Europe Animal Nutrition Market

Market Size in USD Billion

CAGR :

%

USD

7.13 Billion

USD

11.72 Billion

2025

2033

USD

7.13 Billion

USD

11.72 Billion

2025

2033

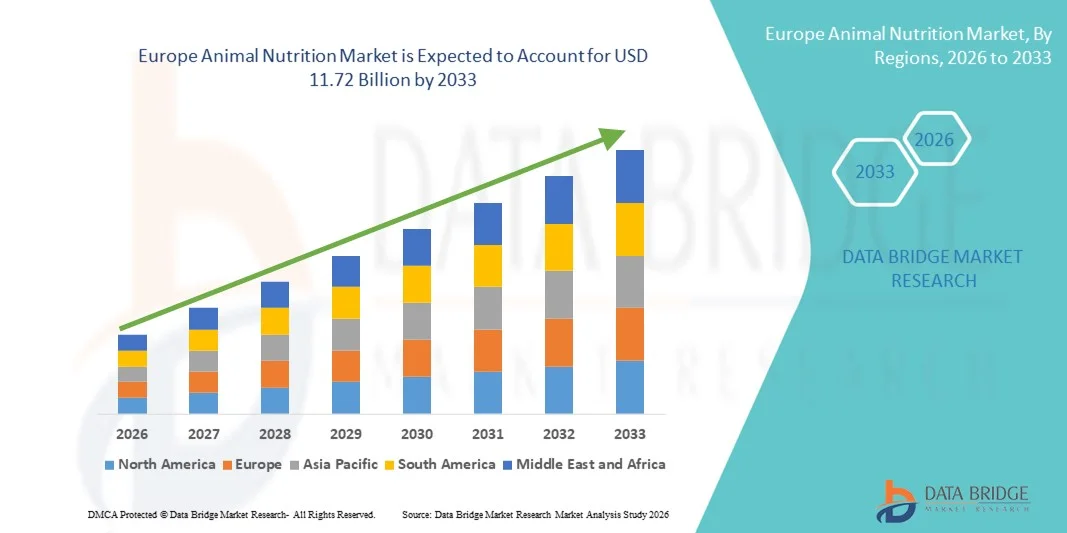

| 2026 –2033 | |

| USD 7.13 Billion | |

| USD 11.72 Billion | |

|

|

|

|

Europe Animal Nutrition Market Size

- The Europe animal nutrition market size was valued at USD 7.13 billion in 2025 and is expected to reach USD 11.72 billion by 2033, at a CAGR of 6.40% during the forecast period

- The market growth is largely fuelled by the rising demand for high-quality animal protein including meat, milk, and eggs driven by population growth and changing dietary preferences

- Increasing awareness among livestock producers regarding the benefits of balanced nutrition in improving animal health, productivity, and feed efficiency is accelerating market expansion

Europe Animal Nutrition Market Analysis

- The market is experiencing steady growth due to the increasing focus on improving livestock productivity, feed conversion efficiency, and overall animal health to meet rising food demand

- Technological advancements in feed formulation and the growing use of functional ingredients such as amino acids, vitamins, minerals, and probiotics are enhancing the effectiveness of animal nutrition products

- Germany animal nutrition market captured the largest revenue share in 2025 within Europe, driven by the country’s well-established livestock industry and strong focus on productivity and quality improvement. Livestock producers are increasingly adopting scientifically balanced feed and advanced nutrition solutions to enhance animal health and production efficiency

- U.K. is expected to witness the highest compound annual growth rate (CAGR) in the Europe animal nutrition market due to increasing focus on animal health and productivity, rising adoption of specialty feed additives, and growing demand for high-quality meat and dairy products

- The Amino Acids segment held the largest market revenue share in 2025 driven by their essential role in improving animal growth, feed efficiency, and overall productivity. Amino acids such as lysine and methionine are widely used in livestock and poultry nutrition to enhance protein synthesis and optimize feed utilization, making them a fundamental component of modern animal feed formulations

Report Scope and Europe Animal Nutrition Market Segmentation

|

Attributes |

Europe Animal Nutrition Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Animal Nutrition Market Trends

Rising Demand For High-Quality Animal Protein And Productivity Enhancement

- The increasing consumption of meat, milk, and eggs is significantly shaping the animal nutrition market, as population growth, urbanization, and income expansion drive demand for high-quality animal protein. Animal nutrition products are gaining importance due to their ability to improve animal growth, immunity, and production efficiency. This trend strengthens their adoption across commercial livestock farms, encouraging manufacturers to develop advanced and species-specific nutrition solutions that meet evolving production requirements

