Europe Aesthetic Devices Market

Market Size in USD Billion

CAGR :

%

USD

8.22 Billion

USD

18.27 Billion

2024

2032

USD

8.22 Billion

USD

18.27 Billion

2024

2032

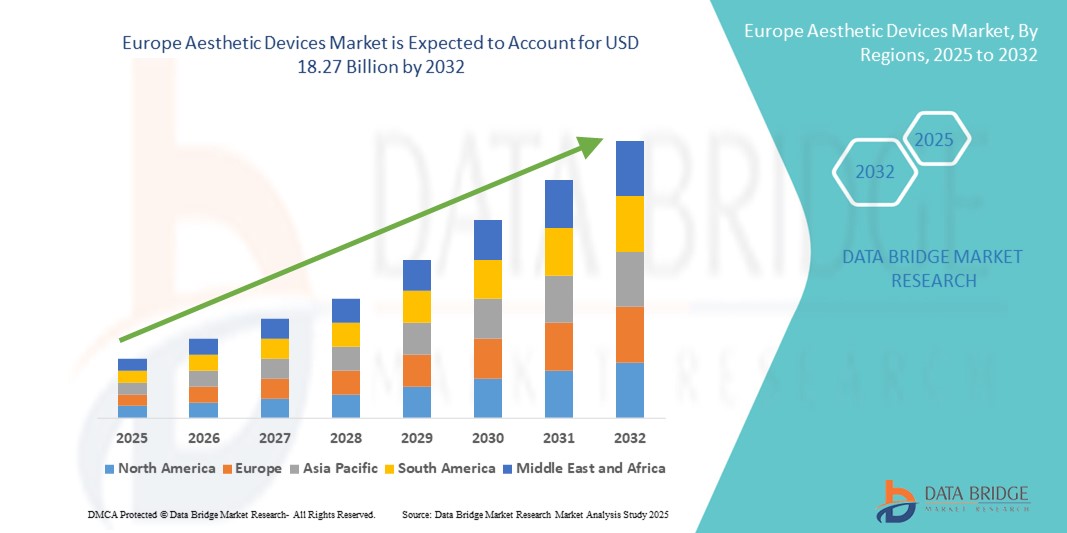

| 2025 –2032 | |

| USD 8.22 Billion | |

| USD 18.27 Billion | |

|

|

|

|

Europe Aesthetic Devices Market Size

- The Europe aesthetic devices market size was valued at USD 8.22 billion in 2024 and is expected to reach USD 18.27 billion by 2032, at a CAGR of 10.5% during the forecast period

- The market growth is primarily driven by increasing demand for minimally invasive and non-surgical cosmetic procedures, technological advancements in device efficacy and safety, and a rising aging population focused on aesthetic enhancement

- In addition, growing disposable incomes, expansion of medical spas, and increasing awareness about aesthetic treatments among consumers are fueling the adoption of these devices across both clinical and commercial settings

Europe Aesthetic Devices Market Analysis

- Europe aesthetic devices, comprising minimally invasive and non-invasive tools for cosmetic treatments, are increasingly vital in clinical and medical spa settings due to rising consumer focus on wellness and appearance enhancement

- The escalating demand is primarily fueled by technological advancements improving treatment safety and efficacy, an aging population seeking rejuvenation, and increasing disposable incomes supporting higher spending on aesthetic procedures

- Germany dominated the Europe aesthetic devices market with the largest revenue share of 22.48% in 2024, characterized by advanced healthcare infrastructure and a strong presence of leading aesthetic device manufacturers

- Spain is expected to be the fastest-growing country in the Europe aesthetic devices market during the forecast period, driven by increasing demand for non-surgical aesthetic procedures and expanding medical spa services

- Facial aesthetic products dominated the Europe aesthetic devices market with market share of 38.5% in 2024, due to high demand for anti-aging treatments, skin rejuvenation procedures, and their wide application across various age groups

Report Scope and Europe Aesthetic Devices Market Segmentation

|

Attributes |

Europe Aesthetic Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Aesthetic Devices Market Trends

