Dominican Republic Biosurgery Intraoperative Care Market

Market Size in USD Million

CAGR :

%

USD

51.74 Million

USD

31.95 Million

2024

2032

USD

51.74 Million

USD

31.95 Million

2024

2032

| 2025 –2032 | |

| USD 51.74 Million | |

| USD 31.95 Million | |

|

|

|

|

Dominican Republic Biosurgery (Intraoperative Care) Market Size

- The Dominican Republic Biosurgery (Intraoperative Care) Market was valued at USD 51.74 Million in 2024 and is expected to reach USD 31.95 Million by 2032

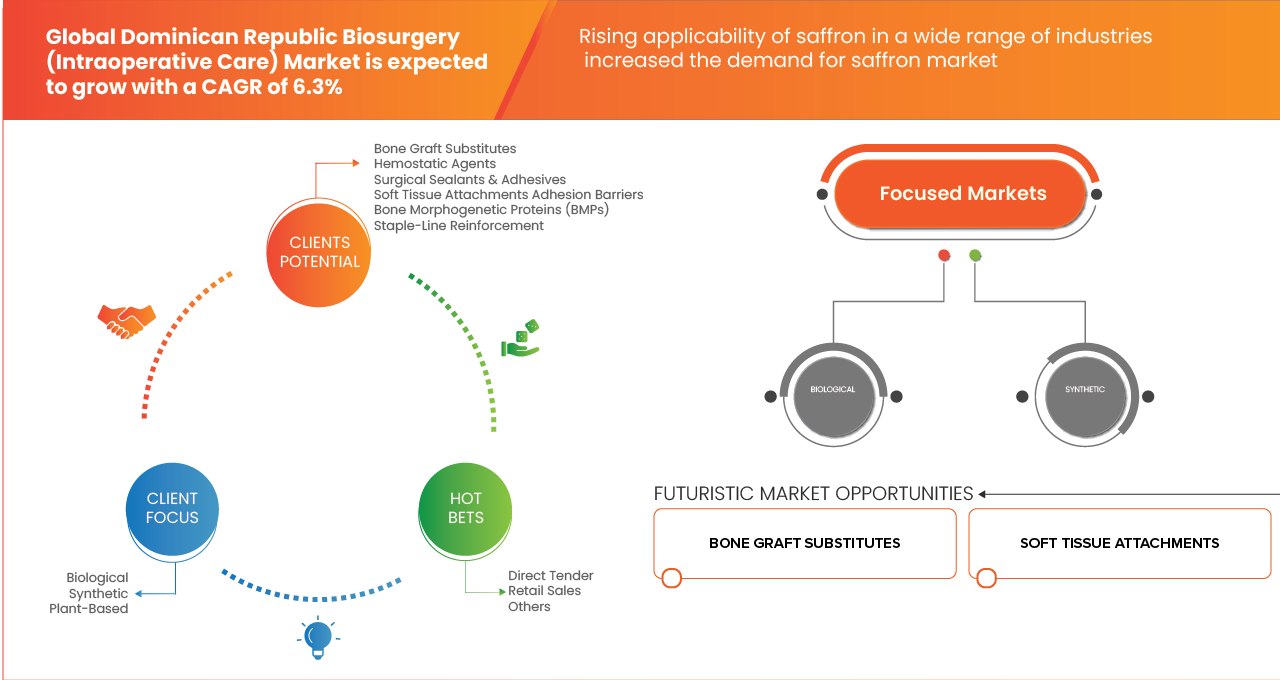

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.3%, primarily driven by the need for enhanced operational efficiency and port capacity.

- The growth of the Dominican Republic Biosurgery (Intraoperative Care) Market is driven by factors such as increasing North America trade volumes, rising demand for high-performance container handling equipment, technological advancements in automation and artificial intelligence, and the expansion of manufacturing and transportation sectors worldwide.

Dominican Republic Biosurgery (Intraoperative Care) Market Analysis

- Biosurgery (intraoperative care) in the Dominican Republic refers to advanced surgical solutions and biomaterials used during operative procedures to reduce blood loss, support tissue repair, and enhance healing outcomes. These products include hemostatic agents, surgical sealants, adhesion barriers, and soft tissue repair materials designed to assist surgeons in managing complex intraoperative conditions. The market plays a crucial role in the country’s growing healthcare infrastructure, particularly across tertiary hospitals and specialty surgical centers, by improving patient safety, reducing operative time, and minimizing postoperative complications.

