Europe Active Pharmaceutical Ingredient Api Market

Market Size in USD Billion

CAGR :

%

USD

66.21 Billion

USD

124.37 Billion

2024

2032

USD

66.21 Billion

USD

124.37 Billion

2024

2032

| 2025 –2032 | |

| USD 66.21 Billion | |

| USD 124.37 Billion | |

|

|

|

|

Europe Active Pharmaceutical Ingredients (API) Market Size

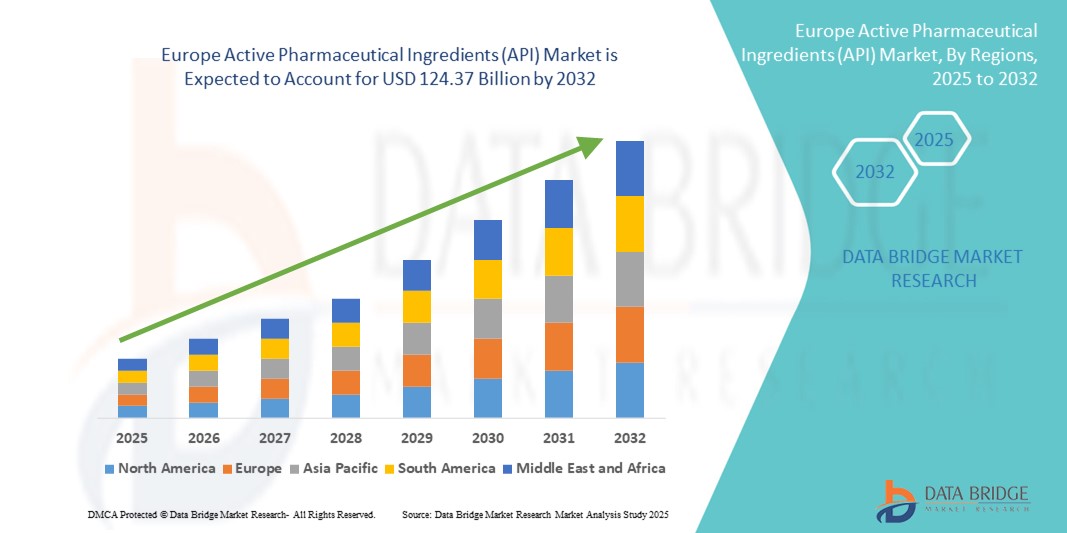

- The Europe active pharmaceutical ingredients (API) market size was valued at USD 66.21 billion in 2024 and is expected to reach USD 124.37 billion by 2032, at a CAGR of 8.02% during the forecast period demand

- The Europe active pharmaceutical ingredients (API) market is witnessing significant growth driven by pharmaceutical manufacturers’ increasing focus on expanding generic and specialty drug production, enhancing process efficiency, and ensuring regulatory compliance across various therapeutic segments. Rising for high-quality APIs to support large-scale drug manufacturing is intensifying throughout the region

- Furthermore, growing investments in advanced manufacturing facilities, adoption of continuous manufacturing processes, and innovations in green chemistry and biocatalysis are fueling the production of sophisticated and cost-effective APIs. Supportive regulatory frameworks from the European Medicines Agency (EMA) and stringent quality standards for drug safety and efficacy are also encouraging pharmaceutical companies to modernize API production processes, facilitating improved integration with downstream drug formulation and global supply chains

Europe Active Pharmaceutical Ingredients (API) Market Analysis

- The Europe Active Pharmaceutical Ingredients (API) market is experiencing strong growth, driven by increasing digitalization of healthcare systems, the need to enhance operational efficiency in hospitals and clinics, and the rising demand for advanced imaging and diagnostic solutions. Hospitals and healthcare providers are adopting API solutions to streamline workflows, improve data management, and optimize drug manufacturing and supply processes across the region

- Growing government initiatives to support healthcare IT adoption, along with investments in hospital modernization and pharmaceutical R&D, are further accelerating the market. Integration of AI, machine learning, and advanced analytics into API platforms is enhancing process optimization, predictive maintenance, and overall operational efficiency in healthcare and pharmaceutical applications

