Europe Blocking Buffers Market

Market Size in USD Million

CAGR :

%

USD

313.09 Million

USD

651.86 Million

2024

2032

USD

313.09 Million

USD

651.86 Million

2024

2032

| 2025 –2032 | |

| USD 313.09 Million | |

| USD 651.86 Million | |

|

|

|

|

Europe Blocking Buffers Market Size

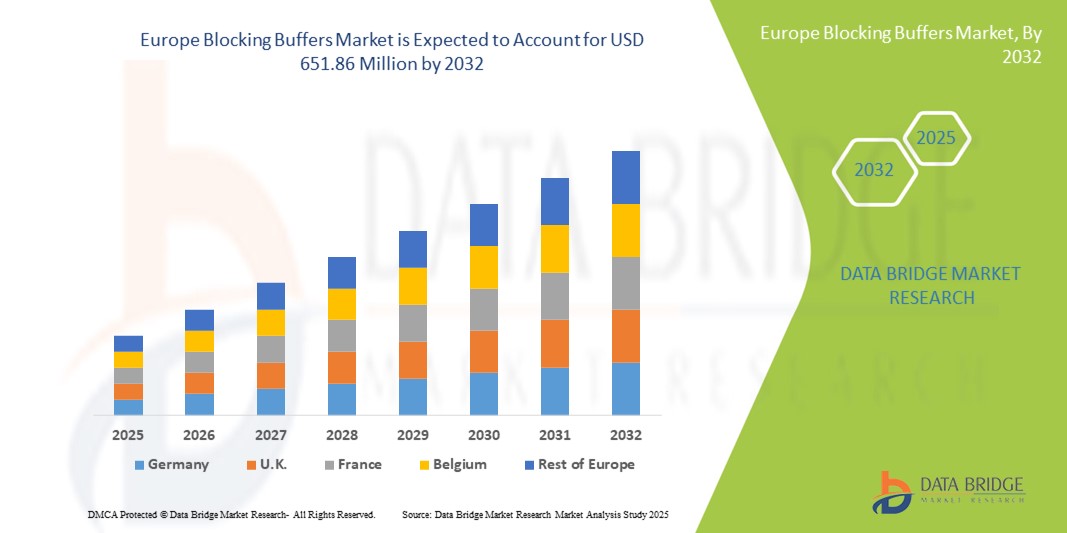

- The Europe blocking buffers market size was valued at USD 313.09 Million in 2024 and is expected to reach USD 651.86 Million by 2032, at a CAGR of 9.60% during the forecast period

- The market growth is largely fueled by the growing adoption of high-throughput and sensitive immunoassays, Western blotting, and ELISA techniques across research laboratories and diagnostic centers in Europe, which require effective blocking agents to minimize background noise and enhance assay specificity

- Furthermore, increasing demand for reliable and reproducible molecular biology and proteomics research, combined with rising investments in academic and pharmaceutical R&D activities, is establishing blocking buffers as an essential component in life science workflows. These converging factors are accelerating the uptake of blocking buffer solutions, thereby significantly boosting the Europe's blocking buffers market growth

Europe Blocking Buffers Market Analysis

- Blocking buffers, essential reagents used in immunoassays to reduce non-specific binding, are increasingly vital components of diagnostic and research workflows in both academic and commercial laboratories across Europe due to their role in enhancing signal-to-noise ratio and ensuring assay reliability

- The escalating demand for blocking buffers is primarily fueled by the growing adoption of ELISA, Western blotting, immunohistochemistry, and other protein-based detection methods, alongside rising investments in pharmaceutical and biotechnological R&D

- Germany dominated the Europe blocking buffers market with the largest market share of 18.5% in 2024, driven by a robust biotechnology sector and high funding in molecular biology and protein expression research. The country’s leadership in academic research and pharmaceutical manufacturing supports steady demand for high-grade blocking reagents

- France is expected to be the fastest growing region in the Europe blocking buffers market during the forecast period, supported by strong government initiatives in clinical diagnostics and translational research. The increasing use of ELISA and IHC in cancer biomarker studies and diagnostic screening is fueling the demand for efficient blocking agents in French laboratories

- The research use segment dominated the Europe blocking buffers market with a market share of 63.2% in 2024, due to the high consumption of blocking buffers in academic and biotechnology R&D environments, where frequent experimental assays necessitate reliable, high-performance reagents for accurate and consistent results

Report Scope and Europe Blocking Buffers Market Segmentation

|

Attributes |

Europe Blocking Buffers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Blocking Buffers Market Trends

“Growing Demand Driven by Enhanced Performance, Ease of Use, and Application Versatility”

- A key emerging trend in the Europe blocking buffers market is the increasing demand for high-performance blocking agents that enhance signal clarity and reproducibility in diagnostic and research applications. This trend is driven by the need for reliable results in immunoassays such as ELISA, Western blotting, and immunohistochemistry (IHC), especially in pharmaceutical and academic research

- For instance, novel formulations combining casein and proprietary detergents are being developed to reduce background noise and nonspecific binding, providing researchers with more accurate and reproducible results. These products are gaining popularity in both commercial and academic laboratories due to their superior consistency and low cross-reactivity

- The shift toward user-friendly, ready-to-use blocking buffer solutions in liquid form is also contributing to market growth. These formulations save time, reduce preparation errors, and support automation in high-throughput testing environments, especially in diagnostic labs and biotech companies

- Increased focus on personalized medicine and molecular diagnostics in Europe is further driving the use of blocking buffers in nucleic acid detection platforms and multiplex assays. Customizable compositions, including specific salt concentrations and pH levels, are being adopted to suit diverse applications ranging from proteomics to genomics

