Europe Aerospace Adhesive Sealants Market

Market Size in USD Million

CAGR :

%

USD

456.86 Million

USD

639.82 Million

2024

2032

USD

456.86 Million

USD

639.82 Million

2024

2032

| 2025 –2032 | |

| USD 456.86 Million | |

| USD 639.82 Million | |

|

|

|

|

Europe Aerospace Adhesive - Sealants Market Size

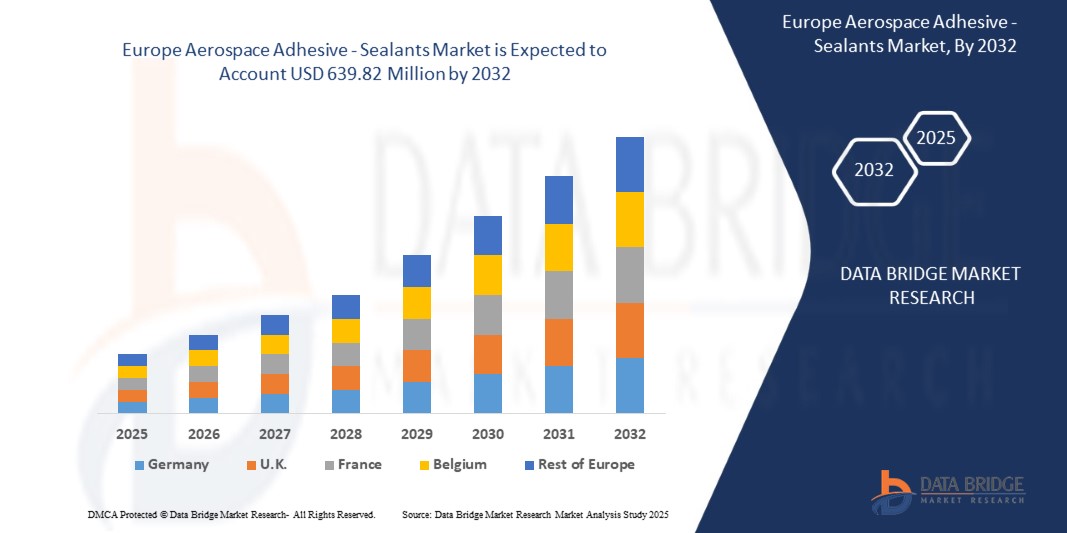

- The Europe aerospace adhesive - sealants market size was valued at USD 456.86 million in 2024 and is expected to reach USD 639.82 million by 2032, at a CAGR of 4.30% during the forecast period

- The market growth is largely fuelled by the rising demand for lightweight and fuel-efficient aircraft components, as adhesive and sealant technologies replace traditional fastening methods to improve structural integrity and reduce overall weight

- Increasing production of commercial aircraft, coupled with advancements in defense and space exploration programs, is further boosting the demand for high-performance adhesive and sealant solutions across the aerospace industry

Europe Aerospace Adhesive - Sealants Market Analysis

- Growing focus on advanced bonding technologies, such as epoxy and polyurethane-based adhesives, is enabling enhanced durability, chemical resistance, and performance in extreme environments, making them indispensable in modern aircraft manufacturing

- The rising emphasis on maintenance, repair, and overhaul (MRO) activities is also contributing to market expansion, as airlines and defense operators increasingly rely on adhesive and sealant solutions to extend aircraft lifespan and ensure compliance with stringent safety regulations

- Germany aerospace adhesive - sealants market captured the largest revenue share in Europe in 2024, fueled by the country’s strong aircraft manufacturing base, technological advancements, and emphasis on high-performance materials

- U.K. is expected to witness the highest compound annual growth rate (CAGR) in the Europe aerospace adhesive - sealants market due to increasing investments in aerospace innovation, rising focus on lightweight and high-performance materials, and the expansion of commercial and defense aircraft production

- The solvent-borne segment held the largest market revenue share in 2024, driven by its high performance in structural bonding applications and long-term reliability under extreme conditions. Solvent-borne adhesives are widely used across assembly lines for fuselage and wing components

Report Scope and Europe Aerospace Adhesive - Sealants Market Segmentation

|

Attributes |

Europe Aerospace Adhesive - Sealants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

• Adoption Of Lightweight And Fuel-Efficient Materials |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Europe Aerospace Adhesive - Sealants Market Trends

Increasing Adoption of Advanced Adhesive and Sealant Solutions in Aerospace

• The growing adoption of advanced adhesives and sealants is transforming the aerospace manufacturing landscape by enabling lightweight, high-strength bonding in aircraft structures. These materials reduce reliance on mechanical fasteners, enhancing fuel efficiency and overall aircraft performance. This results in lower maintenance costs and improved structural integrity

• The rising demand for durable, temperature-resistant, and corrosion-proof adhesives is accelerating the use of epoxy, polyurethane, and silicone-based sealants in airframes, engines, and interior components. These solutions are particularly effective in harsh operating environments and extreme weather conditions

• The focus on weight reduction and eco-friendly materials is making modern adhesives and sealants attractive for both commercial and military aircraft applications. Manufacturers benefit from more efficient assembly processes without compromising safety or regulatory compliance, boosting productivity and reducing production time

