Europe Aluminium Wire Rod Market

Market Size in USD Billion

CAGR :

%

USD

18.62 Billion

USD

33.57 Billion

2024

2035

USD

18.62 Billion

USD

33.57 Billion

2024

2035

| 2025 –2035 | |

| USD 18.62 Billion | |

| USD 33.57 Billion | |

|

|

|

|

Aluminum Wire Rod Market Analysis

The aluminum wire rod market is driven by rising demand in power transmission, automotive, and construction industries. With increasing investments in renewable energy and grid expansion, the need for efficient electrical conductors boosts market growth. Asia-Pacific, led by China and India, dominates due to industrialization and infrastructure development. Key players focus on lightweight, high-conductivity alloys to enhance performance. However, fluctuating aluminum prices and supply chain disruptions pose challenges. The market is expected to grow steadily, supported by technological advancements and the global shift towards energy-efficient solutions.

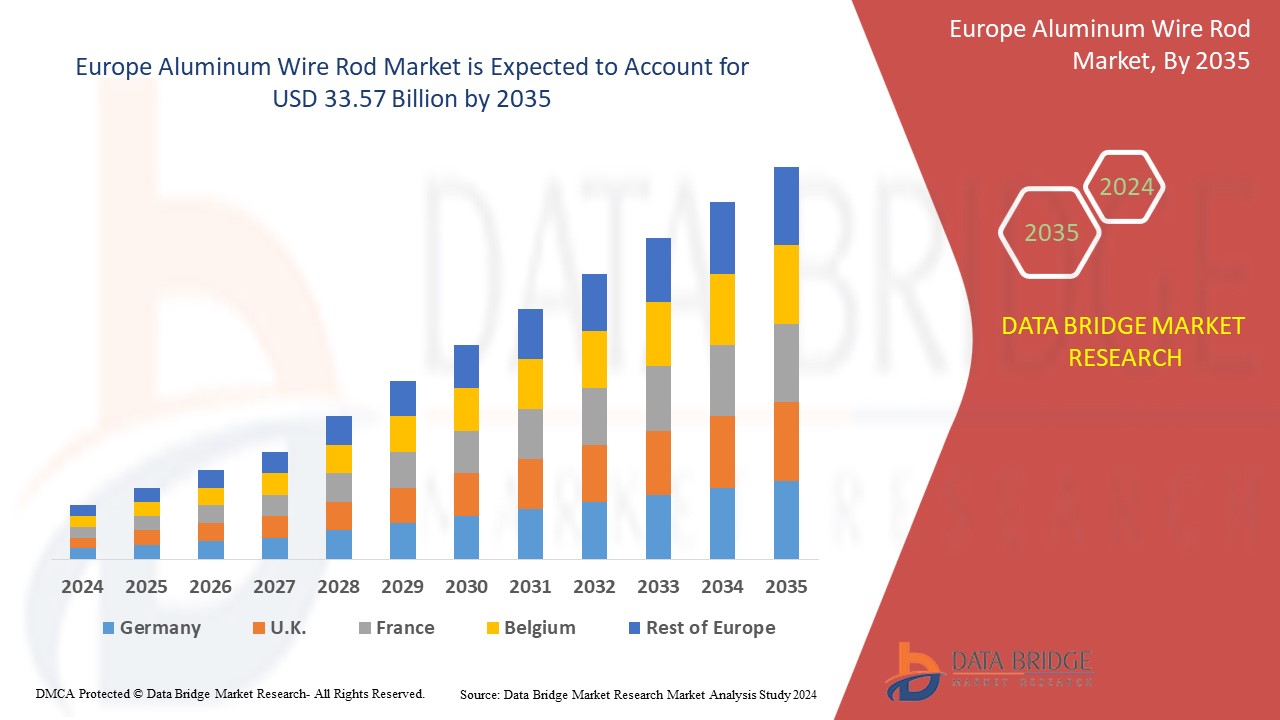

Aluminum Wire Rod Market Size

The Europe Aluminum Wire Rod Market is expected to reach USD 33.57 billion by 2035 from USD 18.62 billion in 2024, growing with a substantial CAGR of 5.6% in the forecast period of 2025 to 2035. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Aluminum Wire Rod Market Trends

The aluminum wire rod market is witnessing key trends, including increasing demand for lightweight and high-conductivity materials in power transmission and automotive industries. The shift towards renewable energy and smart grids is driving growth, along with expanding urban infrastructure projects. Recycling and sustainability initiatives are gaining traction as companies focus on eco-friendly production. Technological advancements in high-strength aluminum alloys improve efficiency and durability. However, market fluctuations due to raw material price volatility and supply chain disruptions remain challenges. Overall, the industry is moving towards innovation and sustainable growth.

