Europe And Middle East Heparin Market

Market Size in USD Billion

CAGR :

%

USD

2.58 Billion

USD

4.01 Billion

2024

2032

USD

2.58 Billion

USD

4.01 Billion

2024

2032

| 2025 –2032 | |

| USD 2.58 Billion | |

| USD 4.01 Billion | |

|

|

|

|

Europe and Middle East Heparin Market Size

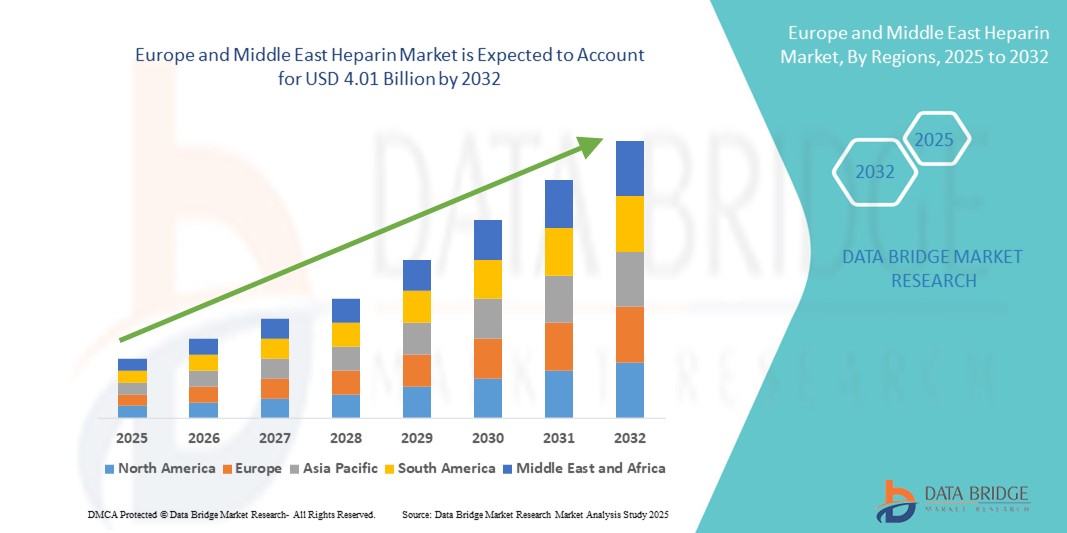

- The Europe and Middle East Heparin market size was valued at USD 2.58 billion in 2024 and is expected to reach USD 4.01 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular and thrombotic disorders, along with a rising geriatric population across Europe and the Middle East, which contributes to higher demand for anticoagulant therapies such as heparin

- Furthermore, growing awareness about venous thromboembolism (VTE) prevention, especially in hospitalized and post-operative patients, is driving the uptake of Europe and Middle East Heparin solutions, thereby significantly boosting the industry’s growth

Europe and Middle East Heparin Market Analysis

- Heparin, a widely used anticoagulant, plays a critical role in preventing and treating blood clots in various clinical settings, including surgeries, dialysis, and the treatment of venous thromboembolism and atrial fibrillation. The rising burden of cardiovascular and chronic diseases across Europe and the Middle East is significantly driving demand for heparin-based therapies

- The escalating demand for low molecular weight heparin (LMWH) and unfractionated heparin is primarily fueled by an increase in surgical procedures, expanding geriatric populations, and a growing prevalence of coagulation disorders. In addition, advancements in drug formulations and supportive government healthcare policies are accelerating market growth

- Europe dominated the Europe and Middle East heparin market with the largest revenue share of 55.55% in 2024, attributed to its well-established healthcare infrastructure, early adoption of advanced anticoagulants, and a strong presence of key pharmaceutical companies. Germany, France, and the U.K. led regional growth due to robust clinical research, favorable reimbursement policies, and increasing usage of LMWH in hospitals and ambulatory care centers

- Middle East is expected to be the fastest-growing region in the Europe and Middle East heparin market during the forecast period, driven by improving healthcare access, government initiatives to expand healthcare services, and the increasing prevalence of lifestyle diseases such as obesity and diabetes—both major contributors to thrombotic disorders

- The Low Molecular Weight Heparin (LMWH) segment dominated the Europe and Middle East heparin market with a market revenue share of 68.4% in 2024, attributed to its predictable pharmacokinetics, longer half-life, and reduced need for monitoring. LMWH is widely preferred in outpatient and long-term settings for preventing and treating thromboembolic disorders