- Increasing awareness among livestock producers regarding the benefits of scientifically balanced feed has accelerated the demand for animal nutrition products in poultry, dairy, aquaculture, and swine production. Farmers and commercial producers are actively seeking nutrition solutions that enhance feed conversion ratios, improve animal health, and reduce mortality rates. This has also led to partnerships between feed manufacturers and livestock producers to improve productivity and profitability

- Productivity optimization and quality improvement trends are influencing purchasing decisions, with producers emphasizing efficient feed utilization, disease prevention, and performance enhancement. These factors are helping producers improve operational efficiency and meet rising food demand, while also supporting the adoption of innovative feed additives and precision nutrition strategies. Companies are increasingly investing in research and development to strengthen their market presence and address changing industry needs

- For instance, in 2024, Cargill and Archer Daniels Midland expanded their animal nutrition portfolios by introducing advanced feed additives and premix solutions for poultry and aquaculture. These launches were introduced in response to rising demand for high-efficiency nutrition products, with distribution across commercial farms and feed producers. The products were also positioned to enhance productivity and profitability, strengthening customer relationships and repeat adoption

- While demand for animal nutrition products is growing, sustained market expansion depends on continuous innovation, cost-effective production, and improving accessibility for small and medium-scale farmers. Manufacturers are also focusing on strengthening supply chains, expanding technical support, and developing customized solutions that improve performance and economic returns

Europe Animal Nutrition Market Dynamics

Driver

Expansion Of Commercial Livestock Farming And Feed Efficiency Focus

- The rapid expansion of commercial livestock farming is a major driver for the animal nutrition market. Producers are increasingly adopting advanced nutrition solutions to improve productivity, support animal health, and enhance feed efficiency. This trend is also encouraging research into innovative feed additives such as probiotics, enzymes, and amino acids, supporting product development and market growth

- Increasing demand for efficient and high-performance feed solutions across poultry, dairy, and aquaculture sectors is influencing market growth. Animal nutrition products help improve digestion, nutrient absorption, and growth rates, enabling producers to achieve higher output and profitability. The expansion of commercial farming operations further reinforces the need for reliable and scientifically formulated nutrition products

- Feed manufacturers and nutrition companies are actively promoting advanced nutrition solutions through product innovation, technical services, and farmer education programs. These efforts are supported by the growing need to improve livestock productivity and ensure food security, and they also encourage collaboration between feed producers and livestock companies to enhance production efficiency

- For instance, in 2023, DSM-Firmenich and Nutreco expanded their animal nutrition operations by introducing precision nutrition and feed additive solutions. This expansion followed rising demand for productivity-enhancing products, driving adoption among commercial livestock producers. Both companies also emphasized performance improvement and sustainability to strengthen their market position

- Although increasing livestock production supports growth, wider adoption depends on affordability, awareness, and accessibility of advanced nutrition solutions. Investment in innovation, farmer education, and efficient distribution networks will be critical for meeting demand and maintaining competitive advantage

Restraint/Challenge

Fluctuating Raw Material Prices And Limited Awareness Among Small Farmers

- Fluctuating prices of raw materials such as corn, soybean, and other feed ingredients remain a key challenge, affecting production costs and profit margins for animal nutrition manufacturers. Price volatility can impact product affordability and adoption rates, particularly among cost-sensitive livestock producers. In addition, supply chain disruptions can further affect pricing stability and availability

- Awareness and adoption remain uneven, particularly among small-scale and traditional farmers who may rely on conventional feeding practices. Limited knowledge about the benefits of balanced nutrition restricts adoption of advanced feed additives and nutrition solutions. This also slows the penetration of innovative products in developing and rural areas

- Supply chain and distribution limitations also impact market growth, as animal nutrition products require efficient logistics, storage, and technical support. Inadequate infrastructure and limited access to quality products in remote areas increase operational challenges. Companies must invest in distribution expansion, training programs, and farmer engagement initiatives to address these barriers

- For instance, in 2024, Alltech reported slower adoption of premium feed additives among some livestock producers due to higher costs and limited awareness. Distribution challenges and lack of technical knowledge were additional barriers. These factors also led some farmers to continue using traditional feed practices, affecting market penetration

- Overcoming these challenges will require stable raw material sourcing, cost optimization, and increased education initiatives for livestock producers. Collaboration with feed manufacturers, governments, and agricultural organizations can help unlock long-term growth potential. Furthermore, improving affordability, strengthening distribution networks, and enhancing awareness of productivity benefits will be essential for broader adoption of animal nutrition products

Europe Animal Nutrition Market Scope

The market is segmented on the basis of type, feed type, and end user.

