Europe Bioherbicides Market

Market Size in USD Million

CAGR :

%

USD

456.13 Million

USD

675.46 Million

2024

2032

USD

456.13 Million

USD

675.46 Million

2024

2032

| 2025 –2032 | |

| USD 456.13 Million | |

| USD 675.46 Million | |

|

|

|

|

Europe Bioherbicides Market Size

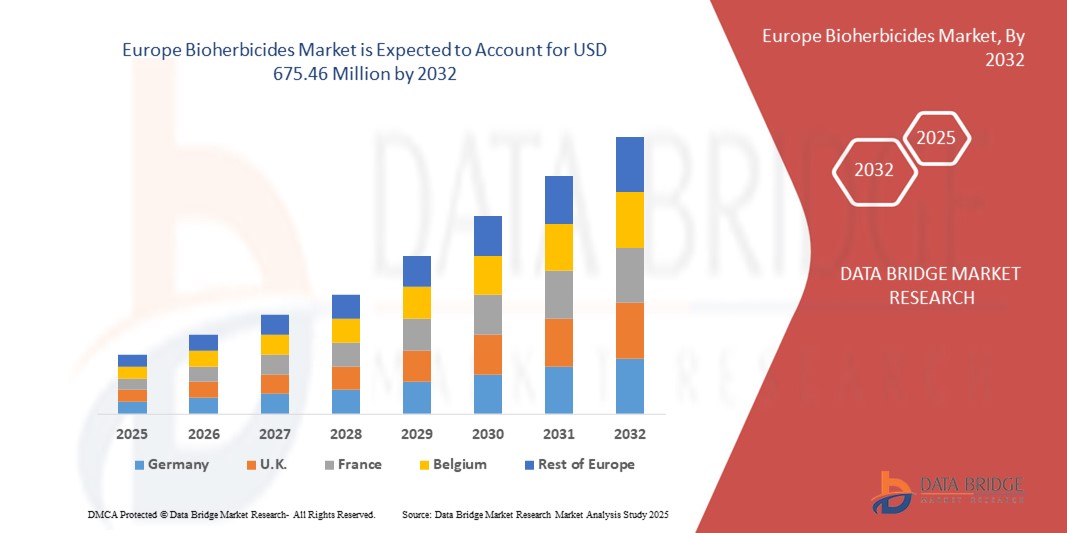

- The Europe bioherbicides market size was valued at USD 456.13 million in 2024 and is expected to reach USD 675.46 million by 2032, at a CAGR of 5.03% during the forecast period

- The market growth is largely fueled by the increasing adoption of sustainable and eco-friendly agricultural practices, alongside rising awareness about the environmental impact of synthetic herbicides. Farmers and agribusinesses are increasingly shifting toward biological solutions to manage weeds while reducing chemical residues in crops and soil

- Furthermore, growing regulatory support for biologically-based crop protection products and advancements in microbial and biochemical formulations are accelerating the development and adoption of bioherbicides, thereby significantly boosting the industry's growth

Europe Bioherbicides Market Analysis

- Bioherbicides are biological agents derived from natural organisms or their metabolites, used to control or suppress weed growth in agricultural fields. They offer targeted, eco-friendly alternatives to conventional chemical herbicides and can be applied in various forms, including liquid, dry, and seed treatments, across multiple crop types

- The escalating demand for bioherbicides is primarily fueled by the need for sustainable weed management solutions, increasing prevalence of herbicide-resistant weeds, and the rising focus on reducing chemical inputs in agriculture. Advances in formulation technology, ease of integration into modern farming practices, and growing awareness among farmers about long-term soil and crop health are further supporting market expansion

- Germany dominated the bioherbicides market in 2024, due to its advanced agricultural sector, strong focus on sustainable farming, and increasing adoption of eco-friendly crop protection solutions

- U.K. is expected to be the fastest growing region in the bioherbicides market during the forecast period due to rising adoption of sustainable and organic farming practices and increasing focus on reducing chemical inputs in crop production

- Liquid segment dominated the market with a market share of 57.6% in 2024, due to its ease of application, rapid absorption, and uniform distribution across target areas. Liquid antivirals are particularly suitable for foliar spraying and seed treatments, enabling efficient delivery of active compounds. Their formulation flexibility and compatibility with automated application systems make them highly appealing for commercial use. In addition, liquid formulations allow for precise dosing and quick response to emerging viral threats, enhancing their effectiveness in large-scale crop protection. Their adaptability across different crop types and environmental conditions further strengthens market adoption

Report Scope and Bioherbicides Market Segmentation

|

Attributes |

Bioherbicides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Bioherbicides Market Trends

