Dominican Republic High Cost Medicines Market

Market Size in USD Million

CAGR :

%

USD

45.65 Million

USD

80.21 Million

2024

2032

USD

45.65 Million

USD

80.21 Million

2024

2032

| 2025 –2032 | |

| USD 45.65 Million | |

| USD 80.21 Million | |

|

|

|

|

Dominican Republic High-Cost Medicines Market Size

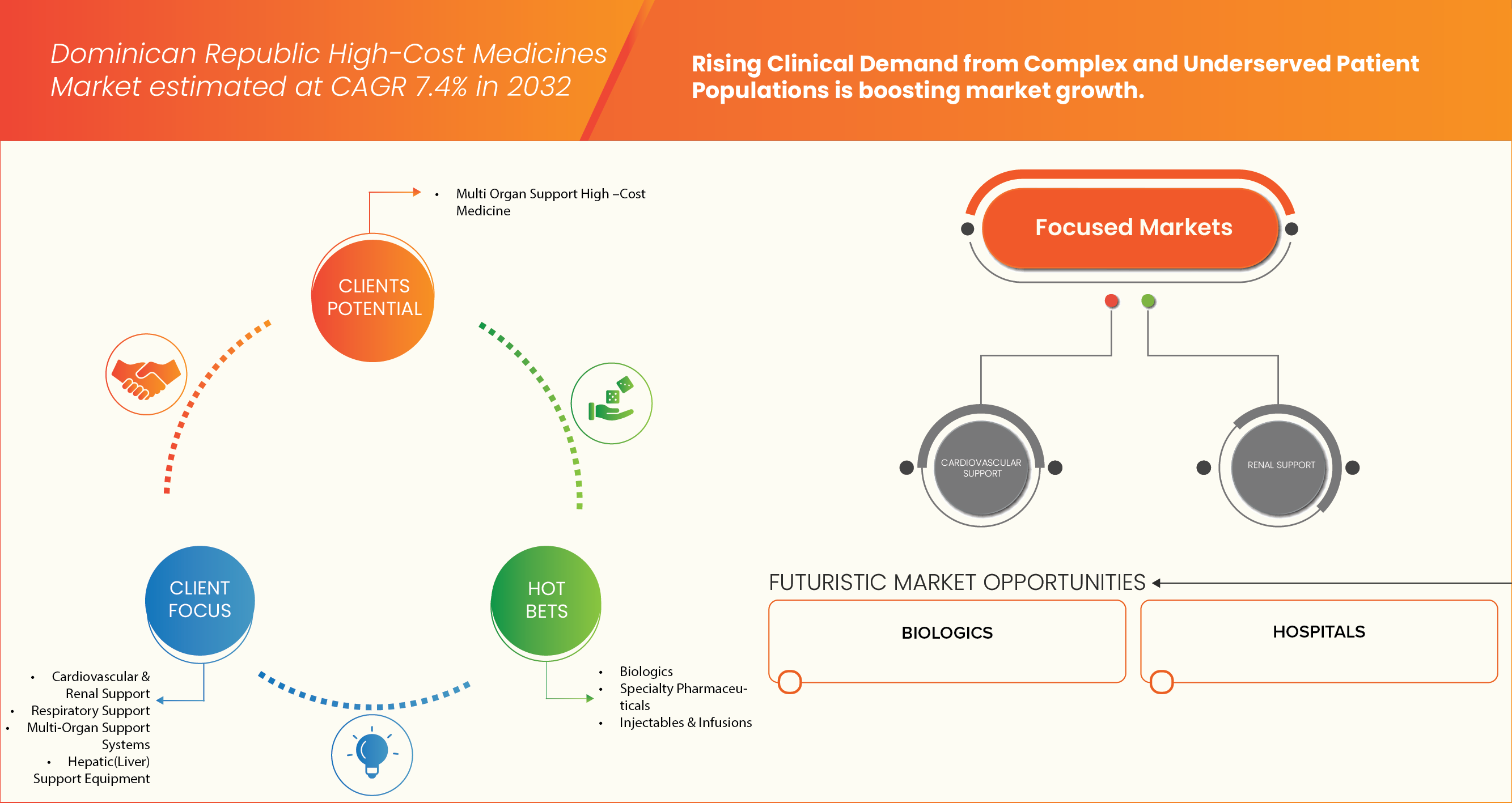

- The Dominican Republic High-Cost Medicines Market was valued at USD 45.65 million in 2024 and is expected to reach USD 80.21 million by 2032, at a CAGR of 7.4% during the forecast period

