Europe Bio Based Lubricants Market

Market Size in USD Million

CAGR :

%

USD

685.00 Million

USD

1,075.00 Million

2024

2032

USD

685.00 Million

USD

1,075.00 Million

2024

2032

| 2025 –2032 | |

| USD 685.00 Million | |

| USD 1,075.00 Million | |

|

|

|

|

Europe Bio-based Lubricants Market Size

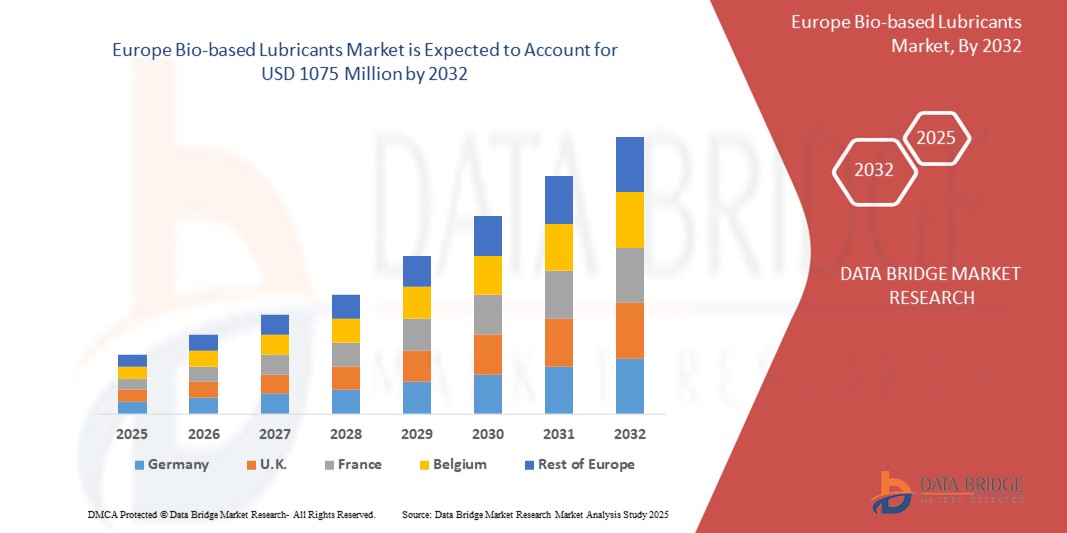

- The global Europe Bio-based Lubricants Market size was valued at USD 685 million in 2024 and is expected to reach USD 1075 million by 2032, at a CAGR of 5.8% during the forecast period

- The market growth is largely fueled by increasingly stringent environmental regulations across Europe and a heightened regional commitment to sustainability, pushing industries towards the adoption of biodegradable and eco-friendly bio-based lubricants

- Furthermore, growing industrial uptake in sectors such as automotive, manufacturing, marine, and agriculture, driven by both technological advancements enhancing bio-lubricant performance and a rising corporate focus on reducing carbon footprints and enhancing operational sustainability, is accelerating market expansion

Europe Bio-based Lubricants Market Analysis

- Bio-based lubricants, derived from renewable feedstocks such as vegetable oils and animal fats, are increasingly vital for sustainable operations across various sectors, offering enhanced biodegradability, lower toxicity, and a reduced carbon footprint compared to conventional mineral oil-based products, making them crucial for applications in environmentally sensitive areas and for entities pursuing green initiatives

- The escalating demand for bio-based lubricants is primarily fueled by stringent environmental regulations mandating the use of eco-friendly products, growing awareness and concerns regarding the environmental impact of conventional lubricants, and an increasing industrial shift towards sustainability and corporate social responsibility goals

- Europe leads the global bio-based lubricants market, accounting for a dominant revenue share over 35% of the global market in 2022, with continued leadership in 2024, characterized by its stringent environmental policies like the EU Ecolabel, high consumer and industrial awareness of sustainability, and strong government initiatives promoting bio-based alternatives. Countries like Germany, France, and the Nordic nations are at the forefront of adoption, driven by robust industrial sectors (automotive, manufacturing) actively seeking to minimize environmental impact and comply with green regulations