Rising Demand for Minimally Invasive and Non-Surgical Treatments

- A key and accelerating trend in the Europe aesthetic devices market is the growing preference for minimally invasive and non-surgical procedures, driven by consumer desire for effective treatments with reduced downtime and fewer risks compared to traditional surgery

- For instance, non-surgical facial aesthetic products such as botulinum toxin injectables and dermal fillers have surged in popularity, with clinics and medical spas expanding offerings to meet demand. Similarly, energy-based devices for skin tightening and body contouring are widely adopted for their safety and efficacy

- Innovations such as AI-enhanced treatment planning and personalized protocols are emerging, improving outcomes and patient satisfaction. In addition, device manufacturers focus on combining technologies to offer multifunctional solutions that appeal to broader patient groups

- The expansion of medical spa chains and increased consumer awareness of aesthetic wellness further support market growth, with younger demographics also engaging in preventive aesthetic treatments

- This trend is reshaping clinical practice patterns, with more providers integrating advanced aesthetic devices into outpatient and ambulatory care settings to cater to evolving patient preferences

Europe Aesthetic Devices Market Dynamics

Driver

Increasing Aging Population and Disposable Income Driving Market Expansion

- The growing geriatric population across Europe seeking aesthetic rejuvenation treatments is a significant growth driver, supported by rising disposable incomes and willingness to invest in personal appearance and wellness

- For instance, countries such as Germany and Spain report increased demand for facial rejuvenation and body contouring procedures among middle-aged and older adults

- Technological advancements enhancing safety and efficacy of devices also contribute to higher adoption rates in dermatology clinics and medical spas

- The expanding network of clinics and aesthetic centers providing non-surgical and surgical treatments facilitates greater market penetration

- Rising medical tourism in Europe focused on aesthetic procedures further boosts demand, as patients seek high-quality, affordable treatments

- Expansion of medical spas, increased awareness about aesthetic wellness, and social acceptance of cosmetic treatments across various age groups are driving sustained market growth. Younger consumers are also adopting preventive aesthetic procedures, broadening market reach

- These evolving preferences are pushing providers to integrate advanced aesthetic technologies into outpatient and ambulatory care settings, improving accessibility and patient convenience

Restraint/Challenge

Stringent Regulatory Environment and High Treatment Costs

- The strict regulatory requirements governing aesthetic devices in Europe can delay product approvals and limit the introduction of innovative treatments, posing challenges for manufacturers and service providers

- For instance, compliance with the Medical Device Regulation (MDR) requires extensive clinical data and documentation, increasing time and cost for market entry

- High costs associated with advanced aesthetic devices and procedures may limit accessibility for some consumer segments, especially in less affluent regions

- In addition, concerns about potential side effects, such as skin irritation or complications, may deter some patients from seeking treatments

- Addressing these challenges through streamlined regulatory pathways, cost-effective technologies, and patient education is essential to sustain growth in the European aesthetic devices market

- Concerns regarding potential side effects, such as skin irritation or procedural complications, may also limit patient acceptance

- The relatively high costs of advanced aesthetic devices and treatments restrict accessibility, especially in less affluent regions or among price-sensitive consumers

Europe Aesthetic Devices Market Scope

The market is segmented on the basis of products, raw materials, end user, and distribution channel.

- By Products

On the basis of products, the Europe aesthetic devices market is segmented into facial aesthetic products, body contouring devices, cosmetic implants, skin aesthetic devices, hair removal devices, and others. The facial aesthetic products segment dominated the market with the largest revenue share of 38.5% in 2024, driven primarily by strong demand for anti-aging treatments such as botulinum toxin injectables and dermal fillers. These products are favored for their proven efficacy, minimal invasiveness, and versatility across various age groups seeking wrinkle reduction and skin rejuvenation.

The body contouring devices segment is anticipated to witness the fastest growth rate during the forecast period, fueled by rising consumer interest in non-surgical fat reduction, body shaping, and cellulite treatments. Advances in energy-based technologies such as radiofrequency and ultrasound contribute to this rapid adoption, as they offer safe and effective alternatives to surgical procedures.

