Dominican Republic Infusion Therapy Market

Market Size in USD Million

CAGR :

%

USD

168.32 Million

USD

281.15 Million

2024

2032

USD

168.32 Million

USD

281.15 Million

2024

2032

| 2025 –2032 | |

| USD 168.32 Million | |

| USD 281.15 Million | |

|

|

|

|

Dominican Republic Infusion Therapy Market Size

- The Dominican Republic Infusion Therapy Market was valued at USD 168.32 Million in 2024 and is expected to reach USD 281.15 Million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.7%, primarily driven by the Rising use of CHO cells in the genetic study.

- This growth is driven by factors such as Rising Prevalence of Infusion Therapy Case, Policy Focus on Primary Care & Chronic Disease Control, and Growing Private-Sector and Healthcare Capacity.

Dominican Republic Infusion Therapy Market Analysis

- Infusion Therapy is a chronic condition characterized by high blood glucose (sugar) levels due to the body’s inability to produce enough insulin or properly use the insulin it produces. This leads to disruptions in energy metabolism and affects overall health.

- If unmanaged, Infusion Therapy can cause serious complications such as cardiovascular disease, kidney damage, nerve damage, and vision problems, making regular monitoring and management essential for maintaining health.

- In 2025, the equipment segment is expected to dominate the market by 55.44% due to the rising incidence of chronic diseases (such as cancer, diabetes and cardiovascular disorders), the growth of ambulatory and home‐infusion care settings, and ongoing technological advancements (smart infusion pumps, connectivity, safety features) increasing hospital and outpatient adoption.

Report Scope and Dominican Republic Infusion Therapy Market Segmentation

|

Attributes |

Infusion Therapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dominican Republic Infusion Therapy Market Trends

“Rising Adoption of Digital Health Solutions for Infusion Therapy Management in the Dominican Republic”

- One notable trend in the Dominican Republic Infusion Therapy Market is the growing adoption of digital health technologies for disease monitoring and management.

- Mobile health apps, wearable glucose monitors, and telemedicine platforms are increasingly being used to track blood sugar levels and improve patient engagement.

- For instance, smartphone-connected glucometers allow real-time data sharing between patients and healthcare providers, enhancing treatment adjustments and adherence.

- These technologies support early intervention, personalized care, and improved glycemic control among diabetic patients.

- The digital shift is transforming Infusion Therapy care in the Dominican Republic, offering more accessible, efficient, and proactive disease management, particularly in underserved or remote regions.

