Europe Bulletproof Glass Market

Market Size in USD Million

CAGR :

%

USD

2,291.45 Million

USD

8,439.62 Million

2022

2030

USD

2,291.45 Million

USD

8,439.62 Million

2022

2030

| 2023 –2030 | |

| USD 2,291.45 Million | |

| USD 8,439.62 Million | |

|

|

|

Europe Bullet Proof Glass Market Analysis and Size

The demand for bulletproof glass has augmented because countries such as Germany, France, the U.K., Netherlands, Switzerland, and Belgium are spending more on their military and doing more development. Moreover, an increase in the number of burglaries and bank robberies in these regions is the major reason for the surge in demand for bulletproof glasses. Furthermore, bulletproof glasses are also installed in cockpit doors to safeguard pilots from unexpected attacks. As a result of augmented threats of attack in the aviation industry, the use of bullet-resistant glass is expected to increase and make the bulletproof glass market grow in the upcoming period.

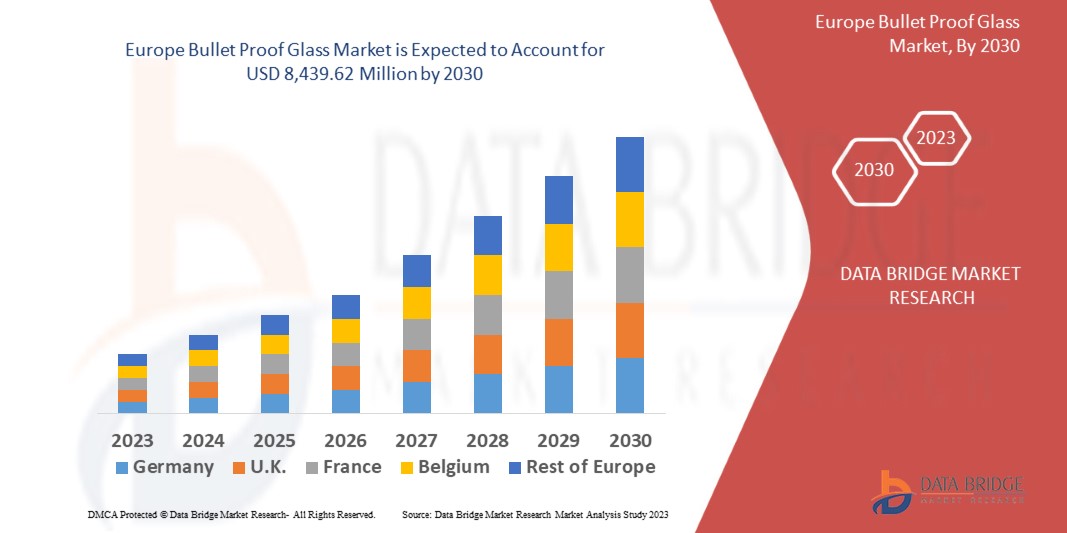

Data Bridge Market Research analyses that the bullet proof glass market is expected to reach USD 8,439.62 million by 2030, which was USD 2,291.45 million in 2022, registering a CAGR of 17.70% during the forecast period of 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Europe Bullet Proof Glass Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Material (Acrylic, Laminated Glass, Polycarbonate, Glass Clad Polycarbonate, Ballistic Insulated Glass, Others), End-User (Automotive, Military, Construction, Banking, and Finance Others), Application (Defense and V.I.P. Vehicles, Government and Law Enforcement, Cash-In-Transit Vehicles, Commercial Buildings, A.T.M. Booths, and Teller Stations and Others), Security Levels (Level-1, Level-2, Level-3, Level-4 to 8, Others) |

|

Countries Covered |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe |

|

Market Players Covered |

Nippon Sheet Glass Co., Ltd (Japan), Saint-Gobain (France), SCHOTT AG (Germany), A.G.C. Inc. (Japan), Taiwan Glass Industry Corporation (Taiwan), Asahi India Glass Limited (India), Guangzhou Topo Glass Co., Ltd. (China), P.P.G. Industries, Inc. (U.S.), Xinyi Glass Holdings Limited., (China), Total Security Solutions (U.S.), Qingdao Tsing Glass Co. Limited (China), Dellner Romag (U.K.), Guardian Industries Holdings (U.S.), E.S.G. (U.S.), Glasstronn India Private Limited (India) |

|

Market Opportunities |

|

Market Definition

Ballistic, bullet-resistant and transparent armor are other names for bulletproof glass. It is a form of thermoplastic that can withstand bullets and is used to make conventional tempered glass. Typically, laminated glass, thermoplastics, and polycarbonate are used in its fabrication. High-security buildings like diamond stores, foreign embassies, military sites, and V.I.P. vehicles use bulletproof glass. Bulletproof eyewear ranges in thickness from 19mm to 89mm.

Europe Bullet Proof Glass Market Dynamics

Drivers

- Growing requirement for safety and protection facilities

Facilities for safety and protection are rapidly becoming more necessary. Due to rising safety and protection standards, bulletproof glasses are highly sought after in many sectors, including construction, science, air traffic control, banking, finance, government, and education. Moreover, the market for bulletproof glass will probably be constrained by the rise in vehicle security measures brought on by terrorist attacks and rising crime rates.

