Europe Alpha Methylstyrene Market

Market Size in USD Million

CAGR :

%

USD

64.29 Million

USD

80.98 Million

2024

2032

USD

64.29 Million

USD

80.98 Million

2024

2032

| 2025 –2032 | |

| USD 64.29 Million | |

| USD 80.98 Million | |

|

|

|

|

Alpha-Methylstyrene Market Size

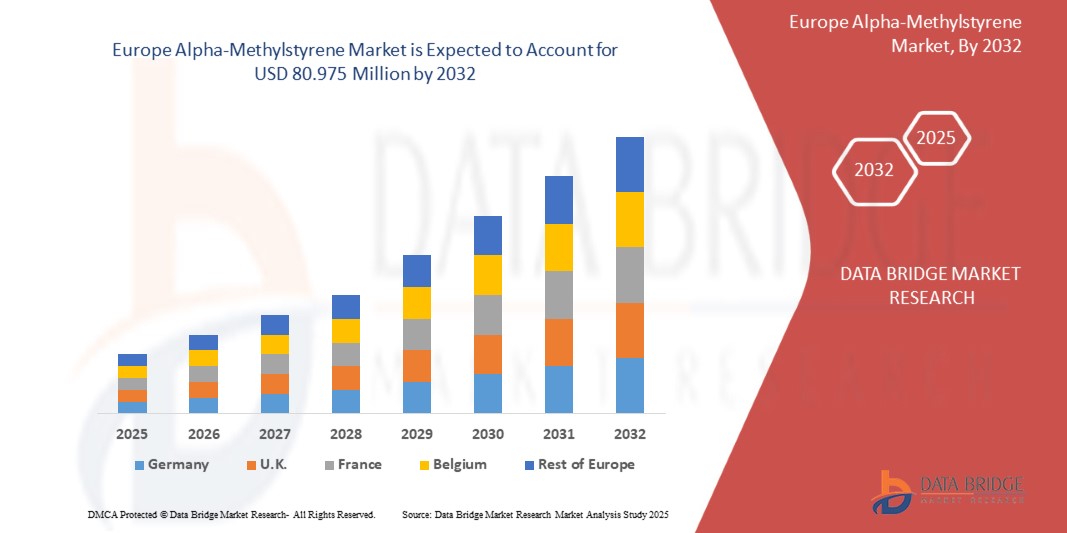

- The Europe alpha-methylstyrene market was valued at USD 64.285 million in 2024 and is expected to reach USD 80.975 million by 2032 at a CAGR of 2.98%, during the forecast period

- This growth is driven by factors such as rising demand for abs resins in automotive and consumer goods, growth in construction and coatings industries, expansion of packaging industry, technological advancements in polymer production

Alpha-Methylstyrene Market Analysis

- Rising AMS demand stems from its use in producing plastics and resins for automotive components, enhancing performance and durability

- Electronics and packaging sectors increasingly use AMS-based adhesives and coatings, driving steady market growth due to reliability and chemical resistance

- Germany is expected to dominate the alpha-methylstyrene market with 22.28% share due to rapid industrialization, expanding manufacturing base, and strong demand from automotive, electronics, and packaging sectors

- Germany is expected to be the fastest growing region in the Alpha-Methylstyrene and its derivatives market due to increasing industrial activities, rising consumer demand, expanding automotive and electronics sectors, and supportive government policies promoting manufacturing and infrastructure development

- The More Than 99% purity segment is expected to dominate the Alpha-Methylstyrene and its derivatives market with a 65.10%share in 2025 due to its superior performance, high stability, and growing use in high-grade resins, adhesives, and polymers required for automotive, electronics, and premium packaging applications

Report Scope and Alpha Methyl-styrene Market Segmentation

|

Attributes |

Alpha Methyl-styrene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Alpha-Methylstyrene Market Trends

“Increasing ABS Resin Production”

- Growing demand for lightweight, durable plastics in automotive and electronics sectors is driving ABS resin production, with Alpha-Methylstyrene playing a key role as a performance-enhancing intermediate in polymer formulations

- The surge in consumer electronics and home appliances manufacturing fuels ABS usage, thereby boosting Alpha-Methylstyrene consumption due to its contribution to impact strength and thermal stability in end products

