Emea Solid Oral Veterinary Excipients Market

Market Size in USD Million

CAGR :

%

USD

199.26 Million

USD

322.42 Million

2024

2032

USD

199.26 Million

USD

322.42 Million

2024

2032

| 2025 –2032 | |

| USD 199.26 Million | |

| USD 322.42 Million | |

|

|

|

|

EMEA Solid Oral Veterinary Excipients Market Size

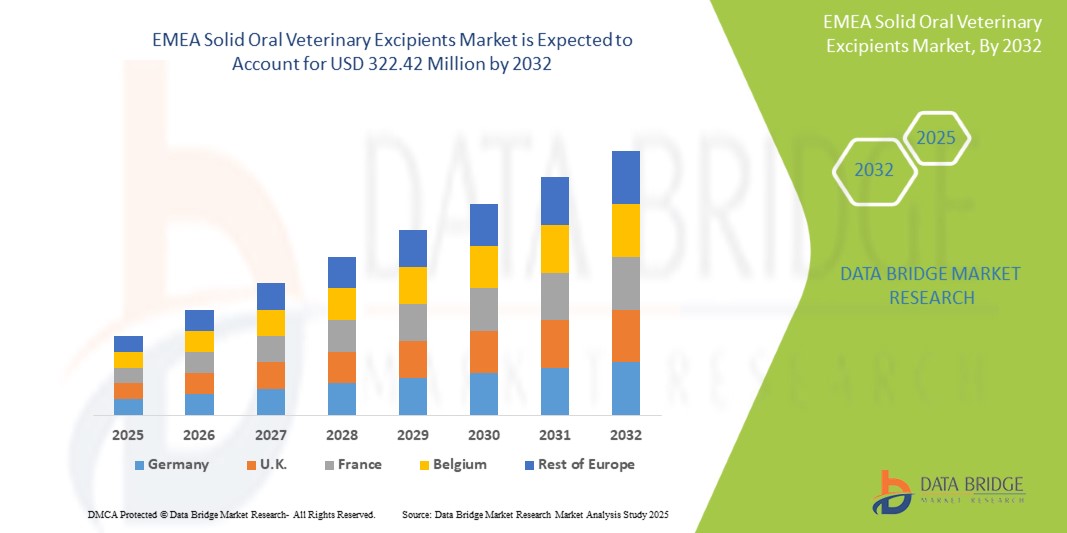

- The EMEA solid oral veterinary excipients market size was valued at USD 199.26 million in 2024 and is expected to reach USD 322.42 million by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is largely fueled by the increasing demand for safe and stable formulations in animal healthcare, along with advancements in pharmaceutical-grade excipient technologies tailored to veterinary needs

- Furthermore, rising livestock production, heightened awareness of animal health, and the push for improved palatability and bioavailability in veterinary drugs are strengthening the role of high-quality excipients in oral dosage forms. These factors are driving the adoption of solid oral excipients across EMEA, thereby significantly supporting the market's growth

EMEA Solid Oral Veterinary Excipients Market Analysis

- Solid oral veterinary excipients, which serve as inactive components used to formulate stable and effective oral dosage forms for animals, are gaining importance across the EMEA region as demand rises for efficient animal healthcare products that ensure palatability, stability, and targeted delivery of active pharmaceutical ingredients

- The growth of the EMEA solid oral veterinary excipients market is primarily driven by an expanding livestock population, increasing pet ownership, heightened awareness of animal health and welfare, and strengthened regulatory focus on the development of safe and standardized veterinary pharmaceutical formulations

- Europe dominated the EMEA solid oral veterinary excipients market with the largest revenue share of 59.2% in 2024, owing to its well-regulated veterinary pharmaceutical landscape, strong R&D infrastructure, and significant presence of leading excipient and animal health companies, particularly in Germany, France, and the U.K.

