Europe Api Intermediates Market

Market Size in USD Billion

CAGR :

%

USD

55.61 Billion

USD

89.30 Billion

2024

2032

USD

55.61 Billion

USD

89.30 Billion

2024

2032

| 2025 –2032 | |

| USD 55.61 Billion | |

| USD 89.30 Billion | |

|

|

|

|

Europe API Intermediates Market Size

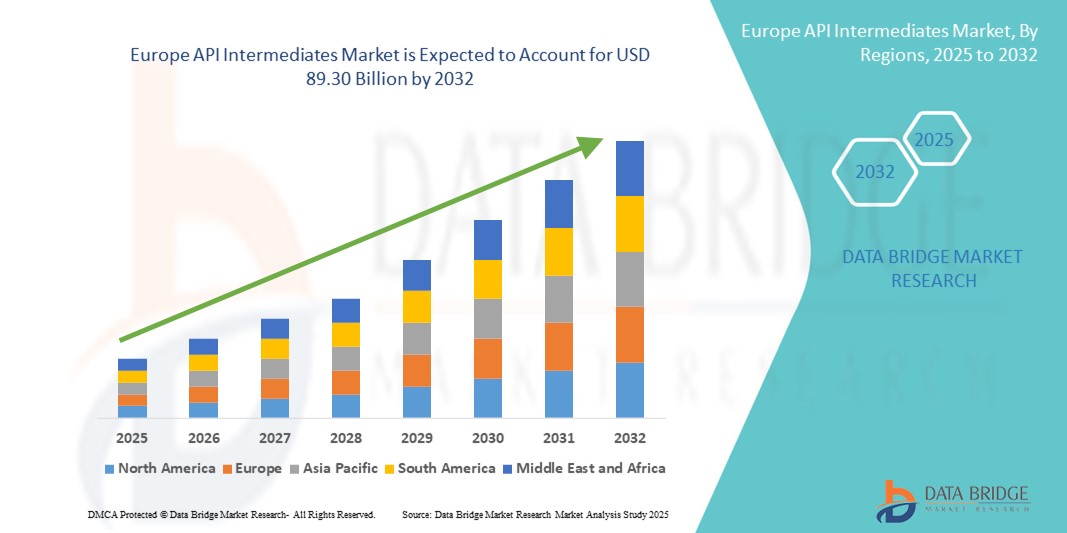

- The Europe API intermediates market size was valued at USD 55.61 billion in 2024 and is expected to reach USD 89.30 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is largely fueled by the rising demand for pharmaceutical and biopharmaceutical products, coupled with increasing outsourcing of API manufacturing to specialized producers, which is driving large-scale production and innovation in API intermediates

- Furthermore, advancements in chemical synthesis technologies, growing adoption of green chemistry practices, and the rising prevalence of chronic diseases are accelerating the uptake of API intermediates across multiple therapeutic areas, thereby significantly boosting the industry's growth

Europe API Intermediates Market Analysis

- The Europe Active Pharmaceutical Ingredients (API) Intermediates market is witnessing strong growth, driven by increasing demand for high-quality intermediates across pharmaceutical manufacturing, rising investments in drug discovery, and the adoption of advanced synthesis and analytical technologies. The growing focus on personalized medicine and complex molecule development is further fueling demand for API intermediates

- Growing government initiatives supporting pharmaceutical R&D, coupled with increased funding for production modernization and regulatory compliance, is accelerating the adoption of advanced API intermediate solutions. In addition, integration of automation, high-throughput synthesis platforms, and process analytical technologies is enabling faster, more efficient, and high-quality intermediate production, improving overall drug development timelines

- Germany dominated the Europe API Intermediates market with the largest revenue share of 34.2% in 2024, supported by its robust pharmaceutical manufacturing infrastructure, high adoption of advanced synthetic and biotech technologies, and strong regulatory frameworks that facilitate large-scale production of intermediates

- U.K. is projected to register the fastest CAGR of 10.8% in the Europe API Intermediates market during the forecast period, driven by ongoing NHS-supported R&D programs, growing investments in biotech and synthetic molecule manufacturing, and rising demand for high-quality intermediates for both domestic and export-oriented pharmaceutical production

- The pharmaceutical/bulk drug intermediates segment dominated the API intermediates market with the largest revenue share of 68.4% in 2024, driven by their extensive application in large-scale drug manufacturing across therapeutic areas such as oncology, cardiovascular, and infectious diseases. The segment benefits from robust demand from generic and branded drug producers worldwide