Report Scope and Aluminum Wire Rod Market Segmentation

|

Attributes |

Aluminum Wire Rod Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

France, Germany, Italy, U.K., Spain, Russia, Netherlands, Poland, Belgium, Switzerland, Denmark, Norway, Sweden, Turkey, Rest of Europe |

|

Key Market Players |

Hindalco Industries Ltd. (India), Norsk Hydro ASA (Norway), Alcoa Corporation (United States), TRIMET Aluminium SE (Germany), RusAL (Russia), Hellenic Cables (Greece), Vimetco NV (Netherlands), Scepter Inc (United States), Lamifil (Belgium), JSC “Zvetlit” (Belarus), Esal Rod Alloys, S.A. (Spain), NPA Skawina (Poland), Emta Cable (Turkey)and among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aluminum Wire Rod Market Definition

Aluminum wire rod is a semi-finished product made from aluminum and its alloys, used primarily in electrical, automotive, and construction industries. Produced through continuous casting and rolling or extrusion, it serves as a key material for manufacturing electrical cables, conductors, and welding wires. Its lightweight, high conductivity, and corrosion resistance make it ideal for power transmission and distribution applications. Aluminum wire rods come in various grades to meet industry standards, ensuring durability and efficiency. Growing demand for energy-efficient solutions and renewable power grids continues to drive market growth.

Aluminum Wire Rod Market Dynamics

Drivers

GROWING DEMAND FOR ALUMINIUM WIRE RODS IN POWER CABLES AND OVERHEAD CONDUCTORS

Overhead conductors are a physical medium to carry electrical energy from one end to another end of conductors, which are good conductors of heat—the important components of overhead conductors and underground electrical transmission and distribution systems. The conductor used in power cables is selected based on the different types and sizes of conductors available. The ideal conductor offers features such as maximum electrical conductivity, high tensile strength, and can withstand mechanical stresses. It has the least specific gravity and is easily available at a low cost.

Power cables have aluminium rod connectors attached for various features that any conductor offers, such as a larger diameter for current flow, which reduces corona, less conductivity, lesser tensile strength, and lower tensile strength than other metals such as copper. Hence, due to various features depicted by the aluminium metal, the metals are in high demand for power cables across Europe. The aluminium products are utilized in power cables; they offer more protection from weather and chemicals and are saved from getting corroded.

The aluminium wire rod is more focused on now a day because various industries require more power and lesser cost material; those are good conductors of heat and need less maintenance.

For instance, In February 2022, Elcowire announced the acquisition of KME's Rod and Wire Business in Germany. This acquisition took place to double its production capacity. The company will be able to have a larger workforce

Thus, there is a huge demand for aluminium wire rods in power cables and overhead conductors, which helps in taking better decisions and thus is expected to drive the growth of the Europe aluminium wire rod market.

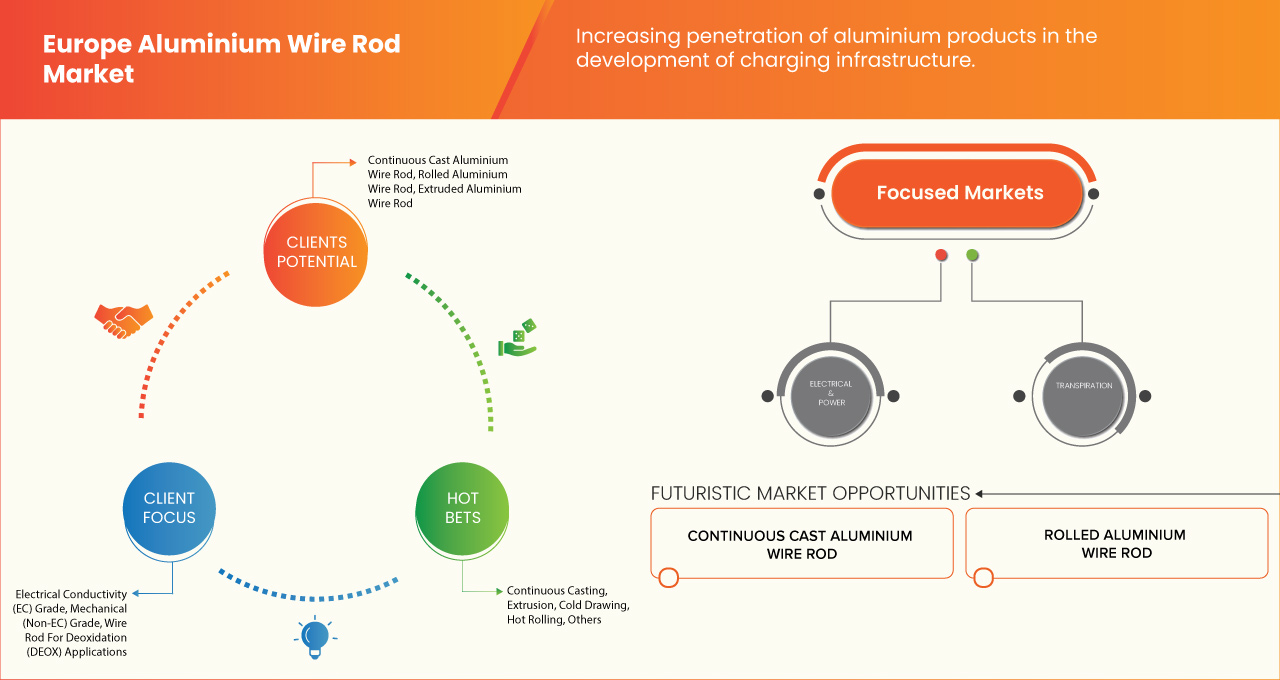

INCREASING PENETRATION OF ALUMINIUM PRODUCTS IN THE DEVELOPMENT OF CHARGING INFRASTRUCTURE

The world of charging stations for electric vehicles is developing quickly. The incorporation of aluminium extrusions in E-charging stations is one of the most useful solutions. The charging stations are being developed in various European countries due to hydro eco-design methodology. The methodology has been introduced to manufacture products with the latest sustainability standard. The light-weighting of aluminium is one of the most effective ways to improve the energy efficiency of electric and hybrid vehicles. Light cars need less electricity to travel the same distance. The modular aluminium solutions for electric vehicle packs can lower production and operations costs and offer maximum design flexibility.

