Europe Antibody Drug Conjugates Market

Market Size in USD Billion

CAGR :

%

USD

2.90 Billion

USD

9.73 Billion

2024

2032

USD

2.90 Billion

USD

9.73 Billion

2024

2032

| 2025 –2032 | |

| USD 2.90 Billion | |

| USD 9.73 Billion | |

|

|

|

|

Europe Antibody Drug Conjugates (ADC) Market Size

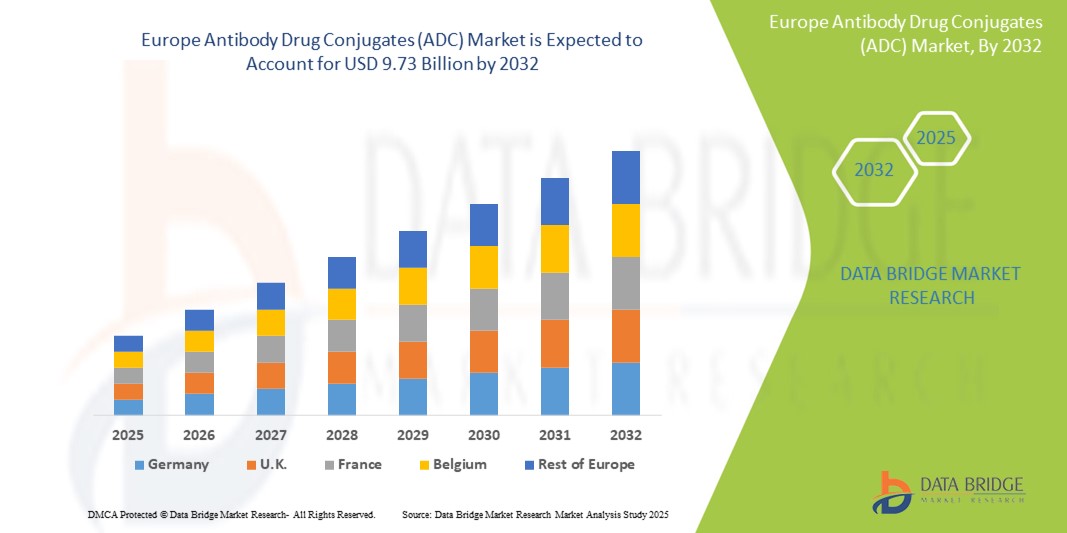

- The Europe antibody drug conjugates (ADC) market size was valued at USD 2.90 billion in 2024 and is expected to reach USD 9.73 billion by 2032, at a CAGR of 16.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cancer and the rising demand for targeted therapies that combine monoclonal antibodies with cytotoxic drugs, offering higher efficacy with reduced side effects

- Furthermore, growing investments in biopharmaceutical R&D, alongside expanding clinical pipelines and regulatory support for advanced oncology treatments, are accelerating the development and adoption of ADCs across Europe. These converging factors are positioning ADCs as a cornerstone of next-generation cancer therapy, thereby significantly boosting the region’s market growth

Europe Antibody Drug Conjugates (ADC) Market Analysis

- Antibody Drug Conjugates (ADCs), which combine the targeting ability of monoclonal antibodies with the cancer-killing potency of cytotoxic drugs, are becoming essential components of precision oncology treatment in Europe due to their targeted mechanism, minimized systemic toxicity, and growing adoption in hematologic and solid tumor therapies

- The rising demand for ADCs is primarily driven by the increasing cancer burden across European countries, a shift toward personalized medicine, and growing awareness and acceptance of novel biologic therapies among healthcare providers

- Germany dominated the antibody drug conjugates (ADC) market with the largest revenue share of 30.4% in 2024, attributed to its strong pharmaceutical industry, high healthcare expenditure, and active participation in clinical trials, with leading biopharma companies and research institutions accelerating ADC development and commercialization

- France is expected to be the fastest growing country in the antibody drug conjugates (ADC) market during the forecast period due to expanding oncology research programs, favorable reimbursement policies, and increased patient access to innovative cancer therapies

- The breast cancer segment led the antibody drug conjugates (ADC) market with a market share of 39.5% in 2024, driven by high disease prevalence and the success of approved ADCs such as trastuzumab deruxtecan in addressing HER2-positive and HER2-low subtypes

Report Scope and Europe Antibody Drug Conjugates (ADC) Market Segmentation

|

Attributes |

Europe Antibody Drug Conjugates (ADC) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Antibody Drug Conjugates (ADC) Market Trends

“Next-Generation ADCs Driving Precision Oncology”

- A major and accelerating trend in the Europe ADC market is the emergence of next-generation ADCs that feature novel linkers, improved payload delivery mechanisms, and enhanced tumor specificity, significantly boosting their therapeutic index and clinical efficacy in cancer treatment

