Europe Cargo Inspection Market

Market Size in USD Million

CAGR :

%

USD

779.10 Million

USD

1,082.77 Million

2025

2033

USD

779.10 Million

USD

1,082.77 Million

2025

2033

| 2026 –2033 | |

| USD 779.10 Million | |

| USD 1,082.77 Million | |

|

|

|

|

Europe Cargo Inspection Market Size

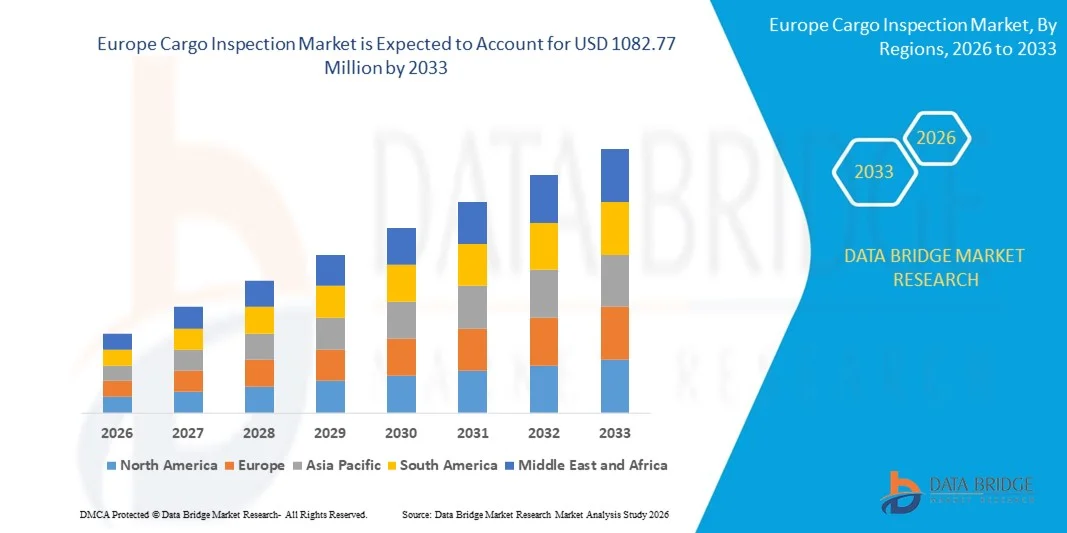

- The Europe cargo inspection market size was valued at USD 779.10 million in 2025 and is expected to reach USD 1082.77 million by 2033, at a CAGR of 4.2% during the forecast period

- The market growth is largely fueled by the increasing volume of global trade and rising complexity of international supply chains, which are driving the need for accurate cargo verification, quality assurance, and regulatory compliance across industries

- Furthermore, stricter trade regulations, growing emphasis on risk mitigation, and higher value of transported goods are accelerating the adoption of cargo inspection services, thereby significantly supporting overall market expansion

Europe Cargo Inspection Market Analysis

- Cargo inspection services, which ensure quality, quantity, safety, and compliance of goods during transportation, are becoming essential components of global logistics and trade operations across maritime, inland, and intermodal networks due to their role in reducing disputes, losses, and regulatory non-compliance

- The escalating demand for cargo inspection is primarily driven by expanding cross-border trade, increasing regulatory scrutiny on imports and exports, and growing reliance on third-party inspection providers to enhance supply chain transparency and operational efficiency

- Germany dominated the cargo inspection market with a share of in 2025, due to its strong export-oriented industrial base, high volume of cross-border trade, and well-established port and logistics infrastructure

- U.K. is expected to be the fastest growing country in the cargo inspection market during the forecast period due to rising international trade activity, expansion of port modernization initiatives, and increasing reliance on third-party inspection services

- Sea ports segment dominated the market with a market share of around 65% in 2025, due to their central role in international maritime trade and high cargo throughput volumes. Most bulk, containerized, and liquid cargo movements rely on sea ports, making inspection services critical for operational continuity and regulatory compliance. The presence of established inspection infrastructure further strengthens dominance

Report Scope and Cargo Inspection Market Segmentation

|

Attributes |

Cargo Inspection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Europe Cargo Inspection Market Trends

