Europe Ablation Devices Market

Market Size in USD Billion

CAGR :

%

USD

3.82 Billion

USD

9.15 Billion

2024

2032

USD

3.82 Billion

USD

9.15 Billion

2024

2032

| 2025 –2032 | |

| USD 3.82 Billion | |

| USD 9.15 Billion | |

|

|

|

|

Europe Ablation Devices Market Size

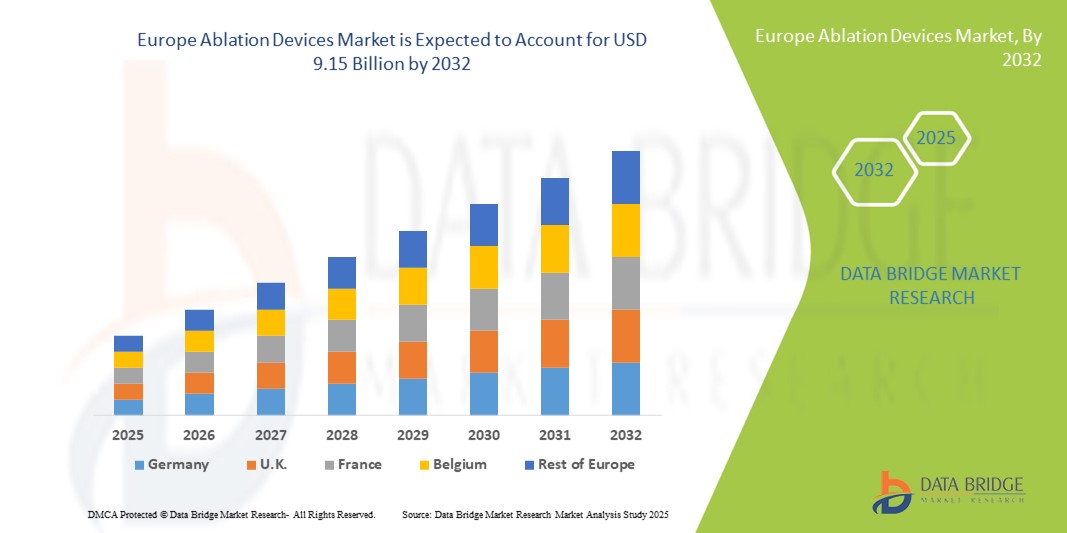

- The Europe ablation devices market size was valued at USD 3.82 billion in 2024 and is expected to reach USD 9.15 billion by 2032, at a CAGR of 11.55% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic diseases such as cardiovascular disorders and cancer, increasing adoption of minimally invasive procedures, and continuous technological advancements in ablation devices

- Furthermore, growing demand from hospitals, specialty clinics, and ambulatory surgical centers for safe, efficient, and precise treatment solutions is positioning ablation devices as the preferred choice for modern therapeutic interventions. These converging factors are accelerating the uptake of ablation technologies, thereby significantly boosting the industry's growth

Europe Ablation Devices Market Analysis

- Ablation devices, providing minimally invasive treatment options for various medical conditions, are increasingly vital components of modern hospitals and specialty clinics due to their precision, reduced recovery times, and compatibility with advanced imaging and navigation systems

- The rising demand for ablation devices is primarily fueled by the growing prevalence of chronic diseases such as cardiovascular disorders and cancer, increasing adoption of minimally invasive procedures, and continuous technological advancements in thermal and non-thermal ablation technologies

- Germany dominated the Europe ablation devices market with the largest revenue share of 29% in 2024, characterized by advanced healthcare infrastructure, high procedure volumes, and a strong presence of key industry players, with hospitals and specialty clinics experiencing substantial growth in procedures such as atrial fibrillation ablation, tumor ablation, and endometrial ablation

- France is expected to be the fastest-growing regions in the Europe ablation devices market during the forecast period due to rising healthcare investments, patient awareness, and increasing adoption of automated/robotic ablation systems

- Thermal ablation segment dominated the Europe ablation devices market with a market share of 42.2% in 2024, driven by its established clinical efficacy, safety profile, and widespread adoption across cardiovascular and oncology procedures

Report Scope and Europe Ablation Devices Market Segmentation

|

Attributes |

Europe Ablation Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Ablation Devices Market Trends

Advancements in Automated and Robotic Ablation Systems

- A significant and accelerating trend in the Europe ablation devices market is the increasing adoption of automated and robotic systems for minimally invasive procedures, improving precision, reducing human error, and enhancing patient safety across hospitals and specialty clinics