- For instance, AstraZeneca’s Enhertu (trastuzumab deruxtecan), co-developed with Daiichi Sankyo, has demonstrated superior outcomes in HER2-positive and HER2-low breast cancers, marking a paradigm shift in the utility of ADCs. Similarly, ImmunoGen’s Elahere has gained traction across European oncology centers for targeting folate receptor α in ovarian cancer

- Advances in ADC technology now enable more stable linkers that only release cytotoxins in targeted cancer cells, reducing off-target effects and toxicity. Moreover, new ADCs are being tailored for previously hard-to-treat cancers, such as triple-negative breast cancer and certain hematologic malignancies

- The growing availability of companion diagnostics and biomarkers further supports patient stratification and optimized ADC use, creating more personalized and effective cancer treatment regimens

- This trend toward precision, efficacy, and safety is redefining ADC development across Europe. Major pharmaceutical companies such as Roche, GSK, and ADC Therapeutics are investing heavily in refining linker technologies and broadening ADC pipelines, aiming to expand indications and enhance overall treatment response

- As oncology specialists increasingly favor targeted and tolerable therapies, the demand for next-gen ADCs is rising across European healthcare systems, driving market growth and reshaping the future of cancer care

Europe Antibody Drug Conjugates (ADC) Market Dynamics

Driver

“Rising Cancer Burden Coupled with Targeted Therapy Advancements”

- The increasing incidence of cancer across European nations, alongside the expanding role of targeted therapies in oncology, is a key driver accelerating the demand for ADCs

- For instance, in 2024, the European Medicines Agency (EMA) approved multiple ADCs for new indications, reflecting the region's commitment to accelerating access to innovative biologics. Countries such as Germany, the U.K., and France are leading the charge with robust clinical trial networks and oncology R&D programs

- ADCs provide the precision of monoclonal antibodies combined with potent cytotoxins, allowing oncologists to target tumor cells while sparing healthy tissue—offering a favorable safety profile and improved patient outcomes

- National cancer plans in Europe increasingly support the integration of precision therapies such as ADCs into standard oncology protocols. The push for patient-specific treatments and real-world evidence collection is further fostering ADC adoption

- In addition, the growing number of collaborative efforts between academia and pharmaceutical companies is boosting clinical research and early access programs, enhancing market uptake of new ADC products

Restraint/Challenge

“Manufacturing Complexity and High Development Costs”

- One of the major challenges limiting broader ADC adoption in Europe is the complex and costly manufacturing process, which requires advanced infrastructure, specialized facilities, and stringent quality controls for conjugation and purification

- For instance, the production of stable linkers and site-specific conjugation techniques demands highly skilled personnel and capital-intensive bioprocessing, which can restrict production scalability and limit availability

- Regulatory hurdles also pose significant constraints, as ADCs must comply with rigorous guidelines covering biologics, cytotoxics, and combination products, often leading to longer development timelines and approval processes

- Furthermore, the high cost of ADC therapies can strain healthcare budgets, particularly in countries with limited reimbursement frameworks or strict pricing controls. While Western European nations such as Germany and the Netherlands offer strong reimbursement support, others face challenges in securing funding for premium oncology biologics

- Overcoming these hurdles will require greater regulatory harmonization, advances in cost-efficient manufacturing, and broader inclusion of ADCs in public healthcare coverage across European markets

Europe Antibody Drug Conjugates (ADC) Market Scope

The market is segmented on the basis of product, antigen component, antibody component, linker component, cytotoxic payloads, linker technology, conjugation technology, indication, end user, and distribution channel.

- By Product

On the basis of product, the Europe antibody drug conjugates (ADC) market is segmented into Enhertu, Kadcyla, Trodelvy, Polivy, Adcetris, Padcev, Besponsa, Elahere, Zylonta, Mylotarg, Tivdak, and Others. The Enhertu segment dominated the market with the largest market revenue share in 2024, driven by its proven efficacy in treating HER2-positive and HER2-low breast cancer. Its rapid clinical adoption across leading European oncology centers is supported by favorable EMA approvals and real-world performance.

The Elahere segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its breakthrough use in folate receptor α-positive ovarian cancer. Its differentiated mechanism of action and expanding clinical use in countries such as France and Italy contribute to its rapid market traction

- By Antigen Component

On the basis of antigen component, the Europe antibody drug conjugates (ADC) market is segmented into HER2 Receptor, Trop-2, CD79B, CD30, Nectin 4, CD22, CD19, CD33, Tissue Factors, and Others. The HER2 Receptor segment dominated the market with the largest market revenue share in 2024, owing to the success of HER2-targeting ADCs such as Enhertu and Kadcyla, particularly in Germany and the U.K., where HER2-positive breast cancer remains a major indication.

The Trop-2 segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing clinical use of Trodelvy in metastatic breast and bladder cancers, with growing approval coverage across European nations.