- One of the primary technologies in the Dominican Republic’s biosurgery market is the integration of biological and synthetic biomaterials that support minimally invasive and precision-based surgeries. The growing adoption of laparoscopic and robotic-assisted procedures is driving demand for advanced intraoperative biosurgical products that offer effective hemostasis and tissue sealing in small, hard-to-reach anatomical sites. Additionally, rising investment in hospital modernization, an increasing number of elective surgeries, and expanding access to private healthcare are fueling the adoption of biosurgical products. Partnerships with global medical device manufacturers and the introduction of training programs for surgical professionals are also enhancing procedural efficiency, safety, and patient recovery outcomes across the Dominican Republic.

- In 2025, the bone graft substitutes segment is expected to dominate the market with a 33.51% market share due to their essential role in orthopedic, trauma, spinal, and reconstructive surgeries. Bone graft substitutes are widely used as alternatives to autografts and allografts, offering benefits such as reduced surgical time, lower risk of donor-site complications, and enhanced patient recovery.

Report Scope and Dominican Republic Biosurgery (Intraoperative Care) Market Segmentation

|

Attributes |

Biosurgery (intraoperative care) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dominican Republic Biosurgery (Intraoperative Care) Market Trends

“Rising Surgical Volume & Elective Procedures”

- Over the past several years, rising surgical volumes and the expansion of elective procedures have become key drivers of growth in the Dominican Republic Biosurgery (Intraoperative Care) Market.

- Whether in public or private settings, healthcare providers are increasingly performing more surgeries ranging from orthopedics, ophthalmology, general surgery, cosmetic and reconstructive procedures, to increasingly complex minimally invasive interventions. This growth is fueled by efforts to reduce surgical backlogs created during the COVID-19 pandemic, coupled with greater investment in healthcare infrastructure, greater medical tourism inflows, and government policy support.

- As surgical throughput increases, demand for intraoperative care consumables, advanced devices, disposables, imaging support, hemostasis, and intraoperative monitoring tools rises in parallel. In such an environment, the more elective procedures a system schedules, and the higher the baseline surgical volume, the more the biosurgery sector is leveraged—making surgical volume and elective procedures foundational growth levers for the intraoperative care market in the Dominican Republic.

- For instance, In January 2025, Vitals today reported that the Dominican Republic’s public hospital system performed 469,784 surgeries in operating rooms, which is a 31.71 % increase compared to 2019

- Consequently, the rising volume of both essential and elective operations directly strengthens demand for biosurgery products, making surgical expansion one of the most critical drivers of market growth in the Dominican Republic’s intraoperative care sector.

