Europe Ceramic Market

Market Size in USD Billion

CAGR :

%

USD

31.10 Billion

USD

50.66 Billion

2024

2032

USD

31.10 Billion

USD

50.66 Billion

2024

2032

| 2025 –2032 | |

| USD 31.10 Billion | |

| USD 50.66 Billion | |

|

|

|

|

Europe Ceramic Market Size

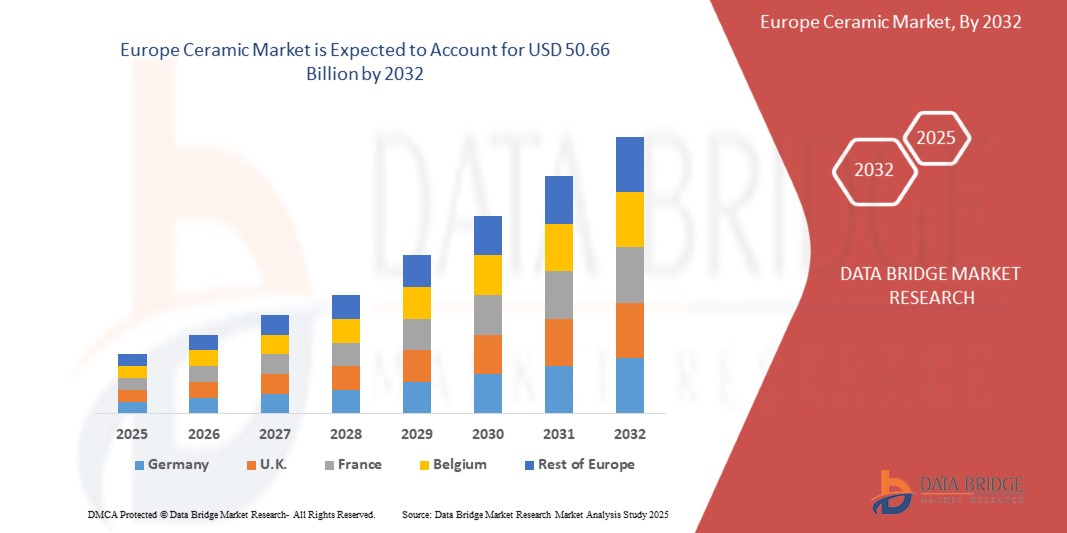

- The Europe Ceramic Market size was valued at USD 31.10 billion in 2024 and is expected to reach USD 50.66 Billion by 2032, at a CAGR of 6.4% during the forecast period

- The market growth is largely fueled by rising construction activities, increasing demand for aesthetically appealing and durable materials, and growing investments in renovation projects. Furthermore, the Europe ceramics market is experiencing robust growth due to expanding applications across residential, commercial, and industrial sectors, supported by technological advancements.

- Furthermore, the Europe ceramics market is benefiting from the shift toward eco-friendly and sustainable building materials, with manufacturers focusing on energy-efficient production processes and recyclable products to meet stringent environmental regulations and consumer preferences.

Europe Ceramic Market Analysis

- The Europe ceramics market is witnessing steady growth due to rising demand from construction, automotive, and healthcare sectors, particularly for advanced ceramics offering high durability and thermal resistance.

- The Europe ceramics market is growing steadily, driven by rising demand in construction, healthcare, and automotive sectors, especially for advanced ceramics. Additionally, sustainability trends and strict EU regulations are pushing manufacturers toward eco-friendly processes, enhancing product innovation and boosting market competitiveness across the region.

