Europe Bag In Box Packaging Machine Market

Market Size in USD Billion

CAGR :

%

USD

13.06 Billion

USD

18.43 Billion

2024

2032

USD

13.06 Billion

USD

18.43 Billion

2024

2032

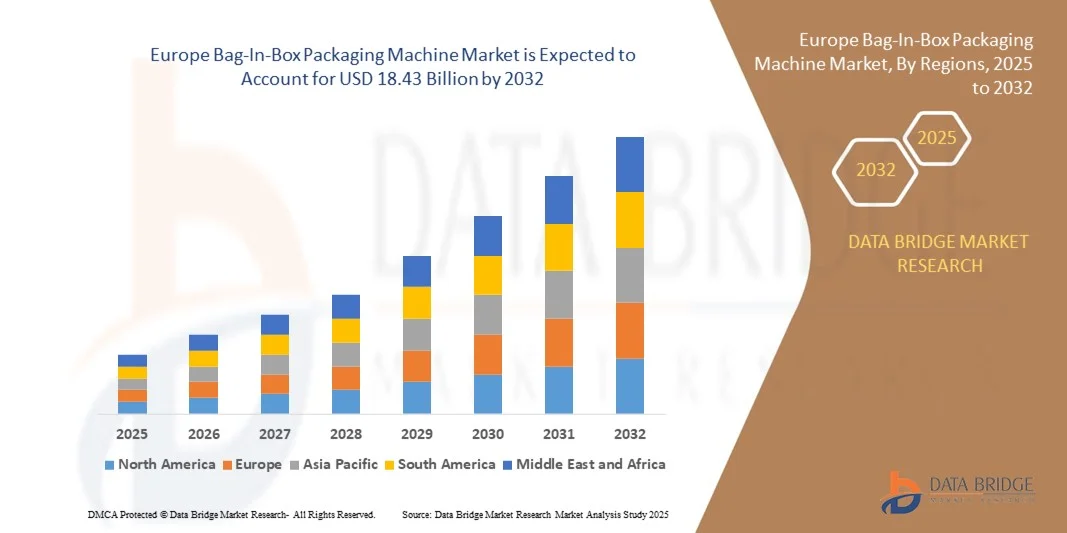

| 2025 –2032 | |

| USD 13.06 Billion | |

| USD 18.43 Billion | |

|

|

|

|

Europe Bag-In-Box Packaging Machine Market Size

- The Europe bag-in-box packaging machine market size was valued at USD 13.06 billion in 2024 and is expected to reach USD 18.43 billion by 2032, at a CAGR of 4.4% during the forecast period

- The market growth is largely fuelled by the rising demand for efficient, cost-effective, and sustainable packaging solutions across industries such as food & beverages, pharmaceuticals, and household products

- Increasing focus on extending product shelf life, reducing packaging waste, and improving logistics efficiency is further accelerating the adoption of bag-in-box packaging machines in Europe

Europe Bag-In-Box Packaging Machine Market Analysis

- The market is experiencing steady growth due to increasing demand for sustainable and cost-efficient packaging solutions

- Strong adoption is seen in food & beverage, dairy, edible oils, and pharmaceutical sectors, where product shelf life and hygiene are critical

- Germany dominated the Europe bag-in-box packaging machine market with the largest revenue share in 2024, driven by a robust food and beverage manufacturing base, high adoption of automation, and stringent EU packaging regulations promoting sustainable and recyclable solutions

- U.K. is expected to witness the highest compound annual growth rate (CAGR) in the Europe bag-in-box packaging machine market due to rising adoption of automated and semi-automatic machines, modernization of production lines, and growing emphasis on cost-efficient and eco-friendly packaging solutions

- The integrated segment held the largest revenue share in 2024, driven by the rising adoption of fully automated lines that combine filling, sealing, and secondary packaging processes in a single system, ensuring higher efficiency and reduced labor costs

Report Scope and Europe Bag-In-Box Packaging Machine Market Segmentation

|

Attributes |

Europe Bag-In-Box Packaging Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Bag-In-Box Packaging Machine Market Trends

Automation and Sustainability Driving Adoption of Bag-In-Box Packaging Machines

- The increasing emphasis on automation and sustainability is reshaping the Europe bag-in-box packaging machine market. Advanced filling and sealing technologies are enabling higher efficiency, accuracy, and reduced product wastage, making them attractive to industries such as food & beverages, dairy, and household products. This aligns with Europe’s focus on sustainable industrial practices

