Europe Alternative Proteins Market

Market Size in USD million

CAGR :

%

USD

5,511,400.77 million

USD

16,603,518.44 million

2022

2030

USD

5,511,400.77 million

USD

16,603,518.44 million

2022

2030

| 2023 –2030 | |

| USD 5,511,400.77 million | |

| USD 16,603,518.44 million | |

|

|

|

|

Europe Alternative Proteins Market Analysis and Size

Proteins are the essential nutrient which is required by the human body. They help in making enzymes, hormones and other body chemicals. Protein is the important building block made up of cartilage, bones, muscles, blood and skin. The meat is considered as the important source for protein. But nowadays people are turning towards the alternative sources for proteins due to the health benefits associated with the alternative proteins.

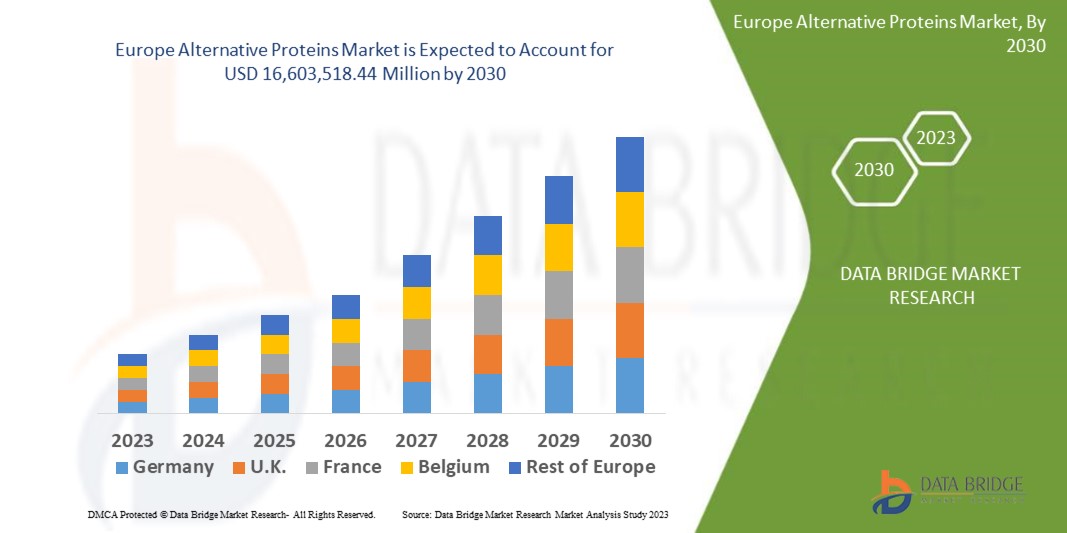

Data Bridge Market Research analyses that the Europe alternative proteins market which was USD 5,511,400.77 thousand in 2022, would rocket up to USD 16,603,518.44 million by 2030, and is expected to undergo a CAGR of 17.01% during the forecast period. This indicates that the market value. Inorganic segment has the largest market share owing to the factors such as the huge portion of farming is in the inorganic cultivation and hence the inorganic products are more as compared to the organic products. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Europe Alternative Proteins Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Category (Organic and Inorganic), Product Type (Plant Protein, Insect Protein, Mycoprotein, Cultured Meat and Others), Form (Dry and Liquid), Application (Food and Beverages, Animal Feed, Pharmaceuticals, Personal Care and Cosmetics and Others) |

|

Countries Covered |

Germany, France, Spain, Turkey, U.K., Netherlands, Russia, Switzerland, Poland, Belgium, Sweden, Denmark, Italy and Rest of Europe |

|

Market Players Covered |

AgriProtein (U.K.), Ÿnsect (France), Protix B.V. (Netherlands), Protifarm (Netherlands), Cargill, Incorporated (U.S.), Axiom Foods, Inc. (U.S.), BENEO (Germany), Roquette Frères (France), ADM (U.S.), DuPont (U.S.), CHS Inc. (U.S.), Ingredion (U.S.), Kerry Group plc (Ireland), and Glanbia PLC (Ireland) |

|

Market Opportunities |

|

Market Definition

Alternative proteins are the proteins which are manufactured by plant and food technology sources and they are dairy-free and meat-free. The alternative proteins are used in various applications such as in food and beverages industry, cosmetics, pharmaceuticals and many more. These plant based alternatives comes in various forms and they are used as a meat replacer in many food applications. The sources for alternative proteins can be plants, insects and mycoproteins among others. The insect proteins are most commonly used in alternative proteins due to the high protein content of around 65% of the weight. Also, the content of omega-3 fatty acid is more in insects apart from the protein content. Thus, many health conscious people are turning towards the alternative proteins.

