Europe Buttermilk Market

Market Size in USD Billion

CAGR :

%

USD

2.75 Billion

USD

4.00 Billion

2024

2032

USD

2.75 Billion

USD

4.00 Billion

2024

2032

| 2025 –2032 | |

| USD 2.75 Billion | |

| USD 4.00 Billion | |

|

|

|

|

Europe Buttermilk Market Size

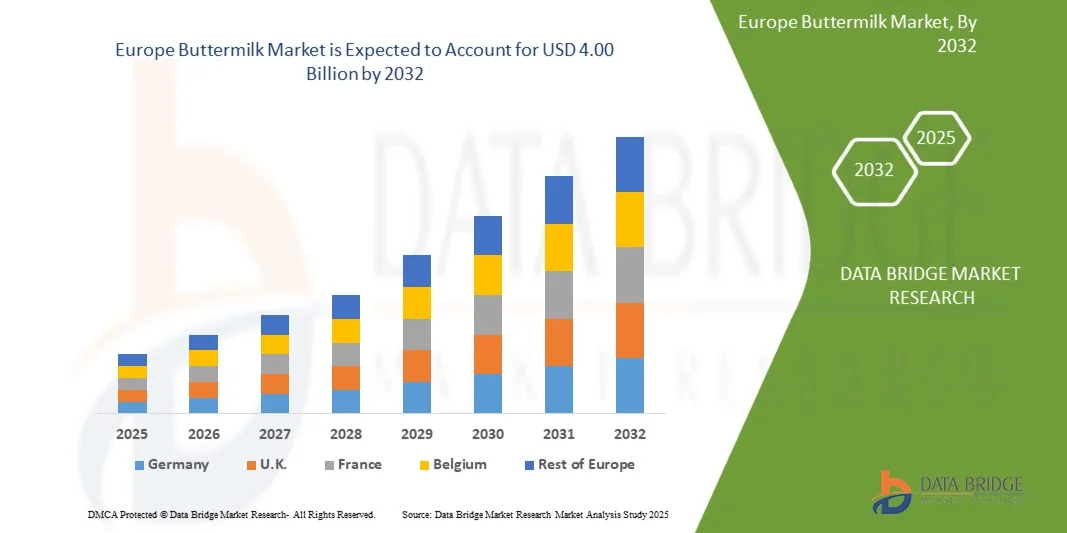

- The Europe buttermilk market size was valued at USD 2.75 billion in 2024 and is expected to reach USD 4.00 billion by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is largely fuelled by increasing consumer preference for healthy and functional dairy products, rising awareness about probiotic benefits, and the expanding demand for fermented beverages

- Growing applications in bakery, confectionery, and beverage industries, along with product innovation such as flavored and low-fat buttermilk variants, are further supporting market growth

Europe Buttermilk Market Analysis

- The market is witnessing strong growth due to increasing health-conscious consumer behavior, rising demand for natural and organic dairy products, and a shift toward high-protein, low-fat beverages

- Innovations in packaging, extended shelf-life formulations, and flavored buttermilk options are driving adoption across retail and foodservice channels

- Germany dominated the Europe buttermilk market with the largest revenue share of 38.50% in 2024, driven by the growing consumer preference for functional and flavored dairy beverages, increasing health awareness, and the expanding demand for probiotic-rich products

- U.K. is expected to witness the highest compound annual growth rate (CAGR) in the Europe buttermilk market due to rising health awareness, growing demand for probiotic and ready-to-drink dairy beverages, and increasing innovation in flavored and functional buttermilk products

- The liquid buttermilk segment held the largest market revenue share in 2024, driven by its widespread availability, ready-to-drink convenience, and growing consumer preference for probiotic-rich beverages. Liquid buttermilk is particularly popular in retail and foodservice channels due to its immediate usability and longer shelf-life with modern packaging solutions

Report Scope and Europe Buttermilk Market Segmentation

|

Attributes |

Europe Buttermilk Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Buttermilk Market Trends

“Rise of Functional and Flavored Buttermilk”

- The growing demand for functional and flavored buttermilk is transforming the European dairy market by providing healthier, probiotic-rich, and convenient beverage options. These products cater to health-conscious consumers seeking digestive benefits, reduced lactose content, and enhanced taste, driving frequent consumption. In addition, the rise in fitness and wellness trends has increased interest in nutrient-enriched beverages, encouraging manufacturers to expand their product portfolios and target a wider demographic

- Increasing popularity of ready-to-drink dairy beverages is accelerating the adoption of buttermilk in urban centers, cafés, and retail outlets. The on-the-go consumption trend and interest in ethnic or regional flavors are further boosting market penetration. Retailers are also leveraging in-store promotions and bundled offerings, helping to strengthen brand loyalty and awareness among busy consumers seeking convenient nutritional options