- Asia-Pacific is expected to be the fastest-growing region in the global bio-based lubricants market during the forecast period, due to rapid industrialization, increasing environmental awareness, and supportive government policies for sustainable products in emerging economies

- The hydraulic fluids segment dominates the Europe bio-based lubricants market, representing the largest application share in 2024, driven by extensive use in environmentally sensitive applications like agriculture, forestry, and marine industries where stringent regulations mandate their adoption, and by their increasing use in general industrial and mobile hydraulic systems due to proven performance and sustainability benefits

Report Scope and Europe Bio-based Lubricants Market Segmentation

|

Attributes |

Smart Lock Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Bio-based Lubricants Market Trends

“Enhanced Sustainability Through Advanced Feedstocks and Circular Economy Pathways”

- A significant and accelerating trend in the Europe bio-based lubricants market is the strategic adoption of advanced sustainable feedstocks—such as agricultural residues, non-food crops, waste cooking oils, and algae—alongside the comprehensive integration of circular economy principles. This pivotal shift is substantially elevating the environmental credentials, resource efficiency, and overall lifecycle sustainability of bio-lubricants

- For instance, companies like Neste are utilizing their NEXBTL technology to produce high-quality renewable base oils from waste and residue raw materials, suitable for top-tier bio-lubricants. Similarly, various EU-backed research consortia and innovative SMEs across Europe are actively developing and scaling up processes to convert diverse lignocellulosic biomass and other waste streams into high-performance lubricant components

- The utilization of advanced feedstocks in bio-lubricants enables enhanced product performance, such as improved thermal stability, better oxidative resistance, and tailored friction properties for specific demanding applications, while also minimizing competition with food sources. For instance, bio-lubricants derived from specifically engineered plant oils or synthetically produced esters from waste can offer superior technical characteristics. Furthermore, circular economy approaches, including the development of chemical recycling for used bio-lubricants and designing products for extended life or easier re-refining, significantly reduce waste generation and conserve valuable resources

- The seamless integration of these advanced feedstock strategies and circular economy models within the lubricants industry facilitates stronger alignment with overarching European sustainability goals, such as those outlined in the EU Green Deal and the Circular Economy Action Plan. Through these initiatives, companies can embed their lubricant choices and production processes into broader corporate sustainability frameworks, contributing to more resilient and environmentally sound value chains and operations

- This trend towards more holistically sustainable and high-performing bio-lubricants is fundamentally reshaping industry expectations, moving beyond basic biodegradability to demand comprehensive lifecycle assessments and significantly reduced carbon footprints. Consequently, leading European lubricant manufacturers such as Fuchs Petrolub, Total Energies, and specialty chemical providers like Croda are intensifying their R&D investments in novel bio-based raw materials, innovative formulation technologies, and sustainable end-of-life solutions

- The demand for bio-lubricants that are not only biodegradable but also originate from verifiably sustainable advanced feedstocks and fit within robust circular economy systems is growing rapidly across key European sectors including automotive, industrial manufacturing, marine, and agriculture, as businesses increasingly prioritize superior environmental performance, regulatory adherence, and enhanced corporate responsibility

Europe Bio-based Lubricants Market Dynamics

Driver

“Demand Driven by Stringent Environmental Regulations and Corporate Sustainability Goals"

- The increasing stringency of environmental regulations across the European Union, coupled with the accelerating adoption of comprehensive corporate sustainability and ESG (Environmental, Social, Governance) frameworks, is a significant driver for the heightened demand for bio-based lubricants

- For instance, the phased implementation of the EU's Corporate Sustainability Reporting Directive (CSRD), with its first reporting requirements for many companies covering the 2024 financial year (reports due in 2025), is compelling businesses to meticulously assess and disclose their environmental impact, including their choice of operational fluids like lubricants. This scrutiny is directly encouraging a shift towards readily biodegradable and lower-carbon bio-based alternatives