Dominican Republic Biosurgery (Intraoperative Care) Market Dynamics

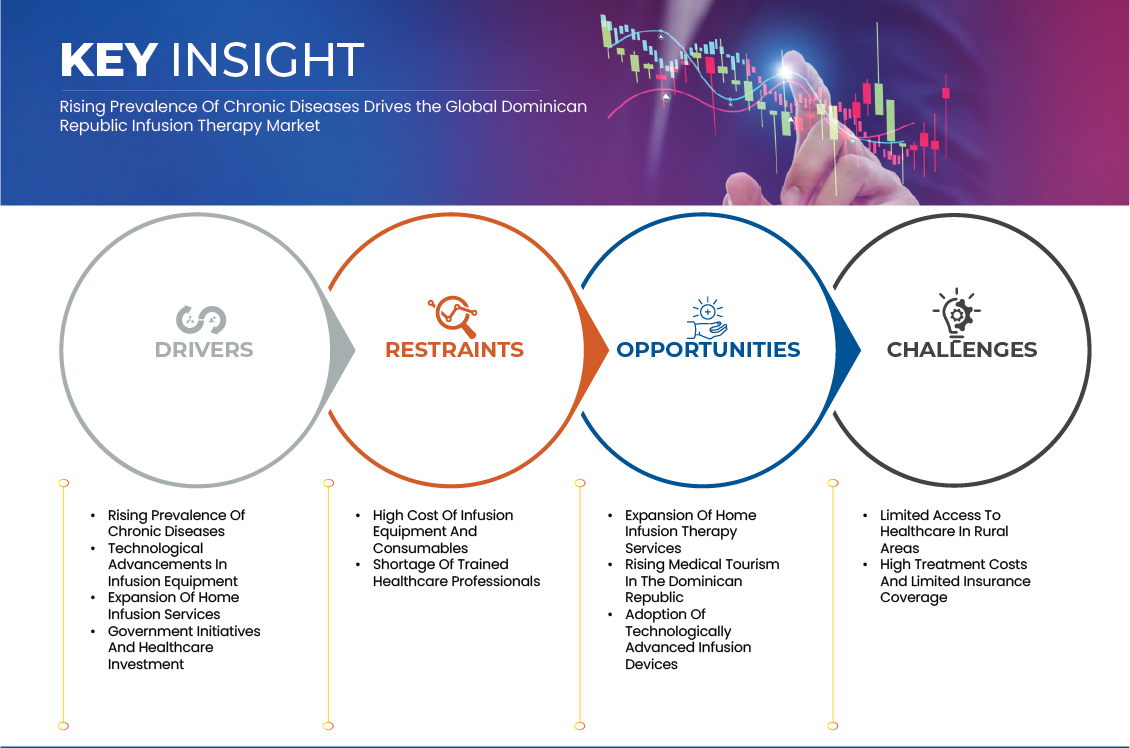

Driver

“Clinical Shift On Blood-Loss Reduction & Patient Outcomes”

- The Dominican Republic's biosurgery and intraoperative care market is experiencing significant growth, driven by a clinical shift towards reducing blood loss and enhancing patient outcomes. This paradigm emphasizes Patient Blood Management (PBM) strategies, aiming to minimize the need for blood transfusions and associated complications.

- The World Health Organization (WHO) updated its guidance on implementing PBM in 2025, highlighting its cost-effectiveness and role in improving patient outcomes. Additionally, advancements in intraoperative autologous blood donation (IABD) have proven effective in reducing transfusion needs and perioperative morbidity.

- The recent initiatives and guidelines clearly demonstrate that a clinical focus on blood-loss reduction and patient outcomes is becoming a key driver of the Dominican Republic’s biosurgery and intraoperative care market. Efforts by the Public Health Ministry to include blood and its derivatives in the social security system signal a systemic commitment to making safe and adequate blood supply universally accessible.

- Concurrently, the adoption of international frameworks such as the Santa Cruz Declaration and WHO’s phased PBM guidance provides a structured approach to managing perioperative anemia, minimizing intraoperative blood loss, and optimizing coagulation. Together, these measures enhance patient safety, improve surgical outcomes, and strengthen the efficiency and sustainability of the Dominican Republic’s healthcare system, making blood-loss reduction a strategic market driver in intraoperative care.

Restraint/Challenge

“Cost Sensitivity & Limited Public Budgets”

- The Dominican Republic's biosurgery and intraoperative care market faces significant constraints due to cost sensitivity and limited public budgets. Despite advancements in healthcare infrastructure, the allocation of financial resources remains a critical challenge.

- The public health system's budget is constrained, leading to disparities in service delivery and limited access to advanced surgical procedures for a substantial portion of the population. These financial limitations hinder the adoption of cutting-edge technologies and the expansion of specialized surgical services, affecting the overall quality and accessibility of biosurgical care.

- The instances highlight the impact of limited public sector financing on healthcare in the Dominican Republic. While the IMF report underscores ongoing challenges in government funding that restrain public healthcare investments, the launch of a state-of-the-art ambulatory surgery unit by Médico Express illustrates how private sector initiatives are stepping in to fill gaps left by public limitations.

- This contrast emphasizes that despite a dynamic economy, financial constraints in the public sector drive restrain on advanced surgical markets.

