Europe B1 Sheetfed Offset Press Market

Market Size in USD Million

CAGR :

%

USD

436.99 Million

USD

608.07 Million

2025

2033

USD

436.99 Million

USD

608.07 Million

2025

2033

| 2026 –2033 | |

| USD 436.99 Million | |

| USD 608.07 Million | |

|

|

|

|

Europe B1 Sheetfed Offset Press Market Size

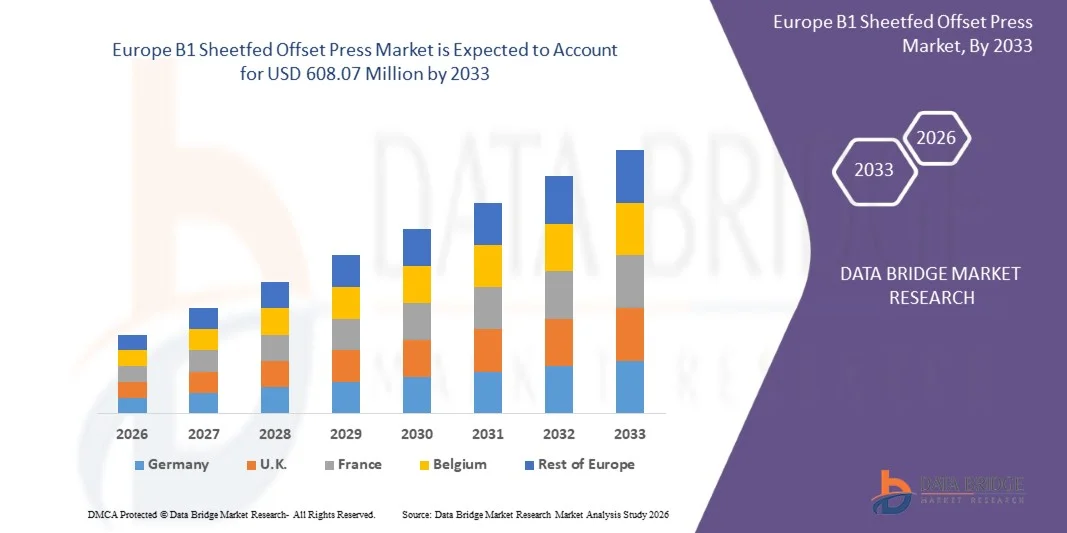

- The Europe B1 sheetfed offset press market is expected to reach USD 608.07 million by 2033 from USD 436.99 million in 2025, growing with a substantial CAGR of 4.3% in the forecast period of 2026 to 2033

- The Europe B1 sheetfed offset press market growth is significantly driven by the increasing demand for high-quality packaging and commercial printing across key sectors like e-commerce, food and beverage, and consumer goods. The need for sustainable printing solutions and customized packaging is also a major driver, alongside innovations in automation and digital/hybrid press technologies that enable faster and more efficient production.

- Market expansion is further supported by technological advancements that enhance press efficiency, reduce operational costs, and improve print quality. The growing focus on eco-friendly practices, such as recyclable materials and low-emission inks, is also boosting demand. Additionally, the rise of short-run printing and personalized packaging solutions, driven by the increasing adoption of on-demand printing and variable data printing, continues to fuel growth in the region.

Europe B1 Sheetfed Offset Press Market Analysis

- The Europe B1 sheetfed offset press market is primarily driven by the rapid growth of e-commerce, which is fueling the demand for high-quality, sustainable packaging in sectors like food and beverage, consumer goods, and electronics. There is also an increasing focus on eco-friendly packaging solutions and recyclable materials, pushing both commercial printers and packaging converters to adopt sustainable printing technologies.

- Technological advancements, including automation and digital/hybrid integration, are enabling B1 presses to handle short-run jobs and personalized printing efficiently. The growing need for short-run and customized print jobs is encouraging the adoption of B1 presses that offer flexibility and fast turnaround times.

- Germany is the dominant country in the Europe B1 sheetfed offset press market, accounting for over 21.69% market share in 2026, driven by its strong demand for high-quality commercial printing and packaging solutions. The growth of e-commerce, sustainability trends, and a highly competitive printing industry contribute to the dominance of B1 presses, particularly in sectors like food, electronics, and consumer goods.

- Furthermore, Switzerland is the fastest-growing country in the region, supported by technological advancements in automation and digital/hybrid press integration, as well as the increasing demand for personalized and short-run prints. The market benefits from a push for sustainable printing practices and the need for cost-effective, high-quality packaging solutions driven by both regulatory pressures and consumer preferences.

- In 2025, conventional (offset) presses segment is expected to dominate the market with the market share of 57.27%. due to their long-standing presence in the industry, established reliability, and high print quality. They are widely used for large-volume printing in sectors such as commercial printing and packaging, where high precision and efficiency are required.

Report Scope and Europe B1 Sheetfed Offset Press Market Segmentation

|

Attributes |

Europe B1 Sheetfed Offset Press Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe B1 Sheetfed Offset Press Market Trends

“Technological Advancements in B1 Sheetfed Offset Presses”

- Technological advancements in B1 sheetfed offset presses are transforming the printing industry. One key development is the integration of automation, such as automatic plate changing and ink adjustment, which reduces human error and speeds up production while ensuring consistent quality.