- As European companies become more accountable for their environmental footprint and seek to enhance their sustainability credentials, bio-based lubricants offer advanced solutions such as significantly improved biodegradability, reduced toxicity to aquatic environments, and a lower carbon footprint (when sourced sustainably), providing a compelling upgrade over conventional mineral oil-based products, especially in sensitive applications like agriculture, forestry, and marine

- Furthermore, the overarching objectives of the European Green Deal and the drive towards a circular economy are making bio-based lubricants an integral component of industries' strategies to reduce reliance on fossil fuels and minimize environmental pollution, fostering their integration into sustainable supply chain management and green procurement policies

- The clear benefits of achieving compliance with specific regulations (e.g., Vessel General Permit in marine applications, or criteria for use in protected natural areas), the availability of credible certifications like the EU Ecolabel (whose criteria for lubricants were extended until December 31, 2028), and the growing pressure from investors and consumers for businesses to demonstrate tangible environmental responsibility are key factors propelling the adoption of bio-based lubricants across industrial, automotive, and marine sectors. The continuous improvement in the performance and application range of bio-lubricants further contributes to market growth

Restraint/Challenge

"Concerns Regarding Performance Consistency, Compatibility, and Higher Initial Costs"

- Concerns surrounding the consistent performance of some bio-based lubricants under demanding operational conditions and their compatibility with existing equipment and materials pose a significant challenge to broader market penetration in Europe. As bio-lubricants are derived from diverse natural feedstocks and can have different chemical properties than conventional mineral oils, they can raise anxieties among industrial and automotive end-users about reliability and potential operational issues

- For instance, historical perceptions or isolated reports of issues such as lower oxidative stability, challenges in extreme temperature performance (pour point or viscosity index), or material compatibility (e.g., with certain elastomers or seals) in some first-generation or less advanced bio-formulations have made some consumers hesitant to switch, particularly for critical or high-stress applications

- Addressing these performance and compatibility concerns through advanced formulation technologies (e.g., use of high-performance synthetic esters, specialized additive packages), rigorous testing against industry standards and OEM specifications, and clear application guidelines is crucial for building end-user trust. Companies such as Fuchs, Panolin, and Total Energies emphasize their extensive R&D, the development of high-stability bio-synthetics, and application-specific product lines (e.g., EU Ecolabel certified hydraulic fluids or gear oils) in their technical documentation and marketing to reassure potential buyers. Additionally, the relatively higher initial purchase cost of many advanced bio-based lubricants compared to conventional mineral oil-based products can be a barrier to adoption for price-sensitive businesses or those focused on upfront expenditure, particularly for SMEs or in highly competitive sectors. While basic bio-hydraulic fluids are becoming more price-competitive, specialized formulations for demanding industrial machinery, marine applications, or high-performance automotive use often come with a premium price tag, influenced by feedstock costs and complex production processes

- While Total Cost of Ownership (TCO) analyses often demonstrate long-term benefits (e.g., extended drain intervals, reduced environmental disposal fees, lower carbon taxes where applicable), the perceived premium for bio-based technology can still hinder widespread adoption, especially for operators who do not see an immediate regulatory mandate or a clear, short-term ROI for the advanced features and environmental benefits offered

- Overcoming these challenges through continued innovation in cost-effective, high-performance bio-formulations, ensuring stable and sustainable feedstock supply chains, transparently communicating lifecycle benefits and TCO advantages, and providing robust technical support and end-user education on correct product selection and application will be vital for sustained market growth in Europe

Europe Bio-based Lubricants Market Scope

The Europe Bio-Based Lubricants Market is segmented on the basis of raw material, application, and end-user industry.

- By Raw Material

On the basis of raw material, the Europe bio-based lubricants market is segmented into Plant Oil, Animal Oil, and Others. The Plant Oil segment dominates the largest market revenue share of 65.5% in 2024, driven by its widespread availability, excellent biodegradability, and superior performance characteristics that make it suitable for a wide range of lubricant applications. The increasing focus on sustainable sourcing and the development of advanced plant oil derivatives further contribute to its dominance

The Others segment is anticipated to witness the fastest growth rate of 18.2% from 2025 to 2032, fueled by the emergence of novel feedstocks and innovative bio-based chemistries. This segment includes synthetic esters derived from bio-based sources and other advanced bio-lubricant formulations that offer enhanced performance in niche applications, attracting significant research and development investments