- Rapid industrialization in emerging economies like India and China accelerates ABS production, increasing the need for Alpha-Methylstyrene as manufacturers seek cost-effective, high-quality plastic materials for diverse industrial applications

- Innovation in ABS resin compositions for 3D printing and sustainable packaging enhances Alpha-Methylstyrene’s relevance, aligning with global trends toward high-performance, eco-conscious materials in modern manufacturing practices

Alpha-Methylstyrene Market Dynamics

Driver

“Rising Demand for Abs Resins in Automotive and Consumer Goods”

- The increasing demand for high-performance resins, particularly in automotive and consumer goods applications, has significantly boosted the use of specific chemical compounds known for their excellent thermal stability, impact resistance, and mechanical strength

- These compounds are crucial in manufacturing durable and aesthetically appealing products, especially in industries where both functionality and visual appeal are key

- In the automotive sector, these compounds are widely utilized for creating components such as dashboards, bumpers, and interior trims. The rising focus on vehicle durability, safety, and lightweight designs is driving the adoption of these materials in various vehicle parts

- In addition, the demand for energy-efficient and environmentally friendly solutions is pushing for innovations that further improve material properties

For instance,

- A report published in Polymer-Search highlighted the increasing use of high-performance polymers in consumer electronics. Polymers' flexibility, heat resistance, and electrical insulation properties make them ideal for producing advanced gadgets. As demand for lighter, more durable, and sustainable devices grows, these materials play a crucial role in innovation

- The growing demand for high-performance resins in the automotive and consumer goods sectors is driving the use of chemical compounds with excellent thermal stability, impact resistance, and strength

Opportunity

“R&D in Eco-Friendly and High-Performance Resins”

- Growing awareness about environmental impact, manufacturers are focusing on developing AMS resins that are not only more durable and efficient but also sustainable

- These resins are being designed to meet both environmental standards and the increasing demand for stronger, lighter, and more adaptable materials across industries like packaging, automotive, and consumer goods.

- The rise in RandD investments is pushing the boundaries of what AMS resins can do. Innovations are enabling the production of resins that offer better thermal stability, chemical resistance, and recyclability

- As a result, AMS resins are becoming a popular choice for sustainable solutions that do not compromise performance

For instance,

- In October 2024, an article on Vertec Biosolvents highlighted the growing role of eco-friendly and high-performance resins in the AMS market. RandD efforts are focused on developing AMS resins that meet environmental standards while offering enhanced durability, thermal stability, and recyclability, driving growth in industries such as packaging and automotive

- A report by Knowledge Sourcing Intelligence LLP highlights advancements in RandD for biodegradable resins, focusing on high-performance materials that offer both durability and sustainability. This development is particularly impacting industries such as packaging, automotive, and consumer goods, where eco-friendly AMS applications are becoming essential in product innovation strategies

- In March 2024, Super Resin Inc. introduced its plant-based epoxy resin, presenting an environmentally sustainable alternative for the composites industry. This innovation highlights the significance of sustainable materials by reducing environmental impact while maintaining high performance. Such RandD advancements are steering the AMS market toward more eco-friendly solutions with enhanced functionality

- RandD in eco-friendly and high-performance resins is driving growth in the AMS market. Innovations are enhancing durability, thermal stability, and recyclability, making AMS resins ideal for sustainable solutions in packaging, automotive, and consumer goods

Restraint/Challenge

“Volatility In Crude Oil And Raw Material Prices”

- As AMS is derived from petroleum-based products, fluctuations in crude oil prices directly impact its production costs. When crude oil prices rise, the cost of raw materials for AMS production increases, resulting in higher production costs and, ultimately higher prices for AMS-based products

- These price fluctuations can make it difficult for manufacturers to maintain stable profit margins, especially when faced with market uncertainties

- Moreover, raw material supply disruptions due to geopolitical tensions, natural disasters, or trade barriers can exacerbate this volatility

- The uncertainty surrounding the availability and pricing of key raw materials for AMS production can hinder the ability of manufacturers to plan and operate efficiently, impacting overall market stability