Report Scope and Europe and Middle East Heparin Market Segmentation

|

Attributes |

Europe and Middle East Heparin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe and Middle East Heparin Market Trends

Growing Adoption of Personalized and Integrated Treatment Approaches

- A significant and accelerating trend in the Europe and Middle East heparin market is the increasing preference for personalized anticoagulant therapy combined with integrated treatment plans across hospital settings and chronic care management

- For instance, low molecular weight heparin (LMWH) formulations such as enoxaparin and dalteparin are being tailored based on patient-specific risk factors, renal function, and therapeutic needs, allowing for optimized dosing schedules and minimized bleeding risks. Major healthcare systems in Germany and the U.K. are incorporating these regimens into standardized care protocols

- Innovative delivery mechanisms—such as prefilled syringes and patient-friendly injection systems—are improving adherence, particularly in home care and outpatient settings. These innovations are especially vital for elderly populations and individuals managing long-term conditions such as deep vein thrombosis (DVT) or atrial fibrillation

- Healthcare providers across the region are also integrating heparin therapy with digital monitoring platforms that track coagulation parameters and patient responses in real-time, reducing hospital readmission rates and enhancing safety

- This movement toward individualized, tech-supported care aligns with broader EU healthcare policies encouraging better chronic disease management and patient-centric treatment models. Companies such as Leo Pharma and Pfizer are at the forefront, offering tailored heparin-based therapies supported by data-driven tools and clinical support programs

- The demand for flexible, safe, and personalized anticoagulant options continues to rise across both inpatient and outpatient settings in the Europe and Middle East region, driving innovation and adoption across the heparin segment

Europe and Middle East Heparin Market Dynamics

Driver

Growing Need Due to Rising Cardiovascular Disorders and Surgical Procedures

- The rising prevalence of cardiovascular diseases (CVDs), pulmonary embolism, and deep vein thrombosis (DVT) across Europe and the Middle East is significantly driving demand for heparin-based anticoagulants, especially in hospital and surgical care settings

- For instance, in June 2024, Sanofi announced the expansion of its heparin production facility in Frankfurt, Germany, to meet the growing demand for Low Molecular Weight Heparin (LMWH) across Europe, signaling increasing investments in domestic production capabilities

- As the number of surgeries, orthopedic procedures, and patients with atrial fibrillation increases, heparin’s role in thromboprophylaxis becomes even more essential, fueling market growth

- Furthermore, growing awareness regarding venous thromboembolism (VTE) prevention, especially among aging populations and hospitalized patients, is leading to a broader use of LMWH in both inpatient and outpatient settings

- The trend towards home-based care and self-administered LMWH injections for long-term anticoagulation is also gaining traction, supported by easy-to-use prefilled syringes and portable devices, improving patient compliance and convenience

Restraint/Challenge

Supply Chain Dependence and Risk of Contamination

- A major challenge for the Europe and Middle East heparin market is its heavy reliance on porcine-derived heparin, primarily sourced from China, making the supply chain vulnerable to geopolitical issues, pandemics, or disease outbreaks in livestock

- For instance, the African Swine Fever outbreak in China severely disrupted global heparin supply in recent years, causing price volatility and shortages across Europe and other regions

- In addition, concerns around batch contamination and product recalls have pushed regulatory bodies to tighten quality control standards. These stringent regulations can increase production costs and delay product approvals, especially for new market entrants

- Companies are addressing these concerns by investing in synthetic or biosynthetic heparin development and forming strategic partnerships to diversify raw material sourcing. For example, Bioiberica S.A.U. is exploring alternative sourcing strategies in collaboration with regional suppliers to enhance resilience

- However, the high costs associated with synthetic heparin production, coupled with slow regulatory pathways, may limit rapid scalability in the short term, posing a hurdle for broader adoption

Europe and Middle East Heparin Market Scope

The market is segmented on the basis of product type, mode of administration, packaging, source, indication, type, container type, packaging material, end user, and distribution channel.

- By Product Type

On the basis of product type, the Europe and Middle East heparin market is segmented into low molecular weight heparin (LMWH) and unfractionated heparin. The low molecular weight heparin (LMWH) segment dominated the largest market revenue share of 68.4% in 2024, attributed to its predictable pharmacokinetics, longer half-life, and reduced need for monitoring. LMWH is widely preferred in outpatient and long-term settings for preventing and treating thromboembolic disorders.

The unfractionated heparin segment is expected to witness stable demand, primarily in hospital settings requiring immediate anticoagulation. However, the LMWH segment is anticipated to witness the fastest growth rate of 6.7% from 2025 to 2032, fueled by increased adoption across both therapeutic and prophylactic indications.

