Dominican Republic Diabetes Market

Market Size in USD Million

CAGR :

%

USD

437.35 Million

USD

753.86 Million

2024

2032

USD

437.35 Million

USD

753.86 Million

2024

2032

| 2025 –2032 | |

| USD 437.35 Million | |

| USD 753.86 Million | |

|

|

|

|

Dominican Republic Diabetes Market Size

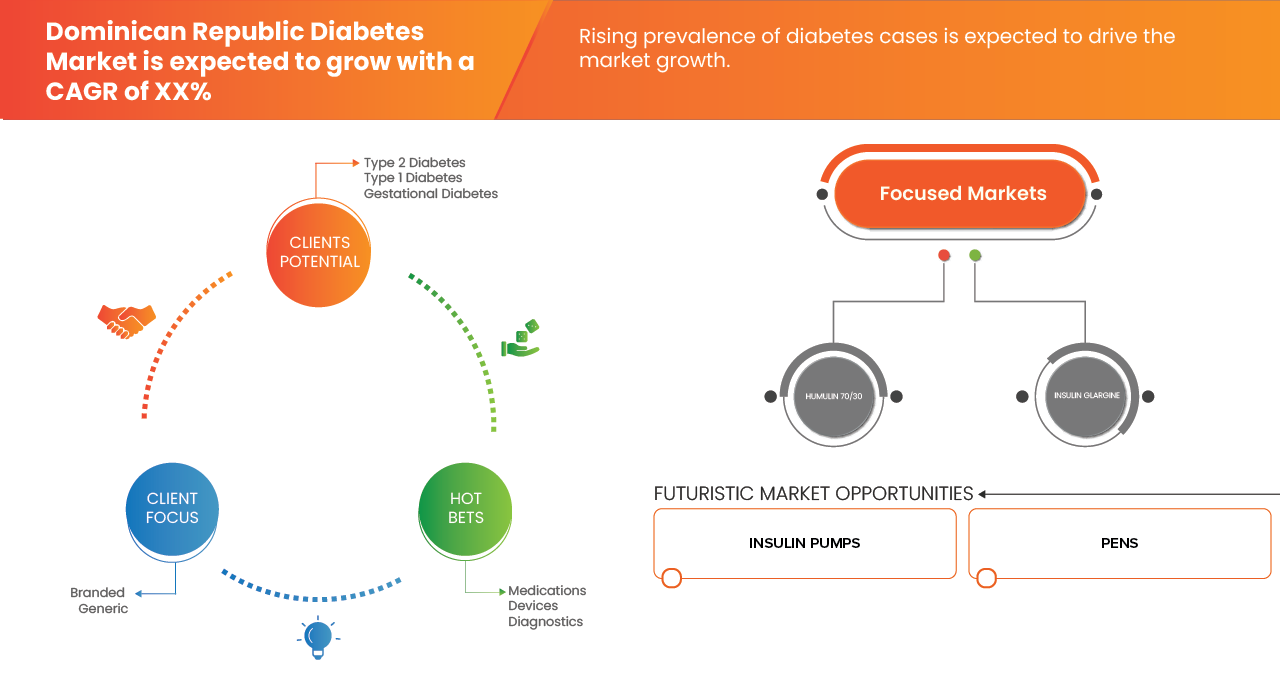

- The Dominican Republic Diabetes Market was valued at USD 437.35 Million in 2024 and is expected to reach USD 753.86 Million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.1%, primarily driven by the Rising use of CHO cells in the genetic study.

- This growth is driven by factors such as Rising Prevalence of Diabetes Case, Policy Focus on Primary Care & Chronic Disease Control, and Growing Private-Sector and Healthcare Capacity.

Dominican Republic Diabetes Market Analysis

- Diabetes is a chronic condition characterized by high blood glucose (sugar) levels due to the body’s inability to produce enough insulin or properly use the insulin it produces. This leads to disruptions in energy metabolism and affects overall health.

- If unmanaged, diabetes can cause serious complications such as cardiovascular disease, kidney damage, nerve damage, and vision problems, making regular monitoring and management essential for maintaining health.