- By Type

On the basis of type, the Europe animal nutrition market is segmented into Amino Acids, Enzymes, Carotenoids, Fiber, Antioxidants, Eubiotics, Lipids, Fatty Acids, Medicated Feed Additives, Minerals, Vitamins, and Others. The Amino Acids segment held the largest market revenue share in 2025 driven by their essential role in improving animal growth, feed efficiency, and overall productivity. Amino acids such as lysine and methionine are widely used in livestock and poultry nutrition to enhance protein synthesis and optimize feed utilization, making them a fundamental component of modern animal feed formulations.

The Eubiotics segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing focus on gut health, disease prevention, and antibiotic alternatives. Eubiotics such as probiotics, prebiotics, and organic acids help improve digestion, immunity, and nutrient absorption, making them highly preferred in commercial livestock production. Their growing adoption is supported by rising awareness regarding sustainable and antibiotic-free animal farming practices.

- By Feed Type

On the basis of feed type, the Europe animal nutrition market is segmented into Poultry Feed, Swine Feed, Ruminant Feed, Pet Food, and Others. The Poultry Feed segment held the largest market revenue share in 2025 driven by the high consumption of poultry meat and eggs across the region and the expansion of commercial poultry farming. Animal nutrition products are extensively used in poultry feed to improve growth performance, feed efficiency, and disease resistance, supporting higher production levels.

The Pet Food segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising pet ownership and increasing demand for premium and nutritionally balanced pet food products. Animal nutrition ingredients are increasingly used to enhance pet health, improve digestion, and support overall well-being. The growing trend of pet humanization and awareness regarding pet nutrition is further accelerating segment growth.

- By End User

On the basis of end user, the Europe animal nutrition market is segmented into Feed Manufacturers, Veterinarians, Pet Food Manufacturers, Livestock Farmers, and Others. The Feed Manufacturers segment held the largest market revenue share in 2025 driven by their central role in producing and supplying nutritionally balanced feed for livestock and poultry. Feed manufacturers widely incorporate various nutrition additives to improve feed quality, performance, and production efficiency, supporting large-scale livestock operations.

The Pet Food Manufacturers segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing demand for high-quality and functional pet food products. Pet food manufacturers are actively adopting advanced nutrition ingredients to enhance product quality, improve animal health, and meet evolving consumer expectations. The rising focus on premium pet nutrition and product innovation is further contributing to segment expansion.

Europe Animal Nutrition Market Regional Analysis

- Germany animal nutrition market captured the largest revenue share in 2025 within Europe, driven by the country’s well-established livestock industry and strong focus on productivity and quality improvement. Livestock producers are increasingly adopting scientifically balanced feed and advanced nutrition solutions to enhance animal health and production efficiency

- The presence of advanced farming practices, high awareness regarding feed optimization, and strong emphasis on food quality standards further support market growth

- Moreover, continuous innovation in feed additives and increasing demand for high-quality animal-derived food products are contributing significantly to the expansion of the animal nutrition industry

U.K. Animal Nutrition Market Insight

The U.K. animal nutrition market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of advanced feed solutions and rising focus on improving livestock productivity. Farmers are increasingly prioritizing animal health, feed efficiency, and sustainable farming practices, which is driving the demand for precision nutrition products. The growing emphasis on improving product quality and operational efficiency is further accelerating market expansion. In addition, the rising awareness regarding the benefits of balanced nutrition and increasing investments in innovative feed technologies are significantly contributing to the growth of the animal nutrition market

Europe Animal Nutrition Market Share

The Europe animal nutrition industry is primarily led by well-established companies, including:

- DSM-Firmenich (Netherlands)

- Nutreco N.V. (Netherlands)

- Adisseo (France)

- AB Agri Ltd. (U.K.)

- Anpario plc (U.K.)

- Royal Agrifirm Group (Netherlands)

- ForFarmers N.V. (Netherlands)

- De Heus Animal Nutrition (Netherlands)

- EW Nutrition (Germany)

- Vilofoss (Denmark)

- Lallemand Animal Nutrition (France)

- Lesaffre (France)

- Phileo by Lesaffre (France)

- Calysta Ltd. (U.K.)

- Biomin Holding GmbH (Austria)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.