- By Application

On the basis of application, the Europe bio-based lubricants market is segmented into Hydraulic Oil, Metal Working Fluids, Penetrating Oils, Grease, Transformer Oil, Crankcase Oils Engine Oils, Elevator Hydraulic Fluid, Bar and Chain Oil, Firearm Lubricant, and Others. The Hydraulic Oil segment held the largest market revenue share in 2024, driven by stringent environmental regulations in Europe promoting the use of biodegradable fluids in hydraulic systems, particularly in sensitive environments like construction, forestry, and marine applications. Bio-based hydraulic oils offer comparable performance to mineral-based counterparts while reducing environmental impact

The Metal Working Fluids segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing demand for sustainable and non-toxic solutions in manufacturing processes. Bio-based metalworking fluids offer improved operator health and safety, reduced waste disposal costs, and enhanced biodegradability, making them increasingly attractive to industries focused on green manufacturing practices

- By End User Industry

On the basis of end-user industry, the Europe bio-based lubricants market is segmented into Power Generation, Automotive and Other Transportation, Heavy Equipment, Food and Beverage, Metallurgy and Metalworking, Chemical Manufacturing, and Other End-user Industries. The Automotive and Other Transportation segment accounted for the largest market revenue share in 2024, driven by the automotive industry's push for sustainability and the increasing adoption of bio-based engine oils, transmission fluids, and greases in both conventional and electric vehicles. The need to meet stricter emission standards and reduce carbon footprints also propels the demand for bio-based lubricants in this sector

The Food and Beverage segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the critical need for food-grade lubricants that are non-toxic and safe for incidental contact with food products. Strict regulatory requirements and growing consumer awareness regarding food safety are accelerating the adoption of bio-based lubricants in processing, packaging, and handling machinery within the food and beverage industry

Europe Bio-based Lubricants Market Regional Analysis

The Europe bio-based lubricants market is driven by a strong commitment to sustainability, stringent environmental regulations, and a well-developed industrial sector seeking eco-friendly solutions. The region's proactive approach to green initiatives and a high level of environmental awareness among consumers and industries are key factors propelling market growth

- Germany Bio-Based Lubricants Market Insight

The Germany bio-based lubricants market is a leading force in Europe, fueled by a robust emphasis on environmental awareness, sustainability, and corporate social responsibility (CSR). Germany's strong manufacturing capabilities and its position as a major exporter of lubricants contribute significantly to the adoption of bio-based alternatives. The market is particularly driven by the automotive industry and heavy industrial sectors, which are increasingly seeking high-performance, eco-conscious lubrication solutions. Regulatory support and ongoing investments in research and development for renewable resources further solidify Germany's market expansion. The hydraulic oil application, in particular, generates substantial revenue, reflecting the industrial prioritization of sustainable lubrication

- U.K. Bio-Based Lubricants Market Insight

The U.K. bio-based lubricants market is experiencing noteworthy growth, primarily driven by a significant shift towards sustainable and environmentally friendly lubricants. This trend is a direct response to stringent environmental regulations from the U.K. government aimed at reducing carbon footprints and achieving net-zero emissions. Increasing awareness of environmental issues among consumers and industries encourages the adoption of bio-based options. The automotive and industrial sectors are key adopters, seeking to comply with regulations and enhance their corporate social responsibility. The U.K.'s robust e-commerce and retail infrastructure also supports the accessibility and adoption of these products

- France Bio-Based Lubricants Market Insight

The France bio-based lubricants market is steadily gaining traction, influenced by the country's strong industrial base, including manufacturing, aerospace, and energy sectors, which are progressively incorporating sustainable practices. The market is driven by the growing prominence of bio-lubricants as an alternative to conventional mineral oils, fueled by increasing environmental awareness and a focus on reducing ecological impact. While the overall lubricants market might face challenges like the slowdown in certain automotive segments, the demand for bio-lubricants is creating new opportunities, particularly as industries seek high-performance, environmentally responsible solutions

