Dominican Republic Parenteral And Enteral Nutrition Market

Market Size in USD Million

CAGR :

%

USD

68.72 Million

USD

118.05 Million

2024

2032

USD

68.72 Million

USD

118.05 Million

2024

2032

| 2025 –2032 | |

| USD 68.72 Million | |

| USD 118.05 Million | |

|

|

|

|

Dominican Republic Parenteral and Enteral Nutrition Market Size

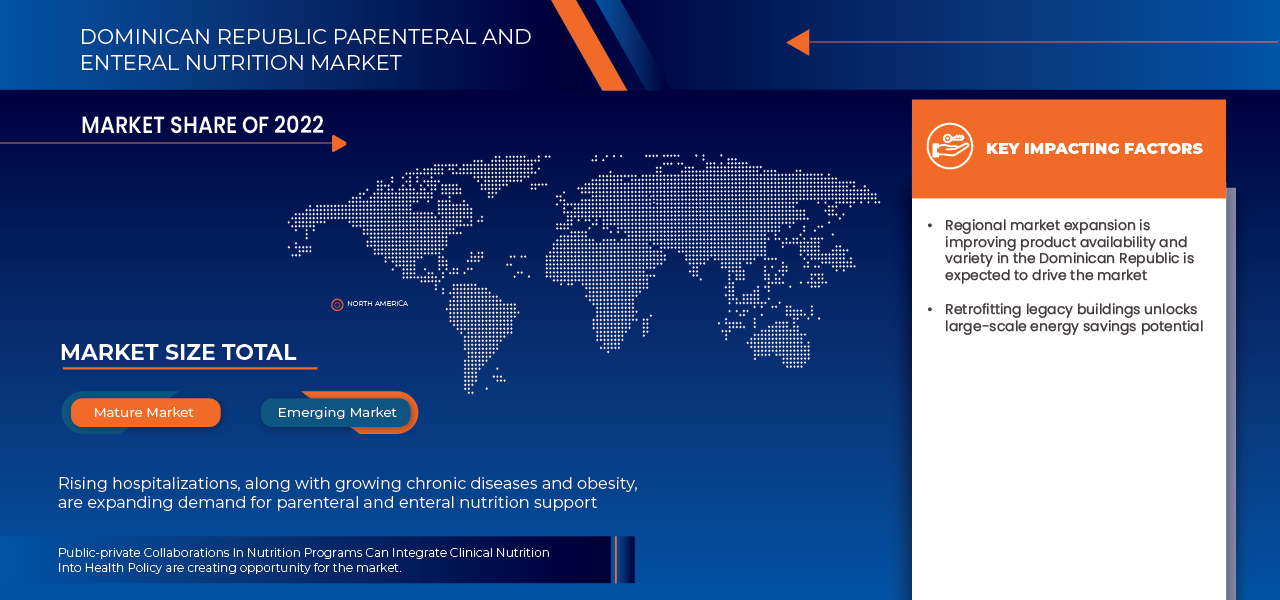

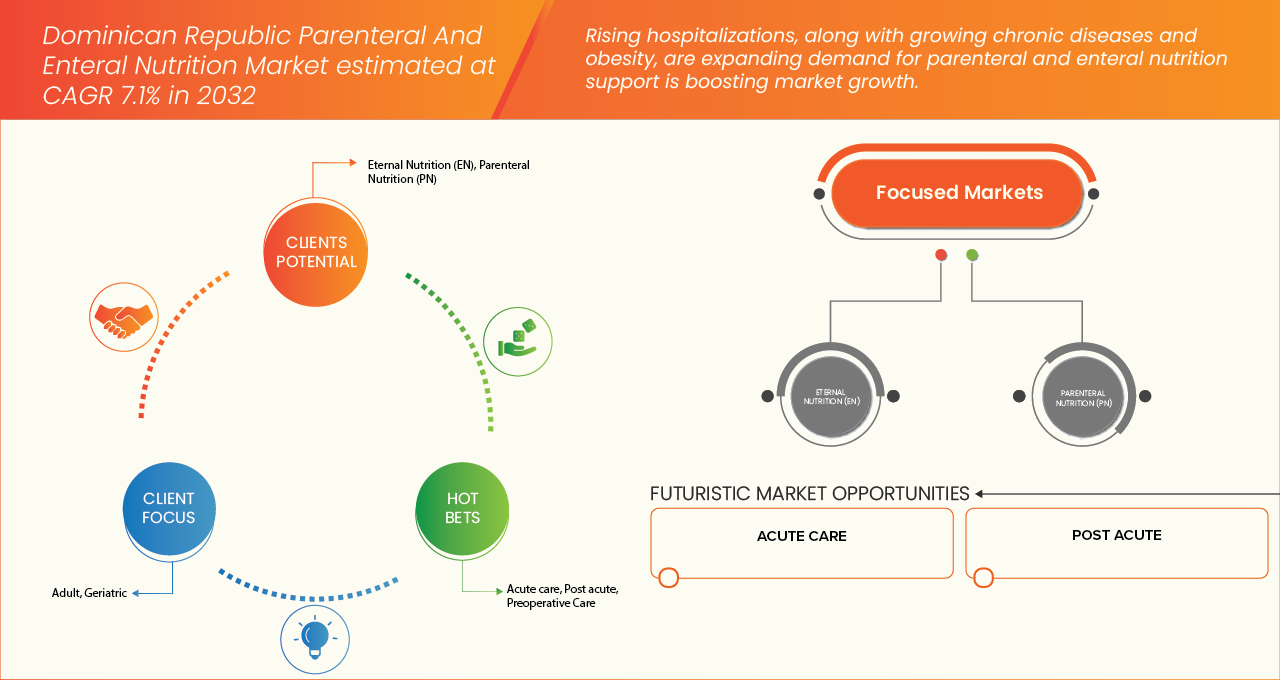

- The Dominican Republic Parenteral & Enteral Nutrition Market size was valued at USD 68.72 million in 2024 and is expected to reach USD 118.05 million by 2032, at a CAGR of 7.1% during the forecast period

- The parenteral and enteral nutrition market is a vital and steadily growing sector, driven by increasing awareness of clinical nutrition's role in patient recovery, chronic disease management, and overall health outcomes. With an emphasis on providing essential nutrients to individuals unable to meet their dietary needs through normal oral intake

- The market includes a broad spectrum of nutritional formulas administered either intravenously (parenteral) or through the gastrointestinal tract (enteral). These solutions are critical for patients suffering from conditions such as cancer, gastrointestinal disorders, neurological impairments, and those in intensive care units

Dominican Republic Parenteral and Enteral Nutrition Market Analysis

