Europe Active Medical Implantable Devices Market

Market Size in USD Billion

CAGR :

%

USD

6.82 Billion

USD

13.79 Billion

2025

2033

USD

6.82 Billion

USD

13.79 Billion

2025

2033

| 2026 –2033 | |

| USD 6.82 Billion | |

| USD 13.79 Billion | |

|

|

|

|

Europe Active Medical Implantable Devices Market Size

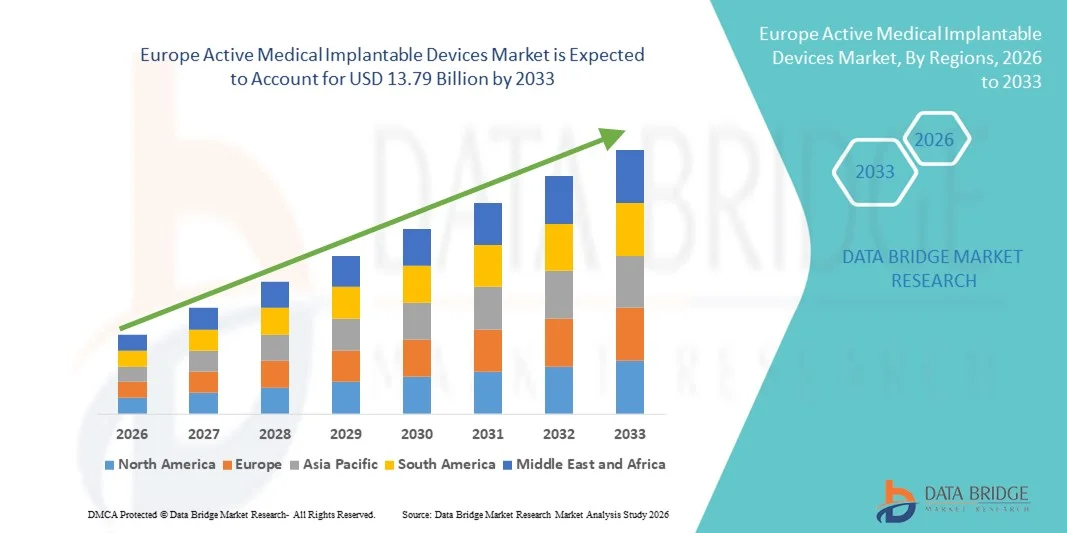

- The Europe active medical implantable devices market size was valued at USD 6.82 billion in 2025 and is expected to reach USD 13.79 billion by 2033, at a CAGR of 9.2% during the forecast period

- The market growth is largely fueled by the rapidly aging population across Europe, increasing prevalence of cardiovascular and neurological disorders, and continuous technological advancements in implantable cardiac pacemakers, defibrillators, neurostimulators, and other life‑sustaining active implants that support long‑term patient care

- Furthermore, rising healthcare expenditure, supportive reimbursement frameworks in major European economies, and the strong clinical adoption of advanced implantable technologies are driving demand for reliable, high‑performance medical implants across hospitals and specialty clinics. These converging factors are accelerating the uptake of active implantable medical device solutions, thereby significantly boosting the industry’s growth

Europe Active Medical Implantable Devices Market Analysis

- Active medical implantable devices, including pacemakers, defibrillators, neurostimulators, and insulin pumps, are increasingly vital components of modern healthcare, providing life-sustaining therapy, continuous monitoring, and enhanced patient quality of life across both hospital and outpatient settings

- The escalating demand for these devices is primarily fueled by the rapidly aging population, rising prevalence of cardiovascular, neurological, and chronic disorders, and growing preference for minimally invasive, technologically advanced implantable solutions

- Germany dominated the Europe active medical implantable devices market with the largest revenue share of 28.9% in 2025, characterized by well-established healthcare infrastructure, high healthcare expenditure, and strong adoption of advanced implantable technologies, with substantial growth driven by increasing clinical use of pacemakers and defibrillators

