Europe Aws Managed Services Market

Market Size in USD Million

CAGR :

%

USD

203.52 Million

USD

653.54 Million

2024

2032

USD

203.52 Million

USD

653.54 Million

2024

2032

| 2025 –2032 | |

| USD 203.52 Million | |

| USD 653.54 Million | |

|

|

|

|

AWS Managed Services Market Size

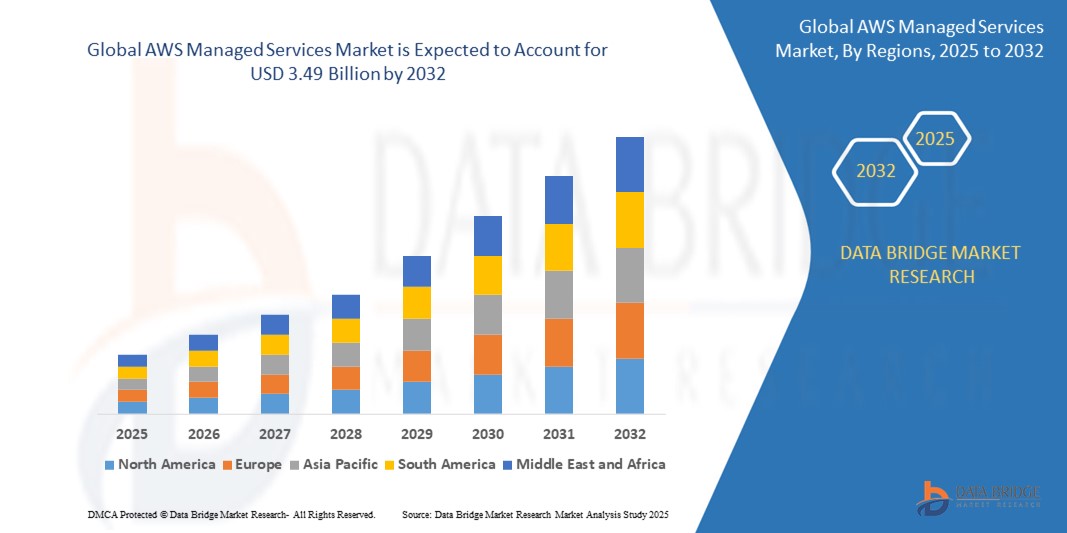

- The Europe AWS Managed Services market size was valued at USD 203.52 Million in 2024 and is expected to reach USD 653.54 million by 2032, at a CAGR of 18.1% during the forecast period

- This growth is driven by factors such as the Digital Transformation Initiatives, Rise of Remote Work, and Growing AWS Customer Base

AWS Managed Services Market Analysis

- The AWS managed services are defined as the type of services that automate infrastructure management for the AWS deployments. These services include migrating the on premise server or workloads to the cloud specifically to public cloud, while also using private or hybrid clouds

- Germany dominates the Europe AWS managed services market due to the advancements in the technology within the region

- France is expected to witness high growth during the forecast period of 2021 to 2028 because of the growth in awareness.

- Advisory Services segment is expected to dominate the market with a market share of 53.46% due to its critical role in guiding cloud strategy, migration planning, and compliance for efficient AWS adoption.

Report Scope and AWS Managed Services Market Segmentation

|

Attributes |

AWS Managed Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

AWS Managed Services Market Trends

“Integration of Artificial Intelligence in Cloud Services”

- There is a growing integration of artificial intelligence (AI) capabilities into cloud services, enabling businesses to leverage machine learning, predictive analytics, and automation within their cloud environments

- The growing demand for cloud services in Europe presents a significant opportunity for AWS Managed Services to expand its infrastructure, particularly in regions like Germany and Spain

- For instance, In March 2025, Amazon Web Services (AWS) launched "Deadline Cloud," a fully managed service designed to optimize cloud-based rendering workflows for creative industries. This service incorporates AI to streamline render management, allowing users to define job parameters and manage projects through an intuitive dashboard. The introduction of such AI-driven services underscores AWS's commitment to enhancing its managed services portfolio with advanced technological capabilities

AWS Managed Services Market Dynamics

Driver

“Increasing Demand for Cloud-Based Solutions”

- The growing adoption of cloud computing is a significant driver for the AWS Managed Services market.