- According to the National Library of Medicine, home enteral nutrition is primarily for patients in whom there is a reduction in oral intake below the amount needed to maintain nutrition or hydration (i.e., oral failure), whereas home parenteral nutrition is used for patients when oral-enteral nutrition is temporarily or permanently impossible or absorption insufficient to maintain nutrition or hydration (i.e., intestinal failure)

- Technological advancements in nutrient formulation, delivery systems, and safety protocols have significantly enhanced the efficacy and precision of nutritional therapies. In the Dominican Republic, rising healthcare infrastructure, a growing aging population, and an increased prevalence of lifestyle-related diseases contribute to the expanding demand for both parenteral and enteral nutrition products. Furthermore, the integration of these nutritional therapies into postoperative care, long-term care, and home healthcare settings supports market growth

- Enteral Nutrition (EN) dominated the Dominican Republic parenteral & enteral nutrition market with 64.10% revenue share in 2024, driven by its widespread adoption as the preferred method for long-term nutritional support. Rising prevalence of chronic illnesses such as cancer, gastrointestinal disorders, and neurological conditions has increased demand for cost-effective and clinically efficient nutrition solutions. In addition, advancements in disease-specific formulations, growing hospital usage, and the shift toward home healthcare have strengthened EN’s position as the leading segment over parenteral nutrition in the global market