- Germany dominated the Europe Active Pharmaceutical Ingredients (API) market in 2024 with the largest revenue share of 34.2%, supported by its well-established pharmaceutical manufacturing ecosystem, strong research and development capabilities, extensive production facilities, and adherence to stringent regulatory standards. The country’s focus on high-quality production, innovation in synthetic and biopharmaceutical intermediates, and growing export-oriented API manufacturing further strengthens its position in the European market

- The U.K. is projected to register the fastest CAGR of 11.8% in the Europe Active Pharmaceutical Ingredients (API) market during the forecast period, driven by increasing investments in pharmaceutical research and development, growing contract manufacturing activities, and rising demand for high-quality API production. The expansion of advanced manufacturing facilities, adoption of innovative production technologies, and supportive regulatory environment further propel market growth, making the U.K. a key emerging contributor in the European API landscape

- Prescription drugs dominated the Europe active pharmaceutical ingredients (API) market with a share of 71.5% in 2024, reflecting their critical role in managing chronic and complex diseases, the need for specialist supervision, and adherence to stringent regulatory requirements

Report Scope and Europe Active Pharmaceutical Ingredients (API) Market Segmentation

|

Attributes |

Europe Active Pharmaceutical Ingredients (API) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Active Pharmaceutical Ingredients (API) Market Trends

Innovation and Automation Propel Expansion of the Europe Active Pharmaceutical Ingredients (API) Market

- The Europe active pharmaceutical ingredients (API) market is witnessing substantial growth driven by rapid advancements in automation, digitalization, and data-driven solutions aimed at optimizing pharmaceutical manufacturing, quality control, and supply chain efficiency across healthcare and industrial sectors. Increasing demand for high-quality APIs, faster production cycles, and compliance with stringent regulatory standards is reshaping the pharmaceutical landscape throughout the region

- Pharmaceutical manufacturers are increasingly adopting AI-powered process control, robotic automation, and advanced analytics to enhance production accuracy, minimize errors, and improve operational efficiency. These technologies reduce manual intervention, streamline workflows, and ensure consistent product quality across batches

- Cloud-based manufacturing and quality management platforms are gaining traction due to their scalability, real-time monitoring capabilities, and seamless integration with enterprise resource planning (ERP) and laboratory information management systems (LIMS). This enables manufacturers to maintain regulatory compliance, optimize supply chains, and enhance collaboration across production sites

- Countries such as Germany, the U.K., and France are witnessing increased investments in advanced API production technologies, automated quality control solutions, and real-time batch monitoring systems to comply with evolving pharmacovigilance and regulatory frameworks

- The growing complexity of pharmaceutical formulations and rising demand for high-purity APIs are driving the adoption of end-to-end automated systems that support the entire production lifecycle—from raw material testing and synthesis to formulation and final release

- Strategic collaborations between API manufacturers, contract development and manufacturing organizations (CDMOs), and technology providers are fostering innovation in production processes, staff training, and quality assurance, ultimately enhancing operational efficiency and product reliability

- With Europe’s pharmaceutical sector emphasizing cost optimization, regulatory compliance, and high-quality production standards, the Active Pharmaceutical Ingredients (API) market is poised for robust growth, fueled by technological innovation, automation, and increasing adoption of digital and cloud-enabled solutions across both public and private pharmaceutical manufacturers

Europe Active Pharmaceutical Ingredients (API) Market Dynamics

Driver

Driving Market Expansion through Digital Innovations and Enhanced Data Management in Europe Active Pharmaceutical Ingredients (API) Market

- The Europe Active Pharmaceutical Ingredients (API) market is witnessing strong growth, propelled by advances in analytical technologies, automation, and data management systems that optimize manufacturing processes, quality control, and regulatory compliance across pharmaceutical and biotechnology sectors. Key countries such as Germany, France, and the U.K. are modernizing production facilities and implementing sophisticated quality testing platforms to ensure precise API formulation, stability, and safety for domestic and export markets