Dominican Republic Biosurgery (Intraoperative Care) Market Scope

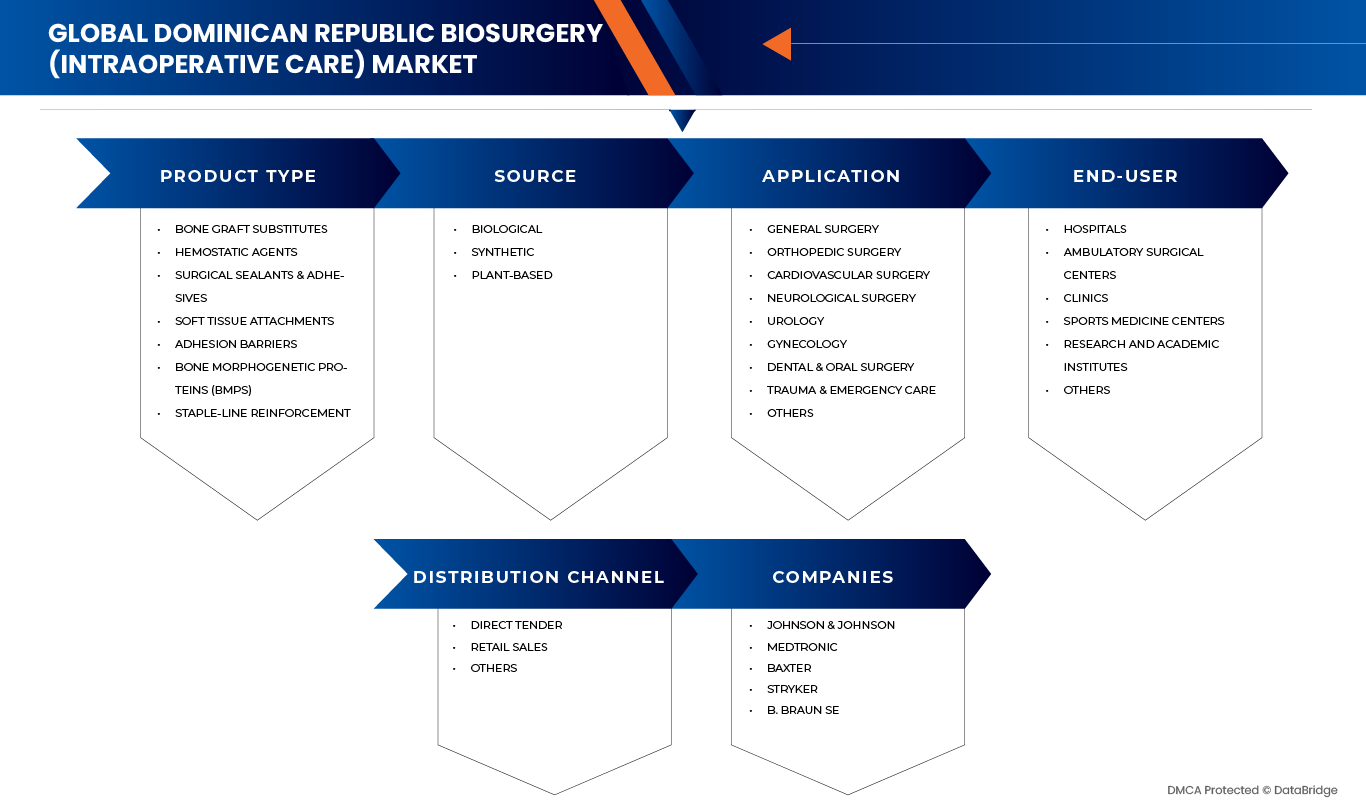

The Dominican Republic Biosurgery (Intraoperative Care) Market is segmented into five notable segments product type, application, source, end user, and distribution channel.

- By Product Type

On the basis of product type, the Republic Dominican Republic Biosurgery (Intraoperative Care) Market is segmented into bone graft substitutes, hemostatic agents, surgical sealants & adhesives, soft tissue attachments, adhesion barriers, Bone Morphogenetic Proteins (BMPs), staple-line reinforcement. In 2025, the bone graft substitutes segment is projected to dominate with a market share of 33.51%, owing to its wide adoption in orthopedic and spinal surgeries and increasing demand for effective bone regeneration solutions.

The bone graft substitutes segment is anticipated to gain traction with a CAGR of 6.7% during the forecast period of 2025 to 2032, driven by the rising incidence of bone-related disorders, an ageing population, and continuous advancements in synthetic and bioactive graft technologies that improve surgical outcomes.

- By Application

On the basis of application, the market is segmented into general surgery, orthopedic surgery, cardiovascular surgery, neurological surgery, urology, gynecology, dental & oral surgery, trauma & emergency care, others. In 2025, general surgery segment is projected to dominate with a market share of 29.27%, owing to the high volume of surgical procedures performed globally, increasing adoption of advanced biosurgery products such as hemostats, sealants, and tissue adhesives, and the growing focus on reducing intraoperative complications and improving patient outcomes.

The general surgery segment is anticipated to gain traction with a CAGR of 6.5% during the forecast period of 2025 to 2032, driven by rising surgical volumes, growing awareness of minimally invasive procedures, increased hospital investments in advanced intraoperative care products, and ongoing innovations in biosurgery technologies that enhance safety and efficacy.

- By Source

On the basis of source, the Republic Dominican Republic Biosurgery (Intraoperative Care) Market is segmented into biological, synthetic, plant-based. In 2025, the biological segment is projected to dominate with a market share of 52.28%, owing to its widespread use in bone grafts, hemostatic agents, and tissue repair applications, as well as high clinical preference for naturally derived materials that enhance biocompatibility and patient outcomes.