- In 2025, the type 2 diabetes segment is expected to dominate the market by 94.26% due to its high prevalence and growing incidence linked to obesity, sedentary lifestyles, and dietary habits. The segment accounts for the majority of diagnosed diabetes cases in the Dominican Republic, driving demand for oral antidiabetic drugs, insulin therapies, and monitoring devices.

Report Scope and Dominican Republic Diabetes Market Segmentation

|

Attributes |

Dominican Republic Diabetes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dominican Republic Diabetes Market Trends

“Rising Adoption of Digital Health Solutions for Diabetes Management in the Dominican Republic”

- One notable trend in the Dominican Republic Diabetes Market is the growing adoption of digital health technologies for disease monitoring and management.

- Mobile health apps, wearable glucose monitors, and telemedicine platforms are increasingly being used to track blood sugar levels and improve patient engagement.

- For instance, smartphone-connected glucometers allow real-time data sharing between patients and healthcare providers, enhancing treatment adjustments and adherence.

- These technologies support early intervention, personalized care, and improved glycemic control among diabetic patients.

- The digital shift is transforming diabetes care in the Dominican Republic, offering more accessible, efficient, and proactive disease management, particularly in underserved or remote regions.

Dominican Republic Diabetes Market Dynamics

Driver

“Rising Prevalence of Diabetes Cases”

- The rising prevalence of diabetes in the Dominican Republic is a significant driver of the country's Dominican Republic Diabetes Market. As of 2024, approximately 17.6% of adults aged 20 to 79 are living with diabetes, equating to over 1.2 million individuals affected by the condition.

- This escalating trend is attributed to various factors, including increasing rates of obesity, sedentary lifestyles, and dietary habits high in sugars and fats. The growing diabetic population has intensified the demand for medical services, diagnostic tools, medications, and patient education programs, thereby

- For Instance, In March 2025, Duke Global Health Institute announced a new grant aimed at supporting individuals with diabetes in the Dominican Republic, highlighting the increasing prevalence and the need for enhanced healthcare initiatives.

- In February 2025, a study published in the Journal of Diabetes Research indicated that diabetes prevalence in the Dominican Republic ranges between 10% and 12% of the total population, reflecting a significant public health concern.

- The escalating prevalence of diabetes in the Dominican Republic is a critical public health issue that is significantly influencing the country's healthcare landscape.

- With over 1.2 million adults affected, the demand for diabetes-related healthcare services, including diagnostics, treatment, and patient education, is on the rise.

Opportunity

“Expand Primary-Care Screening and Early-Detection Programs”

- The Dominican Republic faces a rapidly increasing diabetes burden, with over 1.2 million adults affected as of 2024.

- This growing prevalence presents a significant opportunity to expand primary-care screening and early-detection programs, which remain underutilized. By strengthening these programs at the community and primary-care level, healthcare providers can identify individuals with prediabetes or undiagnosed diabetes earlier, enabling timely interventions and lifestyle modifications.

- For Instance, In August 2025, the Pan American Health Organization reported that 36,207 adults received preventive health screenings in the Dominican Republic during 2023, with 61.5% of these screenings completed, reflecting increased focus on early detection.

- In February 2025, the International Diabetes Federation highlighted initiatives across the Caribbean, including the Dominican Republic, focused on early detection and health education to reduce complications from diabetes.

- Expanding primary-care screening and early-detection programs in the Dominican Republic represents a critical opportunity to curb the growing diabetes burden.

- By improving access to routine screenings, community-level risk assessments, and early diagnostic testing, healthcare providers can detect diabetes and prediabetes cases earlier, allowing timely interventions and better management

Restraint/Challenge

“High Proportion of Undiagnosed Diabetes and Adherence Problems”

- The Dominican Republic's Dominican Republic Diabetes Market faces significant challenges due to its heavy reliance on imported insulin and related medical supplies. This import dependence exposes the country to supply chain vulnerabilities, including disruptions caused by global trade fluctuations, geopolitical tensions, and logistical inefficiencies. Such vulnerabilities can lead to shortages, price volatility, and inconsistent availability of essential diabetes medications, adversely affecting patient care and market stability.

- Addressing these challenges requires strategic investments in local production capabilities, diversified supply sources, and robust logistics infrastructure to ensure a resilient and sustainable diabetes care ecosystem.