- Furthermore, rising investments in life science research across countries such as Germany, the U.K., and France are fostering innovation in blocking buffer products. Companies are increasingly collaborating with research institutes to develop next-generation buffers tailored to novel assay platforms, including antigen microarrays and flow cytometry

- The demand for highly specific, low-background blocking agents is expected to continue rising as laboratories seek to streamline workflows and improve assay precision, positioning blocking buffers as critical components in Europe’s expanding biomedical and clinical research landscape

Europe Blocking Buffers Market Dynamics

Driver

“Growing Demand Driven by Advancements in Proteomics and Immunoassays”

- The increasing application of proteomics and immunoassay technologies across research and clinical diagnostics is significantly driving the demand for high-performance blocking buffers in Europe. These buffers play a crucial role in minimizing background noise and enhancing signal specificity in assays such as ELISA, Western blotting, and immunohistochemistry

- For instance, in March 2024, Thermo Fisher Scientific introduced a next-generation blocking buffer formulation tailored for multiplex immunoassays, which allows enhanced signal clarity and reduced cross-reactivity—highlighting the market’s innovation trajectory

- As research institutions, pharmaceutical companies, and diagnostic labs focus on developing more sensitive and specific biomarker detection methods, the demand for standardized and customizable blocking buffer solutions is expanding

- In addition, the growing use of automated platforms and high-throughput screening in drug discovery and clinical trials necessitates reproducible reagents, further boosting the need for high-quality blocking buffers

- With increased funding for life sciences and biotechnology across countries such as Germany, the U.K., and France, along with the presence of key manufacturers, the Europe blocking buffers market is well-positioned for sustained growth

Restraint/Challenge

“Batch-to-Batch Variability and Storage Instability of Buffers”

- One of the major challenges hampering the Europe blocking buffers market is the batch-to-batch variability and storage instability associated with certain buffer formulations.

- Inconsistent performance across different production lots can negatively impact experimental reproducibility, particularly in sensitive diagnostic and research applications

- For instance, academic researchers and clinical labs have reported variations in blocking efficiency, leading to increased background noise or reduced assay sensitivity, necessitating re-validation of results and increased costs

- Furthermore, improper storage conditions or limited shelf-life of certain protein-based blocking buffers can degrade their effectiveness over time, especially in decentralized or small-scale laboratory settings

- To address this, companies are working on the development of more stable, lyophilized, and synthetic buffer solutions that offer greater consistency and extended shelf-life.

- Manufacturers such as Abcam and Merck have introduced advanced formulations with reduced variability, but widespread adoption still requires increased end-user awareness, standardized quality control processes, and streamlined supply chain mechanisms across the European region

Europe Blocking Buffers Market Scope

The market is segmented on the basis of type, composition, form, product type, application, end user, and distribution channel.

• By Type

On the basis of type, the Europe blocking buffers market is segmented into BSA (Bovine Serum Albumin), casein, gelatin, skimmed milk, and others. The BSA (Bovine Serum Albumin) segment dominated the market with the largest revenue share of 36.4% in 2024, owing to its high specificity and stability in immunoassays such as ELISA and Western blot.

The skimmed milk segment is projected to register the fastest CAGR of 9.8% from 2025 to 2032, driven by its cost-effectiveness and popularity in academic and low-resource settings for protein blocking applications.

• By Composition

On the basis of composition, the Europe blocking buffers market is segmented into salt solution, blocking agents, detergent, and others. The blocking agents segment held the largest market share of 44.7% in 2024, due to their essential function in reducing background interference and improving assay sensitivity.

The detergent segment is expected to grow at the fastest CAGR of 10.6% during the forecast period, driven by rising usage in protein-based applications requiring disruption of nonspecific binding.

• By Form

On the basis of form, the Europe blocking buffers market is segmented into powder and liquid. The liquid segment accounted for 58.9% of the market share in 2024, attributed to its ready-to-use nature, consistency, and ease of integration into automated platforms.

The powder segment is forecasted to grow at a CAGR of 9.4% from 2025 to 2032, due to its longer shelf-life, reconstitution flexibility, and cost advantages for bulk users.

• By Product Type

On the basis of product type, the Europe blocking buffers market is segmented into research use and commercial use. The research use segment led the market with a share of 63.2% in 2024, due to the high consumption of blocking buffers in academic and biotechnology R&D environments.

The commercial use segment is projected to grow at the fastest CAGR of 10.1%, fueled by increasing adoption in diagnostic assay manufacturing and regulated clinical testing.

• By Application

On the basis of application, the Europe blocking buffers market is segmented into Western blot, ELISA, nucleic acid detection, immunohistochemistry (IHC), and others. The ELISA segment captured the largest revenue share of 38.5% in 2024, due to its widespread use in infectious disease diagnostics and autoimmune disease screening.

The IHC segment is expected to grow at the fastest CAGR of 11.3%, supported by growing cancer diagnostics and pathology workflows requiring protein localization and biomarker analysis.

• By End User

On the basis of end user, the Europe blocking buffers market is segmented into research and chemical laboratories, contract research organizations (CROs), pharmaceutical and biotechnology companies, hospitals, clinical laboratories, and others. The research and chemical laboratories segment held the largest share of 34.8% in 2024, driven by continued academic investment and fundamental biosciences research.

The pharmaceutical and biotechnology companies segment is projected to grow at a CAGR of 10.7%, as more blocking buffer products are integrated into preclinical and clinical assay pipelines.