For instance,

- In October 2024, a blog post published by Pearson discussed the volatility in crude oil prices and its direct impact on raw material costs. These fluctuations significantly affect the production of alpha-methylstyrene resins, creating challenges for manufacturers in maintaining stable profit margins amid unpredictable market conditions

- In November 2024, an article from The Economic Times discussed the volatility in crude oil prices and its impact on raw material costs. These fluctuations affect the production of alpha-methylstyrene resins, increasing production costs and complicating price stability, thereby challenging manufacturers in sectors such as packaging and automotive

- In November 2024, a blog by Mercatus Energy discussed how volatility in crude oil prices significantly impacts industries relying on petroleum-based products, such as alpha-methylstyrene. Fluctuating raw material costs increase AMS production costs, complicating profit margins and planning for manufacturers, especially in sectors such as automotive and packaging

- Volatility in crude oil prices and raw material costs significantly impacts the alpha-methylstyrene market. Fluctuations in crude oil prices raise production costs, affecting profit margins

- Supply disruptions from geopolitical issues or trade barriers further exacerbate this volatility, challenging manufacturers and consumers in sectors like packaging, automotive, and consumer goods

Alpha-Methylstyrene Market Scope

The market is segmented on the basis of purity, grade, packaging quantity, packaging, application, and end use.

|

Segmentation |

Sub-Segmentation |

|

By Purity |

|

|

By Grade |

|

|

By Packaging Quantity |

|

|

By Packaging

|

|

|

By Application |

|

|

By End-Use |

|

In 2025, the More Than 99% is projected to dominate the market with a largest share in purity segment

The More Than 99% segment is expected to dominate the Alpha-Methylstyrene market in 2025 due to its superior purity, which is essential for high-performance applications in plastics, adhesives, and resins, driving higher demand across industrial manufacturing sectors.

Standard Grade is expected to account for the largest share during the forecast period in Alpha methylstyrene market

In 2025, the Standard Grade segment is expected to dominate the market with a 41.09% share due to its high purity, making it ideal for advanced applications in resins, coatings, adhesives, and specialty chemical manufacturing industries.

Alpha Methyl-styrene Market Regional Analysis

“Germany is the Dominant Region in the Alpha Methyl-styrene Market”

- Germany is expected to dominate the alpha-methylstyrene market with 22.28% share due to rapid industrialization, expanding manufacturing base, and strong demand from automotive, electronics, and packaging sectors

- Germany is Europe's largest automotive producer, with significant AMS demand for ABS resins used in vehicle components. The country's robust automotive industry drives the AMS market's growth

- Germany boasts a well-established chemical manufacturing sector, including AMS production facilities. This infrastructure supports the high demand for AMS in various applications, reinforcing its market dominance

- German companies focus on technological advancements and eco-friendly AMS production methods. This commitment enhances product quality and sustainability, solidifying Germany's leadership in the AMS market

“Germany is Projected to Register the Highest Growth Rate”

- Germany is expected to be the fastest growing country in the Alpha-Methylstyrene and its derivatives market due to increasing industrial activities, rising consumer demand, expanding automotive and electronics sectors, and supportive government policies promoting manufacturing and infrastructure development

- Germany is increasing its electric vehicle (EV) production, with companies like Ford inaugurating the Cologne Electric Vehicle Center. This growth in EV manufacturing drives demand for AMS in lightweight automotive components

- Germany emphasizes sustainable manufacturing practices, aligning with global trends towards eco-friendly materials. This focus on sustainability boosts the adoption of AMS in various industries, supporting its market expansion

Alpha Methyl-styrene Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- INEOS Capital Limited (U.K.)

- Advansix (U.S.)

- Mitsubishi Chemical Group Corporation (Japan)

- LG Chem (South Korea)

- Solvay (Belgium)

- Kraton Corporation (U.S.)

- ROSNEFT (Russia)

- ALTIVIA (U.S.)

- Evonik Industries AG (Germany)

- Seqens (France)

- Domo Chemicals (Belgium)

- Deepak (India)

- SI Group, Inc. (U.S.)

