Europe Cell Culture Media Market

Market Size in USD Billion

CAGR :

%

USD

1.90 Billion

USD

4.29 Billion

2024

2032

USD

1.90 Billion

USD

4.29 Billion

2024

2032

| 2025 –2032 | |

| USD 1.90 Billion | |

| USD 4.29 Billion | |

|

|

|

|

Europe Cell Culture Media Market Size

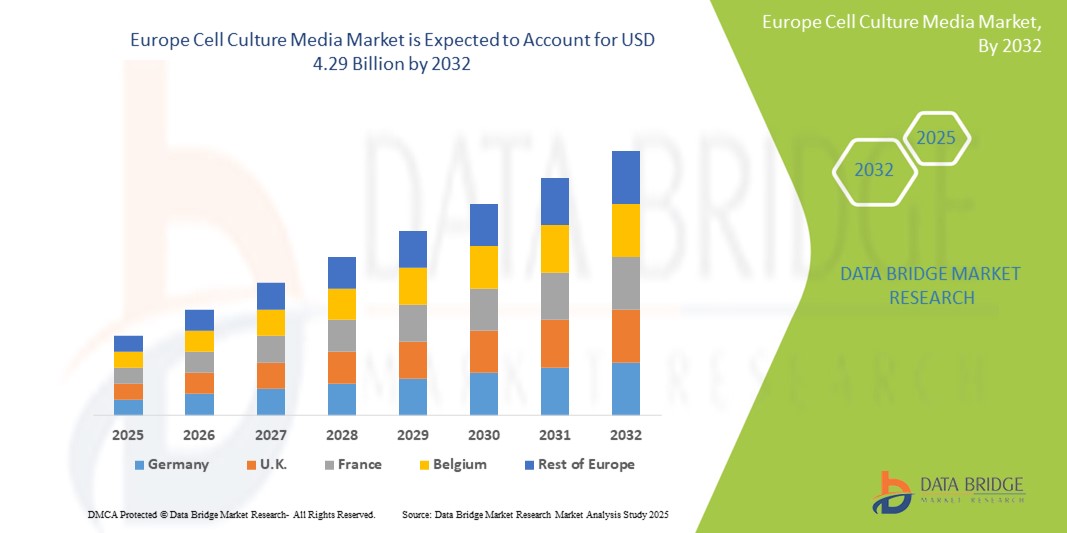

- The Europe cell culture media market size was valued at USD 1.90 billion in 2024 and is expected to reach USD 4.29 billion by 2032, at a CAGR of 10.70% during the forecast period

- The market growth is largely driven by the increasing demand for biopharmaceuticals and advancements in cell-based research across academic, clinical, and industrial applications throughout Europe

- Furthermore, rising investments in regenerative medicine and personalized healthcare, along with a strong focus on vaccine production and cancer research, are positioning cell culture media as a critical component in modern biotechnology workflows. These factors are collectively propelling market expansion and shaping a robust future for the European cell culture media industry

Europe Cell Culture Media Market Analysis

- Cell culture media, essential for supporting the in vitro growth and maintenance of cells, are increasingly integral to biopharmaceutical manufacturing, regenerative medicine, and advanced research applications across Europe, owing to their role in enhancing cell viability, productivity, and reproducibility

- The rising demand for cell culture media is primarily driven by the expanding biotechnology and pharmaceutical sectors, growing investments in cell-based therapies, and the increased prevalence of chronic diseases requiring biologics

- Germany dominated the Europe cell culture media market with the largest revenue share of 29.9% in 2024, attributed to its robust pharmaceutical industry, strong academic research networks, and government funding for biotech innovation, particularly in oncology and personalized medicine

- Poland is expected to be the fastest growing country in the Europe cell culture media market during the forecast period, driven by increasing investments in R&D infrastructure, supportive government policies, and the growth of local biotech startups

- Serum-free media segment dominated the Europe cell culture media market with a market share of 40% in 2024, driven by regulatory preference, lower contamination risk, and its growing adoption in vaccine and monoclonal antibody production

Report Scope and Europe Cell Culture Media Market Segmentation

|

Attributes |

Europe Cell Culture Media Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Cell Culture Media Market Trends

“Shift Toward Serum-Free and Chemically Defined Media”

- A significant and accelerating trend in the Europe cell culture media market is the shift toward serum-free and chemically defined media, which offer enhanced consistency, reduced contamination risk, and greater regulatory compliance, especially in biopharmaceutical production and cell-based research

