Europe Anti Money Laundering Market

Market Size in USD Billion

CAGR :

%

USD

1.71 Billion

USD

5.46 Billion

2024

2032

USD

1.71 Billion

USD

5.46 Billion

2024

2032

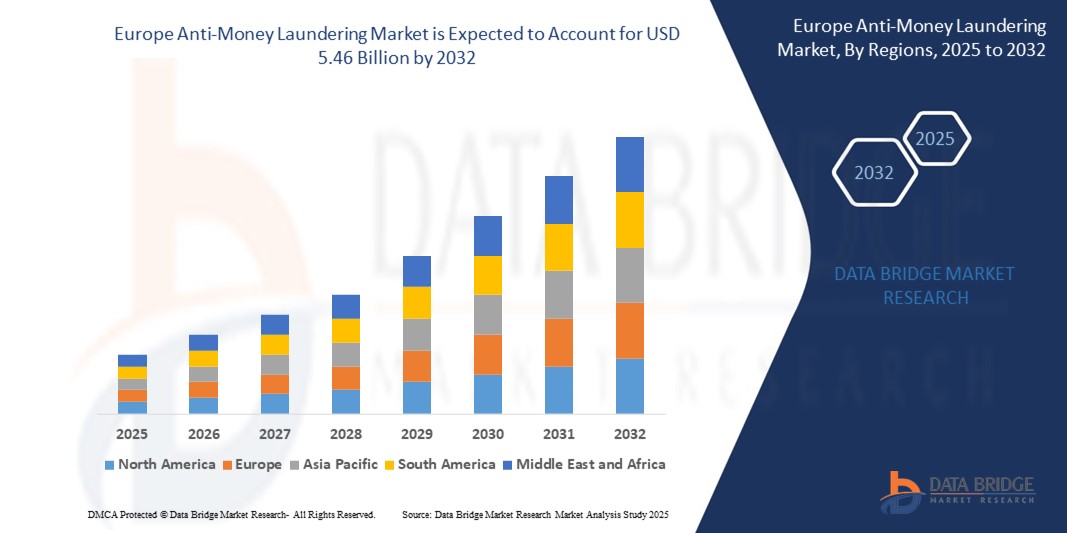

| 2025 –2032 | |

| USD 1.71 Billion | |

| USD 5.46 Billion | |

|

|

|

|

Anti-Money Laundering Market Size

- The Europe anti-money laundering market size was valued at USD 1.71 billion in 2024 and is expected to reach USD 5.46 billion by 2032, at a CAGR of 15.6% during the forecast period

- The market growth is primarily driven by stringent regulatory frameworks, increasing financial crimes, and the adoption of advanced technologies such as AI and machine learning for enhanced detection and compliance

- Rising demand for automated and integrated solutions to combat money laundering and terrorist financing, coupled with growing digitalization in financial services, is accelerating the adoption of anti-money laundering (AML) systems across various sectors

Anti-Money Laundering Market Analysis

- Anti-money laundering solutions, encompassing software and services for detecting and preventing illicit financial activities, are critical for compliance with regulatory mandates and safeguarding financial systems in Europe

- The demand for anti-money laundering solutions is fueled by increasing regulatory scrutiny, the rise in sophisticated financial crimes, and the need for real-time transaction monitoring and customer due diligence

- The U.K. dominated the Europe anti-money laundering market with the largest revenue share of 38.5% in 2024, driven by its robust financial sector, stringent anti-money laundering regulations, and the presence of major market players

- Germany is expected to be the fastest-growing country in the Europe anti-money laundering market during the forecast period, propelled by rapid digital transformation in banking, increasing investments in fintech, and supportive government policies

- The solutions segment held the largest market revenue share of 60.2% in 2024, driven by the increasing demand for advanced anti-money laundering software that enables real-time transaction monitoring, compliance management, and customer identity verification

Report Scope and Anti-Money Laundering Market Segmentation

|

Attributes |

Anti-Money Laundering Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Anti-Money Laundering Market Trends

“Increasing Integration of AI and Machine Learning Technologies”

- The Europe Anti-Money Laundering (AML) market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and Machine Learning (ML) technologies

- These technologies enable advanced data processing and analysis, providing deeper insights into financial transactions, customer behavior, and potential money laundering patterns

- AI-powered anti-money laundering solutions facilitate proactive identification of suspicious activities, enabling financial institutions to detect financial crimes such as terrorist financing, fraud, and money laundering before they escalate

- For instance, companies such as ThetaRay are developing AI-driven platforms that analyze transactional patterns to enhance screening accuracy and optimize compliance processes, reducing false positives and improving efficiency

- This trend is strengthening the value proposition of anti-money laundering systems, making them more appealing to banks, insurance providers, and other regulated entities

- AI algorithms can analyze vast datasets, including transaction histories, customer profiles, and cross-border activities, to identify complex patterns indicative of financial crime