- By Antibody Component

On the basis of antibody component, the Europe antibody drug conjugates (ADC) market is segmented into First Generation ADCs, Second Generation ADCs, Third Generation ADCs, and Fourth Generation ADCs. The Second Generation ADCs segment held the largest market revenue share in 2024, supported by the clinical reliability and commercial success of products such as Kadcyla and Adcetris. These ADCs offer a balanced profile of efficacy and safety.

The Fourth Generation ADCs segment is anticipated to grow at the fastest CAGR from 2025 to 2032, backed by innovative development in site-specific conjugation and optimized payload release mechanisms, offering enhanced targeting and reduced toxicity.

- By Linker Component

On the basis of linker component, the Europe antibody drug conjugates (ADC) market is segmented into cleavable linkers and non cleavable linkers. the Cleavable Linkers segment dominated the market with the largest market revenue share in 2024, due to their selective payload release capability within tumor microenvironments, enhancing therapeutic effect while minimizing off-target toxicity.

The Non Cleavable Linkers segment is projected to grow at the fastest rate, especially in hematologic malignancies, where intracellular processing and stability are critical for drug activation and response consistency.

- By Cytotoxic Payloads

On the basis of cytotoxic payloads or warheads, the Europe antibody drug conjugates (ADC) market is segmented into DNA Damaging Agents and Microtubule Disrupting Agents. The Microtubule Disrupting Agents segment held the largest market revenue share in 2024, widely used in approved ADCs such as Kadcyla and Adcetris, offering proven antitumor activity in both hematologic and solid tumors.

The DNA Damaging Agents segment is expected to witness the fastest growth from 2025 to 2032, owing to the increasing adoption of ADCs such as Enhertu that utilize these potent agents for treating aggressive and resistant cancer types.

- By Linker Technology

On the basis of linker technology, the Europe antibody drug conjugates (ADC) market is segmented into peptide linkers, thioether linkers, hydrazone linkers, and disulfide linkers. The Peptide Linkers segment dominated the market with the largest market revenue share in 2024, favored for their enzymatic cleavability and ability to selectively release cytotoxins inside cancer cells, improving treatment specificity.

The Disulfide Linkers segment is projected to grow at the fastest rate during forecast period, driven by innovation in redox-sensitive delivery systems and increased inclusion in newer ADC clinical pipelines targeting solid tumors.

- By Conjugation Technology

On the basis of conjugation technology, the Europe antibody drug conjugates (ADC) market is segmented into site-specific conjugation and chemical conjugation. The Chemical Conjugation segment held the largest market revenue share in 2024, attributed to its widespread use in early-generation ADCs and established manufacturing protocols.

The Site-Specific Conjugation segment is expected to register the fastest growth rate from 2025 to 2032, supported by growing demand for homogeneous ADCs with consistent pharmacokinetics and reduced off-target effects.

- By Indication

On the basis of indication, the Europe antibody drug conjugates (ADC) market is segmented into breast cancer, blood cancer (leukemia, lymphoma), lung cancer, gynecological cancer, gastrointestinal cancer, genitourinary cancer, and others. The Breast Cancer segment dominated the market with the largest market revenue shareof 39.5 in 2024, driven by the high disease burden in Europe and wide adoption of HER2-targeting ADCs.

The Gynecological Cancer segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by expanding approvals for Elahere and increased focus on ovarian cancer treatment across France, Spain, and Italy.

- By End User

On the basis of end user, the Europe antibody drug conjugates (ADC) market is segmented into hospitals, specialty centers, clinics, ambulatory centers, home healthcare, and others. The Hospitals segment held the largest market revenue share in 2024, supported by advanced infrastructure for cancer diagnostics and treatment, centralized drug procurement, and multidisciplinary care teams.

The Specialty Centers segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by the rising preference for specialized oncology care and the streamlined administration of complex therapies such as ADCs.

- By Distribution Channel

On the basis of distribution channel, the Europe antibody drug conjugates (ADC) market is segmented into direct tenders, retail sales, and others. The Direct Tenders segment dominated the market with the largest market revenue share in 2024, particularly in countries with public healthcare systems such as Germany and the U.K., where centralized procurement ensures access to high-cost biologics.

The Retail Sales segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by increased access to outpatient ADC therapies and expansion of oncology pharmacies across urban centers in Europe.