- For instance, Merck KGaA and Sartorius have introduced specialized serum-free media designed for cell therapy and vaccine manufacturing, helping streamline workflows while meeting strict GMP standards. Similarly, Thermo Fisher Scientific continues to expand its chemically defined media portfolio for scalable bioproduction applications

- These media formulations eliminate animal-derived components, aligning with ethical research practices and minimizing the risk of introducing adventitious agents, which is especially important in clinical-grade manufacturing. Furthermore, they enable researchers to maintain better control over experimental variables and improve reproducibility in both academic and industrial settings

- The growing demand for high-quality biologics, stem cell research, and precision medicine in countries such as Germany, France, and the UK is accelerating the adoption of these advanced formulations

- This shift is facilitating more efficient scale-up of production processes for monoclonal antibodies, cell therapies, and recombinant proteins, contributing to lower downstream purification requirements and improved product yields

- The trend toward high-performance, regulatory-compliant media is fundamentally reshaping laboratory practices and manufacturing standards, prompting key players to innovate solutions that support consistent performance across research, development, and commercial production

Europe Cell Culture Media Market Dynamics

Driver

“Expanding Biopharmaceutical Sector and Supportive Research Ecosystem”

- The rising demand for cell culture media in Europe is strongly driven by the expansion of the biopharmaceutical industry and a supportive research ecosystem backed by government initiatives and funding programs

- For instance, in March 2024, the German government announced increased funding for life sciences and biomanufacturing infrastructure under the National Pharma Strategy, aiming to boost domestic production of biologics and vaccines

- As biologic therapies become more prevalent, particularly for chronic and rare diseases, the need for high-performance culture media to support large-scale cell cultivation has intensified across major pharmaceutical and biotech hubs in Germany, the UK, and Switzerland

- In addition, research-focused initiatives under the Horizon Europe program are supporting collaborative projects in regenerative medicine and cell therapy, further stimulating demand for specialized, serum-free, and GMP-compliant media in both academic and clinical settings

- The increasing prevalence of 3D cell culture models and organoid systems for personalized medicine is also driving the adoption of innovative media solutions tailored to support complex cell types and culture environments

- The alignment of public and private sector interests in advancing biotechnology and cell-based research is reinforcing Europe's position as a leading market for cell culture media and related bioprocessing solutions

Restraint/Challenge

“High Product Cost and Complex Regulatory Landscape”

- The high cost of specialized cell culture media, particularly chemically defined and GMP-grade formulations, remains a significant challenge for widespread adoption across smaller research institutions and emerging biotech companies in Europe

- For instance, while leading manufacturers such as Lonza and Thermo Fisher Scientific offer advanced media optimized for cell therapy and vaccine production, the premium pricing of these products can limit accessibility for budget-constrained users

- In addition, strict regulatory requirements imposed by the European Medicines Agency (EMA) and national health authorities mandate extensive documentation, quality assurance, and validation processes for any media used in clinical and commercial applications, increasing the operational burden on suppliers and users asuch as

- Compliance with these regulations requires investment in certified manufacturing facilities, detailed traceability of components, and ongoing quality audits, which can extend product development timelines and elevate costs

- Moreover, variations in regulatory expectations across different EU countries can create additional hurdles for companies looking to commercialize or distribute cell culture products at scale

- Addressing these challenges through cost-effective innovation, harmonization of regulatory frameworks, and increased funding support for early-stage research will be essential to unlock the full growth potential of the Europe cell culture media market

Europe Cell Culture Media Market Scope

The market is segmented on the basis of type, application, end-user, and distribution channel.

- By Type

On the basis of type, the Europe cell culture media market is segmented into chemically defined media, classical media, serum-free media, specialty media, stem cell media, lysogeny broth (LB), custom media formulation, and others. The serum-free media segment dominated the market with the largest market revenue share of 40% in 2024, owing to its reduced risk of contamination, improved batch consistency, and regulatory preference for animal-free components in biopharmaceutical and vaccine production. The demand for serum-free formulations is growing as pharmaceutical companies in Europe increasingly focus on developing safer and more standardized therapeutic products.

The chemically defined media segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its use in precision cell culture applications and its alignment with the stringent quality requirements of GMP-certified production facilities. This media type is gaining traction in stem cell therapy, diagnostics, and cell-based assays due to its reproducibility, controlled composition, and ability to meet evolving regulatory standards.