Report Scope and Dominican Republic Parenteral and Enteral Nutrition Market Segmentation

|

Attributes |

Dominican Republic Parenteral and Enteral Nutrition Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dominican Republic Parenteral & Enteral Nutrition Market Trends

“Advancements in Clinical Nutrition, Home-Based Care, and Disease-Specific Formulations”

- The Dominican Republic Parenteral & Enteral Nutrition (PEN) market is undergoing a major transformation with rising emphasis on clinical nutrition for critically ill patients, as well as personalized formulations tailored to disease-specific needs

- Hospitals are reformulating traditional nutritional protocols by incorporating ready-to-use (RTU) parenteral bags, specialized enteral blends, and immune-modulating formulas designed for oncology, gastrointestinal disorders, and critical care

- For instance, regional distributors have expanded their portfolios with high-protein enteral formulas enriched with probiotics, prebiotics, and omega-3 fatty acids to address malnutrition and improve recovery outcomes

- This trend reflects growing awareness of the role of nutrition in patient recovery, prevention of complications, and enhanced quality of life, positioning PEN products as a critical component of modern healthcare delivery in the Dominican Republic

Dominican Republic Parenteral & Enteral Nutrition Market Dynamics

Driver

“Increasing Demand for Clinical Nutrition in Hospitals and Homecare”

- The rise in chronic diseases such as cancer, Crohn’s disease, and gastrointestinal disorders is expanding the adoption of both parenteral and enteral nutrition therapies

- Home enteral nutrition (HEN) is gaining traction, supported by patients seeking cost-effective, long-term nutritional care outside hospital settings

- Ready-to-use PN solutions and digitally integrated feeding pumps are reducing risks of contamination and improving patient safety, enhancing adoption across hospitals and homecare facilities

- In 2024, several regional hospitals partnered with global nutrition brands to expand access to pediatric and neonatal formulations, highlighting the rising focus on vulnerable patient groups.

- Such collaborations underscore how healthcare providers and manufacturers are advancing clinical nutrition protocols to address diverse patient needs, ultimately driving sustained growth in the Dominican Republic PEN market

Restraint/Challenge

“High Costs and Limited Local Manufacturing Capacity”

- The substantial cost of sourcing specialized nutrition products, compounded PN solutions, and disease-targeted enteral blends poses a challenge for affordability, particularly in middle- and low-income patient groups

- These costs include reliance on imported formulations, limited local production capacity, stringent regulatory compliance, and high distribution expenses across rural regions

- In addition, the shortage of trained nutrition specialists and compounding pharmacists restricts the safe administration of PN and EN therapies in some hospitals

- In 2023, reports from regional healthcare associations highlighted that the cost of introducing advanced PN formulations goes beyond product sourcing—covering investments in compounding facilities, cold-chain logistics, regulatory approvals, and clinical training

- Smaller healthcare providers and distributors often lack the financial capacity or infrastructure to manage these challenges, delaying the broader adoption of advanced PEN solutions

- This financial and operational barrier slows innovation, limits accessibility, and concentrates market opportunities among a few multinational suppliers dominating the Dominican Republic PEN landscape

