Europe Carrier Screening Market

Market Size in USD Billion

CAGR :

%

USD

16.92 Billion

USD

48.60 Billion

2025

2033

USD

16.92 Billion

USD

48.60 Billion

2025

2033

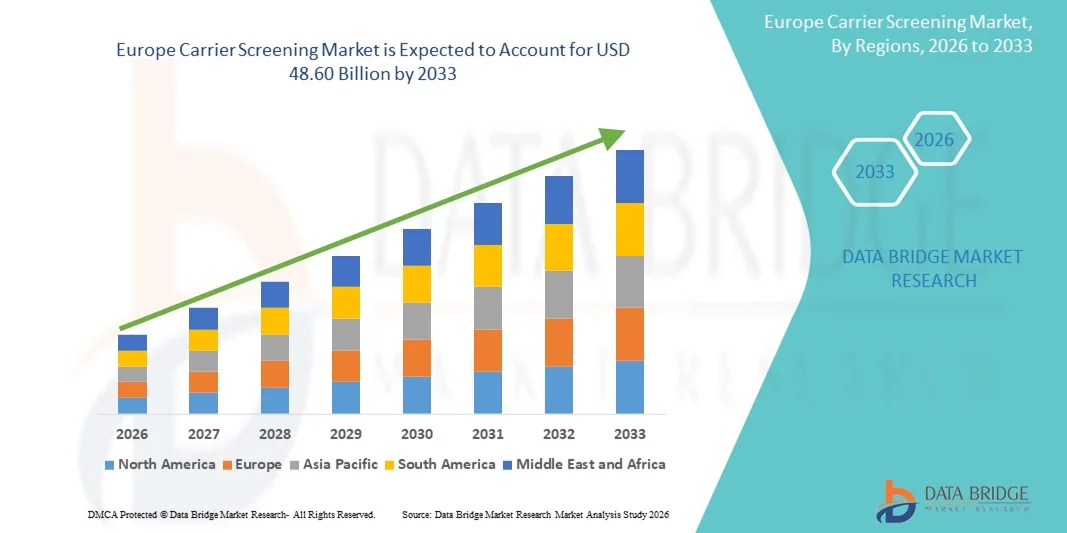

| 2026 –2033 | |

| USD 16.92 Billion | |

| USD 48.60 Billion | |

|

|

|

|

Europe Carrier Screening Market Size

- The Europe carrier screening market size was valued at USD 16.92 billion in 2025 and is expected to reach USD 48.60 billion by 2033, at a CAGR of 14.00% during the forecast period

- The market growth is largely fueled by the increasing awareness of inherited genetic disorders and the rising demand for early detection of carrier status among prospective parents. Advancements in molecular and biochemical screening technologies, coupled with the availability of expanded carrier panels, are enabling more accurate, comprehensive, and rapid testing, thereby driving adoption across hospitals, clinics, and diagnostic laboratories

- Furthermore, growing consumer preference for personalized healthcare and reproductive planning, along with the convenience of at-home and laboratory-based carrier screening solutions, is establishing carrier screening as a standard practice in prenatal and preconception care. These converging factors are accelerating the uptake of carrier screening services, significantly boosting the market's expansion

Europe Carrier Screening Market Analysis

- Carrier screening, which identifies individuals carrying genetic mutations for autosomal recessive and X-linked disorders, is increasingly becoming a vital component of preventive reproductive healthcare in both clinical and home settings due to its ability to guide informed family planning decisions and reduce the risk of passing on inherited conditions

- The escalating demand for carrier screening is primarily fueled by technological advancements such as next-generation sequencing, the rising adoption of expanded and pan-ethnic panels, increasing government and healthcare initiatives promoting genetic testing, and growing awareness among consumers and healthcare providers about the importance of early detection and preventive care

- Germany dominated the carrier screening market due to its strong healthcare infrastructure, advanced diagnostic capabilities, and high adoption of genetic testing in prenatal and preconception care

- U.K. is expected to be the fastest growing country in the carrier screening market during the forecast period due to increasing awareness of genetic disorders, expansion of prenatal and preconception testing programs, and adoption of next-generation screening technologies

- Molecular screening test segment dominated the market with a market share of 62.8% due to its high accuracy in detecting genetic mutations and its growing adoption among prospective parents seeking early detection of inherited disorders. Molecular tests are preferred for their ability to identify carriers of multiple conditions in a single assay, providing comprehensive results and reducing the need for repeated testing. Healthcare providers highly recommend molecular screening due to its reliability and strong clinical validation across diverse populations. The increasing availability of next-generation sequencing panels and targeted mutation analyses further reinforces the dominance of molecular tests in clinical practice

Report Scope and Carrier Screening Market Segmentation

|

Attributes |

Carrier Screening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Carrier Screening Market Trends