- By Application

On the basis of application, the Europe cell culture media market is segmented into biopharmaceutical production, drug screening & development, diagnostics, regenerative medicine & tissue engineering, and others. The biopharmaceutical production segment accounted for the largest market share in 2024, driven by the region’s strong biologics pipeline and increasing reliance on mammalian cell culture for the production of therapeutic proteins and monoclonal antibodies. Leading pharmaceutical companies in Germany, Switzerland, and the UK are investing heavily in scalable, high-yield culture media solutions to optimize their production processes.

The regenerative medicine & tissue engineering segment is expected to grow at the fastest rate during the forecast period, supported by advancements in stem cell research and increased funding for clinical trials in cell and gene therapies. The need for specialized media to support the growth and differentiation of pluripotent cells is creating new opportunities for market expansion in this space

- By End-User

On the basis of end-user, the Europe cell culture media market is segmented into biopharmaceutical companies, biotechnology organizations, academic and research laboratories, hospitals, diagnostic centers, cell banks, forensic laboratories, and others. The biopharmaceutical companies segment held the largest market revenue share in 2024, attributed to their large-scale use of cell culture media in drug development and commercial manufacturing. The growing biologics demand and presence of major industry players in Europe drive this segment's dominance.

Academic and research laboratories are projected to experience the fastest growth from 2025 to 2032, driven by increasing EU and national grants for biomedical research, as well as growing collaborations between academic institutions and biotech firms focusing on cell-based innovations and disease modeling.

- By Distribution Channel

On the basis of distribution channel, the Europe cell culture media market is segmented into direct tenders, third-party distribution, and retail sales. The direct tenders segment led the market in 2024 due to large-volume procurement by hospitals, research institutions, and pharmaceutical manufacturers, often under long-term contracts with media suppliers. These arrangements offer better pricing, ensure consistent supply, and comply with procurement regulations, especially in public and institutional settings.

The third-party distribution segment is anticipated to register the highest growth rate during the forecast period, owing to the increasing presence of specialized life science distributors and the growing demand for streamlined logistics and inventory management services. The rise in biotech startups and smaller research labs seeking flexible purchasing options further supports the expansion of this distribution model

Europe Cell Culture Media Market Regional Analysis

- Germany dominated the Europe cell culture media market with the largest revenue share of 29.9% in 2024, attributed to its robust pharmaceutical industry, strong academic research networks, and government funding for biotech innovation, particularly in oncology and personalized medicine

- The country has emerged as a hub for biologics production and cell-based research, with institutions and companies prioritizing high-quality culture media for drug development, vaccine production, and advanced therapeutic applications

- This leadership position is further supported by Germany’s commitment to innovation, a well-established regulatory framework, and active collaborations between academic institutions and industry players, making it a key market for culture media suppliers in both research and commercial settings

The Germany Cell Culture Media Market Insight

The Germany cell culture media market captured the largest revenue share in Europe in 2024, owing to its strong pharmaceutical manufacturing base and government-backed initiatives supporting biotechnology innovation. Major pharmaceutical companies and academic institutions are actively engaged in cell therapy and vaccine research, boosting demand for serum-free and chemically defined media. The country’s adherence to rigorous regulatory frameworks and commitment to scientific advancement continue to solidify its leadership in the European market.

U.K. Cell Culture Media Market Insight

The U.K. cell culture media market is anticipated to grow steadily, supported by its leading academic institutions, strong biopharma sector, and emphasis on cell-based innovations. Research in gene and cell therapies is a key growth driver, with organizations increasingly adopting defined and serum-free media for enhanced reproducibility. The presence of global suppliers and a focus on next-generation biomanufacturing technologies are further propelling the UK’s position in the market.

Poland Cell Culture Media Market Insight

The Poland cell culture media market is projected to grow at a strong CAGR during the forecast period, fueled by increasing government support for biotechnology development and expansion of research infrastructure. The country is emerging as a key hub in Central and Eastern Europe for clinical trials and biopharmaceutical production, leading to rising demand for high-quality, affordable culture media. Investments in R&D centers, collaboration with European academic institutions, and a growing presence of international suppliers are contributing to Poland’s expanding role in the European cell culture media landscape.

Europe Cell Culture Media Market Share

The Europe cell culture media industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Sartorius AG (Germany)

- Lonza Group AG (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- Cytiva (U.S.)

