Europe Anti Snoring Devices And Snoring Surgery Market

Market Size in USD Billion

CAGR :

%

USD

781.46 Billion

USD

1,551.40 Billion

2025

2033

USD

781.46 Billion

USD

1,551.40 Billion

2025

2033

| 2026 –2033 | |

| USD 781.46 Billion | |

| USD 1,551.40 Billion | |

|

|

|

|

Europe Anti-Snoring Devices and Snoring Surgery Market Size

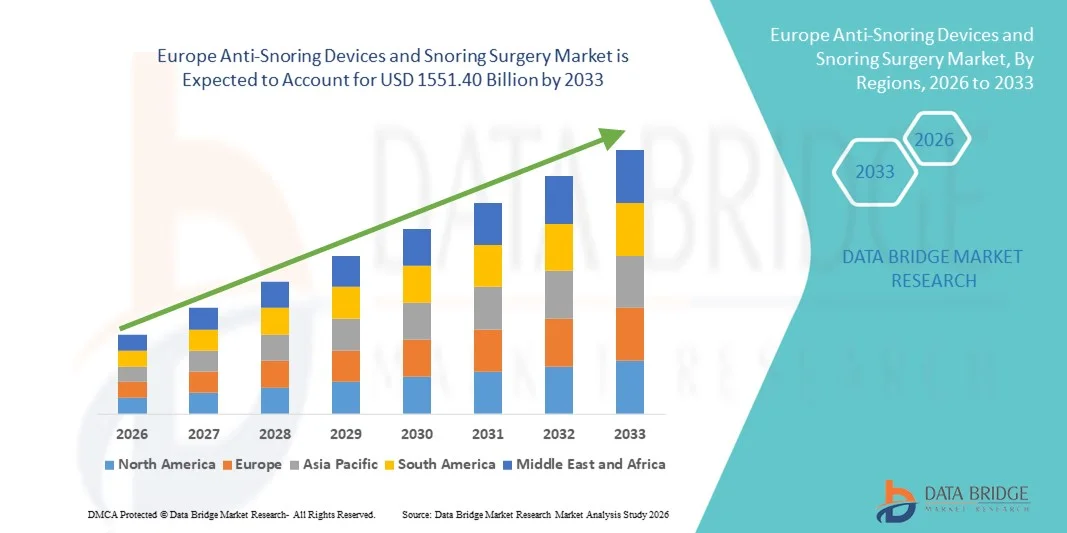

- The Europe Anti-Snoring Devices and Snoring Surgery market size was valued at USD 781.46 billion in 2025 and is expected to reach USD 1551.40 billion by 2033, at a CAGR of 8.95% during the forecast period

- The market growth is largely fueled by the increasing prevalence of sleep disorders, rising awareness about the health risks associated with snoring, and the growing adoption of home-based sleep monitoring and therapy solutions

- Furthermore, advancements in medical devices, minimally invasive snoring surgeries, and the rising preference for non-invasive, user-friendly anti-snoring devices are driving demand, thereby significantly boosting the growth of the Anti-Snoring Devices and Snoring Surgery market

Europe Anti-Snoring Devices and Snoring Surgery Market Analysis

- Anti-snoring devices, including mandibular advancement devices, nasal dilators, and tongue-retaining devices, along with minimally invasive snoring surgeries, are increasingly adopted to improve sleep quality, reduce health risks associated with sleep apnea, and enhance overall patient well-being

- The growing prevalence of sleep-disordered breathing, rising awareness about snoring-related health complications, and demand for non-invasive home therapies are driving the market growth, while technological advancements in surgical procedures and device comfort are further accelerating adoption

- The U.K. dominated the anti-snoring devices and snoring surgery market with the largest revenue share of approximately 36.8% in 2025, supported by advanced healthcare infrastructure, high disposable incomes, and increasing patient preference for minimally invasive therapies