- The demand for eco-friendly packaging solutions is driving the adoption of bag-in-box systems, which reduce material usage and carbon footprint compared to rigid packaging formats. These machines also enhance storage and transportation efficiency, helping companies lower costs and meet environmental regulations

- Growing preference for lightweight, recyclable, and flexible packaging formats is accelerating machine installations across beverage and liquid food manufacturers. The trend is further supported by stricter EU policies aimed at reducing single-use plastics and encouraging circular packaging solutions

- For instance, in 2023, several European wine producers adopted automated bag-in-box filling machines to replace traditional glass bottling, significantly reducing logistics costs and improving sustainability scores. This transition enhanced both operational efficiency and environmental compliance

- While sustainability and automation are driving adoption, long-term growth will depend on continuous technological upgrades, affordability, and machine adaptability to diverse liquid products. Manufacturers must also localize solutions to address varied industry needs across the European market

Europe Bag-In-Box Packaging Machine Market Dynamics

Driver

Rising Demand for Sustainable and Cost-Efficient Packaging Solutions

- The growing need for sustainable packaging is one of the strongest drivers in the Europe bag-in-box packaging machine market. Companies across wine, dairy, edible oils, and juice sectors are moving away from rigid packaging formats, as flexible solutions reduce material usage, improve recyclability, and lower the overall carbon footprint of operations

- Businesses are becoming increasingly aware of the logistical and financial advantages of bag-in-box packaging. These systems reduce transportation costs by maximizing container efficiency, minimize storage requirements through compact design, and extend shelf life by preventing oxidation and contamination, directly improving profitability

- The EU’s focus on environmental regulations and recyclability standards is driving significant investments in flexible packaging. Stricter plastic reduction targets are encouraging companies to adopt bag-in-box solutions, pushing machine manufacturers to innovate with equipment that is compatible with eco-friendly films and barrier materials

- For instance, in 2022, the European Commission introduced updated packaging waste directives, which mandated higher recyclability requirements across industries. This regulatory shift encouraged food and beverage producers to adopt bag-in-box packaging machines to meet compliance standards while maintaining efficiency and cost-effectiveness

- While regulatory support and cost-efficiency continue to accelerate adoption, the market’s long-term growth depends on machine flexibility and adaptability. Equipment that can handle multiple product types and sustainable materials will be crucial for manufacturers aiming to stay competitive and aligned with evolving industry demands

Restraint/Challenge

High Initial Investment and Limited Adoption Among Small Producers

- The relatively high capital cost of automated bag-in-box packaging machines is a significant barrier, especially for small and medium-sized enterprises (SMEs). Many smaller producers in the food and beverage sector prefer manual or semi-automatic systems due to limited budgets, making large-scale automation adoption slower across Europe

- Another challenge is the lack of technical expertise and trained personnel among smaller operators. Without proper training, the efficiency of advanced machines cannot be fully realized, resulting in underutilization of technology and concerns over achieving an adequate return on investment. This limits confidence among SMEs in adopting automation

- The uneven availability of advanced packaging machinery across Europe further restricts market penetration. Rural regions and less industrialized economies often face limited access to suppliers, after-sales service, and spare parts, which creates disparities between large urban manufacturers and smaller regional players

- For instance, in 2023, surveys in Eastern Europe revealed that nearly 60% of mid-sized beverage producers postponed investment in automated bag-in-box machines due to high costs and operational complexity. This shows a clear adoption gap between Western European manufacturers and those in developing sub-regions

- Although machine prices are expected to gradually decline with technological advancements and economies of scale, affordability and accessibility remain core challenges. To overcome this, market stakeholders must provide financing options, localized support services, and modular machine designs that cater to the specific needs of smaller producers

Europe Bag-In-Box Packaging Machine Market Scope

The market is segmented on the basis of machine type, automation type, packaging material, output capacity, filling technology, and end user.

- By Machine Type

On the basis of machine type, the Europe bag-in-box packaging machine market is segmented into standalone and integrated. The integrated segment held the largest revenue share in 2024, driven by the rising adoption of fully automated lines that combine filling, sealing, and secondary packaging processes in a single system, ensuring higher efficiency and reduced labor costs.

The standalone segment is expected to witness the fastest growth rate from 2025 to 2032, supported by growing demand from small and medium-scale producers seeking flexible, cost-effective solutions that allow incremental automation without high capital investments.

- By Automation Type

On the basis of automation type, the market is divided into semi-automatic, automatic, and manual. The automatic segment dominated the market in 2024, as large-scale food and beverage producers increasingly invest in automated systems for precision, speed, and consistency in high-volume packaging.

The semi-automatic segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its balance of affordability and efficiency, making it an attractive option for mid-sized manufacturers and emerging regional players across Europe.