- Poland is expected to be the fastest growing country in the Europe active medical implantable devices market during the forecast period, driven by improving healthcare access, government initiatives to support advanced medical technologies, and rising patient awareness

- Implantable Cardioverter Defibrillators segment dominated the Europe active medical implantable devices market with a market share of 45.7% in 2025, driven by their critical role in preventing sudden cardiac death, ongoing technological advancements, and growing adoption in patients at high risk of life-threatening arrhythmias

Report Scope and Europe Active Medical Implantable Devices Market Segmentation

|

Attributes |

Europe Active Medical Implantable Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Active Medical Implantable Devices Market Trends

Advancements Through AI-Enabled and Remote Monitoring Devices

- A significant and accelerating trend in the Europe active medical implantable devices market is the integration of artificial intelligence (AI) and remote patient monitoring systems. These technologies enhance clinical decision-making, improve patient outcomes, and provide continuous, personalized therapy management

- For instance, next-generation implantable cardioverter defibrillators (ICDs) now include AI algorithms that can predict arrhythmic events and send real-time alerts to healthcare providers, enabling faster interventions. Similarly, modern pacemakers and neurostimulators can communicate with smartphone or tablet apps, allowing patients and physicians to monitor device performance and health status remotely

- AI integration enables devices to learn patient-specific patterns, optimizing therapy delivery, reducing inappropriate shocks in ICDs, and providing actionable insights for clinicians. Some neurostimulators now adjust stimulation parameters automatically based on patient activity or symptoms, enhancing therapy precision

- The seamless integration of implantable devices with digital health platforms facilitates centralized patient monitoring, combining device data with electronic health records (EHRs) and telehealth systems for more holistic care management

- This trend toward intelligent, connected implantable devices is fundamentally reshaping patient and clinician expectations for treatment and monitoring. Consequently, companies such as Boston Scientific and Medtronic are developing AI-enabled ICDs and pacemakers with predictive analytics, automatic adjustments, and remote monitoring capabilities

- The demand for active medical implantable devices with AI and remote monitoring features is growing rapidly across hospitals, cardiac care centers, and outpatient clinics, as healthcare providers increasingly prioritize patient safety, convenience, and comprehensive long-term management

Europe Active Medical Implantable Devices Market Dynamics

Driver

Rising Prevalence of Cardiovascular and Neurological Disorders and Aging Population

- The increasing prevalence of heart disease, arrhythmias, and neurological disorders in Europe, coupled with a rapidly aging population, is a significant driver for the heightened demand for active medical implantable devices

- For instance, Germany and France are witnessing growing ICD and pacemaker implantations due to high rates of cardiovascular diseases and well-established healthcare infrastructure

- Active implantable devices such as ICDs, pacemakers, and neurostimulators offer life-saving therapy, continuous monitoring, and symptom management, making them essential for patients at risk of sudden cardiac events or chronic neurological conditions

- Government initiatives, supportive reimbursement policies, and rising healthcare expenditure in countries like Germany, France, and the U.K. are further driving adoption

- The ability to remotely monitor patients, adjust therapy automatically, and integrate data with hospital EHRs ensures improved patient care, reduced hospital visits, and greater clinical efficiency, reinforcing device adoption across Europe

- Increased adoption of telemedicine platforms allows clinicians to monitor implantable devices remotely, improving follow-up care and reducing hospital readmissions

- Strategic partnerships between implantable device manufacturers and hospitals or clinics are enabling tailored patient programs, training, and remote monitoring solutions, boosting overall adoption and clinical outcomes

Restraint/Challenge

Device Safety, Regulatory Hurdles, and High Costs

- Safety concerns and stringent regulatory requirements pose significant challenges to market growth. Implantable devices are subject to rigorous CE marking, ISO standards, and clinical testing before approval, which can slow time-to-market