The biological segment is anticipated to gain traction with a CAGR of 7.0% during the forecast period of 2025 to 2032, driven by increasing adoption in orthopedic, cardiovascular, and general surgeries, rising demand for safe and effective intraoperative care solutions, and ongoing research and development in advanced biologically sourced materials.

- By End-User

On the basis of end-user, the Republic Dominican Republic Biosurgery (Intraoperative Care) Market is segmented into hospitals, ambulatory surgical centers, clinics, sports medicine centers, research and academic institutes, others. In 2025, the hospital segment is projected to dominate with a market share of 50.79%, owing to the high volume of surgical procedures performed in hospitals, availability of advanced surgical infrastructure, and preference for comprehensive intraoperative care solutions in these settings.

The hospital segment is anticipated to gain traction with a CAGR of 6.2% during the forecast period of 2025 to 2032, driven by increasing healthcare expenditure, rising number of surgeries, growing adoption of advanced biosurgery products, and hospitals’ focus on improving surgical outcomes and patient safety.

- By Distribution Channel

On the basis of distribution channel, the Republic Dominican Republic Biosurgery (Intraoperative Care) Market is segmented into direct tender, retail sales, others. In 2025, the direct tender segment is projected to dominate with a market share of 57.14%, owing to the preference of hospitals and large healthcare institutions for bulk procurement directly from manufacturers, ensuring cost-effectiveness, consistent supply, and access to the latest biosurgery products.

The direct tender segment is anticipated to gain traction with a CAGR of 6.4% during the forecast period of 2025 to 2032, driven by increasing hospital purchases through government and private tenders, growing adoption of advanced intraoperative care products, and manufacturers’ strategies to strengthen direct supply chains in the Republic.

Dominican Republic Biosurgery (Intraoperative Care) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- GE Healthcare (U.S.)

- Medtronic (Ireland)

- BAXTER (U.S.)

- ICU Medical (U.S.)

- B. Braun SE (Germany)

- Apothecaries Sundries Mfg. Pvt. Ltd (India)

- Terumo Corporation (Japan)

- KORU Medical Systems (USA)

- Farmaconol (Ireland)

- Changsha Skyfavor Medical Devices (China)

- Ariss Medical Inc. (U.S.)

- Grupo Hospifar (U.S.)

- BD (U.S.)

- Micrel Medical Devices SA (Greece)

- SternMed GmbH (Germany)

- Teleflex Incorporated (U.S.)

- Global Health (Dominican Repub)

- EPSIMED (U.S.)

- KALSTEIN FRANCE - SIREN (France)

- medzell (Eightwe Digital Transforma) (India)

- INSUMEDRD (Dominican Repub)

- Hunan Beyond Medical Technology (China)

- Avante (U.S.)

- Naugra Medical Lab (India)

- Jaincolab (India)

- Vygon (France)

Latest Developments in Dominican Republic Biosurgery (Intraoperative Care) Market

- In December 2024, Artivion, Inc. received FDA Humanitarian Device Exemption (HDE) approval for its AMDS Hybrid Prosthesis, marking a key regulatory milestone. This allows the early U.S. commercialization of AMDS for treating acute DeBakey Type I aortic dissections with malperfusion—representing roughly 40% of such cases. The device also holds Breakthrough and Humanitarian Use Designation due to its life-saving potential in a rare, high-risk condition. This development strengthens Artivion’s leadership in the structural heart and aortic surgery market, expands its clinical footprint, and paves the way for broader Premarket Approval (PMA) coverage in the future.

- In January 2023, Orthofix Medical Inc. and SeaSpine Holdings completed their merger of equals, creating a leading global spine and orthsopedics company. The combined firm offers a complementary portfolio of biologics, spinal hardware, bone growth therapies, orthopedic solutions, and surgical navigation systems, with operations in 68 countries.

- In March 2025, Smith and Nephew continued to pioneer in Sports Medicine and introduced a new category called Spatial Surgery, a revolutionary frontier in arthroscopic surgical innovation. The TESSA Spatial Surgery System, or Tracking Enabled Spatial Surgery Assistant, combines personalized operative planning with a real-time, tracking enabled device, using advanced imaging and augmented reality guidance to assist surgeons in decision-making.