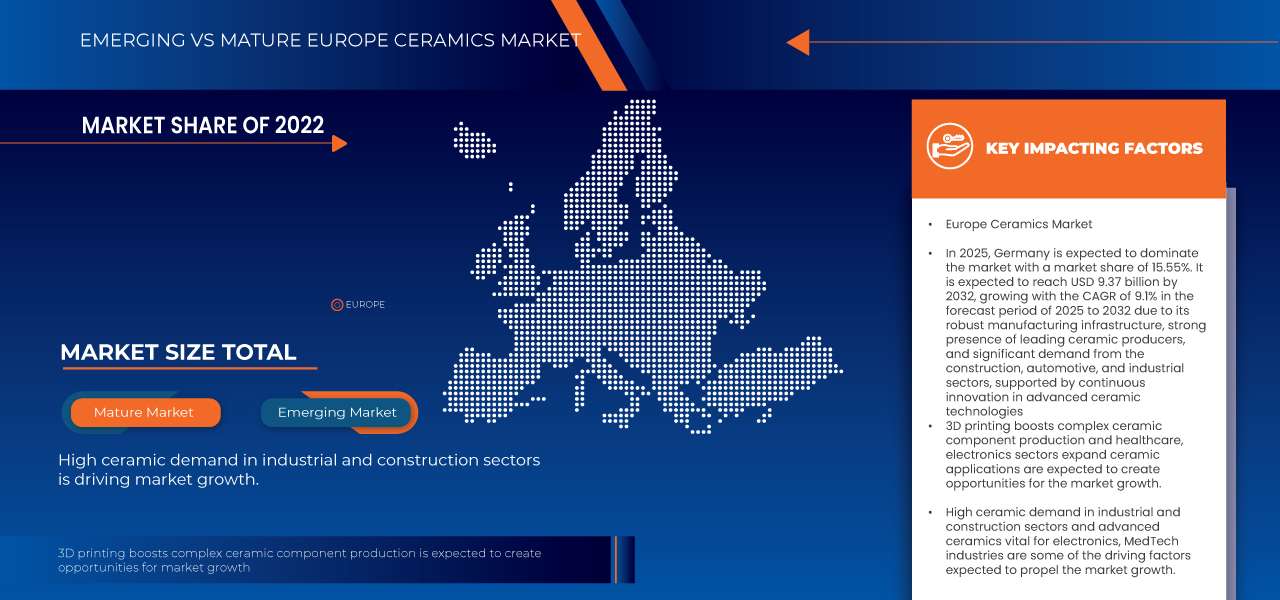

- Germany dominates the Europe Ceramic Market, holding the largest revenue share of 15.55% in 2025, attributed to its strong manufacturing base, advanced construction industry, high export volume of ceramic products, and increasing adoption of energy-efficient and sustainable building materials supported by favorable government initiatives.

- Germany is projected to be the fastest-growing region in the market during the forecast period, driven by rapid urbanization, increasing infrastructure investments, growing demand for advanced ceramics in automotive and healthcare sectors, and a strong focus on sustainable construction practices and innovative manufacturing technologies.

- The construction ceramics segment is expected to dominate the Europe Ceramic Market, with a market share of 35.77% in 2025, owing to the rising demand for durable, aesthetically appealing, and cost-effective materials in residential and commercial buildings, along with increasing renovation and infrastructure development projects globally.

Report Scope and Europe Ceramic Market Segmentation

|

Attributes |

Europe Ceramic Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Ceramic Market Trends

High Ceramic Demand In Industrial And Construction Sectors

- The European ceramics market is witnessing strong momentum, largely propelled by the resurgence of industrial production and sustained growth in the construction sector. Ceramic materials are increasingly favored for their durability, chemical resistance, thermal stability, and aesthetic versatility, making them indispensable in both functional and decorative applications.

- In the construction industry, ceramic tiles, sanitaryware, bricks, and cladding materials are in high demand due to their long life cycle and minimal maintenance needs. With ongoing infrastructure upgrades and housing developments across Western and Southern Europe, the need for high-quality building materials is intensifying.

- Countries like Germany, France, Italy, and Spain are leading in tile consumption for both residential refurbishments and commercial installations, supported by rising urbanization and housing renovations. On the industrial side, technical ceramics are gaining wider application across automotive, aerospace, and machinery manufacturing.

- Their superior performance in high-temperature and corrosive environments positions them as ideal substitutes for metal components, especially in electric vehicles, aerospace turbines, and semiconductors. According to industry estimates, Europe’s advanced ceramics segment is set to grow steadily over the next five years, driven by innovation in materials like alumina, zirconia, and silicon carbide..