• By Distribution Channel

On the basis of distribution channel, the Europe blocking buffers market is segmented into direct tender, retail sales, and others. The direct tender segment accounted for 49.3% of the market share in 2024, primarily due to hospital and institutional procurement models in Europe.

The retail sales segment is expected to witness the fastest CAGR of 11.9%, supported by growing e-commerce sales, third-party reagent distributors, and expanding small-lab demand.

Europe Blocking Buffers Market Regional Analysis

- Europe dominated the global blocking buffers market with the largest revenue share of 38.9% in 2024, driven by increased investment in life sciences research

- Expanding pharmaceutical manufacturing, and strong academic-industry collaborations.

- The region’s advanced laboratory infrastructure, strict regulatory framework, and emphasis on high-quality reagents for Western blotting, ELISA, and IHC applications have significantly boosted the demand for blocking buffers

Germany Blocking Buffers Market Insight

The Germany blocking buffers market accounted for 18.5% of the European market share in 2024, driven by a robust biotechnology sector and high funding in molecular biology and protein expression research. The country’s leadership in academic research and pharmaceutical manufacturing supports steady demand for high-grade blocking reagents.

France Blocking Buffers Market Insight

The France blocking buffers market held a 13.1% share in 2024, supported by strong government initiatives in clinical diagnostics and translational research. Increasing use of ELISA and IHC in cancer biomarker studies and diagnostic screening fuels the demand for efficient blocking agents in French labs.

U.K. Blocking Buffers Market Insight

The U.K. blocking buffers market captured a 12.3% market share in 2024, thanks to its thriving research universities, early adoption of novel assay techniques, and a mature pharmaceutical R&D ecosystem. The country is witnessing rising utilization of blocking buffers in clinical trials and bioanalytical labs.

Netherlands Blocking Buffers Market Insight

The Netherlands blocking buffers market held a 6.4% share of the European blocking buffers market in 2024, driven by its high concentration of life science clusters and a growing CRO industry. The demand for reproducible protein detection in Western blotting and nucleic acid testing is supporting segment growth.

Europe Blocking Buffers Market Share

The Europe blocking buffers industry is primarily led by well-established companies, including:

- Boston Bioproducts (U.S.)

- Merck KGaA (Germany)

- Takara Bio Inc. (Japan)

- Candor Bioscience GmbH (Germany)

- Thistle Scientific Ltd (U.K.)

- Grace Bio-Labs (U.S.)

- Abcam Limited (U.K.)

- Scantibodies Laboratory, Inc. (U.S.)

- Rockland Immunochemicals, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Surmodics, Inc. (U.S.)

- Antibodies Incorporated (U.S.)

- Himedia Laboratories (India)

- Proteintech Group, Inc. (U.S.)

- Kementec (Denmark)

- Bio-Rad Laboratories (U.S.)

- Meridian Life Science, Inc. (U.S.)

- Lifespan Biosciences, Inc. (U.S.)

- Geno Technology Inc. USA (U.S.)

- Azure Biosystems Inc. (U.S.)

- Sino Biological, Inc. (China)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Li-Cor Biotech, LLC (U.S.)

- Arlington Scientific, Inc. (U.S.)

Latest Developments in Europe blocking buffers market

- In July 2024, Roche announced the successful acquisition of LumiraDx’s Point of Care technology, following the necessary antitrust and regulatory approvals. This integration enhanced Roche’s diagnostics portfolio with a user-friendly platform that consolidates various immunoassay and clinical chemistry tests. The acquisition aimed to improve access to diagnostic testing, particularly in primary care and underserved regions, aligning with Roche's commitment to decentralised healthcare solutions

- In May 2023, Thermo Fisher and BRIN have partnered to enhance research capabilities in Indonesia, focusing on advancing scientific innovation and collaboration in life sciences, biotechnology, and environmental studies for local researchers

- In August 2024, MilliporeSigma, the Life Science business of Merck KGaA, Darmstadt, Germany, has completed its acquisition of Mirus Bio for approximately $600 million. This strategic move enhances MilliporeSigma's viral vector bioprocessing capabilities, integrating Mirus Bio's advanced transfection reagents with their extensive bioprocessing portfolio to support cell and gene therapy advancements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET: REGULATIONS