For instance, In September 2021, according to an article by ET Times, it was announced that the U.K. government had pledged £440m to improve the infrastructure around electric vehicles, local authorities devised plans for Clean Air Zones, and the Plug-In Car Grant attracted new buyers to the electric car market every month, which could help the aluminium wire rod business According to a survey conducted by autostat, the Europe public charging infrastructure comprises 285,496 publicly accessible charging points and has been growing immensely over the years.

As per the above instances, Europe has many charging stations and is growing immensely due to a proper resource management system. This is expected to act as a driving factor for the Europe aluminium wire rod.

Opportunities

Increase in Various Strategic Decisions such as Partnerships and Mergers

The strategic partnership helps both companies to work for the desired goal. As the marketplace is changing and evolving, customers are consistently looking for newly developed products. By forming a strategic partnership, companies can understand the market well before entering, which will assist in targeting potential customers and expanding their network in the market. Few market leaders in electronic components are signing an agreement to work with continuous process improvement by making the best use of advanced technology to meet the users' needs in the market. Therefore, the companies can increase their brand awareness and broaden their product line with all advanced instruments and solutions. Hence, a rise in partnerships and mergers among market players is expected to foster the market's growth.

For instance, In May 2022, Midal Cables Ltd announced a partnership between Imerys' Al Zayani, Yellow Door Energy, and Midal to install a solar power plant in Bahrain. The partnership will help the companies to increase solar energy production. This will help the company increase its profit margin and diversify its energy portfolio solutions

These strategic partnerships or mergers can result in technological advancement and improved product portfolios for involved parties. This may give companies a cutting edge or an opportunity in a highly competitive Europe market.

Technological Advancements in Alloy Development

Innovations in aluminium alloys are enhancing material properties such as conductivity, strength, corrosion resistance, and durability, making wire rods more suitable for a broader range of applications. These advancements enable aluminium wire rods to compete more effectively with alternative materials, such as copper, in industries where performance and efficiency are critical. One key area of development is high-conductivity aluminium alloys, which improve electrical transmission efficiency while maintaining the lightweight benefits of aluminium. This makes them particularly valuable for power grids, renewable energy infrastructure, and electric vehicle (EV) wiring, where energy efficiency and sustainability are major concerns. As governments and industries push for energy transition and decarbonization, the demand for such advanced alloys is expected to rise, driving new opportunities for aluminium wire rod manufacturers.

In the automotive and aerospace sectors, the development of high-strength aluminium alloys is expanding the use of aluminium wire rods in lightweight structural components and electrical systems. As industries prioritize weight reduction for fuel efficiency and lower emissions, advanced aluminium alloys provide an ideal solution, further increasing demand.

In addition to above, improvements in alloy processing techniques, such as grain refinement and nanostructured alloys, are enhancing the mechanical properties of aluminium wire rods. These innovations enable manufacturers to produce superior-quality wire rods with greater reliability, reducing material wastage and production costs.

For instance, The offshore wind industry in Scotland has benefited from the development of corrosion-resistant aluminium alloys, which extend the lifespan of electrical components exposed to harsh marine environments. Specialised aluminium wire rods with enhanced anti-corrosion properties are now being used in cable connections, supporting the growth of offshore renewable energy projects

With continuous research and development in alloy formulations, European aluminium wire rod manufacturers have the opportunity to differentiate their products, expand into high-performance applications, and strengthen their position in both domestic and international markets.

Restraints/Challenges

Potential Risks Associated with Aluminium Wiring

The potential risks associated with aluminum wiring pose significant challenges for the Europe aluminum wire rod market, impacting its adoption and market perception. One of the primary concerns is the inherent property of aluminum to oxidize when exposed to air, leading to the formation of a resistive layer on the wire surface. This oxidation can result in poor electrical connections, increased resistance, and overheating, raising safety concerns such as fire hazards. These risks have historically deterred industries, particularly in residential and commercial construction, from fully embracing aluminum wiring, despite its cost advantages over copper.

Another challenge lies in the mechanical properties of aluminum. Compared to copper, aluminum is more prone to creep and fatigue under mechanical stress, which can cause connections to loosen over time. This necessitates the use of specialized connectors, installation techniques, and regular maintenance, increasing the overall cost and complexity of using aluminum wire rods. For manufacturers, this means investing in research and development to create improved alloys and coatings that mitigate these risks, adding to production costs.

Furthermore, the lingering stigma from past incidents involving aluminum wiring continues to affect market confidence. Educating end-users and stakeholders about the advancements in aluminum wire rod technology and its safe application is essential but challenging. Overcoming these perceptions requires significant effort in marketing, certification, and collaboration with regulatory bodies to establish trust.