- In early 2024, leading API manufacturers and service providers expanded high-throughput analytical laboratories and integrated digital solutions across Europe, enabling faster testing, real-time data monitoring, and improved compliance with Good Manufacturing Practices (GMP) and international regulatory standards. These innovations are expected to significantly accelerate market growth throughout the forecast period

- The increasing adoption of advanced analytical techniques—such as high-performance liquid chromatography (HPLC), mass spectrometry, and spectroscopy-based testing—supports accurate characterization of active ingredients, impurity profiling, and batch release validation, thereby enhancing overall manufacturing efficiency and product quality

- Regulatory frameworks, including EMA guidelines and national quality standards, promote stringent API testing and traceability, indirectly driving the demand for automated and integrated analytical platforms across pharmaceutical manufacturing units

- Collaborative initiatives between API producers, contract manufacturing organizations, and regulatory authorities focus on standardizing best practices, implementing digital quality management systems, and training personnel in cutting-edge analytical methodologies, which are crucial for expanding API market capabilities and ensuring consistent product safety

Restraint/Challenge

High Implementation Costs and Variable Adoption Across Facilities

- Despite technological advancements, the high costs associated with automated analytical systems, quality control instruments, and integration services remain a key barrier, particularly for small- and medium-sized manufacturers in Eastern Europe and other cost-sensitive regions, limiting their ability to adopt state-of-the-art API production and testing solutions

- The complexity of deploying fully integrated digital platforms, which require coordination among chemists, quality assurance teams, and IT personnel, restricts adoption in smaller facilities lacking technical expertise, thereby constraining efficiency improvements and comprehensive quality monitoring

- In addition, differences in local regulatory enforcement, infrastructure readiness, and workforce training contribute to uneven adoption patterns across European countries, preventing uniform implementation of best-in-class API manufacturing practices

- To overcome these challenges and sustain growth in the Europe active pharmaceutical Ingredients (API) market, increased investment in digital infrastructure, cross-border harmonization of quality standards, and targeted training programs for analytical and production staff are essential. These measures will enable broader access to advanced API technologies, improved compliance, and enhanced manufacturing efficiency across diverse pharmaceutical facilities

Europe Active Pharmaceutical Ingredients (API) Market Scope

The market is segmented on the basis of molecule, type, type of manufacturer, synthesis, chemical synthesis, type of drug, usage, potency, and therapeutic application.

- By Molecule

On the basis of molecule, the Europe active pharmaceutical ingredients (API) market is segmented into small molecule and large molecule. The small molecule segment dominated the market in 2024 with a revenue share of 62.3%, driven by its long-established and cost-effective manufacturing processes, wide applicability across multiple therapeutic areas, and high-volume production efficiency. Small molecules continue to form the backbone of traditional pharmacotherapy, making them a preferred choice for both generic and innovative drug formulations. Their stability, ease of formulation, and proven clinical efficacy further contribute to their sustained dominance in the market.

The large molecule segment is projected to witness the fastest CAGR of 10.2% from 2025 to 2032, fueled by the increasing adoption of biologics, monoclonal antibodies, and complex protein therapeutics. Rising investments in biotechnology, precision medicine, and personalized therapeutic approaches are driving demand for large molecule APIs across Europe. Technological advancements in protein engineering, cell-based manufacturing, and regulatory support for novel biologics are further accelerating growth in this high-value segment.

- By Type

On the basis of type, the Europe active pharmaceutical ingredients (API) market is segmented into innovative active pharmaceutical ingredients and generic innovative active pharmaceutical ingredients. Innovative APIs held the largest revenue share of 58.7% in 2024, supported by continuous investments in R&D pipelines, regulatory incentives for breakthrough therapies, and growing demand for novel treatments across therapeutic areas such as oncology, cardiology, and neurology. The segment’s dominance is further reinforced by the rising focus on precision medicine, biologics, and targeted therapies, which require specialized, high-quality API formulations to ensure efficacy and safety.

The generic innovative segment is expected to register the fastest CAGR of 9.5% from 2025 to 2032, propelled by the rising need for cost-effective alternatives to branded drugs, increasing pressure on healthcare budgets, and the expansion of generic drug manufacturing facilities across Europe. These factors are enabling broader patient access to essential medications while maintaining high-quality standards in API supply chains.