Europe Antibody Drug Conjugates (ADC) Market Regional Analysis

- Germany dominated the antibody drug conjugates (ADC) market with the largest revenue share of 30.4% in 2024, attributed to its strong pharmaceutical industry, high healthcare expenditure, and active participation in clinical trials, with leading biopharma companies and research institutions accelerating ADC development and commercialization

- Clinicians and researchers in Germany prioritize precision medicine, with ADCs increasingly integrated into cancer treatment protocols for breast, blood, and gynecological cancers, supported by favorable reimbursement frameworks and access to advanced diagnostic tools

- This market leadership is further strengthened by Germany’s active participation in clinical trials, collaborations between biotech firms and academic institutions, and regulatory efficiency, positioning the country at the forefront of ADC innovation and commercialization across Europe

The Germany Antibody Drug Conjugates (ADC) Market Insight

The Germany antibody drug conjugates (ADC) market captured the largest revenue share in Europe in 2024, attributed to its advanced healthcare system, strong oncology infrastructure, and active role in clinical research. With a high adoption rate of next-generation cancer therapies and the presence of key pharmaceutical companies, Germany leads the region in both innovation and treatment access. Strategic partnerships between biotech firms and academic institutions are further fueling pipeline expansion.

France Antibody Drug Conjugates (ADC) Market Insight

The France antibody drug conjugates (ADC) market is anticipated to grow at a notable CAGR during the forecast period, supported by a robust cancer care network and government-backed initiatives in life sciences research. Rising adoption of ADCs for gynecological and breast cancers, coupled with strong reimbursement mechanisms and early market access programs, is contributing to growth. France’s commitment to precision oncology is encouraging clinical development and fast-tracked approvals.

U.K. Antibody Drug Conjugates (ADC) Market Insight

The U.K. antibody drug conjugates (ADC) market is expected to expand steadily, driven by increasing demand for innovative cancer therapies and the prioritization of targeted biologics in the National Health Service (NHS). High cancer prevalence, especially breast and hematological malignancies, is supporting the uptake of EMA-approved ADCs. Moreover, the U.K.’s vibrant biopharma sector and participation in multinational clinical trials are helping strengthen its position in the ADC market.

Italy Antibody Drug Conjugates (ADC) Market Insight

The Italy antibody drug conjugates (ADC) market is witnessing growing interest, propelled by increasing cancer cases and a national focus on improving oncology care pathways. The availability of cutting-edge cancer drugs through hospital-based treatment centers, combined with rising awareness among oncologists about ADC benefits, is driving adoption. Italy is also investing in clinical trials and regulatory alignment to support innovative oncology treatments

Europe Antibody Drug Conjugates (ADC) Market Share

The Europe antibody drug conjugates (ADC) industry is primarily led by well-established companies, including:

- AstraZeneca (U.K.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- BioNTech SE (Germany)

- ADC Therapeutics SA (Switzerland)

- GSK plc (U.K.)

- Mablink Bioscience SAS (France)

- Synaffix B.V. (Netherlands)

- Seagen Inc. (U.S.)

- Daiichi Sankyo Company, Limited (Japan)

- Pfizer Inc. (U.S.)

- Gilead Sciences, Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Amgen Inc. (U.S.)

- ImmunoGen, Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Pierre Fabre Laboratories (France)

- Philogen S.p.A. (Italy)

- Sobi (Sweden)

- Sartorius AG (Germany)

- Bayer AG (Germany)

What are the Recent Developments in Global Europe Antibody Drug Conjugates (ADC) Market?

- In May 2024, AstraZeneca and Daiichi Sankyo announced the expansion of their European clinical trial footprint for Enhertu (trastuzumab deruxtecan), targeting HER2-low breast cancer and non-small cell lung cancer patients. This development underscores the companies’ commitment to advancing ADC research across key EU countries, including Germany, France, and Spain, while broadening patient access to next-generation targeted therapies in the region

- In April 2024, ADC Therapeutics SA, headquartered in Switzerland, partnered with Italian cancer research institutions to initiate Phase II trials of its novel CD25-targeting ADC in relapsed Hodgkin lymphoma. The collaboration reflects a growing emphasis on region-specific oncology trials and reinforces the role of European clinical networks in accelerating ADC innovation

- In March 2024, the European Medicines Agency (EMA) granted accelerated assessment status to ImmunoGen’s Elahere (mirvetuximab soravtansine) for treating platinum-resistant ovarian cancer. This milestone highlights the EMA’s growing support for breakthrough ADC therapies and is expected to fast-track regulatory review and availability across EU member states

- In February 2024, the U.K.’s National Institute for Health and Care Excellence (NICE) issued a positive draft recommendation for Polivy (polatuzumab vedotin) in combination therapies for diffuse large B-cell lymphoma (DLBCL). The move signals strong national backing for integrating ADCs into standard treatment regimens and expanding patient access to advanced biologics

- In January 2024, Germany-based BioNTech SE announced its entry into the ADC space through a strategic acquisition of a European biotech specializing in site-specific conjugation technologies. The acquisition aims to strengthen BioNTech’s oncology pipeline and underscores the growing interest among European biopharma leaders in ADC platforms as a key focus area for targeted cancer treatment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 PESTEL ANALYSIS