- PAN-Biotech GmbH (Germany)

- PromoCell GmbH (Germany)

- Corning Incorporated (U.S.)

- HiMedia Laboratories Pvt. Ltd. (India)

- FUJIFILM Irvine Scientific, Inc. (U.S.)

- Eppendorf SE (Germany)

- Bio-Techne Corporation (U.S.)

- Repligen Corporation (U.S.)

- STEMCELL Technologies Inc. (Canada)

- BD (U.S.)

- Takara Bio Europe SAS (France)

- CellGenix GmbH (Germany)

- Miltenyi Biotec B.V. & Co. KG (Germany)

What are the Recent Developments in Europe Cell Culture Media Market?

- In April 2024, Merck KGaA (Germany) expanded its cell culture media production facility in Darmstadt to meet growing regional demand for high-quality, GMP-compliant media used in biologics and vaccine manufacturing. The expansion reflects Merck’s commitment to bolstering Europe's biopharmaceutical supply chain resilience and its role as a key supplier to advanced therapy manufacturers across the continent

- In March 2024, Sartorius AG (Germany) announced the launch of a new portfolio of chemically defined media tailored for stem cell and CAR-T cell applications. Developed in collaboration with leading academic partners, the product line supports scalable manufacturing of next-generation therapies and enhances reproducibility and regulatory compliance in cell therapy production workflows

- In February 2024, Lonza Group AG (Switzerland) opened a new research and development hub in Visp focused on the innovation of specialty media formulations for immunotherapy and regenerative medicine. This strategic move aims to accelerate product development for European clients involved in cutting-edge cell-based research and advanced biologics manufacturing

- In February 2024, Thermo Fisher Scientific (operational across Europe) collaborated with the University of Oxford to co-develop customized culture media for neuroscience and organoid research. The initiative supports academic research by providing targeted formulations that improve cell viability and experimental consistency, reinforcing the company’s strong academic-industry ties in the region

- In January 2024, PAN-Biotech GmbH (Germany) introduced a new GMP-grade serum-free medium specifically designed for mesenchymal stem cell expansion. This launch aims to support clinical-grade production of cell-based therapies and reflects growing demand in Europe for xeno-free, scalable media solutions that meet both research and regulatory needs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE CELL CULTURE MEDIA MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 EUROPE CELL CULTURE MEDIA MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING FOCUS ON PERSONALIZED MEDICINE