- The affordability, ease of availability, and extended shelf life of packaged buttermilk make it attractive for supermarkets and foodservice providers. Consistent quality and product variety improve consumer loyalty and repeat purchases, contributing to sustained market growth. In addition, partnerships between dairy manufacturers and distribution networks are enhancing market reach, enabling even smaller brands to enter competitive segments

- For instance, in 2023, FrieslandCampina (Netherlands) launched its new line of probiotic buttermilk drinks across Germany and the Netherlands, resulting in a 12% increase in retail sales and reinforcing the product’s reputation for health benefits and taste innovation. The launch also drove heightened visibility in e-commerce platforms, facilitating direct-to-consumer purchases and expanding accessibility beyond traditional retail channels

- While functional and flavored buttermilk is gaining traction, success depends on product innovation, nutritional content, and regulatory compliance. Manufacturers must focus on natural ingredients, sustainable packaging, and new flavor development to meet evolving consumer preferences. In addition, educating consumers about probiotic benefits and integrating traceable labeling practices can boost trust and adoption in competitive markets

Europe Buttermilk Market Dynamics

Driver

“Growing Health Awareness and Shift Towards Functional Dairy Beverages”

- Rising awareness of digestive health, immunity, and overall wellness is driving consumers to opt for buttermilk over traditional dairy beverages. Its natural probiotics, low fat, and calcium content are increasingly valued across all age groups. The increasing popularity of immunity-boosting and gut-friendly diets is pushing consumers to prioritize functional dairy products in their daily routines, further expanding demand

- Product innovations, including fortified and flavored buttermilk variants, are expanding consumer choices and enhancing market acceptance. These developments help dairy manufacturers differentiate offerings and increase shelf visibility. Furthermore, innovation in packaging formats such as single-serve bottles and resealable cartons is making buttermilk more convenient for urban and on-the-go consumers, supporting repeat consumption

- Government campaigns promoting healthy dietary habits and nutritional labeling requirements are further supporting market growth. Policies emphasizing functional foods and probiotics encourage consumers to integrate buttermilk into daily diets. Public-private partnerships aimed at nutrition education in schools and community programs are also raising awareness, indirectly boosting consumption among younger demographics

- For instance, in 2022, Danone (France) launched a probiotic buttermilk line targeting digestive health across France, significantly increasing consumer engagement and driving wider adoption in retail chains. The initiative also included marketing campaigns highlighting the digestive and immune benefits of the products, which strengthened brand credibility and influenced purchasing behavior

- As health-conscious consumption continues to rise, demand for functional and flavored buttermilk is expected to grow steadily, especially in Western Europe. The trend is further amplified by rising interest in plant-forward diets and sustainable dairy sourcing, prompting manufacturers to innovate with hybrid or enhanced formulations to meet evolving consumer expectations

Restraint/Challenge

“High Price Point and Limited Consumer Awareness in Emerging Segments”

- The relatively higher price of premium and fortified buttermilk compared to traditional dairy beverages limits adoption among price-sensitive consumers. This restricts market penetration in smaller towns and rural areas. In addition, fluctuating raw material costs, such as milk and specialty probiotics, can increase production costs, further impacting pricing strategies and accessibility for cost-conscious buyers

- Limited awareness about the nutritional benefits of buttermilk in certain consumer segments further hampers growth. Misconceptions about taste or suitability for children and adults may reduce willingness to try these products. In addition, inconsistent labeling and lack of standardized claims about probiotics and functional nutrients can confuse consumers, delaying adoption in newer markets

- Supply chain challenges, including cold storage requirements and shelf-life management, impact distribution efficiency and product availability in remote locations, affecting consistent market presence. These logistical constraints can also result in spoilage or quality degradation, which affects brand trust and profitability, especially for smaller or regional producers

- For instance, in 2023, a survey conducted by the European Dairy Association reported that over 30% of consumers in Southern Italy were unaware of the health benefits of fortified buttermilk, highlighting gaps in education and outreach. This demonstrates the need for more effective marketing, labeling clarity, and direct consumer engagement initiatives to bridge knowledge gaps and drive market growth

- While innovation and demand are strong, addressing cost barriers, consumer education, and distribution challenges is essential to ensure sustained growth and broader market adoption in Europe. Companies investing in strategic awareness campaigns, subsidized trial programs, and regional distribution networks are more likely to capture emerging opportunities and strengthen long-term market presence

Europe Buttermilk Market Scope

The Europe buttermilk market is segmented on the basis of type, nature, packaging type, application, and end user.

• By Type

On the basis of type, the Europe buttermilk market is segmented into liquid buttermilk and buttermilk powder. The liquid buttermilk segment held the largest market revenue share in 2024, driven by its widespread availability, ready-to-drink convenience, and growing consumer preference for probiotic-rich beverages. Liquid buttermilk is particularly popular in retail and foodservice channels due to its immediate usability and longer shelf-life with modern packaging solutions.

The buttermilk powder segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its ease of storage, longer shelf life, and versatility in food formulations. Powdered buttermilk is widely used in bakery, confectionery, and processed food applications, making it increasingly attractive for commercial manufacturers and industrial users seeking consistency and cost-efficiency.