5 COST STRUCTURE ANALYSIS OF ANTIBODY-DRUG CONJUGATE (ADC) MANUFACTURING

5.1 ANTIBODIES

5.1.1 OVERVIEW OF ANTIBODY PRODUCTION

5.1.1.1 In-house vs. Outsourced:

5.1.2 ANTIBODY PRICING FACTORS

5.2 LINKERS

5.2.1 ROLE AND TYPES OF LINKERS

5.2.1.1 Cost Impact by Linker Type:

5.3 CYTOTOXIC AGENTS

5.3.1 COST CONSIDERATIONS:

5.3.2 BUFFERS AND SOLVENTS

5.4 COST BREAKDOWN BY MANUFACTURING STAGE

5.4.1 PRE-PRODUCTION COSTS

5.4.2 CONJUGATION PROCESS

5.4.3 PURIFICATION AND FILTRATION

5.4.4 QUALITY CONTROL

5.5 COST PROJECTIONS AND PRICING TRENDS (2024–2030)

5.5.1 PROJECTED COST FLUCTUATIONS

5.5.2 COST IMPACT OF SCALABILITY

5.6 SUPPLIER AND GEOGRAPHIC PRICING TRENDS

5.6.1 GEOGRAPHIC COST VARIATIONS

5.6.2 SUPPLIER ANALYSIS

5.6.3 CONCLUSION

6 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING PREVALENCE OF CANCER

7.1.2 ADVANCES IN ANTIBODY-DRUG CONJUGATE (ADC) TECHNOLOGY

7.1.3 INCREASING DEMAND FOR TARGETED THERAPIES

7.1.4 ADVANCEMENTS IN PROTEOMICS AND GENOMICS RESEARCH

7.2 RESTRAINTS

7.2.1 HIGH DEVELOPMENT COST & MANUFACTURING COMPLEXITIES

7.2.2 SAFETY AND TOXICITY ISSUES OF ANTIBODY DRUG CONJUGATES

7.3 OPPORTUNITIES

7.3.1 GROWING ONCOLOGY PIPELINE FOR ANTIBODY DRUG CONJUGATES (ADCS)

7.3.2 INCREASING INVESTMENT IN CANCER RESEARCH

7.3.3 INCREASING COLLABORATION WITH RESEARCH INSTITUTIONS FOR ANTIBODY DRUG CONJUGATES

7.4 CHALLENGES

7.4.1 CLINICAL TRIAL FAILURES FOR ANTIBODY DRUG CONJUGATES DEVELOPMENT

7.4.2 LENGTHY CLINICAL TRIALS AND DEVELOPMENT PHASES

8 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ENHERTU

8.3 KADCYLA

8.4 TRODELVY

8.5 POLIVY

8.6 ADCETRIS

8.7 PADCEV

8.8 BESPONSA

8.9 ELAHERE

8.1 ZYLONTA

8.11 MYLOTARG

8.12 TIVDAK

8.13 OTHERS

9 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT

9.1 OVERVIEW

9.2 HER2 RECEPTOR

9.3 TROP-2

9.4 CD79B

9.5 CD30

9.6 NECTIN 4

9.7 CD22

9.8 CD19

9.9 CD33

9.1 TISSUE FACTORS

9.11 OTHERS

10 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT

10.1 OVERVIEW

10.2 THIRD GENERATION ADCS

10.3 SECOND GENERATION ADCS

10.4 FOURTH GENERATION ADCS

10.5 FIRST GENERATION ADCS

11 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT

11.1 OVERVIEW

11.2 CLEAVABLE LINKERS

11.2.1 PEPTIDE BASED

11.2.2 ACID SENSITIVE OR ACID LABILE

11.2.3 GLUTATHIONE SENSITIVE DISULFIDE

11.3 NON CLEAVABLE LINKERS

12 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT

12.1 OVERVIEW

12.2 DNA DAMAGING AGENTS

12.2.1 CAMPTOTHECIN

12.2.2 CALICHEAMICIN

12.2.3 PYRROLOBENZODIAZEPINES

12.3 MICROTUBULE DISRUPTING AGENTS

12.3.1 AURISTATIN

12.3.2 MAYTANSINOIDS

13 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY

13.1 OVERVIEW

13.2 PEPTIDE LINKERS

13.3 THIOETHER LINKERS

13.4 HYDRAZONE LINKERS

13.5 DISULFIDE LINKERS

14 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY

14.1 OVERVIEW

14.2 SITE-SPECIFIC CONJUGATION

14.3 CHEMICAL CONJUGATION

15 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION

15.1 OVERVIEW

15.2 BREAST CANCER

15.3 BLOOD CANCER (LEUKEMIA, LYMPHOMA)

15.4 LUNG CANCER

15.5 GYNECOLOGICAL CANCER

15.6 GASTROINTESTINAL CANCER

15.7 GENITOURINARY CANCER

15.8 OTHERS

16 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.3 SPECIALTY CENTER

16.4 CLINICS

16.5 AMBULATORY CENTERS

16.6 HOME HEALTHCARE

16.7 OTHERS

17 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 DIRECT TENDERS

17.3 RETAIL SALES

17.3.1 HOSPITAL PHARMACY

17.3.2 RETAIL PHARMACY

17.3.3 ONLINE PHARMACY

17.4 OTHERS

18 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION

18.1 EUROPE

18.1.1 GERMANY

18.1.2 U.K

18.1.3 FRANCE

18.1.4 ITALY

18.1.5 SPAIN

18.1.6 RUSSIA

18.1.7 BELGIUM

18.1.8 NETHERLANDS

18.1.9 SWITZERLAND

18.1.10 AUSTRIA

18.1.11 IRELAND

18.1.12 POLAND

18.1.13 NORWAY

18.1.14 HUNGARY

18.1.15 LITHUANIA

18.1.16 REST OF EUROPE

19 EUROPE ANTIBODY DRUG CONJUGATES (ADC): COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: EUROPE

20 SWOT ANALYSIS

21 COMPANY PROFILES

21.1 DAIICHI SANKYO, INC.

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT DEVELOPMENT

21.2 F. HOFFMANN-LA ROCHE LTD

21.2.1 COMPANY SNAPSHOT

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENT

21.3 GILEAD SCIENCES, INC.

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT DEVELOPMENT

21.4 ASTELLAS PHARMA INC.

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT DEVELOPMENT

21.5 TAKEDA PHARMACEUTICAL COMPANY LIMITED

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT DEVELOPMENT

21.6 ABBVIE INC.

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENT

21.7 ADC THERAPEUTICS SA

21.7.1 6.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 RECENT DEVELOPMENT

21.8 AMGEN, INC.

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENT

21.9 ASTRAZENECA

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT DEVELOPMENT

21.1 BAYER

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 RECENT DEVELOPMENT

21.11 BYONDIS

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENT

21.12 EISAI INC

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENT

21.13 GSK PLC

21.13.1 COMPANY SNAPSHOT

21.13.2 REVENUE ANALYSIS

21.13.3 PRODUCT PORTFOLIO

21.13.4 RECENT DEVELOPMENT

21.14 JOHNSON & JOHNSON SERVICES, INC.

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT DEVELOPMENT

21.15 OXFORD BIOTHERAPEUTICS

21.15.1 COMPANY SNAPSHOT

21.15.2 PRODUCT PORTFOLIO

21.15.3 RECENT DEVELOPMENT

21.16 PFIZER INC.

21.16.1 COMPANY SNAPSHOT

21.16.2 REVENUE ANALYSIS

21.16.3 PRODUCT PORTFOLIO

21.16.4 RECENT UPDATES

21.17 REMEGEN

21.17.1 COMPANY SNAPSHOT

21.17.2 PRODUCT PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 SANOFI

21.18.1 COMPANY SNAPSHOT

21.18.2 REVENUE ANALYSIS

21.18.3 PRODUCT PORTFOLIO

21.18.4 RECENT DEVELOPMENT

21.19 SUTRO BIOPHARMA, INC.

21.19.1 COMPANY SNAPSHOT

21.19.2 REVENUE ANALYSIS

21.19.3 PRODUCT PORTFOLIO

21.19.4 RECENT UPDATES

22 QUESTIONNAIRE

23 RELATED REPORTS

List of Table

TABLE 1 PROJECTED PRICE CHANGE (2024–2030)