Report Scope and API Intermediates Market Segmentation

|

Attributes |

API Intermediates Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe API Intermediates Market Trends

Growing Importance of API Intermediates in Modern Pharmaceutical Manufacturing

- A significant and accelerating trend in the Europe API intermediates market is the increasing adoption of advanced manufacturing technologies, automation, and digital process optimization tools. This integration of innovative production methods is enhancing the efficiency, quality, and scalability of API intermediate production

- For instance, leading pharmaceutical manufacturers are implementing continuous manufacturing techniques for API intermediates, enabling consistent product quality, reduced production timelines, and better control over critical process parameters. Similarly, advanced process analytical technologies (PAT) are being used to monitor reactions in real time, ensuring compliance with stringent regulatory requirements

- Automation and data-driven manufacturing allow for predictive maintenance of equipment, optimization of raw material use, and reduced downtime. For example, some facilities now use AI-driven analytics to forecast production bottlenecks and adjust batch scheduling to meet urgent API demands. Furthermore, these advancements help in reducing manufacturing costs and improving yields, making production more competitive

- The integration of Industry 4.0 principles with API intermediate manufacturing is also facilitating centralized control and oversight across multiple production sites. Through a single digital interface, manufacturers can track batch progress, monitor quality metrics, and ensure supply chain transparency from raw materials to final APIs

- This trend toward more precise, efficient, and connected manufacturing processes is fundamentally reshaping pharmaceutical supply chains. Consequently, major players such as Lonza and Cambrex are investing heavily in expanding high-purity intermediate production facilities equipped with modern, automated systems

- The demand for high-quality API intermediates produced using advanced manufacturing methods is rising rapidly across both branded and generic drug segments, as pharmaceutical companies increasingly prioritize consistent quality, cost efficiency, and regulatory compliance

Europe API Intermediates Market Dynamics

Driver

Growing Importance of API Intermediates in Modern Pharmaceutical Manufacturing

- The rising demand for efficient, high-quality pharmaceutical production, coupled with the need for faster drug development timelines, is significantly driving the growth of the API intermediates market. These intermediates, which are critical raw materials in the synthesis of active pharmaceutical ingredients (APIs), play an indispensable role in ensuring the efficacy, safety, and stability of final drug formulations

- For instance, in April 2024, Divis Laboratories Ltd. announced the expansion of its API intermediates production capacity in India, aimed at catering to both domestic demand and export markets. The company’s investment in advanced chemical synthesis technologies and green chemistry practices reflects a broader industry shift toward sustainable and scalable API manufacturing. Such strategic expansions are expected to fuel the API intermediates market growth during the forecast period

- As the Europe pharmaceutical sector experiences increased demand for generics, biosimilars, and specialty medicines, API intermediates are becoming essential for enabling cost-effective and timely production. Their role in minimizing impurities, improving yield, and supporting complex synthesis processes is making them a cornerstone of pharmaceutical manufacturing

- Furthermore, growing emphasis on supply chain resilience and reducing dependency on single-country sourcing is encouraging manufacturers to diversify their API intermediate production capabilities. This trend is supported by government incentives in multiple countries to boost domestic pharmaceutical ingredient manufacturing

- The integration of continuous manufacturing technologies, advancements in process chemistry, and increased investment in R&D for high-purity intermediates are creating new opportunities in the market. With their adaptability across therapeutic areas—including oncology, cardiovascular diseases, and infectious diseases—API intermediates are witnessing expanding applications that enhance both manufacturing efficiency and product quality

Restraint/Challenge

Concerns Regarding Stringent Regulatory Compliance and High Production Costs

- The API intermediates industry faces challenges related to stringent regulatory requirements in different regions, which can lengthen product approval timelines and increase operational costs. Adhering to Good Manufacturing Practices (GMP) and meeting pharmacopoeia standards requires significant investment in quality control systems, skilled workforce, and compliance infrastructure

- For instance, recent audits by regulatory bodies such as the U.S. FDA and European Medicines Agency (EMA) have resulted in temporary plant shutdowns for some manufacturers failing to meet environmental and safety standards. Such incidents highlight the need for robust compliance frameworks to avoid disruptions in supply