- For instance, the EPiQ Robotic Ablation System enables cardiologists to perform atrial fibrillation ablation with high accuracy while reducing procedure time and radiation exposure, improving overall patient outcomes

- Automation and robotic integration in ablation devices allows features such as real-time imaging guidance, precise catheter navigation, and programmable energy delivery, enhancing procedural efficiency and clinical success rates

- The integration of ablation devices with advanced imaging platforms and hospital information systems facilitates centralized monitoring and control, allowing clinicians to track procedure metrics and patient response from a single interface

- This trend toward more intelligent, precise, and minimally invasive ablation systems is fundamentally reshaping treatment standards, prompting companies such as Biosense Webster to develop AI-assisted robotic solutions for cardiac and tumor ablation procedures

- The demand for ablation devices with automated and robotic capabilities is growing rapidly across Europe, as hospitals and specialty clinics increasingly prioritize procedural accuracy, reduced recovery times, and improved patient safety

Europe Ablation Devices Market Dynamics

Driver

Increasing Prevalence of Chronic Diseases and Minimally Invasive Procedure Adoption

- The rising incidence of cardiovascular disorders, cancer, and other chronic conditions, coupled with the growing preference for minimally invasive procedures, is a significant driver for the heightened demand for ablation devices

- For instance, in March 2024, Medtronic launched a next-generation radiofrequency ablation system for atrial fibrillation, targeting hospitals and cardiac specialty centers across Germany and France, supporting procedure efficiency and clinical outcomes

- As patient populations increase and chronic diseases become more prevalent, ablation devices offer advanced treatment options with reduced recovery times, lower complication risks, and improved long-term results compared to traditional surgical approaches

- Furthermore, technological advancements in thermal and non-thermal ablation systems, including automated and robotic capabilities, are driving adoption in hospitals and specialty clinics

- The convenience of minimally invasive procedures, compatibility with advanced imaging systems, and improved clinical precision are key factors propelling the uptake of ablation devices in Europe, particularly in cardiac, oncology, and gynecological applications

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- The high acquisition cost of advanced ablation devices and stringent regulatory compliance requirements pose significant challenges to broader market penetration, limiting adoption among smaller hospitals and clinics

- For instance, smaller specialty clinics in Eastern Europe face budget constraints and extensive certification processes that can delay the deployment of automated or robotic ablation systems

- Addressing these cost and regulatory challenges through targeted financing options, leasing models, and compliance support services is crucial for expanding market access and encouraging adoption across diverse healthcare settings

- In addition, training requirements for clinicians to operate complex robotic or automated systems can act as a barrier, as institutions must invest in staff education to ensure procedural safety and efficacy

- While technological advancements are increasing procedural efficiency, the high initial investment, ongoing maintenance costs, and regulatory hurdles remain significant adoption barriers that must be mitigated through strategic market entry and support initiatives

Europe Ablation Devices Market Scope

The market is segmented on the basis of technology, function, procedure, and application.

- By Technology

On the basis of technology, the Europe ablation devices market is segmented into thermal ablation and non-thermal ablation. The thermal ablation segment dominated the market with the largest revenue share of 42.2% in 2024, driven by its established clinical efficacy, safety profile, and widespread adoption across cardiovascular and oncology procedures. Thermal ablation techniques, including radiofrequency and microwave, are preferred due to predictable lesion sizes, precise energy delivery, and compatibility with imaging guidance systems. Hospitals and specialty clinics favor thermal ablation for treating atrial fibrillation, tumor ablation, and varicose veins because of reduced procedural risks and shorter recovery times. In addition, thermal ablation devices are supported by extensive clinical data, which enhances physician confidence and patient acceptance. The integration of thermal ablation systems with robotic or automated platforms further improves procedural accuracy and safety.

The non-thermal ablation segment is anticipated to witness the fastest growth rate of 13.2% from 2025 to 2033, fueled by increasing adoption of cryoablation and laser-based therapies across cardiovascular, gynecological, and urological applications. Non-thermal techniques minimize collateral tissue damage and allow treatment of sensitive anatomical regions, enhancing patient outcomes. Rising demand for minimally invasive therapies and technological advancements in non-thermal devices are driving adoption. The segment benefits from growing awareness among clinicians and patients regarding safer, tissue-sparing alternatives to conventional thermal methods.