TABLE 2 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 3 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 4 EUROPE ENHERTU IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 5 EUROPE KADCYLA IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 EUROPE TRODELVY IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 EUROPE POLIVY IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 8 EUROPE ADCETRIS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 9 EUROPE PADCEV IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 EUROPE BESPONSA IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 11 EUROPE ELAHERE IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 EUROPE ZYLONTA IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 13 EUROPE MYLOTARG IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 14 EUROPE TIVDAK IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 15 EUROPE OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 17 EUROPE HER2 RECEPTOR IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 18 EUROPE TROP-2 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 19 EUROPE CD79B IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 20 EUROPE CD30 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 21 EUROPE NECTIN 4 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 22 EUROPE CD22 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 23 EUROPE CD19 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 24 EUROPE CD33 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 25 EUROPE TISSUE FACTORS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 26 EUROPE OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 27 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 28 EUROPE THIRD GENERATION ADCS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 29 EUROPE SECOND GENERATION ADCS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 30 EUROPE FOURTH GENERATION ADCS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 31 EUROPE FIRST GENERATION ADCS IN OPHTHALMOLOGY MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 32 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 33 EUROPE CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 34 EUROPE CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 35 EUROPE NON CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 36 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 37 EUROPE DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 38 EUROPE DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 39 EUROPE MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 40 EUROPE MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 41 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 42 EUROPE PEPTIDE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 43 EUROPE THIOETHER LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 44 EUROPE HYDRAZONE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 45 EUROPE DISULFIDE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 46 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 47 EUROPE SITE-SPECIFIC CONJUGATION IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 48 EUROPE CHEMICAL CONJUGATION IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 49 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 50 EUROPE BREAST CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 51 EUROPE BLOOD CANCER (LEUKEMIA, LYMPHOMA) IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 52 EUROPE LUNG CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 53 EUROPE GYNECOLOGICAL CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 54 EUROPE GASTROINTESTINAL CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 55 EUROPE GENITOURINARY CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 56 EUROPE OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 57 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 58 EUROPE HOSPITALS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 59 EUROPE SPECIALTY CENTERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 60 EUROPE CLINICS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 61 EUROPE AMBULATORY CENTERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 62 EUROPE HOME HEALTHCARE IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 63 EUROPE OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 64 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 65 EUROPE DIRECT TENDERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 66 EUROPE RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 67 EUROPE RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 68 EUROPE OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 69 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 70 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 71 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 72 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 73 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 74 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 75 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 76 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 77 EUROPE CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 78 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 79 EUROPE DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 80 EUROPE MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 81 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 82 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 83 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 84 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 85 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 86 EUROPE RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 87 GERMANY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 88 GERMANY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 89 GERMANY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 90 GERMANY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 91 GERMANY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 92 GERMANY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 93 GERMANY CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 94 GERMANY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 95 GERMANY DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 96 GERMANY MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 97 GERMANY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 98 GERMANY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 99 GERMANY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 100 GERMANY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 101 GERMANY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 102 GERMANY RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 103 U.K. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 104 U.K. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 105 U.K. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 106 U.K. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 107 U.K. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 108 U.K. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 109 U.K. CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 110 U.K. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 111 U.K. DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 112 U.K. MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 113 U.K. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 114 U.K. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 115 U.K. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 116 U.K. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 117 U.K. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 118 U.K. RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 119 FRANCE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 120 FRANCE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 121 FRANCE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 122 FRANCE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 123 FRANCE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 124 FRANCE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 125 FRANCE CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 126 FRANCE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 127 FRANCE DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 128 FRANCE MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 129 FRANCE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 130 FRANCE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 131 FRANCE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 132 FRANCE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 133 FRANCE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 134 FRANCE RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 135 ITALY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 136 ITALY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 137 ITALY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 138 ITALY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 139 ITALY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 140 ITALY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 141 ITALY CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 142 ITALY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 143 ITALY DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 144 ITALY MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 145 ITALY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 146 ITALY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 147 ITALY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 148 ITALY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 149 ITALY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 150 ITALY RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 151 SPAIN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 152 SPAIN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 153 SPAIN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 154 SPAIN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 155 SPAIN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 156 SPAIN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 157 SPAIN CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 158 SPAIN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 159 SPAIN DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 160 SPAIN MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 161 SPAIN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 162 SPAIN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 163 SPAIN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 164 SPAIN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 165 SPAIN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 166 SPAIN RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 167 RUSSIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 168 RUSSIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 169 RUSSIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 170 RUSSIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 171 RUSSIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 172 RUSSIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 