Europe Alternative Proteins Market Dynamics

Drivers

- Increasing Number of Health Conscious Consumers

The insects, plants and fungi are some of the sources for alternative proteins. Insect proteins such as crickets are most commonly used in the food and beverages products due to the high protein content which is around 65% of the weight. Many companies are manufacturing cricket flour because it contains omega-3 fatty acids and essential amino acids apart from their protein content. Thus, the high nutrient content of these alternative proteins are attracting health conscious consumers towards alternative proteins.

- Easy Availability of Edible Insects

The edible insects can be easily found in environment. The sources for edible insects can be aquatic ecosystems, agricultural fields and forests. There are chances that the population of edible insects may decrease in coming years as the effect of climatic changes, overharvesting, habitat degradation, and pollution, among others.

- Rising Awareness About the Benefits of Alternative Proteins

Plant based proteins also helps to minimize high cholesterols, obesity, high blood pressure, type 2 diabetes, certain types of cancer which includes ovarian, colorectal and breast cancers. The non-animal based proteins could increase the life expectancy and decrease the greenhouse gases emission and also require fewer resources for production. Thus, the benefits associated with alternative proteins has created awareness amongst consumers and increasing the demand for the alternative proteins. Thus, this factor is driving the growth of the market.

Opportunity

Furthermore, the alternative protein production is done by the systems and processes which are non-polluting, economically efficient, conserve natural resources and non-renewable energy, safe for communities, workers and consumers and it does not compromise the future generation’s needs.

Restraint/Challenge

Regulatory agencies are developing appropriate rules for the new trend of alternative proteins. These good regulations can protect the public health risks and unsubstantiated claims are important. These regulations can promote value creation and stimulate innovation. Clarity is important about the regulations of specific agencies. The costs of alternative proteins are increasing because the increased demand for alternative proteins. Most of the plant based meat companies operate in a free market. Thus, the rule for these companies is to make profit and thus they involve as much as cost that market bear.

This Europe alternative protein market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, Market share, impact of domestic and localized Market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market . To gain more info on the Europe alternative proteins products market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In September, 2020, DuPont Nutrition & Biosciences (DuPont) has launched the multiple probiotic formulations and dairy cultures for China which offered new solutions for yogurt producers in differentiation and growth of future positioning. This has helped company to widen its product portfolio range

- In February 2020, ADM has expanded the production of non-GMO soy protein concentrate at its facility in Europoort, Netherlands. This has helped company to meet the increasing demand in European market for high quality plant-based proteins. This expansion had helped the company to serve more customers in the European region and thus helped to build the brand image of the company

Europe Alternative Proteins Market Scope

The Europe alternative proteins market is segmented into four notable segments which are based on category, product type, form and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Category

- Organic

- Inorganic

Product Type

- Plant Protein

- Insect Protein

- Mycoprotein

- Cultured Meat

- Others

Form

- Dry

- Liquid

Application

- Food and Beverages

- Animal Feed

- Pharmaceuticals

- Personal Care & Cosmetics

- Others

Europe Alternative Proteins Market Regional Analysis/Insights

The Europe alternative proteins market is analysed and market size insights and trends are provided by category, product type, form and application as referenced above.

The countries covered in the Europe alternative proteins market report are Germany, U.K., France, Spain, Italy, Denmark, Netherlands, Switzerland, Poland, Russia, Sweden, Belgium, Turkey and Rest of Europe.

U.K. dominates the Europe alternative proteins market because of the strong base of consumers, strong presence of major players in the market and rising number of research activities in this country in terms of market share.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and up-stream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the Market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Alternative Proteins Market Share Analysis

The Europe alternative proteins market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the company’s focus related to Europe alternative proteins market.