5.1 REGULATORY AUTHORITIES IN THE U.S.

5.2 EUROPE REGULATORY SCENARIO

5.3 REGULATORY SUBMISSIONS

5.4 JAPAN REGULATORY SCENARIO

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC DISEASES

6.1.2 INCREASED ADOPTION OF WESTERN BLOT AND ELISA TECHNIQUES

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN ASSAY DEVELOPMENT

6.1.4 ADVANCEMENTS IN PROTEOMICS AND GENOMICS

6.2 RESTRAINTS

6.2.1 LIMITED SHELF LIFE OF BLOCKING BUFFERS

6.2.2 POTENTIAL OF CONTAMINATION OR BATCH INCONSISTENCIES FOR BLOCKING BUFFERS

6.3 OPPORTUNITIES

6.3.1 INCREASE IN PUBLIC-PRIVATE FUNDING IN BIOMEDICAL RESEARCH

6.3.2 ANALYTICAL METHODS FOR FOOD SAFETY AND ENVIRONMENTAL TESTING

6.3.3 BLOCKING BUFFERS FOR DIAGNOSTIC AND CLINICAL APPLICATIONS

6.4 CHALLENGES

6.4.1 ALTERNATIVE TECHNOLOGIES AND METHODOLOGIES FOR BLOCKING BUFFERS

6.4.2 SUPPLY CHAIN DISRUPTIONS

7 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET, BY TYPE

7.1 OVERVIEW

7.2 BSA (BOVINE SERUM ALBUMIN)

7.3 CASEIN

7.4 GELATIN

7.5 SKIMMED MILK

7.6 OTHERS

8 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET, BY FORM

8.1 OVERVIEW

8.2 POWDER

8.3 LIQUID

9 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET, BY COMPOSITION

9.1 OVERVIEW

9.2 SALT SOLUTION

9.2.1 PHOSPHATE BUFFERED SALINE

9.2.2 TRIS-BUFFERED SALINE

9.2.3 OTHERS

9.3 BLOCKING AGENTS

9.3.1 ANIMAL-BASED BLOCKING AGENTS

9.3.2 PLANT-BASED BLOCKING AGENTS

9.3.3 FISH-BASED BLOCKING AGENTS

9.3.3.1 PROTEIN BLOCKING BUFFERS

9.3.3.2 NON-PROTEIN BLOCKING BUFFERS

9.3.3.2.1 RABBIT

9.3.3.2.2 MOUSE

9.3.3.2.3 SHEEP

9.3.3.2.4 OTHERS

9.4 DETERGENT

9.4.1 TWEEN-20

9.4.2 TRITON X-100

9.4.3 OTHERS

10 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET, BY PRODUCT TYPE

10.1 OVERVIEW

10.2 RESEARCH USE

10.3 COMMERCIAL USE

11 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 WESTERN BLOT

11.3 ELISA

11.4 NUCLEIC ACID DETECTION

11.5 IMMUNOHISTOCHEMISTRY (IHC)

11.6 OTHERS

12 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET, BY END USER

12.1 OVERVIEW

12.2 RESEARCH AND CHEMICAL LABORATORIES

12.3 CONTRACT RESEARCH ORGANIZATION

12.4 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

12.5 HOSPITALS

12.6 CLINICAL LABORATORIES

12.7 OTHERS

13 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 RETAIL SALES

13.3.1 ONLINE

13.3.2 OFFLINE

13.4 OTHERS

14 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 U.K.

14.1.3 FRANCE

14.1.4 ITALY

14.1.5 SPAIN

14.1.6 RUSSIA

14.1.7 BELGIUM

14.1.8 NETHERLANDS

14.1.9 SWITZERLAND

14.1.10 TURKEY

14.1.11 REST OF EUROPE

15 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: U.S.

15.2 COMPANY SHARE ANALYSIS: EUROPE

15.3 COMPANY SHARE ANALYSIS: JAPAN

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 F. HOFFMANN-LA ROCHE LTD

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATES

17.2 THERMO FISHER SCIENTIFIC, INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 MERCK KGAA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 BIO-RAD LABORATORIES, INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 TAKARA BIO INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 ABCAM LIMITED

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 ASSOCIATES OF CAPE COD, INC.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT UPDATES

17.8 ANTIBODIES INCORPORATED

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATES

17.9 AZURE BIOSYSTEMS INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 ARLINGTON SCIENTIFIC, INC

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT UPDATES

17.11 ADVANSTA INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 BOSTON BIOPRODUCTS

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 CALBIOTECH

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 CANDOR BIOSCIENCE GMBH

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 EASTCOAST BIO

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT UPDATES

17.16 ELABSCIENCE BIONOVATION INC

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT UPDATES

17.17 GRACE BIO-LABS

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 GENO TECHNOLOGY INC.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 HIMEDIA LABORATORIES

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT UPDATES

17.2 KEMENTEC SOLUTIONS

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 LIFESPAN BIOSCIENCES, INC

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 LI-COR BIOTECH, LLC

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT UPDATES

17.23 MERIDIAN BIOSCIENCE, INC.

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 PROTEINTECH GROUP, INC.

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 ROCKLAND IMMUNOCHEMICALS, INC.

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT UPDATES

17.26 SCANTIBODIES LABORATORY, INC.

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 SURMODICS, INC.

17.27.1 COMPANY SNAPSHOT

17.27.2 REVENUE ANALYSIS

17.27.3 PRODUCT PORTFOLIO

17.27.4 RECENT UPDATES

17.28 SINO BIOLOGICAL, INC.

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT UPDATES

17.29 THISTLE SCIENTIFIC

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 U.S. BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 2 EUROPE BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 3 JAPAN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 4 U.S. BLOCKING BUFFERS MARKET, BY FORM, 2022-2031 (USD MILLION)

TABLE 5 EUROPE BLOCKING BUFFERS MARKET, BY FORM, 2022-2031 (USD MILLION)

TABLE 6 JAPAN BLOCKING BUFFERS MARKET, BY FORM, 2022-2031 (USD MILLION)

TABLE 7 U.S. BLOCKING BUFFERS MARKET, BY COMPOSITION, 2022-2031 (USD MILLION)

TABLE 8 EUROPE BLOCKING BUFFERS MARKET, BY COMPOSITION, 2022-2031 (USD MILLION)

TABLE 9 JAPAN BLOCKING BUFFERS MARKET, BY COMPOSITION, 2022-2031 (USD MILLION)

TABLE 10 U.S. SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 11 EUROPE SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 12 JAPAN SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 13 U.S. SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 14 EUROPE SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 15 JAPAN SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 16 U.S. BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 17 EUROPE BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 18 JAPAN BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 19 U.S. ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 20 EUROPE ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 21 JAPAN ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 22 U.S. ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY ANIMAL TYPE, 2022-2031 (USD MILLION)

TABLE 23 EUROPE ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY ANIMAL TYPE, 2022-2031 (USD MILLION)

TABLE 24 JAPAN ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY ANIMAL TYPE, 2022-2031 (USD MILLION)