- Reports of device malfunctions, battery issues, or unexpected shocks from ICDs have made some clinicians and patients cautious, highlighting the importance of device reliability and continuous post-market surveillance

- Addressing these safety and regulatory concerns through robust testing, post-market monitoring, and compliance with European Medical Device Regulation (MDR) is crucial for building clinician and patient trust

- Additionally, the high initial cost of advanced implantable devices, particularly AI-enabled ICDs and neurostimulators, can be a barrier for smaller hospitals or budget-conscious patients, even with reimbursement support

- The successful implantation and management of advanced devices require trained cardiologists, electrophysiologists, and specialized nursing staff. A shortage of skilled professionals in certain European countries can delay procedures and limit device adoption

- Some patients may be hesitant to adopt implantable devices due to fear of surgery, device malfunction, or lifestyle disruption. Lack of awareness about the benefits of AI-enabled or remote monitoring devices can slow market penetration, particularly in Eastern European countries

- While technological advancements are improving device longevity and reducing complications, overcoming safety, regulatory, and cost barriers is vital for sustained adoption and market growth

Europe Active Medical Implantable Devices Market Scope

The market is segmented on the basis of product, surgery type, procedure, and end user.

- By Product

On the basis of product, the market is segmented into Cardiac Resynchronization Therapy Devices (CRT-D), implantable cardioverter defibrillators (icds), implantable cardiac pacemakers, eye implants, neurostimulators, active implantable hearing devices, ventricular assist devices, implantable heart monitors/insertable loop recorders, brachytherapy, implantable glucose monitors, dropped foot implants, shoulder implants, implantable infusion pumps, and implantable accessories. The Implantable Cardioverter Defibrillators (ICDs) segment dominated the market with the largest market revenue share of 45.7% in 2025, driven by their critical role in preventing sudden cardiac death in patients with high-risk arrhythmias. ICDs are widely adopted across hospitals and specialty cardiac clinics in Germany, France, and the U.K., supported by favorable reimbursement policies and advanced clinical infrastructure. The segment’s dominance is further strengthened by ongoing technological innovations, such as AI-enabled detection, remote monitoring capabilities, and enhanced battery life, which improve patient outcomes and clinician confidence. Additionally, growing awareness of cardiac health and increasing prevalence of cardiovascular disorders in Europe contribute to the sustained demand for ICDs.

The Neurostimulators segment is anticipated to witness the fastest growth during the forecast period, driven by rising prevalence of neurological disorders, such as Parkinson’s disease, epilepsy, and chronic pain conditions. Advancements in minimally invasive implantation techniques and adaptive neurostimulation technologies have made these devices more effective and patient-friendly. Furthermore, integration with remote monitoring platforms and AI-powered therapy adjustments increases adoption in specialty clinics and hospitals. The growing trend of personalized neuromodulation therapy and awareness campaigns promoting neurostimulation treatments also fuel rapid growth for this segment.

- By Surgery Type

On the basis of surgery type, the market is segmented into traditional surgical methods and minimally invasive surgery. The Traditional Surgical Methods segment dominated the market in 2025, accounting for the majority of device implantation procedures due to established clinical familiarity, proven safety, and accessibility in well-equipped hospitals. Complex procedures, such as ICD or CRT-D implantation, are often performed using traditional surgical methods to ensure precise device placement and reduce procedural complications. Many healthcare providers continue to rely on conventional approaches due to clinician training and long-term clinical outcomes data.

The Minimally Invasive Surgery segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising patient preference for less invasive procedures, shorter recovery times, and reduced post-operative complications. Technological advancements, including robotic-assisted implantation and percutaneous approaches, enable precise device placement with minimal tissue disruption. Growing awareness among patients and physicians regarding the benefits of minimally invasive techniques is driving adoption in both cardiac and neurovascular device procedures.