Some of the major players operating in the Europe alternative proteins market are:

- AgriProtein (U.K.)

- Ÿnsect (France)

- Protix B.V. (Netherlands)

- Protifarm (Netherlands)

- Cargill, Incorporated (U.S.)

- Axiom Foods, Inc. (U.S.)

- BENEO (Germany)

- Roquette Frères (France)

- ADM (U.S.)

- DuPont (U.S.)

- CHS Inc. (U.S.)

- Ingredion (U.S.)

- Kerry Group plc (Ireland)

- Glanbia PLC (Ireland)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ALTERNATIVE PROTEIN MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE EUROPE ALTERNATIVE PROTEIN MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 EUROPE ALTERNATIVE PROTEIN MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 EUROPE ALTERNATIVE PROTEIN MARKET, BY PROTEIN TYPE, 2022-2030 (USD MILLION) (TONS)

9.1 OVERVIEW

9.2 SOY PROTEIN

9.3 WHEAT PROTEIN

9.4 RICE PROTEIN

9.5 PEA PROTEIN

9.5.1 PEA PROTEIN, BY TYPE

9.5.1.1. YELLOW PEA PROTEIN

9.5.1.2. GREEN PEA PROTEIN

9.6 HEMP PROTEIN

9.6.1 HEMP PROTEIN, BY TYPE

9.6.1.1. HEMP GLOBULIN (EDESTIN)

9.6.1.2. HEMP ALBUMIN

9.6.2 HEMP PROTEIN, BY HEMP STRAIN

9.6.2.1. INDICA

9.6.2.2. SATIVA

9.6.2.3. HYBRID

9.7 POTATO PROTEIN

9.8 CANOLA PROTEIN

9.9 MUSHROOM PROTEIN

9.1 INSECT PROTEIN

9.10.1 INSECT PROTEIN, BY SOURCE

9.10.1.1. BEETLE

9.10.1.2. CATERPILLARS

9.10.1.3. BEES

9.10.1.4. WASPS & AUNTS

9.10.1.5. GRASHOPPER

9.10.1.6. LOCUSTS

9.10.1.7. CRICKETS

9.10.1.8. TRUE BUGS

9.10.1.9. BLACK SOLDIER FLIES (BSF)

9.10.1.10. CICADAS

9.10.1.11. LEAFHOPPER

9.10.1.12. PLANT HOPPERS

9.10.1.13. SCALE INSECTS

9.10.1.14. TERMITES

9.10.1.15. DRAGONFLIES

9.10.1.16. FLIES

9.10.1.17. MEALWORMS

9.10.1.18. OTHERS

9.11 MICROBIAL-BASED PROTIEN

9.11.1 MICROBIAL-BASED PROTIEN, BY SOURCE

9.11.1.1. BACTERIA

9.11.1.2. FUNCGI

9.11.1.3. YEAST

9.11.1.4. ALGAE

9.12 CULTURED MEAT

9.12.1 CULTURED MEAT, BY TYPE

9.12.1.1. POULTRY

9.12.1.2. BEEF

9.12.1.3. PORK

9.12.1.4. FISH

9.12.1.5. OTHERS

9.13 OTHERS

10 EUROPE ALTERNATIVE PROTEIN MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION) (TONS)

10.1 OVERVIEW

10.2 PROTEIN ISOLATES

10.3 PROTEIN CONCENTRATES

10.4 PROTEIN HYDROLYSATES

10.5 TEXTURED PROTEIN

11 EUROPE ALTERNATIVE PROTEIN MARKET, BY NATURE, 2022-2030 (USD MILLION) (TONS)

11.1 OVERVIEW

11.2 GMO

11.3 NON-GMO

12 EUROPE ALTERNATIVE PROTEIN MARKET, BY CATGEORY , 2022-2030 (USD MILLION) (TONS)

12.1 OVERVIEW

12.2 CONVENTIONAL

12.3 ORGANIC

13 EUROPE ALTERNATIVE PROTEIN MARKET, BY APPLICATION , 2022-2030 (USD MILLION)

13.1 OVERVIEW

13.2 FOOD AND BEVERAGES

13.2.1 FOOD AND BEVERAGES, BY TYPE

13.2.1.1. BAKERY

13.2.1.1.1. BAKERY, BY TYPE

13.2.1.1.1.1 BREAD & ROLLS

13.2.1.1.1.2 CAKES, PASTRIES & TRUFFLE

13.2.1.1.1.3 BISCUIT

13.2.1.1.1.4 TART & PIES

13.2.1.1.1.5 BROWNIES

13.2.1.1.1.6 COOKIES & CRACKERS

13.2.1.1.1.7 TORTILLA

13.2.1.1.1.8 OTHERS

13.2.1.2. MEAT ALTERNATIVES

13.2.1.2.1. MEAT LATERNATIVES, BY TYPE