- By Function

On the basis of function, the market is segmented into automated/robotic and conventional ablation systems. The automated/robotic segment dominated the market with the largest share in 2024, driven by enhanced precision, reduced procedural errors, and real-time imaging integration. Robotic systems allow clinicians to navigate catheters or ablation probes accurately, lowering radiation exposure and procedural complications. Hospitals and cardiac specialty centers prefer automated solutions for complex procedures such as atrial fibrillation ablation and tumor ablation. The segment is further strengthened by AI-assisted navigation, programmable energy delivery, and integrated monitoring systems. Training programs and clinical support by manufacturers improve physician adoption and confidence in robotic systems. Patient demand for minimally invasive, highly precise treatments further supports the segment’s dominance.

The conventional segment is expected to witness the fastest growth during the forecast period, particularly in emerging European markets, due to lower initial costs, simplicity of use, and compatibility with existing hospital infrastructure. Conventional ablation systems remain relevant for smaller hospitals or clinics where automated solutions are not cost-effective. Rising procedure volumes and clinician familiarity with conventional techniques also contribute to growth. The segment benefits from ongoing innovations improving safety and ease of use, maintaining its relevance alongside automated solutions.

- By Procedure

On the basis of procedure, the market is segmented into atrial fibrillation, tumor ablation, endometrial ablation, benign prostatic hyperplasia, body sculpting and fat reduction, spinal decompression and denervation, varicose veins, and others. The atrial fibrillation segment dominated the market with the largest revenue share in 2024, driven by the high prevalence of cardiovascular disorders and the preference for minimally invasive catheter-based ablation procedures. Hospitals and cardiac centers adopt advanced radiofrequency and cryoablation devices for effective rhythm management. Clinical evidence supporting reduced recurrence rates and shorter hospital stays enhances adoption. Increasing awareness among patients and physicians of the benefits of catheter-based ablation further boosts market share. The segment also benefits from integration with imaging technologies and robotic navigation systems.

The tumor ablation segment is expected to witness the fastest growth during the forecast period, driven by rising cancer incidence and demand for minimally invasive oncological interventions. Thermal and non-thermal ablation therapies provide targeted tumor destruction with reduced collateral damage. Growth is fueled by advancements in imaging-guided ablation, combination therapies, and adoption across oncology centers. Patients increasingly prefer outpatient procedures with shorter recovery times, supporting rapid uptake. Expansion of reimbursement policies and hospital investments in interventional oncology further accelerate growth.

- By Application

On the basis of application, the market is segmented into cardiovascular, cancer, gynecology, urology, orthopedics, ophthalmology, and others. The cardiovascular segment dominated the Europe ablation devices market with the largest revenue share in 2024, driven by the high prevalence of atrial fibrillation and other arrhythmias requiring minimally invasive interventions. Hospitals and cardiac specialty centers prefer advanced ablation devices that offer precise lesion formation, robotic assistance, and integrated imaging guidance. The segment is supported by strong clinical evidence demonstrating improved outcomes and lower complication rates. Physician preference for catheter-based interventions over open-heart surgeries enhances market share. Awareness campaigns and patient education programs further stimulate adoption.

The cancer segment is expected to witness the fastest growth from 2025 to 2033, due to increasing demand for minimally invasive tumor ablation therapies across hospitals and oncology centers. Rising cancer incidence, advancements in thermal and non-thermal technologies, and growing adoption of imaging-guided procedures drive expansion. Patients increasingly favor targeted, outpatient procedures with reduced recovery times. Technological innovations in device design and procedure automation contribute to segment growth. Expanding insurance coverage and reimbursement policies in Europe also facilitate adoption.

Europe Ablation Devices Market Regional Analysis

- Germany dominated the Europe ablation devices market with the largest revenue share of 29% in 2024, characterized by advanced healthcare infrastructure, high procedure volumes, and a strong presence of key industry players, with hospitals and specialty clinics experiencing substantial growth in procedures such as atrial fibrillation ablation, tumor ablation, and endometrial ablation

- Clinicians and healthcare providers in the region highly value the precision, safety, and reduced recovery times offered by ablation devices for procedures such as atrial fibrillation, tumor ablation, and endometrial ablation

- This widespread adoption is further supported by significant healthcare investments, increasing patient awareness, and the presence of key market players introducing innovative thermal and non-thermal ablation solutions, establishing ablation devices as a preferred treatment option across cardiovascular, oncology, and gynecological applications

The Germany Europe Ablation Devices Market Insight

The Germany ablation devices market captured the largest revenue share of 29% in 2024 within Europe, driven by advanced healthcare infrastructure, high procedural volumes, and strong adoption of minimally invasive technologies. Hospitals and specialty clinics highly value precision, safety, and reduced recovery times offered by ablation devices for cardiovascular, oncological, and gynecological procedures. Continuous technological innovation in thermal, non-thermal, and robotic systems further propels market growth. Growing patient awareness and physician preference for automated and imaging-guided ablation solutions are supporting adoption. The presence of key industry players introducing innovative devices also enhances market expansion.