For instance, Aluminum's tendency to creep under mechanical stress has been a significant issue in electrical applications. In industrial settings where vibrations are common, aluminum wiring connections have been known to loosen over time, leading to arcing and potential fire risks. This has forced industries to adopt more expensive and complex installation methods, such as using specialized connectors and anti-oxidant pastes, increasing overall costs

Collectively, these risks create barriers to the widespread adoption of aluminum wire rods in Europe, challenging manufacturers to innovate while addressing safety and reliability concerns to remain competitive in the market.

Rise in Dependency of Manufacturers on Different Suppliers

Different aluminium components such as wires, cables, and rods are required to manufacture electrical devices and build charging infrastructure. Consumer demand for advanced devices has raised the requirement for aluminium products. Manufacturing companies mostly get these components such as ICs, semiconductors, PCBs, and others from their supplier as they mostly give those discounts and provide the products in bulk. COVID-19 has disrupted the global supply chain of several electronic companies.

The supply chain of Europe aluminium wire rods starts with gathering raw material, manufacturing and assembly of those material which are in solid form to liquid form to mould the forms of aluminium into a wire rod shape. The next stage in supply chain analysis is transferring materials such as rods, wires and cables to various industries per the requirements of various industries.

The most important stage in the supply chain is the market being covered to distribute the products to various retailers and consumers. The demand for aluminium wire rods is increasing daily due to properties of aluminium products that have high sustainability and can be used for various connection such as the power supply. The supply chain is the most important part for any manufacturers as it plays an important role in transporting finished goods to the consumers.

For instance, In March 2021, AMAG Austria Metall AG was awarded the certificate IATF 16949:2016. The certification has been awarded for producing rolled products of aluminium and aluminium alloys. This certification will give companies product recognition in the market. The production of alloys with certified manufacturers is tough for startups. Hence, it may act as a challenging factor for the market

Hence, manufacturers' dependency on different suppliers is expected to challenge the Europe aluminium wire rod market.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Aluminum Wire Rod Market Scope

The market is segmented on the basis of product type, grade, diameter, processing, application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market Sources.

Europe Aluminium Wire Rod Market, By Product Type

- Continuous Cast Aluminium Wire Rod

- Rolled Aluminium Wire Rod

- Extruded Aluminium Wire Rod

Europe Aluminium Wire Rod Market, By Grade

- Electrical Conductivity (Ec) Grade

- Electrical Conductivity (Ec) Grade, By Grade

- High-Purity Aluminium (99.5%+)

- High-Purity Aluminium (99.5%+), By Grade

- 1350 Ec Aluminium Wire Rod

- 1370 Ec Aluminium Wire Rod

- Other High-Conductivity Grades

- Alloyed Ec Grade Rods

- Alloyed Ec Grade Rods, By Grade

- 6101 Aluminium Wire Rod

- 6201 Aluminium Wire Rod

- Alloyed Ec Grade Rods, By Grade

- Mechanical (Non-Ec) Grade

- Mechanical (Non-Ec) Grade, By Grade

- 5005 Aluminium Wire Rod

- 5052 Aluminium Wire Rod

- 8176 Aluminium Wire Rod

- 6xxx Series Mechanical Rods

- Mechanical (Non-Ec) Grade, By Grade

- Wire Rod For Deoxidation (Deox) Applications

- Wire Rod For Deoxidation (Deox) Applications, By Grade

- Primary Aluminium Deoxidation Rods

- Secondary Aluminium Deoxidation Rods

- Wire Rod For Deoxidation (Deox) Applications, By Grade

- Electrical Conductivity (Ec) Grade, By Grade

Europe Aluminium Wire Rod Market, By Diameter

- Below 9.5 Mm

- 5 Mm - 12 Mm

- Above 12 Mm

Europe Aluminium Wire Rod Market, By Processing

- Continuous Casting

- Extrusion

- Cold Drawing

- Hot Rolling

- Others

Europe Aluminium Wire Rod Market, By Application

- Electrical & Power

- Electrical & Power, By Application

- Overhead Conductors

- Overhead Conductors, By Application

- AAC

- ACAR

- AAAC

- ACSR

- Overhead Conductors, By Application

- Transformer Winding

- Underground Power Cables

- Busbars & Switchgear Components

- Others

- Overhead Conductors

- Electrical & Power, By Application

- Industrial & Manufacturing

- Industrial & Manufacturing, By Application

- Welding Wire

- Machinery Components

- Aluminium Mesh & Netting

- Wire Rod For Deoxidation (Deox) Applications

- Others

- Industrial & Manufacturing, By Application

- Transportation

- Transportation, By Application

- Automotive Wiring Harness

- Electric Vehicles (Ev) Components

- Railways & Metro Applications

- Others

- Transportation, By Application

- Others

Europe Aluminium Wire Rod Market, By End-Use

- Energy & Utilities

- Telecommunications

- Automotive

- Aerospace & Defense

- Building & Construction

- Industrial Machinery & Equipment

- Others

Europe Aluminium Wire Rod Market, By Country

- France

- Germany

- Italy

- U.K.