- In July 2025, Zimmer Biomet entered into a strategic partnership with Getinge to distribute Getinge’s operating room capital products to its Ambulatory Surgery Center (ASC) customers. This collaboration aims to provide a comprehensive solution for ASC customers, combining Zimmer Biomet's surgical robotics and implant offerings with Getinge's infection control and surgical portfolio.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.3 INDUSTRY INSIGHTS– DOMINICAN REPUBLIC BIOSURGERY(INTRAOPERATIVE CARE) MARKET

4.3.1 PATENT ANALYSIS

4.3.2 PATENT LANDSCAPE

4.3.3 USPTO NUMBER

4.3.4 PATENT EXPIRY

4.3.5 EPIO NUMBER

4.3.6 PATENT STRENGTH AND QUALITY

4.3.7 PATENT CLAIMS

4.3.8 PATENT CITATIONS

4.3.9 FILE OF PATENT

4.3.10 PATENT RECEIVED COUNTRIES

4.3.11 TECHNOLOGY BACKGROUND

4.3.12 DRUG TREATMENT RATE BY MATURED MARKETS

4.3.13 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.3.14 PATIENT FLOW DIAGRAM

4.3.15 KEY PRICING STRATEGIES

4.3.16 KEY PATIENT ENROLLMENT STRATEGIES

4.4 MARKET ACCESS LANDSCAPE: DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) THERAPY

4.4.1 INTRODUCTION

4.4.2 ANNUAL NEW FDA-APPROVED DRUGS

4.4.3 DRUG MANUFACTURER AND DEALS

4.4.4 MAJOR DRUG UPTAKE

4.4.5 CURRENT TREATMENT PRACTICES

4.4.6 IMPACT OF UPCOMING THERAPY

4.4.7 CONCLUSION

4.5 PIPELINE ANALYSIS – BIOSURGERY (INTRAOPERATIVE CARE) THERAPY IN THE DOMINICAN REPUBLIC

4.5.1 OVERVIEW OF PIPELINE LANDSCAPE

4.5.2 CLINICAL TRIAL LANDSCAPE

4.5.3 STUDY STATUS AND DEVELOPMENT STAGES

4.5.4 KEY INDICATIONS ADDRESSED

4.5.5 INTERVENTIONS AND THERAPEUTIC MODALITIES

4.5.6 SPONSORS AND COLLABORATORS

4.5.7 PHASE DISTRIBUTION INSIGHTS

4.5.8 THERAPEUTIC EQUIPMENT AND DEVICES

4.5.9 FUTURE OUTLOOK

4.5.10 CONCLUSION

5 REGULATORY FRAMEWORK FOR BIOSURGERY (INTRAOPERATIVE CARE) THERAPY IN THE DOMINICAN REPUBLIC

5.1 REGULATORY APPROVAL PROCESS

5.1.1 INSTITUTIONAL AUTHORITY AND LEGAL BASIS

5.1.2 DOSSIER STRUCTURE AND EVIDENCE EXPECTATIONS

5.1.3 SUBMISSION CHANNELS AND PROCEDURAL MODERNIZATION

5.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.2.1 RELIANCE AND REGIONAL HARMONIZATION MECHANISMS

5.2.2 DIFFERENTIAL EASE ACROSS PRODUCT TYPES

5.3 REGULATORY APPROVAL PATHWAYS

5.3.1 STANDARD COMPLETE ASSESSMENT PATHWAY

5.3.2 RELIANCE AND EXPEDITED ROUTES

5.3.3 SPECIFIC CONSIDERATIONS FOR BIOLOGICS AND ADVANCED BIOSURGERY PRODUCTS

5.4 LICENSING AND REGISTRATION

5.4.1 LOCAL REPRESENTATION AND ADMINISTRATIVE REQUIREMENTS

5.4.2 MANUFACTURING LICENSES, GMP EVIDENCE, AND INSPECTIONS

5.4.3 ADVERTISING, PROMOTIONAL CONTROLS, AND COMPLIANCE

5.5 POST-MARKETING SURVEILLANCE

5.5.1 PHARMACOVIGILANCE ARCHITECTURE AND REPORTING OBLIGATIONS

5.5.2 MARKET SURVEILLANCE AND CORRECTIVE ACTIONS

5.6 GOOD MANUFACTURING PRACTICES (GMP) GUIDELINES

5.6.1 EXPECTATIONS AND INTERNATIONAL ALIGNMENT

5.6.2 PREPAREDNESS FOR INSPECTIONS AND CONTINUOUS COMPLIANCE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING SURGICAL VOLUME & ELECTIVE PROCEDURES