- The market is primarily driven by the rising cancer prevalence, increasing healthcare expenditure, and growing awareness of advanced treatment options. Rapid improvements in healthcare infrastructure, expansion of specialized cancer treatment centres

- This growth is driven by factors such as government initiatives promoting early diagnosis and innovative therapies, large patient pool and increasing investments by international and local companies in photodynamic therapy technologies

Dominican Republic High-Cost Medicines Market Analysis

- The Dominican Republic High-Cost Medicines Market represents a key segment of the national pharmaceutical industry, focusing on the supply, distribution, and utilization of advanced, specialized, and often life-saving therapies used in the treatment of chronic, rare, and complex diseases. These include oncology drugs, biologics, immunotherapies, and treatments for conditions such as multiple sclerosis, rheumatoid arthritis, and rare genetic disorders. High-cost medicines play a vital role in improving patient outcomes and quality of life, particularly in tertiary hospitals and specialty care centers across the Dominican Republic.

- The growing demand for high-cost medicines in the Dominican Republic is driven by the rising prevalence of chronic and non-communicable diseases, greater diagnostic capabilities, and the expanding access to innovative treatments. Increased healthcare spending by both the government and private sector, coupled with the expansion of health insurance coverage, has further enhanced the adoption of costly but effective therapies. Additionally, the introduction of biosimilars and government initiatives to negotiate drug prices are improving affordability and availability.

- The Dominican Republic has emerged as an important regional market for high-cost medicines due to continuous improvements in healthcare infrastructure, partnerships with international pharmaceutical companies, and government efforts to strengthen access to essential and innovative drugs. These developments are enhancing treatment availability for patients suffering from life-threatening or rare conditions that require high-cost interventions.

- The Dominican Republic High-Cost Medicines Market is expected to grow steadily, with a projected CAGR of around 7.4% during the forecast period. Growth is fueled by ongoing health sector modernization, rising disease burden, and an increased emphasis on improving outcomes for patients requiring advanced therapies. Continued reforms in pricing, reimbursement, and drug importation policies are also expected to support sustained market expansion in the coming years.

- The Hospital segment is expected to dominate the Dominican Republic High-Cost Medicines Market with a market share of 79.85% in 2025, driven by their increasing prevalence of chronic and rare diseases, the availability of specialized treatment facilities, and higher access to advanced therapies through hospital-based procurement and reimbursement programs.

Report Scope and Dominican Republic High-Cost Medicines Market Segmentation

|

Attributes |

High-Cost Medicines Market Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include Pipeline Analysis, industry insights, market access, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dominican Republic High-Cost Medicines Market Trends

“Defined public budget for high-cost drugs”

The establishment of a defined public budget for high-cost medicines in the Dominican Republic represents a pivotal market opportunity within the nation’s evolving healthcare and pharmaceutical landscape. By institutionalizing state funding for expensive drugs covering oncology, autoimmune, and rare disease therapies—the government is transitioning from reactive procurement to a predictable, policy-driven expenditure framework. This commitment enhances market visibility for suppliers, enables structured tender participation, and supports the long-term entry of multinational and regional biopharmaceutical firms. Moreover, the budgeted mechanism under programs such as PROMESE/CAL and the Directorate of Access to High-Cost Medicines strengthens fiscal transparency, accelerates access timelines, and anchors consistent public demand—transforming high-cost drug provision from an unpredictable expense into a sustainable, investment-grade market segment.

For instances,

- In August 2022, DR1 Daily News reported that the government, via its Promese/Cal programme, has spent USD 15.5 million US dollars. on “costly medicines” during the year, with a new tender launched to complete supply of drugs for serious or catastrophic illnesses.

- In February 2023, Dominican Today reported that the government invests approximately USD 144.39 million USD annually in the Directorate of Access to High-Cost Medicines to benefit about 15,000 patients with chronic disease.

- In July 2023, Adolfo Pérez (director of Promese Cal) stated in Dominican Today that under President Abinader the budget for high-cost medicines has doubled since 2020, and the number of beneficiaries has tripled (from ~5,729 to over 16,500).