• By Nature

On the basis of nature, the Europe buttermilk market is segmented into organic and conventional buttermilk. The conventional segment held the largest revenue share in 2024, driven by higher production volumes, affordability, and wide availability across supermarkets and foodservice outlets. Conventional buttermilk remains a staple in traditional recipes and daily consumption across Europe.

The organic segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising health awareness, preference for chemical-free and sustainable dairy products, and increasing demand for functional beverages enriched with probiotics. Consumers are actively seeking certified organic products, boosting adoption across premium retail and health-focused outlets.

• By Packaging Type

On the basis of packaging type, the Europe buttermilk market is segmented into pouches, tetra packs, bottles, and others. The tetra pack segment held the largest market share in 2024, driven by its convenience, extended shelf life, and suitability for on-the-go consumption. Tetra packs also provide protection against contamination and maintain product quality during storage and transportation.

The bottles segment is expected to witness the fastest growth rate from 2025 to 2032, owing to growing consumer preference for resealable, easy-to-handle packaging in retail and foodservice channels. Bottled buttermilk allows portion control, convenience, and improved visibility on shelves, supporting frequent purchase and repeat consumption.

• By Application

On the basis of application, the Europe buttermilk market is segmented into confectionery, ice cream, bakery and pastry products, soups, dressings and dips, and others. The bakery and pastry products segment held the largest revenue share in 2024, driven by the high demand for buttermilk as a functional ingredient that enhances texture, flavor, and shelf life. Buttermilk contributes to soft, moist baked goods, making it a preferred ingredient among commercial bakers.

The confectionery segment is expected to witness the fastest growth from 2025 to 2032, fueled by innovation in flavored and functional confections, as well as increasing use of buttermilk powders for consistency and nutritional enhancement in sweets and snacks.

• By End User

On the basis of end user, the Europe buttermilk market is segmented into foodservice and retail. The retail segment held the largest market share in 2024, driven by the increasing availability of packaged buttermilk in supermarkets, convenience stores, and e-commerce platforms. Retail sales benefit from strong brand visibility, promotions, and accessibility for daily consumption.

The foodservice segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising demand in cafés, restaurants, and institutional kitchens for ready-to-use and consistent-quality buttermilk. Foodservice operators are increasingly incorporating buttermilk into beverages, baked goods, and dressings to meet evolving consumer taste preferences and dietary trends.

Europe Buttermilk Market Regional Analysis

- Germany dominated the Europe buttermilk market with the largest revenue share of 38.50% in 2024, driven by the growing consumer preference for functional and flavored dairy beverages, increasing health awareness, and the expanding demand for probiotic-rich products

- Consumers in the country highly value nutritional benefits, convenience, and the availability of ready-to-drink and fortified buttermilk options across retail outlets and foodservice channels

- This widespread adoption is further supported by strong distribution networks, urbanization, and government initiatives promoting healthy diets, establishing buttermilk as a preferred choice among health-conscious consumers

U.K. Buttermilk Market Insight

The U.K. buttermilk market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising popularity of functional and flavored dairy beverages and increasing awareness of digestive health benefits. The growing demand for probiotic-rich and fortified buttermilk, combined with widespread availability in modern retail and foodservice channels, is further propelling the market. In addition, product innovations in packaging formats such as pouches, bottles, and tetra packs, along with organic and conventional options, are significantly contributing to market expansion.

Europe Buttermilk Market Share

The Europe buttermilk industry is primarily led by well-established companies, including:

- Arla Foods amba (Denmark)

- FrieslandCampina (Netherlands)

- Danone (France)

- LACTALIS (France)

- Valio Oy (Finland)

- MÜLLER UK & IRELAND (Germany)

- Yeo Valley Organic Limited (U.K.)

- Emmi Group (Switzerland)

- Kerry Group plc. (Ireland)

- First Milk (U.K.)

Latest Developments in Europe Buttermilk Market

- In September 2022, Berchtesgadener Land (Germany) launched a new organic buttermilk in a 400 g beverage carton. The product uses packaging made from 93 % renewable raw materials, offering eco-friendly solutions for consumers. This launch caters to the growing demand for sustainable and organic dairy products, enhancing the company’s portfolio and supporting a greener supply chain. The introduction of this organic buttermilk is expected to strengthen brand loyalty, boost retail sales, and positively impact the European dairy beverage market

- In October 2025, DMK Group (Germany) unveiled Buttermilk Zero, a sugar-free buttermilk under its Milram brand at the Anuga trade fair. This innovation targets health-conscious consumers seeking low-sugar and functional dairy options. By combining nutritional benefits with convenience, the product aims to expand market penetration in the European dairy segment. The launch is anticipated to drive consumer adoption, stimulate competition in the functional beverages category, and support overall growth in the European buttermilk market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Buttermilk Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Buttermilk Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Buttermilk Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.