Europe Aluminum Casting Market

Market Size in USD Billion

CAGR :

%

USD

19.43 Billion

USD

35.96 Billion

2024

2032

USD

19.43 Billion

USD

35.96 Billion

2024

2032

| 2025 –2032 | |

| USD 19.43 Billion | |

| USD 35.96 Billion | |

|

|

|

|

Europe Aluminum Casting Market Size

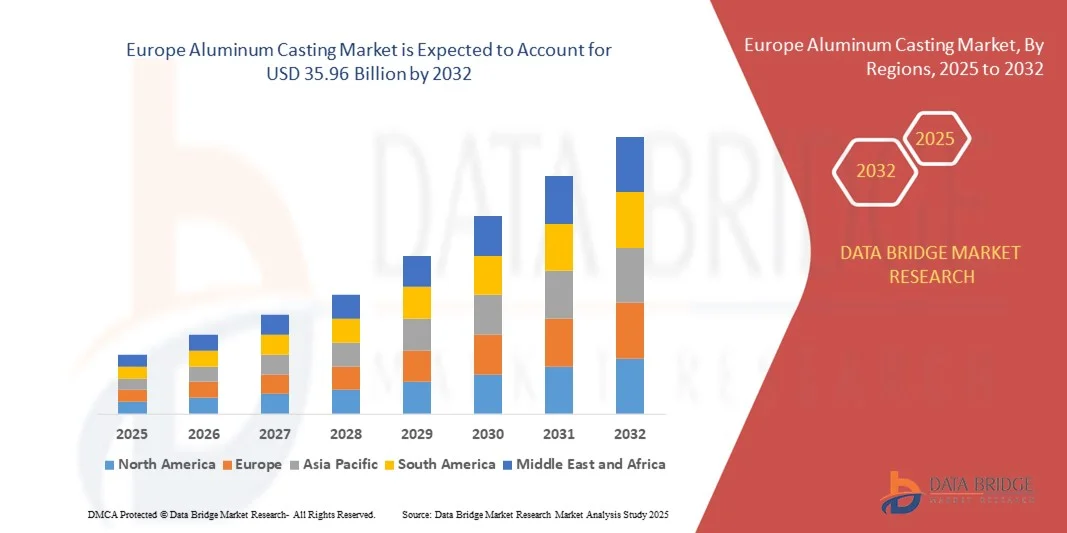

- The Europe Aluminum Casting Market size was valued at USD 19.43 billion in 2024 and is expected to reach USD 35.96 billion by 2032, at a CAGR of 8.00% during the forecast period.

- The market growth is primarily driven by increasing demand for lightweight and durable components across automotive, aerospace, and industrial machinery sectors, coupled with advancements in casting technologies that enhance precision and efficiency.

- Additionally, stringent environmental regulations and the push for fuel-efficient vehicles are promoting the use of aluminum over traditional metals, further propelling the adoption of aluminum casting solutions. These combined factors are fueling market expansion and solidifying the industry's growth trajectory.

Europe Aluminum Casting Market Analysis

- Aluminum casting, providing lightweight, high-strength components for automotive, aerospace, and industrial applications, is increasingly critical in modern manufacturing due to its durability, corrosion resistance, and energy-efficient production capabilities in both commercial and industrial sectors.

- The rising demand for aluminum casting is primarily driven by the automotive industry’s shift toward lightweight vehicles, growth in aerospace and defense sectors, and advancements in casting technologies that improve precision and reduce production costs.

- Germany dominated the Europe Aluminum Casting Market with the largest revenue share of 38.5% in 2024, characterized by advanced manufacturing infrastructure, high adoption of electric and hybrid vehicles, and a strong presence of key casting companies, with Germany and Italy experiencing substantial growth in automotive and industrial applications, driven by innovations in low-pressure die casting and high-pressure permanent mold casting techniques.

- U.K. is expected to be the fastest growing region in the Europe Aluminum Casting Market during the forecast period due to rapid industrialization, expansion of the automotive sector, and increasing investments in aerospace manufacturing.

- The Expendable Mold Casting segment dominated the market with the largest revenue share of 62.4% in 2024, attributed to its cost-effectiveness, flexibility in producing complex shapes, and suitability for both low and high-volume production runs

Report Scope and Europe Aluminum Casting Market Segmentation

|

Attributes |

Aluminum Casting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Aluminum Casting Market Trends

Technological Advancements in Automated and Precision Casting

- A significant and accelerating trend in the Europe Aluminum Casting Market is the growing integration of automation, robotics, and artificial intelligence (AI) within casting operations. This technological convergence is enhancing precision, production efficiency, and overall quality control across foundries and manufacturing facilities.