- In June 2024, the Pan American Health Organization’s report to its Executive Committee referenced that 20 countries (including DR) are adopting or strengthening policies on access and rational use of high-cost medicines, pointing to evolving governance frameworks for defined public funding of costly therapies.

- In the May 2025 Healthcare Financing & Reimbursement Survey (Dominican Republic), the IBA/health survey notes that the government “maintains a special budget for high-cost medicines,” managed via MISPAS.

Collectively, the documented budget expansions and institutional reforms demonstrate that the Dominican Republic is moving toward a mature and fiscally grounded model for financing high-cost therapies. For market participants, this evolution signals a more predictable and scalable demand environment, where procurement cycles and payment flows are increasingly codified under national health policy. As public allocations grow and patient coverage widens, suppliers gain leverage to negotiate volume-based contracts, implement access partnerships, and localize distribution networks. In essence, the defined budget transforms the state into a stable, high-value purchaser capable of sustaining innovation inflows, encouraging biosimilar adoption, and attracting long-term investment. This convergence of policy stability and rising expenditure firmly positions the Dominican Republic as a strategic growth node in the Caribbean high-cost drug ecosystem.

Dominican Republic High-Cost Medicines Market Dynamics

Driver

“Improved Diagnostic Capabilities and Specialist Access”

The high‑cost medicines market in the Dominican Republic is being driven by steadily improving diagnostic infrastructure and greater access to specialized medical expertise. Enhanced cancer registries, expanded early detection programs, and the development of medical residency specialties are enabling earlier and more accurate diagnoses of conditions requiring expensive, targeted therapies. As hospitals and public health bodies invest in better laboratory, imaging, and pathology services, more patients are being identified earlier in their disease courses—making expensive high‑cost treatments clinically effective and financially justifiable. Meanwhile, specialist training programs in areas such as nephrology, dermatology, infectious diseases, and pediatric oncology are increasing the number of physicians capable of managing biologics, immunosuppressants, and other high‑cost interventions in both public and private sectors.

For instance,

- In September 2025, as per the article published by NIH (National Cancer Institute) The National Strategic Childhood Cancer Plan 2023‑2030 was introduced, with government initiatives to expand hospital infrastructure, create early‑detection manuals, and formalize pediatric oncology capacity to improve diagnostic and therapeutic outcomes.

- Also in May 2024, the SciELO - Scientific Electronic Library Online published an article mentioning the first early detection manual and public policy for childhood cancer were published and disseminated among primary health care teams and provincial health officers. The goal is to increase timely diagnosis for pediatric cancer.

- In January 2025, the article published by Vitals Today stated that from 2019 to 2024 there has been a substantial increase in diagnostic services: labs tests rose 42.66%, imaging exams 51.55%, surgeries 31.71%, laboratory / diagnostic capacity growing notably.

These developments strengthen the market by ensuring that high‑cost medicines are used smartly—targeted toward patients most likely to benefit—and supported by specialists who can manage care appropriately. As diagnostic precision and specialist availability continue to improve, demand for high‑cost medicines is expected to rise in line with better detection and treatment ability.

Restraints

“High cost of medicines limiting accessibility for a large segment of the population”

The high cost of branded and innovative medicines in the Dominican Republic remains a significant barrier to healthcare accessibility, particularly for low- and middle-income populations. Many high-cost treatments, including cancer therapies, biologics, and specialty drugs, require substantial financial outlays, often exceeding the means of patients without comprehensive health insurance. This affordability barrier limits patient access to life-saving therapies and creates inequities in healthcare delivery across the country.

Efforts such as partial insurance coverage, government subsidies, and patient assistance programs are helping some patients access essential treatments, but the overall cost factor continues to restrict equitable access. There is a pressing need for expanded insurance coverage, public-private partnerships, and innovative financing mechanisms to ensure broader availability of high-cost medicines.

For Instance,

- As reported by Dominican Today on September 26, 2022, the National Social Security Council (CNSS) approved a 50% reduction in the copay of the Family Health Insurance (SFS) for hospitalization, surgeries, kidney transplants, and other high-cost treatments. While this initiative improves affordability for some, many patients still face significant out-of-pocket expenses.