Growing Demand for Organic and Sustainable Farming

- The accelerated shift towards organic and sustainable farming practices is boosting the demand for bioherbicides, as they provide eco-friendly alternatives to synthetic chemical weed-control solutions. Farmers and producers are increasingly seeking natural inputs that minimize environmental damage while maintaining productivity

- For instance, Marrone Bio Innovations has developed bioherbicide products that target weed control using natural microbes and plant-based compounds. Their portfolio demonstrates how sustainable solutions can effectively address weed challenges while supporting organics-driven market growth

- The rise in consumer preference for chemical-free food products is pushing farmers to adopt inputs that align with sustainability certifications. Bioherbicides, being residue-free and biodegradable, strengthen compliance with organic farming standards and consumer-driven demands for safer agricultural practices

- In addition, awareness around soil health and biodiversity has influenced farming strategies. Bioherbicides support these objectives by reducing chemical accumulation, enhancing microbial activity, and contributing to long-term farmland sustainability compared to synthetic herbicides

- The expanding organic farming sector offers favorable conditions for bioherbicides. As food security challenges mount, sustainable weed management through bio-based controls is becoming a key priority for the agricultural ecosystem

- Altogether, the trend towards organic and sustainable farming underpins the pivotal role of bioherbicides. Their ability to meet consumer expectations, improve soil quality, and align with regulatory and environmental goals is positioning them as a vital part of future agriculture

Europe Bioherbicides Market Dynamics

Driver

Regulatory Support and Government Initiatives

- Global regulatory frameworks and government policies are playing a crucial role in driving adoption of bioherbicides. Policies focused on reducing reliance on chemical herbicides are reinforcing the transition to sustainable alternatives in mainstream farming

- For instance, the European Union has introduced stricter regulations on synthetic pesticides, creating opportunities for bioherbicide adoption. Companies such as BioWorks are leveraging these policy shifts by scaling production of biologically derived solutions that meet regulatory requirements for safer agriculture

- Government-funded research programs and subsidies are further promoting adoption. Many countries are investing in biopesticide development and offering incentives to farmers for integrating bio-based inputs into integrated weed management systems

- In addition, the emphasis on achieving United Nations Sustainable Development Goals (SDGs) has increased support for environmentally friendly farming inputs. Bioherbicides align closely with both climate action and sustainable agricultural productivity targets

- Altogether, regulatory backing, policy incentives, and institutional funding are creating a strong foundation for widespread market adoption of bioherbicides. These supportive frameworks are expected to reinforce demand and encourage innovation in the sector

Restraint/Challenge

Limited Farmer Awareness of Bioherbicide Benefits

- A significant challenge in the bioherbicides market is the limited awareness among farmers regarding their effectiveness compared to conventional chemicals. Many farmers remain hesitant due to concerns over performance, application processes, and limited product availability in local markets

- For instance, surveys in emerging economies show that agribusiness companies such as BASF Biologicals face difficulties in persuading farmers to adopt bioherbicides over traditional herbicides due to perceived risks in yield reliability and control effectiveness

- The absence of robust extension services and farmer education programs often hinders knowledge dissemination about bioherbicides. Lack of clear guidelines and demonstrations further contributes to low adoption rates, particularly among small and medium-scale farmers

- In addition, the higher cost and limited commercial availability compared to synthetic herbicides restrict access in price-sensitive markets. Farmers with small budgets are more likely to continue with conventional chemicals that provide quick and familiar results

- Overcoming these challenges requires widespread farmer education, demonstration projects, and government-backed awareness campaigns. Addressing these gaps will be essential in enhancing confidence, expanding adoption, and realizing the full potential of bioherbicides in sustainable farming

Europe Bioherbicides Market Scope

The market is segmented on the basis of type, mode of action, form, application, crop type, and distribution channel.

- By Type

On the basis of type, the antiviral market is segmented into microbial, biochemical, and others. The microbial segment dominated the largest market revenue share in 2024, owing to its proven efficacy in controlling viral pathogens and its compatibility with both agricultural and healthcare applications. Microbial antivirals are favored for their environmentally friendly nature and minimal impact on non-target organisms, making them a preferred choice for sustainable disease management. Strong research and development in microbial formulations has further enhanced their stability, efficacy, and ease of application. Their ability to integrate with existing crop protection and healthcare protocols also boosts adoption.

The biochemical segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by advances in molecular antiviral compounds and increased demand for precision-targeted solutions. Biochemical antivirals are highly effective at disrupting viral replication, offering specificity that reduces collateral damage to beneficial organisms. Rising investment in biotechnology and the growing awareness of chemical-free alternatives in both agriculture and healthcare sectors are further propelling market expansion.