6.1.2 ADVANCES IN CELL THERAPY AND REGENERATIVE MEDICINE

6.1.3 INCREASE IN R&D SPENDING ON BIOPHARMACEUTICAL PROJECTS

6.1.4 GROWING DEMAND FOR VACCINE DEVELOPMENT

6.2 RESTRAINTS

6.2.1 RISKS ASSOCIATED WITH CONTAMINATION

6.2.2 HIGH COST OF PRODUCTION

6.3 OPPORTUNITIES

6.3.1 RISING COLLABORATION AND PARTNERSHIPS

6.3.2 INCREASING DEMAND FOR BIOPHARMACEUTICALS AND VACCINES

6.3.3 INNOVATIONS IN 3D CELL CULTURE

6.4 CHALLENGES

6.4.1 COMPLEXITY OF MEDIA FORMULATION

6.4.2 INTENSE MARKET COMPETITION

7 EUROPE CELL CULTURE MEDIA MARKET, BY TYPE

7.1 OVERVIEW

7.2 CHEMICALLY DEFINED MEDIA CHEMICALLY DEFINED MEDIA

7.3 CLASSICAL MEDIA

7.4 SERUM-FREE MEDIA

7.5 SPECIALTY MEDIA

7.6 STEM CELL MEDIA

7.7 LYSOGENY BROTH (LB)

7.8 CUSTOM MEDIA FORMULATION

7.9 OTHERS

8 EUROPE CELL CULTURE MEDIA MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BIOPHARMACEUTICAL PRODUCTION

8.3 DRUG SCREENING & DEVELOPMENT

8.4 DIAGNOSTICS

8.5 REGENERATIVE MEDICINE & TISSUE ENGINEERING

8.6 OTHERS

9 EUROPE CELL CULTURE MEDIA MARKET, BY END-USER

9.1 OVERVIEW

9.2 BIOPHARMACEUTICAL COMPANIES

9.3 BIOTECHNOLOGY ORGANIZATIONS

9.4 ACADEMIC AND RESEARCH LABORATORIES

9.5 HOSPITALS

9.6 DIAGNOSTIC CENTERS

9.7 CELL BANKS

9.8 FORENSIC LABORATORIES

9.9 OTHERS

10 EUROPE CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT TENDERS

10.3 THIRD PARTY DISTRIBUTION

10.4 RETAILS SALES

11 EUROPE CELL CULTURE MEDIA MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 FRANCE

11.1.4 NETHERLANDS

11.1.5 SPAIN

11.1.6 SWITZERLAND

11.1.7 BELGIUM

11.1.8 ITALY

11.1.9 RUSSIA

11.1.10 TURKEY

11.1.11 REST OF EUROPE

12 EUROPE CELL CULTURE MEDIA MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 MERCK KGAA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 DANAHER CORPORATION (CYTIVA)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 SARTORIUS AG

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 LONZA

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 CORNING INCORPORATED

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 COMPANY SHARE ANALYSIS

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT UPDATES

14.7 AJINOMOTO CO., INC

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 AKRON BIOTECH

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 BD

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT UPDATES

14.1 BIO-RAD LABORATORIES, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 CAISSON LABS INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATES

14.12 CELL APPLICATION, INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 ELEX BIOLOGICAL PRODUCTS (SHANGHAI) CO., LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 FUJIFILM HOLDINGS CORPORATION

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT UPDATES

14.15 HIMEDIA LABORATORIES

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 KOH JIN-BIO CO., LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATES

14.17 PAN-BIOTECH

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATES

14.18 PROMOCELL GMBH

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 SERA-SCANDIA A/S

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 STEMCELL TECHNOLOGIES

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 TAKARA BIO INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 GMP REQUIREMENTS

TABLE 2 SCOPE OF THE CURRENT DOCUMENT

TABLE 3 EUROPE CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 4 EUROPE CHEMICALLY DEFINED MEDIA IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 5 EUROPE CLASSICAL MEDIA IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 6 EUROPE SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 7 EUROPE SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 8 EUROPE SPECIALTY MEDIA IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 9 EUROPE STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 10 EUROPE STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 11 EUROPE LYSOGENY BROTH (LB) IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 12 EUROPE CUSTOM MEDIA FORMULATION IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 13 EUROPE OTHERS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 14 EUROPE CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 15 EUROPE BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 16 EUROPE BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 17 EUROPE DRUG SCREENING & DEVELOPMENT IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 18 EUROPE DIAGNOSTICS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 19 EUROPE REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 20 EUROPE REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 21 EUROPE OTHERS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 22 EUROPE CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 23 EUROPE BIOPHARMACEUTICAL COMPANIES IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 24 EUROPE BIOTECHNOLOGY ORGANIZATIONS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 25 EUROPE ACADEMIC AND RESEARCH LABORATORIES IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 26 EUROPE HOSPITALS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 27 EUROPE DIAGNOSTIC CENTERS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 28 EUROPE CELL BANKS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 29 EUROPE FORENSIC LABORATORIES IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 30 EUROPE OTHERS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 31 EUROPE CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 32 EUROPE DIRECT TENDERS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 33 EUROPE THIRD PARTY DISTRIBUTION IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 34 EUROPE RETAIL SALES IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 35 EUROPE CELL CULTURE MEDIA MARKET, BY COUNTRY, 2018-2035 (USD MILLION)