- A study by the Inter-American Development Bank (IDB) found that unbranded generics are 3.5 times less expensive than their branded counterparts. If the Dominican Republic's contributive regime were to replace branded drugs with unbranded generics, it could achieve annual savings of USD 13 to USD 60 million. Redirecting these savings toward expanding health services could yield 4,000 to 18,000 additional life years in perfect health per year.

- The Dominican Republic's public healthcare system often finances higher-cost branded pharmaceuticals, despite the availability of equally effective unbranded generics. This misallocation of resources leads to opportunity costs in terms of population health.

- According to Dominican Today on April 25, 2023, limited coverage of high-cost treatments, such as organ transplants beyond kidneys, prevents many low-income individuals from accessing necessary therapies.

The high cost of medicines in the Dominican Republic remains a significant barrier to healthcare accessibility, particularly for low- and middle-income populations. Despite partial insurance coverage, government subsidies, and patient assistance programs, many high-cost treatments, including cancer therapies, biologics, and organ transplants, remain financially out of reach for a large segment of the population. This affordability challenge continues to limit equitable access to life-saving therapies and underscores the need for expanded insurance coverage, public-private partnerships, and innovative financing solutions to ensure broader availability of advanced treatments.

Dominican Republic High-Cost Medicines Market Scope

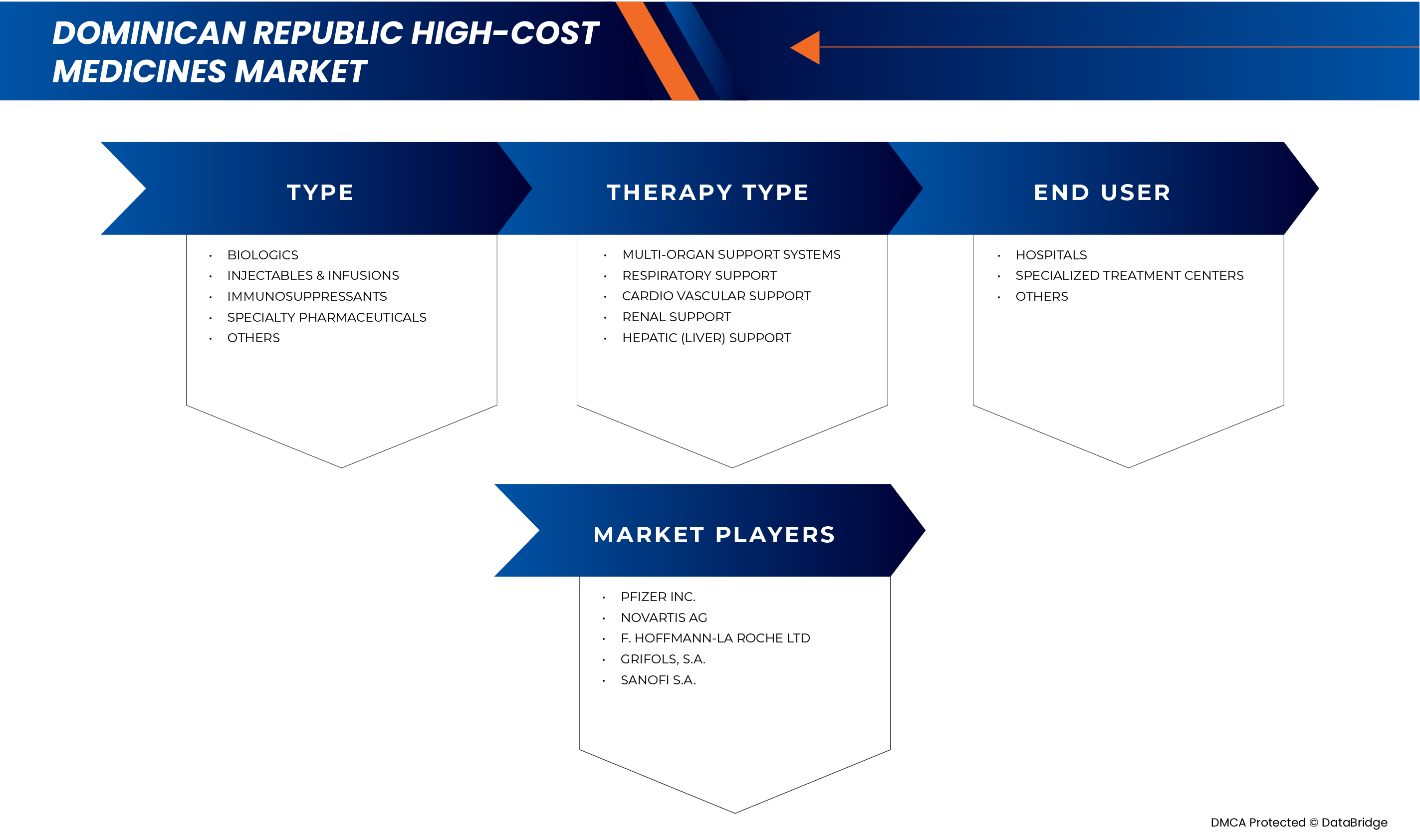

The market is segmented on the basis of type, therapy type, and end user.

- By Type

On the basis of Type, Dominican Republic High-Cost Medicines Market is segmented into Biologics, Injectables & Infusions, Immunosuppressants, Specialty Pharmaceuticals, Others. In 2025, the Biologics segment is expected to dominate the market with 34.47% market share due to rising adoption of advanced biologic therapies for treating chronic and life-threatening diseases such as cancer, autoimmune disorders, and rare genetic conditions. The growing preference for biologics is further supported by their superior efficacy, targeted mechanisms of action, and expanding availability of biosimilars, which enhance accessibility and affordability. Additionally, increased healthcare investments and the expansion of hospital-based biologic treatment programs are contributing to the segment’s strong market position in the Dominican Republic.