U.K. Europe Ablation Devices Market Insight

The U.K. ablation devices market is expected to grow at a noteworthy CAGR during the forecast period, driven by increasing prevalence of cardiac arrhythmias and cancer, coupled with rising adoption of minimally invasive procedures. Hospitals and specialty clinics are integrating advanced ablation devices to improve procedural accuracy and clinical outcomes. Regulatory approvals for novel ablation technologies, combined with growing patient and clinician awareness, are stimulating market growth. The U.K.’s strong focus on healthcare innovation and technological adoption encourages uptake of both automated and conventional ablation systems.

France Europe Ablation Devices Market Insight

The France ablation devices market is projected to expand at a significant CAGR, fueled by increasing investments in healthcare infrastructure and rising demand for minimally invasive therapies. Hospitals and oncology and cardiac centers are adopting thermal and non-thermal ablation systems to enhance treatment precision and patient safety. Growing awareness about the benefits of ablation procedures among patients and clinicians supports market adoption. Integration of ablation devices with imaging and monitoring systems further improves procedural efficacy. The market is also supported by government healthcare initiatives promoting advanced therapeutic technologies.

Italy Europe Ablation Devices Market Insight

The Italy ablation devices market is expected to witness steady growth, driven by increasing prevalence of chronic diseases and growing adoption of minimally invasive therapies in hospitals and specialty clinics. Cardiovascular and oncological procedures are the key contributors to market demand. Hospitals prioritize advanced ablation systems, including robotic-assisted and automated solutions, for precise and safe interventions. Patient awareness and physician preference for less invasive procedures enhance adoption. Continuous technological advancements and supportive healthcare policies further accelerate market expansion.

Europe Ablation Devices Market Share

The Europe Ablation Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Terumo Corporation (Japan)

- ATRICURE, INC. (U.S.)

- Boston Scientific Corporation (U.S.)

- Abbott (U.S.)

- Biotronik (Germany)

- Koninklijke Philips N.V., (Netherlands)

- Siemens Healthineers AG (Germany)

- Elekta AB (Sweden)

- Varian Medical Systems, Inc. (U.S.)

- Johnson & Johnson Medical Devices (U.S.)

- Cook (U.S.)

- AngioCare (Netherlands)

- F Care Systems (Belgium)

- Quantum Surgical (France)

- Erbe Elektromedizin GmbH (Germany)

- Innoblative Designs (U.S.)

- Cambridge Interventional (U.K.)

- ECO Medical (China)

- GE Healthcare (U.K.)

What are the Recent Developments in Europe Ablation Devices Market?

- In July 2025, Varian, a Siemens Healthineers company, introduced its next-generation IntelliBlate microwave ablation system in Europe. The system, which received CE Mark approval, is designed for the minimally invasive treatment of soft tissue tumors. IntelliBlate offers enhanced precision and efficiency in tumor ablation procedures, aligning with the growing demand for advanced oncological treatments in Europe

- In July 2025, Boston Scientific announced the introduction of its Intracept Intraosseous Nerve Ablation System in Europe. The system, which received CE Mark approval, is designed to provide long-lasting relief from vertebrogenic low back pain through basivertebral nerve ablation. This development highlights the expansion of ablation technologies into the field of orthopedic pain management

- In March 2025, Abbott announced that it had received the CE Mark for its Volt™ Pulsed Field Ablation (PFA) System, a novel treatment for atrial fibrillation (AFib). This approval enables the company to commence commercial use of the system across European Union markets. The Volt PFA System employs non-thermal energy to create precise lesions in heart tissue, offering a potential alternative to traditional thermal ablation methods

- In December 2023, Medtronic completed enrollment for its SPHERE Per-AF Trial, a pivotal study evaluating the safety and efficacy of its ablation catheter in patients with persistent atrial fibrillation. The trial, conducted across 23 centers in Europe and the U.S., aims to provide critical data to support regulatory approvals and clinical adoption of the device

- In June 2023, Hologic announced that its NovaSure V5 Endometrial Ablation System received CE Mark approval in Europe. The system is designed to treat abnormal uterine bleeding by removing the endometrial lining. NovaSure V5 incorporates advancements in technology to improve procedural efficiency and patient outcomes, reflecting the ongoing innovation in gynecological ablation therapies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.