Europe Ceramic Market Dynamics

Driver

Advanced Ceramics Vital For Electronics, Medtech Industries

- Europe’s advanced ceramics segment is experiencing rapid growth, fueled by their critical role in high-tech industries such as electronics and medical technology. These materials offer exceptional thermal resistance, electrical insulation, biocompatibility, and structural strength—making them indispensable across a range of precision-driven applications.

- In electronics, advanced ceramics such as alumina, zirconia, and silicon nitride are widely used in substrates, semiconductors, capacitors, and thermal management components. As the demand for miniaturized and high-performance electronic devices increases, particularly in the consumer electronics and automotive sectors, ceramic components are becoming integral to next-generation circuit design.

- Europe’s focus on electric vehicles (EVs) and 5G infrastructure is further accelerating the adoption of ceramic insulators and heat-dissipating components. In the medtech sector, advanced ceramics are being used for dental implants, joint replacements, and surgical tools due to their biocompatibility, corrosion resistance, and long lifespan.

- Zirconia-based ceramics, for instance, are now preferred for high-load-bearing orthopedic applications. The European medical device market—valued at over EUR 160 billion—is witnessing steady growth, with ceramics playing a pivotal role in innovative and implantable solutions.

- Furthermore, European R&D institutions and manufacturers are increasingly collaborating on next-gen ceramic composites for emerging applications in biotechnology, imaging, and microelectronics. Governments across the EU are supporting this shift through funding programs under Horizon Europe and related initiatives targeting advanced manufacturing.

Restraint/Challenge

High Energy And Material Costs Hinder Growth

- The European ceramics industry is under significant pressure due to rising input costs, particularly energy and raw materials. As ceramics manufacturing is inherently energy-intensive—requiring high-temperature kilns, continuous firing, and long production cycles—the sector is highly vulnerable to fluctuations in gas and electricity prices. Since the 2021–2022 energy crisis, many European producers have faced a sharp spike in energy bills, with industrial gas prices rising by over 120% in key regions like Germany, Italy, and France.

- Raw material prices, including kaolin, alumina, zircon, and feldspar, have also seen upward trends due to limited global supply, geopolitical instability, and higher logistics costs.

- The dependence on imports from countries like Ukraine, Turkey, and China for specialty clays and refractory minerals further exposes the industry to global supply chain disruptions. For example, the war in Ukraine impacted the availability of ceramic-grade clays and glazes, causing production delays and cost surges.

- These rising operational costs are eroding margins for manufacturers and making European ceramic products less competitive globally, especially against low-cost imports from Asia and Eastern Europe. Many SMEs in the sector, which represent a significant share of the market, are struggling to maintain profitability without passing costs onto consumers—something not always feasible in a price-sensitive market..