- Germany is expected to be the fastest growing region in the anti-snoring devices and snoring surgery market during the forecast period, contributing around 22.5% of the market revenue, fueled by rising awareness of sleep disorders, expansion of home healthcare solutions, and government initiatives promoting sleep health

- The oral appliances segment dominated the largest market revenue share of 41.8% in 2025, driven by their widespread adoption in treating mild to moderate obstructive sleep apnea and habitual snoring

Report Scope and Anti-Snoring Devices and Snoring Surgery Market Segmentation

|

Attributes |

Anti-Snoring Devices and Snoring Surgery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Anti-Snoring Devices and Snoring Surgery Market Trends

Advancements in Minimally Invasive and Personalized Therapies

- A major trend in the Europe Anti‑Snoring Devices and Snoring Surgery market is the increasing adoption of minimally invasive treatment modalities and personalized therapy solutions, aimed at improving patient comfort, reducing recovery times, and enhancing clinical outcomes

- For instance, in November 2023, European Society of Otorhinolaryngology – Head and Neck Surgery highlighted outcomes from multicenter studies showing enhanced patient satisfaction and reduced postoperative discomfort following radiofrequency tissue reduction (RFTR) procedures for snoring. These findings support the shift toward less invasive surgical interventions

- Custom‑fitted oral appliances, developed using digital imaging and 3D modeling technologies, are gaining traction as first‑line interventions for mild to moderate snoring, improving patient adherence and efficacy

- Patient‑centric approaches that combine diagnostic sleep assessments with tailor‑made devices are enhancing clinical precision and personalized care planning

- Collaboration between sleep clinics, dental specialists, and otolaryngologists is fostering growth in integrated care pathways that improve long‑term management of snoring and sleep apnea symptoms

- Expanded distribution through online and specialty retail channels is also broadening access to innovative device solutions across Europe

Europe Anti-Snoring Devices and Snoring Surgery Market Dynamics

Driver

Rising Prevalence of Sleep Disorders and Associated Health Risks

- The increasing incidence of snoring and related sleep disorders—especially obstructive sleep apnea (OSA)—is driving demand for both device‑based and surgical treatment options in Europe, as clinicians and patients seek to reduce the associated health risks such as hypertension and cardiovascular complications

- For instance, in February 2024, data presented by European Respiratory Society at its annual congress showed that an estimated 1 in 5 adults in Western Europe experiences moderate to severe snoring or sleep apnea symptoms, prompting healthcare providers to expand screening and treatment efforts

- In response, sleep clinics and outpatient facilities are increasing their capacity to diagnose and treat snoring, encouraging broader uptake of both non‑invasive devices and minimally invasive surgical procedures

- Rising public awareness campaigns about sleep health and the links between snoring, daytime fatigue, and long‑term metabolic disorders are prompting earlier intervention and higher patient engagement

- Healthcare infrastructure improvements and expanded insurance coverage in key European countries support procedural access and reimbursement for therapeutic solutions

- The combination of growing clinical need and increased awareness among patients and physicians continues to enhance the overall demand landscape for anti‑snoring treatments

Restraint/Challenge

High Treatment Costs, Compliance Barriers, and Regulatory Hurdles

- Challenges in the Europe anti‑snoring devices and snoring surgery market include high upfront costs of premium devices and surgical procedures, variable patient compliance with device use, and rigorous regulatory requirements for medical device approvals under the EU Medical Device Regulation (MDR)

- For instance, in August 2022, an industry report from European Commission noted that the implementation of MDR compliance increased certification costs for manufacturers of sleep therapy devices, delaying product launches and limiting smaller companies’ ability to compet

- Patient reluctance to adhere to nightly use of oral appliances or continuous positive airway pressure (CPAP) therapy remains a key barrier that affects long‑term outcomes

- Out‑of‑pocket costs for surgical procedures or advanced oral devices may deter price‑sensitive patients, particularly in markets with limited reimbursement support

- Inconsistent reimbursement policies across European healthcare systems can also hamper the adoption of certain device categories

- To address these challenges, stakeholders are focusing on clinician education, patient support programs, and cost‑effective product development to improve compliance and expand access across demographic groups.