- By Mode of Action

On the basis of mode of action, the antiviral market is segmented into selective bioherbicides and non-selective bioherbicides. The selective bioherbicides segment dominated the largest market revenue share in 2024, as it targets specific viral pathogens without affecting other organisms, reducing unintended damage to crops or microbial communities. This specificity allows for safer, more predictable outcomes in both agricultural and healthcare applications. Regulatory support for selective solutions and growing adoption among precision farming practices also contribute to its market leadership.

The non-selective bioherbicides segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing need for broad-spectrum antiviral solutions in regions prone to multiple viral strains and frequent disease outbreaks. These antivirals provide rapid and comprehensive control, effectively targeting a wide range of pathogens and reducing the risk of crop losses. Their ability to offer consistent protection across diverse environmental conditions makes them particularly suitable for large-scale crop protection and emergency outbreak management. Rising adoption is also supported by advancements in formulation technologies that enhance stability, efficacy, and ease of application.

- By Form

On the basis of form, the antiviral market is segmented into liquid and dry. The liquid segment dominated the largest market revenue share of 57.6% in 2024, owing to its ease of application, rapid absorption, and uniform distribution across target areas. Liquid antivirals are particularly suitable for foliar spraying and seed treatments, enabling efficient delivery of active compounds. Their formulation flexibility and compatibility with automated application systems make them highly appealing for commercial use. In addition, liquid formulations allow for precise dosing and quick response to emerging viral threats, enhancing their effectiveness in large-scale crop protection. Their adaptability across different crop types and environmental conditions further strengthens market adoption.

The dry segment is projected to witness the fastest growth rate from 2025 to 2032, driven by advantages such as longer shelf life, ease of storage, and cost-effective transportation. Dry antivirals can be reconstituted as needed, reducing wastage and supporting sustainable application practices. Their stability under varying environmental conditions makes them suitable for regions with limited cold-chain infrastructure. The convenience of handling and precise dosing further enhances their appeal among farmers and agricultural operators. In addition, the rising demand in remote or resource-limited regions, where liquid formulations may be less practical, is expected to accelerate the adoption of dry antiviral products. Growing awareness about sustainable and efficient crop protection practices is also contributing to market expansion.

- By Application

On the basis of application, the antiviral market is segmented into foliar spray, seed treatment, soil treatment, post-harvest, chemigation, and others. The foliar spray segment dominated the largest market revenue share in 2024 due to its direct application on crops, providing immediate viral control and reducing the spread of infections. Foliar sprays allow precise dosing and uniform coverage, enhancing treatment efficiency while minimizing environmental impact. Their compatibility with automated spraying systems and precision agriculture techniques further strengthens their adoption in commercial farming. In addition, foliar sprays are versatile across different crop types and climatic conditions, making them a preferred choice for large-scale and high-value agricultural operations. Increasing awareness about timely and effective disease management is also driving market demand.

The seed treatment segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its role in early-stage protection against viral pathogens, improving crop resilience and yield. Seed treatments are gaining traction due to their efficiency, lower chemical input requirements, and compatibility with modern agricultural practices, supporting preventive disease management strategies. Their ability to deliver targeted protection at the critical germination stage reduces the risk of crop failure and enhances overall productivity. Moreover, advancements in seed coating technologies and growing adoption of sustainable farming practices are expected to further accelerate the growth of this segment. Rising demand from regions focusing on high-quality and disease-free crop production is also boosting adoption.

- By Crop Type

On the basis of crop type, the antiviral market is segmented into cereals & grains, fruits & vegetables, oilseeds & pulses, turf & ornamentals, and other crops. The fruits & vegetables segment dominated the largest market revenue share in 2024, driven by the high susceptibility of these crops to viral infections and the increasing demand for safe, high-quality produce. Consumers’ preference for chemical-free solutions further boosts the adoption of antiviral treatments in these crops. Advanced application techniques and precision agriculture practices also enhance the effectiveness of antivirals in this segment.

The cereals & grains segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by rising demand for staple crops and increasing outbreaks of viral pathogens affecting global food security. Antiviral solutions for cereals and grains help prevent yield losses, improve crop resilience, and ensure food supply stability, prompting higher adoption rates. Growing awareness among farmers about the economic impact of viral infections, coupled with the integration of antivirals into modern agricultural practices, is further driving the uptake of these solutions.

- By Distribution Channel

On the basis of distribution channel, the antiviral market is segmented into direct and indirect. The direct distribution segment dominated the largest market revenue share in 2024, due to stronger relationships between manufacturers and large-scale end-users, such as agricultural cooperatives, commercial farms, and healthcare institutions. Direct channels allow better control over pricing, timely deliveries, and customized solutions tailored to end-user needs. Strong manufacturer support and after-sales services further reinforce its dominance.