- For Instance, In February 2024, Dominican Today reported an acute insulin shortage in the country's private pharmaceutical sector, particularly affecting the widely used type 70/30 insulin. Patients were compelled to seek alternatives at public institutions, indicating significant supply chain gaps.

- In September 2024, Direct Relief highlighted the challenges faced by neighboring Haiti, where insulin is entirely dependent on imports, and political instability has severely disrupted medical supply chains, underscoring the regional vulnerabilities that could impact the Dominican Republic.

- The Dominican Republic's import dependence for insulin and related medical supplies presents substantial challenges to the stability and sustainability of its Dominican Republic Diabetes Market.

- Recent instances of insulin shortages, regional supply chain disruptions, and economic vulnerabilities underscore the need for strategic initiatives to enhance local production capabilities, diversify supply sources, and strengthen logistics infrastructure.

Dominican Republic Diabetes Market Scope

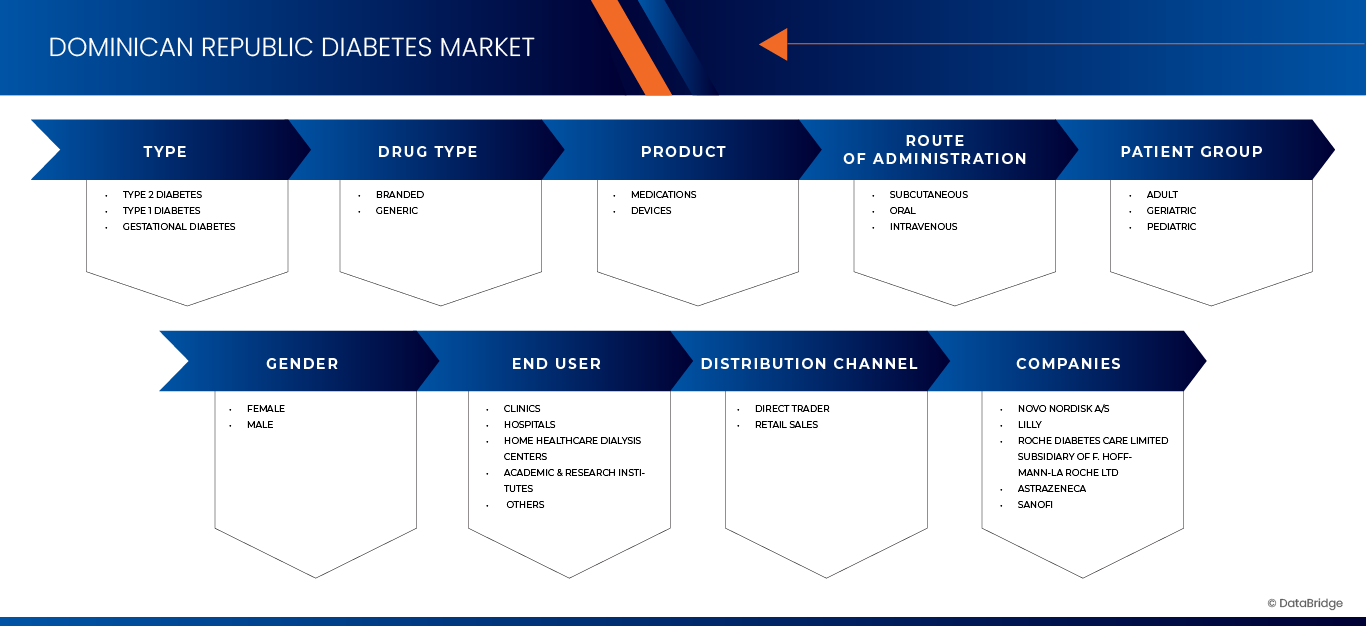

The market is segmented on the basis type, product, drug type, route of administration, gender, patient group, end-user, and distribution channel.

- By Type

On the basis of type, the market is segmented into type 1 diabetes, type 2 diabetes, gestational diabetes. In 2025, the type 2 diabetes segment is expected to dominate the market with a market share of 94.26% and is growing at a CAGR of 7.1% in the forecast period of 2025 to 2032. due to its high prevalence and growing incidence linked to obesity, sedentary lifestyles, and dietary habits. The segment accounts for the majority of diagnosed diabetes cases in the Dominican Republic, driving demand for oral antidiabetic drugs, insulin therapies, and monitoring devices.