Europe Anti-Snoring Devices and Snoring Surgery Market Scope

The market is segmented on the basis of device type, surgical procedure, end user, and distribution channel.

- By Device Type

On the basis of device type, the Anti-Snoring Devices and Snoring Surgery market is segmented into oral appliances, nasal devices, position control devices, chin straps, tongue-stabilizing devices, and expiratory positive airway pressure (EPAP) therapy devices. The oral appliances segment dominated the largest market revenue share of 41.8% in 2025, driven by their widespread adoption in treating mild to moderate obstructive sleep apnea and habitual snoring. Oral appliances are favored for their non-invasive design, ease of use, and ability to reposition the jaw and tongue to maintain airway patency during sleep. Rising awareness among patients and clinicians, coupled with the convenience of home use, enhances adoption. Oral appliances are also cost-effective alternatives to surgical procedures, promoting wider acceptance. Their compatibility with custom-fitted designs, growing preference for personalized therapy, and minimal side effects further drive revenue. Healthcare providers increasingly recommend oral appliances as first-line therapy, boosting prescription rates. Advances in 3D printing and dental imaging improve device fit and comfort, further solidifying market dominance.

The nasal devices segment is expected to witness the fastest CAGR of 19.6% from 2026 to 2033, driven by increasing use of nasal dilators, strips, and CPAP adjuncts to improve airflow and reduce snoring frequency. Nasal devices offer non-invasive, easy-to-use solutions that are suitable for home healthcare settings and mild snoring patients. Rising awareness of sleep-disordered breathing and the availability of comfortable, user-friendly nasal therapies are key growth factors. The segment also benefits from integration with digital monitoring devices and telemedicine platforms, allowing real-time compliance tracking. Growing preference for portable and wearable solutions for travel or active lifestyles further supports adoption. Healthcare professionals increasingly recommend nasal devices as complementary therapy alongside oral appliances or surgical interventions. Expanding awareness campaigns and insurance coverage for devices are expected to boost demand. Innovations in flexible materials and adjustable designs improve efficacy, comfort, and patient compliance.

- By Surgical Procedure

On the basis of surgical procedure, the market is segmented into laser-assisted uvulopalatoplasty, radiofrequency ablation, pillar procedure, uvulopalatopharyngoplasty (UPPP), injection snoreplasty, palatal stiffening, sclerotherapy, and other surgical procedures. The uvulopalatopharyngoplasty (UPPP) segment dominated the largest market revenue share of 35.7% in 2025, driven by its established effectiveness in treating severe obstructive sleep apnea and persistent snoring. UPPP involves the removal or reshaping of tissues in the throat to widen the airway, offering durable results for patients unresponsive to device therapy. Hospitals and specialized sleep clinics often prefer UPPP due to predictable outcomes and high clinical success rates. The segment benefits from increasing prevalence of sleep disorders and growing acceptance among ENT surgeons. Advancements in minimally invasive techniques and enhanced post-operative care reduce complications and recovery time, supporting adoption. Rising demand in developed countries and growing patient awareness further reinforce market dominance.

The radiofrequency ablation segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, driven by its minimally invasive approach, shorter recovery times, and reduced post-operative pain. Radiofrequency devices allow precise tissue shrinkage or remodeling, making them suitable for patients with mild to moderate airway obstruction. Surgeons increasingly adopt this technique due to its ease of use, lower risk profile, and ability to perform under local anesthesia. Rising patient preference for outpatient procedures and home recovery supports growth. Increasing adoption in sleep clinics and ENT departments, combined with technological improvements, enhances treatment efficacy. Awareness programs, improved reimbursement coverage, and better post-operative monitoring are expected to accelerate adoption. Continuous innovation in energy delivery systems and targeted ablation devices further drives market expansion.