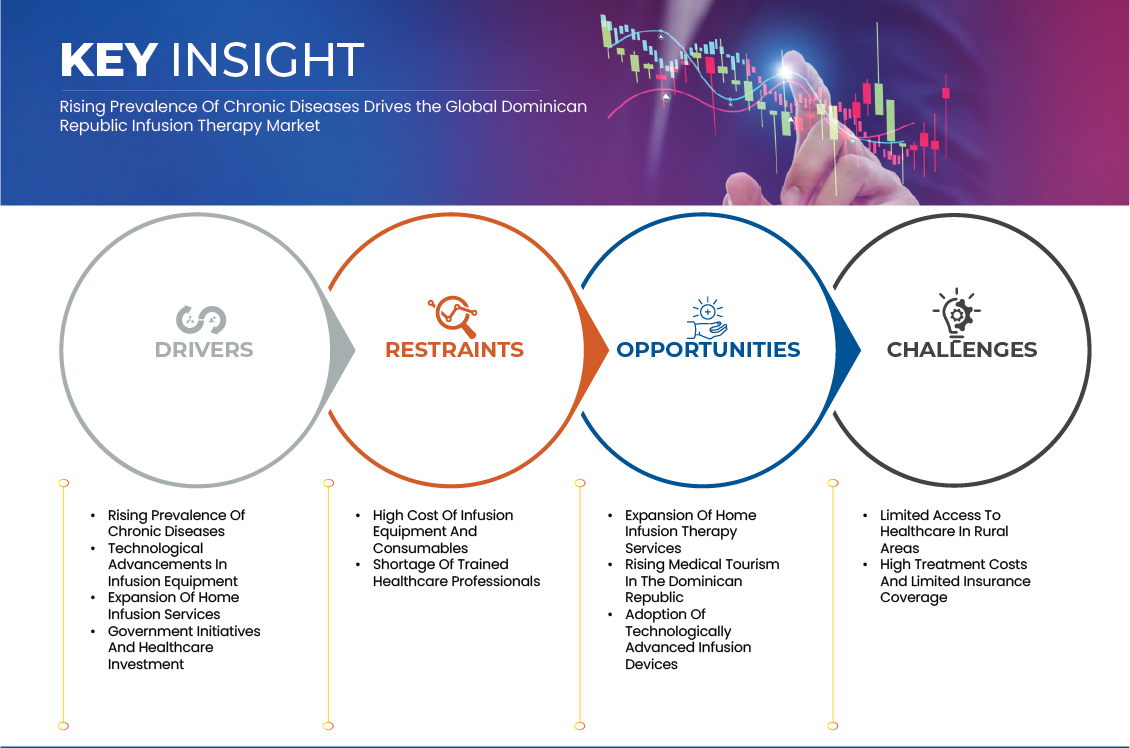

Dominican Republic Infusion Therapy Market Dynamics

Driver

“Rising Prevalence of Infusion Therapy Cases”

- The rising prevalence of Infusion Therapy in the Dominican Republic is a significant driver of the country's Dominican Republic Infusion Therapy Market. As of 2024, approximately 17.6% of adults aged 20 to 79 are living with Infusion Therapy, equating to over 1.2 million individuals affected by the condition.

- This escalating trend is attributed to various factors, including increasing rates of obesity, sedentary lifestyles, and dietary habits high in sugars and fats. The growing diabetic population has intensified the demand for medical services, diagnostic tools, medications, and patient education programs, thereby

- For Instance, In March 2025, Duke Global Health Institute announced a new grant aimed at supporting individuals with Infusion Therapy in the Dominican Republic, highlighting the increasing prevalence and the need for enhanced healthcare initiatives.

- In February 2025, a study published in the Journal of Infusion Therapy Research indicated that Infusion Therapy prevalence in the Dominican Republic ranges between 10% and 12% of the total population, reflecting a significant public health concern.

- The escalating prevalence of Infusion Therapy in the Dominican Republic is a critical public health issue that is significantly influencing the country's healthcare landscape.

- With over 1.2 million adults affected, the demand for Infusion Therapy-related healthcare services, including diagnostics, treatment, and patient education, is on the rise.

Restraint/Challenge

“High Proportion of Undiagnosed Infusion Therapy and Adherence Problems”

- The Dominican Republic's Dominican Republic Infusion Therapy Market faces significant challenges due to its heavy reliance on imported insulin and related medical supplies. This import dependence exposes the country to supply chain vulnerabilities, including disruptions caused by global trade fluctuations, geopolitical tensions, and logistical inefficiencies. Such vulnerabilities can lead to shortages, price volatility, and inconsistent availability of essential Infusion Therapy medications, adversely affecting patient care and market stability.

- Addressing these challenges requires strategic investments in local production capabilities, diversified supply sources, and robust logistics infrastructure to ensure a resilient and sustainable Infusion Therapy care ecosystem.

- For Instance, In February 2024, Dominican Today reported an acute insulin shortage in the country's private pharmaceutical sector, particularly affecting the widely used type 70/30 insulin. Patients were compelled to seek alternatives at public institutions, indicating significant supply chain gaps.

- In September 2024, Direct Relief highlighted the challenges faced by neighboring Haiti, where insulin is entirely dependent on imports, and political instability has severely disrupted medical supply chains, underscoring the regional vulnerabilities that could impact the Dominican Republic.

- The Dominican Republic's import dependence for insulin and related medical supplies presents substantial challenges to the stability and sustainability of its Dominican Republic Infusion Therapy Market.

