Europe Anti Aging Skincare Ingredients Market

Market Size in USD Million

CAGR :

%

USD

415.80 Million

USD

589.05 Million

2024

2032

USD

415.80 Million

USD

589.05 Million

2024

2032

| 2025 –2032 | |

| USD 415.80 Million | |

| USD 589.05 Million | |

|

|

|

|

Europe Anti-Aging Skincare Ingredients Market Size

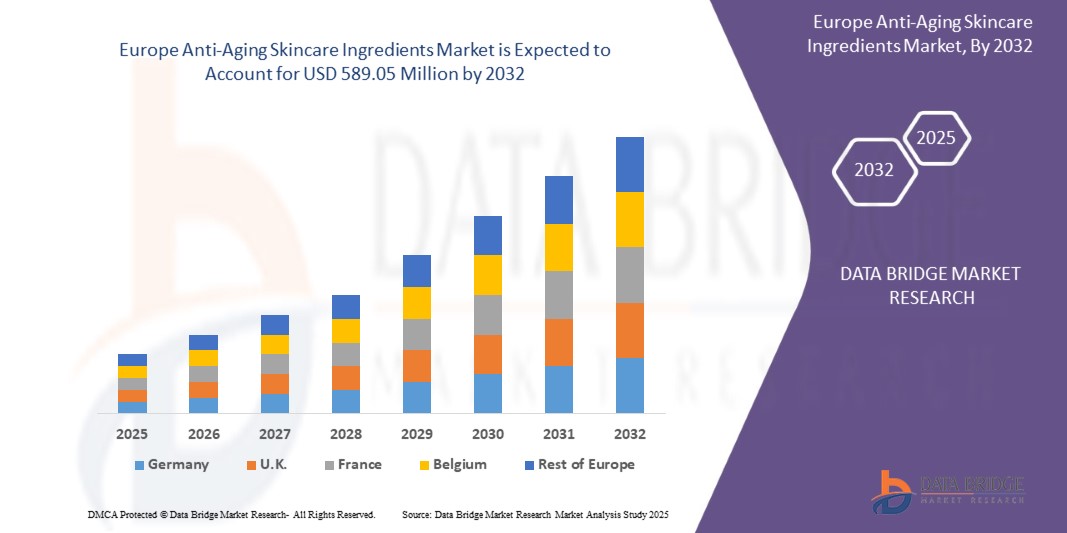

- The Europe Anti-Aging Skincare Ingredients Market size was valued at USD 415.80 million in 2024 and is expected to reach USD 589.05 million by 2032, at a CAGR of 4.45% during the forecast period

- The market growth is largely fueled by rising consumer awareness of skincare, increasing demand for preventive and anti-aging solutions, and technological innovations in bioactive and multifunctional ingredients, which are enabling more effective formulations for wrinkle reduction, skin brightening, and hydration

- Furthermore, the growing preference for natural, sustainably sourced, and ethically produced ingredients is driving the adoption of premium anti-aging formulations. These converging factors are accelerating the uptake of advanced skincare ingredients, thereby significantly boosting the industry's growth

Europe Anti-Aging Skincare Ingredients Market Analysis

- Anti-aging skincare ingredients include bioactive compounds such as retinoids, peptides, hyaluronic acid, antioxidants, and ceramides, which help reduce visible signs of aging, improve skin elasticity, and promote overall skin health. These ingredients are widely incorporated into serums, creams, masks, and sunscreens for both preventive and corrective skincare applications

- The escalating demand for anti-aging skincare ingredients is primarily fueled by a growing aging population, increasing disposable incomes, rising consumer focus on personal care, and expanding penetration of premium skincare products in both developed and emerging markets. Rising digital engagement and e-commerce adoption are further enhancing product accessibility and market growth

- Germany dominated Europe Anti-Aging Skincare Ingredients Market in 2024, due to its well-established cosmetic and personal care industry, advanced R&D infrastructure, and high adoption of premium and science-backed skincare products

- U.K. is expected to be the fastest growing country in the Europe Anti-Aging Skincare Ingredients Market during the forecast period due to rapid adoption of premium and multifunctional skincare products

- Antioxidants segment dominated the market with a market share of 34.2% in 2024, due to their proven ability to neutralize free radicals, protect against oxidative stress, and slow visible signs of aging such as wrinkles and fine lines. Antioxidants such as vitamin C, vitamin E, green tea extract, and coenzyme Q10 are widely incorporated across serums, creams, and sunscreens, making them highly versatile in product formulations. Their multifunctional role in brightening skin, enhancing collagen stability, and providing protection against environmental aggressors such as UV radiation and pollution has cemented their position as a cornerstone in anti-aging skincare