- By End User

On the basis of end user, the market is segmented into hospitals, community healthcare, sleep clinics, home healthcare, and others. The hospitals segment accounted for the largest market revenue share of 44.2% in 2025, due to their ability to perform both complex surgical procedures and device-based interventions. Hospitals offer access to multidisciplinary teams, including ENT specialists, pulmonologists, and sleep medicine experts, ensuring comprehensive care. The segment benefits from higher procedure volumes, advanced surgical infrastructure, and strong patient trust. Hospitals also provide follow-up and monitoring services, increasing adoption of both devices and surgeries. Established hospital networks and partnerships with medical device manufacturers strengthen supply chains and product availability.

The home healthcare segment is expected to witness the fastest CAGR of 20.5% from 2026 to 2033, driven by increasing patient preference for at-home snoring management, non-invasive device use, and convenience. Growth is fueled by rising awareness of sleep health, remote patient monitoring technologies, and telemedicine support. Patients increasingly adopt oral appliances, nasal devices, and EPAP therapy devices in home settings, supported by simplified instructions and remote consultations. Home healthcare reduces costs, hospital visits, and post-operative risks. Integration with digital health platforms and wearable compliance monitors further accelerates adoption. Expanding distribution through online channels and direct-to-patient sales also contributes to rapid growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into retail and direct sales. The retail segment dominated the largest market revenue share of 47.1% in 2025, driven by wide availability of over-the-counter snoring devices, oral appliances, and nasal products. Retail channels provide easy access for consumers seeking non-invasive, cost-effective treatments, enhancing market penetration. The segment benefits from strong presence in pharmacies, medical stores, and e-commerce platforms. Growing awareness campaigns and product promotions further drive retail sales.

The direct sales segment is expected to witness the fastest CAGR of 21.2% from 2026 to 2033, fueled by manufacturer-to-consumer models, subscription-based services, and online consultations. Direct sales allow personalized device fitting, remote monitoring, and ongoing support, increasing compliance and patient satisfaction. Adoption is further driven by telemedicine integration, home delivery of custom-fitted oral appliances, and digital ordering platforms. Manufacturers are increasingly leveraging direct sales to educate patients and promote advanced snoring therapies.

Europe Anti-Snoring Devices and Snoring Surgery Market Regional Analysis

- The Europe anti-snoring devices and snoring surgery market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of sleep disorders, rising prevalence of obstructive sleep apnea (OSA), and the growing adoption of minimally invasive therapies. Healthcare infrastructure improvements across Western Europe, coupled with rising disposable incomes, are fostering adoption of advanced anti-snoring devices and surgical solutions

- The region is witnessing significant growth across hospital, homecare, and specialized ENT clinic settings. Increasing patient preference for non-invasive, convenient treatment options is further supporting market expansion. Technological advancements, including custom-fit oral appliances and surgical innovations, are contributing to enhanced efficacy and patient satisfaction. Europe is also seeing growth in telemedicine-based sleep therapy consultations. Multi-country awareness campaigns and physician recommendations encourage device adoption

- Home-use devices and wearable sleep monitoring solutions are gaining traction. Clinical guidelines promoting early intervention and treatment of snoring and sleep apnea are boosting adoption. Rising interest in preventive healthcare and lifestyle management further supports market growth

U.K. Anti-Snoring Devices and Snoring Surgery Market Insight

The U.K. anti-snoring devices and snoring surgery market dominated Europe with the largest revenue share of approximately 36.8% in 2025, supported by advanced healthcare infrastructure, high disposable incomes, and increasing patient preference for minimally invasive therapies. Patients are increasingly opting for oral appliances, CPAP alternatives, and laser-assisted uvulopalatoplasty procedures. Hospitals and specialized ENT clinics are investing in modern diagnostic and surgical solutions for sleep disorders. The U.K.’s robust e-commerce and retail infrastructure supports easy access to home-use anti-snoring devices. Rising awareness of obstructive sleep apnea and associated health risks contributes to market growth. Clinical adoption of evidence-based therapies enhances patient outcomes. Insurance coverage and reimbursement policies further enable affordability. Public health campaigns and professional recommendations encourage adoption. Availability of technologically advanced devices, such as smart mandibular advancement splints, is increasing. Telemedicine sleep consultations are gaining traction. Growing interest in preventive sleep healthcare is driving patient-driven demand. Expansion of minimally invasive surgery adoption supports overall market dominance.