Biologics is the fastest-growing segment with the highest CAGR of 8.2% in the Dominican Republic High-Cost Medicines Market due to increasing prevalence of chronic and rare diseases, coupled with the rising adoption of targeted and personalized therapies. Growth is further fueled by the expansion of oncology, immunology, and autoimmune disease treatments, where biologics have demonstrated superior clinical outcomes. Additionally, improvements in healthcare infrastructure, greater physician awareness, and the introduction of cost-effective biosimilars are driving wider acceptance and accessibility of biologic drugs across the country.

- By Therapy Type

On the basis of Therapy Type, the Dominican Republic High-Cost Medicines Market is segmented into Renal Support, Respiratory Support, Cardio Vascular Support, Multi-Organ Support Systems, Hepatic (Liver) Support. In 2025, the Multi-Organ Support Systems segment is expected to dominate the market with 30.52% market share due to rising incidence of critical illnesses and complex conditions such as sepsis, multi-organ failure, and severe infections that require integrated and advanced therapeutic interventions. The segment’s growth is further driven by the increasing adoption of comprehensive care approaches in intensive care units (ICUs), the availability of high-cost combination therapies, and technological advancements in organ support systems that improve survival rates and patient outcomes in tertiary healthcare settings.

Multi-Organ Support Systems is the fastest-growing segment with a CAGR of 8.7% in the Dominican Republic High-Cost Medicines Market due to its increasing use in managing critically ill patients with multiple organ dysfunction and failure. Growth in this segment is driven by advancements in critical care technologies, rising investments in intensive care infrastructure, and the growing availability of integrated therapies that provide simultaneous support for multiple organ systems. Additionally, the increasing prevalence of severe infections, sepsis, and chronic comorbid conditions has intensified the demand for comprehensive, high-cost therapeutic solutions aimed at improving patient survival and recovery outcomes in advanced hospital settings.

- By End User

On the basis of End User, the Dominican Republic High-Cost Medicines Market is segmented into Hospitals, Specialized Treatment Centers, Others. In 2025, the Hospitals segment is expected to dominate the market with 79.85% market share due to high concentration of advanced healthcare infrastructure, availability of specialized medical professionals, and the centralized procurement and administration of high-cost and complex therapies. Hospitals serve as the primary point of access for patients requiring biologics, immunotherapies, and multi-organ support treatments, ensuring safe administration and continuous monitoring. Moreover, government-funded healthcare programs and institutional partnerships with pharmaceutical companies further support the widespread availability and use of high-cost medicines within hospital settings.