- Spain

- Russia

- Netherlands

- Poland

- Belgium

- Switzerland

- Denmark

- Norway

- Sweden

- Turkey

- Rest Of Europe

Aluminum Wire Rod Market Regional Analysis

The market is analyzed and market size insights and trends are provided six notable segments based on product Type, Type, Form, Source, function, end use, and Application as reference above.

The countries covered in the market are France, Germany, Italy, U.K., Spain, Russia, Netherlands, Poland, Belgium, Switzerland, Denmark, Norway, Sweden, Turkey, Rest of Europe

The highest growing country in the Europe Aluminium Wire Market is France due to increasing demand in industries like automotive, construction, and electrical. The country benefits from advanced manufacturing technologies, strong infrastructure, and a shift towards sustainable, lightweight materials for various applications.

France is dominating the European aluminium wire rod market due to its robust industrial base, technological advancements, and strong demand from sectors like automotive, construction, and electrical. The country’s established infrastructure, skilled workforce, and emphasis on sustainability and energy efficiency contribute significantly to its leadership in the market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of U.S. brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Aluminum Wire Rod Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, country presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, Source dominance. The above data points provided are only related to the companies' focus related to market.

Aluminum Wire Rod Market Leaders Operating in the Market Are:

- Hindalco Industries Ltd. (India)

- Norsk Hydro ASA (Norway)

- Alcoa Corporation (United States)

- TRIMET Aluminium SE (Germany)

- RusAL (Russia), Hellenic Cables (Greece)

- Vimetco NV (Netherlands)

- Scepter Inc (United States)

- Lamifil (Belgium)

- JSC “Zvetlit” (Belarus)

- Esal Rod Alloys, S.A. (Spain)

- NPA Skawina (Poland)

- Emta Cable (Turkey)

Latest Developments in Aluminum Wire Rod Market

- In March 2021, Norsk Hydro ASA has decide to launch a plant with an ambition of total primary production in Norway to reduce cost and increase the production capacity. The launch will help the company to utilise their resources according to the demand of market.

- In September 2023, Hindalco Industries Limited, an aluminium rolling and recycling company, has partnered with Italy’s Metra SpA, a leader in aluminium extrusions. This collaboration aims to develop advanced aluminium extrusion and fabrication technologies for high-speed rail coaches in India, supporting the Indian Government’s vision to boost domestic manufacturing. By combining Hindalco’s expertise in aluminium with Metra’s advanced technology in extrusion, machining, and welding, this partnership will bring world-class technology—currently limited to Europe, China, Japan, and a few other countries—to India, aiding the modernization of Indian Railways.

- In August 2023, Hindalco has formed a strategic alliance with Texmaco Rail & Engineering Ltd., a specialized engineering firm, to develop and manufacture aluminium rail wagons and coaches. This collaboration aims to help Indian Railways meet its emission targets and enhance operational efficiency. In this partnership, Hindalco will provide its advanced aluminium alloys, including profiles, sheets, and plates, along with fabrication and welding expertise. The company's aluminium freight rake, launched last year, is 180 tonnes lighter, offers a 19% higher payload-to-tare weight ratio, and is energy-efficient with minimal wear and tear. Texmaco, with 80 years of experience in manufacturing freight cars, will contribute its design expertise, set up the production facility, and manage production and skilled workforce.

- In January 2021, Emta Cable was awarded with certificate ISO 9001:2015 for manufacture of all aluminium products quality. This certification will help the company to diversify their product portfolio with best possible quality. This will help the company to increase its brand value.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INTERNAL COMPETITION