- In addition, these presses now feature smart technology with sensors and real-time data monitoring. This allows operators to track machine performance, predict maintenance needs, and optimize workflows, ultimately reducing downtime and improving efficiency.

- Another major trend is the hybridization of offset and digital printing, allowing B1 presses to handle both high-volume runs and short-run digital jobs, making them more versatile. Finally, advancements in print quality are becoming a focus, with innovations in ink, coating technologies, and color consistency ensuring sharper details and more vibrant colors.

- These improvements meet the growing demand for high-quality products, especially in sectors like premium packaging and commercial printing. Together, these technologies are making B1 presses faster, more flexible, and cost-effective, driving growth in the market.

Europe B1 Sheetfed Offset Press Market Dynamics

Driver

“Expansion of Packaging & Commercial Printing Industry”

- The growth of packaging and commercial printing is increasingly shaping demand in the Global B1 sheetfed offset press market, as broader industry trends show that print applications tied to packaging and business communications remain resilient even amid digital shifts. Packaging print including labels, folding cartons, and branded graphics continues to expand globally, driven by factors such as e-commerce demand and consumer preference for visually engaging product experiences. Annual industry forecasts underscore robust growth in the overall packaging printing market, which is projected to increase substantially over the coming decade due to sustained demand for printed packaging across food, beverage, pharmaceutical, and consumer goods sectors.

- Commercial printing remains a foundational use case for sheetfed offset presses, as enterprises and brands continue to source high-quality brochures, catalogs, and marketing collateral in medium-to-large runs where offset offers cost advantages and superior image fidelity. While digital printing is expanding in some niche areas, commercial print markets overall are substantial and still anchored in traditional offset technologies in many regions. Combined with packaging demand, this creates a supportive backdrop for continued investment in B1 sheetfed offset presses capable of delivering high precision and flexibility across substrates.

- Overall, the growth trajectories of packaging and commercial printing are pivotal drivers of the Global B1 sheetfed offset press market. Packaging’s robust expansion propelled by product branding needs, regulatory drivers, and e-commerce increasingly absorbs printing capacity and underpins demand for sheetfed offset equipment capable of high-quality, multi-color output. Meanwhile, commercial printing, though facing digital competition, remains a substantial market segment where offset technology delivers efficiency and visual quality advantages. Together, these forces suggest that investments in sheetfed offset press capacity are likely to continue, as printers balance legacy demand with evolving requirements for premium packaging and business print applications.

Restraint/Challenge

“Shift Toward Digital Printing”

- The shift toward digital printing has emerged as a significant restraint for the Global B1 sheetfed offset press market, particularly affecting traditional offset equipment demand. Digital printing technologies (such as inkjet and electrophotography) have gained traction because they eliminate the need for plates, reduce setup time, and enable on‑demand, short‑run printing advantages that directly challenge the traditional strength of offset presses in high‑volume runs. Industry sources highlight that digital printing is growing rapidly in applications such as print‑on‑demand books, transactional print, and advertising, which are eroding some segments historically supplied by offset technology. This trend is reinforced by changing customer preferences for faster turnaround, greater customization, and integration with web‑to‑print services, all of which favor digital workflows over conventional offset processes.

- Moreover, established industry data indicate that digital printing’s market value and volume are increasing at a faster rate than offset, accelerating its influence on the broader printing ecosystem. Offset demand especially in heatset and coldset segments has been declining due to reduced consumption of traditional media like newspapers and magazines, a decline partly attributable to digital media consumption trends. While sheetfed offset retains relevance especially in packaging, the rising share of digital printing in shorter runs limits the utilization rates and investment appeal for new traditional presses.

- While B1 sheetfed offset presses continue to dominate high-volume, premium-quality printing, the shift toward digital printing for short-run, customizable, and on-demand applications poses a restraint on market growth. Digital printing’s speed, flexibility, and lower setup costs divert smaller jobs away from traditional sheetfed offset platforms, limiting the expansion of B1 press adoption to specific high-volume and specialized production segments.

Europe B1 Sheetfed Offset Press Market Scope

The Europe B1 sheetfed offset press market is segmented into by press type, automation level, color configuration, application and end user.

• By Press Type

On the basis of press type, the market is segmented into conventional (offset) presses, UV curing presses, digital/hybrid B1 presses, others. In 2025, the conventional (offset) presses segment dominated the market with a share of 57.27%. The conventional (offset) presses segment is expected to dominate the market due to their long-standing presence in the industry, established reliability, and high print quality. They are widely used for large-volume printing in sectors like commercial printing and packaging, where high precision and efficiency are required.

The digital/hybrid B1 presses segment is projected to register the highest CAGR of 5.1% during the forecast period of 2026 to 2033, as these presses offer greater flexibility and shorter setup times, enabling high-quality output for short-run jobs and customized prints. The ability to integrate digital printing features into offset printing helps meet the growing demand for personalized and on-demand printing.