- Italy Bio-Based Lubricants Market Insight

The Italy bio-based lubricants market is experiencing growth driven by its expanding industrial sector and a shift towards eco-friendly lubricants in response to environmental regulations. The automotive industry is a major consumer, with the recovery and growth in vehicle sales and maintenance needs directly influencing lubricant demand. Furthermore, Italy's growing industrial production, particularly in manufacturing and construction, necessitates a higher demand for industrial lubricants. The Italian government, aligning with EU directives, is promoting the use of bio-lubricants to meet CO2 emission reduction targets, compelling industries to adopt biodegradable and low-toxicity options

- Eastern Europe Bio-Based Lubricants Market Insight

The Eastern Europe bio-based lubricants market is poised for significant growth, driven by rapid industrialization and increasing demand for high-performance, eco-friendly lubrication solutions, particularly in automotive manufacturing and heavy industries. While Western Europe has historically led in bio-lubricant adoption, Eastern European countries are catching up due to increasing environmental awareness and the adoption of more stringent environmental regulations. The shift towards bio-based and eco-friendly lubricants is a notable trend, offering biodegradability and reduced environmental impact compared to traditional mineral oils, which aligns with the region's industrial expansion and sustainability goals

Europe Bio-based Lubricants Market Share

The Europe Bio-based Lubricants industry is primarily led by well-established companies, including:

- Shell group of companies (UK/Netherlands)

- BP (UK)

- Chevron Corporation (US)

- Exxon Mobil Corporation (US)

- Total (France)

- BASF SE (Germany)

- Biosynthetic Technologies (US)

- Carl Bechem Lubricants India Private Limited (India)

- CASTROL LIMITED (UK)

- CITGO Petroleum Corporation (US)

- FUCHS (Germany)

- Green Earth Technologies, Inc. (US)

- KLÜBER LUBRICATION INDIA Pvt. Ltd. (India)

- Magna International Pte Ltd. (Singapore)

- MMXIX DSI Ventures, Inc. (US)

- Mitsubishi Chemical Corporation (Japan)

- Novozymes (Denmark)

- Polnox Corp. (US)

- ROCOL (UK)

- RSC Bio Solutions (US)

- DSM (Netherlands)

Latest Developments in Europe Bio-based Lubricants Market

- In April 2025, Argent Energy, a prominent European biofuels manufacturer, officially launched Europe's largest facility dedicated to producing bio-based, technical-grade glycerine at its Port of Amsterdam site. This state-of-the-art refinery upgrades crude glycerine, a by-product of Argent's waste-based biodiesel process, into 99.7% purely technical-grade glycerine, providing chemical producers with a bio-based alternative to petrochemicals

- In 2023, Renewable Lubricants launched Bio-E. P Wire Rope Lubricants, a biodegradable vegetable oil-formulated lubricant designed with anti-wear, extreme pressure, and anti-rust properties. This product caters to the growing demand for environmentally friendly solutions in heavy-duty industrial applications, emphasizing the continuous innovation in bio-based formulations

- In September 2022, the LIFE Bio-Lubricant project was announced, financed by the European Commission's Life Programme. This project, coordinated by A&A Fratelli Parodi SpA (Italy), aims to demonstrate a short and efficient supply chain for the exclusive recycling of bio-lubricants, currently collected and regenerated without distinction from mineral oils. The goal is to recover and treat 1,000 tons of waste bio/synthetic esters for the production of regenerated bio-lubricants and advanced biofuels

- In 2022, Vbase Oil Company announced that its bio-based base oil had been added to the EU Ecolabel Lubricant Substance Classification list in Europe. This signifies the increasing adoption of certifications and standards to provide quality assurance to end-users and promotes the market for bio-based lubricants that meet stringent European environmental criteria

- In 2022, Kixx introduced Kixx bio1, an eco-friendly lubricant that is fully synthetic and utilizes 100% plant-based base oil. This product highlights the industry's commitment to minimizing environmental impact while maximizing vehicle performance, catering to the growing eco-conscious consumer base in Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Bio Based Lubricants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Bio Based Lubricants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Bio Based Lubricants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.