Rising Adoption of Expanded and At-Home Carrier Screening Panels

- The carrier screening market is witnessing a growing trend towards expanded and at-home screening panels, driven by the rising awareness of inherited genetic disorders and the need for proactive reproductive healthcare. These panels provide comprehensive testing that can detect multiple genetic conditions, enabling informed family planning decisions

- For instance, Mitera’s Peaches & Me and 23 Pears at-home testing kits offer multi-condition carrier screening from home, improving accessibility for consumers and encouraging early adoption. Such at-home solutions reduce the need for clinical visits and provide convenient options for tech-savvy and health-conscious populations

- Advanced molecular and biochemical technologies enhance test accuracy and reduce turnaround time, allowing for more reliable results. These technological improvements also support personalized risk assessment, enabling healthcare providers to offer targeted counseling based on test outcomes

- The growing availability of population-specific and pan-ethnic carrier screening panels supports adoption across diverse demographic groups. In addition, these panels ensure broader detection of rare genetic conditions, making them increasingly essential for comprehensive reproductive health management

- Integration of digital reporting and tele-genetic counseling with carrier screening services is improving user experience. Such innovations allow patients to receive test results securely online and access expert guidance, thereby strengthening consumer confidence in testing

- The combination of technological advancement, convenience, and broader accessibility is shaping the market and positioning expanded and at-home panels as central to preventive reproductive healthcare. This trend is expected to sustain growth across clinical, consumer, and telehealth segments

Europe Carrier Screening Market Dynamics

Driver

Rising Awareness of Genetic Disorders

- Increasing awareness of inherited genetic disorders among prospective parents, healthcare providers, and policymakers is a key driver for the carrier screening market. Greater understanding of genetic risks encourages early testing and informed reproductive decision-making

- For instance, companies such as Natera and Fulgent Genetics have launched expanded carrier panels and awareness campaigns that educate consumers about the benefits of early detection. In addition, these initiatives foster adoption across hospitals, clinics, and at-home testing services, expanding market penetration

- The growing focus on preventive healthcare and personalized medicine is prompting healthcare systems to integrate carrier screening into routine preconception and prenatal care programs. Such integration enhances early detection of risk factors and reduces the likelihood of genetic disorders in offspring

- Educational initiatives, social media outreach, and genetic counseling services further improve understanding and acceptance of carrier screening. In addition, these efforts empower prospective parents to make informed reproductive choices, which is accelerating market growth

- Support from government programs and private organizations for reproductive health, combined with technological advancements in screening, continues to drive adoption. Such coordinated efforts ensure wider accessibility and establish carrier screening as a standard component of reproductive healthcare

Restraint/Challenge

High Cost and Limited Insurance Coverage

- The high cost of comprehensive carrier screening tests is a significant barrier to market adoption. Such costs can limit access for price-sensitive populations and reduce overall uptake in both clinical and consumer-focused segments

- For instance, expanded panels from companies such as Invitae and Myriad Genetics remain expensive, restricting accessibility and discouraging adoption in regions with limited financial resources. In addition, this limits the penetration of premium testing solutions that provide broader disease coverage

- Limited reimbursement and insurance coverage exacerbate financial challenges, particularly in countries where healthcare expenses are largely out-of-pocket. Such constraints make it difficult for many prospective parents to afford advanced testing services

- While basic testing options are more affordable, premium panels offering higher accuracy and wider condition coverage may still deter users from opting for testing. In addition, inconsistent coverage policies across insurers reduce uniform access to carrier screening services

- Overcoming these barriers requires efforts to reduce test costs, expand insurance coverage, and educate consumers on the value of carrier screening. Addressing these financial and coverage constraints is essential to ensure equitable access and sustained growth in both developed and emerging markets

Europe Carrier Screening Market Scope

The market is segmented on the basis of test type, disease type, medical condition, technology, and end use.

- By Test Type

On the basis of test type, the carrier screening market is segmented into molecular screening tests and biochemical screening tests. The molecular screening test segment dominated the market with the largest market revenue share of 62.8% in 2025, driven by its high accuracy in detecting genetic mutations and its growing adoption among prospective parents seeking early detection of inherited disorders. Molecular tests are preferred for their ability to identify carriers of multiple conditions in a single assay, providing comprehensive results and reducing the need for repeated testing. Healthcare providers highly recommend molecular screening due to its reliability and strong clinical validation across diverse populations. The increasing availability of next-generation sequencing panels and targeted mutation analyses further reinforces the dominance of molecular tests in clinical practice.

The biochemical screening test segment is anticipated to witness the fastest growth rate of 19.4% from 2026 to 2033, fueled by ongoing research into cost-effective and rapid screening methods. For instance, companies such as Natera and Invitae are expanding biochemical screening panels to include broader disease coverage, offering simpler sample collection processes and faster turnaround times. Biochemical tests are increasingly adopted in regions with limited access to advanced molecular laboratories due to their lower infrastructure requirements. Rising awareness among clinicians and patients about early detection and preventive care also supports the adoption of biochemical tests.