173 RUSSIA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 174 RUSSIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 175 RUSSIA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 176 RUSSIA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 177 RUSSIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 178 RUSSIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 179 RUSSIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 180 RUSSIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 181 RUSSIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 182 RUSSIA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 183 BELGIUM ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 184 BELGIUM ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 185 BELGIUM ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 186 BELGIUM ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 187 BELGIUM ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 188 BELGIUM ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 189 BELGIUM CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 190 BELGIUM ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 191 BELGIUM DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 192 BELGIUM MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 193 BELGIUM ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 194 BELGIUM ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 195 BELGIUM ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 196 BELGIUM ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 197 BELGIUM ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 198 BELGIUM RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 199 NETHERLANDS ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 200 NETHERLANDS ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 201 NETHERLANDS ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 202 NETHERLANDS ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 203 NETHERLANDS ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 204 NETHERLANDS ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 205 NETHERLANDS CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 206 NETHERLANDS ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 207 NETHERLANDS DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 208 NETHERLANDS MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 209 NETHERLANDS ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 210 NETHERLANDS ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 211 NETHERLANDS ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 212 NETHERLANDS ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 213 NETHERLANDS ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 214 NETHERLANDS RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 215 SWITZERLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 216 SWITZERLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 217 SWITZERLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 218 SWITZERLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 219 SWITZERLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 220 SWITZERLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 221 SWITZERLAND CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 222 SWITZERLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 223 SWITZERLAND DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 224 SWITZERLAND MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 225 SWITZERLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 226 SWITZERLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 227 SWITZERLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 228 SWITZERLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 229 SWITZERLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 230 SWITZERLAND RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 231 AUSTRIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 232 AUSTRIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 233 AUSTRIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 234 AUSTRIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 235 AUSTRIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 236 AUSTRIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 237 AUSTRIA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 238 AUSTRIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 239 AUSTRIA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 240 AUSTRIA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 241 AUSTRIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 242 AUSTRIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 243 AUSTRIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 244 AUSTRIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 245 AUSTRIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 246 AUSTRIA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 247 IRELAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 248 IRELAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 249 IRELAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 250 IRELAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 251 IRELAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 252 IRELAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 253 IRELAND CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 254 IRELAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 255 IRELAND DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 256 IRELAND MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 257 IRELAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 258 IRELAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 259 IRELAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 260 IRELAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 261 IRELAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 262 IRELAND RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 263 POLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 264 POLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 265 POLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 266 POLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 267 POLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 268 POLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 269 POLAND CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 270 POLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 271 POLAND DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 272 POLAND MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 273 POLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 274 POLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 275 POLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 276 POLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 277 POLAND ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 278 POLAND RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 279 NORWAY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 280 NORWAY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 281 NORWAY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 282 NORWAY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 283 NORWAY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 284 NORWAY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 285 NORWAY CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 286 NORWAY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 287 NORWAY DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 288 NORWAY MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 289 NORWAY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 290 NORWAY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 291 NORWAY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 292 NORWAY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 293 NORWAY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 294 NORWAY RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 295 HUNGARY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 296 HUNGARY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 297 HUNGARY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 298 HUNGARY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 299 HUNGARY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 300 HUNGARY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 301 HUNGARY CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 302 HUNGARY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 303 HUNGARY DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 304 HUNGARY MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 305 HUNGARY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 306 HUNGARY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 307 HUNGARY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 308 HUNGARY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 309 HUNGARY ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 310 HUNGARY RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 311 LITHUANIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 312 LITHUANIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 313 LITHUANIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 314 LITHUANIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 315 LITHUANIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 316 LITHUANIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 317 LITHUANIA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 318 LITHUANIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 319 LITHUANIA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 320 LITHUANIA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 321 LITHUANIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 322 LITHUANIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 323 LITHUANIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 324 LITHUANIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 325 LITHUANIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 326 LITHUANIA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 327 REST OF EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 328 REST OF EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 329 REST OF EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 330 REST OF EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 331 REST OF EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 332 REST OF EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 333 REST OF EUROPE CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 334 REST OF EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 335 REST OF EUROPE DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 336 REST OF EUROPE MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 337 REST OF EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 338 REST OF EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 339 REST OF EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 340 REST OF EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 341 REST OF EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 342 REST OF EUROPE RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