Specialized Treatment Centers is the fastest-growing segment with CAGR of 8.2% in the Dominican Republic High-Cost Medicines Market due to the rising prevalence of chronic and rare diseases that require focused, multidisciplinary, and long-term management. Growth in this segment is driven by the increasing establishment of specialty clinics for oncology, immunology, and metabolic disorders, along with greater access to advanced diagnostic tools and targeted therapies. Additionally, collaborations between public health authorities and private healthcare providers are expanding the reach of high-cost medicines beyond traditional hospital settings, enabling personalized care and improved treatment outcomes for patients with complex medical needs.

Dominican Republic High-Cost Medicines Market Regional Analysis

- The Dominican Republic is recognized as a significant market for high-cost medicines, driven by the rising prevalence of chronic, rare, and life-threatening diseases such as cancer, autoimmune disorders, and multi-organ dysfunction, making these therapies an essential component of advanced patient care and hospital treatment protocols.

- The growing burden of complex conditions, coupled with increasing access to specialized healthcare services, advanced diagnostics, and targeted therapies, is a major catalyst for the adoption of high-cost medicines in the region. Government initiatives to improve healthcare coverage and reimbursement for innovative treatments further support market growth.

- The steady expansion and modernization of hospital infrastructure, particularly in major urban centers like Santo Domingo and Santiago, and the increasing establishment of specialized treatment centers, are accelerating the demand for advanced biologics, immunotherapies, and multi-organ support systems. This trend reflects the country’s focus on improving clinical outcomes and ensuring availability of critical, high-cost therapies for patients with severe and complex medical conditions.

Dominican Republic High-Cost Medicines Market Insight

The Dominican Republic High-Cost Medicines Market plays a significant role in the Caribbean and Latin American healthcare landscape, fueled by its expanding healthcare infrastructure, growing number of specialized treatment centers, and increasing availability of advanced therapies. High adoption of innovative biologics, immunotherapies, and multi-organ support systems, supportive government initiatives for access to high-cost medicines, and rising prevalence of chronic and rare diseases drive market growth. Additionally, collaborations between local hospitals, specialty clinics, and global pharmaceutical companies accelerate the introduction and accessibility of advanced therapies, positioning the Dominican Republic as a key contributor to the regional high-cost medicines market.

The Major Market Leaders Operating in the Market Are:

- Baxter (U.S.)

- Pfizer Inc. (U.S.)

- Takeda Pharmaceutical Company (Japan)

- Amgen Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- B. Braun SE (Germany)

- GSK plc. (U.K.)

- Alexion Pharmaceuticals, Inc (U.S.)

- AbbVie Inc. (U.S.)

- Astellas Pharma US, Inc. (U.S.)

- Novartis AG (Switzerland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Bristol-Myers Squibb Company (U.S.)

- Sanofi S.A. (France)

- Grifols, S.A. (Spain)

Latest Developments in Dominican Republic High-Cost Medicines Market

- In October 2025, Roche announced that the U.S. Food and Drug Administration (FDA) approved Tecentriq® (atezolizumab) and Tecentriq Hybreza® (atezolizumab and hyaluronidase-tqjs) in combination with lurbinectedin (Zepzelca®) for the maintenance treatment of adult patients with extensive-stage small cell lung cancer (ES-SCLC) whose disease has not progressed after first-line induction therapy with Tecentriq or Tecentriq Hybreza, carboplatin, and etoposide. This approval represents the first and only combination therapy for first-line maintenance of ES-SCLC and has been incorporated as a category 2A preferred option in the U.S. NCCN Clinical Practice Guidelines for this indication.

- In August 2025, AbbVie announced the completion of its USD 2.1 billion acquisition of Capstan Therapeutics, a clinical-stage biotechnology company specializing in in vivo targeted lipid nanoparticle (tLNP) technology. This acquisition includes Capstan’s lead asset, CPTX2309, a Phase 1 anti-CD19 chimeric antigen receptor T-cell (CAR-T) therapy designed to treat B cell-mediated autoimmune diseases. CPTX2309 utilizes tLNPs to generate CD8+ CAR-T cells directly within the body, aiming for rapid and deep B cell depletion without the need for lymphodepleting chemotherapy. The integration of Capstan's proprietary tLNP platform enhances AbbVie's capabilities in developing novel RNA-based therapies and advancing its immunology pipeline.