The indirect distribution segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the expanding network of distributors, retailers, and online platforms. Indirect channels improve product accessibility for small-scale farmers and regional agricultural operators, enhancing market penetration and supporting widespread adoption. The growth is further bolstered by the rise of e-commerce and digital marketplaces, which allow manufacturers to reach remote and underserved regions. In addition, partnerships with local distributors and agritech service providers are facilitating education and awareness about bioherbicide benefits, accelerating adoption across diverse geographies.

Europe Bioherbicides Market Regional Analysis

- Germany dominated the bioherbicides market with the largest revenue share in 2024, driven by its advanced agricultural sector, strong focus on sustainable farming, and increasing adoption of eco-friendly crop protection solutions

- The country’s leadership is reinforced by extensive R&D investments, government support for biological pest and weed management, and integration of precision agriculture technologies

- Growing demand for cereals, grains, and horticultural crops, along with rising awareness of herbicide-resistant weeds, further strengthens Germany’s position. Collaboration between domestic bioherbicide manufacturers and global companies continues to drive innovation and market expansion, consolidating Germany’s dominant status in the region

U.K. Bioherbicides Market Insight

The U.K. market is projected to register the fastest CAGR in Europe during 2025–2032, fueled by rising adoption of sustainable and organic farming practices and increasing focus on reducing chemical inputs in crop production. Growth is supported by government initiatives promoting eco-friendly agriculture, the expansion of high-value crop cultivation, and increasing awareness among farmers about the benefits of bioherbicides. Investments in research, technology integration, and collaborations with global bioherbicide providers are enhancing product efficacy and accessibility. The U.K.’s emphasis on environmentally responsible farming and precision agriculture is expanding market penetration and accelerating adoption rates.

France Bioherbicides Market Insight

France is expected to witness steady growth during 2025–2032, supported by its established agricultural sector, increasing production of cereals, fruits, and vegetables, and growing interest in organic and sustainable crop protection solutions. Rising adoption of microbial and biochemical bioherbicides, coupled with government policies favoring reduced chemical usage, is driving market expansion. Collaboration between domestic producers and international bioherbicide developers enhances availability, efficacy, and farmer awareness. The country’s focus on sustainable farming practices, environmental compliance, and technological integration continues to strengthen France’s market outlook.

Europe Bioherbicides Market Share

The bioherbicides industry is primarily led by well-established companies, including:

- BASF (Germany)

- FMC Corporation (U.S.)

- Coromandel International Limited (India)

- Certis USA L.L.C. (U.S.)

- Emery Oleochemicals (Malaysia)

- BioHerbicides Australia (Australia)

- Herbanatur (Spain)

- Andermatt Biocontrol Suisse (Switzerland)

- Syngenta AG (Switzerland)

- Bayer CropScience AG (Germany)

- Novozymes A/S (Denmark)

- Marrone Bio Innovations Inc. (U.S.)

- Verdesian Life Sciences (U.S.)

- Deer Creek Holdings (U.S.)

- EcoPesticides International, Inc. (U.S.)

Latest Developments in Europe Bioherbicides Market

- In July 2025, Seipasa, a Spanish company specializing in biopesticides, announced its efforts to register a new bioherbicide featuring a novel mode of action. This development aims to provide an alternative to existing synthetic herbicides, addressing the growing demand for sustainable crop protection solutions. The introduction of this innovative product is expected to enhance Seipasa's portfolio and contribute to the advancement of eco-friendly agricultural practices

- In December 2022, Seipasa inaugurated a new industrial base, encompassing 4,000 m², to support the development and registration of its bioherbicide products. This facility aims to facilitate the company's growth and enhance its capacity to meet the increasing demand for biopesticide solutions

- In May 2023, BASF introduced two new herbicides, Facet and Duvelon, to aid Indian rice and tea farmers in managing problematic weeds. Facet targets the grassy weed Echinochloa spp in rice crops, while Duvelon, powered by Kixor Active, combats broadleaf weeds in tea plantations. This launch expands BASF’s offerings, addressing key challenges faced by rice and tea growers in India, further emphasizing the company's commitment to sustainable agricultural practices

- In October 2024, FMC Corporation announced the launch of Ambriva herbicide in Chandigarh, India, aimed at helping wheat farmers combat the resistant weed Phalaris minor. Featuring Isoflex active, a novel group 13 herbicide, Ambriva offers effective early post-emergence control and long-lasting residual protection. The herbicide has been rigorously tested and provides a powerful new solution for farmers in Punjab, Haryana, Uttar Pradesh, and Rajasthan, addressing significant challenges posed by this destructive weed

- In December 2022, FMC Corporation and Micropep Technologies announced their collaboration to develop biological solutions for controlling herbicide-resistant weeds. This partnership combines FMC's agricultural expertise with Micropep's micropeptide technology to accelerate the development of innovative bioherbicide solutions, aiming to enhance crop yields and promote sustainable farming practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Bioherbicides Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Bioherbicides Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Bioherbicides Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.