TABLE 36 EUROPE CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 37 EUROPE SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 38 EUROPE STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 39 EUROPE CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 40 EUROPE BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 41 EUROPE REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 42 EUROPE CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 43 EUROPE CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 44 GERMANY CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 45 GERMANY SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 46 GERMANY STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 47 GERMANY CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 48 GERMANY BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 49 GERMANY REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 50 GERMANY CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 51 GERMANY CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 52 U.K. CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 53 U.K. SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 54 U.K. STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 55 U.K. CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 56 U.K. BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 57 U.K. REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 58 U.K. CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 59 U.K. CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 60 FRANCE CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 61 FRANCE SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 62 FRANCE STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 63 FRANCE CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 64 FRANCE BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 65 FRANCE REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 66 FRANCE CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 67 FRANCE CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 68 NETHERLANDS CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 69 NETHERLANDS SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 70 NETHERLANDS STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 71 NETHERLANDS CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 72 NETHERLANDS BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 73 NETHERLANDS REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 74 NETHERLANDS CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 75 NETHERLANDS CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 76 SPAIN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 77 SPAIN SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 78 SPAIN STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 79 SPAIN CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 80 SPAIN BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 81 SPAIN REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 82 SPAIN CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 83 SPAIN CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 84 SWITZERLAND CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 85 SWITZERLAND SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 86 SWITZERLAND STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 87 SWITZERLAND CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 88 SWITZERLAND BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 89 SWITZERLAND REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 90 SWITZERLAND CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 91 SWITZERLAND CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 92 BELGIUM CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 93 BELGIUM SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 94 BELGIUM STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 95 BELGIUM CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 96 BELGIUM BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 97 BELGIUM REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 98 BELGIUM CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 99 BELGIUM CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 100 ITALY CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 101 ITALY SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 102 ITALY STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 103 ITALY CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 104 ITALY BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 105 ITALY REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 106 ITALY CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 107 ITALY CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 108 RUSSIA CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 109 RUSSIA SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 110 RUSSIA STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 111 RUSSIA CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 112 RUSSIA BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 113 RUSSIA REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 114 RUSSIA CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 115 RUSSIA CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 116 TURKEY CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 117 TURKEY SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 118 TURKEY STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 119 TURKEY CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 120 TURKEY BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 121 TURKEY REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 122 TURKEY CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 123 TURKEY CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 124 REST OF EUROPE CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

List of Figure

FIGURE 1 EUROPE CELL CULTURE MEDIA MARKET: SEGMENTATION

FIGURE 2 EUROPE CELL CULTURE MEDIA MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE CELL CULTURE MEDIA MARKET: DROC ANALYSIS

FIGURE 4 EUROPE CELL CULTURE MEDIA MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE CELL CULTURE MEDIA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE CELL CULTURE MEDIA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE CELL CULTURE MEDIA MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 EUROPE CELL CULTURE MEDIA MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE CELL CULTURE MEDIA MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE CELL CULTURE MEDIA MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS BY KEY PLAYERS

FIGURE 13 INCREASING FOCUS ON PERSONALIZED MEDICINE IS DRIVING THE GROWTH OF THE EUROPE CELL CULTURE MEDIA MARKET FROM 2025 TO 2035

FIGURE 14 THE CHEMICALLY DEFINED MEDIA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE CELL CULTURE MEDIA MARKET IN 2025 AND 2035

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE CELL CULTURE MEDIA MARKET

FIGURE 16 EUROPE CELL CULTURE MEDIA MARKET: BY TYPE, 2024

FIGURE 17 EUROPE CELL CULTURE MEDIA MARKET, BY TYPE, 2025-2035

FIGURE 18 EUROPE CELL CULTURE MEDIA MARKET, BY TYPE, CAGR, 2025-2035

FIGURE 19 EUROPE CELL CULTURE MEDIA MARKET, BY TYPE, LIFE LINE CURVE

FIGURE 20 EUROPE CELL CULTURE MEDIA MARKET: BY APPLICATION, 2024

FIGURE 21 EUROPE CELL CULTURE MEDIA MARKET, BY APPLICATION,2025-2035

FIGURE 22 EUROPE CELL CULTURE MEDIA MARKET, BY APPLICATION, CAGR (2025-2035)

FIGURE 23 EUROPE CELL CULTURE MEDIA MARKET, BY APPLICATION, LIFE LINE CURVE

FIGURE 24 EUROPE CELL CULTURE MEDIA MARKET: BY END-USER, 2024

FIGURE 25 EUROPE CELL CULTURE MEDIA MARKET, BY END USER, (2025-2035)

FIGURE 26 EUROPE CELL CULTURE MEDIA MARKET, BY END-USER, CAGR (2025-2035)

FIGURE 27 EUROPE CELL CULTURE MEDIA MARKET, BY END-USER, LIFE LINE CURVE

FIGURE 28 EUROPE CELL CULTURE MEDIA MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 29 EUROPE CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL,2025-2035

FIGURE 30 EUROPE CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, CAGR, (2025-2035)

FIGURE 31 EUROPE CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, LIFE LINE CURVE

FIGURE 32 EUROPE CELL CULTURE MEDIA MARKET: SNAPSHOT (2024)

FIGURE 33 EUROPE CELL CULTURE MEDIA MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.