Dominican Republic Parenteral & Enteral Nutrition Market Scope

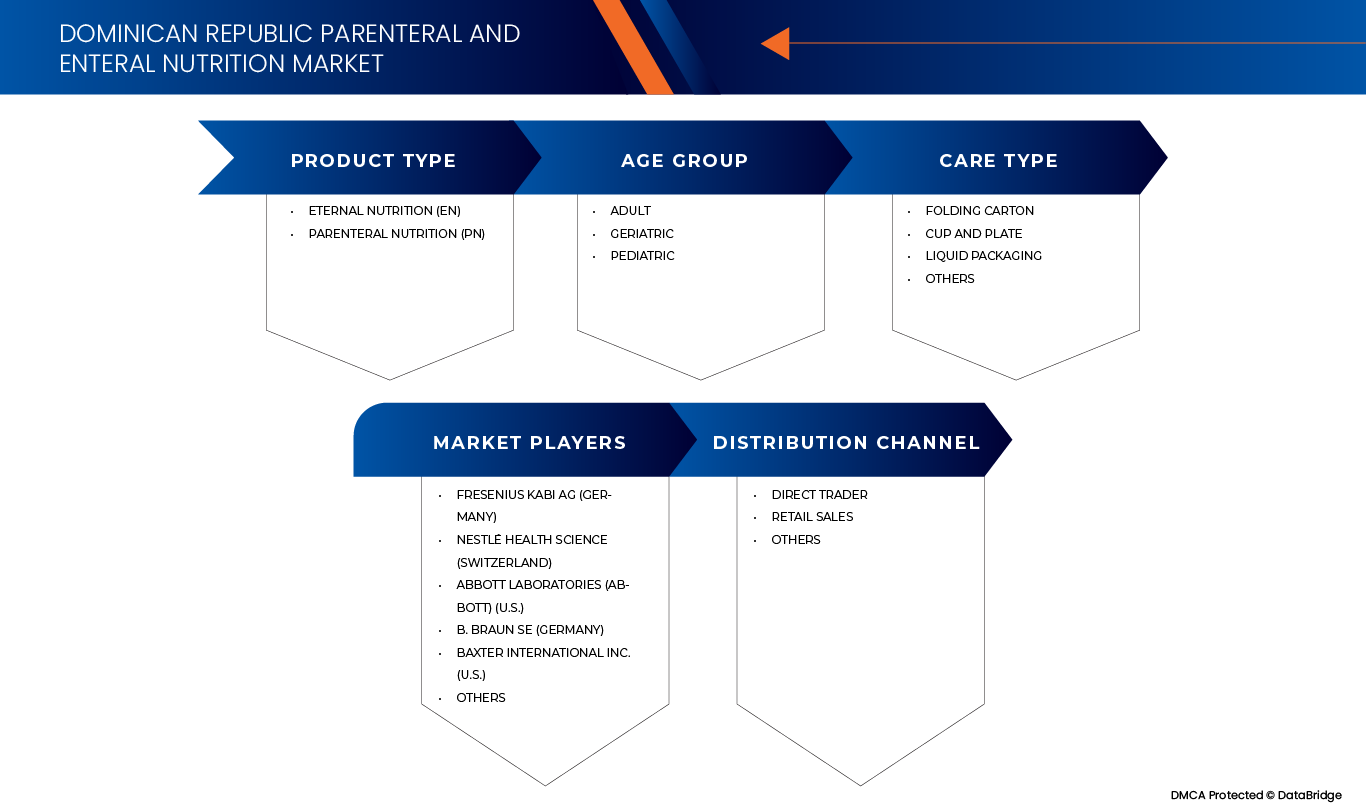

The market is segmented on the basis of product type, age group, care type and distribution channel.

- By Product Type

On the basis of product type, the parenteral & enteral nutrition market is segmented into Eternal Nutrition (EN) and Parenteral Nutrition (PN). In 2025 Eternal Nutrition (EN) segment is expected to dominate the market with a market share of 64.61% and it is anticipated to show the fastest growth during the forecast period with a CAGR of 7.9%. This dominance is attributed to its lower risk of complications compared to parenteral methods, cost-effectiveness, and growing acceptance of gastrointestinal-based feeding. EN is widely preferred in clinical settings as well as homecare, as it supports natural digestive processes while reducing infection risks. Its efficiency in providing essential nutrients while minimizing healthcare costs further strengthens its leading position.

- By Age Group

On the basis of age group, the parenteral & enteral nutrition market is segmented into adult, geriatric, and pediatric. In 2025 the adult segment is expected to dominate the market with a market share of 58.13% and it is anticipated to show the fastest growth during the forecast period with a CAGR of 7.4%. as due to This trend is primarily driven by the higher prevalence of chronic diseases, such as diabetes and cancer, which often require nutritional support during treatment. In addition, rising surgical interventions and hospital admissions among adults further fuel the demand for both enteral and parenteral nutrition. With an expanding adult patient base, this segment continues to anchor overall market growth.