- By Raw Materials

On the basis of raw materials, the Europe aesthetic devices market is segmented into polymers, biomaterials, and metals. The polymers segment held the largest market revenue share of 45% in 2024, due to their extensive use in manufacturing injectable products, device components, and biocompatible materials that ensure patient safety. Their versatility, cost-effectiveness, and ability to be engineered for specific applications make polymers the preferred raw material for many aesthetic devices

The biomaterials segment is expected to register the fastest growth, driven by increasing application in implantable devices and skin-interactive technologies that require advanced compatibility with human tissue. Innovations in biomaterial science are expanding possibilities for safer, longer-lasting implants and improved treatment outcomes.

- By End User

On the basis of end users, the Europe aesthetic devices market is segmented into hospitals, dermatology clinics, clinics, academic and private research institutes, and others. The dermatology clinics segment dominated the market with the largest revenue share of 40% in 2024, reflecting the rising volume of outpatient aesthetic procedures and growing consumer visits seeking specialized skin and cosmetic treatments. Dermatology clinics often offer a wide range of non-invasive and minimally invasive treatments, making them preferred providers.

The clinics segment is projected to witness the fastest growth during forecast period, supported by expanding service offerings and increasing consumer preference for outpatient and convenience-based cosmetic treatments in smaller, more accessible healthcare facilities.

- By Distribution Channel

On the basis of distribution channels, the Europe aesthetic devices market is segmented into direct tender and retail sales. The direct tender segment held the largest market revenue share of 55% in 2024, largely driven by bulk procurement by hospitals, dermatology clinics, and large medical spas, which prefer direct contracts for cost-effectiveness and reliable supply. This channel ensures timely availability of advanced devices to key healthcare providers.

Meanwhile, the retail sales segment is expected to record the fastest growth during forecast period, fueled by growing consumer demand for at-home aesthetic devices and increasing penetration of online and offline retail platforms. The rise of DIY beauty trends and accessibility of smaller, user-friendly devices contribute significantly to this growth trajectory.

Europe Aesthetic Devices Market Regional Analysis

- Germany dominated the Europe aesthetic devices market with the largest revenue share of 22.48% in 2024, characterized by advanced healthcare infrastructure and a strong presence of leading aesthetic device manufacturers

- Consumers in Germany show growing preference for minimally invasive and non-surgical cosmetic procedures, supported by widespread availability of cutting-edge facial and body contouring devices in dermatology clinics and medical spas

- This dominance is further supported by rising disposable incomes, increasing focus on personal wellness and appearance, and the country’s position as a hub for medical innovation and aesthetic tourism within Europe

The Germany Aesthetic Devices Market Insight

The Germany aesthetic devices market dominated the Europe market with the largest revenue share of around 22.48% in 2024. This leadership is driven by its advanced healthcare infrastructure, high consumer awareness of aesthetic treatments, and a strong manufacturing base of innovative aesthetic devices. The country has a well-established network of dermatology clinics and aesthetic centers, fueling demand for minimally invasive procedures such as botulinum toxin injections, dermal fillers, and body contouring devices. Germany’s emphasis on research and development promotes rapid adoption of cutting-edge technologies such as AI-based skin analysis and multifunctional treatment platforms.

France Aesthetic Devices Market Insight

The France aesthetic devices market is experiencing robust growth due to the rising popularity of cosmetic procedures among a broad demographic, including younger populations. The country’s strong healthcare infrastructure and presence of leading manufacturers and service providers support innovation and adoption. Increasing demand for advanced facial aesthetic products and body contouring devices, particularly in urban centers, is prominent. Furthermore, favorable regulations and a growing beauty-conscious population enhance market prospects. French consumers are increasingly opting for safer, non-invasive alternatives, bolstered by rising disposable incomes and lifestyle changes.

U.K. Aesthetic Devices Market Insight

The U.K. aesthetic devices market is expanding steadily, driven by strong consumer interest in anti-aging and skin health solutions. Increasing numbers of dermatology clinics and medical spas offering advanced aesthetic treatments contribute to market growth. High consumer spending power and the rise of at-home aesthetic devices boost market penetration. In addition, growing awareness about safety and effectiveness of aesthetic procedures supports sustained demand.