- By Disease Type

On the basis of disease type, the carrier screening market is segmented into cystic fibrosis, Tay-Sachs, Gaucher disease, sickle cell disease, spinal muscular atrophy, and other autosomal recessive genetic disorders. The cystic fibrosis segment dominated the market with the largest market revenue share of 28.5% in 2025, owing to the high prevalence of CF carriers in several populations and the established guidelines recommending routine screening. Cystic fibrosis screening provides critical information for family planning and reduces the risk of passing on severe genetic disorders. Laboratory and clinical networks have invested significantly in panels that include CF mutations, reinforcing its market leadership.

The spinal muscular atrophy segment is expected to witness the fastest CAGR of 18.7% from 2026 to 2033, driven by the increasing incidence of SMA and breakthroughs in early diagnostic technologies. For instance, companies such as Fulgent Genetics and Blueprint Genetics are offering expanded carrier panels including SMA detection, promoting early intervention strategies. Rising awareness of SMA therapies and newborn screening programs further encourages adoption. Healthcare providers are increasingly emphasizing SMA testing due to its impact on early treatment outcomes and quality of life.

- By Medical Condition

On the basis of medical condition, the carrier screening market is segmented into pulmonary conditions, hematological conditions, neurological conditions, and others. The pulmonary conditions segment dominated the market with the largest market revenue share of 31.2% in 2025, primarily driven by the prevalence of diseases such as cystic fibrosis and other genetic lung disorders. Pulmonary condition screening is critical for early diagnosis, carrier identification, and personalized counseling. Laboratories have developed comprehensive panels that address multiple pulmonary conditions simultaneously, increasing test adoption in prenatal and preconception care settings.

The neurological conditions segment is anticipated to witness the fastest growth rate of 20.1% from 2026 to 2033, fueled by increasing awareness of neurological genetic disorders and the rise of diagnostic technologies capable of detecting SMA, Tay-Sachs, and related conditions. For instance, Invitae’s neurological disorder screening panels are gaining adoption in clinics and hospitals due to their ability to detect carriers early. Advances in neurogenetic research and expanding insurance coverage for genetic testing are expected to drive demand further. Clinicians increasingly recommend neurological condition testing for high-risk populations, accelerating market growth.

- By Technology

On the basis of technology, the carrier screening market is segmented into DNA sequencing, polymerase chain reaction (PCR), microarrays, and others. The DNA sequencing segment dominated the market with the largest market revenue share of 55.6% in 2025, driven by its high accuracy, scalability, and ability to detect a broad spectrum of mutations across multiple genes simultaneously. DNA sequencing is widely preferred for both prenatal and preconception carrier screening, enabling comprehensive insights and improved counseling outcomes. The adoption of next-generation sequencing (NGS) has further enhanced the efficiency and cost-effectiveness of DNA-based carrier tests.

The PCR segment is expected to witness the fastest CAGR of 19.2% from 2026 to 2033, fueled by its rapid detection capability, cost efficiency, and applicability in targeted mutation analysis. For instance, companies such as GeneDx and Myriad Genetics are expanding PCR-based screening offerings to detect high-prevalence mutations quickly. PCR technology continues to attract adoption in smaller laboratories and regions with limited NGS infrastructure. The ease of implementation and high sensitivity of PCR assays make it suitable for routine carrier detection programs, further driving growth.

- By End Use

On the basis of end use, the carrier screening market is segmented into hospitals, reference laboratories, physician offices and clinics, and others. The hospitals segment dominated the market with the largest market revenue share of 42.3% in 2025, driven by the integration of carrier screening into prenatal care, preconception counseling, and genetic testing services. Hospitals benefit from in-house laboratory capabilities and the ability to provide integrated care pathways for patients, which strengthens adoption. Large hospital networks and academic medical centers increasingly partner with diagnostic companies to offer expanded carrier screening panels, ensuring comprehensive patient care.

The reference laboratories segment is anticipated to witness the fastest growth rate of 21.5% from 2026 to 2033, fueled by the expansion of high-throughput genetic testing services. For instance, laboratories such as Quest Diagnostics and Labcorp are investing in advanced carrier screening platforms to serve multiple hospitals and clinics efficiently. Reference laboratories are also leveraging automation and multiplex testing to improve turnaround times and accuracy. The ability to provide cost-effective, large-scale testing solutions positions reference laboratories as a rapidly growing segment in the carrier screening market.