Europe Ceramic Market Scope

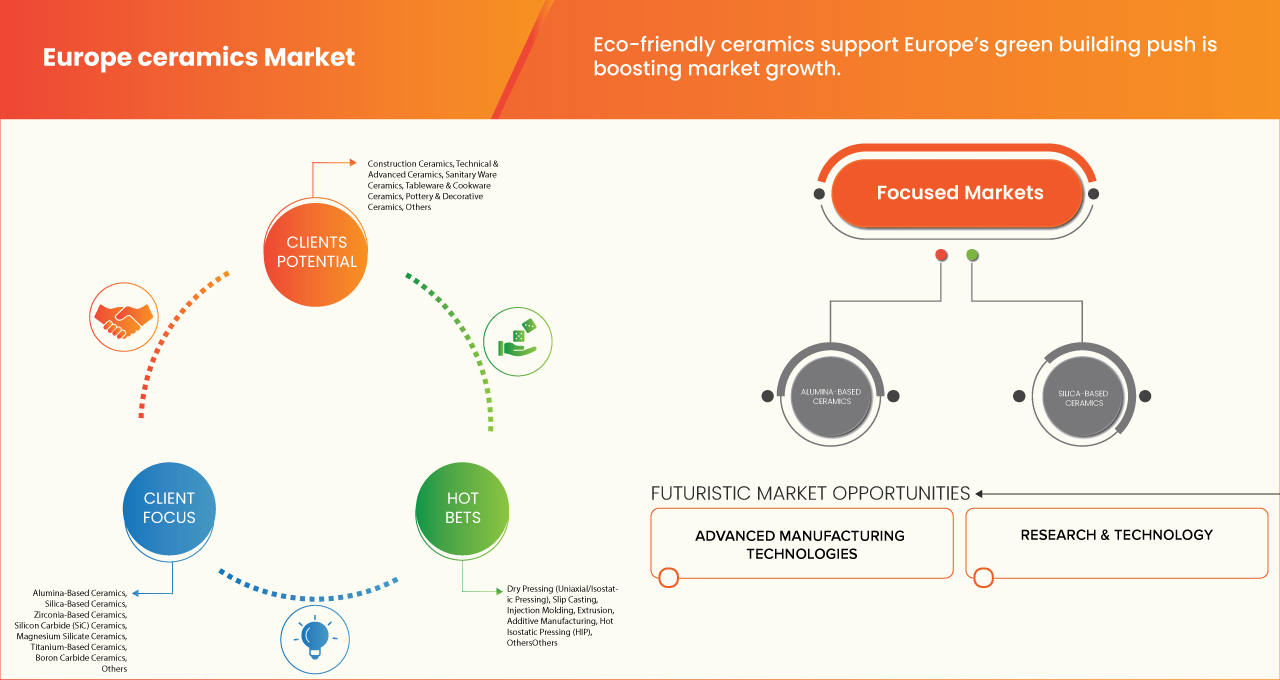

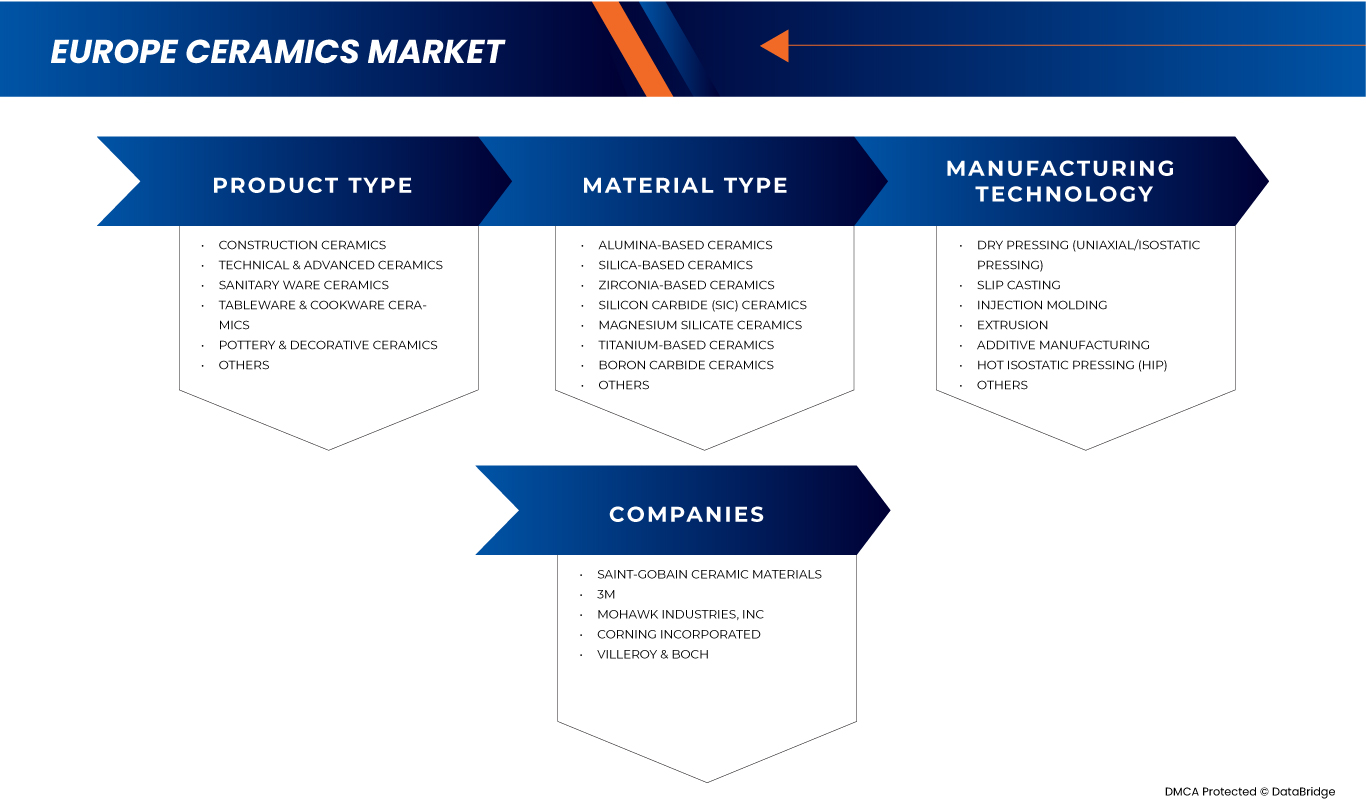

The Europe Ceramic Market is segmented into three segments based on product type, material type and manufacturing technology.

- By Product Type

On the basis of product type, the market is segmented into construction ceramics, technical & advanced ceramics, sanitary ware ceramics, tableware & cookware ceramics, pottery & decorative ceramics, and others. In 2025, the construction ceramics segment is expected to dominate the market with a market share of 35.77%, driven by increasing demand for durable, cost-effective, and aesthetically appealing materials in residential and commercial construction, coupled with rising infrastructure development and renovation activities across emerging and developed economies.

The construction ceramics segment is anticipated to witness the fastest growth rate of 6.7% from 2025 to 2032, fueled by its increasing adoption in aerospace, medical implants, and defense due to its exceptional thermal resistance, mechanical strength, lightweight properties, and ability to withstand harsh environments and high-performance applications.

- By Application

On the basis of material type, the market is segmented into alumina-based ceramics, silica-based ceramics, zirconia-based ceramics, silicon carbide (SiC) ceramics, magnesium silicate ceramics, titanium-based ceramics, boron carbide ceramics, and others. In 2025, the alumina-based ceramics segment is expected to dominate the market, driven by its widespread use in electrical and electronic components, high thermal and chemical stability, excellent wear resistance, and cost-effectiveness across various industrial applications including automotive, healthcare, and manufacturing.

The alumina-based ceramics segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing demand in electronics, automotive, and biomedical industries due to its superior hardness, corrosion resistance, thermal conductivity, and biocompatibility, along with ongoing advancements in high-performance ceramic technologies.