Digitalization and Integration of Remote Inspection Technologies

- A key trend in the cargo inspection market is the accelerating digitalization of inspection processes through the integration of remote inspection technologies, driven by the need for faster clearance, enhanced transparency, and reduced manual intervention across global trade operations. Digital platforms, data analytics, and remote monitoring tools are transforming traditional cargo inspection by enabling real-time information exchange between inspectors, ports, logistics providers, and regulatory authorities

- For instance, organizations such as Bureau Veritas and SGS have implemented digital inspection platforms and remote verification solutions to conduct cargo inspections with minimal physical presence. These solutions improve inspection efficiency, reduce delays at ports, and enhance compliance tracking across international supply chains

- The adoption of remote inspection technologies is expanding as drones, IoT sensors, and digital imaging tools enable inspectors to assess cargo condition, container integrity, and sealing status from distant locations. This trend is improving safety outcomes while minimizing disruption to cargo handling operations in high-volume trade environments

- Customs authorities and port operators are increasingly leveraging digital inspection systems to manage growing cargo volumes while maintaining regulatory oversight. This is supporting faster decision-making, improving risk profiling, and strengthening coordination between inspection agencies and logistics stakeholders

- The integration of digital documentation and automated reporting tools is also enhancing data accuracy and audit readiness across inspection workflows. These capabilities are reducing paperwork dependency and supporting standardized inspection practices across regions

- Overall, the shift toward digital and remote inspection technologies is reshaping the cargo inspection market by enabling scalable, technology-driven inspection models. This trend is reinforcing efficiency, transparency, and reliability across global cargo movement and compliance ecosystems

Europe Cargo Inspection Market Dynamics

Driver

Rising Global Trade Volumes and Stringent Regulatory Compliance Requirements

- The continuous growth in global trade volumes is driving demand for robust cargo inspection services that ensure safety, quality, and regulatory compliance across international supply chains. Governments and trade bodies are enforcing stricter inspection standards to prevent fraud, contamination, and security risks associated with cross-border cargo movement

- For instance, regulatory frameworks enforced by organizations such as the World Customs Organization and inspection mandates supported by agencies such as the U.S. Customs and Border Protection require comprehensive cargo verification before clearance. These regulations increase reliance on professional inspection services to meet compliance obligations

- Rising shipment volumes across maritime, air, and land transport are intensifying the need for systematic inspection processes to manage risk and ensure cargo integrity. Inspection providers play a critical role in verifying documentation, physical condition, and adherence to trade standards under tight timelines

- The expansion of international trade agreements and cross-border commerce is further increasing the complexity of compliance requirements. This is compelling exporters, importers, and logistics providers to engage specialized cargo inspection services to navigate regulatory variations

- As global trade networks continue to expand, the combined impact of higher cargo volumes and stringent regulatory oversight is strengthening demand for reliable cargo inspection solutions. This driver remains a central force supporting market growth and long-term service adoption

Restraint/Challenge

High Operational Costs and Complexity of Inspection Processes

- The cargo inspection market faces challenges related to high operational costs and the inherent complexity of inspection processes, which involve skilled personnel, specialized equipment, and compliance with diverse international standards. These factors increase service costs and create barriers for scalability across high-volume trade routes

- For instance, inspection operations conducted by companies such as Intertek require trained inspectors, advanced testing tools, and detailed reporting systems to meet regulatory and client requirements. Maintaining these capabilities results in elevated operational expenditures

- Cargo inspections often involve coordination across multiple stakeholders including ports, customs authorities, shipping lines, and cargo owners, which adds procedural complexity and increases administrative burden. This coordination can slow inspection timelines and impact overall logistics efficiency

- Variations in inspection standards and regulatory requirements across countries further complicate service delivery and require continuous process adaptation. Inspection providers must invest in training and compliance systems to manage these regional differences effectively

- Collectively, high operational expenses and complex inspection workflows pose challenges to market participants seeking to balance cost efficiency with regulatory accuracy. Addressing these issues remains critical for sustaining profitability and ensuring consistent service quality in the cargo inspection market

Europe Cargo Inspection Market Scope

The market is segmented on the basis of industry type, cargo type, offering, inspection type, technology, and port types.

- By Industry Type

On the basis of industry type, the cargo inspection market is segmented into mining, metals, agriculture, oil, gas, petrochemicals, chemicals, machine manufacturing, automotive, medical devices, and others. The oil, gas, and petrochemicals segment dominated the market in 2025, supported by the high value of cargo, strict regulatory frameworks, and the critical need for quality and quantity verification during international trade. Cargo inspection in this sector plays a key role in minimizing financial losses, ensuring contractual compliance, and maintaining safety standards across global supply chains. The frequent movement of bulk liquids and hazardous materials further reinforces consistent demand for inspection services.