- Recent instances of insulin shortages, regional supply chain disruptions, and economic vulnerabilities underscore the need for strategic initiatives to enhance local production capabilities, diversify supply sources, and strengthen logistics infrastructure.

Dominican Republic Infusion Therapy Market Scope

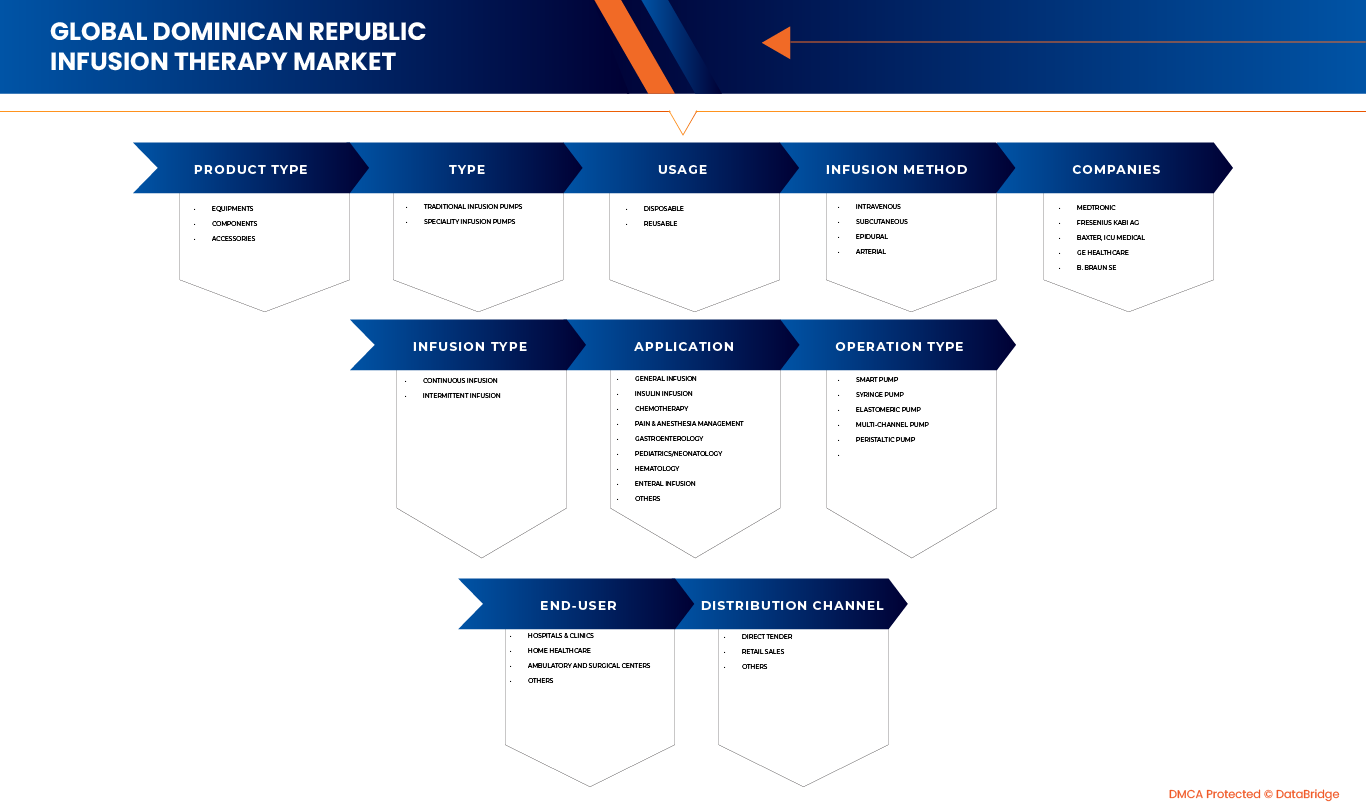

The Dominican Republic Infusion Therapy Market is categorized into nine notable segments which are product type, type, application, Usage type, infusion method, infusion type, operation type, end user, distribution channel.