- The Middle East and Africa are expected to be the fastest-growing region in the EMEA solid oral veterinary excipients market during the forecast period, due to expanding veterinary infrastructure, increasing government initiatives for animal disease control, and the growing commercial livestock sector

- The binders segment dominated the EMEA solid oral veterinary excipients market with a market share at 37.5% in 2024, attributed to their critical role in maintaining tablet integrity, improving mechanical strength, and enabling uniform distribution of active ingredients across a range of veterinary formulations

Report Scope and EMEA Solid Oral Veterinary Excipients Market Segmentation

|

Attributes |

EMEA Solid Oral Veterinary Excipients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

EMEA Solid Oral Veterinary Excipients Market Trends

“Innovation in Palatable and Species-Specific Formulations”

- A significant and accelerating trend in the EMEA solid oral veterinary excipients market is the shift toward palatable and species-specific formulation development, aimed at improving treatment adherence among both companion and livestock animals. This trend is being driven by rising demand for veterinary drugs that are easier to administer and more effective in achieving desired therapeutic outcomes

- For instance, manufacturers such as DFE Pharma and Roquette are actively developing taste-masking and flavor-enhancing excipients, including sweeteners and natural flavors, to improve palatability in chewable tablets and powders. These advances are tailored to different species’ preferences, ensuring more successful administration

- Functional excipients are also being optimized to support enhanced drug stability, controlled release, and bioavailability across varied animal gastrointestinal systems. For instance, multi-functional binders and coating agents are being utilized to achieve precise drug delivery in monogastric and ruminant species

- The integration of these excipients into solid oral dosage forms supports better disease management, especially in high-value pets and production animals, where consistent dosing and compliance are critical

- This trend is further bolstered by stringent European regulations emphasizing safety, quality, and animal welfare, encouraging innovation in excipient design that aligns with both regulatory and therapeutic expectations

- The push toward more animal-friendly, high-performance excipient solutions is reshaping veterinary drug formulation practices across EMEA, offering new value propositions for manufacturers and improving outcomes in veterinary healthcare

EMEA Solid Oral Veterinary Excipients Market Dynamics

Driver

“Rising Livestock Population and Pet Ownership Driving Demand”

- The increasing livestock population across Eastern Europe and Africa, combined with rising pet ownership and veterinary spending in Western Europe, is a significant driver for the growing demand for solid oral veterinary excipients

- For instance, in January 2024, IMCD Group announced an expansion of its veterinary excipient offerings in EMEA to support local manufacturers in producing high-quality solid dosage forms. Such efforts by industry leaders are expected to accelerate market growth over the coming years

- As animal owners and producers seek reliable, palatable, and effective oral medications, excipients that support flavor enhancement, tablet integrity, and improved bioavailability are gaining significant traction in veterinary formulation

- Furthermore, growing awareness of animal health, increasing regulatory oversight, and the need for consistent therapeutic outcomes are making excipients a critical component of veterinary product innovation and market competitiveness

- The convenience of solid oral dosage forms, including tablets, boluses, and powders, supported by advanced excipient technologies, continues to drive preference among veterinarians, pet owners, and livestock managers

- The rising demand for cost-effective, scalable solutions in veterinary pharmaceuticals is also supporting the development and adoption of multi-functional excipients across both commercial livestock and companion animal segments

Restraint/Challenge

“Regulatory Complexities and Raw Material Cost Volatility”

- Regulatory complexities across EMEA, including differences in excipient standards, approval timelines, and compliance requirements, present a major challenge for manufacturers operating in multiple jurisdictions

- For instance, while EU countries may follow standardized pharmacopoeial guidelines, the Middle East and parts of Africa often have varying national regulations, resulting in delays and increased compliance costs for veterinary excipient products

- In addition, the market is vulnerable to raw material price fluctuations, particularly for commonly used excipients such as cellulose derivatives, starches, and synthetic binders, which can significantly affect formulation costs and pricing strategies

- Such volatility places pressure on manufacturers to secure stable, quality-compliant supply chains, while also adapting formulations to meet cost constraints without compromising performance or safety

- Although global players are responding through regional partnerships and localized production strategies, maintaining consistent quality and regulatory adherence across regions remains resource-intensive

- Addressing these challenges through harmonized regulatory efforts, investment in affordable excipient technologies, and resilient sourcing frameworks will be essential for long-term growth and innovation in the EMEA veterinary excipients market

EMEA Solid Oral Veterinary Excipients Market Scope

The market is segmented on the basis of functionality, origin type, formulation, animal, application, and distribution channel.