The agriculture segment is expected to witness the fastest growth from 2026 to 2033, driven by rising global food trade and increasing focus on quality assurance for grains, fertilizers, and perishable commodities. Exporters and importers rely heavily on cargo inspection to meet international phytosanitary requirements and avoid shipment rejections. Growing cross-border trade from emerging economies and heightened food safety awareness continue to accelerate inspection demand in this segment.

- By Type

On the basis of type, the cargo inspection market is categorized into LNG, LPG, coal, iron ore, grains, fertilizers, Ro-Ro, cruise, and others. The coal and iron ore segment accounted for the largest revenue share in 2025 due to the high volume of bulk shipments and extensive use in power generation and industrial manufacturing. Cargo inspection ensures accurate weight measurement, moisture assessment, and compliance with trade agreements, making it an essential service in bulk mineral transportation. The scale and frequency of shipments contribute significantly to market dominance.

The LNG and LPG segment is projected to grow at the fastest rate during the forecast period, supported by rising global energy demand and increasing adoption of cleaner fuel alternatives. Stringent safety regulations and precise measurement requirements for liquefied cargo drive the need for specialized inspection services. Expansion of LNG trade routes and infrastructure investments further strengthen growth prospects in this segment.

- By Offering

On the basis of offering, the cargo inspection market is divided into product and services. The services segment dominated the market in 2025, as inspection activities are primarily expertise-driven and require skilled professionals, certifications, and compliance knowledge. Cargo owners depend on third-party inspection services for independent verification, risk mitigation, and regulatory adherence across international shipments. The recurring nature of inspection services across trade cycles ensures steady revenue generation.

The product segment is anticipated to register the fastest growth from 2026 to 2033, driven by increasing adoption of advanced inspection tools, sensors, and monitoring equipment. Digital inspection solutions and portable testing devices enhance inspection efficiency and accuracy. Growing investments in automation and inspection technology upgrades support rapid expansion of this segment.

- By Inspection Type

On the basis of inspection type, the market includes bunker quantity surveys, hold and hatch inspection hold survey, draft survey, cargo damage survey, cargo lashing and handling logistics, cargo tally verification draft survey, cargo survey, pre-shipment inspection, cargo sampling oil, cargo measurement oil, proof and inspection of asset, pre-vetting inspection, pre-purchase vessel inspection, vessel on and off hire survey, vessel condition and damage survey, cleanliness ISM preparation audit, marine warranty survey navigation audit, and others. The draft survey and cargo survey segment held the largest market share in 2025 due to their widespread use in bulk cargo transportation for weight verification and loss prevention. These inspections are essential for dispute resolution between buyers and sellers, particularly in bulk commodity trades.

Pre-shipment inspection is expected to grow at the fastest pace during the forecast period, driven by increasing regulatory scrutiny and the need to ensure cargo quality before dispatch. Exporters increasingly rely on pre-shipment inspections to avoid customs delays and shipment rejections. The growing emphasis on supply chain transparency further accelerates demand for this inspection type.

- By Technology

On the basis of technology, the cargo inspection market is segmented into non-intrusive inspection technology and non-destructive evaluation technology. Non-destructive evaluation technology dominated the market in 2025 due to its ability to assess cargo condition without causing damage. This technology is widely used for structural integrity checks, material analysis, and defect detection across high-value and sensitive cargo types. Its accuracy and reliability support consistent adoption across industries.

Non-intrusive inspection technology is expected to witness the fastest growth from 2026 to 2033, driven by increasing demand for rapid, contactless inspection methods. Advanced imaging and scanning technologies improve inspection speed while reducing operational downtime. Rising port congestion and efficiency requirements further support accelerated adoption.

- By Port Types

On the basis of port types, the market is segmented into sea ports, inland ports, dry ports, and warm water ports. Sea ports dominated the market with the largest share of around 65% in 2025 due to their central role in international maritime trade and high cargo throughput volumes. Most bulk, containerized, and liquid cargo movements rely on sea ports, making inspection services critical for operational continuity and regulatory compliance. The presence of established inspection infrastructure further strengthens dominance.