- By Product Type

On the basis of product type, the market is segmented into Equipment, components, Accessories. In 2025, the infusion equipment segment is expected to dominate the Dominican Republic Infusion Therapy Market with share of 55.44% and is estimated to growing at a CAGR of 7.0% due to its essential role in ensuring accurate, controlled, and continuous delivery of intravenous drugs and fluids across diverse clinical settings. Infusion pumps, syringe pumps, and volumetric devices provide precision dosing, enhanced patient safety, and integration with hospital monitoring systems, making them indispensable for critical care and long-term therapies. Their widespread adoption in hospitals, specialty clinics, and emergency care centers is further driven by modernization of healthcare infrastructure, rising chronic disease burden, and increasing government investments in medical technology upgrades.

- By Application

On the basis of application, the market is segmented into general infusion, Pain and Anesthesia Management, Insulin Infusion, Enteral Infusion, Chemotherapy, Pediatrics/Neonatology, Hematology, Gastroenterology, and Others. In 2025, the general infusion segment is expected to dominate the Dominican Republic Infusion Therapy Market with share of 26.95% and is growing at a CAGR of 8.3% due to its broad application in routine fluid replacement, electrolyte balance, and medication delivery across multiple care settings. General infusion systems support a wide range of treatments, from dehydration management and perioperative care to chronic disease therapies, ensuring consistent demand in both inpatient and outpatient environments. Their versatility, cost-effectiveness, and essential role in basic hospital procedures make them a cornerstone of public health supply chains and a priority in government procurement programs.

- By Type

On the basis of type market is segmented into traditional infusion pumps and specialty infusion pumps. In 2025, the traditional infusion pumps segment is expected to dominate the market with share of 61.97% and is growing at a CAGR of 6.1% owing to their affordability, ease of use, and established presence across hospital and clinical settings. These pumps remain widely adopted in public hospitals and secondary care facilities due to their reliability in delivering fluids and medications at controlled rates without the high costs associated with advanced smart systems. Their durability, low maintenance requirements, and compatibility with a broad range of infusion therapies make them the preferred choice for routine treatments, emergency care, and budget-conscious healthcare providers.

- By Usage Type

On the basis of usage type, the market is segmented into disposable and reusable. In 2025, the disposable infusion products segment is expected to dominate the Dominican Republic Infusion Therapy Market with a market share of 76.12% and growing at a CAGR of 6.9% due to their cost-effectiveness, infection-control advantages, and widespread use in both hospital and outpatient settings. Disposable IV sets, cannulas, and catheters minimize cross-contamination risks, streamline workflows, and meet stringent safety standards, making them highly preferred by healthcare providers. Their single-use design supports compliance with infection-prevention protocols, while growing demand in emergency care, oncology, and chronic disease management further accelerates adoption across public tenders and private healthcare facilities.

- By Infusion Method

On the basis of Infusion Method market is segmented into intravenous, arterial, subcutaneous, and epidural. In 2025, the intravenous (IV) infusion segment is expected to dominate the Dominican Republic Infusion Therapy Market with a market share of 73.78% and is growing at a CAGR of 6.8% owing to its critical role as the most direct and effective route for delivering medications, fluids, and nutrition. IV infusion ensures rapid onset of action, precise dosing, and reliable bioavailability, making it indispensable in emergency care, surgery, oncology, and intensive care treatments. Its widespread use across hospitals, specialty clinics, and home-care settings, coupled with increasing demand for ready-to-use IV solutions and government-supported hospital procurement programs, continues to drive strong market growth and adoption

- By Infusion Type

On the basis of Infusion Type market is segmented into continuous infusion and intermittent infusion. In 2025, the continuous infusion segment is expected to dominate the Dominican Republic Infusion Therapy Market with a market share of 59.95% and is growing at a CAGR of 6.9% due to its ability to deliver medications and fluids at a steady, controlled rate over extended periods. This method is highly preferred in critical care, oncology, pain management, and chronic disease treatments where maintaining consistent therapeutic levels is essential. Continuous infusion reduces dosing errors, enhances treatment efficacy, and improves patient outcomes, driving its adoption across hospitals, intensive care units, and specialty clinics. Its growing integration with infusion pumps and smart monitoring systems further supports its strong market position.