Report Scope and Europe Anti-Aging Skincare Ingredients Market Segmentation

|

Attributes |

Europe Anti-Aging Skincare Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Anti-Aging Skincare Ingredients Market Trends

Shifting Preference Towards Natural and Organic Products

- The Europe Anti-Aging Skincare Ingredients Market is undergoing a transformation as consumers prioritize natural and organic compounds, seeking safer alternatives to synthetic chemicals. This preference is opening new growth paths and driving product innovation in both mass and premium segments

- For instance, brands such as Shiseido and Lady Green have launched organic anti-aging serums and face creams featuring bio-fermented botanicals and plant actives. Such launches are gaining traction among millennials and health-conscious consumers looking for ethical and sustainable skincare solutions

- Technological advancements in ingredient delivery systems are elevating efficacy and consumer trust. Companies are using encapsulation, microfluidics, and biotechnology to make natural anti-aging actives such as hyaluronic acid and peptides more bioavailable and potent in topical applications

- Demand for ingredient transparency and safe formulations is rising, with customers turning to clean-label and vegan-certified products. Sustainability and ethical sourcing claims are important purchase drivers, affecting how brands position their anti-aging ingredient offerings globally

- Customized beauty regimes using natural anti-aging ingredients are becoming prevalent. Consumers seek targeted solutions for specific concerns such as wrinkles, pigmentation, or loss of elasticity, requiring brands to offer tailored blends and holistic skincare kits

- Multifunctional and minimalist anti-aging products using high-quality natural ingredients have gained appeal. Brands market them as efficient solutions for a busy lifestyle and reduced exposure to unnecessary additives, echoing trends in overall wellness and self-care

Europe Anti-Aging Skincare Ingredients Market Dynamics

Driver

Innovative Product Branding and Advertising Activities

- Effective branding and advertising activities are amplifying market growth by making anti-aging skincare ingredients quickly recognizable, enhancing consumer engagement, and reinforcing loyalty in a competitive landscape. Brands leverage design, social media, and immersive experiences to differentiate their offerings

- For instance, DSM and major beauty players have utilized influencer partnerships and targeted online campaigns to highlight the clinically proven anti-aging benefits of natural ingredients such as peptides and antioxidants. Their data-driven branding approaches broaden reach and accelerate sales conversion in core markets

- Advanced digital technologies enable brands to interact directly with consumers, strengthening awareness and trial of innovative skincare. Virtual try-ons, AI-generated personalization, and integrated omni-channel advertising are shaping preferences for new ingredient launches in a dynamic global market

- Continuous product innovation is sustaining consumer excitement, as brands introduce anti-aging ingredient stories focused on efficacy, science, and wellness. Strategic campaigns position these products as essentials within multi-step skincare routines and holistic health regimens across all age groups

- Social media engagement and customer feedback loops help brands rapidly adapt offerings. Companies optimize branding and messaging to address evolving consumer priorities, creating a responsive market environment that drives sustained demand and market expansion

Restraint/Challenge

Increasing Side Effects of Some Skincare Ingredients

- The side effects linked with some anti-aging ingredients present a persistent challenge, impacting consumer trust and regulatory oversight. Reports of allergic reactions, rashes, and skin sensitivity from synthetic additives or counterfeit products undermine confidence in conventional anti-aging solutions

- For instance, growing awareness about parabens, sulfates, and artificial fragrances has led to product recalls and restrictions in several countries. This scrutiny compels manufacturers to rethink formulations and comply with ever-evolving safety regulations, adding complexity to market operations

- Lengthy product approval processes and rigorous testing requirements slow down the introduction of new ingredients. Regulatory frameworks, particularly in Europe and North America, require exhaustive trials to verify safety and efficacy, delaying launches and raising development costs for suppliers

- Counterfeit and low-quality products exacerbate market challenges, as widespread availability and competitive pricing lure consumers towards unsafe alternatives. These issues prompt increased industry investment in authenticity, tracking, and consumer education campaigns

- The rising demand for organic and natural solutions, driven by side effect concerns, increases pressure on ingredient supply chains. Brands must ensure consistency, traceability, and safety while navigating cost fluctuations and scalability issues for botanical extracts and natural actives

Europe Anti-Aging Skincare Ingredients Market Scope

The market is segmented on the basis of product, form, function, application, and end use.