Anti-Money Laundering Market Dynamics

Driver

“Rising Demand for Regulatory Compliance and Financial Crime Prevention”

- The increasing regulatory scrutiny and demand for robust compliance frameworks, driven by directives such as the EU’s 6th Anti-Money Laundering Directive (6AMLD), are major drivers for the Europe AML market

- Anti-money laundering systems enhance financial security by providing features such as real-time transaction monitoring, Know Your Customer (KYC) verification, and automated suspicious activity reporting

- Government mandates, particularly in the U.K., which dominates the market, are pushing financial institutions to adopt advanced anti-money laundering solutions to meet stringent compliance requirements

- The proliferation of digital banking, cryptocurrencies, and cross-border transactions, supported by advancements in cloud computing and 5G technology, is expanding anti-money laundering applications, enabling faster data processing and real-time risk detection

- Financial institutions are increasingly adopting anti-money laundering systems as standard solutions to meet regulatory expectations and enhance operational integrity

Restraint/Challenge

“High Implementation Costs and Data Privacy Concerns”

- The substantial initial investment required for anti-money laundering software, hardware, and integration poses a significant barrier to adoption, particularly for small and medium enterprises (SMEs) in emerging European markets

- Integrating anti-money laundering systems into existing financial infrastructures can be complex and costly, requiring specialized expertise and resources

- Data security and privacy concerns are major challenges, as anti-money laundering systems collect and process vast amounts of sensitive customer and transactional data, raising risks of breaches or misuse

- The fragmented regulatory landscape across Europe, with varying data protection laws such as GDPR, complicates compliance for international providers and financial institutions

- These factors can deter adoption, particularly in regions such as Germany, the fastest-growing market, where cost sensitivity and heightened awareness of data privacy may limit market expansion

Anti-Money Laundering market Scope

The market is segmented on the basis of offering, function, deployment, enterprise size, and end use.

- By Offering

On the basis of offering, the Europe anti-money laundering market is segmented into solutions and services. The solutions segment held the largest market revenue share of 60.2% in 2024, driven by the increasing demand for advanced anti-money laundering software that enables real-time transaction monitoring, compliance management, and customer identity verification. These solutions leverage AI and machine learning to enhance detection of financial crimes such as money laundering and terrorist financing.

The services segment is expected to witness the fastest growth rate of 15.8% from 2025 to 2032, driven by the rising need for expert guidance and managed services to navigate complex anti-money laundering regulations. Financial institutions are increasingly outsourcing compliance tasks to ensure cost-effective regulatory adherence and reduce operational risks.

- By Function

On the basis of function, the Europe anti-money laundering market is segmented into compliance management, customer identity management, transaction monitoring, currency transaction reporting, and others. The compliance management segment dominated the market with a 32.6% revenue share in 2024, owing to stringent regulations and the need for financial institutions to strengthen their anti-money laundering frameworks to avoid penalties and ensure regulatory compliance.

The transaction monitoring segment is anticipated to experience the fastest growth rate of 16.4% from 2025 to 2032, driven by the increasing adoption of AI-driven systems that enhance the detection of suspicious transactions and reduce false positives, improving efficiency in combating financial crimes.

- By Deployment

On the basis of deployment, the Europe anti-money laundering market is segmented into cloud and on-premise. The cloud segment held the largest market revenue share of 54.4% in 2024, attributed to its flexibility, scalability, and cost-effectiveness, enabling financial institutions to integrate advanced technologies such as AI and real-time analytics without significant infrastructure investments.

The on-premise segment is expected to witness significant growth from 2025 to 2032, driven by organizations prioritizing control and security over their compliance systems. On-premise solutions offer customization and integration with existing IT infrastructure, which is crucial for large enterprises with complex regulatory needs.

- By Enterprise Size

On the basis of enterprise size, the Europe anti-money laundering market is segmented into large enterprises and small & medium enterprises (SMEs). The large enterprises segment dominated the market with a 56.8% revenue share in 2024, driven by their focus on digital payment systems and the need for robust anti-money laundering solutions to address transaction monitoring and compliance requirements in high-volume financial operations.

The SMEs segment is anticipated to grow rapidly at a CAGR of 17.2% from 2025 to 2032, fueled by increasing awareness of anti-money laundering regulations and the adoption of cost-effective cloud-based solutions that cater to smaller organizations with limited resources.

- By End Use

On the basis of end use, the Europe anti-money laundering market is segmented into banks & financial institutions, insurance providers, government, gaming & gambling, and others. The banks & financial institutions segment held the largest market revenue share of 45.3% in 2024, driven by the critical need for anti-money laundering solutions to combat financial crimes such as fraud, terrorist financing, and money laundering in the banking sector.