- By Type of Manufacturer

On the basis of type of manufacturer, the Europe active pharmaceutical ingredients (API) market is segmented into captive API manufacturers and merchant API manufacturers. Captive API manufacturers dominated with a revenue share of 55.4% in 2024, benefitting from vertical integration, full control over production quality, and reliable supply chains for their in-house pharmaceutical products. These manufacturers are better positioned to meet stringent regulatory standards, maintain consistent product quality, and optimize cost efficiency, providing a competitive advantage in the European market.

Merchant API manufacturers are anticipated to grow at the fastest CAGR of 10.1% during 2025–2032, fueled by the increasing trend of outsourcing among pharmaceutical companies, strategic partnerships, and contract manufacturing collaborations. The segment’s growth is supported by the flexibility, scalability, and cost efficiency offered to smaller pharmaceutical players seeking access to high-quality API supplies without investing heavily in production infrastructure.

- By Synthesis

On the basis of synthesis, the Europe active pharmaceutical ingredients (API) market is segmented into synthetic active pharmaceutical ingredients and biotech active pharmaceutical ingredients. Synthetic APIs held the largest share of 63.8% in 2024, reflecting their cost-effective production processes, high scalability, and consistent demand across conventional therapeutic categories such as pain management, cardiovascular diseases, and anti-infective treatments. The segment benefits from mature manufacturing technologies, well-established supply networks, and wide availability of raw materials across Europe.

Biotech APIs are projected to record the fastest CAGR of 11.3% from 2025 to 2032, driven by the rapid expansion of biologics, vaccines, and personalized therapies, particularly in oncology and immunology. Increasing investments in advanced biotechnology R&D, coupled with rising adoption of complex protein-based therapeutics, cell and gene therapies, and regulatory support for innovative biologics, are accelerating the growth of this high-value segment across the region.

- By Chemical Synthesis

On the basis of chemical synthesis, the Europe active pharmaceutical ingredients (API) market is segmented into acetaminophen, artemisinin, saxagliptin, sodium chloride, ibuprofen, losartan potassium, enoxaparin sodium, rufinamide, naproxen, tamoxifen, and others. Ibuprofen dominated the market in 2024 with a share of 14.2%, driven by its widespread use as a pain reliever and anti-inflammatory agent for conditions such as arthritis, headaches, and musculoskeletal pain. Its extensive availability, affordability, and proven efficacy in both acute and chronic treatments contribute to its leading position.

Enoxaparin sodium is expected to grow at the fastest CAGR of 10.5% during the forecast period from 2025 to 2032. This growth is fueled by the rising prevalence of cardiovascular diseases, increasing demand for anticoagulant therapies, and technological advancements that enhance drug safety, precision dosing, and delivery mechanisms. Expanding awareness of preventive cardiovascular care and supportive government health initiatives are also accelerating the adoption of enoxaparin sodium in clinical settings.

- By Type of Drug

On the basis of type of drug, the Europe active pharmaceutical ingredients (API) market is segmented into prescription and over-the-counter. Prescription drugs held the largest market share of 71.5% in 2024, reflecting their critical role in managing chronic and complex diseases, the need for specialist supervision, and adherence to stringent regulatory requirements. The dominance of prescription drugs is also supported by ongoing innovations in targeted therapies, biologics, and personalized medicine.

over-the-counter drugs are projected to witness the fastest CAGR of 9.6% during the forecast period from 2025 to 2032. This growth is driven by increasing consumer awareness regarding self-care, rising trends in self-medication for minor ailments, and easier access to medications through retail pharmacies and online platforms. The segment is further supported by health campaigns promoting preventive care, convenience-focused product offerings, and the expanding role of e-pharmacies in Europe.