• By Automation Level

On the basis of automation level, the market is segmented into fully automated inline systems, standalone systems, semi-automated / manual. In 2025, the fully automated inline systems segment dominated the market with a share of 52.60%. The fully automated inline systems segment is expected to dominate the market, owing to their ability to streamline workflows, reduce human intervention, and improve efficiency. These systems offer continuous production with minimal downtime and faster turnaround times, making them ideal for high-volume and commercial printing applications.

Moreover, this segment is projected to register the highest CAGR of 4.6% during the forecast period of 2026 to 2033, driven by their advantages in speed, quality, and cost-efficiency, especially in high-volume production.

• By Color Configuration

On the basis of color configuration, the market is segmented into multicolor presses (4–8 colors), two-color press, single color presses, others. In 2025, the multicolor presses (4–8 colors) segment dominated the market with a share of 66.76%. The multicolor presses (4–8 colors) segment is expected to dominate the market owing to their versatility and ability to produce vibrant, high-quality prints for commercial printing, packaging, and publishing. Multicolor presses are in high demand due to their capacity to meet diverse and complex printing requirements across various industries.

Moreover, this segment is projected to register the highest CAGR of 4.6% during the forecast period of 2026 to 2033, driven by the increasing demand for high-quality packaging and commercial print products that require more complex color configurations.

• By Application

On the basis of application, the market is segmented into packaging printing, commercial printing, publication printing (magazines, books), label printing, security printing, others. In 2025, the packaging printing segment dominated the market with a share of 57.69%. The packaging printing is expected to dominate the market owing to the growing demand for premium packaging solutions, especially in food and beverage, cosmetics, and electronics. Additionally, the rise of e-commerce and brand differentiation drives the need for innovative packaging solutions.

The commercial printing segment is projected to register the highest CAGR of 4.7% during the forecast period of 2026 to 2033, driven by the increased demand for personalized marketing materials, direct mail, and variable data printing.

• By End User

On the basis of end user, the market is segmented into packaging converters, printing companies, publishers, in-plant printers (corporate/institutional), others. In 2025, the packaging converters segment dominated the market with a share of 43.72%. The packaging converters is expected to dominate the market as demand for innovative and sustainable packaging solutions continues to rise. Packaging converters require B1 presses for large-volume production of branded packaging, labels, and folding cartons.

The printing companies segment is projected to register the highest CAGR of 4.6% during the forecast period of 2026 to 2033, driven by the growth in short-run printing and personalized services, especially in industries like advertising, direct mail, and on-demand printing.

Europe B1 Sheetfed Offset Press Market Regional Analysis

- The Germany is the dominant player in Global B1 sheetfed offset press market, driven by strong demand in commercial printing and packaging sectors. E-commerce growth is fueling packaging needs, particularly for retail and electronics. There is also a shift toward sustainable packaging solutions, supported by government regulations and consumer demand for eco-friendly products. Key sectors driving this growth include food and beverage, consumer goods, and pharmaceuticals.

- In U.K, the demand for B1 sheetfed offset presses is growing due to the rise in high-quality packaging and short-run printing needs. The market is heavily influenced by sectors such as healthcare, retail, and automotive. There is a strong focus on sustainability, with printers adopting recyclable and biodegradable materials to meet environmental goals and consumer expectations.

- Turkey is experiencing growth in manufacturing and export-oriented industries, including automotive and electronics. There is also a rise in demand for packaging solutions as e-commerce grows. The market is witnessing a shift toward cost-effective, sustainable printing technologies, driven by both local demand and export needs to Europe and beyond.

Germany B1 Sheetfed Offset Press Market Insight

The Germany B1 sheetfed offset press market is primarily driven by the growing demand for high-quality commercial printing and packaging solutions, particularly in sectors like e-commerce, food and beverage, consumer goods, and pharmaceuticals. The rise of sustainable packaging solutions, influenced by government regulations and consumer demand for eco-friendly products, also plays a major role. Additionally, the push for shorter print runs and customized packaging further fuels the adoption of B1 sheetfed offset presses across various industries.

U.K. B1 Sheetfed Offset Press Market Insight

U.K. B1 sheetfed offset press market is primarily driven by the growth in manufacturing, particularly in automotive and electronics, alongside the expansion of the e-commerce sector. The increasing demand for cost-effective, high-quality packaging and short-run printing solutions is also a key factor. Additionally, the push for sustainable printing technologies to meet both local and export needs is contributing to market expansion.

B1 Sheetfed Offset Press Market Share

The B1 sheetfed offset press industry is primarily led by well-established companies, including:

- HEIDELBERGER DRUCKMASCHINEN AG (Germany)

- Komori Corporation (Japan)

- KOENIG & BAUER AG (Germany)

- Langley Holdings plc (U.K.