- In July 2025, Bristol Myers Squibb (BMS) announced that the U.S. FDA accepted for review its supplemental New Drug Application (sNDA) for Sotyktu® (deucravacitinib) for the treatment of adults with active psoriatic arthritis, assigning a PDUFA goal date of March 6, 2026. This regulatory milestone follows similar submission acceptances by China’s Center for Drug Evaluation, Japan’s Ministry of Health, Labour and Welfare, and the European Medicines Agency (EMA), highlighting BMS’s global efforts to expand Sotyktu’s therapeutic reach beyond plaque psoriasis.

- In June 2025, Astellas Pharma Inc. and Mitsubishi Research Institute (MRI) announced a collaboration under a Memorandum of Understanding (MoU) to support drug-discovery startups in Japan aiming to go global. The partnership will leverage MRI’s experience running Japan’s Medical Innovation Support Office (MEDISO) and Astellas’s scientific and infrastructure resources—offering access to lab and office space at SakuLab-Tsukuba, expert consultation, and networking with Astellas researchers. This initiative seeks to accelerate commercialization of Japanese life-science innovations and strengthen Japan’s position as a global hub for drug discovery.

- In March 2025, Novartis announced that the U.S. Food and Drug Administration (FDA) has approved Pluvicto® (lutetium Lu 177 vipivotide tetraxetan) for the treatment of patients with prostate-specific membrane antigen (PSMA)-positive metastatic castration-resistant prostate cancer (mCRPC) who have previously received an androgen receptor pathway inhibitor (ARPI) therapy and are suitable to delay chemotherapy. This approval expands treatment options for advanced prostate cancer patients, reinforcing Novartis’ leadership in radioligand therapy.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 ARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.3 INDUSTRY INSIGHTS– DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET

4.3.1 PATENT ANALYSIS

4.3.1.1 PATENT LANDSCAPE

4.3.1.2 USPTO NUMBER

4.3.1.3 PATENT EXPIRY

4.3.1.4 EPIO NUMBER

4.3.1.5 PATENT STRENGTH AND QUALITY

4.3.1.6 PATENT CLAIMS

4.3.1.7 PATENT CITATIONS

4.3.1.8 FILE OF PATENT

4.3.1.9 PATENT RECEIVED COUNTRIES

4.3.1.10 TECHNOLOGY BACKGROUND

4.3.2 DRUG TREATMENT RATE BY MATURED MARKETS

4.3.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.3.4 PATIENT FLOW DIAGRAM

4.3.5 KEY PRICING STRATEGIES

4.3.6 KEY PATIENT ENROLLMENT STRATEGIES

4.4 MARKET ACCESS: DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET

4.4.1 REGULATORY ENTRY PATHWAYS

4.4.2 PUBLIC HEALTH INSURANCE AND REIMBURSEMENT MECHANISMS

4.4.3 PRICING AND PROCUREMENT POLICIES

4.4.4 DISTRIBUTION AND SUPPLY CHAIN FRAMEWORK

4.4.5 HEALTH TECHNOLOGY ASSESSMENT AND INCLUSION CRITERIA

4.4.6 PRIVATE INSURANCE AND OUT-OF-POCKET MARKET

4.4.7 CONCLUSION

5 PIPELINE ANALYSIS — DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET

5.1 PHASE DISTRIBUTION

5.2 KEY TRENDS IN THE EXPANDED PIPELINE

5.3 GEOGRAPHICAL AND INSTITUTIONAL TRENDS

5.4 STRATEGIC INSIGHTS

6 REGULATION FRAMEWORK: DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING CLINICAL DEMAND FROM COMPLEX AND UNDERSERVED PATIENT POPULATIONS