13.2.1.2.1.1 PLANT-BASED SAUSAGES

13.2.1.2.1.2 PLANT-BASED NUGGESTS

13.2.1.2.1.3 PLANT-BASED STRIPS

13.2.1.2.1.4 PLANT-BASED BURGER PATTIES

13.2.1.2.1.5 PLANT-BASED MEAT CHUNKS

13.2.1.2.1.6 OTHERS

13.2.1.3. DAIRY PRODUCTS

13.2.1.3.1. DAIRY PRODUCTS, BY TYPE

13.2.1.3.1.1 YOGURT

13.2.1.3.1.2 FRESH

13.2.1.3.1.3 FROZEN

13.2.1.3.1.4 ICE CREAM

13.2.1.3.1.5 CHEESE

13.2.1.3.1.6 OTHERS

13.2.1.4. PROCESSED FOOD

13.2.1.4.1. PROCESSED FOOD, BY TYPE

13.2.1.4.1.1 READY MEALS

13.2.1.4.1.2 SAUCES, DRESSINGS AND CONDIMENTS

13.2.1.4.1.3 SOUPS

13.2.1.4.1.4 JAMS, PRESERVES & MARMALADES

13.2.1.4.1.5 OTHERS

13.2.1.5. MEAT PRODUCTS

13.2.1.5.1. MEAT PRODUCTS, BY TYPE

13.2.1.5.1.1 PORK PRODUCTS

13.2.1.5.1.2 POULTRY PRODUCTS

13.2.1.5.1.3 BEEF RODUCTS

13.2.1.6. CONFECTIONERY

13.2.1.6.1. CONFECTIONERY, BY TYPE

13.2.1.6.1.1 HARD-BOILED SWEETS

13.2.1.6.1.2 MINTS

13.2.1.6.1.3 GUMS & JELLIES

13.2.1.6.1.4 CHOCOLATE

13.2.1.6.1.5 CHOCOLATE SYRUPS

13.2.1.6.1.6 CARAMELS & TOFFEES

13.2.1.6.1.7 OTHERS

13.2.1.7. FROZEN DESSERTS

13.2.1.7.1. FROZEN DESSERTS, BY TYPE

13.2.1.7.1.1 GELATO

13.2.1.7.1.2 CUSTARD

13.2.1.7.1.3 SORBET

13.2.1.7.1.4 OTHERS

13.2.1.8. BABY FOOD

13.2.1.9. FUCNTIONAL FOOD

13.2.1.10. CONVENIENCE FOOD

13.2.1.10.1. CONVENIENCE FOOD, BY TYPE

13.2.1.10.1.1 INSTANT NOODLES

13.2.1.10.1.2 PIZZA & PASTA

13.2.1.10.1.3 SANCKS& EXTRUDED SNACKS

13.2.1.10.1.4 OTHERS

13.2.1.11. BEVERAGES

13.2.1.11.1. BEVERAGES, BY TYPE

13.2.1.11.1.1 SMOOTHIES

13.2.1.11.1.2 SPORTS DRINKS

13.2.1.11.1.3 PLANT-BASED MILK

13.2.1.11.1.4 FORTIFIED BEVERAGES

13.2.1.11.1.5 OTHERS

13.2.2 FOOD AND BEVERAGES, BY PROTEIN TYPE

13.2.2.1. SOY PROTEIN

13.2.2.2. WHEAT PROTEIN

13.2.2.3. RICE PROTEIN

13.2.2.4. PEA PROTEIN

13.2.2.5. HEMP PROTEIN

13.2.2.6. POTATO PROTEIN

13.2.2.7. CANOLA PROTEIN

13.2.2.8. MUSHROOM PROTEIN

13.2.2.9. INSECT PROTEIN

13.2.2.10. MICROBIAL BASED PROTEIN

13.2.2.11. CULTURED MEAT

13.2.2.12. OTHERS

13.3 DIETERY AND NUTRIONAL SUPPLEMENTS

13.3.1 DIETERY AND NUTRITIONAL SUPPLEMMENTS, BY TYPE

13.3.1.1. IMMUNITY SUPPLEMENTS

13.3.1.2. BONE AND JOINT HEALTH SUPPLEMENTS

13.3.1.3. OVERALL WELLBEING SUPPLEMENTS

13.3.1.4. BRAIN HEALTH SUPPLLEMNTS

13.3.1.5. SKIN HEALTH SUPPLEMENTS

13.3.1.6. OTEHRS

13.3.2 DIETARY SUPPLEMENTS, BY PROTEIN TYPE

13.3.2.1. SOY PROTEIN

13.3.2.2. WHEAT PROTEIN

13.3.2.3. RICE PROTEIN

13.3.2.4. PEA PROTEIN

13.3.2.5. HEMP PROTEIN

13.3.2.6. POTATO PROTEIN

13.3.2.7. CANOLA PROTEIN

13.3.2.8. MUSHROOM PROTEIN

13.3.2.9. INSECT PROTEIN

13.3.2.10. MICROBIAL BASED PROTEIN

13.3.2.11. CULTURED MEAT

13.3.2.12. OTHERS

13.4 SPORTS NUTRITION

13.4.1 SPORTS NUTRTION, BY TYPE

13.4.1.1. SPORT DRINK MIXES

13.4.1.2. SPORTS NUTRITION BARS

13.4.1.3. PROTEIN POWDERS

13.4.1.4. OTHERS

13.4.2 SPORTS NUTRITION, BY PROTEIN TYPE

13.4.2.1. SOY PROTEIN

13.4.2.2. WHEAT PROTEIN

13.4.2.3. RICE PROTEIN

13.4.2.4. PEA PROTEIN

13.4.2.5. HEMP PROTEIN