- RMGT (RYOBI MHI GRAPHIC TECHNOLOGY) (Japan)

- Haverer Group (Germany)

- Nilpeter (Denmark)

- MGI Digital Technology (France)

- Comexi (Spain)

- FUJIFILM Europe GmbH (Germany)

- Wanjie Machine (China)

- Landa Corporation Ltd. (Israel)

- Shanghai UPG International Industry and Trade Group Co., Ltd. (China)

- SCREEN Europe (Netherlands)

- Kunshan RUIYUAN Intelligent Equipment Co., Ltd. (China)

- MPS Printing B.V. (Netherlands)

- Shanghai Printyoung International Industry Co., Ltd. (China)

- Good Choice Machinery Co., Ltd. (China)

- Anhui Innovo Bochen Machinery Manufacturing Co., Ltd. (China)

- Hangzhou Ecoographix Digital Technology Co., Ltd. (China)

Latest Developments in Europe B1 Sheetfed Offset Press Market

- In April, Komori announced the addition of the Lithrone GX29 advance offset printing press to its product lineup. This new 29‑inch press is designed to deliver world‑class return on investment by printing high‑quality work even on specialty materials like clear film and metallized paper. The machine supports larger sheet sizes (up to 610 × 750 mm), speeds up production, reduces setup time and waste, and helps optimize the whole workflow.

- In January 2025, Koenig & Bauer Durst has opened a dedicated VariJET 106 Customer Experience Center in Radebeul, Germany, where customers can demo and test digital, offset, and post-print production on site using their own files and substrates. The facility highlights the hybrid VariJET 106 press, developed with Durst, showcasing its flexibility and performance for folding carton printing to global visitors.

- In 2025, Comexi officially presented the Comexi F4 Origin, a new generation of compact presses ideal for short runs and label markets with improved performance and energy efficiency, as confirmed on the company’s Pioneering Flexible Solutions at K 2025 page.

- In August, 2024 Komori announced that the new 37‑inch offset printing presses, the Lithrone E37 and E37P, were added to its lineup. These compact, high‑performance models offer stable, high‑quality printing with an optimal speed of about 13,000 sheets per hour and support a wide range of sheet sizes. They feature user‑friendly design, excellent cost performance with reduced waste, and include Komori’s Smart Inking Flow technology and cloud‑connected monitoring to improve efficiency and reduce energy use.

- In May 2024, Landa Digital Printing and Gelato announced a strategic collaboration to combine Landa’s Nanographic Printing technology with Gelato’s global software platform, GelatoConnect, enabling on-demand, short-to-medium run digital printing with high quality and efficiency. The partnership leverages Gelato’s fulfillment network in over 32 countries to streamline workflows, expand market reach, and support sustainable production. By integrating Landa’s fast, high-fidelity B1 printing with Gelato’s platform, the collaboration enhances production speed, creative flexibility, cost-effectiveness, and customer experience, while also highlighting the global impact and innovation of Landa Corporation Ltd.’s Nanography technology.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE B1 SHEETFED OFFSET PRESS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRESS TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 VENDOR SELECTION CRITERIA

4.2.1 TECHNICAL PERFORMANCE & PRINT QUALITY

4.2.2 AUTOMATION & OPERATIONAL EFFICIENCY

4.2.3 FLEXIBILITY & SUBSTRATE VERSATILITY

4.2.4 RELIABILITY, SERVICE & SUPPORT

4.2.5 COST STRUCTURE & TOTAL COST OF OWNERSHIP (TCO)

4.2.6 INNOVATION & TECHNOLOGY ROADMAP

4.2.7 MARKET REPUTATION & TRACK RECORD

4.2.8 SUSTAINABILITY & ENVIRONMENTAL COMPLIANCE

4.2.9 CUSTOMIZATION & SCALABILITY

4.3 TECHNOLOGICAL ADVANCEMENTS

4.3.1 ADVANCED AUTOMATION & SMART MAKEREADY

4.3.2 INLINE COLOR & QUALITY CONTROL

4.3.3 HIGH-SPEED & HIGH-VOLUME PRODUCTIVITY

4.3.4 SUBSTRATE VERSATILITY & SPECIALTY MEDIA HANDLING

4.3.5 ENERGY EFFICIENCY & SUSTAINABILITY

4.3.6 INLINE FINISHING & VALUE-ADDED FEATURES

4.4 INVESTMENT OPPORTUNITY BY 2033

4.5 INNOVATION TRACKER AND STRATEGIC ANALYSIS – EUROPE B1 SHEETFED OFFSET PRESS MARKET

4.5.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.5.1.1 Joint Ventures

4.5.1.2 Mergers and Acquisitions

4.5.1.3 Licensing and Partnership

4.5.1.4 Technology Collaborations

4.5.1.5 Strategic Divestments

4.5.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.5.3 STAGE OF DEVELOPMENT

4.5.4 TIMELINES AND MILESTONES

4.5.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.5.6 RISK ASSESSMENT AND MITIGATION