• For instance, in 2023, several aerospace manufacturers reported reduced assembly time and improved structural performance after integrating high-performance epoxy adhesives in critical bonding processes. This led to cost savings and enhanced overall aircraft durability

• While adhesives and sealants are driving efficiency and performance, their impact depends on continued innovation, regulatory approvals, and compatibility with emerging composite materials. Companies must focus on R&D and customized solutions to fully capitalize on market growth

Europe Aerospace Adhesive - Sealants Market Dynamics

Driver

Rising Demand For Lightweight, Durable, And High-Performance Materials

• The growing focus on fuel efficiency and performance optimization across the aerospace sector is propelling the demand for advanced adhesive and sealant solutions. Their ability to provide strong, lightweight, and durable bonding makes them indispensable in modern aircraft manufacturing. In addition, the shift toward composite materials in airframes and interiors is driving the need for adhesives that can handle multi-material assemblies while maintaining structural integrity

• OEMs and aircraft maintenance providers are increasingly aware of the benefits of adhesives and sealants, including weight reduction, corrosion resistance, and simplified assembly processes. These factors are encouraging large-scale adoption, particularly in commercial and defense aerospace applications. Furthermore, improved fatigue resistance and vibration dampening properties of modern adhesives enhance overall aircraft lifespan and reliability

• Governments and aviation authorities are supporting innovations in aerospace materials through certifications, subsidies, and R&D initiatives, further boosting the market for high-performance adhesives and sealants globally. This support also includes funding for environmentally friendly and low-emission materials, aligning with sustainability goals in aerospace manufacturing

• For instance, in 2022, several aerospace manufacturers adopted advanced structural adhesives for interior and exterior aircraft components, improving safety standards and reducing assembly complexity. This integration also contributed to shorter production cycles, higher throughput, and more cost-effective maintenance schedules

• While market demand and institutional support are strong, further advancements in composite compatibility, high-temperature resistance, and environmentally friendly formulations are necessary to unlock the full potential of aerospace adhesives and sealants. Continuous innovation in lightweight thermoset and thermoplastic adhesives will be critical to meet the next generation of aircraft design requirements

Restraint/Challenge

High Cost Of Advanced Adhesive And Sealant Systems And Regulatory Compliance

• The significant upfront cost of high-performance aerospace adhesives and sealants, including material procurement and certification expenses, remains a major barrier for small and mid-sized manufacturers. These costs often limit adoption despite clear operational benefits. In addition, installation and curing processes may require specialized labor and equipment, further adding to operational expenditures

• Strict regulatory requirements and lengthy certification processes for aerospace materials add complexity and slow down the introduction of new adhesive technologies, particularly in regions with stringent safety standards. Meeting both national and international compliance standards often involves time-consuming testing, documentation, and validation procedures, delaying market entry

• Supply chain limitations in sourcing specialty resins, catalysts, and composite-compatible formulations also restrict market penetration, especially for emerging aerospace markets. Delays in material availability can impact production schedules, while global logistical challenges and raw material price volatility exacerbate cost concerns

• For instance, in 2023, several aircraft maintenance organizations reported project delays due to high costs and extended certification timelines for new epoxy and polyurethane adhesive systems. These delays not only affected delivery schedules but also increased operational risks and created challenges in inventory management.

• While aerospace adhesives and sealants offer significant performance advantages, overcoming financial, regulatory, and supply chain challenges through scalable solutions, localized production, and strategic partnerships is essential for broader market adoption. Companies that invest in innovation, training, and regional manufacturing hubs are better positioned to capture market share and support sustainable aerospace growth

Europe Aerospace Adhesive - Sealants Market Scope

The market is segmented on the basis of product, resins, technology, aircraft type, aisle type, user, and end use.

- By Product

On the basis of product, the Europe aerospace adhesive - sealants market is segmented into adhesives and sealants. The adhesives segment held the largest market revenue share in 2024, driven by its high demand in structural bonding applications, providing lightweight, strong, and durable solutions for aircraft assembly and maintenance. Adhesives are increasingly preferred over mechanical fasteners due to their ability to reduce weight, improve fuel efficiency, and simplify complex assemblies.

The sealants segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their excellent sealing properties, corrosion resistance, and versatility in protecting aircraft components from environmental and operational stresses. Sealants are especially popular in cabin interiors, fuel tanks, and exterior surfaces where long-term durability and performance under extreme conditions are critical.

- By Resins

On the basis of resins, the Europe aerospace adhesive - sealants market is segmented into epoxy, polyurethane, silicone, and others. The epoxy segment held the largest market revenue share in 2024, driven by its superior mechanical strength, thermal resistance, and wide applicability in bonding composite and metal structures. Epoxy resins are preferred in critical structural applications for both commercial and military aircraft.

The polyurethane segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their flexibility, impact resistance, and effectiveness in sealing, insulation, and vibration damping. These resins are increasingly used in cabin interiors, fuel tanks, and exterior aircraft surfaces where durability and environmental resistance are required.