Europe Carrier Screening Market Regional Analysis

- Germany dominated the carrier screening market with the largest revenue share in 2025, driven by its strong healthcare infrastructure, advanced diagnostic capabilities, and high adoption of genetic testing in prenatal and preconception care

- The country’s focus on preventive healthcare, coupled with widespread awareness of inherited genetic disorders, has accelerated the use of carrier screening services. A robust presence of leading diagnostic companies, ongoing R&D in molecular and biochemical screening technologies, and collaborations with hospitals and research institutions further strengthen market expansion

- Germany’s emphasis on integrating carrier screening into standard clinical protocols, improving patient counseling, and supporting personalized healthcare reinforces its leadership position in the regional market

U.K. Carrier Screening Market Insight

The U.K. market is projected to register the fastest CAGR in the Europe carrier screening market during 2026–2033, fueled by increasing awareness of genetic disorders, expansion of prenatal and preconception testing programs, and adoption of next-generation screening technologies. Rising government and healthcare initiatives promoting early detection, combined with strategic partnerships between domestic laboratories and international diagnostic companies, are driving market demand. For instance, companies such as Natera and Invitae are collaborating with NHS-affiliated hospitals to expand carrier screening access. The U.K.’s emphasis on improving patient outcomes, enhancing access to advanced genetic testing, and supporting preventive care positions it as the fastest-growing market in the region.

France Carrier Screening Market Insight

France is expected to witness steady growth between 2026 and 2033, supported by expansion in healthcare services, fertility clinics, and prenatal care programs, as well as increasing adoption of comprehensive carrier screening panels. The country’s focus on early diagnosis of genetic disorders, preventive healthcare, and integration of molecular technologies is driving demand for carrier testing services that offer accuracy, broad disease coverage, and reliable counseling outcomes. Rising investments in advanced diagnostic laboratories, coupled with strong government support for reproductive health programs, are improving adoption rates among domestic clinics and hospitals. Collaborations between French diagnostic providers and international companies further enhance technology integration and service quality. France’s commitment to advancing preventive care and operational efficiency underpins its stable market outlook in the European region.

Europe Carrier Screening Market Share

The carrier screening industry is primarily led by well-established companies, including:

- Eurofins Scientific (Luxembourg)

- Invitae Corporation (U.S)

- Opko Health Inc. (U.S)

- Luminex Corporation (U.S)

- Fulgent Genetics (U.S)

- Quest Diagnostics (U.S)

- Sema4 OpCo, Inc. (U.S)

- Myriad Genetics (U.S)

- Illumina Inc. (U.S)

- Thermo Fisher Scientific Inc. (U.S)

- MedGenome (U.S)

- Myriad Genetics Inc. (U.S)

- Natera Inc. (U.S)

- Gene By Gene Ltd. (U.S)

- Laboratory Corporation of America Holdings (U.S)

- Mount Sinai Genomics Inc. (U.S)

- Otogenetics Corporation (U.S)

Latest Developments in Europe Carrier Screening Market

- In October 2024, Myriad Genetics announced the launch of its Foresight Plus carrier screening panel, covering over 500 genes. This expanded panel allows for more comprehensive detection of rare and less common genetic conditions, enabling clinicians and prospective parents to gain deeper insights into potential inherited risks. The launch reinforces the trend toward broader, high-coverage screening solutions, increases the clinical utility of carrier testing, and encourages adoption in hospitals, fertility clinics, and specialized diagnostic centers

- In January 2024, Natera acquired Invitae’s reproductive-health portfolio, including carrier screening and noninvasive prenatal testing services, for $52.5 million. This strategic acquisition consolidates Natera’s position in the reproductive genetics market, allowing it to offer integrated, end-to-end screening solutions. The move is expected to streamline clinical workflows, enhance access to advanced carrier tests, and support broader adoption among healthcare providers and patients seeking comprehensive reproductive risk assessment

- In February 2023, Fulgent Genetics launched its Beacon787 Expanded Carrier Screening Panel, testing for 787 genes associated with autosomal recessive and X-linked disorders. This development significantly broadens the scope of carrier screening, offering prospective parents a more complete picture of their genetic risk profile. It strengthens the market trend toward pan-ethnic, high-coverage panels and encourages wider use of carrier screening in prenatal and preconception care programs across clinical and laboratory settings

- In January 2022, Mitera announced the availability of its Peaches & Me and 23 Pears at-home reproductive genetic testing kits across all 50 U.S. states. These kits allow users to screen for conditions such as Down syndrome from the comfort of home, increasing accessibility and convenience. The development highlights the growing consumer-focused segment of the carrier screening market and is expected to drive adoption among tech-savvy, health-conscious populations seeking early and convenient reproductive risk assessment

- In June 2021, Grail launched the Galleri multi-cancer blood test, designed to screen adults over 50 or those with an elevated risk of cancer. While primarily focused on cancer detection, this launch underscores the broader movement toward multi-disease genetic testing and advanced screening technologies in preventive healthcare. It demonstrates the market’s evolution toward early, noninvasive detection solutions and the integration of innovative genetic testing approaches into routine clinical care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.