- By Usage

On the basis of usage, the Europe active pharmaceutical ingredients (API) market is segmented into clinical and research applications. Clinical usage dominated the market in 2024 with a revenue share of 68.3%, supported by widespread therapeutic applications across hospitals, specialty clinics, and healthcare centers. The high demand is driven by routine treatment procedures, growing patient volumes, and the increasing adoption of standardized API formulations in clinical practice. The segment also benefits from advancements in personalized medicine, targeted therapies, and integration of APIs in combination treatments, which collectively enhance treatment efficacy and patient outcomes.

Research usage is anticipated to register the fastest CAGR of 10.7% during the forecast period from 2025 to 2032. This growth is fueled by the expansion of clinical trials, increased focus on drug discovery and preclinical studies, and rising R&D investments in Europe. Growing emphasis on innovation in therapeutic development, regulatory support for experimental drug programs, and collaborations between pharmaceutical companies and research institutions are further accelerating the adoption of APIs in research applications.

- By Potency

On the basis of potency, the Europe active pharmaceutical ingredients (API) market is segmented into low-to-moderate potency active pharmaceutical ingredients and potent-to-highly potent active pharmaceutical ingredients. Low-to-moderate potency APIs dominated the market in 2024 with a share of 59.4%, driven by their broad therapeutic applicability across multiple disease areas, simpler handling requirements, and lower safety and containment constraints. These APIs are widely used in conventional therapies and routine treatment regimens, making them a staple in both hospital and outpatient settings. Their ease of production, cost efficiency, and well-established regulatory pathways further contribute to their dominant position in the market.

Potent-to-highly potent APIs are projected to grow at the fastest CAGR of 11.0% during the forecast period from 2025 to 2032. This growth is fueled by their critical role in specialty therapeutics, including oncology, antiviral therapies, and targeted treatments that require precise dosing and stringent safety protocols. Increasing R&D investments in high-potency drugs, advancements in containment and delivery technologies, and the rising demand for specialty APIs in personalized medicine are key factors driving the rapid expansion of this segment across Europe.

- By Therapeutic Application

On the basis of therapeutic application, the Europe active pharmaceutical ingredients (API) market is segmented into cardiology, CNS and neurology, oncology, orthopedic, endocrinology, pulmonology, gastroenterology, nephrology, ophthalmology, and other therapeutic applications. Oncology dominated the market in 2024 with a revenue share of 32.8%, driven by the rising prevalence of various cancers, increased investments in targeted therapies, and the expansion of personalized medicine initiatives across Europe. The demand for oncology APIs is further supported by advancements in immunotherapy, precision medicine programs, and government-backed cancer research funding.

CNS and neurology APIs are expected to witness the fastest CAGR of 10.8% during the forecast period from 2025 to 2032. This growth is fueled by the increasing incidence of neurodegenerative and neurological disorders, the development of novel therapeutic options for conditions such as Alzheimer’s, Parkinson’s, and multiple sclerosis, and a growing focus on R&D within the European pharmaceutical sector. Rising awareness about mental health, coupled with technological advancements in drug formulation and delivery for neurological applications, is also contributing to the rapid expansion of this segment.

Europe Active Pharmaceutical Ingredients (API) Market Regional Analysis

- Europe is a significant region in the global Active Pharmaceutical Ingredients (API) market, accounting for a notable revenue share in 2024. The region’s contribution is supported by its advanced pharmaceutical manufacturing ecosystem, strong regulatory frameworks, and growing emphasis on operational efficiency and quality compliance. Increasing investments in innovative API production technologies, focus on sustainable manufacturing practices, and expansion of contract manufacturing organizations (CMOs) are driving market activities. Moreover, rising demand for high-quality APIs, coupled with stringent standards for drug safety and efficacy, is encouraging pharmaceutical companies to strengthen their production capabilities, thereby enhancing Europe’s role in the global API landscape

- The market’s expansion in Europe benefits from robust regulatory frameworks, comprehensive reimbursement policies, and high patient engagement, collectively promoting broader adoption of API solutions. Governments and healthcare authorities are investing in healthcare IT modernization and supporting value-based care models that emphasize compliance, transparency, and efficient drug management. These initiatives, coupled with increased awareness among pharmaceutical manufacturers and healthcare providers about the need for quality control, integrated drug development, and operational optimization, are key drivers of API market adoption