4.5.7 FUTURE OUTLOOK

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL SOURCING & PROCUREMENT

4.6.2 PROCESSING & PRODUCT MANUFACTURING (PRODUCTION)

4.6.3 SUPPLY CHAIN & DISTRIBUTION LOGISTICS (TRANSPORTATION)

4.6.4 RETAIL & COMMERCIAL BUYER CHANNELS (DISTRIBUTION & SALES)

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATIONS

4.8 INDUSTRY ECOSYSTEM ANALYSIS

4.8.1 INTRODUCTION

4.8.2 PROMINENT COMPANIES

4.8.3 SMALL & MEDIUM SIZE COMPANIES

4.8.4 END USERS

4.9 PRICING ANALYSIS

4.9.1 COMPREHENSIVE PRICING CONTEXT

4.9.2 GRADUAL PRICE ESCALATION DRIVEN BY TECHNOLOGICAL INTEGRATION (2026–2027)

4.9.3 MID-TERM PRICING ACCELERATION REFLECTING STRUCTURAL COST PRESSURES (2028–2030)

4.9.4 LATE-STAGE PRICING MATURITY AND VALUE CONSOLIDATION (2031–2033)

4.9.5 STRATEGIC IMPLICATIONS OF PRICING TRENDS

4.9.6 CONCLUSION

5 TARIFFS & IMPACT ON THE EUROPE B1 SHEETFED OFFSET PRESS MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS. IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.5.3 IMPACT ON PRICES

5.5.4 REGULATORY INCLINATION

5.5.5 GEOPOLITICAL SITUATION

5.5.6 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.5.6.1 Free Trade Agreements

5.5.6.2 Alliances Establishments

5.5.7 STATUS ACCREDITATION (INCLUDING MFN)

5.5.8 DOMESTIC COURSE OF CORRECTION

5.5.8.1 Incentive Schemes to Boost Production Outputs

5.5.8.2 Establishment of SEZs / Industrial Parks

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.4 REGION-WISE REGULATORY CROSS-MAPPING

6.4.1 EUROPE

6.4.2 ASIA-PACIFIC

6.4.3 AMERICAS

6.5 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 EXPANSION OF PACKAGING & COMMERCIAL PRINTING INDUSTRY

7.1.2 INCLINATION TOWARDS HIGH-QUALITY AND COST-EFFICIENT PRINTING MACHINES

7.1.3 INTEGRATION OF ADVANCED TECHNOLOGIES IN SHEETFED PRINTING PRESSES

7.2 RESTRAINTS

7.2.1 SHIFT TOWARD DIGITAL PRINTING

7.2.2 HIGH INITIAL INVESTMENT & OPERATING COSTS OF EQUIPMENT

7.3 OPPORTUNITIES

7.3.1 EXPANSION AND INVESTMENTS IN EMERGING MARKETS

7.3.2 AUGUMENTATION IN PUBLICATION AND LABEL PRINTING

7.4 CHALLENGES

7.4.1 VOLATILITY IN RAW MATERIAL PRICES

7.4.2 LIMITED ACCESS TO SKILLED LABOR

8 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE

8.1 OVERVIEW

8.2 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

8.2.1 CONVENTIONAL (OFFSET) PRESSES

8.2.2 UV CURING PRESSES

8.2.3 DIGITAL/HYBRID B1 PRESSES

8.2.4 OTHERS

8.3 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

8.3.1 CONVENTIONAL (OFFSET) PRESSES

8.3.2 UV CURING PRESSES

8.3.3 DIGITAL/HYBRID B1 PRESSES

8.3.4 OTHERS

8.4 EUROPE CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

8.4.1 FULLY AUTOMATED INLINE SYSTEMS

8.4.2 STANDALONE SYSTEMS

8.4.3 SEMI-AUTOMATED / MANUAL

8.5 EUROPE UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

8.5.1 FULLY AUTOMATED INLINE SYSTEMS

8.5.2 STANDALONE SYSTEMS

8.5.3 SEMI-AUTOMATED / MANUAL

8.6 EUROPE DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

8.6.1 FULLY AUTOMATED INLINE SYSTEMS

8.6.2 STANDALONE SYSTEMS

8.6.3 SEMI-AUTOMATED / MANUAL

8.7 EUROPE OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

8.7.1 FULLY AUTOMATED INLINE SYSTEMS

8.7.2 STANDALONE SYSTEMS

8.7.3 SEMI-AUTOMATED / MANUAL

9 EUROPE B1 SHEETFED OFFSET PRESS MARKET , BY AUTOMATION LEVEL.

9.1 OVERVIEW

9.2 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

9.2.1 FULLY AUTOMATED INLINE SYSTEMS

9.2.2 STANDALONE SYSTEMS

9.2.3 SEMI-AUTOMATED / MANUAL

9.3 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (UNITS)

9.3.1 FULLY AUTOMATED INLINE SYSTEMS

9.3.2 STANDALONE SYSTEMS

9.3.3 SEMI-AUTOMATED / MANUAL

10 EUROPE B1 SHEETFED OFFSET PRESS MARKET , BY COLOR CONFIGURATION.

10.1 OVERVIEW

10.2 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

10.2.1 MULTICOLOR PRESSES (4–8 COLORS)

10.2.2 TWO-COLOR PRESS

10.2.3 SINGLE COLOR PRESSES

10.2.4 OTHERS

10.3 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

10.3.1 MULTICOLOR PRESSES (4–8 COLORS)

10.3.2 TWO-COLOR PRESS

10.3.3 SINGLE COLOR PRESSES

10.3.4 OTHERS

10.4 EUROPE MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

10.4.1 4-COLOR PRESSES

10.4.2 6-COLOR PRESSES

10.4.3 5-COLOR PRESSES

10.4.4 8-COLOR PRESSES

10.5 EUROPE MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

10.5.1 4-COLOR PRESSES

10.5.2 6-COLOR PRESSES

10.5.3 5-COLOR PRESSES

10.5.4 8-COLOR PRESSES

11 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11.2.1 PACKAGING PRINTING