- In addition, the relatively high cost of advanced API intermediates—particularly those requiring multi-step synthesis or specialized catalysts—can be a barrier for smaller pharmaceutical companies or for cost-sensitive markets. Factors such as volatility in raw material prices, dependency on imported precursors, and energy-intensive production processes further contribute to high manufacturing costs

- While process optimization and economies of scale are gradually reducing costs, the perceived premium pricing for high-purity or niche API intermediates can still limit widespread adoption, especially in low- and middle-income regions

- Overcoming these challenges will require not only technological advancements in process chemistry but also greater collaboration between manufacturers, regulatory agencies, and raw material suppliers to create a more cost-efficient and compliant supply ecosystem for API intermediates

Europe API Intermediates Market Scope

The market is segmented on the basis of type, product, therapeutic type, customers, end user, and distribution channel.

- By Type

On the basis of type, the API intermediates market is segmented into veterinary drug intermediates and pharmaceutical/bulk drug intermediates. The pharmaceutical/bulk drug intermediates segment dominated the market with the largest revenue share of 68.4% in 2024, driven by their extensive application in large-scale drug manufacturing across therapeutic areas such as oncology, cardiovascular, and infectious diseases. The segment benefits from robust demand from generic and branded drug producers worldwide.

The veterinary drug intermediates segment is projected to witness the fastest CAGR of 9.7% from 2025 to 2032, supported by the rising focus on animal healthcare, the expansion of the livestock industry, and increasing Europe approvals of veterinary pharmaceuticals. Growing awareness of animal health, preventive care, and regulatory incentives for livestock management are further driving demand for veterinary-specific API intermediates.

- By Product

On the basis of product, the API intermediates market is segmented into bromo compound, O-benzyl salbutamol, hemisulfate, oxirane, bisoprolol base, chiral PCBHP, pheniramine base, chlorpheniramine base, brompheniramine base, mepyramine/pyrilamine base, 6-amino-1,3-dimethyl uracil, theophylline, acefylline, xanthine, nitriles, and others. The bromo compound segment accounted for the largest market share of 21.3% in 2024, attributed to its wide application in producing active pharmaceutical ingredients for cardiovascular, respiratory, and oncology drugs.

The chiral PCBHP segment is anticipated to register the fastest CAGR of 10.8% from 2025 to 2032, driven by the escalating demand for chiral synthesis in high-value therapeutic drugs, where achieving precise enantiopurity is essential for maximizing drug efficacy and minimizing adverse effects. This growth is further supported by the increasing adoption of advanced asymmetric synthesis techniques, the expansion of biologics and specialty pharmaceuticals, and the rising emphasis on regulatory compliance for enantiomerically pure compound

- By Therapeutic Type

On the basis of therapeutic type, the API intermediates market is segmented into autoimmune diseases, oncology, metabolic diseases, ophthalmology, cardiovascular diseases, infectious diseases, neurology, respiratory disorders, dermatology, urology, and others. The oncology segment led the market in 2024 with a revenue share of 27.9%, owing to the rising prevalence of cancer, increasing approvals of targeted therapies, and the demand for high-purity intermediates for complex formulations.

The autoimmune diseases segment is expected to grow at the fastest CAGR of 11.2% from 2025 to 2032, propelled by the rising Europe prevalence of autoimmune disorders, which has increased the demand for targeted therapeutic solutions. This growth is further supported by a robust R&D pipeline focused on developing innovative biologics and small molecule drugs designed to modulate immune responses effectively.

- By Customers

On the basis of customers, the API intermediates market is segmented into direct users/pharma companies, traders/wholesalers/distributors, and associations/government & private institutions. The direct users/pharma companies segment dominated in 2024 with 62.1% market share, as pharmaceutical manufacturers prefer direct procurement to ensure quality control, traceability, and compliance with regulatory standards.

The traders/wholesalers/distributors segment is projected to expand at the fastest CAGR of 8.9% from 2025 to 2032, driven by the increasing presence of regional suppliers who efficiently cater to the needs of small and mid-sized drug manufacturers. These intermediaries play a crucial role in ensuring timely availability of API intermediates, enhancing supply chain flexibility, and supporting the growth of emerging pharmaceutical players.

- By End User

On the basis of end user, the API intermediates market is segmented into API manufacturers and finished product manufacturers. API manufacturers accounted for the largest market revenue share of 54.7% in 2024, primarily driven by the growing trend of outsourcing intermediate production to specialized facilities. These facilities provide cost-effective, scalable, and high-quality solutions, enabling API manufacturers to focus on core production while ensuring compliance with stringent regulatory standards.