- Prasol Chemicals Limited (India)

- TIANJIN ZHONGXIN CHEMTECH CO., LTD. (China)

- KUMHO PandB CHEMICALS., INC. (South Korea)

- Hefei TNJ Chemical Industry Co., Ltd. (China)

- Group of Companies «Titan» (Russia)

- Moeve (Germany)

- Shanghai Theorem Chemical Technology Co., Ltd. (China)

- Equilex BV (Netherlands)

- Otto Chemie Pvt. Ltd (India)

- eastindiachemicals (India)

- Tokyo Chemical Industry (India) Pvt. Ltd. (India)

- SimSon Pharma Limited (India)

- vizagchemical (India)

- rxchemical (India)

- Maha Automations (India)

Latest Developments in Europe Alpha-Methylstyrene Market

- In April, Domo Chemicals has inaugurated a new factory in China with a USD 15.02 million investment, enhancing production capacity. The facility, located south of Shanghai, will double output in the short term and potentially triple it in the future.

- In April, DOMO Chemicals has inaugurated a new compounding line at its Mahape, Navi Mumbai facility, expanding its capacity to meet growing demand for polyamide-based solutions. The state-of-the-art line will serve key sectors including automotive, electronics, and consumer goods.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF BUYERS

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 COMPETITIVE RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.5.1 QUALITY AND CONSISTENCY

4.5.2 TECHNICAL EXPERTISE

4.5.3 SUPPLY CHAIN RELIABILITY

4.5.4 COMPLIANCE AND SUSTAINABILITY

4.5.5 COST AND PRICING STRUCTURE

4.5.6 FINANCIAL STABILITY

4.5.7 FLEXIBILITY AND CUSTOMIZATION

4.5.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.6 CLIMATE CHANGE SCENARIO

4.6.1 ENVIRONMENTAL CONCERNS

4.6.2 INDUSTRY RESPONSE

4.6.3 GOVERNMENT’S ROLE

4.6.4 ANALYST RECOMMENDATIONS

4.7 RAW MATERIAL COVERAGE

4.7.1 CUMENE

4.7.2 CUMYL ALCOHOL

4.7.3 PHENOL AND ACETONE

4.7.4 ALTERNATIVE FEEDSTOCKS

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 SUPPLY DEMAND DYNAMICS

4.9.1 SUPPLY SIDE DYNAMICS

4.9.1.1 RAW MATERIAL DEPENDENCY

4.9.1.2 PRODUCTION CAPACITY AND INTEGRATION

4.9.1.3 GEOGRAPHIC CONCENTRATION

4.9.1.4 PRICE VOLATILITY

4.9.2 DEMAND SIDE DYNAMICS

4.9.2.1 KEY END-USE APPLICATIONS

4.9.2.2 REGIONAL DEMAND TRENDS

4.9.2.3 SUBSTITUTION AND SUSTAINABILITY PRESSURES

4.9.2.4 DEMAND VOLATILITY AND ELASTICITY

4.1 TARIFFS AND THEIR IMPACT ON MARKET

4.10.1 CURRENT TARIFF RATES IN TOP 5 COUNTRY MARKETS

4.10.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

4.10.3 VENDOR SELECTION CRITERIA DYNAMICS

4.10.4 IMPACT ON SUPPLY CHAIN

4.10.4.1 RAW MATERIAL PROCUREMENT

4.10.4.2 MANUFACTURING AND PRODUCTION

4.10.4.3 LOGISTICS AND DISTRIBUTION:

4.10.4.4 PRICE PITCHING AND POSITIONING IN THE MARKET

4.10.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.10.5.1 SUPPLY CHAIN OPTIMIZATION

4.10.5.2 JOINT VENTURE ESTABLISHMENTS

4.10.6 IMPACT ON PRICES

4.10.6.1 RAW MATERIAL DEPENDENCY

4.10.6.2 ENERGY AND LOGISTICS COSTS

4.10.6.3 REGIONAL SUPPLY-DEMAND GAPS

4.10.6.4 REGULATORY AND TRADE BARRIERS

4.10.7 REGULATORY INCLINATION

4.10.7.1 GEOPOLITICAL SITUATION

4.10.8 TRADE PARTNERSHIPS BETWEEN COUNTRIES

4.10.8.1 FREE TRADE AGREEMENTS

4.10.8.2 STATUS ACCREDITATION (INCLUDING MFN)

4.10.9 DOMESTIC COURSE OF CORRECTION

4.10.9.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.10.9.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