TABLE 25 U.S. DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 26 EUROPE DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 27 JAPAN DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 28 U.S. BLOCKING BUFFERS MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 29 EUROPE BLOCKING BUFFERS MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 30 JAPAN BLOCKING BUFFERS MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 31 U.S. BLOCKING BUFFERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 32 EUROPE BLOCKING BUFFERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 33 JAPAN BLOCKING BUFFERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 34 U.S. BLOCKING BUFFERS MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 35 EUROPE BLOCKING BUFFERS MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 36 JAPAN BLOCKING BUFFERS MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 37 U.S. BLOCKING BUFFERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 38 EUROPE BLOCKING BUFFERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 39 JAPAN BLOCKING BUFFERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 40 U.S. RETAIL SALES IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 41 EUROPE RETAIL SALES IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 42 JAPAN RETAIL SALES IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 43 EUROPE BLOCKING BUFFERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 44 GERMANY BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 45 GERMANY BLOCKING BUFFERS MARKET, BY COMPOSITION, 2022-2031 (USD MILLION)

TABLE 46 GERMANY SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 47 GERMANY SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 48 GERMANY SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 49 GERMANY BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 50 GERMANY ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 51 GERMANY ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY ANIMAL TYPE, 2022-2031 (USD MILLION)

TABLE 52 GERMANY DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 53 GERMANY DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 54 GERMANY DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 55 GERMANY BLOCKING BUFFERS MARKET, BY FORM, 2022-2031 (USD MILLION)

TABLE 56 GERMANY BLOCKING BUFFERS MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 57 GERMANY BLOCKING BUFFERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 58 GERMANY BLOCKING BUFFERS MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 59 GERMANY BLOCKING BUFFERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 60 GERMANY RETAIL SALES IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 61 U.K. BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 62 U.K. BLOCKING BUFFERS MARKET, BY COMPOSITION, 2022-2031 (USD MILLION)

TABLE 63 U.K. SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 64 U.K. SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 65 U.K. SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 66 U.K. BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 67 U.K. ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 68 U.K. ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY ANIMAL TYPE, 2022-2031 (USD MILLION)

TABLE 69 U.K. DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 70 U.K. DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 71 U.K. DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 72 U.K. BLOCKING BUFFERS MARKET, BY FORM, 2022-2031 (USD MILLION)

TABLE 73 U.K. BLOCKING BUFFERS MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 74 U.K. BLOCKING BUFFERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 75 U.K. BLOCKING BUFFERS MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 76 U.K. BLOCKING BUFFERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 77 U.K. RETAIL SALES IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 78 FRANCE BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 79 FRANCE BLOCKING BUFFERS MARKET, BY COMPOSITION, 2022-2031 (USD MILLION)

TABLE 80 FRANCE SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 81 FRANCE SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 82 FRANCE SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 83 FRANCE BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 84 FRANCE ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 85 FRANCE ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY ANIMAL TYPE, 2022-2031 (USD MILLION)

TABLE 86 FRANCE DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 87 FRANCE DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 88 FRANCE DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 89 FRANCE BLOCKING BUFFERS MARKET, BY FORM, 2022-2031 (USD MILLION)

TABLE 90 FRANCE BLOCKING BUFFERS MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 91 FRANCE BLOCKING BUFFERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 92 FRANCE BLOCKING BUFFERS MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 93 FRANCE BLOCKING BUFFERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 94 FRANCE RETAIL SALES IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 95 ITALY BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 96 ITALY BLOCKING BUFFERS MARKET, BY COMPOSITION, 2022-2031 (USD MILLION)

TABLE 97 ITALY SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 98 ITALY SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 99 ITALY SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 100 ITALY BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 101 ITALY ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 102 ITALY ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY ANIMAL TYPE, 2022-2031 (USD MILLION)

TABLE 103 ITALY DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 104 ITALY DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 105 ITALY DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 106 ITALY BLOCKING BUFFERS MARKET, BY FORM, 2022-2031 (USD MILLION)

TABLE 107 ITALY BLOCKING BUFFERS MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 108 ITALY BLOCKING BUFFERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 109 ITALY BLOCKING BUFFERS MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 110 ITALY BLOCKING BUFFERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 111 ITALY RETAIL SALES IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 112 SPAIN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 113 SPAIN BLOCKING BUFFERS MARKET, BY COMPOSITION, 2022-2031 (USD MILLION)

TABLE 114 SPAIN SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 115 SPAIN SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 116 SPAIN SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 117 SPAIN BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 118 SPAIN ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 119 SPAIN ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY ANIMAL TYPE, 2022-2031 (USD MILLION)

TABLE 120 SPAIN DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 121 SPAIN DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 122 SPAIN DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 123 SPAIN BLOCKING BUFFERS MARKET, BY FORM, 2022-2031 (USD MILLION)

TABLE 124 SPAIN BLOCKING BUFFERS MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 125 SPAIN BLOCKING BUFFERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 126 SPAIN BLOCKING BUFFERS MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 127 SPAIN BLOCKING BUFFERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 128 SPAIN RETAIL SALES IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 129 RUSSIA BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 130 RUSSIA BLOCKING BUFFERS MARKET, BY COMPOSITION, 2022-2031 (USD MILLION)

TABLE 131 RUSSIA SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 132 RUSSIA SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 133 RUSSIA SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 134 RUSSIA BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 135 RUSSIA ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 136 RUSSIA ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY ANIMAL TYPE, 2022-2031 (USD MILLION)

TABLE 137 RUSSIA DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 138 RUSSIA DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 139 RUSSIA DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 140 RUSSIA BLOCKING BUFFERS MARKET, BY FORM, 2022-2031 (USD MILLION)