- By Drug Type

On the basis of drug type, the market is segmented into branded, generic. In 2025, the branded segment is expected to dominate the market with a market share of 72.20% and is growing at a CAGR of 7.3% in the forecast period of 2025 to 2032. due to strong physician preference, proven clinical efficacy, and higher trust among patients for established diabetes therapies. Branded drugs and devices are often associated with superior quality, reliability, and consistent treatment outcomes, which drive their adoption across hospitals, clinics, and pharmacies. Additionally, ongoing launches of innovative branded formulations and advanced insulin delivery systems by multinational companies further strengthen their presence

- By Product

On the basis of product, the market is segmented into medications, devices. In 2025, the medications segment is expected to dominate the market with a market share of 73.76% and is growing at a CAGR of 6.9% in the forecast period of 2025 to 2032, due to the high prevalence of type 2 diabetes, increasing adoption of oral antidiabetic drugs and insulin therapies, improved access to pharmaceuticals through public health programs, and growing awareness of early diagnosis and treatment adherence. The continued innovation in drug formulations and rising healthcare spending further support the segment’s dominance in the market.

- By Route of Administration

On the basis of route of administration, the market is segmented into subcutaneous, oral, intravenous. In 2025, the subcutaneous segment is expected to dominate the market with a market share of 94.18% and is growing at a CAGR of 7.1% in the forecast period of 2025 to 2032. due to its extensive use in insulin administration for diabetes management. This route offers convenience, reliable absorption, and patient-friendly options through insulin pens, syringes, and pumps. Its suitability for long-term self-administration and preference among both patients and healthcare providers enhance its adoption across hospitals, specialty clinics, and homecare settings in the Dominican Republic.

- By Patient Group

On the basis of patient group, the market is segmented into adult, geriatric, pediatric. In 2025, the adult segment is expected to dominate the market with a market share of 94.16% and is growing at a CAGR of 7.1% in the forecast period of 2025 to 2032. due to the higher prevalence of type 2 diabetes among middle-aged and older adults, driven by lifestyle factors, obesity, and aging populations. Adults represent the largest patient pool requiring continuous monitoring, medication, and long-term disease management. Their higher healthcare utilization and increased risk of diabetes-related complications further strengthen the adoption of treatment and monitoring solutions across hospitals, specialty clinics, and community healthcare settings in the Dominican Republic

- By Gender

On the basis of gender, the market is segmented into female, male. In 2025, the female segment is expected to dominate the market with a market share of 56.08% and is growing at a CAGR of 7.4% in the forecast period of 2025 to 2032. due to the rising incidence of type 2 diabetes and gestational diabetes among women, influenced by hormonal changes, obesity, and lifestyle factors. Women face unique health risks, including complications during pregnancy and a higher likelihood of cardiovascular issues linked to diabetes, which drive demand for specialized care and monitoring

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, dialysis centers, home healthcare, research & academic institutes, others. In 2025, the clinics segment is expected to dominate the market with a market share of 41.38% and is growing at a CAGR of 7.9% in the forecast period of 2025 to 2032. due to their critical role in providing accessible and cost-effective diabetes management services. Clinics serve as primary points of care for regular check-ups, monitoring, and treatment adjustments, especially for patients requiring long-term follow-up. Their growing presence in urban and semi-urban areas, along with the availability of specialized diabetes care programs, enhances their adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, others. In 2025, the retail sales segment is expected to dominate the market with a market share of 58.33% and is growing at a CAGR of 7.3% in the forecast period of 2025 to 2032, due to the increasing availability and accessibility of diabetes medicines, insulin, and monitoring devices through community pharmacies and retail outlets. Retail stores play a vital role in ensuring continuous patient access to essential drugs and consumables such as test strips, lancets, and glucose meters. Their widespread presence, affordability, and convenience make them a preferred channel for diabetes patients managing their condition on a daily basis

|

Segmentation |

Sub-Segmentation |

|

By Product |

MEDICATIONS BYTYPE

DEVICES BY TYPE

BY PRODUCT

BY TECHNOLOGY

BY SITE

BY TYPE

BY USAGE

BY TECHNOLOGY

BY TYPE

BY COMPONENT

|

|

By Drug Type |

|

|

By Type

|

|

|

By Gender |

|

|

By Patient Group

|

|

|

By Route of Administration |

|

|

By End User |

|

|

By Distribution Channel |

|

Dominican Republic Diabetes Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Dominican Republic presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Novo Nordisk A/S (Denmark), Lilly (U.S.)