6.1.2 CLINICAL SHIFT ON BLOOD-LOSS REDUCTION & PATIENT OUTCOMES

6.1.3 HOSPITAL MODERNIZATION & PRIVATE SECTOR EXPANSION

6.2 RESTRAINS

6.2.1 COST SENSITIVITY & LIMITED PUBLIC BUDGETS

6.2.2 REGULATORY COMPLEXITY AND VARIABLE TIMELINES

6.3 OPPORTUNITIES

6.3.1 COLLABORATION BETWEEN PUBLIC AND PRIVATE HEALTHCARE FACILITIES

6.3.2 VALUE-BASED BUNDLES & COST-PER-PROCEDURE MESSAGING

6.4 CHALLENGES

6.4.1 DISTRIBUTION & LOGISTICS INFRASTRUCTURE

6.4.2 LACK OF TRAINING AND KNOWLEDGE ABOUT SURGICAL PRODUCTS

7 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 BONE GRAFT SUBSTITUTES

7.3 HEMOSTATIC AGENTS

7.4 SURGICAL SEALANTS & ADHESIVES

7.5 SOFT TISSUE ATTACHMENTS

7.6 SOFT TISSUE ATTACHMENTS

7.7 ADHESION BARRIERS

7.8 ADHESION BARRIERS

7.9 BONE MORPHOGENETIC PROTEINS (BMPS)

7.1 STAPLE-LINE REINFORCEMENT

7.11 STAPLE-LINE REINFORCEMENT

8 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY SOURCE

8.1 OVERVIEW

8.2 BIOLOGICAL

8.3 SYNTHETIC

8.4 PLANT-BASED

9 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 GENERAL SURGERY

9.3 ORTHOPEDIC SURGERY

9.4 CARDIOVASCULAR SURGERY

9.5 NEUROLOGICAL SURGERY

9.6 UROLOGY

9.7 GYNECOLOGY

9.8 DENTAL & ORAL SURGERY

9.9 TRAUMA & EMERGENCY CARE

9.1 OTHERS

10 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY END-USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 AMBULATORY SURGICAL CENTERS

10.4 CLINICS

10.5 SPORTS MEDICINE CENTERS

10.6 RESEARCH AND ACADEMIC INSTITUTES

10.7 OTHERS

11 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 RETAIL SALES

11.4 OTHERS

12 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET

12.1 COMPANY SHARE ANALYSIS: DOMINICAN REPUBLIC

13 COMPANY PROFILES

13.1 JOHNSON & JOHNSON

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 MEDTRONIC

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 BAXTER

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 STRYKER

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 B.BRAUN SE.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 ADVANCED MEDICAL SOLUTIONS GROUP PLC.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 ARTIVION, INC.

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENT

13.8 BAUMER SA

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 BD

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENT

13.1 BIOVENTUS

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 DEROYAL INDUSTRIES, INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 FIN-CERAMICA FAENZA S.P.A.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 FZIOMED, INC.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 GDT DENTAL IMPLANTS

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 GEISTLICH PHARMA AG

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 HEMOSTASIS, LLC

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 INTEGRA LIFESCIENCES CORPORATION

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 MEDZELL (EIGHTWE DIGITAL TRANSFORMATIONS PVT. LTD)

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 MERIL

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 ORTHOFIX MEDICAL INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