- By Procedure

On the basis of procedure, the market is segmented into neurovascular, cardiovascular, hearing, and others. The Cardiovascular procedure segment dominated the market in 2025, driven by high demand for pacemakers, ICDs, CRT-Ds, and ventricular assist devices to treat heart failure, arrhythmias, and other cardiac conditions. Cardiovascular diseases remain the leading cause of morbidity and mortality in Europe, making the adoption of life-saving implantable devices essential. Hospitals and specialty cardiac clinics in Germany, France, and the U.K. are key contributors to market dominance. The segment benefits from continuous innovation in AI-enabled cardiac monitoring, remote device management, and improved battery life.

The Neurovascular procedure segment is expected to witness the fastest growth from 2026 to 2033, supported by rising prevalence of stroke, aneurysms, and neurological disorders. Advanced neurovascular devices, including neurostimulators and implantable loop recorders, are increasingly used to prevent and manage chronic neurological conditions. Integration with telehealth monitoring platforms and AI-driven predictive analytics further boosts procedural adoption. Growth is also fueled by government initiatives promoting neurological care and increased patient awareness of minimally invasive interventions.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and clinics. The Hospitals segment dominated the market in 2025, accounting for the largest share due to their well-equipped infrastructure, access to specialized clinicians, and capability to perform complex implantable device procedures. Hospitals are preferred for high-risk cardiovascular and neurological procedures, as they provide comprehensive pre- and post-operative care, continuous monitoring, and advanced emergency support. Major hospitals in Germany, France, and the U.K. are at the forefront of adopting AI-enabled ICDs and pacemakers.

The Specialty Clinics segment is anticipated to witness the fastest growth during the forecast period, driven by increasing adoption of minimally invasive procedures, rising patient preference for focused care centers, and growing availability of advanced neurostimulators, hearing implants, and cardiac devices in outpatient specialty facilities. The convenience, reduced procedural costs, and shorter recovery periods offered by specialty clinics contribute to the rapid expansion of this segment.

Europe Active Medical Implantable Devices Market Regional Analysis

- Germany dominated the Europe active medical implantable devices market with the largest revenue share of 28.9% in 2025, characterized by well-established healthcare infrastructure, high healthcare expenditure, and strong adoption of advanced implantable technologies, with substantial growth driven by increasing clinical use of pacemakers and defibrillators

- Patients and healthcare providers in the region prioritize reliable, clinically proven devices with advanced features such as AI-enabled monitoring, remote management, and life-saving functionality, making Germany a key hub for implantable device adoption

- This widespread adoption is further supported by favorable reimbursement policies, strong presence of leading medical device companies, and growing awareness of cardiovascular and neurological health, establishing Germany as the leading market for active medical implantable devices in Europe

Germany Active Medical Implantable Devices Market Insight

Germany dominated the Europe active medical implantable devices market in 2025, capturing the largest revenue share of 28.9%, driven by its advanced healthcare infrastructure, high healthcare expenditure, and early adoption of cutting-edge cardiac and neurovascular devices. Hospitals and specialty cardiac clinics in Germany prioritize reliable, clinically validated devices such as implantable cardioverter defibrillators (ICDs), pacemakers, and CRT-Ds, supported by AI-enabled monitoring and remote diagnostics to enhance patient outcomes. The presence of leading device manufacturers, robust reimbursement policies, and well-established hospital networks further strengthen Germany’s dominant position.

Poland Active Medical Implantable Devices Market Insight

Poland is expected to be the fastest-growing country in Europe during the forecast period, driven by improving healthcare access, expansion of hospitals and specialty clinics, and increasing awareness of advanced implantable medical solutions. Rising prevalence of cardiovascular disorders, chronic diseases, and neurological conditions, combined with supportive government initiatives and reimbursement policies, is fueling device adoption. The increasing use of minimally invasive procedures, telemedicine platforms, and remote monitoring solutions is also accelerating growth. Patient awareness campaigns and collaborations between healthcare providers and device manufacturers are helping to bridge knowledge gaps, making Poland one of the most dynamic growth markets in Europe.