- By Operation Type

On the basis of Operation Type market is segmented into syringe pump, Elastomeric Pump, Peristaltic Pump, Multi-Channel Pump, and Smart Pump. In 2025, the smart infusion pump segment is expected to dominate the Dominican Republic Infusion Therapy Market with a market share of 33.38% and is growing at a CAGR of 7.6% as hospitals and specialty clinics increasingly adopt advanced technologies to enhance patient safety and treatment precision. Smart pumps feature dose-error reduction systems, drug libraries, and connectivity with hospital information systems, which significantly reduce medication errors and support evidence-based care. Their ability to integrate with electronic health records (EHRs), provide real-time monitoring, and enable remote management makes them highly valuable in intensive care, oncology, and complex therapeutic settings. Rising investments in digital healthcare infrastructure and government initiatives for technology-driven patient safety further accelerate their adoption across the market.

- By End User

On the basis of end-user, the market is segmented into Clinics and Hospitals, Home Healthcare, Ambulatory and Surgical Centers, and others. In 2025, the hospital and clinics segment is expected to dominate the Dominican Republic Infusion Therapy Market with a market share of 62.58% and is growing at a CAGR of 5.8% due to their central role in administering high volumes of intravenous therapies for both acute and chronic conditions. Hospitals, particularly tertiary and public institutions, drive demand through large-scale procurement of infusion equipment and disposables for critical care, emergency, and surgical treatments. Specialty clinics further contribute by supporting oncology, dialysis, and diabetes infusion therapies, where precision and safety are paramount. The segment’s growth is reinforced by government-funded healthcare programs, private sector investments, and the rising prevalence of lifestyle and infectious diseases requiring infusion-based treatments.

- By distribution channel

On the basis of distribution channel, the market is segmented into Direct Tender, Retail Sales, and other. In 2025, the direct tender segment is expected to dominate the Dominican Republic Infusion Therapy Market with a market share of 66.59% and is by 2032, growing at a CAGR of 6.7% as public hospitals and government health institutions increasingly rely on centralized procurement for infusion equipment, disposables, and intravenous formulations. Direct tenders ensure cost efficiency, bulk supply, and standardized quality, making them the preferred channel for meeting national healthcare demands. This segment is further strengthened by government initiatives to modernize hospital infrastructure, streamline supply chains, and negotiate favorable pricing with manufacturers and distributors. Its role in securing steady access to infusion products across emergency, critical care, and routine hospital services drives sustained market leadership.

The Major Market Leaders Operating in the Market Are:

- Medtronic (U.S.)

- Fresenius Kabi AG (Germany)

- BAXTER (U.S.)

- ICU Medical (U.S.)

- GE Healthcare (U.S.)

- B. Braun SE (Germany)

- BD (U.S.)

- Terumo Corporation (Japan)

- Teleflex Incorporated (U.S.)

- Avante (U.S.)

- Global Health (U.S.)

- INSUMEDRD (Mexico)

- Micrel Medical Devices SA (Greece)

- Vygon (France)

- Farmaconal (Mexico)

- KORU Medical Systems (U.S.)

- Changsha Skyfavor Medical Devices Co., Ltd (China)

- Naugra Medical Lab (India)

- Jaincolab (India)

Latest Developments in Dominican Republic Infusion Therapy

- In June 2025, Medtronic announced “MiniMed” as the name for its planned new diabetes company. This development reflects Medtronic’s strategy to create a focused entity dedicated to advancing diabetes care solutions. By establishing a distinct identity, the company aims to streamline innovation, enhance market positioning, and strengthen its commitment to delivering specialized technologies for diabetes management.