TABLE 141 RUSSIA BLOCKING BUFFERS MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 142 RUSSIA BLOCKING BUFFERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 143 RUSSIA BLOCKING BUFFERS MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 144 RUSSIA BLOCKING BUFFERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 145 RUSSIA RETAIL SALES IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 146 BELGIUM BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 147 BELGIUM BLOCKING BUFFERS MARKET, BY COMPOSITION, 2022-2031 (USD MILLION)

TABLE 148 BELGIUM SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 149 BELGIUM SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 150 BELGIUM SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 151 BELGIUM BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 152 BELGIUM ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 153 BELGIUM ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY ANIMAL TYPE, 2022-2031 (USD MILLION)

TABLE 154 BELGIUM DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 155 BELGIUM DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 156 BELGIUM DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 157 BELGIUM BLOCKING BUFFERS MARKET, BY FORM, 2022-2031 (USD MILLION)

TABLE 158 BELGIUM BLOCKING BUFFERS MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 159 BELGIUM BLOCKING BUFFERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 160 BELGIUM BLOCKING BUFFERS MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 161 BELGIUM BLOCKING BUFFERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 162 BELGIUM RETAIL SALES IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 163 NETHERLANDS BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 164 NETHERLANDS BLOCKING BUFFERS MARKET, BY COMPOSITION, 2022-2031 (USD MILLION)

TABLE 165 NETHERLANDS SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 166 NETHERLANDS SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 167 NETHERLANDS SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 168 NETHERLANDS BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 169 NETHERLANDS ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 170 NETHERLANDS ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY ANIMAL TYPE, 2022-2031 (USD MILLION)

TABLE 171 NETHERLANDS DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 172 NETHERLANDS DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 173 NETHERLANDS DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 174 NETHERLANDS BLOCKING BUFFERS MARKET, BY FORM, 2022-2031 (USD MILLION)

TABLE 175 NETHERLANDS BLOCKING BUFFERS MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 176 NETHERLANDS BLOCKING BUFFERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 177 NETHERLANDS BLOCKING BUFFERS MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 178 NETHERLANDS BLOCKING BUFFERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 179 NETHERLANDS RETAIL SALES IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 180 SWITZERLAND BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 181 SWITZERLAND BLOCKING BUFFERS MARKET, BY COMPOSITION, 2022-2031 (USD MILLION)

TABLE 182 SWITZERLAND SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 183 SWITZERLAND SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 184 SWITZERLAND SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 185 SWITZERLAND BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 186 SWITZERLAND ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 187 SWITZERLAND ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY ANIMAL TYPE, 2022-2031 (USD MILLION)

TABLE 188 SWITZERLAND DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 189 SWITZERLAND DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 190 SWITZERLAND DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 191 SWITZERLAND BLOCKING BUFFERS MARKET, BY FORM, 2022-2031 (USD MILLION)

TABLE 192 SWITZERLAND BLOCKING BUFFERS MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 193 SWITZERLAND BLOCKING BUFFERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 194 SWITZERLAND BLOCKING BUFFERS MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 195 SWITZERLAND BLOCKING BUFFERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 196 SWITZERLAND RETAIL SALES IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 197 TURKEY BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 198 TURKEY BLOCKING BUFFERS MARKET, BY COMPOSITION, 2022-2031 (USD MILLION)

TABLE 199 TURKEY SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 200 TURKEY SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 201 TURKEY SALT SOLUTION IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 202 TURKEY BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 203 TURKEY ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 204 TURKEY ANIMAL BASED BLOCKING AGENTS IN BLOCKING BUFFERS MARKET, BY ANIMAL TYPE, 2022-2031 (USD MILLION)

TABLE 205 TURKEY DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 206 TURKEY DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (VOLUME)

TABLE 207 TURKEY DETERGENT IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031(ASP)

TABLE 208 TURKEY BLOCKING BUFFERS MARKET, BY FORM, 2022-2031 (USD MILLION)

TABLE 209 TURKEY BLOCKING BUFFERS MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 210 TURKEY BLOCKING BUFFERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 211 TURKEY BLOCKING BUFFERS MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 212 TURKEY BLOCKING BUFFERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 213 TURKEY RETAIL SALES IN BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 214 REST OF EUROPE BLOCKING BUFFERS MARKET, BY TYPE, 2022-2031 (USD MILLION)

List of Figure

FIGURE 1 U.S., EUROPE AND JAPAN BLOCKING BUFFERS MARKET: SEGMENTATION

FIGURE 2 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET: DATA TRIANGULATION

FIGURE 3 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET: DROC ANALYSIS

FIGURE 4 U.S. BLOCKING BUFFERS MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE BLOCKING BUFFERS MARKET: REGION MARKET ANALYSIS

FIGURE 6 JAPAN BLOCKING BUFFERS MARKET: COUNTRY MARKET ANALYSIS

FIGURE 7 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 8 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET: MULTIVARIATE MODELLING

FIGURE 9 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 U.S., EUROPE AND JAPAN BLOCKING BUFFERS MARKET: DBMR MARKET POSITION GRID

FIGURE 11 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET: MARKET END USER COVERAGE GRID