- By Care Type

On the basis of Care Type, the parenteral & enteral nutrition market is segmented into Acute Care, Post Acute, Preoperative Care, Urgent Care, General Care, and others. In 2025, the acute care segment is expected to dominate the market with a market share of 39.08% and it is anticipated to show the fastest growth during the forecast period with a CAGR of 7.8%. This is largely due to the rising incidence of critical illnesses, trauma cases, and intensive care admissions that demand immediate nutritional support. Patients in intensive or emergency settings often require carefully monitored feeding methods to stabilize health outcomes. The urgent need for rapid recovery and prevention of complications in high-risk patients drives strong adoption of nutritional therapies in acute care environments.

- By Distribution Channel

On the basis of Distribution Channel, the parenteral & enteral nutrition market is segmented into direct trader, retail sales, and others. In 2025, the Direct Trader segment is expected to dominate the market with a market share of 61.20% and it is anticipated to show the fastest growth during the forecast period with a CAGR of 7.5%, due to Strong procurement partnerships with hospitals, clinics, and healthcare institutions contribute to its dominance. Direct traders also offer competitive pricing structures through bulk purchases, which appeal to large-scale healthcare buyers. In addition, efficient supply chain management ensures timely and reliable delivery of clinical nutrition products, reducing the risk of shortages. These advantages make direct trading the preferred channel for institutional buyers.

Dominican Republic Parenteral & Enteral Nutrition Market Regional Analysis

- Dominican Republic is growing with a CAGR of 7.1% during the forecast period due to rising hospital admissions, increasing chronic disease prevalence, expanding healthcare infrastructure, and growing adoption of home-based nutritional care solutions across diverse patient demographics and treatment settings.

- Rising awareness of nutritional needs, technological advancements, and improved healthcare infrastructure are contributing to the growth of the clinical nutrition market in the country

- These factors are likely influencing the adoption of enteral and parenteral nutrition therapies in the Dominican Republic.

Dominican Republic Parenteral & Enteral Nutrition Market Share

The Dominican Republic Parenteral & Enteral Nutrition industry is primarily led by well-established companies, including

- Fresenius Kabi AG (Germany)

- Nestlé Health Science (Switzerland)

- Abbott Laboratories (Abbott) (U.S.)

- B. Braun SE (Germany)

- Baxter International Inc. (U.S.)

- Bayer AG (Germany)

- Nutricia (Netherlands)

- Grifols, S.A. (Spain)

- Mead Johnson Nutrition (U.S.)

- Cardinal Health, Inc. (U.S.)

- Carbery Group (Ireland), Macrotech (China)

- Botanic Supplements, LLC (U.S.)

- Grupo Hospifar (Dominican Republic)

- B&D Nutritional Ingredients (U.S.)

- AAK AB (Sweden)

- Otsuka Holdings Co., Ltd. (Japan)

- Balaxi Pharmaceuticals Limited (India)

Latest Developments in Dominican Republic Parenteral & Enteral Nutrition Market

- In February 2025, Biogen and Stoke Therapeutics have partnered to develop and commercialize zorevunersen, a potential first-in-class disease-modifying therapy for Dravet syndrome. This investigational antisense oligonucleotide targets the SCN1A gene to reduce seizures and improve cognition. A Phase 3 study begins in 2025, with regulatory filings expected in 2027. Stoke retains U.S. rights, while Biogen handles global commercialization

- In March 2025, Biogen will establish its new global headquarters at Kendall Common in Cambridge, Massachusetts, as part of a multi-year real estate consolidation. The state-of-the-art facility, set to open in 2028, will foster collaboration, innovation, and sustainability while housing Biogen’s research, development, and commercial teams alongside the Biogen CoLab for life sciences education

- In March 2025, Ionis Pharmaceuticals, Inc. announced that Wainzua (Eplontersen) has been approved by the European Medicines Agency (EMA) for the treatment of hereditary transthyretin amyloidosis (hATTR). This antisense therapy targets the underlying cause of the disease, offering a new therapeutic option for patients suffering from this rare, life-threatening condition