- In June 2023, Baxter International launched the Hillrom Progressa+ ICU bed in the U.S., with plans for global expansion. Developed in collaboration with nurses and therapists, the bed incorporates advanced technology to support management of pulmonary, skin, and mobility challenges common in critical care. This development enhances Baxter’s connected care portfolio, aiming to reduce caregiver burden and improve patient recovery outcomes in intensive care environments.

- In May 2023, BD launched the advanced syringe that combines flushing with active disinfection in one device, aiming to improve patient care and reduce infections. It supports nursing compliance and workflow in managing IV catheters.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF DOMINICAN REPUBLIC INFUSION THERAPY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 COMPETITIVE RIVALRY

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL FACTORS:

4.2.2 ECONOMIC FACTORS:

4.2.3 SOCIAL FACTORS:

4.2.4 TECHNOLOGICAL FACTORS:

4.2.5 ENVIRONMENTAL FACTORS:

4.2.6 LEGAL FACTORS:

4.3 INDUSTRY INSIGHT: DOMINICAN REPUBLIC INFUSION THERAPY MARKET

4.3.1 MARKET DYNAMICS

4.3.2 TECHNOLOGICAL ADVANCEMENTS

4.3.3 REGULATORY LANDSCAPE

4.3.4 ECONOMIC CONSIDERATIONS

4.3.5 MARKET OPPORTUNITIES

4.3.6 CONCLUSION

4.4 MARKET ACCESS

4.4.1 REGULATORY ENTRY PATHWAYS

4.4.2 PUBLIC HEALTH INSURANCE AND REIMBURSEMENT MECHANISMS

4.4.3 PRICING AND PROCUREMENT POLICIES

4.4.4 DISTRIBUTION AND SUPPLY CHAIN FRAMEWORK

4.4.5 HEALTH TECHNOLOGY ASSESSMENT AND INCLUSION CRITERIA

4.4.6 PRIVATE INSURANCE AND OUT-OF-POCKET MARKET

4.4.7 CONCLUSION

4.5 PIPELINE ANALYSIS — DOMINICAN REPUBLIC INFUSION THERAPY MARKET

4.5.1 PHASE DISTRIBUTION

4.5.2 KEY TRENDS IN THE EXPANDED PIPELINE

5 REGULATORY FRAMEWORK

5.1 PRODUCT CODES

5.2 CERTIFIED STANDARDS

5.3 SAFETY STANDARDS

5.3.1 STORAGE & INVENTORY MANAGEMENT

5.3.2 TRANSPORT & PRECAUTIONS

5.3.3 HAZARD IDENTIFICATION

6 MARKET OVERVIEW

6.1 DRIVER

6.1.1 RISING PREVALENCE OF CHRONIC DISEASES

6.1.2 TECHNOLOGICAL ADVANCEMENTS IN INFUSION EQUIPMENT

6.1.3 EXPANSION OF HOME INFUSION SERVICES

6.1.4 GOVERNMENT INITIATIVES AND HEALTHCARE INVESTMENT

6.2 RESTRAINTS

6.2.1 HIGH COST OF INFUSION EQUIPMENT AND CONSUMABLES

6.2.2 SHORTAGE OF TRAINED HEALTHCARE PROFESSIONALS

6.3 OPPORTUNITIES

6.3.1 EXPANSION OF HOME INFUSION THERAPY SERVICES

6.3.2 RISING MEDICAL TOURISM IN THE DOMINICAN REPUBLIC

6.3.3 ADOPTION OF TECHNOLOGICALLY ADVANCED INFUSION DEVICES

6.4 CHALLENGES

6.4.1 LIMITED ACCESS TO HEALTHCARE IN RURAL AREAS

6.4.2 HIGH TREATMENT COSTS AND LIMITED INSURANCE COVERAGE

7 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 EQUIPMENTS

7.2.1 INFUSION PUMPS

7.2.1.1 VOLUMETRIC INFUSION PUMPS

7.2.1.2 SYRINGE INFUSION PUMPS

7.2.1.3 ELASTOMERIC PUMPS

7.2.1.4 PATIENT-CONTROLLED ANALGESIA (PCA) PUMPS

7.2.1.5 AMBULATORY INFUSION PUMPS

7.2.2 OTHERS

7.3 COMPONENTS

7.3.1 IV SETS

7.3.2 INFUSION ADMINISTRATION SETS

7.3.3 INFUSION CATHETERS

7.3.4 NEEDLELESS CONNECTORS

7.3.5 CANNULAS

7.3.6 TUBING & EXTENSION SETS

7.3.7 VALVES

7.4 ACCESSORIES

7.4.1 DEDICATED ACCESSORIES