Germany Anti-Snoring Devices and Snoring Surgery Market Insight

The Germany anti-snoring devices and snoring surgery market is expected to be the fastest-growing region, contributing around 22.5% of the market revenue, fueled by rising awareness of sleep disorders, expansion of home healthcare solutions, and government initiatives promoting sleep health. Hospitals, ENT clinics, and homecare providers are increasingly adopting advanced anti-snoring devices and minimally invasive surgical options. Patients are becoming more aware of long-term health risks associated with untreated snoring and OSA. Government programs and health insurance schemes supporting early diagnosis and treatment are driving adoption. Germany’s focus on innovation and high-quality medical device manufacturing ensures availability of state-of-the-art solutions. Growing adoption of telehealth and wearable sleep monitoring devices supports rapid market growth. Expansion of homecare and outpatient therapy services enhances accessibility. Professional training programs for ENT specialists improve device utilization. Rising disposable incomes and preference for convenient treatment options boost adoption. Technological innovations, such as adjustable mandibular advancement devices, are increasingly favored. Early screening programs in urban and semi-urban areas contribute to higher adoption rates.

Europe Anti-Snoring Devices and Snoring Surgery Market Share

The Anti-Snoring Devices and Snoring Surgery industry is primarily led by well-established companies, including:

- ResMed (Australia)

- Philips Respironics (Netherlands)

- Fisher & Paykel Healthcare (New Zealand)

- Compumedics (Australia)

- SomnoMed (Australia)

- EnsoData (U.S.)

- Apnea Sciences (U.S.)

- Apex Medical (Taiwan)

- Panasonic Healthcare (Japan)

- CareFusion (U.S.)

- BMC Medical (China)

- DeVilbiss Healthcare (U.S.)

- Drive DeVilbiss Healthcare (U.S.)

- Invacare (U.S.)

- Respicardia (U.S.)

- OrthoApnea (U.S.)

- NightBalance (Netherlands)

- SomnoHealth (U.S.)

- 3B Medical (U.S.)

- AgVa Healthcare (India)

Latest Developments in Europe Anti-Snoring Devices and Snoring Surgery Market

- In February 2021, the U.S. Food and Drug Administration (FDA) granted approval for the eXciteOSA anti‑snoring device developed by Rotech Healthcare. This device uses electrical muscle stimulation via a specially designed tongue mouthpiece to help reduce snoring by strengthening tongue muscles, offering a non‑invasive treatment alternative for patients intolerant to CPAP therapy

- In May 2022, Illusion Aligners introduced an innovative oral anti‑snoring device designed to be comfortable and easy to wear, aimed at reducing snoring and improving sleep quality for users. This product supports the broader adoption of oral appliances in the home healthcare space

- In January 2024, SnoreLessNow launched the Anti‑Snore Mouth Guard+ in the United States after receiving FDA clearance. The device positions the jaw forward to open the airway and reduce snoring, expanding patient options beyond traditional CPAP or surgical treatments

- In January 2024, Airway Management Inc. announced availability of its non‑custom oral appliance solution myTAP through a partnership with Sleep Doctor, aimed at helping consumers with snoring and obstructive sleep apnea who are non‑compliant with CPAP therapy

- In July 2025, Signifier Medical Technologies Limited updated its eXciteOSA device to meet CMS (Medicare & Medicaid) reimbursement requirements in the United States, broadening access to the therapy for a larger patient population and enhancing its commercial viability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.