• By Product

On the basis of product, the Europe Anti-Aging Skincare Ingredients Market is segmented into retinoid, hyaluronic acid, antioxidants, peptides, niacinamide (Vitamin B3), alpha hydroxy acids (AHAs), ceramides, zinc oxide & titanium dioxide, beta hydroxy acid (BHA), coenzyme Q10 (ubiquinone), green tea extract, alpha lipoic acid, caffeine, bakuchiol, squalane, kojic acid, alpha-arbutin, soy isoflavones, and others. The antioxidants segment dominated the largest market revenue share of 34.2% in 2024, attributed to their proven ability to neutralize free radicals, protect against oxidative stress, and slow visible signs of aging such as wrinkles and fine lines. Antioxidants such as vitamin C, vitamin E, green tea extract, and coenzyme Q10 are widely incorporated across serums, creams, and sunscreens, making them highly versatile in product formulations. Their multifunctional role in brightening skin, enhancing collagen stability, and providing protection against environmental aggressors such as UV radiation and pollution has cemented their position as a cornerstone in anti-aging skincare.

The hyaluronic acid segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising consumer demand for hydration-driven anti-aging solutions. Hyaluronic acid is widely valued for its moisture-retaining properties, which improve skin elasticity and reduce wrinkle appearance. Its inclusion across serums, sheet masks, and moisturizers aligns with the clean-label trend, as it is naturally occurring in the body and well-tolerated by all skin types. The growing appeal of non-invasive hydration treatments and its expanding use in dermal filler formulations further strengthen its rapid adoption.

• By Form

On the basis of form, the market is segmented into powder, liquid, and granular. The liquid segment dominated the largest market revenue share in 2024, primarily due to its high applicability in serums, moisturizers, and creams. Liquids allow for better ingredient solubility, faster skin absorption, and easy formulation into multi-functional anti-aging products. This makes them the preferred choice among manufacturers seeking to combine multiple active ingredients such as antioxidants, peptides, and retinoids into a single formulation.

The powder segment is anticipated to witness the fastest CAGR from 2025 to 2032, as brands increasingly turn toward powdered ingredients for stability and longer shelf life. Powders allow end-users to mix products before application, preserving potency and reducing the need for preservatives. The format is also gaining popularity in DIY skincare, minimalist beauty routines, and sustainable packaging, aligning well with eco-conscious consumer trends.

• By Function

On the basis of function, the market is segmented into moisturizing, collagen boosting, sun protection, exfoliation, skin brightening, anti-inflammatory, skin repair, and others. The moisturizing segment held the largest market share in 2024, as hydration remains the most sought-after benefit in anti-aging skincare. Moisturizing ingredients such as hyaluronic acid, ceramides, and squalane enhance skin barrier function, making them staples in virtually all anti-aging formulations. The segment benefits from its universal application across age groups, skin types, and climates, strengthening its long-term dominance.

The collagen boosting segment is projected to grow at the fastest rate from 2025 to 2032, supported by rising demand for firmer, youthful-looking skin. Ingredients such as peptides, retinoids, and vitamin C are increasingly used in anti-aging formulations for their ability to stimulate collagen synthesis and reduce visible signs of aging. The growing interest in early-age preventive skincare, combined with scientific innovations in peptide technology, is fueling accelerated adoption.

• By Application

On the basis of application, the market is segmented into anti-wrinkle, anti-pigmentation, anti-oxidation, dermal fillers, and others. The anti-wrinkle segment dominated the largest market revenue share in 2024, owing to its position as the primary concern driving consumer demand in the anti-aging sector. With ingredients such as retinoids, peptides, and hyaluronic acid directly addressing wrinkle reduction, this category receives strong investment in product development and clinical claims. The prevalence of aging populations in developed markets further consolidates its dominance.

The anti-pigmentation segment is forecasted to record the fastest growth from 2025 to 2032, driven by growing consumer awareness of hyperpigmentation, uneven tone, and sun-induced spots. Ingredients such as niacinamide, kojic acid, and alpha-arbutin are witnessing high adoption in brightening and anti-spot formulations. The trend is reinforced by rising demand in Asia-Pacific markets, where skin tone evenness is a major beauty priority, and in Western markets where sun damage correction is increasingly emphasized.

• By End Use

On the basis of end use, the market is segmented into serum, moisturizer, cleanser, eye cream, face oil, mask, toner, and others. The serum segment held the largest market revenue share in 2024, as serums provide concentrated delivery of active anti-aging ingredients. Their lightweight formulation and deep skin penetration make them highly effective for wrinkle reduction, brightening, and hydration, which resonates strongly with both premium and mass-market consumers. Rising consumer preference for multi-functional serums containing blends of antioxidants, peptides, and hydration boosters further solidifies this segment’s leadership.

The eye cream segment is expected to experience the fastest growth from 2025 to 2032, reflecting the increasing awareness of early signs of aging that often appear around the delicate eye area. Eye creams are formulated with targeted ingredients such as caffeine, peptides, and hyaluronic acid to address puffiness, fine lines, and dark circles. Rising demand among younger demographics for preventive solutions and growing innovations in sensitive skin-friendly formulations are propelling its growth trajectory.