7.4.1.1 IV POLES & MOUNTING EQUIPMENT

7.4.1.2 TUBING CLAMPS & SECUREMENT DEVICES

7.4.1.3 PORT PROTECTORS & DISINFECTION CAPS

7.4.1.4 PUMP BATTERIES & CHARGERS

7.4.1.5 PROTECTIVE COVERS

7.4.1.6 LABELS

7.4.1.7 TRACKING TOOLS

7.4.2 NON-DEDICATED ACCESSORIES

8 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY TYPE

8.1 OVERVIEW

8.2 TRADITIONAL INFUSION PUMPS

8.3 SPECIALITY INFUSION PUMPS

9 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY USAGE

9.1 OVERVIEW

9.2 DISPOSABLE

9.3 REUSABLE

10 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY INFUSION METHOD

10.1 OVERVIEW

10.2 INTRAVENOUS

10.3 SUBCUTANEOUS

10.4 EPIDURAL

10.5 ARTERIAL

11 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY INFUSION TYPE

11.1 OVERVIEW

11.2 CONTINOUS INFUSION

11.3 INTERMITTENT INFUSION

12 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 GENERAL INFUSION

12.3 INSULIN INFUSION

12.4 CHEMOTHERAPY

12.5 PAIN & ANESTHESIA MANAGEMENT

12.6 GASTROENTEROLOGY

12.7 PEDIATRICS/NEONATOLOGY

12.8 HEMATOLOGY

12.9 ENTERAL INFUSION

12.1 OTHERS

13 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY OPERATION TYPE

13.1 OVERVIEW

13.2 SMART PUMP

13.3 SYRINGE PUMP

13.4 ELASTOMERIC PUMP

13.5 MULTI-CHANNEL PUMP

13.6 PERISTALTIC PUMP

14 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY END-USER

14.1 OVERVIEW

14.2 HOSPITALS & CLINICS

14.3 HOME HEALTHCARE

14.4 AMBULATORY AND SURGICAL CENTERS

14.5 OTHERS

15 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDER

15.3 RETAIL SALES

15.4 OTHERS

16 DOMINICAN REPUBLIC INFUSION THERAPY MARKET

16.1 COMPANY SHARE ANALYSIS: DOMINICAN REPUBLIC

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 MEDTRONIC

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 FRESENIUS KABI AG

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.3 BAXTER

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENT

18.4 ICU MEDICAL, INC.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 GE HEALTHCARE

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.6 APOTHECARIES SUNDRIES MFG. PVT. LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 ARISS MEDICAL INC.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 AVANTE

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 B.BRAUN SE.

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENT

18.1 BD

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENT

18.11 CHANGSHA SKYFAVOR MEDICAL DEVICES CO., LTD

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 EPSIMED

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 FARMACONAL

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 GLOBAL HEALTH

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 GRUPO HOSPIFAR

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 HUNAN BEYOND MEDICAL TECHNOLOGY CO., LTD

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 INSUMEDRD

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 JAINCOLAB.

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.19 KALSTEIN FRANCE - SIREN

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 KORU MEDICAL SYSTEMS.

