Europe Cardiopulmonary Bypass Accessory Equipment Market

Market Size in USD Billion

CAGR :

%

USD

4.30 Billion

USD

6.40 Billion

2025

2033

USD

4.30 Billion

USD

6.40 Billion

2025

2033

| 2026 –2033 | |

| USD 4.30 Billion | |

| USD 6.40 Billion | |

|

|

|

|

Europe Cardiopulmonary Bypass Accessory Equipment Market Size

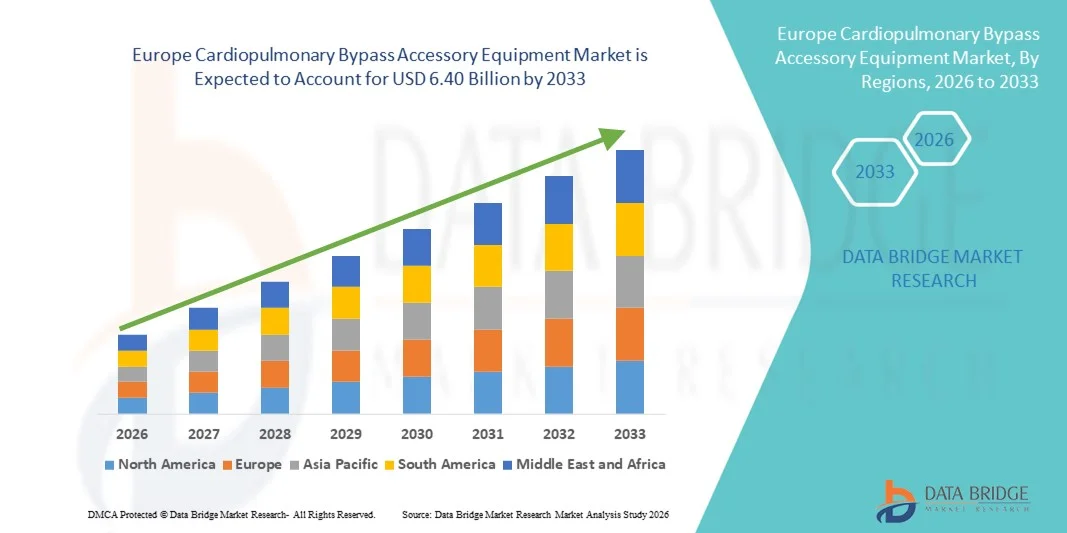

- The Europe cardiopulmonary bypass accessory equipment market size was valued at USD 4.30 billion in 2025 and is expected to reach USD 6.40 billion by 2033, at a CAGR of 5.1% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular diseases across Europe, supportive healthcare regulation, rising surgical procedure volumes, and continuous advancements in extracorporeal circulation technologies

- Furthermore, an aging population combined with rising demand for safer, more efficient cardiac surgical outcomes is establishing cardiopulmonary bypass accessories as essential to modern cardiovascular care. Technological progress in device miniaturization, perfusion efficiency, and integration with ECMO systems is enhancing clinical utility and driving sustained regional investment

Europe Cardiopulmonary Bypass Accessory Equipment Market Analysis

- Cardiopulmonary bypass accessory equipment, including oxygenators, pumps, filters, and monitoring systems, are increasingly vital components of modern cardiac surgery due to their role in ensuring patient safety, maintaining perfusion, and enabling complex surgical procedures in both adult and pediatric settings

- The escalating demand for cardiopulmonary bypass accessories is primarily fueled by the rising prevalence of cardiovascular diseases, increasing cardiac surgery volumes, and growing adoption of advanced perfusion technologies across European healthcare facilities

- Germany dominated the market in 2025 with the largest revenue share of 28.7%, supported by advanced healthcare infrastructure, early adoption of innovative cardiac technologies, and a strong presence of leading medical device manufacturers

- Poland is expected to be the fastest-growing market during the forecast period due to increasing healthcare investments, rising cardiovascular surgery rates, and improving access to modern medical technologies

- The oxygenator segment dominated the cardiopulmonary bypass accessory equipment market with a market share of 41.5% in 2025, driven by its critical role in supporting extracorporeal circulation and continuous technological improvements enhancing surgical outcomes

Report Scope and Europe Cardiopulmonary Bypass Accessory Equipment Market Segmentation

|

Attributes |

Europe Cardiopulmonary Bypass Accessory Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Cardiopulmonary Bypass Accessory Equipment Market Trends

Advancements Through Miniaturization and AI-Enabled Perfusion Monitoring

- A significant and accelerating trend in the Europe cardiopulmonary bypass accessory equipment market is the integration of AI-enabled perfusion monitoring and miniaturized bypass components, improving surgical precision and patient outcomes in both adult and pediatric cardiac surgeries