13.21 REGENITY

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENT

13.22 SMITH+NEPHEW

13.22.1 COMPANY SNAPSHOT

13.22.2 REVENUE ANALYSIS

13.22.3 PRODUCT PORTFOLIO

13.22.4 RECENT DEVELOPMENT

13.23 TECH MEDICAL GROUP INC.

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT DEVELOPMENT

13.24 TELEFLEX INCORPORATED

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 PRODUCT PORTFOLIO

13.24.4 RECENT DEVELOPMENT

13.25 ZIMMER BIOMET

13.25.1 COMPANY SNAPSHOT

13.25.2 REVENUE ANALYSIS

13.25.3 PRODUCT PORTFOLIO

13.25.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 3 DOMINICAN REPUBLIC BONE GRAFT SUBSTITUTES IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 DOMINICAN REPUBLIC DEMINERALIZED BONE MATRIX IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 DOMINICAN REPUBLIC DEMINERALIZED BONE MATRIX IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 6 DOMINICAN REPUBLIC SYNTHETIC BONE GRAFTS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 DOMINICAN REPUBLIC CERAMICS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 DOMINICAN REPUBLIC HEMOSTATIC AGENTS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 9 DOMINICAN REPUBLIC HEMOSTATIC AGENTS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 10 DOMINICAN REPUBLIC SURGICAL SEALANTS & ADHESIVES IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 DOMINICAN REPUBLIC NATURAL/BIOLOGICAL SEALANTS AND ADHESIVES IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 DOMINICAN REPUBLIC SYNTHETIC AND SEMI-SYNTHETIC SEALANTS AND ADHESIVES IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 DOMINICAN REPUBLIC SOFT TISSUE ATTACHMENTS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 DOMINICAN REPUBLIC TISSUE MATRIX IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 DOMINICAN REPUBLIC SYNTHETIC MESH IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 DOMINICAN REPUBLIC BIOLOGICAL MESH IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 DOMINICAN REPUBLIC TISSUE FIXATION PRODUCTS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 DOMINICAN REPUBLIC SOFT TISSUE ATTACHMENTS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 DOMINICAN REPUBLIC ORTHOPEDIC SURGERY IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 DOMINICAN REPUBLIC GENERAL SURGERY IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 DOMINICAN REPUBLIC GYNECOLOGICAL SURGERY IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 DOMINICAN REPUBLIC PLASTIC AND RECONSTRUCTIVE SURGERY IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 DOMINICAN REPUBLIC SPORTS MEDICINE IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 DOMINICAN REPUBLIC ADHESION BARRIERS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 DOMINICAN REPUBLIC SYNTHETIC ADHESION BARRIERS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 DOMINICAN REPUBLIC NATURAL/BIOLOGICAL ADHESION BARRIERS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 DOMINICAN REPUBLIC ADHESION BARRIERS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY FORMULATIONS, 2018-2032 (USD THOUSAND)

TABLE 28 DOMINICAN REPUBLIC BONE MORPHOGENETIC PROTEINS (BMPS) IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 DOMINICAN REPUBLIC BONE MORPHOGENETIC PROTEINS (BMPS) IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 30 DOMINICAN REPUBLIC STAPLE-LINE REINFORCEMENT IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 31 DOMINICAN REPUBLIC SYNTHETIC REINFORCEMENT MATERIALS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 DOMINICAN REPUBLIC BIOLOGIC REINFORCEMENT MATERIALS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 DOMINICAN REPUBLIC STAPLE-LINE REINFORCEMENT IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 DOMINICAN REPUBLIC STAPLE-LINE REINFORCEMENT IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY RESORBABILITY, 2018-2032 (USD THOUSAND)

TABLE 35 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 36 DOMINICAN REPUBLIC BIOLOGICAL IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 DOMINICAN REPUBLIC ANIMAL-DERIVED IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 DOMINICAN REPUBLIC SYNTHETIC IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 40 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 41 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: SEGMENTATION

FIGURE 2 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: DATA TRIANGULATION

FIGURE 3 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: DROC ANALYSIS

FIGURE 4 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: MULTIVARIATE MODELLING

FIGURE 8 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: SEGMENTATION

FIGURE 12 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: EXECUTIVE SUMMARY

FIGURE 13 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: STRATEGIC DECISIONS

FIGURE 14 SEVEN SEGMENTS COMPRISE THE DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY PRODUCT TYPE (2024)

FIGURE 15 RISING SURGICAL VOLUME & ELECTIVE PROCEDURES IS EXPECTED TO DRIVE THE GROWTH OF THE DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET FROM 2025 TO 2032

FIGURE 16 THE BONE GRAFT SUBSTITUTES BIOSURGERY (INTRAOPERATIVE CARE) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET IN 2025 & 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 PATENT ANALYSIS BY APPLICANTS

FIGURE 20 PATENT ANALYSIS BY YEAR

FIGURE 21 PATENT ANALYSIS BY COUNTRIES

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET

FIGURE 23 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY PRODUCT TYPE, 2024

FIGURE 24 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 25 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY PRODUCT TYPE, CAGR (2025- 2032)

FIGURE 26 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 27 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY SOURCE, 2024

FIGURE 28 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY SOURCE, 2025 TO 2032 (USD THOUSAND)

FIGURE 29 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY SOURCE, CAGR (2025- 2032)

FIGURE 30 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 31 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY APPLICATION, 2024

FIGURE 32 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND

FIGURE 33 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY APPLICATION, CAGR (2025- 2032)

FIGURE 34 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 35 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY END-USER, 2024

FIGURE 36 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY END-USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 37 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY END-USER, CAGR (2025- 2032)

FIGURE 38 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY END-USER, LIFELINE CURVE

FIGURE 39 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 40 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 41 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 42 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 43 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.