U.K. Active Medical Implantable Devices Market Insight

The U.K. market is expected to grow at a noteworthy CAGR, supported by rising prevalence of heart disease, arrhythmias, and neurological disorders. Hospitals and specialty clinics are increasingly adopting AI-enabled ICDs, pacemakers, and neurostimulators to enhance therapy outcomes. Government initiatives for chronic disease management, reimbursement support, and public awareness campaigns are further driving adoption. The U.K.’s focus on minimally invasive implantation techniques and patient-centric care also encourages the use of advanced devices in both urban hospitals and smaller specialty clinics.

France Active Medical Implantable Devices Market Insight

France’s market is projected to expand steadily, driven by robust healthcare infrastructure, strong research and clinical networks, and growing demand for implantable cardiac and neurovascular devices. Integration of remote monitoring, AI-driven diagnostics, and telehealth solutions is enhancing patient management and therapy optimization. Hospitals in major cities and semi-urban regions are increasingly investing in advanced ICDs, pacemakers, and neurostimulators to improve patient outcomes and reduce hospital readmissions.

Europe Active Medical Implantable Devices Market Share

The Europe Active Medical Implantable Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- Cochlear Ltd (Australia)

- Biotronik (Germany)

- LivaNova PLC (U.K.)

- MED EL Medical Electronics (Austria)

- Sonova (Switzerland)

- Axonics, Inc. (U.S.)

- NeuroPace, Inc. (U.S.)

- NEVRO CORP (U.S.)

- Zhejiang Nurotron Biotechnology Co., Ltd (China)

- Demant A/S (Denmark)

- Oticon Medical (Denmark)

- Sonova Holding AG (Switzerland)

- Microson (Australia)

- Nano Retina (Israel)

- GluSense (U.S.)

- Second Sight (U.S.)

What are the Recent Developments in Europe Active Medical Implantable Devices Market?

- In February 2025, BIOTRONIK announced a strategic shift to focus on active implantable devices and digital health technologies, reinforcing its leadership in cardiac rhythm management, patient monitoring, electrophysiology, heart failure, and neuromodulation. This shift includes bolstering innovation in AI‑enabled implants and remote patient care platforms, and divesting its Vascular Intervention business to sharpen its focus on implantable therapies

- In August 2024, Royal Papworth Hospital NHS Foundation Trust in the U.K. became the first in Europe outside clinical trials to fit patients with a new implantable cardioverter‑defibrillator (ICD) designed to correct irregular heart rhythms and prevent sudden cardiac arrest, illustrating real‑world clinical adoption of advanced ICD technology in European care settings

- In April 2024, BIOTRONIK introduced the BIOMONITOR IV insertable cardiac monitor with artificial intelligence at the EHRA Congress, marking its CE approval and first European implant. This new monitor reduces false positives and enhances remote patient management through advanced signal processing and AI‑driven detection

- In September 2023, Precis GmbH (Heidelberg, Germany) received CE Mark approval for its EASEE® System for treating refractory focal epilepsy, an implantable neuromodulation device designed to deliver targeted electrical stimulation to reduce seizure frequency in adults with epilepsy that does not respond to medication. Clinical data published in JAMA Neurology demonstrated significant reductions in seizure frequency with the EASEE® implant, marking a key step forward for implantable neurological devices in Europe

- In February 2023, Medtronic received CE Mark approval for its Aurora Extravascular Implantable Cardioverter Defibrillator (EV‑ICD) system in Europe, providing a novel defibrillator option that places the lead outside the heart and veins to reduce long‑term vascular complications while still delivering life‑saving arrhythmia therapy. This CE Mark enables commercial availability of the system in select European countries and marks a meaningful advance in ICD technology for patients at risk of sudden cardiac arrest

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.