4.11 TECHNOLOGY ADVANCEMENT BY MANUFACTURERS

4.11.1 ADVANCED CATALYTIC PROCESSES

4.11.2 AUTOMATION AND PROCESS CONTROL

4.11.3 SUSTAINABLE PRODUCTION PRACTICES

4.11.4 PURIFICATION AND QUALITY ENHANCEMENT

4.11.5 EXPANSION OF APPLICATION AREAS

4.11.6 STRATEGIC INVESTMENTS AND COLLABORATIONS

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR ABS RESINS IN AUTOMOTIVE AND CONSUMER GOODS

6.1.2 GROWTH IN CONSTRUCTION AND COATINGS INDUSTRIES

6.1.3 EXPANSION OF PACKAGING INDUSTRY

6.1.4 TECHNOLOGICAL ADVANCEMENTS IN POLYMER PRODUCTION

6.2 RESTRAINTS

6.2.1 VOLATILITY IN CRUDE OIL AND RAW MATERIAL PRICES

6.2.2 STRINGENT ENVIRONMENTAL AND HEALTH REGULATIONS

6.3 OPPORTUNITIES

6.3.1 R&D IN ECO-FRIENDLY AND HIGH-PERFORMANCE RESINS

6.3.2 RISING DEMAND FOR SPECIALTY CHEMICALS AND CUSTOM POLYMERS

6.3.3 POTENTIAL IN RECYCLABLE AND SUSTAINABLE AMS DERIVATIVES

6.4 CHALLENGES

6.4.1 SUPPLY CHAIN VULNERABILITIES DUE TO GEOPOLITICAL ISSUES

6.4.2 STIFF COMPETITION FROM BIO-BASED ALTERNATIVES

7 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY

7.1 OVERVIEW

7.2 MORE THAN 99%

7.3 0.99

7.4 0.98

7.5 0.95

8 EUROPE ALPHA-METHYLSTYRENE MARKET, BY GRADE

8.1 OVERVIEW

8.2 STANDARD GRADE

8.3 TECHNICAL GRADE

8.4 INDUSTRIAL GRADE

8.5 OTHERS

9 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY

9.1 OVERVIEW

9.2 100-200 KG

9.3 50-100 KG

9.4 ABOVE 200 KG

9.5 25-50 KG

10 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING

10.1 OVERVIEW

10.2 TANKER

10.3 DRUM

10.4 IBC

10.5 OTHERS

11 EUROPE ALPHA-METHYLSTYRENE MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 POLYMERS

11.3 BULK AND SPECIALTY CHEMICALS

12 EUROPE ALPHA-METHYLSTYRENE MARKET, BY END-USE

12.1 OVERVIEW

12.2 AUTOMOTIVE

12.3 ELECTRONICS & ELECTRICAL

12.4 PHARMACEUTICALS

12.5 BUILDING & CONSTRUCTION

12.6 OIL & GAS

12.7 AGRICULTURE

12.8 TEXTILES

12.9 FOOD & BEVERAGES

12.1 OTHERS

13 EUROPE ALPHA-METHYLSTYRENE MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 FRANCE

13.1.4 NETHERLAND

13.1.5 BELGIUM

13.1.6 SPAIN

13.1.7 ITALY

13.1.8 RUSSIA

13.1.9 SWITZERLAND

13.1.10 TURKEY

13.1.11 SWEDEN

13.1.12 DENMARK

13.1.13 FINLAND

13.1.14 NORWAY

13.1.15 REST OF EUROPE

14 EUROPE ALPHA-METHYLSTYRENE MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 INEOS CAPITAL LIMITED

16.1.1 COMPANY SNAPSHOT

16.1.2 COMPANY SHARE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 ADVANSIX

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 MITSUBISHI CHEMICAL GROUP CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 LG CHEM

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 SOLVAY

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ALTIVIA

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 DEEPAK

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 DOMO CHEMICALS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 EASTINDIACHEMICALS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 EQUILEX BV

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 EVONIK INDUSTRIES AG

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 GROUP OF COMPANIES «TITAN»

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 HEFEI TNJ CHEMICAL INDUSTRY CO.,LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 KRATON CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 KUMHO P&B CHEMICALS.,INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 MAHA AUTOMATIONS

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 MOEVE

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 OTTO CHEMIE PVT. LTD

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 PRASOL CHEMICALS LIMITED

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 ROSNEFT

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 RXCHEMICALS

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SEQENS

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SHANGHAI THEOREM CHEMICAL TECHNOLOGY CO., LTD.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SI GROUP, INC.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 SIMSON PHARMA LIMITED

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 TIANJIN ZHONGXIN CHEMTECH CO.,LTD.