4.3 PRODUCTION CAPACITY OUTLOOK

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATIONS

4.5.5 CONCLUSION

4.6 COMPETITIVE ANALYSIS: ALUMINIUM WIRE RODS/CABLES VS COPPER WIRE ROD/CABLES

4.6.1 KEY PLAYERS IN THE ALUMINIUM AND COPPER WIRE ROD/CABLE MARKET

4.6.2 TECHNICAL COMPARISON OF ALUMINIUM VS. COPPER WIRE RODS/CABLES

4.6.3 INDUSTRY-SPECIFIC DEMAND TRENDS IN EUROPE

4.6.4 COMPETITIVE POSITIONING AND MARKET SHARE IN EUROPE

4.6.5 FUTURE MARKET TRENDS AND GROWTH DRIVERS

4.6.6 CONCLUSION

4.7 IMPORT ANALYSIS

4.7.1 IMPORT VOLUME OF ALUMINIUM WIRE ROD INTO EUROPE

4.7.1.1 APPLICATIONS AND DEMAND DRIVERS

4.7.1.2 TRADE DYNAMICS AND GEOPOLITICAL FACTORS

4.7.1.3 OUTLOOK AND STRATEGIC CONSIDERATIONS

4.7.2 MAJOR IMPORTERS

4.7.2.1 MAJOR IMPORTING COUNTRIES IN EUROPE

4.7.2.1.1 GERMANY

4.7.2.1.2 FRANCE

4.7.2.1.3 U.K.

4.7.2.1.4 ITALY

4.7.2.1.5 SPAIN AND EASTERN EUROPE (POLAND, HUNGARY, CZECH REPUBLIC)

4.7.2.2 KEY SUPPLIERS AND ALTERNATIVE IMPORT SOURCES OF ALUMINIUM WIRE ROD FOR EUROPE

4.7.2.2.1 MALAYSIA

4.7.2.2.2 TURKEY

4.7.2.2.3 INDIA

4.7.2.2.4 BAHRAIN

4.7.2.2.5 OMAN

4.7.2.2.6 EGYPT

4.7.2.2.7 UNITED ARAB EMIRATES

4.7.3 FUTURE OUTLOOK FOR ALUMINUM WIRE ROD IMPORTS IN EUROPE

4.7.3.1 DECLINING DEPENDENCE ON RUSSIAN ALUMINUM

4.7.3.2 THE RISE OF ALTERNATIVE SUPPLIERS

4.7.3.3 TRADE REGULATIONS AND MARKET POLICIES WILL SHAPE IMPORT STRATEGIES

4.7.3.4 GROWTH IN DEMAND FOR SUSTAINABLE AND RECYCLED ALUMINUM

4.7.4 FLUCTUATING RAW MATERIAL AND ENERGY PRICES

4.7.4.1 TECHNOLOGICAL ADVANCEMENTS IN ALUMINUM PROCESSING

4.7.5 FUTURE IMPORT VOLUMES AND MARKET GROWTH EXPECTATIONS

4.7.6 CONCLUSION

4.8 RAW MATERIAL COVERAGE

4.8.1 PRIMARY RAW MATERIALS USED IN ALUMINUM WIRE ROD PRODUCTION

4.8.2 SUPPLY CHAIN AND IMPORT TRENDS

4.8.3 CONCLUSION

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9.4 CONCLUSION

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.10.1 ADVANCEMENTS IN SMELTING AND REFINING TECHNOLOGIES

4.10.2 INNOVATIONS IN CONTINUOUS CASTING AND ROLLING TECHNOLOGIES

4.10.3 SURFACE TREATMENT AND COATING TECHNOLOGIES

4.10.4 RECYCLING AND CIRCULAR ECONOMY INNOVATIONS

4.10.5 INDUSTRY 4.0 AND DIGITALIZATION IN ALUMINUM WIRE ROD PRODUCTION

4.10.6 ADVANCEMENTS IN ALUMINUM WIRE RODS FOR ELECTRICAL AND AUTOMOTIVE APPLICATIONS

4.10.7 CONCLUSION

4.11 VENDOR SELECTION CRITERIA

4.11.1 PRODUCT QUALITY AND COMPLIANCE

4.11.2 RAW MATERIAL SOURCING AND PURITY

4.11.3 MANUFACTURING PROCESS AND TECHNOLOGY

4.11.4 SUPPLY CHAIN RELIABILITY AND LOGISTICS

4.11.5 SUSTAINABILITY AND ENVIRONMENTAL COMPLIANCE

4.11.6 PRICING AND COST COMPETITIVENESS

4.11.7 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR ALUMINIUM WIRE RODS IN POWER CABLES AND OVERHEAD CONDUCTORS

6.1.2 INCREASING PENETRATION OF ALUMINIUM PRODUCTS IN THE DEVELOPMENT OF CHARGING INFRASTRUCTURE

6.1.3 INCREASING NEED FOR ALLOY GRADE WIRES

6.2 RESTRAINTS

6.2.1 HIGH COST OF DIFFERENT TYPES OF ALUMINIUM WIRES

6.2.2 CHANGE IN ECONOMIC AND POLITICAL OUTLOOK

6.3 OPPORTUNITIES

6.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIPS AND MERGERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN ALLOY DEVELOPMENT