- For instance, leading manufacturers such as Rheinmetall Automotive and Constellium are increasingly adopting automated die-casting and real-time quality monitoring systems to optimize metal flow, reduce defects, and minimize material waste during production. Similarly, Gränges AB utilizes advanced data analytics to ensure consistent alloy composition and casting performance.

- The integration of AI in aluminum casting processes enables predictive maintenance, adaptive process control, and intelligent defect detection. AI-driven systems can analyze casting parameters in real time, predict anomalies, and automatically adjust temperature or pressure levels to maintain optimal output. Furthermore, robotics and automation ensure consistent cycle times, improved safety, and reduced labor dependency in high-volume production environments.

- The seamless use of digital twins and Industry 4.0 solutions allows manufacturers to simulate casting processes, monitor energy usage, and enhance process traceability. Through centralized digital platforms, companies can manage production lines, analyze performance data, and integrate with supply chain systems, ensuring greater transparency and operational efficiency.

- This trend toward smarter, more connected, and data-driven aluminum casting operations is redefining industrial manufacturing standards across Europe. Consequently, companies such as Hydro Aluminium and Nemak are investing heavily in AI-enabled casting facilities that emphasize sustainability, automation, and consistent quality output.

- The demand for technologically advanced and automated casting solutions is rising rapidly across the automotive, aerospace, and industrial sectors as manufacturers increasingly prioritize lightweight materials, efficiency, and digitalized production capabilities.

Europe Aluminum Casting Market Dynamics

Driver

Growing Demand Driven by Lightweight Vehicle Production and Industrial Expansion

- The increasing emphasis on fuel efficiency, carbon emission reduction, and sustainable manufacturing practices across Europe is a significant driver for the heightened demand for aluminum casting. Lightweight aluminum components are becoming essential in automotive, aerospace, and industrial applications to enhance performance and energy efficiency.

- For instance, in March 2024, Constellium SE announced an expansion of its aluminum casting operations in France to support the growing production of electric vehicles (EVs) and lightweight automotive structures. Such strategic initiatives by key players are expected to propel market growth throughout the forecast period.

- As automotive manufacturers shift toward EVs and hybrid vehicles, aluminum casting offers benefits such as high strength-to-weight ratio, corrosion resistance, and recyclability — making it a preferred choice over heavier materials like steel or iron.

- Furthermore, the rapid industrial expansion and the adoption of automation and precision casting technologies are strengthening demand across machinery, construction, and aerospace sectors. The ability to produce complex geometries and high-performance components efficiently is driving the wider integration of aluminum casting in various applications.

- The advantages of lower energy consumption during production, recyclability, and reduced material waste are key factors propelling the adoption of aluminum casting. Additionally, ongoing innovations in die-casting, sand casting, and investment casting methods are further boosting efficiency and performance across industries.

Restraint/Challenge

High Energy Costs and Fluctuating Raw Material Prices

- High energy consumption and volatility in raw material prices, particularly aluminum ingots, pose significant challenges to the sustained profitability of the Europe Aluminum Casting Market. Since aluminum production and melting processes are energy-intensive, rising electricity costs across Europe directly impact production expenses.

- For instance, the energy crisis in 2023–2024 led to temporary production halts and cost escalations for several European foundries, affecting their ability to meet growing demand.

- Addressing these cost-related challenges through energy-efficient furnace technologies, renewable energy adoption, and improved recycling processes is becoming crucial for manufacturers to maintain competitiveness. Leading companies such as Hydro Aluminium and Rheinmetall Automotive are increasingly focusing on circular production models and low-carbon casting solutions to mitigate these risks.

- Additionally, fluctuating aluminum prices in the global market, driven by geopolitical uncertainties and supply chain disruptions, can affect profit margins and limit large-scale investments in new casting facilities.

- Overcoming these challenges through sustainable sourcing, energy optimization, and technological innovation will be essential to ensure long-term growth and resilience in the Europe Aluminum Casting Market.

Europe Aluminum Casting Market Scope

Europe aluminum casting market is segmented based on process, source, application, and end-user.

- By Process

On the basis of process, the Europe Aluminum Casting Market is segmented into Expendable Mold Casting and Non-Expendable Mold Casting. The Expendable Mold Casting segment dominated the market with the largest revenue share of 62.4% in 2024, attributed to its cost-effectiveness, flexibility in producing complex shapes, and suitability for both low and high-volume production runs. Processes such as sand casting and investment casting are widely used in automotive and industrial sectors due to their ability to produce intricate geometries with excellent surface finish.