- Roche Diabetes Care Limited, subsidiary of F. Hoffmann-La Roche Ltd (Switzerland)

- AstraZeneca (U.K.)

- Sanofi (France)

- Johnson & Johnson and its affiliates (U.S.)

- Medtronic (U.S.)

- Abbott (U.S.)

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- Dexcom, Inc. (U.S.)

- Carelife USA (U.S.)

- MHCmed (U.S.)

- Inmenol Industrial Laboratorios, S.R.L. (Argentina)

- Cruz Ayala (Mexico)

- LUMINOVA PHARMA GROUP (Mexico)

- AOSS Medical Supply (U.S.)

- Macrotech (India)

- Alfa Laboratories (U.K.)

- Tandem Diabetes Care, Inc. (U.S.)

Latest Developments in Dominican Republic Diabetes Market

- In December 2024, Novo Holdings' acquisition of Catalent, Inc. This acquisition aims to expand Novo Nordisk's manufacturing capacity, helping the company scale its production to meet the growing demand for treatments for serious chronic diseases. It will support Novo Nordisk's efforts to reach more people in need of these life-changing therapies.

- In February 2025, European Medicines Agency's Committee for Medicinal Products for Human Use (CHMP) recommended the approval of Jaypirca (pirtobrutinib) for the treatment of adult patients with relapsed or refractory mantle cell lymphoma. This approval would offer a new treatment option for patients who have exhausted other therapies, potentially improved outcomes and providing a targeted, less toxic alternative to traditional therapies. The approval is expected to significantly benefit those with limited treatment options in this challenging condition.

- In December 2024, Eli Lilly announced the results of the Phase 3 BRUIN CLL-321 trial for pirtobrutinib (Jaypirca), a non-covalent Bruton's tyrosine kinase inhibitor, in patients with chronic lymphocytic leukemia or small lymphocytic lymphoma previously treated with a BTK inhibitor. The results showed that pirtobrutinib reduced the risk of disease progression or death by 46% compared to standard treatments. Additionally, pirtobrutinib extended the median time to the next treatment or death by 23.9 months, providing clinically meaningful improvements in progression-free survival and time to next treatment, thereby offering a promising new option for patients with limited alternatives.

- In march 2025, Novo Nordisk announced the results of the REDEFINE 2 trial, a Phase 3 study evaluating CagriSema, a combination of cagrilintide and semaglutide, in adults with obesity or overweight and type 2 diabetes. The trial demonstrated that CagriSema led to significant weight loss, with participants achieving a 15.7% reduction in body weight compared to 3.1% in the placebo group. The treatment was well tolerated, with most side effects being mild to moderate gastrointestinal issues. Novo Nordisk plans to file for regulatory approval in early 2026.

- In November 2024, Abbott presented late-breaking clinical data demonstrating sustained benefits of its Esprit BTK system for patients with peripheral artery disease below the knee. The findings highlight the device’s effectiveness in improving blood flow and long-term limb outcomes in this patient population. This development reinforces Abbott’s peripheral vascular portfolio, supporting the adoption of minimally invasive interventions that address critical unmet needs in lower extremity revascularization.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF DOMINICAN REPUBLIC DIABETES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTER'S FIVE FORCES ANALYSIS