Finished product manufacturers are expected to post the fastest CAGR of 9.4% from 2025 to 2032, supported by their strategic integration of intermediate production within vertical manufacturing chains. This integration allows for enhanced quality control, improved operational efficiency, and faster time-to-market for final pharmaceutical products, meeting the rising demand for high-quality medications Europely.

- By Distribution Channel

On the basis of distribution channel, the API Intermediates market is segmented into direct tender, retail sales, and others. The direct tender segment held the highest share of 48.6% in 2024, largely attributed to bulk procurement practices by large pharmaceutical companies and government agencies. These entities often require high-volume intermediates for large-scale drug production, making direct tender the most efficient and cost-effective procurement method.

Retail sales are forecasted to grow at the fastest CAGR of 8.7% from 2025 to 2032, driven by the increasing demand from small-scale manufacturers and contract research organizations. These buyers typically require intermediates in smaller quantities, and retail channels provide the flexibility, accessibility, and convenience necessary to meet their production needs efficiently.

Europe API Intermediates Market Insight

- The Europe active pharmaceutical ingredients (API) intermediates market is witnessing strong growth, driven by increasing demand for high-quality intermediates across pharmaceutical manufacturing, rising investments in drug discovery, and the adoption of advanced synthetic and biotech technologies. The growing focus on complex molecule development, personalized medicine, and precision therapeutics is further fueling demand for API intermediates

- Europe held a significant position in the global API Intermediates market, contributing a notable revenue share. The region benefits from a well-established pharmaceutical manufacturing infrastructure, stringent regulatory frameworks, and steady adoption of synthetic and biotech technologies. Emphasis on quality, efficiency, and compliance in intermediate production, along with a growing focus on export-oriented pharmaceutical manufacturing, continues to support market operations and growth across Europe

- The market’s expansion in Europe benefits from robust R&D investments, government-supported initiatives for pharmaceutical innovation, and modernization of production facilities. Collaborative efforts between pharmaceutical companies, contract manufacturers, and technology providers are driving advancements in automated synthesis, high-throughput production, and analytical validation, improving both quality and scalability of API intermediates

Germany Europe API Intermediates Market Insight

The Germany API intermediates market led Europe with a significant revenue share of 34.2% in 2024. This dominance stems from Germany’s strong pharmaceutical manufacturing ecosystem, widespread adoption of advanced synthetic and biotech technologies, and regulatory frameworks that enable large-scale production of high-quality intermediates. Well-established networks of research institutions, contract manufacturing organizations (CMOs), and analytical laboratories support efficient intermediate production, quality control, and compliance, reinforcing Germany’s leadership position.

U.K. Europe API Intermediates Market Insight

The U.K. API intermediates market accounted for a notable share of the Europe market in 2024 and is projected to register the fastest CAGR of 10.8% during the forecast period. This growth is driven by ongoing NHS-supported R&D programs, rising investments in synthetic and biotech molecule manufacturing, and increasing demand for high-quality intermediates to support both domestic and export-oriented pharmaceutical production. Expansion of specialized manufacturing facilities, integration of advanced technologies, and supportive government policies are fostering rapid market growth across the U.K..

API Intermediates Market Share

The API intermediates industry is primarily led by well-established companies, including:

- Cambrex Corporation (U.S.)

- AlzChem Group AG (Germany)

- Aceto Group (U.S.)

- Aurobindo Pharma Limited (India)

- BASF (Germany)

- Evonik Industries (Germany)

- Hovione (Portugal)

- Pathway Intermediates Limited (UK)

Latest Developments in Europe API Intermediates Market

- In June 2025, The Economic Times reported a significant decline in the prices of active pharmaceutical ingredients (APIs) in India. This drop has provided much-needed relief to the country's pharmaceutical industry, reducing production expenses for drugmakers who have faced pressure from high raw material prices in recent years. The fall in API prices is expected to enhance profitability and stabilize the supply chain within the sector, which is a crucial component of India's healthcare and export economy

- In January 2021, Vertellus has been acquired by the company, Pritzker Private Capital who partners with the middle-market companies established in North America and builds up the long-term relationship with that company. As Vertellus is considered as leading company or provider of specialty chemicals in different sectors such as healthcare, food & agriculture, personal care, transportation and coatings, so PPC has made a partnership with the company. This helped the company Vertellus to increase their market growth which will drive revenues of the company

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.