- Organizations are recognizing the benefits of cloud infrastructure in terms of scalability, agility, and cost efficiency, leading to a surge in demand for managed services to effectively manage cloud environments

- With the rise in cyber threats and stringent regulatory requirements, organizations are investing heavily in managed security services to protect their sensitive data and IT infrastructure. AWS Managed Services provide robust security measures, including continuous monitoring, threat detection, and incident response, which are essential for maintaining security and compliance

For instance,

- In December 2023, a Netherlands-based international organization reported a 4.2 percentage point increase in the percentage of EU businesses purchasing cloud computing services compared to 2021. This uptick reflects the broader trend of European enterprises embracing cloud solutions, thereby driving the demand for AWS Managed Services to support their cloud infrastructure needs

Opportunity

“Expansion of Cloud Infrastructure in Europe”

- The expansion of cloud infrastructure in Europe offers a major opportunity for the AWS Managed Services sector. As more European businesses shift toward digital operations, they need reliable, scalable cloud solutions to support growth and innovation. AWS can meet this demand by increasing its data center presence across the region

- With strict EU regulations around data privacy and sovereignty, localized cloud infrastructure is essential. By building more regional availability zones, AWS can ensure compliance while offering low-latency services. This infrastructure expansion also supports emerging technologies like AI, IoT, and machine learning. As governments push digital transformation in sectors like healthcare, finance, and education, AWS has a chance to become the cloud partner of choice

- Furthermore, the rise in remote work and hybrid models increases the need for secure, cloud-based collaboration tools

For instance,

- In 2025, Amazon committed to investing €17.8 billion in Germany to enhance its logistics and cloud infrastructure. Of this, €7.8 billion is allocated to AWS, focusing on AI-driven technologies and the development of the European Sovereign Cloud project in Brandenburg. This expansion is expected to create thousands of jobs and strengthen AWS's presence in the European market

- AWS Managed Services can help businesses manage these environments efficiently. Overall, Europe’s growing digital ecosystem creates a long-term growth path for AWS cloud solutions

Restraint/Challenge

“Data Sovereignty and Regulatory Challenges”

- As organizations increasingly adopt cloud services, navigating the complexities of data sovereignty and compliance with regional regulations becomes a significant challenge. Data stored in one jurisdiction may be subject to the legal requirements of that region, potentially conflicting with the regulations of another jurisdiction where the organization operates

- This complexity necessitates careful planning and management to ensure compliance across multiple regions

For instance,

- In April 2025, Amazon Web Services (AWS) issued internal guidance to its staff to prepare for customer concerns related to tariffs, data sovereignty, and potential political restrictions. This guidance was in response to escalating global trade tensions and uncertainty over U.S. government policies. AWS emphasized its commitment to customer data privacy and compliance with legal government data requests, while also acknowledging the challenges posed by varying international regulations

AWS Managed Services Market Scope

The market is segmented on the basis service type, deployment mode, organization size and industry vertical.

|

Segmentation |

Sub-Segmentation |

|

Service type |

|

|

Deployment mode |

|

|

Organization size |

|

|

Industry vertical |

|

In 2025, the Advisory Services is projected to dominate the market with a largest share in segment

In 2025, the Advisory Services segment is projected to dominate the AWS Managed Services market with the largest share of 53.46%. This growth is mainly due to the rising need for expert guidance as businesses increasingly move to cloud environments. Companies rely on advisory services to design efficient migration strategies, ensure compliance with complex regulations, and optimize cloud performance. As cloud architectures grow more advanced, the demand for specialized consultation continues to rise. These services help organizations reduce risks and maximize return on cloud investments

The Cloud Migration Services is expected to account for the largest share during the forecast period in market

The Cloud Migration Services segment is expected to account for the largest share of 51.67% in the AWS Managed Services market during the forecast period. This is driven by the increasing shift of enterprises from legacy systems to scalable and cost-effective cloud infrastructure. Migration services help businesses transition their workloads, data, and applications smoothly to the AWS cloud. As digital transformation becomes a priority, companies are seeking expert support to minimize downtime and avoid data loss

AWS Managed Services Market Regional Analysis

“Germany Holds the Largest Share in the AWS Managed Services Market”

- Germany holds the largest share in the Europe AWS Managed Services market due to its strong industrial base and technological advancements. As one of Europe's leading economies, Germany has a high adoption rate of cloud services across industries such as automotive, manufacturing, finance, and healthcare. The country’s robust digital infrastructure and focus on innovation make it an attractive market for AWS Managed Services.