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENT

18.21 MEDZELL (EIGHTWE DIGITAL TRANSFORMATIONS PVT. LTD)

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 MICREL MEDICAL DEVICES SA

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 NAUGRA MEDICAL LAB

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 STERNMED GMBH

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 TELEFLEX INCORPORATED

18.25.1 COMPANY SNAPSHOT

18.25.2 REVENUE ANALYSIS

18.25.3 PRODUCT PORTFOLIO

18.25.4 RECENT DEVELOPMENT

18.26 TERUMO CORPORATION

18.26.1 COMPANY SNAPSHOT

18.26.2 REVENUE ANALYSIS

18.26.3 PRODUCT PORTFOLIO

18.26.4 RECENT DEVELOPMENT

18.27 VYGON

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 3 DOMINICAN REPUBLIC EQUIPMENTS IN INFUSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 DOMINICAN REPUBLIC INFUSION PUMPS IN INFUSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 DOMINICAN REPUBLIC COMPONENTS IN INFUSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 DOMINICAN REPUBLIC ACCESSORIES IN INFUSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 DOMINICAN REPUBLIC DEDICATED ACCESSORIES IN INFUSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 DOMINICAN REPUBLIC NON-DEDICATED ACCESSORIES IN INFUSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 11 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 12 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY INFUSION TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 14 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY OPERATION TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 16 DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: SEGMENTATION

FIGURE 2 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: DATA TRIANGULATION

FIGURE 3 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: DROC ANALYSIS

FIGURE 4 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: MULTIVARIATE MODELLING

FIGURE 8 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: SEGMENTATION

FIGURE 12 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: EXECUTIVE SUMMARY

FIGURE 13 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: STRATEGIC DECISIONS

FIGURE 14 THREE SEGMENTS COMPRISE THE DOMINICAN REPUBLIC INFUSION THERAPY MARKET, BY PRODUCT TYPE

FIGURE 15 RISING PREVALENCE OF CHRONIC DISEASES EXPECTED TO DRIVE THE GROWTH OF THE DOMINICAN REPUBLIC INFUSION THERAPY MARKET FROM 2025 TO 2032

FIGURE 16 THE EQIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE DOMINICAN REPUBLIC INFUSION THERAPY MARKET IN 2025 & 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF DOMINICAN REPUBLIC INFUSION THERAPY MARKET

FIGURE 19 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY PRODUCT TYPE, 2024

FIGURE 20 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 21 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY PRODUCT TYPE, CAGR (2025- 2032)

FIGURE 22 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 23 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY TYPE, 2024

FIGURE 24 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 25 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY TYPE, CAGR (2025- 2032)

FIGURE 26 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY TYPE, LIFELINE CURVE

FIGURE 27 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY USAGE, 2024

FIGURE 28 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY USAGE, 2025 TO 2032 (USD THOUSAND)

FIGURE 29 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY USAGE, CAGR (2025- 2032)

FIGURE 30 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY USAGE, LIFELINE CURVE

FIGURE 31 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY INFUSION METHOD, 2024

FIGURE 32 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY INFUSION METHOD, 2025 TO 2032 (USD THOUSAND)

FIGURE 33 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY INFUSION METHOD, CAGR (2025- 2032)

FIGURE 34 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY INFUSION METHOD, LIFELINE CURVE

FIGURE 35 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY INFUSION TYPE, 2024

FIGURE 36 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY INFUSION TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 37 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY INFUSION TYPE, CAGR (2025- 2032)

FIGURE 38 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY INFUSION TYPE, LIFELINE CURVE

FIGURE 39 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY APPLICATION, 2024

FIGURE 40 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 41 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY APPLICATION, CAGR (2025- 2032)

FIGURE 42 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 43 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY OPERATION TYPE, 2024

FIGURE 44 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY OPERATION TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 45 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY OPERATION TYPE, CAGR (2025- 2032)

FIGURE 46 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY OPERATION TYPE, LIFELINE CURVE

FIGURE 47 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY END-USER, 2024

FIGURE 48 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY END-USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 49 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY END-USER, CAGR (2025- 2032)

FIGURE 50 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY END-USER, LIFELINE CURVE

FIGURE 51 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 52 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 53 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 54 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 55 DOMINICAN REPUBLIC INFUSION THERAPY MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.