FIGURE 13 U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET: SEGMENTATION

FIGURE 14 EXECUTIVE SUMMARY OF U.S., EUROPE, AND JAPAN BLOCKING BUFFERS MARKET

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 FIVE SEGMENTS COMPRISE THE U.S. BLOCKING BUFFERS MARKET, BY TYPE

FIGURE 17 FIVE SEGMENTS COMPRISE THE EUROPE BLOCKING BUFFERS MARKET, BY TYPE

FIGURE 18 FIVE SEGMENTS COMPRISE THE JAPAN BLOCKING BUFFERS MARKET, BY TYPE

FIGURE 19 RISING PREVALENCE OF CHRONIC DISEASES, INCREASED ADOPTION OF WESTERN BLOT AND ELISA TECHNIQUES, TECHNOLOGICAL ADVANCEMENTS IN ASSAY DEVELOPMENT AND ADVANCEMENTS IN PROTEOMICS AND GENOMICS ARE DRIVING THE U.S BLOCKING BUFFERS MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 20 BSA (BOVINE SERUM ALBUMIN) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S BLOCKING BUFFERS MARKET IN 2024 & 2031

FIGURE 21 RISING PREVALENCE OF CHRONIC DISEASES, INCREASED ADOPTION OF WESTERN BLOT AND ELISA TECHNIQUES, TECHNOLOGICAL ADVANCEMENTS IN ASSAY DEVELOPMENT AND ADVANCEMENTS IN PROTEOMICS AND GENOMICS ARE DRIVING THE EUROPE BLOCKING BUFFERS MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 22 BSA (BOVINE SERUM ALBUMIN) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE BLOCKING BUFFERS MARKET IN 2024 & 2031

FIGURE 23 RISING PREVALENCE OF CHRONIC DISEASES, INCREASED ADOPTION OF WESTERN BLOT AND ELISA TECHNIQUES, TECHNOLOGICAL ADVANCEMENTS IN ASSAY DEVELOPMENT AND ADVANCEMENTS IN PROTEOMICS AND GENOMICS ARE DRIVING THE JAPAN BLOCKING BUFFERS MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 24 BSA (BOVINE SERUM ALBUMIN) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE JAPAN BLOCKING BUFFERS MARKET IN 2024 & 2031

FIGURE 25 DROC ANALYSIS

FIGURE 26 U.S. BLOCKING BUFFERS MARKET: BY TYPE, 2023

FIGURE 27 U.S. BLOCKING BUFFERS MARKET: BY TYPE, 2024-2031 (USD MILLION)

FIGURE 28 U.S. BLOCKING BUFFERS MARKET: BY TYPE, CAGR (2024-2031)

FIGURE 29 U.S. BLOCKING BUFFERS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 30 EUROPE BLOCKING BUFFERS MARKET: BY TYPE, 2023

FIGURE 31 EUROPE BLOCKING BUFFERS MARKET: BY TYPE, 2024-2031 (USD MILLION)

FIGURE 32 EUROPE BLOCKING BUFFERS MARKET: BY TYPE, CAGR (2024-2031)

FIGURE 33 EUROPE BLOCKING BUFFERS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 34 JAPAN BLOCKING BUFFERS MARKET: BY TYPE, 2023

FIGURE 35 JAPAN BLOCKING BUFFERS MARKET: BY TYPE, 2024-2031 (USD MILLION)

FIGURE 36 JAPAN BLOCKING BUFFERS MARKET: BY TYPE, CAGR (2024-2031)

FIGURE 37 JAPAN BLOCKING BUFFERS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 38 U.S. BLOCKING BUFFERS MARKET: BY FORM, 2023

FIGURE 39 U.S. BLOCKING BUFFERS MARKET: BY FORM, 2024-2031 (USD MILLION)

FIGURE 40 U.S. BLOCKING BUFFERS MARKET: BY FORM, CAGR (2024-2031)

FIGURE 41 U.S. BLOCKING BUFFERS MARKET: BY FORM, LIFELINE CURVE

FIGURE 42 EUROPE BLOCKING BUFFERS MARKET: BY FORM, 2023

FIGURE 43 EUROPE BLOCKING BUFFERS MARKET: BY FORM, 2024-2031 (USD MILLION)

FIGURE 44 EUROPE BLOCKING BUFFERS MARKET: BY FORM, CAGR (2024-2031)

FIGURE 45 EUROPE BLOCKING BUFFERS MARKET: BY FORM, LIFELINE CURVE

FIGURE 46 JAPAN BLOCKING BUFFERS MARKET: BY FORM, 2023

FIGURE 47 JAPAN BLOCKING BUFFERS MARKET: BY FORM, 2024-2031 (USD MILLION)

FIGURE 48 JAPAN BLOCKING BUFFERS MARKET: BY FORM, CAGR (2024-2031)

FIGURE 49 JAPAN BLOCKING BUFFERS MARKET: BY FORM, LIFELINE CURVE

FIGURE 50 U.S. BLOCKING BUFFERS MARKET: BY COMPOSITION, 2023

FIGURE 51 U.S. BLOCKING BUFFERS MARKET: BY COMPOSITION, 2024-2031 (USD MILLION)

FIGURE 52 U.S. BLOCKING BUFFERS MARKET: BY COMPOSITION, CAGR (2024-2031)

FIGURE 53 U.S. BLOCKING BUFFERS MARKET: BY COMPOSITION, LIFELINE CURVE

FIGURE 54 EUROPE BLOCKING BUFFERS MARKET: BY COMPOSITION, 2023

FIGURE 55 EUROPE BLOCKING BUFFERS MARKET: BY COMPOSITION, 2024-2031 (USD MILLION)

FIGURE 56 EUROPE BLOCKING BUFFERS MARKET: BY COMPOSITION, CAGR (2024-2031)

FIGURE 57 EUROPE BLOCKING BUFFERS MARKET: BY COMPOSITION, LIFELINE CURVE

FIGURE 58 JAPAN BLOCKING BUFFERS MARKET: BY COMPOSITION, 2023

FIGURE 59 JAPAN BLOCKING BUFFERS MARKET: BY COMPOSITION, 2024-2031 (USD MILLION)