- Europe is home to numerous leading pharmaceutical technology companies specializing in API production, quality management, and clinical integration. Strong collaborations between healthcare institutions, manufacturers, and software providers are fostering advancements in automated quality control, process optimization, and regulatory reporting tools. These innovations not only improve production efficiency but also enhance compliance and patient safety, reinforcing Europe’s leadership in the global API market

Germany Active Pharmaceutical Ingredients (API) Market Insight

The Germany active pharmaceutical ingredients (API) market held a leading position in Europe in 2024, capturing the largest revenue share of 34.2%. This strong performance is attributed to Germany’s well-established pharmaceutical manufacturing ecosystem, stringent regulatory compliance standards, and emphasis on high-quality API production. The country benefits from a dense network of pharmaceutical companies and research institutions, which fosters innovation in drug development, quality assurance, and process optimization. Advanced manufacturing technologies, including continuous processing, process analytical technology (PAT), and automation solutions, are increasingly deployed to enhance production efficiency and product consistency. Germany’s strategic focus on sustainable API production and export-oriented manufacturing further reinforces its prominence within the European market.

U.K. Active Pharmaceutical Ingredients (API) Market Insight

The U.K. active pharmaceutical ingredients (API) market accounted for a notable share of the European API landscape in 2024 and is projected to register the fastest CAGR of 11.8% during the forecast period. Growth in the U.K. market is fueled by investments in modern pharmaceutical infrastructure, increasing adoption of digital manufacturing solutions, and a growing emphasis on compliance with regulatory standards. The integration of cloud-based systems, automated process monitoring, and advanced analytics is enhancing operational efficiency and ensuring consistent API quality. Rising demand for innovative and high-purity APIs, along with initiatives to strengthen local pharmaceutical production capabilities, is driving the country’s robust growth trajectory within the Europe Active Pharmaceutical Ingredients (API) market.

Europe Active Pharmaceutical Ingredients (API) Market Share

The Europe Active Pharmaceutical Ingredients (API) industry is primarily led by well-established companies, including:

- Novartis AG (Switzerland)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Abbott (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Bausch Health Companies Inc. (Canada)

- UCB S.A. (Belgium)

- Sunovion Pharmaceuticals Inc. (U.S.)

- Jazz Pharmaceuticals, Inc. (U.K.)

- AstraZeneca (U.K.)

- GSK plc (U.K.)

- H. Lundbeck A/S (Denmark)

- Takeda Pharmaceutical Company Limited (Japan)

- Sumitomo Dainippon Pharma Co., Ltd. (Japan)

- Cadila Pharmaceuticals (India

Latest Developments in Europe Active Pharmaceutical Ingredients (API) market

- In May 2025, Xellia Pharmaceuticals, Europe's last manufacturer of key antibiotic ingredients, announced the closure of its largest domestic factory in Copenhagen, resulting in 500 job losses. The company cited unsustainable competition and plans to relocate some production to China. This move underscores the challenges facing Europe's pharmaceutical self-sufficiency, as approximately 80% of APIs used in the EU already come from China

- In February 2024, Teva Pharmaceutical Industries confirmed its decision to remain a unified company for generic and branded drugs, despite speculation about a split. The CEO highlighted significant interest in the company's API business, valued at USD 1 billion in a global industry worth USD 85 billion. Teva plans to divest its API business by 2025, aiming to streamline operations and focus on core areas

- In July 2023, EUROAPI, a leading European API manufacturer, reported a 2.6% increase in net sales for the first half of 2023, reaching EUR 496.6 million. The company added 35 new clients in both small and large molecules and resumed prostaglandin production in Budapest, contributing to the positive performance

- In November 2022, EUROAPI completed the acquisition of Biano, enhancing its capabilities in the Contract Development and Manufacturing Organization (CDMO) sector. This strategic move aimed to expand EUROAPI's service offerings and strengthen its position in the European API market

- In December 2021, EUROAPI appointed a new Executive Committee, signaling a commitment to strengthening leadership and governance structures. This organizational change was part of the company's broader strategy to enhance operational efficiency and market competitiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.