Europe Anticoagulation Therapy Market

Market Size in USD Billion

CAGR :

%

USD

10.06 Billion

USD

14.75 Billion

2024

2032

USD

10.06 Billion

USD

14.75 Billion

2024

2032

| 2025 –2032 | |

| USD 10.06 Billion | |

| USD 14.75 Billion | |

|

|

|

|

Anticoagulation Therapy Market Size

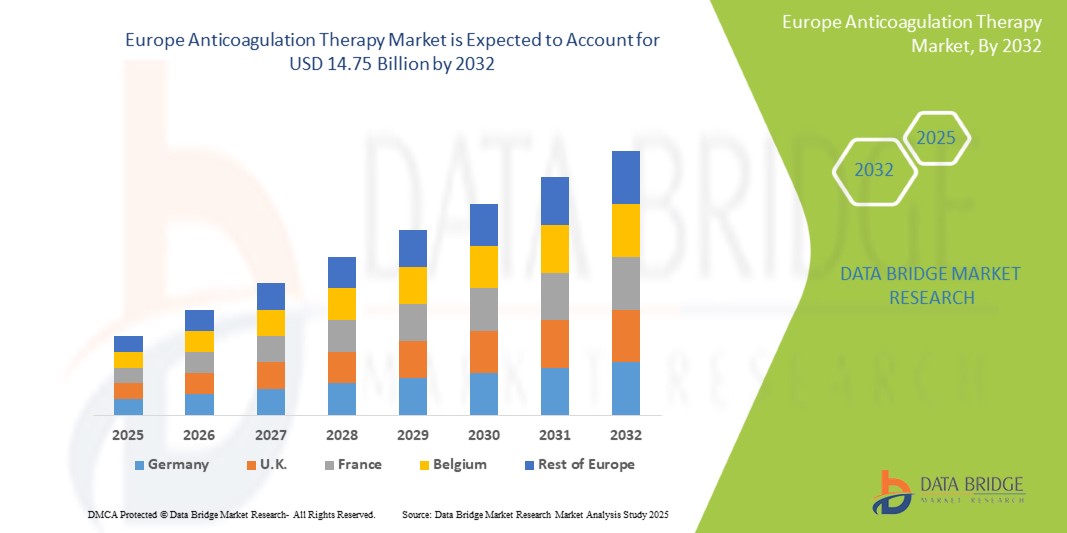

- The Europe anticoagulation therapy market size was valued at USD 10.06 billion in 2024 and is expected to reach USD 14.75 billion by 2032, at a CAGR of 4.9% during the forecast period

- This growth is driven by increasing prevalence of thromboembolic disorders, rising geriatric population, and the adoption of novel oral anticoagulants across key European countries such as Germany, France, Italy, and the UK.

Anticoagulation Therapy Market Analysis

- Anticoagulation therapies help prevent blood clots, reducing the risk of stroke, heart attacks, and venous thromboembolism. These therapies have become essential in managing cardiovascular and hematological disorders, especially among the elderly and high-risk patient groups.

- In Europe, demand for anticoagulation therapy is rising due to better diagnostic practices, higher awareness of atrial fibrillation-related complications, and the favorable reimbursement frameworks across Western Europe.

- Germany is expected to dominate the Europe Anticoagulation Therapy market due to its strong healthcare infrastructure, early adoption of DOACs, and robust clinical trial network.

- The UK is anticipated to register the highest CAGR due to national guidelines recommending DOACs over traditional therapies, e-prescription systems, and increased NHS spending on stroke prevention.

- Direct Oral Anticoagulants (DOACs) segment is expected to hold the largest share of 53.2% due to their predictable pharmacokinetics, reduced need for monitoring, and broad clinical adoption.

Report Scope and Anticoagulation Therapy Market Segmentation

|

Attributes |

Anticoagulation Therapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anticoagulation Therapy Market Trends

‘’Shift Towards DOACs from Traditional Therapies”

Across Europe, Direct Oral Anticoagulants are replacing traditional anticoagulants like warfarin and heparin due to their superior safety profiles, once-daily dosing, and minimal interaction requirements. European health agencies are revising formularies to include DOACs as first-line therapies. Digital adherence tools and home INR monitoring systems are enabling patients to maintain therapeutic outcomes without frequent hospital visits. Countries like France and the UK are leveraging real-world data to assess long-term DOAC effectiveness and safety, further accelerating their uptake in both hospital and outpatient settings.