Dry ports are projected to grow at the fastest rate over the forecast period, supported by expanding inland logistics networks and intermodal transportation systems. Increasing use of dry ports helps reduce congestion at sea ports while improving cargo handling efficiency. Rising trade activities in landlocked regions contribute to strong inspection demand at dry port facilities.

Europe Cargo Inspection Market Regional Analysis

- Germany dominated the cargo inspection market with the largest revenue share in 2025, driven by its strong export-oriented industrial base, high volume of cross-border trade, and well-established port and logistics infrastructure

- Germany’s advanced manufacturing ecosystem, strict quality assurance requirements, and strong regulatory oversight across industrial and bulk cargo movements support consistent demand for inspection and verification services

- The country’s emphasis on supply chain transparency, risk mitigation in international trade, and compliance with European trade and safety regulations strengthens its leading position in the regional cargo inspection market

U.K. Cargo Inspection Market Insight

The U.K. is projected to register the fastest CAGR in the Europe cargo inspection market during the forecast period, supported by rising international trade activity, expansion of port modernization initiatives, and increasing reliance on third-party inspection services. Growing focus on trade compliance following evolving customs frameworks and increased movement of energy, agricultural, and consumer goods are accelerating inspection demand. Higher adoption of digital inspection processes and efficiency-driven port operations further contribute to rapid market growth. The U.K.’s role as a major trade gateway positions it as the fastest-growing cargo inspection market in Europe.

France Cargo Inspection Market Insight

France is expected to witness steady growth during the forecast period, driven by consistent cargo movement across agricultural products, industrial goods, and energy-related shipments. Strong inland and maritime logistics networks support continuous demand for cargo quality, quantity, and compliance inspections. Ongoing focus on trade standardization, risk reduction, and regulatory alignment within Europe sustains market expansion. Stable trade flows and operational consistency reinforce France’s steady growth in the Europe cargo inspection market.

Europe Cargo Inspection Market Share

The cargo inspection industry is primarily led by well-established companies, including:

- SGS Group (Switzerland)

- Bureau Veritas SA (France)

- Intertek Group plc (U.K.)

- ALS Limited (Australia)

- Cotecna Inspection SA (Switzerland)

- Peterson & Conmtrol Union (Netherlands)

- SWISS APPROVAL International (Switzerland)

- AIM Control Group (Vietnam)

- Cargo Inspection Group (U.K.)

- Alex Stewart International (U.K.)

- CWM Survey & Inspection BV (Netherlands)

- Certispec Group (U.K.)

- Cargo Inspectors and Superitendence Co. Pvt. Ltd. (India)

Latest Developments in Europe Cargo Inspection Market

- In July 2025, SGS agreed to acquire Applied Technical Services for USD 1.325 billion, significantly strengthening its cargo inspection and testing capabilities in North America. The addition of 85 facilities and over 2,100 skilled professionals expands SGS’s operational footprint and service capacity, enabling faster turnaround times and broader inspection coverage. This move enhances SGS’s competitive positioning in large-scale industrial and cargo inspection services while supporting market consolidation trends

- In May 2025, the U.S. Department of Agriculture initiated routine inspections of Brazilian beef processing plants under a sanitary-equivalence review. This development reinforces the importance of cargo and food inspection services in international agricultural trade, as stricter oversight ensures compliance with U.S. safety standards. The action increases demand for inspection services tied to cross-border food shipments and strengthens regulatory-driven market growth

- In March 2022, National Cargo Bureau launched a remote container inspection service supported by a web-based inspection database and access portal. The introduction of remote assessment capabilities allows customers to inspect container transport units without physical presence, improving efficiency and reducing inspection turnaround time. This development accelerates digital adoption within the cargo inspection market and highlights the shift toward technology-enabled inspection solutions

- In February 2021, TÜV SÜD received accreditation from the U.S. Department of Transportation for inspections and approvals of unportable tanks under international regulations. This approval enhances TÜV SÜD’s credibility and service scope in regulated cargo segments, supporting increased customer acquisition. The development strengthens the company’s role in compliance-driven inspection services, contributing to steady market expansion

- In September 2020, Vela Software Group acquired Navarik Corporation, expanding its software portfolio across upstream, midstream, and downstream oil and gas operations. Navarik’s integrated cargo inspection lifecycle management capabilities enhance digital process efficiency for inspection activities. This acquisition underscores the growing role of software platforms in modernizing cargo inspection workflows and improving operational transparency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Cargo Inspection Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Cargo Inspection Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Cargo Inspection Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.