4.3 INDUSTRY INSIGHTS — DOMINICAN REPUBLIC DIABETES MARKET

4.4 MARKET ACCESS

4.4.1 REGULATORY ENTRY PATHWAYS

4.4.2 PUBLIC HEALTH INSURANCE AND REIMBURSEMENT MECHANISMS

4.4.3 PRICING AND PROCUREMENT POLICIES

4.4.4 DISTRIBUTION AND SUPPLY CHAIN FRAMEWORK

4.4.5 HEALTH TECHNOLOGY ASSESSMENT AND INCLUSION CRITERIA

4.4.6 PRIVATE INSURANCE AND OUT-OF-POCKET MARKET

4.4.7 CONCLUSION

4.5 PIPELINE ANALYSIS — DOMINICAN REPUBLIC DIABETES MARKET

5 REGULATION COVERAGE — DOMINICAN REPUBLIC DIABETES MARKET

5.1 PRODUCT CODES

5.2 CERTIFIED STANDARDS

5.3 SAFETY STANDARDS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF DIABETES CASES

6.1.2 POLICY FOCUS ON PRIMARY CARE & CHRONIC DISEASE CONTROL

6.1.3 GROWING PRIVATE-SECTOR AND HEALTHCARE CAPACITY

6.2 RESTRAINS

6.2.1 WORKFORCE SHORTAGES AND LIMITED DIABETES EDUCATION

6.2.2 HIGH OUT-OF-POCKET SPENDING AND PUBLIC-SECTOR LIMITATIONS

6.3 OPPORTUNITIES

6.3.1 EXPAND PRIMARY-CARE SCREENING AND EARLY-DETECTION PROGRAMS.

6.3.2 AFFORDABLE INSULIN AND GENERICS / BIOSIMILARS DISTRIBUTION.

6.4 CHALLENGES

6.4.1 HIGH PROPORTION OF UNDIAGNOSED DIABETES AND ADHERENCE PROBLEMS

6.4.2 PRICE BARRIER FOR PREMIUM DIABETES CARE

7 DOMINICAN REPUBLIC DIABETES MARKET, BY DRUG TYPE

7.1 OVERVIEW

7.2 BRANDED

7.3 GENERIC

8 DOMINICAN REPUBLIC DIABETES MARKET, BY ROUTE OF ADMINISTRATION

8.1 OVERVIEW

8.2 SUBCUTANEOUS

8.3 ORAL

8.4 INTRAVENOUS

9 DOMINICAN REPUBLIC DIABETES MARKET, BY PATIENT GROUP

9.1 OVERVIEW

9.2 ADULT

9.3 GERIATRIC

9.4 PEDIATRIC

10 DOMINICAN REPUBLIC DIABETES MARKET, BY GENDER

10.1 OVERVIEW

10.2 FEMALE

10.3 MALE

11 DOMINICAN REPUBLIC DIABETES MARKET, BY END USER

11.1 OVERVIEW

11.2 CLINICS

11.3 HOSPITALS

11.4 HOME HEALTHCARE

11.5 DIALYSIS CENTERS

11.6 ACADEMIC & RESEARCH INSTITUTES

11.7 OTHERS

12 DOMINICAN REPUBLIC DIABETES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 RETAIL SALES

12.3 DIRECT TENDER

12.4 OTHERS

13 DOMINICAN REPUBLIC DIABETES MARKET, BY TYPE

13.1 OVERVIEW

13.2 TYPE 2 DIABETES

13.3 TYPE 1 DIABETES

13.4 GESTATIONAL DIABETES

14 DOMINICAN REPUBLIC DIABETES MARKET, BY PRODUCT

14.1 MEDICATIONS

14.1.1 INSULIN THERAPY

14.1.2 NON-INSULIN THERAPY

14.2 DEVICES

15 DOMINICAN REPUBLIC DIABETES MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: DOMINICAN REPUBLIC

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 NOVO NORDISK A/S

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 LILLY

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT/NEWS

17.3 SANOFI

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 (ROCHE DIABETES CARE LIMITED.) F. HOFFMANN-LA ROCHE LTD

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT/NEWS

17.5 ABBOTT

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 ALFA LABORATORIES

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 AOSS MEDICAL SUPPLY

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ASTRAZENECA

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT/NEWS

17.9 CARELIFE USA

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 CRUZ AYALA

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 DEXCOM, INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 INMENOL INDUSTRIAL LABORATORIOS, S.R.L

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 JOHNSON & JOHNSON AND ITS AFFILIATES

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT/NEWS

17.14 LUMINOVA PHARMA GROUP

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 MACROTECH

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 MEDTRONIC

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENT

17.17 MHCMED.COM

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 NOVERTIS AG

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENT

17.19 PFIZER INC

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 TANDEM DIABETES CARE, INC.