Anticoagulation Therapy Market Dynamics

Driver

“Rising Cardiovascular Disease Burden and Aging Population”

- Europe faces a significant cardiovascular disease burden, with atrial fibrillation, venous thromboembolism, and stroke among leading causes of disability and mortality. The aging population further increases susceptibility to clot-related disorders. National screening initiatives and improved access to echocardiography and blood coagulation tests are improving early detection rates.

- For instance, In 2024, Germany’s Federal Ministry of Health launched an atrial fibrillation awareness campaign targeting adults over 60 years, encouraging early detection through smart devices and routine health checkups. This initiative has led to a 22% increase in atrial fibrillation diagnoses in primary care.

Opportunity

“Technological Advancements in Anticoagulation Monitoring”

- Technological innovations such as self-monitoring devices, wearable coagulation sensors, and e-health dashboards are transforming patient management in anticoagulation therapy. These tools facilitate real-time monitoring of bleeding risks and clotting profiles, enabling timely intervention and personalized dosing.

- For instance, In January 2025, a collaborative initiative between the University of Oxford and NHS Digital introduced a mobile-based anticoagulation tracker integrated with NHS records, improving patient compliance and reducing emergency hospitalizations due to adverse drug events.

Restraint/Challenge

“Bleeding Risks and Limited Access in Eastern Europe”

- Despite advancements, bleeding risks remain a concern, especially in elderly patients or those with renal impairment. Access to newer anticoagulants remains limited in Eastern European countries due to pricing constraints and insufficient reimbursement support. Moreover, many primary care settings lack trained personnel for anticoagulation management.

- For instance, A 2023 survey by the European Society of Cardiology revealed that over 40% of clinics in Eastern Europe still rely on outdated warfarin protocols due to cost barriers and lack of awareness about DOACs. This gap underscores the need for regional education programs and public-private partnerships to improve access.

Anticoagulation Therapy Market Scope:

The market is segmented on the basis of drug class, indication, route of administration, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Drug Class |

|

|

By Indication |

|

|

By Route of Administration |

|

|

By End User |

|

|

By Distribution Channel

|

|

In 2025, the Direct Oral Anticoagulants (DOACs) segment is projected to dominate the market with the largest share in drug class segment

In 2025, the DOACs segment is expected to hold a 53.2% market share, driven by clinical preference for simplified dosing regimens and safety in elderly populations.

The Atrial Fibrillation & Heart Attack segment is expected to account for the largest share during the forecast period in indication segment

In 2025, the Atrial Fibrillation & Heart Attack segment is anticipated to hold a 49.7% market share due to increasing diagnostic rates and guideline-based prescribing patterns.

Anticoagulation Therapy Market Regional Analysis

“Germany Holds the Largest Share in the Anticoagulation Therapy Market”

Germany leads the Europe Anticoagulation Therapy market due to established clinical pathways, early DOAC adoption, and consistent payer support for novel therapies.

“United Kingdom is Projected to Register the Highest CAGR in the Anticoagulation Therapy Market”

The UK is expected to witness the highest growth rate, supported by digitized prescription systems, government-funded stroke prevention programs, and real-world data integration.

Anticoagulation Therapy Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Bristol-Myers Squibb Company (U.S.)

- Pfizer Inc. (U.S.)

- Bayer AG (Germany)

- Daiichi Sankyo Company, Limited (Japan)

- Johnson & Johnson Services, Inc. (U.S.)

- Sanofi S.A. (France)

- Boehringer Ingelheim International GmbH (Germany)

- Abbott Laboratories (U.S.)

- AstraZeneca (UK)

- F. Hoffmann-La Roche Ltd (Switzerland)

Latest Developments in Europe Anticoagulation Therapy Market

- In March 2025, Bayer AG received extended EMA approval for Xarelto (rivaroxaban) in pediatric atrial fibrillation treatment.

- In February 2025, Boehringer Ingelheim launched a post-marketing safety study of dabigatran in elderly AF patients across Germany and Sweden.

- In January 2025, the UK MHRA approved a mobile app linked to NHS electronic prescriptions for DOAC dose reminders.

- In December 2024, Pfizer Inc. and Bristol Myers Squibb expanded their collaborative real-world registry for Eliquis in France and Italy to evaluate bleeding outcomes.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.