13.4.2.6. POTATO PROTEIN

13.4.2.7. CANOLA PROTEIN

13.4.2.8. MUSHROOM PROTEIN

13.4.2.9. INSECT PROTEIN

13.4.2.10. MICROBIAL BASED PROTEIN

13.4.2.11. CULTURED MEAT

13.4.2.12. OTHERS

13.5 PHARMACEUTICAL

13.5.1 PHARMACEUTICAL, BY PROTEIN TYPE

13.5.1.1. SOY PROTEIN

13.5.1.2. WHEAT PROTEIN

13.5.1.3. RICE PROTEIN

13.5.1.4. PEA PROTEIN

13.5.1.5. HEMP PROTEIN

13.5.1.6. POTATO PROTEIN

13.5.1.7. CANOLA PROTEIN

13.5.1.8. MUSHROOM PROTEIN

13.5.1.9. INSECT PROTEIN

13.5.1.10. MICROBIAL BASED PROTEIN

13.5.1.11. CULTURED MEAT

13.5.1.12. OTHERS

13.6 ANIMAL FEED

13.6.1 ANIMAL FEED, BY TYPE

13.6.1.1. RUMINANT FEED

13.6.1.1.1. DAIRY CATTLE

13.6.1.1.2. BEEF CATTLE

13.6.1.1.3. CALVES

13.6.1.1.4. OTHERS

13.6.1.2. POULTRY FEED

13.6.1.2.1. BOILERS

13.6.1.2.2. LAYERS

13.6.1.2.3. BREEDERS

13.6.1.3. SWINE FEED

13.6.1.3.1. SOW

13.6.1.3.2. GROWER

13.6.1.3.3. STARTER

13.6.1.4. AQUAFEED

13.6.1.4.1. FISH FEED

13.6.1.4.2. MOLLUSK FEED

13.6.1.4.3. CRUSTACEANS

13.6.1.5. PET FEED

13.6.1.5.1. DOGS

13.6.1.5.2. CATS

13.6.1.5.3. RABBITS

13.6.1.6. OTEHRS

13.6.2 ANIMAL FEED, BY PROTEIN TYPE

13.6.2.1. SOY PROTEIN

13.6.2.2. WHEAT PROTEIN

13.6.2.3. RICE PROTEIN

13.6.2.4. PEA PROTEIN

13.6.2.5. HEMP PROTEIN

13.6.2.6. POTATO PROTEIN

13.6.2.7. CANOLA PROTEIN

13.6.2.8. MUSHROOM PROTEIN

13.6.2.9. INSECT PROTEIN

13.6.2.10. MICROBIAL BASED PROTEIN

13.6.2.11. CULTURED MEAT

13.6.2.12. OTHERS

13.7 OTHERS

14 EUROPE ALTERNATIVE PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2022-2030 (USD MILLION)

14.1 OVERVIEW

14.2 DIRECT

14.3 INDIRECT

15 EUROPE ALTERNATIVE PROTEIN MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

15.2 MERGERS & ACQUISITIONS

15.3 NEW PRODUCT DEVELOPMENT & APPROVALS

15.4 EXPANSIONS & PARTNERSHIP

15.5 REGULATORY CHANGES

16 EUROPE ALTERNATIVE PROTEIN MARKET, BY COUNTRY, 2022-2030 (USD MILLION) (TONS)

Overview (All Segmentation Provided Above Is Represnted In This Chapter By Country)

16.1 EUROPE

16.1.1 GERMANY

16.1.2 U.K.

16.1.3 ITALY

16.1.4 FRANCE

16.1.5 SPAIN

16.1.6 SWITZERLAND

16.1.7 RUSSIA

16.1.8 TURKEY

16.1.9 BELGIUM

16.1.10 NETHERLANDS

16.1.11 SWITZERLAND

16.1.12 DENMARK

16.1.13 NORWAY

16.1.14 FINLAND

16.1.15 SWEDEN

16.1.16 REST OF EUROPE

17 EUROPE ALTERNATIVE PROTEIN MARKET, SWOT & DBMR ANALYSIS

18 EUROPE ALTERNATIVE PROTEIN MARKET, COMPANY PROFILE

18.1 ADM

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHICAL PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 CARGILL, INCORPORATED

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHICAL PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 DUPONT

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHICAL PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 WILMAR INTERNATIONAL

18.4.1 COMPANY OVERVIEW

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHICAL PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 ROQUETTE FRÈRES