- For instance, the Terumo Advanced Perfusion System integrates AI-driven monitoring to optimize flow rates and oxygen delivery during procedures, enhancing safety and efficiency

- AI integration enables predictive alerts for abnormal perfusion parameters and automated adjustments to maintain optimal circulation, while miniaturized pumps and oxygenators facilitate less invasive procedures and quicker recovery

- The seamless adoption of these intelligent accessories allows surgical teams to monitor multiple parameters in real time and adjust bypass settings without manual intervention, creating a more controlled and precise operative environment

- This trend toward highly automated, compact, and data-driven bypass accessory systems is fundamentally reshaping clinical expectations, with companies such as Medtronic and LivaNova developing AI-integrated pumps and filters that enhance surgical workflow and patient safety

- The demand for cardiopulmonary bypass accessories that incorporate AI and miniaturization is growing rapidly across hospitals and specialized cardiac centers, as clinicians increasingly prioritize precision, efficiency, and reduced procedural risk

- Enhanced biocompatible coatings and improved oxygenator materials are trending, reducing inflammatory responses and improving postoperative recovery, which is driving clinician preference for upgraded bypass accessories

Europe Cardiopulmonary Bypass Accessory Equipment Market Dynamics

Driver

Increasing Cardiac Surgery Volumes and Technological Adoption

- The rising prevalence of cardiovascular diseases in Europe, combined with increasing cardiac surgery volumes, is a significant driver for heightened demand for advanced bypass accessories

- For instance, in March 2025, LivaNova introduced next-generation oxygenators with AI-assisted perfusion monitoring for use in major cardiac centers across Germany and France, aiming to improve procedural efficiency

- As hospitals and surgical centers seek improved patient outcomes, bypass accessories offer features such as automated flow control, real-time monitoring, and reduced prime volume, providing a clear advantage over traditional devices

- Furthermore, the adoption of minimally invasive and pediatric cardiac procedures is making advanced bypass systems an essential component of surgical protocols, ensuring safe and precise extracorporeal circulation

- The need for reliable, technologically advanced devices that reduce surgical complications and streamline cardiac operations is propelling the adoption of cardiopulmonary bypass accessories across hospitals and specialized cardiac centers

- Expansion of training and certification programs for perfusionists and surgical staff is enhancing the adoption rate of advanced bypass accessories by increasing operator confidence and expertise

- Growing investments in hospital modernization and cardiac surgery infrastructure, especially in Germany, France, and the U.K., are creating new demand for next-generation bypass equipment with AI and miniaturized technology

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The relatively high cost of advanced cardiopulmonary bypass accessory equipment compared to traditional systems poses a significant barrier to adoption, particularly in smaller hospitals or budget-constrained centers

- For instance, high-end AI-integrated oxygenators and miniaturized pump sets can cost several times more than conventional devices, limiting accessibility for some facilities

- Compliance with stringent European medical device regulations, including CE marking and ISO standards, adds complexity and time to product approval, slowing market penetration for new innovations

- Addressing these challenges through cost-effective device design, streamlined regulatory strategies, and clinician training programs is crucial for broader adoption and sustained market growth

- While the overall safety and performance benefits are clear, hospitals and healthcare providers remain cautious about capital investment in premium bypass accessories, making affordability and compliance key considerations for manufacturers

- Limited awareness and experience among perfusionists in smaller hospitals can slow adoption, as advanced AI-enabled systems require specialized training for effective use

- Uncertainty regarding long-term clinical outcomes and maintenance costs of next-generation bypass accessories can lead to hesitancy among hospital administrators when considering budget allocation for new devices

Europe Cardiopulmonary Bypass Accessory Equipment Market Scope

The market is segmented on the basis of product, operation, application, age, end user, and distribution channel.

- By Product

On the basis of product, the market is segmented into oxygenator, Ecmo machine, pumps, cannula, temperature monitors, heat exchanger, filters, tubing clamps, hemoconcentrators, system panel, sensor and accessories, cardioplegia control, reservoir, bubble detector, electronic gas blender, electrical venous occluder, venous line clamp and accessories. The Oxygenator segment dominated the market with the largest market revenue share of 41.5% in 2025, driven by its critical role in supporting extracorporeal circulation during cardiac surgeries. Oxygenators ensure efficient oxygen transfer and removal of carbon dioxide, making them essential in both adult and pediatric bypass procedures. Hospitals prioritize high-performance oxygenators due to their direct impact on patient safety and surgical outcomes. Continuous technological advancements, such as improved biocompatible coatings and AI-enabled monitoring, have enhanced performance, reliability, and clinical adoption. The demand is further reinforced by their compatibility with other perfusion devices and ease of integration into existing surgical setups. European cardiac centers, particularly in Germany, France, and the U.K., rely heavily on oxygenators due to high volumes of cardiac surgeries and specialized care facilities.