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 TOKYO CHEMICAL INDUSTRY (INDIA) PVT. LTD.

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 VIZAGCHEMICAL

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 3 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 4 EUROPE MORE THAN 99% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 5 EUROPE MORE THAN 99% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 6 EUROPE 99% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 7 EUROPE 99% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 8 EUROPE 98% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 9 EUROPE 98% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 10 EUROPE 95% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 11 EUROPE 95% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 12 EUROPE ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 13 EUROPE STANDARD GRADE IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 14 EUROPE TECHNICAL GRADE IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 15 EUROPE INDUSTRIAL GRADE IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 16 EUROPE OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 17 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 18 EUROPE 100-200 KG IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 19 EUROPE 50-100 KG IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 20 EUROPE ABOVE 200 KG IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 21 EUROPE 25-50 KG IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 22 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 23 EUROPE TANKER IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 24 EUROPE DRUM IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 25 EUROPE DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 26 EUROPE IBC IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 27 EUROPE OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 28 EUROPE ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 29 EUROPE POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 30 EUROPE POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 31 EUROPE POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 32 EUROPE BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 33 EUROPE BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 34 EUROPE ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 35 EUROPE AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 36 EUROPE AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 37 EUROPE ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 38 EUROPE ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 39 EUROPE PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 40 EUROPE PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 41 EUROPE BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 42 EUROPE BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 43 EUROPE OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 44 EUROPE OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 45 EUROPE AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 46 EUROPE AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 47 EUROPE TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 48 EUROPE TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 49 EUROPE FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 50 EUROPE FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 51 EUROPE OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 52 EUROPE OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 53 EUROPE ALPHA-METHYLSTYRENE MARKET, BY COUNTRY, 2018-2032 (USD)