11.2.2 COMMERCIAL PRINTING

11.2.3 PUBLICATION PRINTING (MAGAZINES, BOOKS)

11.2.4 LABEL PRINTING

11.2.5 SECURITY PRINTING

11.2.6 OTHERS

11.3 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

11.3.1 PACKAGING PRINTING

11.3.2 COMMERCIAL PRINTING

11.3.3 PUBLICATION PRINTING (MAGAZINES, BOOKS)

11.3.4 LABEL PRINTING

11.3.5 SECURITY PRINTING

11.3.6 OTHERS

11.4 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

11.4.1 PACKAGING CONVERTERS

11.4.2 PRINTING COMPANIES

11.4.3 PUBLISHERS

11.4.4 IN-PLANT PRINTERS (CORPORATE/INSTITUTIONAL)

11.4.5 OTHERS

12 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY END USER

12.1 OVERVIEW

12.2 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

12.3 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

12.3.1 PACKAGING CONVERTERS

12.3.2 PRINTING COMPANIES

12.3.3 PUBLISHERS

12.3.4 IN-PLANT PRINTERS (CORPORATE/INSTITUTIONAL)

12.3.5 OTHERS

13 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 ITALY

13.1.4 FRANCE

13.1.5 SPAIN

13.1.6 RUSSIA

13.1.7 TURKEY

13.1.8 SWITZERLAND

13.1.9 BELGIUM

13.1.10 NETHERLANDS

13.1.11 DENMARK

13.1.12 NORWAY

13.1.13 FINLAND

13.1.14 SWEDEN

13.1.15 REST OF EUROPE

14 EUROPE B1 SHEETFED OFFSET PRESS MARKET: COMPANY LANDSCAPE

14.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 MANUFACTURER COMPANY PROFILE

16.1 HEIDELBERGER DRUCKMASCHINEN AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 KOMORI CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 KOENIG & BAUER AG

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 LANGLEY HOLDINGS PLC

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 RMGT (RYOBI MHI GRAPHIC TECHNOLOGY)

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ANHUI INNOVO BOCHEN MACHINERY MANUFACTURING CO., LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 COMEXI.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 FUJIFILM EUROPE GMBH

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 GOOD CHOICE MACHINERY CO., LTD

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 HANGZHOU ECOOGRAPHIX DIGITAL TECHNOLOGY CO., LTD.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 HAVERER GROUP

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 JIANGSU HANSHENG PRINTING MACHINERY CO., LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 KUNSHAN RUIYUAN INTELLIGENT EQUIPMENT CO

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 LANDA CORPORATION LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 MGI DIGITAL TECHNOLOGY

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 MPS.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 NILPETER

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 SCREEN EUROPE

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 SHANGHAI PRINTYOUNG INTERNATIONAL INDUSTRY CO., LTD.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 SHANGHAI UPG INTERNATIONAL INDUSTRY AND TRADE GROUP CO., LTD.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 HEBEI WANJIE GROUP

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

17 DISTRIBUTOR COMPANY PROFILE

17.1 ALLFORPRINTMARKET

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENT

17.2 ORSAY MATBAA VE AMBALAJ MAKINALARI A.Ş.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENT

17.3 PRESSXCHANGE

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 SHANGHAI SHM INTERNATIONAL TRADING CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 SUPPLY CHAIN OVERVIEW

TABLE 2 CLIMATE CHANGE SCENARIO: MARKET IMPACT AND STRATEGIC OUTLOOK

TABLE 3 REGULATORY INTELLIGENCE COMPARISON – VALUE-DRIVEN VIEW

TABLE 4 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 6 EUROPE CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 EUROPE UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 EUROPE DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 9 EUROPE OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 EUROPE CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 11 EUROPE UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 12 EUROPE DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 13 EUROPE OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 14 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 15 EUROPE FULLY AUTOMATED INLINE SYSTEMS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 EUROPE STANDALONE SYSTEMS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 EUROPE SEMI-AUTOMATED / MANUAL IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 18 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (UNITS)

TABLE 19 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 20 EUROPE MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 21 EUROPE TWO-COLOR PRESS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 EUROPE SINGLE COLOR PRESSES B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 23 EUROPE OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 25 EUROPE MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 26 EUROPE MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 27 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 28 EUROPE PACKAGING PRINTING IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 EUROPE COMMERCIAL PRINTING IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 30 EUROPE PUBLICATION PRINTING (MAGAZINES, BOOKS) IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 EUROPE LABEL PRINTING IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 EUROPE SECURITY PRINTING IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 EUROPE OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 35 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 36 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 37 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 38 EUROPE PACKAGING CONVERTERS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 EUROPE PRINTING COMPANIES IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 40 EUROPE PUBLISHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 EUROPE IN-PLANT PRINTERS (CORPORATE/INSTITUTIONAL) IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 42 EUROPE OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 44 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY COUNTRY, 2018-2033 (UNITS)