- By Mode of Administration

On the basis of mode of administration, the Europe and Middle East heparin market is segmented into subcutaneous, intravenous, and others. The subcutaneous segment dominated the market with a 63.5% revenue share in 2024, attributed to its ease of self-administration, particularly in homecare and outpatient settings.

The subcutaneous route is anticipated to grow at the fastest CAGR of 7.1% from 2025 to 2032, due to the increasing preference for non-hospital-based treatment.

- By Packaging

On the basis of packaging, the Europe and Middle East heparin market is categorized into 10 Unit, 100 Unit, 1000 Unit, 5000 Unit, 10000 Unit, 25000 Unit, and others. The 5000 Unit segment captured the largest share of 28.6% in 2024, owing to its standard use in hospital dosing protocols.

The 100 Unit segment is expected to register the highest CAGR of 7.8% during the forecast period, fueled by the demand for safe, accurate, and single-use dosing formats.

- By Source

On the basis of source, the Europe and Middle East heparin market is divided into biological and synthetic heparin. The biological segment dominated with an 85.2% market share in 2024, reflecting widespread clinical use and consistent sourcing from porcine and bovine tissue.

The synthetic segment is forecasted to expand at the fastest CAGR of 9.3% from 2025 to 2032, driven by concerns over animal-derived products and increasing demand for contamination-free alternatives.

- By Indication

On the basis of indication, the Europe and Middle East heparin market is segmented into deep vein thrombosis (DVT), pulmonary embolism, peripheral artery disease, arterial thromboembolism, myocardial infarction, atrial fibrillation, and others. The DVT segment led with a 26.9% market share in 2024, primarily due to its high occurrence in post-operative and hospitalized patients.

The DVT segment is projected to sustain the highest CAGR of 6.4% through 2032, driven by the rising prevalence of sedentary lifestyles, increasing post-operative complications, and a growing elderly population—key risk factors associated with deep vein thrombosis (DVT).

- By Type

On the basis of type, the Europe and Middle East heparin market is segmented into generics and branded heparin. The generics segment commanded the largest share of 61.5% in 2024, supported by cost-efficiency, broader accessibility, and patent expirations.

Generics are expected to grow at the fastest CAGR of 6.9% during the forecast period, with healthcare providers increasingly opting for affordable options.

- By Container Type

On the basis of container type, the Europe and Middle East heparin market is segmented into vials, bottles, bags, and others. Vials dominated with a 49.6% share in 2024, due to their widespread use in hospital and surgical environments for injectable drugs.

The bags segment anticipated to expand at the fastest CAGR of 6.6% during the forecast period, owing to growing demand in infusion therapy.

- By Packaging Material

On the basis of packaging material, the Europe and Middle East heparin market is segmented by packaging material into glass and plastic. Glass packaging led with a 64.2% share in 2024, due to its chemical inertness and superior compatibility with injectable formulations.

Plastic is projected to grow at the fastest CAGR of 7.4% through 2032, especially for portable and home-use heparin products.

- By End User

On the basis of end user, the Europe and Middle East heparin market is segmented into hospitals, clinics, ambulatory surgical centers, homecare, and others. Hospitals dominated with a 46.9% share in 2024, reflecting their central role in performing surgeries, intensive care, and administering high-volume anticoagulation treatments.

The homecare segment is expected to witness the fastest CAGR of 7.9%, driven by the rising geriatric population and increasing shift toward decentralized healthcare models.

- By Distribution Channel

On the basis of distribution channel, the Europe and Middle East heparin market is segmented into hospital pharmacy, retail pharmacy & drug store, online pharmacy, and others. Hospital Pharmacy led with 54.3% market share in 2024, supported by bulk procurement and centralized hospital supply systems.

Online Pharmacy is projected to grow at the fastest CAGR of 8.5% during the forecast period, driven by expanding e-commerce platforms and consumer preference for home delivery.

Europe and Middle East Heparin Market Regional Analysis

- Europe dominated the Europe and Middle East heparin market with the largest revenue share of 55.55% in 2024, driven by the high prevalence of cardiovascular diseases, deep vein thrombosis (DVT), and pulmonary embolism, coupled with increased surgical procedures and aging populations across the region

- Countries in Europe benefit from well-established healthcare systems, strong regulatory oversight, and broad accessibility to anticoagulant therapies such as low molecular weight heparin (LMWH), resulting in higher consumption per capita compared to developing regions

- Furthermore, local manufacturing capabilities and government-backed initiatives to prevent hospital-acquired thrombosis are enhancing market penetration and driving sustained growth across hospital and outpatient settings

Germany Europe and Middle East Heparin Market Insight

The Germany heparin market accounted for the largest share in the European region in 2024, supported by robust healthcare infrastructure, extensive use of heparin in orthopedic and cardiovascular surgeries, and favorable reimbursement policies. The country is also a hub for several leading heparin manufacturers such as Sanofi and Bioiberica, which ensures consistent supply and innovation in formulation. Germany’s commitment to high-quality generics and clinical best practices further strengthens its position in the regional market.