- By Packaging Material

On the basis of packaging material, the market is segmented into plastic, paper and paperboard, metal, and others. The plastic segment accounted for the largest share in 2024, supported by its wide availability, durability, and compatibility with different liquid products. It remains the preferred choice for wine, dairy, and edible oil packaging applications.

The paper and paperboard segment is expected to witness the fastest growth rate from 2025 to 2032, driven by Europe’s regulatory focus on reducing plastic use and the increasing adoption of recyclable and eco-friendly packaging formats.

- By Output Capacity

On the basis of output capacity, the market is segmented into 10 bags/min, 11–50 bags/min, 51–100 bags/min, and above 100 bags/min. The 11–50 bags/min segment held the largest revenue share in 2024, owing to its suitability for mid-sized production lines commonly used in food and beverage manufacturing facilities.

The above 100 bags/min segment is expected to witness the fastest growth rate from 2025 to 2032, as high-output automated systems gain traction among large enterprises aiming to maximize throughput and meet rising demand efficiently.

- By Filling Technology

On the basis of filling technology, the market is segmented into aseptic and non-aseptic. The non-aseptic segment dominated the market in 2024, as it is widely used across standard food, beverage, and household product packaging applications due to its relatively lower cost and simpler design.

The aseptic segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising demand for extended shelf-life products such as dairy, juices, and pharmaceuticals, where sterility and contamination-free packaging are essential.

- By End User

On the basis of end user, the market is categorized into food and beverages, paints and lubricants, personal care, household products, healthcare, and others. The food and beverages segment captured the largest share in 2024, driven by strong demand from wine, juice, and dairy manufacturers adopting bag-in-box packaging for cost efficiency and sustainability.

The healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, as pharmaceutical and medical fluid manufacturers increasingly rely on aseptic bag-in-box solutions for safe storage and efficient dispensing.

Europe Bag-In-Box Packaging Machine Market Regional Analysis

- Germany dominated the Europe bag-in-box packaging machine market with the largest revenue share in 2024, driven by a robust food and beverage manufacturing base, high adoption of automation, and stringent EU packaging regulations promoting sustainable and recyclable solutions

- Manufacturers in Germany highly value the efficiency, reduced product waste, and cost savings offered by integrated bag-in-box packaging machines

- This widespread adoption is further supported by a well-established industrial infrastructure, advanced technological capabilities, and the growing preference for eco-friendly, flexible packaging across food, beverage, and household product industries

U.K. Bag-In-Box Packaging Machine Market Insight

The U.K. bag-in-box packaging machine market is expected to witness the fastest growth rate from 2025 to 2032. Growth is fueled by rising adoption of automated and semi-automatic machines in food, beverage, and household product production. Increasing modernization of production lines, strong e-commerce and retail infrastructure, and growing emphasis on cost-efficient, sustainable packaging solutions are further propelling market expansion. In addition, manufacturers are increasingly investing in flexible and modular systems to meet evolving industry demands and regulatory requirements.

Europe Bag-In-Box Packaging Machine Market Share

The Europe bag-in-box packaging machine industry is primarily led by well-established companies, including:

- IC Filling Systems (U.K.)

- Smurfit Kappa (Ireland)

- DS Smith (U.K.)

- Robert Bosch GmbH (Germany)

- ALFA LAVAL (Sweden)

- Engi-O (U.K.)

- Pattyn (Belgium)

- SACMI IMOLA S.C Via Selice (Italy)

- SIG (Switzerland)

- Technibag (France)

- Franz Haniel & Cie. GmbH (Germany)

- ProXES GmbH (Germany)

- Flexifill Ltd. (U.K.)

- Amcor plc (Switzerland)

Latest Developments in Europe Bag-In-Box Packaging Machine Market

- In February 2024, Smurfit Kappa announced a plant expansion in Alicante, Spain. The company is investing USD 58.2 million to double its bag-in-box machine production capacity. This expansion aims to broaden the product portfolio and enhance operational efficiency, supporting sustainable production practices. The new facility is expected to strengthen Smurfit Kappa’s market presence in Europe and meet rising demand from food and beverage manufacturers

- In February 2024, Aran Group completed the acquisition of a majority stake in IBA Germany from Liquid Concept GmbH. This strategic acquisition enhances Aran Group’s production capabilities in intermediate bulk containers and bag-in-box solutions, boosting its footprint in the German and wider European market. The deal is expected to improve operational synergy and accelerate growth in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Bag In Box Packaging Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Bag In Box Packaging Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Bag In Box Packaging Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.