6.4 CHALLENGES

6.4.1 POTENTIAL RISKS ASSOCIATED WITH ALUMINIUM WIRING

6.4.2 RISE IN DEPENDENCY OF MANUFACTURERS ON DIFFERENT SUPPLIERS

7 EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CONTINUOUS CAST ALUMINIUM WIRE ROD

7.3 ROLLED ALUMINIUM WIRE ROD

7.4 EXTRUDED ALUMINIUM WIRE ROD

8 EUROPE ALUMINIUM WIRE ROD MARKET, BY GRADE

8.1 OVERVIEW

8.2 ELECTRICAL CONDUCTIVITY (EC) GRADE

8.2.1 ELECTRICAL CONDUCTIVITY (EC) GRADE, BY GRADE

8.2.1.1 HIGH-PURITY ALUMINIUM (99.5%+), BY GRADE

8.2.1.2 ALLOYED EC GRADE RODS, BY GRADE

8.3 MECHANICAL (NON-EC) GRADE

8.3.1 MECHANICAL (NON-EC) GRADE, BY GRADE

8.4 WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS

8.4.1 WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS, BY GRADE

9 EUROPE ALUMINIUM WIRE ROD MARKET, BY DIAMETER

9.1 OVERVIEW

9.2 BELOW 9.5 MM

9.3 5 MM - 12 MM

9.4 ABOVE 12 MM

10 EUROPE ALUMINIUM WIRE ROD MARKET, BY PROCESSING

10.1 OVERVIEW

10.2 CONTINUOUS CASTING

10.3 EXTRUSION

10.4 COLD DRAWING

10.5 HOT ROLLING

10.6 OTHERS

11 EUROPE ALUMINIUM WIRE ROD MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ELECTRICAL & POWER

11.2.1 ELECTRICAL & POWER, BY APPLICATION

11.2.1.1 OVERHEAD CONDUCTORS, BY APPLICATION

11.3 INDUSTRIAL & MANUFACTURING

11.3.1 INDUSTRIAL & MANUFACTURING, BY APPLICATION

11.4 TRANSPORTATION

11.4.1 TRANSPORTATION, BY APPLICATION

11.5 OTHERS

12 EUROPE ALUMINIUM WIRE ROD MARKET, BY END-USE

12.1 OVERVIEW

12.2 ENERGY & UTILITIES

12.3 TELECOMMUNICATIONS

12.4 AUTOMOTIVE

12.5 AEROSPACE & DEFENSE

12.6 BUILDING & CONSTRUCTION

12.7 INDUSTRIAL MACHINERY & EQUIPMENT

12.8 OTHERS

13 EUROPE ALUMINIUM WIRE ROD MARKET, BY COUNTRIES

13.1 EUROPE

13.1.1 FRANCE

13.1.2 GERMANY

13.1.3 ITALY

13.1.4 U.K.

13.1.5 SPAIN

13.1.6 RUSSIA

13.1.7 NETHERLANDS

13.1.8 POLAND

13.1.9 BELGIUM

13.1.10 SWITZERLAND

13.1.11 DENMARK

13.1.12 NORWAY

13.1.13 SWEDEN

13.1.14 TURKEY

13.1.15 REST OF EUROPE

14 EUROPE ALUMINIUM WIRE ROD MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 NORSK HYDRO ASA

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 TRIMET ALUMINIUM SE

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 HINDALCO INDUSTRIES LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 ALCOA CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 HELLENIC CABLES

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 EMTA CABLE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ESAL ROD ALLOYS, S.A.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 JSC "ZVETLIT"

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 LAMIFIL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 NPA SKAWINA

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 RUSAL

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 SCEPTER INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 VIMETCO NV

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 REGULATORY COVERAGE

TABLE 3 EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 4 EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 5 EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD/KG)

TABLE 6 EUROPE ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 7 EUROPE ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 8 EUROPE HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 9 EUROPE ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 10 EUROPE MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 11 EUROPE WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 12 EUROPE ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 13 EUROPE ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 14 EUROPE ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 15 EUROPE ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 16 EUROPE OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 17 EUROPE INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 18 EUROPE TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 19 EUROPE ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 20 EUROPE ALUMINIUM WIRE ROD MARKET, BY COUNTRY, 2018-2035 (USD THOUSAND)

TABLE 21 EUROPE ALUMINIUM WIRE ROD MARKET, BY COUNTRY, 2018-2035 (TONS)