18.5.1 COMPANY OVERVIEW

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHICAL PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 GLANBIA

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHICAL PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 KERRY GROUP PLC

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHICAL PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENTS

18.8 DSM

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHICAL PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 INGREDION

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHICAL PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.1 INTERNATIONAL FLAVORS & FRAGRANCES INC (IFF)

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHICAL PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 AGT FOOD & INGREDIENTS

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHICAL PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 BENEO

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHICAL PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 AXIOM FOODS, INC

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 GEOGRAPHICAL PRESENCE

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 INNOVAFEED

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHICAL PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 PROTIX

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHICAL PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 YNSECT

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHICAL PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 HEXAFLY

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHICAL PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

18.18 ENTOCYCLE

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHICAL PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 BIOFLYTECH

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHICAL PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

18.2 INSECTUM

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHICAL PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

18.21 NEXT PROTEIN

18.21.1 COMPANY OVERVIEW

18.21.2 REVENUE ANALYSIS

18.21.3 GEOGRAPHICAL PRESENCE

18.21.4 PRODUCT PORTFOLIO

18.21.5 RECENT DEVELOPMENTS

18.22 PROTIFLY

18.22.1 COMPANY OVERVIEW

18.22.2 REVENUE ANALYSIS

18.22.3 GEOGRAPHICAL PRESENCE

18.22.4 PRODUCT PORTFOLIO

18.22.5 RECENT DEVELOPMENTS

18.23 TEBRIO

18.23.1 COMPANY OVERVIEW

18.23.2 REVENUE ANALYSIS

18.23.3 GEOGRAPHICAL PRESENCE

18.23.4 PRODUCT PORTFOLIO

18.23.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 RELATED REPORTS

20 CONCLUSION

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Europe Alternative Proteins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Alternative Proteins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Alternative Proteins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.