7.1.2 IMPROVED DIAGNOSTIC CAPABILITIES AND SPECIALIST ACCESS

7.1.3 INCREASED ENTRY OF GLOBAL PHARMA AND BIOSIMILAR PLAYERS

7.2 RESTRAINTS

7.2.1 HIGH COST OF MEDICINES LIMITING ACCESSIBILITY FOR A LARGE SEGMENT OF THE POPULATION

7.2.2 DEPENDENCE ON IMPORTS AFFECTING SUPPLY STABILITY

7.3 OPPORTUNITIES

7.3.1 DEFINED PUBLIC BUDGET FOR HIGH-COST DRUGS

7.3.2 GOVERNMENT POLICY ATTENTION

7.4 CHALLENGES

7.4.1 PRICE SENSITIVITY AND NEGOTIATION PRESSURE

7.4.2 REGULATORY COMPLEXITY AND APPROVAL TIMELINES

8 DOMINICAN REPUBLIC HIGH COST MEDICINES MARKET, BY TYPE

8.1 OVERVIEW

8.2 BIOLOGICS

8.3 INJECTABLES & INFUSIONS

8.4 IMMUNOSUPPRESSANTS

8.5 SPECIALTY PHARMACEUTICALS

8.6 OTHERS

9 DOMINICAN REPUBLIC HIGH COST MEDICINES MARKET, BY THERAPY TYPE

9.1 OVERVIEW

9.2 MULTI-ORGAN SUPPORT SYSTEMS

9.3 RESPIRATORY SUPPORT

9.4 CARDIO VASCULAR SUPPORT

9.5 RENAL SUPPORT

9.6 HEPATIC(LIVER) SUPPORT

10 DOMINICAN REPUBLIC HIGH COST MEDICINES MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.2.1 PUBLIC

10.2.2 PRIVATE

10.2.3 SPECIALIZED TREATMENT CENTERS

10.3 OTHERS

11 DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET

11.1 COMPANY SHARE ANALYSIS: DOMINICAN REPUBLIC

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 PFIZER INC

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 NOVARTIS AG

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 F. HOFFMANN-LA ROCHE LTD

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 GRIFOLS, S.A.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 SANOFI

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 ABBVIE INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 ALEXION PHARMACEUTICALS, INC

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 AMGEN INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 ASTELLAS PHARMA INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 B. BRAUN SE

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 BAXTER

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 BRISTOL-MYERS SQUIBB COMPANY

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 GSK PLC.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 TAKEDA PHARMACEUTICAL COMPANY LIMITED

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENT

13.15 TEVA PHARMACEUTICAL INDUSTRIES LTD.

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Figure

FIGURE 1 DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET: SEGMENTATION

FIGURE 2 DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET: DATA TRIANGULATION

FIGURE 3 DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET: DROC ANALYSIS

FIGURE 4 DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET: GLOBAL VS REGIONAL ANALYSIS

FIGURE 5 DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 EXECUTIVE SUMMARY

FIGURE 10 STRATEGIC DECISIONS

FIGURE 11 FIVE SEGMENTS COMPRISE THE DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET, BY TYPE (2024)

FIGURE 12 DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET: SEGMENTATION

FIGURE 13 EXPANSION OF HEALTH INSURANCE COVERAGE ENABLING BETTER ACCESS TO COMPLEX ORGAN SUPPORT TREATMENTS EXPECTED TO DRIVE THE DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 BIOLOGICS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET IN 2025 & 2032, BY TYPE

FIGURE 15 PESTEL ANALYSIS

FIGURE 16 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET

FIGURE 18 DOMINICAN REPUBLIC HIGH COST MEDICINES MARKET: BY TYPE, 2024

FIGURE 19 DOMINICAN REPUBLIC HIGH COST MEDICINES MARKET: BY TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 20 DOMINICAN REPUBLIC HIGH COST MEDICINES MARKET: BY TYPE, CAGR (2025- 2032)

FIGURE 21 DOMINICAN REPUBLIC HIGH COST MEDICINES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 DOMINICAN REPUBLIC HIGH COST MEDICINES MARKET: BY THERAPY TYPE, 2024

FIGURE 23 DOMINICAN REPUBLIC HIGH COST MEDICINES MARKET: BY THERAPY TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 24 DOMINICAN REPUBLIC HIGH COST MEDICINES MARKET: BY THERAPY TYPE, CAGR (2025- 2032)

FIGURE 25 DOMINICAN REPUBLIC HIGH COST MEDICINES MARKET: BY THERAPY TYPE, LIFELINE CURVE

FIGURE 26 DOMINICAN REPUBLIC HIGH COST MEDICINES MARKET: BY END USER, 2024

FIGURE 27 DOMINICAN REPUBLIC HIGH COST MEDICINES MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 28 DOMINICAN REPUBLIC HIGH COST MEDICINES MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 29 DOMINICAN REPUBLIC HIGH COST MEDICINES MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 DOMINICAN REPUBLIC HIGH-COST MEDICINES MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.