The Non-Expendable Mold Casting segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing adoption of permanent mold and die-casting techniques that offer high dimensional accuracy, reduced cycle times, and superior mechanical properties. Increasing automation and technological advancements in high-pressure die casting are further propelling this segment’s growth.

- By Source

On the basis of source, the Europe Aluminum Casting Market is categorized into Primary (Fresh Aluminum) and Secondary (Recycled Aluminum). The Secondary (Recycled Aluminum) segment dominated the market with a revenue share of 57.8% in 2024, driven by the growing emphasis on sustainability, energy efficiency, and cost reduction. Recycled aluminum requires significantly less energy than primary production, aligning with Europe’s stringent environmental regulations and carbon reduction goals.

The Primary Aluminum segment is projected to register the fastest CAGR from 2025 to 2032, supported by rising demand for high-purity aluminum alloys in aerospace and automotive applications. Continuous improvements in smelting technologies and the availability of high-grade raw materials are expected to further enhance primary aluminum’s market potential during the forecast period.

- By Application

On the basis of application, the Europe Aluminum Casting Market is segmented into Intake Manifolds, Oil Pan Housings, Structural Parts, Chassis Parts, Cylinder Heads, Engine Blocks, Transmissions, Wheels and Brakes, Heat Transfers, and Others. The Engine Blocks segment dominated the market with the largest revenue share of 24.6% in 2024, as aluminum engine components offer excellent strength-to-weight ratios, thermal conductivity, and corrosion resistance. Automakers are increasingly replacing cast iron with aluminum to enhance vehicle performance and fuel efficiency.

The Structural Parts segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising demand for lightweight materials in electric vehicles (EVs) and aerospace components. Advancements in precision casting and alloy development are enabling the production of stronger, lighter, and more durable structural components.

- By End-User

On the basis of end-user, the Europe Aluminum Casting Market is segmented into Automotive, Building and Construction, Industrial, Household Appliances, Aerospace, Electronic and Electrical, Engineering Tools, and Others. The Automotive segment dominated the market with a revenue share of 46.3% in 2024, supported by the region’s growing focus on vehicle weight reduction, improved fuel efficiency, and compliance with emission regulations. Aluminum casting is widely used for engine, chassis, and transmission components.

The Aerospace segment is expected to register the fastest CAGR from 2025 to 2032, driven by the increasing use of lightweight, high-strength aluminum alloys in aircraft structures and engine parts. Rising air travel demand, along with investments in next-generation aircraft manufacturing, is anticipated to further accelerate the growth of this segment.

Europe Aluminum Casting Market Regional Analysis

- Germany dominated the Europe Aluminum Casting Market with the largest revenue share of 38.5% in 2024, driven by the strong presence of automotive and aerospace manufacturing hubs in countries such as Germany, France, and Italy, alongside increasing adoption of lightweight materials to meet stringent emission and efficiency standards.

- Manufacturers in the region emphasize precision engineering, automation, and sustainability, with advanced aluminum casting technologies being utilized for the production of critical automotive engine parts, structural components, and industrial machinery.

- This widespread adoption is further supported by government initiatives promoting electric vehicle production, a well-established industrial base, and growing investments in energy-efficient and recyclable materials, positioning aluminum casting as a preferred solution for next-generation mobility and industrial applications across Europe.

Germany Aluminum Casting Market Insight

The Germany aluminum casting market captured the largest revenue share in Europe in 2024, driven by the country’s robust automotive and industrial manufacturing base. Germany’s strong focus on engineering excellence, precision manufacturing, and innovation supports widespread adoption of advanced casting techniques such as high-pressure die casting and vacuum-assisted casting. The growing demand for lightweight and fuel-efficient vehicles, combined with the country’s push toward electric mobility, is propelling the use of aluminum components in engines, chassis, and battery housings. Furthermore, Germany’s emphasis on sustainability and recycling aligns with the increasing use of secondary (recycled) aluminum in production, ensuring both cost efficiency and environmental responsibility.

France Aluminum Casting Market Insight

The France aluminum casting market is projected to expand at a steady CAGR throughout the forecast period, supported by rising demand from the automotive, aerospace, and defense industries. France’s well-established aerospace sector, led by major players such as Airbus, is a major consumer of high-performance aluminum castings for aircraft structures and engine components. The transition to electric vehicles (EVs) and the government’s initiatives promoting low-emission manufacturing are driving aluminum usage in the automotive industry. Additionally, investments in modernizing foundries and adopting automation and AI-driven quality control systems are enhancing production efficiency and casting precision across French manufacturing facilities.

