresses the growing demand for efficient imaging solutions in hospitals and large diagnostic centers, promoting improved patient care and productivity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF DOMINICAN REPUBLIC ANESTHESIA MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT & SERVICES SEGMENT LIFELINE CURVE

2.8 MARKET END USER COVERAGE GRID

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PATENT ANALYSIS

4.2.1 PATENT QUALITY AND STRENGTH – DOMINICAN REPUBLIC ANESTHESIA MARKET

4.2.2 COUNTRY PATENT LANDSCAPE

4.2.3 IP STRATEGY AND MANAGEMENT

4.2.4 LICENSING COLLABORATION

4.3 DRUG TREATMENT RATE BY MATURED MARKETS

4.3.1 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.3.2 PATIENT FLOW DIAGRAM

4.3.3 KEY PRICING STRATEGIES

4.3.4 KEY PATIENT ENROLLMENT STRATEGIES

4.3.5 INTERVIEWS WITH SPECIALISTS

4.4 PIPELINE ANALYSIS – ANESTHESIA MARKET

4.4.1 PHASE DISTRIBUTION

4.4.2 KEY TRENDS IN THE EXPANDED PIPELINE

4.4.3 GEOGRAPHICAL AND INSTITUTIONAL TRENDS

4.4.4 STRATEGIC INSIGHTS

5 REGULATION COVERAGE — DOMINICAN REPUBLIC ANESTHESIA MARKET

5.1 PRODUCT CODES

5.2 CERTIFIED STANDARDS

5.3 SAFETY STANDARDS

5.4 STORAGE & INVENTORY MANAGEMENT

5.5 TRANSPORT & PRECAUTIONS

5.6 HAZARD IDENTIFICATION

5.7 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVER

6.1.1 INCREASING ADOPTION OF ADVANCED MONITORING & SAFETY STANDARDS.

6.1.2 AGING POPULATION & NONCOMMUNICABLE DISEASE (NCD) BURDEN RAISING SURGICAL NEED

6.1.3 REPLACEMENT CYCLE FOR AGING ANESTHESIA EQUIPMENT

6.2 RESTRAINS

6.2.1 HIGH OUT-OF-POCKET SPENDING AND PUBLIC-SECTOR LIMITATIONS.

6.2.2 FRAGMENTED HOSPITAL FOOTPRINT & SMALL AVERAGE HOSPITAL SIZE.

6.3 OPPORTUNITIES

6.3.1 GOVERNMENT HEALTHCARE INVESTMENTS EXPANDING SURGICAL CAPACITY.

6.3.2 INCREASING MEDICAL TOURISM FOCUSED ON ELECTIVE AND COSMETIC SURGERIES

6.4 CHALLENGES

6.4.1 IMPORT DEPENDENCE CAUSING SUPPLY CHAIN VULNERABILITIES

6.4.2 REGULATORY DELAYS SLOWING ADOPTION OF NEW TECHNOLOGIES.

7 DOMINICAN REPUBLIC ANESTHESIA MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 DRUGS

7.2.1 GENERAL ANESTHETICS

7.2.1.1 PROPOFOL

7.2.1.2 SEVOFLURANE

7.2.1.3 DESFLURANE

7.2.1.4 REMIFENTANIL

7.2.1.5 MIDAZOLAM

7.2.1.6 DEXMEDETOMIDINE

7.2.1.7 OTHERS

7.2.2 LOCAL ANESTHETICS

7.2.2.1 BUPIVACAINE

7.2.2.2 LIDOCAINE

7.2.2.3 ROPIVACAINE

7.2.2.4 CHLOROPROCAINE

7.2.2.5 PRILOCAINE

7.2.2.6 BENZOCAINE

7.2.2.7 OTHERS

7.2.3 GENERAL SURGERIES

7.2.4 DENTAL SURGERIES

7.2.5 COSMETIC SURGERIES

7.2.6 PLASTIC SURGERY

7.2.7 OTHER SURGERIES

7.2.8 INTRAVENOUS (IV)

7.2.9 INHALATION

7.2.10 EPIDURAL

7.2.11 OTHER

7.3 DEVICES

7.3.1 DELIVERY AND MONITORING DEVICES

7.3.1.1 ANESTHESIA WORKSTATIONS

7.3.1.2 ANESTHESIA MACHINES

7.3.1.3 ANESTHESIA VENTILATORS

7.3.1.4 ANESTHETIC GAS MONITORS

7.3.1.5 ANESTHESIA MONITORS

7.3.1.6 VAPORIZERS

7.3.1.7 ANESTHESIA DELIVERY MACHINES

7.3.1.7.1 STANDALONE

7.3.1.7.2 PORTABLE

7.3.1.8 FLOWMETERS

7.3.1.9 OTHER DEVICES

7.3.2 CONSUMABLES

7.3.2.1 ENDOTRACHEAL TUBES (ETTS)

7.3.2.2 ANESTHESIA CIRCUITS (BREATHING CIRCUITS)

7.3.2.3 ANESTHESIA MASKS

7.3.2.4 LARYNGEAL MASK AIRWAYS (LMAS)

7.3.3 OTHER ACCESSORIES

8 DOMINICAN REPUBLIC ANESTHESIA MARKET, BY DRUG CLASS

8.1 OVERVIEW

8.2 PROPOFOL

8.3 INHALATIONAL AGENTS

8.4 OPIOIDS

8.5 KETAMINE

8.6 BENZODIAZEPINES

8.7 BARBITURATES

8.8 OTHERS

9 DOMINICAN REPUBLIC ANESTHESIA MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 GENERAL SURGERY

9.3 ORTHOPEDIC SURGERY

9.4 GYNECOLOGY

9.5 TRAUMA & EMERGENCY CARE

9.6 CARDIOVASCULAR SURGERY

9.7 DENTAL & ORAL SURGERY

9.8 NEUROLOGICAL SURGERY

9.9 UROLOGY

9.1 OTHERS

10 DOMINICAN REPUBLIC ANESTHESIA MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 AMBULATORY SURGICAL CENTERS

10.4 CLINICS

10.5 NURSING HOMES

10.6 HOME HEALTHCARE

10.7 RESEARCH & ACADEMIC INSTITUTES

10.8 OTHERS

11 DOMINICAN REPUBLIC ANESTHESIA MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TRADER

11.3 RETAIL SALES

11.4 OTHERS

12 DOMINICAN REPUBLIC ANAESTHESIA MARKET

12.1 COMPANY SHARE ANALYSIS: DOMINICAN REPUBLIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 BAXTER

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 FRESENIUS KABI AG

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 ABBOTT

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 PFIZER INC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 GE HEALTHCARE

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 AETOS PHARMA PVT LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 ASCO (APOTHECARIES SUNDRIES MFG. PVT. LTD.)

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 ASPEN HOLDINGS

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 AVANTE HEALTH SOLUTIONS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 EPSIMED

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 GLOBAL HEALTH

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 INCAV MEDICAL AND LABORATORY EQUIPMENT