TABLE 54 EUROPE ALPHA-METHYLSTYRENE MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 55 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 56 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 57 EUROPE ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 58 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 59 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 60 EUROPE DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 61 EUROPE ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 62 EUROPE POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 63 EUROPE POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 64 EUROPE BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 65 EUROPE ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 66 EUROPE AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 67 EUROPE ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 68 EUROPE PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 69 EUROPE BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 70 EUROPE OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 71 EUROPE AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 72 EUROPE TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 73 EUROPE FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 74 EUROPE OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 75 GERMANY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 76 GERMANY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 77 GERMANY ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 78 GERMANY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 79 GERMANY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 80 GERMANY DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 81 GERMANY ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 82 GERMANY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 83 GERMANY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 84 GERMANY BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 85 GERMANY ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 86 GERMANY AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 87 GERMANY ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 88 GERMANY PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 89 GERMANY BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 90 GERMANY OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 91 GERMANY AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 92 GERMANY TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 93 GERMANY FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 94 GERMANY OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 95 U.K. ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 96 U.K. ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 97 U.K. ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 98 U.K. ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 99 U.K. ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 100 U.K. DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 101 U.K. ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 102 U.K. POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 103 U.K. POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 104 U.K. BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 105 U.K. ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 106 U.K. AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 107 U.K. ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 108 U.K. PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 109 U.K. BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 110 U.K. OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 111 U.K. AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 112 U.K. TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 113 U.K. FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 114 U.K. OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 115 FRANCE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 116 FRANCE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 117 FRANCE ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 118 FRANCE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 119 FRANCE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 120 FRANCE DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 121 FRANCE ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 122 FRANCE POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 123 FRANCE POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 124 FRANCE BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 125 FRANCE ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 126 FRANCE AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 127 FRANCE ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 128 FRANCE PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 129 FRANCE BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 130 FRANCE OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 131 FRANCE AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 132 FRANCE TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 133 FRANCE FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 134 FRANCE OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 135 NETHERLANDS ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 136 NETHERLANDS ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 137 NETHERLANDS ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 138 NETHERLANDS ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 139 NETHERLANDS ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 140 NETHERLANDS DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 141 NETHERLANDS ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 142 NETHERLANDS POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 143 NETHERLANDS POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 144 NETHERLANDS BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 145 NETHERLANDS ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 146 NETHERLANDS AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 147 NETHERLANDS ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 148 NETHERLANDS PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 149 NETHERLANDS BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 150 NETHERLANDS OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 151 NETHERLANDS AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 152 NETHERLANDS TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 153 NETHERLANDS FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 154 NETHERLANDS OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 155 BELGIUM ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 156 BELGIUM ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 157 BELGIUM ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 158 BELGIUM ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 159 BELGIUM ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 160 BELGIUM DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 161 BELGIUM ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 162 BELGIUM POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 163 BELGIUM POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 164 BELGIUM BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 165 BELGIUM ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 166 BELGIUM AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 167 BELGIUM ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 168 BELGIUM PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 169 BELGIUM BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 170 BELGIUM OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 171 BELGIUM AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 172 BELGIUM TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 173 BELGIUM FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 174 BELGIUM OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 175 SPAIN ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 176 SPAIN ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 177 SPAIN ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 178 SPAIN ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 179 SPAIN ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 180 SPAIN DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 181 SPAIN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 182 SPAIN POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 183 SPAIN POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 184 SPAIN BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 185 SPAIN ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 186 SPAIN AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 187 SPAIN ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 188 SPAIN PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 189 SPAIN BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 190 SPAIN OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 191 SPAIN AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 192 SPAIN TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 193 SPAIN FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 194 SPAIN OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 195 ITALY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 196 ITALY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 197 ITALY ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 198 ITALY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 199 ITALY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 200 ITALY DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 201 ITALY ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 202 ITALY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 203 ITALY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 204 ITALY BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 205 ITALY ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 206 ITALY AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 207 ITALY ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 208 ITALY PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 209 ITALY BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 210 ITALY OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 211 ITALY AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 212 ITALY TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 213 ITALY FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 214 ITALY OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 215 RUSSIA ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 216 RUSSIA ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 217 RUSSIA ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 218 RUSSIA ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 219 RUSSIA ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 220 RUSSIA DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 221 RUSSIA ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 222 RUSSIA POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 223 RUSSIA POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 224 RUSSIA BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 225 RUSSIA ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 226 RUSSIA AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 227 RUSSIA ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 228 RUSSIA PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 229 RUSSIA BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 230 RUSSIA OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 231 RUSSIA AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 232 RUSSIA TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 233 RUSSIA FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 234 RUSSIA OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 235 SWITZERLAND ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 236 SWITZERLAND ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 237 SWITZERLAND ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 238 SWITZERLAND ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 239 SWITZERLAND ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 240 SWITZERLAND DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 241 SWITZERLAND ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 242 SWITZERLAND POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 243 SWITZERLAND POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 244 SWITZERLAND BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 245 SWITZERLAND ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 246 SWITZERLAND AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 247 SWITZERLAND ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 248 SWITZERLAND PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 249 SWITZERLAND BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 250 SWITZERLAND OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 251 SWITZERLAND AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 252 SWITZERLAND TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 253 SWITZERLAND FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 254 SWITZERLAND OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 255 TURKEY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 256 TURKEY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 257 TURKEY ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 258 TURKEY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 259 TURKEY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 260 TURKEY DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 261 TURKEY ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 262 TURKEY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 263 TURKEY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 264 TURKEY BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 265 TURKEY ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 266 TURKEY AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 267 TURKEY ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 268 TURKEY PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 269 TURKEY BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 270 TURKEY OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 271 TURKEY AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 272 TURKEY TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 273 TURKEY FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 274 TURKEY OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 275 SWEDEN ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 276 SWEDEN ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 277 SWEDEN ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 278 SWEDEN ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 279 SWEDEN ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 280 SWEDEN DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 281 SWEDEN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 282 SWEDEN POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 283 SWEDEN POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 284 SWEDEN BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 285 SWEDEN ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 286 SWEDEN AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 287 SWEDEN ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 288 SWEDEN PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 289 SWEDEN BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 290 SWEDEN OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 291 SWEDEN AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 292 SWEDEN TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 293 SWEDEN FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 294 SWEDEN OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 295 DENMARK ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 296 DENMARK ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 297 DENMARK ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 298 DENMARK ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 299 DENMARK ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 300 DENMARK DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 301 DENMARK ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 302 DENMARK POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 303 DENMARK POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 304 DENMARK BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 305 DENMARK ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 306 DENMARK AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 307 DENMARK ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 308 DENMARK PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 309 DENMARK BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 310 DENMARK OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 311 DENMARK AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 312 DENMARK TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 313 DENMARK FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 314 DENMARK OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 315 FINLAND ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 316 FINLAND ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 317 FINLAND ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 318 FINLAND ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 319 FINLAND ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 320 FINLAND DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 321 FINLAND ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 322 FINLAND POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 323 FINLAND POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 324 FINLAND BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 325 FINLAND ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 326 FINLAND AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 327 FINLAND ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 328 FINLAND PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 329 FINLAND BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 330 FINLAND OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 331 FINLAND AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 332 FINLAND TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 333 FINLAND FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 334 FINLAND OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 335 NORWAY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 336 NORWAY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 337 NORWAY ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 338 NORWAY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 339 NORWAY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 340 NORWAY DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 341 NORWAY ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 342 NORWAY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 343 NORWAY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 344 NORWAY BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 345 NORWAY ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 346 NORWAY AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 347 NORWAY ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 348 NORWAY PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 349 NORWAY BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 350 NORWAY OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 351 NORWAY AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 352 NORWAY TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 353 NORWAY FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 354 NORWAY OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 355 REST OF EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 356 REST OF EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