The ECMO Machine segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing prevalence of acute respiratory failure and cardiac complications requiring extracorporeal support. ECMO machines offer long-term cardiopulmonary support, enabling survival in critical care settings and during complex surgeries. The adoption of portable and miniaturized ECMO systems has expanded access to smaller hospitals and ambulatory surgical centers. Advancements such as AI-assisted monitoring, integrated sensors, and remote control capabilities enhance clinical outcomes and operational efficiency. Growing awareness of ECMO therapy in pediatric and geriatric populations is further driving adoption. In addition, government initiatives and hospital investments in advanced life-support equipment across Europe support the rapid expansion of this segment.

- By Operation

On the basis of operation, the market is segmented into manually operated, electrically operated, and battery operated. The Electrically Operated segment dominated the market with the largest revenue share in 2025, owing to the precision, reliability, and automated control offered by electrically powered pumps, oxygenators, and monitoring systems. These devices reduce manual errors, improve procedural efficiency, and allow integration with AI-assisted perfusion monitoring. Hospitals prefer electrically operated systems for complex surgeries that require continuous adjustment and precise flow regulation. Continuous technological enhancements, such as integration with smart dashboards and real-time parameter monitoring, further strengthen adoption. The segment is widely adopted in tertiary care hospitals, specialized cardiac centers, and research institutions due to its performance consistency and ease of maintenance. In addition, electrically operated systems support compatibility with other high-end perfusion devices, increasing their market share.

The Battery Operated segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing demand for portable bypass systems and emergency surgical setups. Battery-operated pumps and oxygenators are particularly valuable in ambulatory surgical centers, mobile cardiac units, and smaller hospitals with limited infrastructure. Their portability allows safe transportation of patients during inter-facility transfers while maintaining perfusion support. Improvements in battery life, efficiency, and monitoring capabilities have enhanced their reliability in critical care scenarios. Growing interest in remote and emergency cardiac care solutions across Europe is fueling adoption. Moreover, battery-operated systems complement telemonitoring platforms, expanding their application in modern cardiac surgery workflows.

- By Application

On the basis of application, the market is segmented into cardiac surgery, cardiac surgery oxygenators, acute respiratory failure treatment, lung cancer, transplant operation, and others. The Cardiac Surgery segment dominated the market with the largest revenue share in 2025, as bypass accessories are indispensable for routine and complex cardiac procedures. This segment includes adult, pediatric, and geriatric surgeries, covering valve repair, CABG, and congenital defect corrections. Hospitals prioritize advanced perfusion equipment for cardiac surgery due to its direct impact on patient safety, surgical precision, and postoperative outcomes. Technological advancements, including AI-enabled monitoring, biocompatible materials, and improved flow regulation, have enhanced procedural efficiency. European cardiac centers in Germany, France, and the U.K. lead adoption due to high surgical volumes and specialized care infrastructure. Continuous clinician training programs further ensure effective use of these devices, reinforcing market dominance.

The Acute Respiratory Failure Treatment segment is expected to witness the fastest growth from 2026 to 2033, driven by rising cases of respiratory complications requiring ECMO or bypass support. Devices in this segment, such as portable ECMO machines and advanced oxygenators, enable long-term life support and improve survival rates. The increasing geriatric population and rising incidence of critical respiratory conditions amplify demand. Integration of AI and real-time monitoring enhances patient safety and operational efficiency in intensive care units. Investments in critical care infrastructure and expansion of specialized respiratory care centers across Europe further propel growth. In addition, adoption in pediatric and emergency care units supports rapid market expansion in this subsegment

- By Age

On the basis of age, the market is segmented into adult, geriatric, and pediatric. The Adult segment dominated the market with the largest revenue share in 2025, as the majority of cardiac surgeries and bypass procedures are performed on adult patients. Advanced oxygenators, pumps, and ECMO systems are primarily designed to support adult cardiac physiology, ensuring optimal perfusion and oxygenation during surgery. Hospitals prioritize devices that accommodate a wide range of adult patients, including those with complex comorbidities. Technological innovations, such as AI-assisted monitoring and biocompatible coatings, further enhance surgical safety and reduce postoperative complications. Adoption is particularly strong in high-volume cardiac centers in Germany, France, and the U.K., where advanced adult cardiac procedures are routine. Continuous training of perfusionists and surgical teams ensures efficient use of these devices, reinforcing their dominant position.