- In February 2024, Pfizer Inc. and UT Southwestern Medical Center have partnered to develop advanced RNA delivery technologies for genetic medicine. This collaboration integrates UTSW’s expertise in Lipid Nanoparticle (LNP) delivery systems with Pfizer’s RNA innovation to enhance RNA-based therapies. The research aims to expand gene editing applications, improve targeted delivery, and accelerate the development of next-generation genetic medicines

- In January 2022, Pfizer Inc. has partnered with Acuitas Therapeutics to expand Lipid Nanoparticle (LNP) delivery technology for mRNA-based vaccines and therapeutics. This agreement allows Pfizer to license Acuitas’ LNP technology for up to 10 targets, strengthening its mRNA strategy. The collaboration enhances vaccine development and enables next-generation genetic medicines, building on the success of COMIRNATY, the Pfizer-BioNTech COVID-19 vaccine

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 MARKET APPLICATION COVERAGE GRID

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE

4.2.5 INDUSTRY RIVALRY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING HOSPITALIZATIONS, ALONG WITH GROWING CHRONIC DISEASES AND OBESITY, ARE EXPANDING DEMAND FOR PARENTERAL AND ENTERAL NUTRITION SUPPORT

5.1.2 REGIONAL MARKET EXPANSION IS IMPROVING PRODUCT AVAILABILITY AND VARIETY IN THE DOMINICAN REPUBLIC

5.1.3 RISING FOCUS ON ELDERLY CARE AND AGE-RELATED MALNUTRITION IS BOOSTING ADOPTION OF ENTERAL AND PARENTERAL NUTRITION

5.2 RESTRAINTS

5.2.1 DEPENDENCE ON IMPORTS AND SUPPLY-CHAIN FRAGILITY RAISES COSTS AND AFFECTS PRODUCT AVAILABILITY

5.2.2 LIMITED KNOWLEDGE OF NUTRITIONAL DEFICIENCIES AMONG PATIENTS AND CAREGIVERS

5.3 OPPORTUNITIES

5.3.1 PUBLIC-PRIVATE COLLABORATIONS IN NUTRITION PROGRAMS CAN INTEGRATE CLINICAL NUTRITION INTO HEALTH POLICY

5.3.2 IMPLEMENTING PERSONALIZED NUTRITION STRATEGIES

5.4 CHALLENGES

5.4.1 REGULATORY COMPLEXITY FOR STERILE PARENTERAL NUTRITION PRODUCTS

5.4.2 REGIONAL MIGRATION PRESSURES BURDEN PARENTERAL AND ENTERAL NUTRITION SERVICES

6 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 ETERNAL NUTRITION (EN)

6.3 PARENTERAL NUTRITION (PN)

7 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET, BY AGE GROUP

7.1 OVERVIEW

7.2 ADULT

7.3 GERIATRIC

7.4 PEDIATRIC

8 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET, BY CARE TYPE

8.1 OVERVIEW

8.2 ACUTE CARE

8.3 POST ACUTE

8.4 PREOPERATIVE CARE

8.5 URGENTCARE

8.6 GENERAL CARE

8.7 OTHERS

9 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 DIRECT TRADER

9.3 RETAIL SALES

9.4 OTHERS

10 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET

10.1 COMPANY SHARE ANALYSIS: DOMINICAN REPUBLIC

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 FRESENIUS SE & CO. KGAA

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT/ SERVICE PORTFOLIO

12.1.4 RECENT DEVELOPMENTS

12.2 NESTLÉ

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 BRAND PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 ABBOTT

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT/ SERVICE PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 B. BRAUN SE

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT/ SERVICE PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 BAXTER

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT/SERVICE PORTFOLIO

12.5.4 RECENT UPDATES

12.6 AAK

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 B&D NUTRITIONAL INGREDIENTS

12.7.1 COMPANY SNAPSHOT

12.7.2 SERVICE PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 BAYER AG

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENT

12.9 BOTANIC SUPPLEMENTS

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 BALAXI PHARMACEUTICALS LIMITED

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

12.11 CARDINAL HEALTH

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENT

12.12 CARBERY

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.13 GRIFOLS, S.A.