Europe Anti-Aging Skincare Ingredients Market Regional Analysis

- Germany dominated the Europe Anti-Aging Skincare Ingredients Market with the largest revenue share in 2024, driven by its well-established cosmetic and personal care industry, advanced R&D infrastructure, and high adoption of premium and science-backed skincare products

- The country’s leadership is reinforced by strong consumer demand for anti-aging solutions, stringent product safety and regulatory standards, and well-developed supply chains for high-quality ingredients such as retinoids, peptides, hyaluronic acid, and antioxidants

- Germany’s position is further strengthened by ongoing investments in innovative formulations, rising consumer focus on natural and multifunctional ingredients, and continuous expansion of dermatologically tested and efficacy-driven products

U.K. Europe Anti-Aging Skincare Ingredients Market Insight

The U.K. market is projected to register the fastest CAGR in Europe during 2025–2032, driven by rapid adoption of premium and multifunctional skincare products. Growing awareness of anti-aging routines, consumer preference for ethical, natural, and cruelty-free ingredients, and strong e-commerce penetration are accelerating demand. Retail expansion and collaborations between dermatologists and cosmetic brands are fueling market growth, while investment in high-quality formulations ensures continued consumer trust and adoption.

France Europe Anti-Aging Skincare Ingredients Market Insight

France is expected to grow steadily during 2025–2032, supported by a strong tradition of premium and luxury skincare, increasing consumer focus on natural and sustainable ingredients, and regulatory emphasis on product safety and transparency. Growing interest in multifunctional formulations and innovative bioactive compounds is reshaping market demand. Investments in localized supply chains, R&D for novel anti-aging ingredients, and the promotion of high-quality, science-backed skincare further support market expansion.

Europe Anti-Aging Skincare Ingredients Market Share

The anti-aging skincare ingredients industry is primarily led by well-established companies, including:

- ADEKA CORPORATION (Japan)

- Beiersdorf AG (Germany)

- Croda International Plc (U.K.)

- BASF SE (Germany)

- Wacker Chemie AG (Germany)

- Lonza (Switzerland)

- CLARIANT (Switzerland)

- Evonik Industries AG (Germany)

- DSM (Netherlands)

- Kao Corporation (Japan)

- BioThrive Sciences (U.S.)

- Contipro a.s (Czech Republic)

Latest Developments in Europe Anti-Aging Skincare Ingredients Market

- In February 2025, Estée Lauder Companies (ELC) collaborated with Serpin Pharma to develop innovative anti-aging skincare ingredients focused on longevity. This partnership leverages Serpin Pharma’s expertise in anti-inflammatory research, particularly Serine Protease Inhibitors, which help the body repair inflamed cells. The collaboration is expected to strengthen ELC’s portfolio in advanced skincare solutions, enhancing product efficacy and attracting consumers seeking long-lasting, science-backed anti-aging benefits

- In February 2025, NIVEA MEN introduced the Age Defense skincare line, targeting common signs of aging such as wrinkles, dryness, rough texture, dullness, and loss of firmness. The range incorporates key ingredients such as Thiamidol and Hyaluronic Acid to deliver visible results while maintaining a simple routine. The launch, including advanced serums, eye creams, and a daily moisturizer with SPF 30, is likely to expand the brand’s market share by appealing to male consumers seeking comprehensive yet convenient anti-aging solutions

- In January 2025, Croda International announced the launch of LongevityActive, a bioactive ingredient designed to combat cellular aging and oxidative stress. The ingredient promotes skin repair and enhances natural antioxidant defenses, supporting formulation of advanced serums and moisturizers. This launch is expected to drive product differentiation and adoption among premium skincare brands focused on efficacy-driven anti-aging solutions

- In September 2023, BASF expanded its production footprint in the Asia-Pacific region with Uvinul A Plus, one of the few photostable UVA filters available that protects against harmful UVA rays, free radicals, and skin damage. The product’s oil-soluble granule form offers formulation flexibility, high efficiency at low concentrations, and preservative-free benefits, supporting long-lasting sun care and anti-aging products. This expansion is expected to strengthen BASF’s market position in the rapidly growing Asia-Pacific skincare sector

- In March 2023, DSM broadened its PARSOL portfolio with the launch of PARSOL® DHHB, a versatile UVA filter suitable for multifunctional skincare products. Its excellent solubility and wide formulation compatibility enable the creation of sunscreens, facial care, and color cosmetics with adequate UVA protection and high eco-class ratings. The innovation provides formulators with flexibility to meet growing consumer demand for sustainable, multifunctional, and high-performance anti-aging skincare products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.