List of Figure

FIGURE 1 EUROPE ALPHA-METHYLSTYRENE MARKET

FIGURE 2 EUROPE ALPHA-METHYLSTYRENE MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ALPHA-METHYLSTYRENE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ALPHA-METHYLSTYRENE MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ALPHA-METHYLSTYRENE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ALPHA-METHYLSTYRENE MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE ALPHA-METHYLSTYRENE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE ALPHA-METHYLSTYRENE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE ALPHA-METHYLSTYRENE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MARKET APPLICATION COVERAGE GRID: EUROPE ALPHA-METHYLSTYRENE MARKET

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 FOUR SEGMENTS COMPRISE THE EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY (2024)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 EUROPE ALPHA-METHYLSTYRENE MARKET: SEGMENTATION

FIGURE 15 RISING DEMAND FOR ABS RESINS IN THE AUTOMOTIVE AND CONSUMER GOODS IS EXPECTED TO DRIVE THE EUROPE ALPHA-METHYLSTYRENE MARKET IN THE FORECAST PERIOD

FIGURE 16 THE MORE THAN 99% SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ALPHA-METHYLSTYRENE MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 PRODUCTION CONSUMPTION ANALYSIS: EUROPE ALPHA-METHYLSTYRENE MARKET

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR EUROPE ALPHA-METHYLSTYRENE MARKET

FIGURE 23 EUROPE ALPHA-METHYLSTYRENE MARKET: BY PURITY, 2024

FIGURE 24 EUROPE ALPHA-METHYLSTYRENE MARKET: BY GRADE, 2024

FIGURE 25 EUROPE ALPHA-METHYLSTYRENE MARKET: BY PACKAGING QUANTITY, 2024

FIGURE 26 EUROPE ALPHA-METHYLSTYRENE MARKET: BY PACKAGING, 2024

FIGURE 27 EUROPE ALPHA-METHYLSTYRENE MARKET: BY APPLICATION, 2024

FIGURE 28 EUROPE ALPHA-METHYLSTYRENE MARKET: BY END-USE, 2024

FIGURE 29 EUROPE ALPHA-METHYLSTYRENE MARKET: SNAPSHOT (2024)

FIGURE 30 EUROPE ALPHA-METHYLSTYRENE MARKET: COMPANY SHARE 2024 (%)

Europe Alpha Methylstyrene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Alpha Methylstyrene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Alpha Methylstyrene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.