TABLE 45 USD THOUSAND

TABLE 46 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 48 EUROPE CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 49 EUROPE UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 50 EUROPE DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 51 EUROPE OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 52 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 53 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 54 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 55 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 56 EUROPE MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 57 EUROPE MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 58 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 59 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 60 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 61 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 62 GERMANY B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 GERMANY B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 64 GERMANY CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 65 GERMANY UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 66 GERMANY DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 67 GERMANY OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 68 GERMANY B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 69 GERMANY B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 70 GERMANY B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 71 GERMANY B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 72 GERMANY MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 73 GERMANY MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 74 GERMANY B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 75 GERMANY B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 76 GERMANY B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 77 GERMANY B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 78 U.K. B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 U.K. B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 80 U.K. CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 81 U.K. UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 82 U.K. DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 83 U.K. OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 84 U.K. B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 85 U.K. B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 86 U.K. B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 87 U.K. B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 88 U.K. MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 89 U.K. MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 90 U.K. B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 91 U.K. B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 92 U.K. B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 93 U.K. B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 94 USD THOUSAND

TABLE 95 ITALY B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 ITALY B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 97 ITALY CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 98 ITALY UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 99 ITALY DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 100 ITALY OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 101 ITALY B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 102 ITALY B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 103 ITALY B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 104 ITALY B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 105 ITALY MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 106 ITALY MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 107 ITALY B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 108 ITALY B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 109 ITALY B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 110 ITALY B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 111 USD THOUSAND

TABLE 112 FRANCE B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 113 FRANCE B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 114 FRANCE CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 115 FRANCE UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 116 FRANCE DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 117 FRANCE OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 118 FRANCE B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 119 FRANCE B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 120 FRANCE B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 121 FRANCE B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 122 FRANCE MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 123 FRANCE MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 124 FRANCE B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 125 FRANCE B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 126 FRANCE B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 127 FRANCE B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 128 USD THOUSAND

TABLE 129 SPAIN B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 SPAIN B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 131 SPAIN CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 132 SPAIN UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 133 SPAIN DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 134 SPAIN OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 135 SPAIN B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 136 SPAIN B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 137 SPAIN B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 138 SPAIN B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 139 SPAIN MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 140 SPAIN MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 141 SPAIN B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 142 SPAIN B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 143 SPAIN B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 144 SPAIN B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 145 USD THOUSAND

TABLE 146 RUSSIA B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 RUSSIA B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 148 RUSSIA CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 149 RUSSIA UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 150 RUSSIA DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 151 RUSSIA OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 152 RUSSIA B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 153 RUSSIA B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 154 RUSSIA B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 155 RUSSIA B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 156 RUSSIA MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 157 RUSSIA MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 158 RUSSIA B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 159 RUSSIA B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 160 RUSSIA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 161 RUSSIA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 162 USD THOUSAND