- By Functionality

On the basis of functionality, the EMEA solid oral veterinary excipients market is segmented into binders, fillers and diluents, bulking agents, disintegrants, lubricants, coating agents, flavoring agents, colorants, buffering agents, and others. The binders segment dominated the market with the largest market revenue share of 37.5% in 2024, attributed to its critical role in ensuring tablet cohesion, uniform drug content, and structural integrity during manufacturing and administration. Binders are widely used across solid dosage forms for both farm and pet animals due to their compatibility with various active ingredients and production processes. The high usage of cellulose derivatives and starch-based binders also contributes to their strong market position.

The coating agents segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of taste-masking and controlled-release technologies in veterinary tablets. Coating agents enhance product stability, palatability, and ease of swallowing, particularly for companion animals. Their growing application in species-specific formulations is expected to support segment expansion.

- By Origin Type

On the basis of origin type, the EMEA solid oral veterinary excipients market is segmented into organic chemicals and inorganic chemicals. The organic chemicals segment held the largest market revenue share in 2024, owing to the widespread use of natural and synthetic organic compounds such as cellulose derivatives, sugars, and starches in veterinary formulations. These compounds are preferred due to their safety profile, versatility, and biodegradability, especially in pet medication. Their functional roles span binding, diluting, and flavoring across oral dosage forms.

The inorganic chemicals segment is expected to grow steadily over the forecast period, driven by increasing application of mineral-based excipients such as calcium phosphates, magnesium stearate, and sodium bicarbonate. These excipients play key roles as buffering agents, lubricants, and bulking agents in farm animal medication where cost efficiency and robustness are essential.

- By Formulation

On the basis of formulation, the EMEA solid oral veterinary excipients market is segmented into tablets, capsules, and others. The tablets segment dominated the market with the largest market revenue share in 2024, supported by their ease of administration, stable shelf life, and suitability for mass production. Veterinary tablets, often used in herd health and preventive care, benefit from a wide selection of excipients that ensure durability and controlled release. Tablets are the preferred formulation in both farm and pet animal sectors due to their dosing precision and manufacturing flexibility.

The capsules segment is expected to grow at a moderate rate during forecast period, particularly in the pet segment where soft gelatin and hard capsules offer convenient alternatives for animals that are difficult to medicate. Capsules enable precise delivery of APIs and allow combination with excipients that improve palatability and digestibility.

- By Animal

On the basis of animal type, the EMEA solid oral veterinary excipients market is segmented into farm animals and pet animals. The farm animals segment held the largest market revenue share in 2024, attributed to large-scale use of oral veterinary drugs in livestock such as cattle, poultry, and swine for disease prevention and productivity enhancement. Excipients used in this segment emphasize cost-effectiveness, durability, and compatibility with high-volume dosing requirements. Government initiatives in animal disease control and food safety also contribute to segment dominance.

The pet animals segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing pet ownership, rising veterinary expenditures, and growing demand for species-specific, palatable oral formulations. The segment is benefiting from a shift toward premium excipients that improve administration and taste in chewable tablets and capsules.

- By Application

On the basis of application, the EMEA solid oral veterinary excipients market is segmented into anti-infectives, anti-inflammatory drugs, nutritional supplements, and others. The anti-infectives segment dominated the market with the largest market revenue share in 2024, owing to the widespread prevalence of bacterial and parasitic infections in livestock and pets. Oral solid dosage forms used in anti-infective therapy rely heavily on excipients that support stability, solubility, and bioavailability, especially in diverse digestive systems. The increasing use of preventive medications in herd management further fuels this segment.

The nutritional supplements segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising awareness of preventive healthcare and wellness in animals. Excipients used in this category support improved palatability, tablet disintegration, and ease of administration for vitamins, minerals, and probiotic-based supplements across animal species.