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 INDOSURGICALS PRIVATE LIMITED

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 KONINKLIJKE PHILIPS N.V.,

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 MEDTRONIC

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 MEDLINE INDUSTRIES LP

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 METCURY MEDICAL

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 NAUGRA

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 TEVA PHARMACEUTICAL INDUSTRIES LTD.

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 DOMINICAN REPUBLIC ANESTHESIA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 DOMINICAN REPUBLIC DRUGS IN ANESTHESIA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 DOMINICAN REPUBLIC GENERAL ANESTHETICS IN ANESTHESIA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 DOMINICAN REPUBLIC LOCAL ANESTHETICS IN ANESTHESIA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 DOMINICAN REPUBLIC DRUGS IN ANESTHESIA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 6 DOMINICAN REPUBLIC DRUGS IN ANESTHESIA MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 7 DOMINICAN REPUBLIC DEVICES IN ANESTHESIA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 DOMINICAN REPUBLIC DELIVERY AND MONITORING DEVICES IN ANESTHESIA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 DOMINICAN REPUBLIC ANESTHESIA DELIVERY MACHINES IN ANESTHESIA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 DOMINICAN REPUBLIC CONSUMABLES IN ANESTHESIA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 DOMINICAN REPUBLIC ANESTHESIA MARKET, BY DRUG CLASS, 2018-2032 (USD THOUSAND)

TABLE 12 DOMINICAN REPUBLIC ANESTHESIA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 13 DOMINICAN REPUBLIC ANESTHESIA MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 14 DOMINICAN REPUBLIC ANESTHESIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 DOMINICAN REPUBLIC ANESTHESIA MARKET: SEGMENTATION

FIGURE 2 DOMINICAN REPUBLIC ANESTHESIA MARKET: DATA TRIANGULATION

FIGURE 3 DOMINICAN REPUBLIC ANESTHESIA MARKET: DROC ANALYSIS

FIGURE 4 DOMINICAN REPUBLIC ANESTHESIA MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 DOMINICAN REPUBLIC ANESTHESIA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 DOMINICAN REPUBLIC ANESTHESIA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 DOMINICAN REPUBLIC ANESTHESIA MARKET: MULTIVARIATE MODELLING

FIGURE 8 DOMINICAN REPUBLIC ANESTHESIA MARKET: PRODUCT TYPE LIFELINE CURVE

FIGURE 9 DOMINICAN REPUBLIC ANESTHESIA MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 DOMINICAN REPUBLIC ANESTHESIA MARKET: DBMR MARKET POSITION GRID

FIGURE 11 DOMINICAN REPUBLIC ANESTHESIA MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 DOMINICAN REPUBLIC ANESTHESIA MARKET: SEGMENTATION

FIGURE 13 DOMINICAN REPUBLIC ANESTHESIA MARKET: EXECUTIVE SUMMARY

FIGURE 14 DOMINICAN REPUBLIC ANESTHESIA MARKET: STRATEGIC DECISIONS

FIGURE 15 TWO SEGMENTS COMPRISE THE DOMINICAN REPUBLIC ANESTHESIA MARKET, BY PRODUCT TYPE

FIGURE 16 INCREASING ADOPTION OF ADVANCED MONITORING & SAFETY STANDARDS IS EXPECTED TO DRIVE THE GROWTH OF THE DOMINICAN REPUBLIC ANESTHESIA MARKET FROM 2025 TO 2032

FIGURE 17 THE PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE DOMINICAN REPUBLIC ANESTHESIA MARKET IN 2025 & 2032

FIGURE 18 DROC ANALYSIS

FIGURE 19 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY PRODUCT TYPE, 2024

FIGURE 20 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 21 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY PRODUCT TYPE, CAGR (2025- 2032)

FIGURE 22 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 23 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY DRUG CLASS, 2024

FIGURE 24 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY DRUG CLASS, 2025 TO 2032 (USD THOUSAND)

FIGURE 25 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY DRUG CLASS, CAGR (2025- 2032)

FIGURE 26 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY DRUG CLASS, LIFELINE CURVE

FIGURE 27 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY APPLICATION, 2024

FIGURE 28 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 29 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY APPLICATION, CAGR (2025- 2032)

FIGURE 30 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY END USER, 2024

FIGURE 32 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 33 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 34 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 36 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 37 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 38 DOMINICAN REPUBLIC ANESTHESIA MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 39 DOMINICAN REPUBLIC ANAESTHESIA MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.