- Furthermore, Germany’s strict data protection regulations align well with AWS’s security features, enhancing trust among businesses. With Germany's commitment to digital transformation and Industry 4.0, the demand for AWS solutions continues to grow.

- AWS's local data centers also help meet the demand for data sovereignty and compliance. Germany’s government initiatives to support digital and IT transformation contribute to the market's expansion. As businesses in Germany continue to prioritize cloud adoption, AWS Managed Services are poised to maintain their leading position.

“France is Projected to Register the Highest CAGR in the AWS Managed Services Market”

- In 2025, France is projected to register the highest Compound Annual Growth Rate (CAGR) in the European AWS Managed Services market, driven by several key factors. The nation's rapid digital transformation across various industries, including finance, healthcare, and manufacturing, is significantly contributing to this growth.

- Additionally, France's emphasis on data sovereignty and stringent data protection regulations, like the General Data Protection Regulation (GDPR), aligns well with AWS's commitment to secure and compliant cloud solutions. The increasing demand for advanced technologies such as artificial intelligence (AI), big data analytics, and the Internet of Things (IoT) is further accelerating the need for scalable and flexible cloud infrastructure, which AWS Managed Services can provide.

- Moreover, the establishment of local data centers by major cloud providers enhances service delivery and compliance with local regulations, boosting customer confidence. The convergence of these factors positions France as a rapidly growing market for AWS Managed Services in Europe

AWS Managed Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- RACKSPACE US INC,

- Smartronix Inc.,

- Capgemini,

- DXC Technology Company,

- Onica,

- Accenture,

- Slalom, LLC,

- 8K Miles Software Services Ltd.,

- e-Zest Solutions,

- Great Software Laboratory,

- Cloudnexa,

- Logicworks,

- CLOUDREACH,

- AllCloud,

- Rean Cloud,

- Mission Cloud Services, Inc,

- Claranet limited

Latest Developments in Europe AWS Managed Services Market

- In October 2024, Rackspace Technology entered into a long-term Strategic Collaboration Agreement with Amazon Web Services (AWS). This partnership is designed to provide comprehensive cloud services, including advisory, financial operations (FinOps), migration, cloud data, modernization, and machine learning (ML) solutions. Additionally, Rackspace launched a service called the Rackspace Rapid Migration Offer (RRMO) to help organizations quickly move their data centers to AWS. They also unveiled the Foundry for AI by Rackspace (FAIR™), a solution aimed at assisting businesses in creating AI applications that are ready for production. This move highlights Rackspace’s dedication to helping its clients get the most value from their cloud transformation

- In August 2024, Accenture took its collaboration with AWS a step further by launching the Accenture Responsible AI Platform. This platform helps businesses adopt and scale AI technologies safely and confidently, ensuring that their AI systems comply with best practices. It offers services such as setting up AI governance frameworks, conducting risk assessments, and providing ongoing support for compliance, security, and generative AI testing on AWS. By integrating responsible AI principles, this platform aims to make AI implementations more transparent, secure, and continuously compliant throughout the organization

- In November 2023, DXC Technology deepened its existing relationship with AWS to help its clients transition to more modern, cloud-driven IT environments. The collaboration will help accelerate the move of about 1,000 large DXC clients to AWS, with a focus on cloud solutions. As part of this initiative, DXC plans to train 15,000 of its employees through role-based AWS certifications over the next five years. This push will build a skilled workforce capable of driving the cloud transformation for clients. The expansion of this partnership is expected to shift DXC’s service delivery model to be more cloud-focused and cost-efficient

- In January 2024, Capgemini signed a multi-year strategic agreement with AWS aimed at helping organizations integrate generative AI solutions. This collaboration is designed to guide businesses through the challenges of adopting AI, including cost management, scalability, and trust. Together, Capgemini and AWS will create specialized solutions and tools for different industries to help companies improve their cloud investments’ Total Cost of Ownership (TCO). They will also use Amazon Bedrock to provide access to a suite of foundational AI models, enabling organizations to build AI applications securely and efficiently

- In January 2025, Slalom announced its expansion into Colombia, opening new offices in Bogotá and Medellín. This move is part of Slalom’s strategy to meet the growing demand for cloud and AI consulting services in Latin America. The expansion will allow Slalom to serve emerging markets with tailored consulting services, particularly in areas such as software development, data science, and AI. Slalom’s focus is to strengthen its presence in the region and provide businesses with the tools they need to thrive in a rapidly evolving digital landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.