TABLE 163 TURKEY B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 TURKEY B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 165 TURKEY CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 166 TURKEY UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 167 TURKEY DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 168 TURKEY OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 169 TURKEY B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 170 TURKEY B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 171 TURKEY B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 172 TURKEY B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 173 TURKEY MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 174 TURKEY MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 175 TURKEY B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 176 TURKEY B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 177 TURKEY B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 178 TURKEY B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 179 SWITZERLAND B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 SWITZERLAND B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 181 SWITZERLAND CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 182 SWITZERLAND UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 183 SWITZERLAND DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 184 SWITZERLAND OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 185 SWITZERLAND B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 186 SWITZERLAND B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 187 SWITZERLAND B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 188 SWITZERLAND B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 189 SWITZERLAND MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 190 SWITZERLAND MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 191 SWITZERLAND B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 192 SWITZERLAND B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 193 SWITZERLAND B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 194 SWITZERLAND B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 195 BELGIUM B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 BELGIUM B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 197 BELGIUM CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 198 BELGIUM UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 199 BELGIUM DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 200 BELGIUM OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 201 BELGIUM B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 202 BELGIUM B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 203 BELGIUM B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 204 BELGIUM B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 205 BELGIUM MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 206 BELGIUM MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 207 BELGIUM B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 208 BELGIUM B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 209 BELGIUM B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 210 BELGIUM B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 211 NETHERLANDS B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 NETHERLANDS B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 213 NETHERLANDS CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 214 NETHERLANDS UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 215 NETHERLANDS DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 216 NETHERLANDS OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 217 NETHERLANDS B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 218 NETHERLANDS B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 219 NETHERLANDS B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 220 NETHERLANDS B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 221 NETHERLANDS MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 222 NETHERLANDS MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 223 NETHERLANDS B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 224 NETHERLANDS B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 225 NETHERLANDS B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 226 NETHERLANDS B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 227 DENMARK B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 228 DENMARK B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 229 DENMARK CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 230 DENMARK UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 231 DENMARK DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 232 DENMARK OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 233 DENMARK B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 234 DENMARK B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 235 DENMARK B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 236 DENMARK B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 237 DENMARK MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 238 DENMARK MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 239 DENMARK B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 240 DENMARK B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 241 DENMARK B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 242 DENMARK B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 243 NORWAY B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 244 NORWAY B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 245 NORWAY CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 246 NORWAY UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 247 NORWAY DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 248 NORWAY OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 249 NORWAY B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 250 NORWAY B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 251 NORWAY B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 252 NORWAY B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 253 NORWAY MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 254 NORWAY MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 255 NORWAY B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 256 NORWAY B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 257 NORWAY B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 258 NORWAY B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 259 FINLAND B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 FINLAND B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 261 FINLAND CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 262 FINLAND UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 263 FINLAND DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 264 FINLAND OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 265 FINLAND B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 266 FINLAND B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 267 FINLAND B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 268 FINLAND B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 269 FINLAND MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 270 FINLAND MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 271 FINLAND B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 272 FINLAND B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 273 FINLAND B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 274 FINLAND B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 275 SWEDEN B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 276 SWEDEN B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 277 SWEDEN CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 278 SWEDEN UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 279 SWEDEN DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 280 SWEDEN OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 281 SWEDEN B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 282 SWEDEN B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 283 SWEDEN B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 284 SWEDEN B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 285 SWEDEN MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 286 SWEDEN MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 287 SWEDEN B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 288 SWEDEN B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 289 SWEDEN B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 290 SWEDEN B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 291 REST OF EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 292 REST OF EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 293 REST OF EUROPE CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 294 REST OF EUROPE UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 295 REST OF EUROPE DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 296 REST OF EUROPE OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 297 REST OF EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 298 REST OF EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 299 REST OF EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 300 REST OF EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 301 REST OF EUROPE MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 302 REST OF EUROPE MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 303 REST OF EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 304 REST OF EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 305 REST OF EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 306 REST OF EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

List of Figure

FIGURE 1 EUROPE B1 SHEETFED OFFSET PRESS MARKET: SEGMENTATION

FIGURE 2 EUROPE B1 SHEETFED OFFSET PRESS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE B1 SHEETFED OFFSET PRESS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE B1 SHEETFED OFFSET PRESS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE B1 SHEETFED OFFSET PRESS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE B1 SHEETFED OFFSET PRESS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE B1 SHEETFED OFFSET PRESS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE B1 SHEETFED OFFSET PRESS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE B1 SHEETFED OFFSET PRESS MARKET: MULTIVARIVATE MODELING

FIGURE 10 EUROPE B1 SHEETFED OFFSET PRESS MARKET: PRESS TYPE TIMELINE CURVE

FIGURE 11 EUROPE B1 SHEETFED OFFSET PRESS MARKET: APPLICATION COVERAGE GRID

FIGURE 12 EUROPE B1 SHEETFED OFFSET PRESS MARKET: SEGMENTATION

FIGURE 13 FOUR SEGMENTS COMPRISE THE EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE (2025)

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO BE THE DOMINANT AND FASTEST GRWOING REGION IN THE EUROPE B1 SHEETFED OFFSET PRESS MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 15 EUROPE B1 SHEETFED OFFSET PRESS MARKET: EXECUTIVE SUMMARY

FIGURE 16 STRATEGIC DECISIONS

FIGURE 17 EXPANSION OF PACKAGING & COMMERCIAL PRINTING INDUSTRY IS EXPECTED TO DRIVE THE EUROPE B1 SHEETFED OFFSET PRESS MARKET DURING THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 18 CONVENTIONAL (OFFSET) PRESSES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE B1 SHEETFED OFFSET PRESS MARKET IN 2025 & 2033

FIGURE 19 ASIA-PACIFIC THE FASTEST-GROWING REGION FOR THE EUROPE B1 SHEETFED OFFSET PRESS MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 20 AVERAGE PRICE TREND OF B1 SHEETFED OFFSET PRESSES (2025–2033)

FIGURE 21 DROC

FIGURE 22 EUROPE B1 SHEETFED OFFSET PRESS MARKET , BY PRESS TYPE, 2025

FIGURE 23 EUROPE B1 SHEETFED OFFSET PRESS MARKET , BY AUTOMATION LEVEL, 2025

FIGURE 24 EUROPE B1 SHEETFED OFFSET PRESS MARKET , BY COLOR CONFIGURATION, 2025

FIGURE 25 EUROPE B1 SHEETFED OFFSET PRESS MARKET , BY APPLICATION, 2025

FIGURE 26 EUROPE B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2025

FIGURE 27 EUROPE B1 SHEETFED OFFSET PRESS MARKET: SNAPSHOT (2025)

FIGURE 28 EUROPE B1 SHEETFED OFFSET PRESS MARKET: SNAPSHOT (2025)

FIGURE 29 EUROPE B1 SHEETFED OFFSET PRESS MARKET: COMPANY SHARE 2025 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.