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 HOSPIFAR GROUP.

12.14.1 COMPANY SNAPSHOT

12.14.2 SERVICE PORTFOLIO

12.14.3 RECENT DEVELOPMENT

12.15 MEAD JOHNSON & COMPANY, LLC

12.15.1 COMPANY SNAPSHOT

12.15.2 SERVICE PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 MACROTECH

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 NUTRICIA

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT/ SERVICE PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 OTSUKA HOLDINGS CO., LTD.

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET, BY PRODUCT TYPE, 2018-2032 (VOLUME IN THOUSAND LITER)

TABLE 3 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET, BY PRODUCT TYPE, 2018-2032 (ASP IN USD PER LITER)

TABLE 4 DOMINICAN REPUBLIC ETERNAL NUTRITION (EN) IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 DOMINICAN REPUBLIC SIP FEEDS IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 DOMINICAN REPUBLIC TUBE FEED IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 DOMINICAN REPUBLIC ETERNAL NUTRITION (EN) IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY NUTRITIONAL FORMULA, 2018-2032 (USD THOUSAND)

TABLE 8 DOMINICAN REPUBLIC ETERNAL NUTRITION (EN) IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 9 DOMINICAN REPUBLIC ETERNAL NUTRITION (EN) IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 10 DOMINICAN REPUBLIC ETERNAL NUTRITION (EN) IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 11 DOMINICAN REPUBLIC ETERNAL NUTRITION (EN) IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 12 DOMINICAN REPUBLIC CANCER IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 DOMINICAN REPUBLIC NEUROLOGICAL PROBLEM IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 DOMINICAN REPUBLIC PARENTERAL NUTRITION (PN) IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 DOMINICAN REPUBLIC AMINO ACID IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 DOMINICAN REPUBLIC DISEASE-SPECIFIC AA IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 DOMINICAN REPUBLIC LIPID EMULSION IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY NUTRITIONAL FORMULA, 2018-2032 (USD THOUSAND)

TABLE 18 DOMINICAN REPUBLIC PN COMPOUNDING IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 DOMINICAN REPUBLIC ADDITIVES IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 DOMINICAN REPUBLIC VITAMINS IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 DOMINICAN REPUBLIC MCBS IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 DOMINICAN REPUBLIC 3CBS IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 DOMINICAN REPUBLIC 2CBS IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 DOMINICAN REPUBLIC PARENTERAL NUTRITION (PN) IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 25 DOMINICAN REPUBLIC PARENTERAL NUTRITION (PN) IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY DELIVERY MODE, 2018-2032 (USD THOUSAND)

TABLE 26 DOMINICAN REPUBLIC PARENTERAL NUTRITION (PN) IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 27 DOMINICAN REPUBLIC PARENTERAL NUTRITION (PN) IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 28 DOMINICAN REPUBLIC PARENTERAL NUTRITION (PN) IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 29 DOMINICAN REPUBLIC PARENTERAL NUTRITION (PN) IN PARENTERAL AND ENTERAL NUTRITION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 30 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 31 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET, BY CARE TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET: SEGMENTATION

FIGURE 2 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET: DATA TRIANGULATION

FIGURE 3 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET: DROC ANALYSIS

FIGURE 4 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 TWO SEGMENTS COMPRISE THE DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET, BY PRODUCT TYPE

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 INCREASING PREVALENCE OF CHRONIC DISEASES IS DRIVING THE GROWTH OF THE DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET FROM 2024 TO 2032

FIGURE 15 THE ETERNAL NUTRITION (EN) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET IN 2024 AND 2032

FIGURE 16 PESTEL ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET

FIGURE 19 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET, BY PRODUCT TYPE, 2024

FIGURE 20 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET, BY AGE GROUP, 2023

FIGURE 21 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET: BY CARE TYPE, 2024

FIGURE 22 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 23 DOMINICAN REPUBLIC PARENTERAL AND ENTERAL NUTRITION MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.