- By Technology

On the basis of technology, the Europe aerospace adhesive - sealants market is segmented into solvent-borne, water-borne, hot-melt, and radiation-cured adhesives and sealants. The solvent-borne segment held the largest market revenue share in 2024, driven by its high performance in structural bonding applications and long-term reliability under extreme conditions. Solvent-borne adhesives are widely used across assembly lines for fuselage and wing components.

The water-borne segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by environmental regulations, faster curing processes, and lower VOC emissions. These technologies are increasingly adopted in eco-friendly manufacturing and rapid production environments.

- By Aircraft

On the basis of aircraft type, the Europe aerospace adhesive - sealants market is segmented into small wide, medium wide, large wide, and others. The large wide aircraft segment held the largest market revenue share in 2024, driven by the extensive use of adhesives and sealants in structural components, interiors, and fuel systems. Large aircraft require advanced bonding solutions for lightweight and high-strength assembly.

The small wide segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising production of regional jets, business aircraft, and short-haul planes in Europe. Adhesives and sealants improve operational efficiency and assembly speed in these aircraft types.

- By Aisle Type

On the basis of aisle type, the Europe aerospace adhesive - sealants market is segmented into single aisle and multiple aisle. The single-aisle segment held the largest market revenue share in 2024, fueled by high production volumes of commercial jets and their widespread use in passenger aviation. Adhesives in single-aisle aircraft are critical for structural integrity and lightweight construction.

The multiple-aisle segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing demand for long-haul and premium aircraft. Adhesive solutions support enhanced performance, safety, and fuel efficiency in these larger aircraft.

- By User

On the basis of user, the Europe aerospace adhesive - sealants market is segmented into OEM and aftermarket. The OEM segment held the largest market revenue share in 2024, driven by strong aircraft production and integration of adhesives during initial assembly. OEMs prefer adhesives and sealants to reduce weight and simplify complex manufacturing processes.

The aftermarket segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing maintenance, repair, and overhaul (MRO) activities in commercial, military, and general aviation fleets. Adhesive solutions extend component life and improve repair efficiency.

- By End Use

On the basis of end use, the Europe aerospace adhesive - sealants market is segmented into commercial, military, general aviation, space, and others. The commercial aviation segment held the largest market revenue share in 2024, driven by rising aircraft deliveries, fleet modernization, and the adoption of lightweight materials. Adhesives improve fuel efficiency and structural performance in commercial aircraft.

The military segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the development of advanced defense aircraft, business jets, and spacecraft. Adhesive and sealant solutions ensure high reliability, safety, and durability in specialized applications.

Europe Aerospace Adhesive - Sealants Market Regional Analysis

- Germany aerospace adhesive - sealants market captured the largest revenue share in Europe in 2024, fueled by the country’s strong aircraft manufacturing base, technological advancements, and emphasis on high-performance materials

- German OEMs and MRO providers increasingly prioritize lightweight, durable, and corrosion-resistant adhesives for both structural and interior applications

- The integration of advanced adhesive solutions in aircraft assembly and maintenance, combined with stringent safety standards, is driving significant market growth

U.K. Aerospace Adhesive – Sealants Market Insight

U.K. aerospace adhesive - sealants market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising investments in aerospace manufacturing, fleet modernization, and the adoption of eco-friendly and high-performance bonding solutions. The country’s focus on innovation, regulatory compliance, and sustainable manufacturing practices is encouraging widespread adoption across commercial, military, and general aviation segments.

Europe Aerospace Adhesive - Sealants Market Share

The Europe aerospace adhesive - sealants industry is primarily led by well-established companies, including:

- Bostik (France)

- Chemetall (Germany)

- Henkel AG & Co. KGaA (Germany)

- SIKA (Switzerland)

- Solvay (Belgium)

- Hylomar Products (U.K.)

- Delo (Germany)

- Permabond (U.K.)

- ThreeBond Europe (Germany)

- Weicon GmbH & Co. KG (Germany)

- Huntsman Advanced Materials (Switzerland)

Latest Developments in Europe Aerospace Adhesive - Sealants Market

- In August 2024, H.B Fuller acquired H.S.Butyl Limited, the world’s largest of adhesives company announced that it has acquired HS Butyl Limited (HS Butyl), the largest distributor and manufacturer of premium butyl tapes in the UK. These tapes offer robust, long-lasting, watertight seals for a range of applications in the infrastructure, automotive, and renewable energy sectors. This acquisition strengthened and expanded position in the Europe specialty construction tapes market

- In May 2024, Henkel AG & Co. KGaA showcased sustainable product innovations at Drupa 2024, highlighting advancements in eco-friendly packaging and printing solutions. By presenting sustainable innovations, Henkel reinforced its position as a leader in eco-friendly solutions, attracting environmentally conscious customers and strengthening its market presence in the packaging and printing industries

- In June 2024, recent advancements in nano-based adhesive bonding involve adding nanoparticles to adhesives, enhancing their strength, flexibility, and durability. This improvement boosts adhesion and performance, particularly in aerospace. For aerospace applications, these enhanced adhesives offer greater strength and durability, leading to more reliable components and cost-effective manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.