TABLE 22 FRANCE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 23 FRANCE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 24 FRANCE ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 25 FRANCE ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 26 FRANCE HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 27 FRANCE ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 28 FRANCE MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 29 FRANCE WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 30 FRANCE ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 31 FRANCE ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 32 FRANCE ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 33 FRANCE ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 34 FRANCE OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 35 FRANCE INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 36 FRANCE TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 37 FRANCE ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 38 GERMANY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 39 GERMANY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 40 GERMANY ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 41 GERMANY ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 42 GERMANY HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 43 GERMANY ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 44 GERMANY MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 45 GERMANY WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 46 GERMANY ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 47 GERMANY ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 48 GERMANY ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 49 GERMANY ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 50 GERMANY OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 51 GERMANY INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 52 GERMANY TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 53 GERMANY ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 54 ITALY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 55 ITALY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 56 ITALY ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 57 ITALY ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 58 ITALY HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 59 ITALY ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 60 ITALY MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 61 ITALY WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 62 ITALY ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 63 ITALY ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 64 ITALY ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 65 ITALY ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 66 ITALY OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 67 ITALY INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 68 ITALY TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 69 ITALY ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 70 U.K. ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 71 U.K. ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 72 U.K. ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 73 U.K. ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 74 U.K. HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 75 U.K. ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 76 U.K. MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 77 U.K. WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 78 U.K. ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 79 U.K. ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 80 U.K. ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 81 U.K. ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 82 U.K. OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 83 U.K. INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 84 U.K. TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 85 U.K. ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 86 SPAIN ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 87 SPAIN ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 88 SPAIN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 89 SPAIN ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 90 SPAIN HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 91 SPAIN ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 92 SPAIN MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 93 SPAIN WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 94 SPAIN ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 95 SPAIN ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 96 SPAIN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 97 SPAIN ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 98 SPAIN OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 99 SPAIN INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 100 SPAIN TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 101 SPAIN ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 102 RUSSIA ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 103 RUSSIA ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 104 RUSSIA ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 105 RUSSIA ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 106 RUSSIA HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 107 RUSSIA ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 108 RUSSIA MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 109 RUSSIA WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 110 RUSSIA ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 111 RUSSIA ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 112 RUSSIA ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 113 RUSSIA ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 114 RUSSIA OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 115 RUSSIA INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 116 RUSSIA TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 117 RUSSIA ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 118 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 119 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 120 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 121 NETHERLANDS ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 122 NETHERLANDS HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 123 NETHERLANDS ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 124 NETHERLANDS MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 125 NETHERLANDS WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 126 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 127 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 128 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 129 NETHERLANDS ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 130 NETHERLANDS OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 131 NETHERLANDS INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 132 NETHERLANDS TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 133 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 134 POLAND ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 135 POLAND ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 136 POLAND ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 137 POLAND ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 138 POLAND HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 139 POLAND ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 140 POLAND MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 141 POLAND WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 142 POLAND ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 143 POLAND ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 144 POLAND ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 145 POLAND ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 146 POLAND OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 147 POLAND INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 148 POLAND TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 149 POLAND ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 150 BELGIUM ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 151 BELGIUM ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 152 BELGIUM ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 153 BELGIUM ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 154 BELGIUM HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 155 BELGIUM ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 156 BELGIUM MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 157 BELGIUM WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 158 BELGIUM ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 159 BELGIUM ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 160 BELGIUM ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 161 BELGIUM ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 162 BELGIUM OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 163 BELGIUM INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 164 BELGIUM TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 165 BELGIUM ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 166 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 167 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 168 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 169 SWITZERLAND ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 170 SWITZERLAND HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 171 SWITZERLAND ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 172 SWITZERLAND MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 173 SWITZERLAND WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 174 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 175 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 176 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 177 SWITZERLAND ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 178 SWITZERLAND OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 179 SWITZERLAND INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 180 SWITZERLAND TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 181 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 182 DENMARK ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 183 DENMARK ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 184 DENMARK ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 185 DENMARK ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 186 DENMARK HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 187 DENMARK ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 188 DENMARK MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 189 DENMARK WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 190 DENMARK ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 191 DENMARK ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 192 DENMARK ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 193 DENMARK ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 194 DENMARK OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 195 DENMARK INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 196 DENMARK TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 197 DENMARK ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 198 NORWAY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 199 NORWAY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 200 NORWAY ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 201 NORWAY ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 202 NORWAY HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 203 NORWAY ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 204 NORWAY MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 205 NORWAY WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 206 NORWAY ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 207 NORWAY ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 208 NORWAY ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 209 NORWAY ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 210 NORWAY OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 211 NORWAY INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 212 NORWAY TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 213 NORWAY ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 214 SWEDEN ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 215 SWEDEN ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 216 SWEDEN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 217 SWEDEN ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 218 SWEDEN HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 219 SWEDEN ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 220 SWEDEN MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 221 SWEDEN WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 222 SWEDEN ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 223 SWEDEN ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 224 SWEDEN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 225 SWEDEN ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 226 SWEDEN OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 227 SWEDEN INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 228 SWEDEN TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 229 SWEDEN ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 230 TURKEY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 231 TURKEY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 232 TURKEY ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 233 TURKEY ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 234 TURKEY HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 235 TURKEY ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 236 TURKEY MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 237 TURKEY WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 238 TURKEY ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 239 TURKEY ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 240 TURKEY ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 241 TURKEY ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 242 TURKEY OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 243 TURKEY INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 244 TURKEY TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 245 TURKEY ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 246 REST OF EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 247 REST OF EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

List of Figure

FIGURE 1 EUROPE ALUMINIUM WIRE ROD MARKET

FIGURE 2 EUROPE ALUMINIUM WIRE ROD MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ALUMINIUM WIRE ROD MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ALUMINIUM WIRE ROD MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ALUMINIUM WIRE ROD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ALUMINIUM WIRE ROD MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE ALUMINIUM WIRE ROD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE ALUMINIUM WIRE ROD MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE ALUMINIUM WIRE ROD MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE ALUMINIUM WIRE ROD MARKET: APPLICATION COVERAGE GRID

FIGURE 11 EUROPE ALUMINIUM WIRE ROD MARKET: SEGMENTATION

FIGURE 12 GROWING DEMAND FOR ALUMINIUM WIRE RODS IN POWER CABLES AND OVERHEAD CONDUCTORS IS EXPECTED TO DRIVE THE EUROPE ALUMINIUM WIRE ROD MARKET IN THE FORECAST PERIOD

FIGURE 13 THE CONTINUOUS CAST ALUMINIUM WIRE ROD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ALUMINIUM WIRE ROD MARKET IN 2025 AND 2035

FIGURE 14 EXECUTIVE SUMMARY

FIGURE 15 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE ALUMINIUM WIRE ROD MARKET

FIGURE 18 EUROPE ALUMINIUM WIRE ROD MARKET: BY PRODUCT TYPE, 2024

FIGURE 19 EUROPE ALUMINIUM WIRE ROD MARKET, BY GRADE, 2024

FIGURE 20 EUROPE ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2024

FIGURE 21 EUROPE ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2024

FIGURE 22 EUROPE ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2024

FIGURE 23 EUROPE ALUMINIUM WIRE ROD MARKET, BY END-USE, 2024

FIGURE 24 EUROPE ALUMINIUM WIRE ROD MARKET

FIGURE 25 EUROPE ALUMINUM WIRE ROD MARKET: COMPANY SHARE 2024 (%)

Europe Aluminium Wire Rod Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Aluminium Wire Rod Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Aluminium Wire Rod Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.