- By Distribution Channel

On the basis of distribution channel, the EMEA solid oral veterinary excipients market is segmented into direct tender, retail sales, and others. The direct tender segment accounted for the largest market revenue share in 2024, driven by centralized purchasing by governments, veterinary institutions, and livestock cooperatives, particularly for large-scale livestock health programs. This distribution model ensures consistent supply and cost efficiency in mass treatments where standardized excipient formulations are required.

The retail sales segment is expected to register strong growth from 2025 to 2032, supported by the expansion of veterinary clinics, pharmacies, and e-commerce platforms offering pet medications. Increased consumer preference for convenient access to over-the-counter veterinary products is boosting demand for packaged solid oral dosage forms, driving excipient usage in retail-oriented manufacturing.

EMEA Solid Oral Veterinary Excipients Market Regional Analysis

- Europe dominated the EMEA solid oral veterinary excipients market with the largest revenue share of 59.2% in 2024, owing to its well-regulated veterinary pharmaceutical landscape, strong R&D infrastructure, and significant presence of leading excipient and animal health companies, particularly in Germany, France, and the U.K.

- Consumers and veterinary professionals in the region prioritize high-quality, palatable, and safe oral dosage formulations for both companion and farm animals, resulting in strong demand for advanced excipients that enhance stability, taste, and bioavailability

- The region’s growth is further supported by the presence of major excipient manufacturers, rising pet ownership, and ongoing advancements in veterinary drug formulation, positioning Europe as a key hub for innovation and adoption of solid oral veterinary excipients across diverse animal health applications

The Germany Solid Oral Veterinary Excipients Market Insight

Germany’s solid oral veterinary excipients market is experiencing consistent growth, backed by the country's robust veterinary pharmaceutical industry and stringent quality standards for animal medications. The demand for functional excipients in chewable and tablet formulations is rising as producers focus on improving drug stability and bioavailability. In addition, Germany’s emphasis on sustainable and animal-friendly excipient solutions, aligned with EU green policies, is spurring innovation in plant-based and multifunctional excipients.

France Solid Oral Veterinary Excipients Market Insight

The France solid oral veterinary excipients market is poised to grow at a steady pace, supported by the country’s expanding livestock sector and increasing R&D efforts in veterinary formulations. Regulatory support for excipient standardization and a focus on animal welfare are prompting the development of improved delivery systems. French veterinary drug manufacturers are adopting specialized excipients for improved palatability and extended shelf life, particularly for ruminants and companion animals.

U.K. Solid Oral Veterinary Excipients Market Insight

The U.K. solid oral veterinary excipients market is anticipated to expand significantly during the forecast period due to advancements in veterinary medicine and rising pet ownership. Post-Brexit regulatory adaptations have created opportunities for localized excipient manufacturing and formulation innovation. Increased demand for high-performance excipients in tablets and boluses, especially for equine and pet care, is accelerating the market, with a focus on taste-masking and controlled-release technologies.

Middle East Solid Oral Veterinary Excipients Market Insight

The Middle East solid oral veterinary excipients market is emerging as a promising segment in EMEA, fueled by a rising emphasis on food security and the growing demand for livestock healthcare. Countries such as Saudi Arabia and the UAE are investing in veterinary infrastructure and pharmaceutical capabilities. This is leading to greater adoption of high-quality excipients in solid dosage forms. The market is witnessing increased use of binding agents and disintegrants for improved compliance in mass livestock treatment.

Saudi Arabia Solid Oral Veterinary Excipients Market Insight

Saudi Arabia solid oral veterinary excipients market is the dominant market in the Middle East for solid oral veterinary excipients, driven by its strong government support for the livestock sector and self-sufficiency goals in animal health. The country’s push toward modernization of veterinary healthcare is promoting the uptake of advanced excipient-based formulations for oral therapies. The need for high-quality, stable, and easily administrable veterinary drugs is leading to growth in demand for excipients that enhance drug delivery and palatability.