The gaming & gambling segment is expected to witness the fastest growth rate of 18.1% from 2025 to 2032, fueled by the rising adoption of anti-money laundering solutions to monitor high-risk transactions and ensure compliance with regulations, particularly in online gambling platforms where illicit financial flows are a concern.

Anti-Money Laundering Market Regional Analysis

- The U.K. dominated the Europe anti-money laundering market with the largest revenue share of 38.5% in 2024, driven by its robust financial sector, stringent anti-money laundering regulations, and the presence of major market players

- The trend towards enhanced compliance and increasing regulations promoting stricter financial monitoring standards further boost market expansion. The integration of advanced AML technologies in both banking institutions and government bodies complements the growing demand for comprehensive compliance solutions, creating a robust market ecosystem

Germany Anti-Money Laundering Market Insight

Germany is expected to witness the fastest growth rate in the Europe anti-money laundering market, attributed to its advanced financial sector and high focus on regulatory compliance and financial security. German financial institutions prefer technologically advanced AML solutions, such as AI-powered transaction monitoring and cloud-based platforms, that enhance detection of suspicious activities and contribute to operational efficiency. The integration of these solutions in premium financial institutions and aftermarket services supports sustained market growth.

Anti-Money Laundering Market Share

The anti-money laundering industry is primarily led by well-established companies, including:

- NICE (Israel)

- IBM (U.S.)

- sanctions.io (U.S.)

- Intel Corporation (U.S.)

- Oracle (U.S.)

- SAP SE (Germany)

- Accenture (U.S.)

- Experian Information Solution

- Inc. (Ireland)

- Open Text Corporation (Canada)

- BAE Systems (U.K.)

- SAS Institute Inc (U.S.)

- ACI Worldwide (U.S.)

- Cognizant (U.S.)

- Trulioo (Canada)

- Temenos Headquarters SA (Switzerland)

- WorkFusion, Inc, (U.S.)

- Vixio Regulatory Intelligence (England)

What are the Recent Developments in Europe Anti-Money Laundering Market?

- In May 2025, the European Union formally established the Anti-Money Laundering Authority (AMLA), marking a pivotal shift toward centralized AML/CFT supervision across the bloc. Created under Regulation (EU) 2024/1620, AMLA aims to harmonize enforcement, reduce fragmentation, and strengthen oversight of high-risk financial institutions operating in at least six Member States. While AMLA began operations in summer 2025, full implementation—including the replacement of previous AML directives—is scheduled for July 2029. Headquartered in Frankfurt, AMLA will directly supervise select entities from 2028, coordinate national authorities, and lead cross-border investigations, setting a new benchmark for EU-wide financial integrity

- In April 2025, FIS announced the acquisition of Global Payments’ Issuer Solutions business for an enterprise value of $13.5 billion, reinforcing its role as a globally scaled fintech leader. Issuer Solutions processes over 40 billion transactions annually across 75+ countries, offering advanced credit processing, fraud detection, and loyalty services. This strategic move complements FIS’s existing debit processing capabilities and expands its reach among large financial institutions, enhancing its ability to support AML compliance through integrated transaction monitoring and risk analytics. The acquisition also unlocks in EBITDA synergies and is expected to be accretive to adjusted EPS and free cash flow within the first year

- In February 2025, LexisNexis Risk Solutions, a subsidiary of RELX, completed its acquisition of IDVerse™, an AI-powered document authentication and fraud detection provider. IDVerse’s proprietary technology uses deep neural networks and biometric algorithms to verify over 16,000 types of identity documents globally, detect deepfakes, and perform liveness checks. The solution is being integrated into LexisNexis’s RiskNarrative®, IDU®, and Dynamic Decision Platform®, enhancing fraud prevention and identity verification capabilities across Europe and beyond. This strategic move underscores the growing reliance on AI-driven identity tools to support AML compliance, financial inclusion, and risk management in regulated industries

- In December 2024, the European Banking Authority (EBA) advanced its work on Regulatory Technical Standards (RTS) under the new EU Anti-Money Laundering (AML) framework, supporting the transition to centralized supervision via AMLA. These RTS aim to clarify obligations for multinational financial groups, including parent entity identification, cross-border information sharing, and compliance protocols. The initiative is part of a broader effort to harmonize AML/CFT practices across Member States, reduce fragmentation, and ensure consistent enforcement. These standards will underpin the EU’s evolving AML regime and guide institutions ahead of AMLA’s full operational rollout

- In April 2024, the European Parliament adopted the new Anti-Money Laundering (AML) Package, concluding five years of legislative work to strengthen financial integrity across the EU. Key reforms include mandatory beneficial ownership registration for foreign companies and trusts owning EU real estate since 2014, a cap for commercial transactions, and enhanced due diligence for luxury goods purchases.The package also expands AML obligations to crypto service providers, football clubs, and crowdfunding platforms, and establishes the EU Anti-Money Laundering Authority (AMLA) for centralized supervision

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.