The Pediatric segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing awareness and treatment of congenital heart diseases and pediatric cardiac complications. Miniaturized oxygenators, pumps, and ECMO systems designed specifically for pediatric physiology are gaining traction. The demand is further fueled by specialized pediatric cardiac centers and hospitals across Europe investing in child-specific bypass accessories. AI-enabled monitoring and improved flow control are particularly beneficial in pediatric surgeries, ensuring safe and precise perfusion. Government and hospital initiatives to expand pediatric cardiac care infrastructure further support growth. In addition, increasing survival rates and postoperative care improvements are encouraging hospitals to adopt advanced pediatric bypass systems.

- By End User

On the basis of end user, the market is segmented into hospitals, cardiac centers, research and academic institutions, ambulatory surgical centers, and others. The Hospitals segment dominated the market with the largest revenue share in 2025, as hospitals perform the majority of cardiac surgeries and critical care procedures requiring cardiopulmonary bypass accessories. Large tertiary care hospitals and multispecialty centers prefer advanced oxygenators, pumps, and ECMO systems due to their reliability, AI-enabled features, and integration with other surgical equipment. Adoption is reinforced by the high volume of adult, geriatric, and pediatric cardiac cases. Hospitals also benefit from clinician training programs and service agreements provided by device manufacturers. Germany, France, and the U.K. lead adoption due to well-established cardiac surgery infrastructure and high surgical procedure volumes. Continuous advancements in device safety, biocompatibility, and monitoring further solidify hospitals as the dominant end user.

The Cardiac Centers segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing establishment of specialized cardiac care facilities across Europe. These centers focus on complex cardiac surgeries, minimally invasive procedures, and high-risk patients, creating strong demand for advanced bypass accessories. Investments in AI-enabled pumps, oxygenators, and ECMO systems allow precise control and monitoring, improving patient outcomes. Pediatric and geriatric care programs within these centers further amplify adoption. Government and private initiatives to expand specialized cardiac care units contribute to rapid growth. In addition, partnerships with device manufacturers for advanced training and system integration enhance utilization rates in cardiac centers.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, third party distributor, and retail sales. The Direct Tender segment dominated the market with the largest revenue share in 2025, as hospitals and cardiac centers often procure cardiopulmonary bypass accessories directly from manufacturers through tenders. Direct tendering ensures device authenticity, manufacturer support, training, and service contracts, which are critical for high-value and high-complexity equipment such as ECMO machines and AI-enabled oxygenators. European healthcare facilities prioritize reliability, compliance, and post-sale support when procuring devices through direct tender. Large hospitals and cardiac centers in Germany, France, and the U.K. dominate procurement through this channel. Manufacturers also prefer this channel to establish long-term partnerships with end users and ensure consistent product supply.

The Third Party Distributor segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing demand in smaller hospitals, ambulatory surgical centers, and emerging cardiac care facilities across Europe. Distributors provide flexible access to advanced bypass accessories without the need for direct manufacturer contracts. Growth is fueled by distributors offering localized service support, training, and bundled solutions, which simplify adoption for mid-sized hospitals and clinics. Expanding distribution networks and strategic partnerships between manufacturers and distributors further accelerate market penetration. In addition, this channel allows access to remote regions and emerging markets where direct tender procurement is less prevalent.

Europe Cardiopulmonary Bypass Accessory Equipment Market Regional Analysis

- Germany dominated the market in 2025 with the largest revenue share of 28.7%, supported by advanced healthcare infrastructure, early adoption of innovative cardiac technologies, and a strong presence of leading medical device manufacturers

- Hospitals and specialized cardiac centers in Germany highly value advanced oxygenators, pumps, and ECMO systems due to their critical role in ensuring patient safety, improving surgical outcomes, and supporting complex adult, pediatric, and geriatric procedures

- This widespread adoption is further supported by continuous investments in cardiac care facilities, high procedural expertise among perfusionists, and integration of AI-enabled monitoring and miniaturized bypass accessories, establishing Germany as the leading market within Europe for cardiopulmonary bypass equipment

The Germany Cardiopulmonary Bypass Accessory Equipment Market Insight

The Germany market captured the largest revenue share of 28.7% in 2025, driven by its high volume of cardiac surgeries, advanced healthcare infrastructure, and strong presence of key medical device manufacturers. Hospitals and cardiac centers prioritize high-performance bypass accessories for their reliability, precision, and compatibility with AI-enabled monitoring systems. Technological innovation, coupled with continuous clinician training programs, ensures efficient use of advanced devices, enhancing patient outcomes. The adoption of miniaturized and AI-assisted oxygenators and pumps is particularly high in tertiary care hospitals. In addition, Germany’s emphasis on medical technology innovation and investment in cardiac surgery infrastructure continues to support market expansion.