Africa Solid Oral Veterinary Excipients Market Insight

The Africa solid oral veterinary excipients market is projected to grow at the fastest CAGR in EMEA during the forecast period, owing to expanding veterinary service access and increasing demand for livestock productivity. The rising prevalence of zoonotic diseases and the need for effective oral treatment options in rural and peri-urban areas are boosting the use of solid oral veterinary formulations. Moreover, regional collaboration on animal health standards is enabling the adoption of better-quality excipients.

South Africa Solid Oral Veterinary Excipients Market Insight

The South Africa solid oral veterinary excipients market is the fastest-growing country in Africa for solid oral veterinary excipients, supported by a well-established veterinary regulatory system and increasing demand for livestock health products. The country’s focus on biosecurity and sustainable farming is encouraging the adoption of efficient, cost-effective excipients. Local manufacturers are emphasizing the development of stable, easy-to-administer dosage forms, creating opportunities for innovative excipient solutions tailored to regional animal species and climatic conditions.

EMEA Solid Oral Veterinary Excipients Market Share

The EMEA solid oral veterinary excipients industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- DFE Pharma GmbH & Co. KG (Germany)

- Roquette Frères (France)

- IMCD Group (Netherlands)

- Meggle GmbH & Co. KG (Germany)

- Azelis Holdings S.A. (Belgium)

- Colorcon Ltd. (U.K.)

- Croda International Plc (U.K.)

- Merck KGaA (Germany)

- Ashland Global Holdings Inc. (U.S.)

- Evonik Industries AG (Germany)

- JRS Pharma GmbH & Co. KG (Germany)

- SPI Pharma, Inc. (U.S.)

- Seppic (France)

- DFE Pharma Egypt (Egypt)

- Omya International AG (Switzerland)

- Barentz International B.V. (Netherlands)

- Kerry Group plc (Ireland)

What are the Recent Developments in EMEA Solid Oral Veterinary Excipients Market?

- In April 2024, DFE Pharma, a global excipient manufacturer with operations in Germany and the Netherlands, expanded its veterinary product line to include species-specific solid oral excipients. These new formulations are designed to enhance palatability, bioavailability, and stability in both companion and livestock animals. This initiative reinforces DFE Pharma’s commitment to addressing the evolving needs of veterinary pharmaceutical manufacturers across the EMEA region with tailored, high-performance excipient solutions

- In March 2024, Roquette Frères (France) announced a strategic collaboration with a Middle Eastern veterinary drug manufacturer to supply plant-based excipients for solid oral dosage forms. The partnership focuses on clean-label, sustainable excipients that meet growing regulatory and consumer demands. Roquette's investment in regional supply chains reflects its strategy to expand veterinary applications of its excipient portfolio across emerging EMEA markets while promoting responsible sourcing and production

- In March 2024, Meggle Group (Germany), a leading producer of lactose-based excipients, launched a new co-processed excipient blend aimed at improving compressibility and stability in veterinary boluses. Designed for high-throughput manufacturing in the livestock segment, this innovation addresses key challenges related to large-dose oral formulations. The product launch demonstrates Meggle’s focus on optimizing animal health drug delivery while maintaining cost-efficiency and product integrity

- In February 2024, Azelis (Belgium), a key distributor of specialty ingredients, expanded its animal health portfolio across North Africa by partnering with leading European excipient manufacturers. This move aims to improve the accessibility of advanced excipients used in veterinary tablets and powders in markets such as Egypt and Morocco. The initiative highlights Azelis’ strategic commitment to supporting local veterinary medicine production with technical expertise and innovative excipient solutions

- In January 2024, BASF SE (Germany) introduced a new line of multifunctional binders and disintegrants tailored for use in solid oral veterinary pharmaceuticals. These excipients, designed for improved functionality under variable storage conditions, are especially suited for climates across Sub-Saharan Africa and the Middle East. The development underscores BASF’s focus on resilience and efficacy in excipient performance, ensuring broader application in challenging environments and expanding access to quality veterinary healthcare across EMEA

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.