France Europe and Middle East Heparin Market Insight

The France heparin market is projected to grow steadily, driven by increasing surgical procedures and rising incidences of chronic cardiovascular disorders. Government healthcare initiatives to improve thromboprophylaxis and stringent safety regulations are reinforcing demand for high-purity LMWH. French hospitals are also early adopters of biosimilar heparin products, which help control treatment costs while ensuring efficacy.

U.K. Europe and Middle East Heparin Market Insight

The U.K. heparin market for Heparin is anticipated to expand at a notable CAGR during the forecast period, due to a growing burden of lifestyle-related diseases such as obesity and atrial fibrillation. The National Health Service (NHS) promotes the use of anticoagulants for preventive care in stroke and DVT patients. The strong presence of contract manufacturing organizations and increasing clinical trials in the U.K. also contribute to its prominence in the regional heparin supply chain.

Middle East and Africa Heparin Market Insight

The Middle East heparin market is projected to expand at a substantial CAGR throughout the forecast period, driven by the growing burden of lifestyle-related conditions such as obesity, cardiovascular diseases, and diabetes—conditions that significantly increase the need for anticoagulation therapies. The region’s expanding healthcare infrastructure, medical tourism, and increasing public awareness around deep vein thrombosis (DVT) and pulmonary embolism are key factors fueling market growth. In addition, the increasing adoption of advanced surgical procedures and greater access to low molecular weight heparin (LMWH) products through government-funded hospitals and clinics is supporting broader market penetration.

Saudi Arabia Europe and Middle East Heparin Market Insight

Saudi Arabia is one of the largest and fastest-growing heparin markets in the Middle East, capturing a significant portion of the regional share in 2024, driven by the country’s high investment in healthcare infrastructure and public health initiatives under Vision 2030. The rising incidence of cardiovascular disease and a growing aging population have led to a surge in heparin use for both preventive and therapeutic applications. Government-run hospitals and private healthcare facilities increasingly rely on LMWH in surgical and ICU settings. Moreover, the expansion of local pharmaceutical manufacturing and partnerships with international suppliers have enhanced drug availability and reduced dependency on imports.

U.A.E. Europe and Middle East Heparin Market Insight

The United Arab Emirates (U.A.E.) held a notable share of the Middle East heparin market in 2024, supported by rapid healthcare digitization, advanced hospital infrastructure, and a strong focus on chronic disease management. The country’s emphasis on adopting international clinical guidelines, such as those related to thrombosis prevention and cardiac care, is driving demand for both injectable and biosimilar heparin products. Increased medical tourism, a high volume of elective surgeries, and strategic collaborations with global pharmaceutical firms are helping accelerate the adoption of LMWH in both public and private healthcare systems. In addition, the U.A.E. government’s proactive regulatory approvals for biosimilars have facilitated faster market entry for new heparin products, fostering competitive pricing and wider patient access.

Europe and Middle East Heparin Market Share

The Europe and Middle East Heparin industry is primarily led by well-established companies, including:

- LABORATORIOS FARMACEUTICOS ROVI SA (Spain)

- ITALFARMACO S.p.A. (Italy)

- LEO Pharma A/S (Denmark)

- Bioiberica S.A.U. (Spain)

- Hepac (U.K.)

- B. Braun SE (Germany)

- Viatris NV (U.S.)

- Dr. Reddy’s Laboratories Ltd. (India)

- Sandoz Group AG (Switzerland)

- Hikma Pharmaceuticals PLC (U.K.)

- Shenzhen Techdow Pharmaceutical Co., Ltd (China)

Latest Developments in Europe and Middle East Heparin Market

- In March 2024, Sanofi announced the expansion of its low molecular weight heparin (LMWH) production capacity at its industrial site in Le Trait, France, to meet rising demand across Europe and the Middle East. This strategic investment aims to strengthen the company’s supply resilience and cater to the increasing incidence of venous thromboembolism (VTE) in the region [Source: Sanofi Press Release]

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.