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 DOMINICAN REPUBLIC DIABETES MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 DOMINICAN REPUBLIC DIABETES MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 3 DOMINICAN REPUBLIC DIABETES MARKET, BY PATIENT GROUP, 2018-2032 (USD THOUSAND

TABLE 4 DOMINICAN REPUBLIC DIABETES MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 5 DOMINICAN REPUBLIC DIABETES MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 6 DOMINICAN REPUBLIC DIABETES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 7 DOMINICAN REPUBLIC RETAIL SALES IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 DOMINICAN REPUBLIC DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 OVERVIEW

TABLE 10 DOMINICAN REPUBLIC DIABETES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 11 DOMINICAN REPUBLIC DIABETES MARKET, BY PRODUCT, 2018-2032 (THOUSAND UNITS)

TABLE 12 DOMINICAN REPUBLIC MEDICATIONS IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 DOMINICAN REPUBLIC INSULIN THERAPY IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 DOMINICAN REPUBLIC PRE-MIXED INSULIN IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 TABLE 13 DOMINICAN REPUBLIC LONG-ACTING IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 DOMINICAN REPUBLIC RAPID-ACTING IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 TABLE 15 DOMINICAN REPUBLIC REGULAR OR SHORT-ACTING IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 TABLE 16 DOMINICAN REPUBLIC NON-INSULIN IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 TABLE 17 DOMINICAN REPUBLIC BIGUANIDES IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 TABLE 18 DOMINICAN REPUBLIC GLUCAGON-LIKE PEPTIDE-1 (GLP-1) RECEPTOR AGONISTS IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 TABLE 19 DOMINICAN REPUBLIC SODIUM-GLUCOSE COTRANSPORTER 2 (SGLT2) INHIBITORS IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 TABLE 20 DOMINICAN REPUBLIC ALPHA-GLUCOSIDASE INHIBITORS IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 TABLE 21 DOMINICAN REPUBLIC THIAZOLIDINEDIONES IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 TABLE 22 DOMINICAN REPUBLIC DEVICES IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 TABLE 23 DOMINICAN REPUBLIC MONITORING DEVICES IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 TABLE 24 DOMINICAN REPUBLIC BLOOD GLUCOSE METERS (BGM) IN DIABETES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 27 TABLE 25 DOMINICAN REPUBLIC BLOOD GLUCOSE METERS (BGM) IN DIABETES MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 28 TABLE 26 DOMINICAN REPUBLIC BLOOD GLUCOSE METERS (BGM) IN DIABETES MARKET, BY SITE, 2018-2032 (USD THOUSAND)

TABLE 29 TABLE 27 DOMINICAN REPUBLIC BLOOD GLUCOSE METERS (BGM) IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 TABLE 28 DOMINICAN REPUBLIC INSULIN DELIVERY DEVICES IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 TABLE 29 DOMINICAN REPUBLIC PENS IN DIABETES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 32 TABLE 30 DOMINICAN REPUBLIC PENS IN DIABETES MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 33 TABLE 31 DOMINICAN REPUBLIC INSULIN PUMPS IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 TABLE 32 DOMINICAN REPUBLIC INSULIN PUMPS IN DIABETES MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 35 TABLE 33 DOMINICAN REPUBLIC PUMPS IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 TABLE 33 DOMINICAN REPUBLIC ACCESSORIES IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 TABLE 34 DOMINICAN REPUBLIC SYRINGES IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 TABLE 35 DOMINICAN REPUBLIC JET INJECTORS IN DIABETES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 DOMINICAN REPUBLIC DIABETES MARKET: SEGMENTATION

FIGURE 2 DOMINICAN REPUBLIC DIABETES MARKET: DATA TRIANGULATION

FIGURE 3 DOMINICAN REPUBLIC DIABETES MARKET: DROC ANALYSIS

FIGURE 4 DOMINICAN REPUBLIC DIABETES MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 DOMINICAN REPUBLIC DIABETES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 DOMINICAN REPUBLIC DIABETES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 DOMINICAN REPUBLIC DIABETES MARKET: MULTIVARIATE MODELLING

FIGURE 8 DOMINICAN REPUBLIC DIABETES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 DOMINICAN REPUBLIC DIABETES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 DOMINICAN REPUBLIC DIABETES MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 DOMINICAN REPUBLIC DIABETES MARKET: SEGMENTATION