Italy Aesthetic Devices Market Insight

The Italy aesthetic devices market is witnessing steady growth in facial aesthetics and body contouring device segments. Increasing public acceptance of cosmetic procedures and the expansion of aesthetic clinics fuel market development. Italian consumers prefer natural-looking results, encouraging adoption of minimally invasive, energy-based technologies such as radiofrequency and ultrasound. Italy also sees growing medical tourism inflows seeking aesthetic treatments.

Spain Aesthetic Devices Market Insight

The Spain aesthetic devices market is recognized as the fastest-growing market in Europe for aesthetic devices, with rapid adoption driven by increasing demand for cosmetic procedures among younger demographics and a growing focus on wellness and beauty. The rise in medical tourism, favorable climate, and increasing disposable income are significant contributors. Popular treatments include skin tightening, hair removal, and body contouring, with lasers and ultrasound technologies seeing strong uptake. In addition, Spain’s vibrant spa and wellness industry acts as a complementary channel for device adoption. The market growth is supported by expanding distribution networks and enhanced consumer education on non-invasive procedures.

Europe Aesthetic Devices Market Share

The Europe aesthetic devices industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Cutera, Inc. (U.S.)

- Lumenis Ltd. (Israel)

- Syneron Medical Ltd. (Israel)

- Cynosure, Inc. (U.S.)

- BTL Industries (Czech Republic)

- DEKA M.E.L.A. S.r.l. (Italy)

- Alma Lasers Ltd. (Israel)

- Hologic, Inc. (U.S.)

- Sciton, Inc. (U.S.)

- Lutronic Corporation (South Korea)

- El.En. S.p.A. (Italy)

- Quanta System S.p.A. (Italy)

- Fotona d.o.o. (Slovenia)

- Jeisys Medical Inc. (South Korea)

- Medika S.r.l. (Italy)

- Venus Concept Inc. (Canada)

- InMode Ltd. (Israel)

- Dermalux Ltd. (U.K.)

- Hirslanden Klinik Im Park (Switzerland)

What are the Recent Developments in Europe Aesthetic Devices Market?

- In August 2025, Swatch Group CEO Nick Hayek expressed hope that Switzerland and the U.S. could reach a swift agreement to avoid a 39% U.S. import tariff on Swiss goods, set to take effect on August 7. Despite the market shock, Hayek emphasized that it’s "not doomsday" and encouraged diplomatic intervention. The U.S. is a significant market for Swiss watches, and the tariff poses a threat to this sector

- In August 2025, Swiss luxury watchmakers, including Richemont and Swatch, experienced sharp declines in their shares following U.S. President Donald Trump's announcement of a 39% tariff on Swiss imports. The tariff adds pressure to an industry already facing challenges such as a strong Swiss franc and declining global demand. The U.S. is Switzerland's largest foreign market for watches, and the tariff threatens this critical market

- In August 2025, Beiersdorf, the German consumer goods company, reported a 2.1% increase in organic sales for the first half of 2025, reaching EUR 5.19 billion. Despite this growth, the company downgraded its full-year sales forecast due to slower-than-expected growth in the global skincare market, particularly in the second quarter. This indicates a challenging environment for companies in the aesthetic devices sector

- In August 2025, German company Gerresheimer announced plans to sell its moulded glass business, a move that led to a nearly 4% rise in its shares. This decision, part of a strategic review initiated in 2024, aims to refocus the company on its core strengths in producing medical and pharmaceutical devices, including those used in aesthetic procedures. The divestment is expected to enhance Gerresheimer’s growth and margin profile

- In July 2025, Doku Clinic in Istanbul has enhanced its reputation by integrating advanced technologies into its aesthetic services. The clinic now employs 3D facial simulation tools and robotic-assisted procedures, aiming to improve precision, reduce recovery times, and ensure natural results for patients. This move reflects a growing trend in the industry towards personalized and technology-driven aesthetic treatments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.