France Cardiopulmonary Bypass Accessory Equipment Market Insight

The France market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the rising number of complex cardiac procedures and increasing hospital investments in advanced bypass technologies. Hospitals are adopting high-end oxygenators, ECMO machines, and AI-integrated pumps to enhance surgical precision and patient safety. Government support for cardiac care modernization, alongside growing awareness of advanced perfusion devices, is boosting adoption in both urban and regional hospitals. Continuous training programs for perfusionists and cardiologists are facilitating effective use of these devices. The demand is strong across adult and pediatric cardiac surgeries, with both public and private hospitals contributing to growth.

U.K. Cardiopulmonary Bypass Accessory Equipment Market Insight

The U.K. market is expected to expand at a considerable CAGR during the forecast period, driven by growing cardiac surgery volumes and the adoption of technologically advanced bypass accessories. Hospitals and specialized cardiac centers are increasingly deploying AI-enabled oxygenators, ECMO systems, and pumps for precise perfusion control during complex procedures. The emphasis on improving surgical outcomes, coupled with strong healthcare infrastructure and training programs, supports market growth. Integration of advanced devices into both adult and pediatric cardiac care units is becoming prevalent. In addition, government initiatives to modernize hospital facilities and promote high-quality cardiac care contribute to the expansion of the market.

Poland Cardiopulmonary Bypass Accessory Equipment Market Insight

The Poland market is expected to witness the fastest growth in Europe during the forecast period, driven by increasing cardiac surgery volumes, rising investments in hospital infrastructure, and growing awareness of advanced perfusion technologies. Hospitals and cardiac centers are increasingly adopting AI-enabled oxygenators, ECMO machines, and miniaturized pumps to improve surgical outcomes and patient safety. Expansion of specialized cardiac care units in urban and regional hospitals is fueling demand, while continuous training programs for perfusionists are facilitating effective device utilization. The rising prevalence of both pediatric and geriatric cardiac cases is further supporting adoption. In addition, government initiatives to modernize cardiac surgery facilities and promote the use of advanced medical technologies are accelerating market penetration in Poland

Europe Cardiopulmonary Bypass Accessory Equipment Market Share

The Europe Cardiopulmonary Bypass Accessory Equipment industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Getinge AB (Sweden)

- LivaNova PLC (U.K.)

- Terumo Corporation (Japan)

- Edwards Lifesciences Corporation (U.S.)

- EUROSETS S.r.l. (Italy)

- Boston Scientific Corporation (U.S.)

- Abbott (U.S.)

- SCHNELL Medical Corp. (Switzerland)

- NIPRO CORPORATION (Japan)

- XENIOS AG (Germany)

- Teleflex Incorporated (U.S.)

- APC Cardiovascular Ltd (U.K.)

- Braile Biomedica Ltda (Brazil)

- Fresenius Medical Care AG & Co. KGaA (Germany)

- B. Braun SE (Germany)

- MC3 Cardiopulmonary (U.S.)

- MicroPort Scientific Corporation (China)

- Surge Cardiovascular (U.S.)

- BD (U.S.)

What are the Recent Developments in Europe Cardiopulmonary Bypass Accessory Equipment Market?

- In October 2025, Medtronic launched its VitalFlow ECMO system across Europe at the European Association for Cardio‑Thoracic Surgery meeting, expanding availability of a configurable, bedside‑to‑transport life support platform for heart and lung support

- In July 2025, Medtronic’s VitalFlow™ ECMO System received CE Mark approval in Europe, enabling a new fully integrated extracorporeal membrane oxygenation solution to support critically ill cardiac and respiratory patients across advanced ICU and surgical settings

- In February 2025, Swedish medical technology leader Getinge announced it would phase out its cardiopulmonary surgical perfusion product line by end of 2025, reallocating resources toward higher‑growth areas such as extracorporeal membrane oxygenation and transplant care

- In May 2024, Hemovent GmbH’s integrated portable pneumatic ECMO system, the MOBYBOX®, completed its initial commercial applications in Europe, successfully demonstrating its portability for intra‑hospital and inter‑hospital transfers and expanding practical use of extracorporeal oxygenation support in critical care settings across European hospitals

- In April 2022, LivaNova initiated the launch of its Essenz™ Patient Monitor for cardiopulmonary bypass procedures, a targeted perfusion monitoring technology designed to tailor support and enhance clinical efficiency during cardiac surgeries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.