U.K. Aluminum Casting Market Insight

The U.K. aluminum casting market is anticipated to grow at a notable CAGR during the forecast period, fueled by increased demand for lightweight materials in automotive, construction, and aerospace applications. With the nation’s growing focus on sustainability and emission reduction, manufacturers are replacing traditional ferrous materials with aluminum alloys that offer improved performance and recyclability. The presence of advanced engineering and R&D facilities, along with investments in high-pressure die casting and additive manufacturing, is accelerating market growth. Furthermore, the U.K.’s expanding EV manufacturing ecosystem and strong export potential for aluminum components are expected to reinforce its position as a key European aluminum casting hub.

Netherlands Aluminum Casting Market Insight

The Netherlands aluminum casting market is expected to witness healthy growth during the forecast period, driven by its advanced industrial infrastructure and commitment to sustainable manufacturing. The nation’s strategic position as a logistics and manufacturing hub in Europe facilitates the export of high-quality aluminum components to neighboring countries. Increasing investments in renewable energy, electric mobility, and industrial automation are spurring demand for precision-cast aluminum parts. Dutch manufacturers are focusing on implementing energy-efficient casting technologies, recycling initiatives, and digital foundry solutions to optimize productivity and reduce carbon emissions. The combination of technological innovation, sustainability focus, and strong supply chain integration positions the Netherlands as an emerging contributor to the regional aluminum casting market.

Europe Aluminum Casting Market Share

The Aluminum Casting industry is primarily led by well-established companies, including:

• Gränges AB (Sweden)

• Nemak (Mexico)

• Constellium (France)

• Rheinmetall Automotive (Germany)

• Sapa Group (Sweden)

• Novelis Inc. (U.S.)

• Aluminium Rheinfelden GmbH (Germany)

• Kaiser Aluminum (U.S.)

• ALCOA Corporation (U.S.)

• Aleris (U.S.)

• Novelis Europe (Germany)

• Conalcast Europe (Belgium)

• Foseco International (U.K.)

• Sidenor (Spain)

• Hydro Aluminium (Norway)

• SLM Solutions (Germany)

• Arconic Corporation (U.S.)

• Metalúrgica de Castromil (Spain)

• Alumeco (Poland)

• Aleris Rolled Products (Germany)

What are the Recent Developments in Europe Aluminum Casting Market?

- In April 2024, Constellium SE, a leading global aluminum products manufacturer headquartered in France, announced the expansion of its aluminum casting facility in Singen, Germany, to meet the growing demand for lightweight components in electric vehicles (EVs). The expansion focuses on enhancing high-pressure die-casting capacity and improving sustainability through energy-efficient furnaces. This initiative underscores Constellium’s commitment to supporting Europe’s transition toward cleaner mobility solutions while strengthening its position in the global Europe Aluminum Casting Market.

- In March 2024, Rheinmetall Automotive AG (Germany) launched a new state-of-the-art low-pressure die casting production line at its Neckarsulm plant. The new system is designed to produce complex aluminum engine and structural components for hybrid and electric vehicles with improved strength and reduced weight. This development reflects Rheinmetall’s dedication to advancing manufacturing efficiency, precision, and sustainability, reinforcing its leadership in the European aluminum casting industry.

- In February 2024, Hydro Aluminium ASA (Norway) introduced a major investment program focused on recycled aluminum casting operations at its Clervaux, Luxembourg, facility. The project aims to increase the use of post-consumer scrap and reduce carbon emissions across the production chain. This strategic investment highlights Hydro’s efforts to drive circular economy principles in metal production, aligning with Europe’s sustainability and carbon neutrality goals for 2030.

- In January 2024, Nemak S.A.B. de C.V. (Mexico/Europe operations) inaugurated an advanced aluminum casting R&D center in the Czech Republic. The center is dedicated to developing next-generation casting alloys and lightweight solutions for EV battery housings and structural parts. By integrating simulation technologies and AI-driven quality control, Nemak aims to accelerate innovation in sustainable casting and solidify its footprint within the European market.

- In December 2023, Gränges AB (Sweden) announced the completion of its foundry modernization project at its Konin, Poland, facility. The project focuses on improving energy efficiency and increasing production capacity for rolled and cast aluminum products used in automotive heat exchangers and industrial applications. This modernization reflects Gränges’ ongoing efforts to enhance performance, reduce emissions, and meet the surging demand for high-quality aluminum casting products across Europe.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Aluminum Casting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Aluminum Casting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Aluminum Casting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.