- Rising demand for acrylic material-based bullet proof glasses

An increase in demand for bulletproof glasses made of acrylic material throughout the projected period is likely to drive market expansion. Transparent thermoplastic homopolymer acrylic is also known as plexiglass. This substance has unique qualities that make it ideal for various uses, from household goods to fiber optic cables. In addition to enhanced optical clarity, natural weather resistance, U.V. resistance, dimensional stability, and excellent chemical resistance, this material offers high impact resistance to bulletproof glasses. All these factors contribute to increased demand for acrylic material, accelerating market growth.

Opportunities

- Rising usage of bullet proof glass in the automotive sector

As the global automotive industry develops, the market for bulletproof glass is expanding quickly. A tough substitute for glass for cars that need an extra layer of protection is one reason the industry is growing. The growing utilization of bulletproof glass in the automotive sector will likely boost the market's growth during the forecast period. As an illustration, Tesla introduced the Model S P100D electric vehicle with bulletproof protective glass in 2018.

- Growth and expansion of glass-based manufacturing facilities

Growth and expansion of glass-based manufacturing facilities will likely create lucrative market growth opportunities during the forecast period. For instance, Guardian Glass L.L.C. led to the growth of coated glass manufacturing and additional float through a new plant in 2017 at their Czestochowa facility in Poland. This will allow the company to meet the growing demand for fabricated, float, and coated glass products across Europe.

Restraints/ Challenges

- Issues associated with the physical properties of some bullet proof glass

Some bullet proof glass reacts differently to high variations in daily temperature. Furthermore, if the bullet proof glass is not prepared with proper interlayers that generally allow the expansion of the glass molecules due to heat, then there are a lot of chances of creating a crack in these glasses. Therefore, it could even break in extreme weather conditions. This factor is expected hamper the market growth.

- Declining defense budgets

The diminishing defense budgets of the industrialized European countries will hamper the market's growth for bulletproof glass. Germany, France, U.K., Netherlands, Switzerland, and Belgium are among the countries that heavily rely on defense spending to limit the expansion of their respective bulletproof glass sectors. As a result, over the projected period, the market's growth rate for bulletproof glass would be constrained.

This bullet proof glass market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the bullet proof glass market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- In 2023, Asahi India Glass Limited announced its collaboration with Enormous Brands to make brand films for its complete windows and doors solutions brand, A.I.S. Windows. Through this collaboration, A.I.S. Windows is directing to make a large impact in the windows and doors segment.

- In 2023, Guardian Glass signed a contract to acquire Vortex Glass, a fabrication business. This transaction between these companies will provide complete tempered glass packages for commercial and residential construction, including shower doors, office partitions, and glass railings.

Europe Bullet Proof Glass Market Scope

The bullet proof glass market is segmented on the basis of material, end-user, application, and security levels. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Material

- Acrylic

- Laminated Glass

- Polycarbonate

- Glass Clad Polycarbonate

- Ballistic Insulated Glass

- Others

End-User

- Automotive

- Defense & V.I.P. Vehicles

- Law Enforcement Vehicles

- Cash-In Transit Vehicles

- Passenger Car

- Military

- Fighter Aircraft

- Ships and Boats

- Submarines

- Others

- Construction

- Residential

- Commercial

- Industrial

- Banking and Finance

- Others

- Presidential Gatherings

- Election Department

Application

- Defense and V.I.P. Vehicles

- Government and Law Enforcement

- Cash-In-Transit Vehicles

- Commercial Buildings

- A.T.M. Booths and Teller Stations

- Others

- Post Offices

- Jewellery Shop

- Retail Stores

- Gas Stations

- Pharmacies

- Schools

- Police Stations

- Government Facilities

Security Levels

- Level-1

- Level-2

- Level-3

- Level-4 to 8

- Others

Bullet Proof Glass Market Regional Analysis/Insights

The bullet proof glass is analyzed and market size insights and trends are provided by country, material, end-user, application, and security levels as referenced above.

The countries covered in the bullet proof glass market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe.

Germany is expected to dominate the bulletproof jacket market due to the high amount of investments from manufacturers and governments. Moreover, increasing security levels by the government on the protection and safety of civilians and defense will further increase the market growth in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Bullet Proof Glass Market Share Analysis

The bullet proof glass market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to bullet proof glass market.

Some of the major players operating in the bullet proof glass market are:

- Nippon Sheet Glass Co., Ltd (Japan)

- Saint-Gobain (France)

- SCHOTT AG (Germany)

- A.G.C. Inc. (Japan)

- Taiwan Glass Industry Corporation (Taiwan)

- Asahi India Glass Limited (India)

- Guangzhou Topo Glass Co., Ltd. (China)

- P.P.G. Industries, Inc. (U.S.)

- Xinyi Glass Holdings Limited., (China)

- Total Security Solutions (U.S.)

- Qingdao Tsing Glass Co. Limited (China)

- Dellner Romag (U.K.)

- Guardian Industries Holdings (U.S.)

- E.S.G. (U.S.)

- Glasstronn India Private Limited (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Bulletproof Glass Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Bulletproof Glass Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Bulletproof Glass Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.