FIGURE 60 JAPAN BLOCKING BUFFERS MARKET: BY COMPOSITION, CAGR (2024-2031)

FIGURE 61 JAPAN BLOCKING BUFFERS MARKET: BY COMPOSITION, LIFELINE CURVE

FIGURE 62 U.S. BLOCKING BUFFERS MARKET: BY PRODUCT TYPE, 2023

FIGURE 63 U.S. BLOCKING BUFFERS MARKET: BY PRODUCT TYPE, 2024-2031 (USD MILLION)

FIGURE 64 U.S. BLOCKING BUFFERS MARKET: BY PRODUCT TYPE, CAGR (2024-2031)

FIGURE 65 U.S. BLOCKING BUFFERS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 66 EUROPE BLOCKING BUFFERS MARKET: BY PRODUCT TYPE, 2023

FIGURE 67 EUROPE BLOCKING BUFFERS MARKET: BY PRODUCT TYPE, 2024-2031 (USD MILLION)

FIGURE 68 EUROPE BLOCKING BUFFERS MARKET: BY PRODUCT TYPE, CAGR (2024-2031)

FIGURE 69 EUROPE BLOCKING BUFFERS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 70 JAPAN BLOCKING BUFFERS MARKET: BY PRODUCT TYPE, 2023

FIGURE 71 JAPAN BLOCKING BUFFERS MARKET: BY PRODUCT TYPE, 2024-2031 (USD MILLION)

FIGURE 72 JAPAN BLOCKING BUFFERS MARKET: BY PRODUCT TYPE, CAGR (2024-2031)

FIGURE 73 JAPAN BLOCKING BUFFERS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 74 U.S. BLOCKING BUFFERS MARKET: BY APPLICATION, 2023

FIGURE 75 U.S. BLOCKING BUFFERS MARKET: BY APPLICATION, 2024-2031 (USD MILLION)

FIGURE 76 U.S. BLOCKING BUFFERS MARKET: BY APPLICATION, CAGR (2024-2031)

FIGURE 77 U.S. BLOCKING BUFFERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 78 EUROPE BLOCKING BUFFERS MARKET: BY APPLICATION, 2023

FIGURE 79 EUROPE BLOCKING BUFFERS MARKET: BY APPLICATION, 2024-2031 (USD MILLION)

FIGURE 80 EUROPE BLOCKING BUFFERS MARKET: BY APPLICATION, CAGR (2024-2031)

FIGURE 81 EUROPE BLOCKING BUFFERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 82 JAPAN BLOCKING BUFFERS MARKET: BY APPLICATION, 2023

FIGURE 83 JAPAN BLOCKING BUFFERS MARKET: BY APPLICATION, 2024-2031 (USD MILLION)

FIGURE 84 JAPAN BLOCKING BUFFERS MARKET: BY APPLICATION, CAGR (2024-2031)

FIGURE 85 JAPAN BLOCKING BUFFERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 86 U.S. BLOCKING BUFFERS MARKET: BY END USER, 2023

FIGURE 87 U.S. BLOCKING BUFFERS MARKET: BY END USER, 2024-2031 (USD MILLION)

FIGURE 88 U.S. BLOCKING BUFFERS MARKET: BY END USER, CAGR (2024-2031)

FIGURE 89 U.S. BLOCKING BUFFERS MARKET: BY END USER, LIFELINE CURVE

FIGURE 90 EUROPE BLOCKING BUFFERS MARKET: BY END USER, 2023

FIGURE 91 EUROPE BLOCKING BUFFERS MARKET: BY END USER, 2024-2031 (USD MILLION)

FIGURE 92 EUROPE BLOCKING BUFFERS MARKET: BY END USER, CAGR (2024-2031)

FIGURE 93 EUROPE BLOCKING BUFFERS MARKET: BY END USER, LIFELINE CURVE

FIGURE 94 JAPAN BLOCKING BUFFERS MARKET: BY END USER, 2023

FIGURE 95 JAPAN BLOCKING BUFFERS MARKET: BY END USER, 2024-2031 (USD MILLION)

FIGURE 96 JAPAN BLOCKING BUFFERS MARKET: BY END USER, CAGR (2024-2031)

FIGURE 97 JAPAN BLOCKING BUFFERS MARKET: BY END USER, LIFELINE CURVE

FIGURE 98 U.S. BLOCKING BUFFERS MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 99 U.S. BLOCKING BUFFERS MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD MILLION)

FIGURE 100 U.S. BLOCKING BUFFERS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 101 U.S. BLOCKING BUFFERS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 102 EUROPE BLOCKING BUFFERS MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 103 EUROPE BLOCKING BUFFERS MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD MILLION)

FIGURE 104 EUROPE BLOCKING BUFFERS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 105 EUROPE BLOCKING BUFFERS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 106 JAPAN BLOCKING BUFFERS MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 107 JAPAN BLOCKING BUFFERS MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD MILLION)

FIGURE 108 JAPAN BLOCKING BUFFERS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 109 JAPAN BLOCKING BUFFERS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 110 EUROPE BLOCKING BUFFERS MARKET; SNAPSHOT (2023)

FIGURE 111 U.S. BLOCKING BUFFERS MARKET: COMPANY SHARE 2023 (%)

FIGURE 112 EUROPE BLOCKING BUFFERS MARKET: COMPANY SHARE 2023 (%)

FIGURE 113 JAPAN BLOCKING BUFFERS MARKET: COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.