FIGURE 12 DOMINICAN REPUBLIC DIABETES MARKET: EXECUTIVE SUMMARY

FIGURE 13 DOMINICAN REPUBLIC DIABETES MARKET: STRATEGIC DECISIONS

FIGURE 14 RISING PREVALENCE OF DIABETES CASES EXPECTED TO DRIVE THE GROWTH OF THE DOMINICAN REPUBLIC DIABETES MARKET FROM 2025 TO 2032

FIGURE 15 THE TYPE 2 DIABETES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE DOMINICAN REPUBLIC DIABETES MARKET IN 2025 & 2032

FIGURE 16 TWO SEGMENTS COMPRISE THE DOMINICAN REPUBLIC DIABETES MARKET, BY TYPE..

FIGURE 17 DROC ANALYSIS

FIGURE 18 DOMINICAN REPUBLIC DIABETES MARKET BY DRUG TYPE, 2024

FIGURE 19 DOMINICAN REPUBLIC DIABETES MARKET: BY DRUG TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 20 DOMINICAN REPUBLIC DIABETES MARKET: BY DRUG TYPE, CAGR (2025- 2032)

FIGURE 21 DOMINICAN REPUBLIC DIABETES MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 22 DOMINICAN REPUBLIC DIABETES MARKET BY ROUTE OF ADMINISTRATION, 2024

FIGURE 23 DOMINICAN REPUBLIC DIABETES MARKET: BY ROUTE OF ADMINISTRATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 24 DOMINICAN REPUBLIC DIABETES MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2025- 2032)

FIGURE 25 DOMINICAN REPUBLIC DIABETES MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 26 DOMINICAN REPUBLIC DIABETES MARKET BY PATIENT GROUP, 2024

FIGURE 27 DOMINICAN REPUBLIC DIABETES MARKET: BY PATIENT GROUP, 2025 TO 2032 (USD THOUSAND)

FIGURE 28 DOMINICAN REPUBLIC DIABETES MARKET: BY PATIENT GROUP, CAGR (2025- 2032)

FIGURE 29 DOMINICAN REPUBLIC DIABETES MARKET: BY PATIENT GROUP, LIFELINE CURVE

FIGURE 30 DOMINICAN REPUBLIC DIABETES MARKET BY GENDER, 2024

FIGURE 31 DOMINICAN REPUBLIC DIABETES MARKET: BY GENDER, 2025 TO 2032 (USD THOUSAND)

FIGURE 32 DOMINICAN REPUBLIC DIABETES MARKET: BY GENDER, CAGR (2025- 2032)

FIGURE 33 DOMINICAN REPUBLIC DIABETES MARKET: BY GENDER, LIFELINE CURVE

FIGURE 34 DOMINICAN REPUBLIC DIABETES MARKET BY END USER, 2024

FIGURE 35 DOMINICAN REPUBLIC DIABETES MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 36 DOMINICAN REPUBLIC DIABETES MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 37 DOMINICAN REPUBLIC DIABETES MARKET: BY END USER, LIFELINE CURVE

FIGURE 38 DOMINICAN REPUBLIC DIABETES MARKET BY DISTRIBUTION CHANNEL, 2024

FIGURE 39 DOMINICAN REPUBLIC DIABETES MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 40 DOMINICAN REPUBLIC DIABETES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 41 DOMINICAN REPUBLIC DIABETES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 42 DOMINICAN REPUBLIC DIABETES MARKET BY TYPE, 2024

FIGURE 43 DOMINICAN REPUBLIC DIABETES MARKET: BY TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 44 DOMINICAN REPUBLIC DIABETES MARKET: BY TYPE, CAGR (2025- 2032)

FIGURE 45 DOMINICAN REPUBLIC DIABETES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 46 DOMINICAN REPUBLIC DIABETES MARKET BY PRODUCT, 2024

FIGURE 47 DOMINICAN REPUBLIC DIABETES MARKET: BY PRODUCT, 2025 TO 2032 (USD THOUSAND)

FIGURE 48 DOMINICAN REPUBLIC DIABETES MARKET: BY PRODUCT, CAGR (2025- 2032)

FIGURE 49 DOMINICAN REPUBLIC DIABETES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 50 DOMINICAN REPUBLIC DIABETES MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.