List of Figure

FIGURE 1 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: SEGMENTATION

FIGURE 2 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISING INCIDENCE OF CANCER IS DRIVING THE GROWTH OF THE EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET FROM 2024 TO 2031

FIGURE 14 THE PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET IN 2024 AND 2031

FIGURE 15 DROC

FIGURE 16 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, 2023

FIGURE 17 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, 2024-2031 (USD MILLION)

FIGURE 18 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, CAGR (2024-2031)

FIGURE 19 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, 2023

FIGURE 21 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, 2024-2031 (USD MILLION)

FIGURE 22 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, CAGR (2024-2031)

FIGURE 23 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, LIFELINE CURVE

FIGURE 24 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, 2023

FIGURE 25 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, 2024-2031 (USD MILLION)

FIGURE 26 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, CAGR (2024-2031)

FIGURE 27 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, LIFELINE CURVE

FIGURE 28 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, 2023

FIGURE 29 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, 2024-2031 (USD MILLION)

FIGURE 30 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, CAGR (2024-2031)

FIGURE 31 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, LIFELINE CURVE

FIGURE 32 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2023

FIGURE 33 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2024-2031 (USD MILLION)

FIGURE 34 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, CAGR (2024-2031)

FIGURE 35 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, LIFELINE CURVE

FIGURE 36 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, 2023

FIGURE 37 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, 2024-2031 (USD MILLION)

FIGURE 38 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, CAGR (2024-2031)

FIGURE 39 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, LIFELINE CURVE

FIGURE 40 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, 2023

FIGURE 41 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, 2024-2031 (USD MILLION)

FIGURE 42 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, CAGR (2024-2031)

FIGURE 43 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, LIFELINE CURVE

FIGURE 44 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, 2023

FIGURE 45 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, 2024-2031 (USD MILLION)

FIGURE 46 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, CAGR (2024-2031)

FIGURE 47 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 48 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, 2023

FIGURE 49 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, 2024-2031 (USD MILLION)

FIGURE 50 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, CAGR (2024-2031)

FIGURE 51 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, LIFELINE CURVE

FIGURE 52 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 53 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD MILLION)

FIGURE 54 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 55 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 56 EUROPE ANTIBODY DRUG CONJUGATES (ADC) MARKET: SNAPSHOT (2023)

FIGURE 57 EUROPE ANTIBODY DRUG CONJUGATES (ADC): COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.