- By Manufacturing Technology

On the basis of manufacturing technology, the market is segmented into dry pressing (uniaxial/isostatic pressing), slip casting, injection molding, extrusion, additive manufacturing, hot isostatic pressing (HIP), and others. In 2025, the dry pressing (uniaxial/isostatic pressing) segment is expected to dominate the market, driven by its cost-effectiveness, high production efficiency, suitability for mass production of simple and complex ceramic components, and widespread adoption in electrical insulators, tiles, and structural ceramic applications.

The dry pressing (uniaxial/isostatic pressing) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for high-density and dimensionally precise ceramic components in electronics, automotive, and industrial applications, along with advancements in automation and tooling technologies that enhance production speed and consistency.

Europe Ceramic Market Regional Analysis

- Germany is the largest market for ceramic, holding a substantial revenue share in 2025 and is projected to grow at a robust CAGR of 8.8% from 2025 to 2032. The region's growth is driven by strong industrial infrastructure, rising demand for advanced ceramics in automotive and electronics, increasing construction and renovation activities, and a strong focus on sustainable and energy-efficient building materials.

- Germany benefits from a well-established manufacturing base, advanced R&D capabilities, skilled workforce, and strong export potential, making it a key hub for ceramic production and innovation across construction, automotive, medical, and industrial applications.

- Countries such as Italy, Spain, and France are also emerging as significant contributors to the Europe Ceramic Market, driven by strong construction activity, rich tradition in ceramic craftsmanship, growing demand for decorative and sanitary ceramics, and increasing adoption of advanced manufacturing technologies.

Germany Europe Ceramic Market Insight

Germany accounted for the largest market revenue share in Europe in 2025, owing to its long-standing heritage in ceramic craftsmanship, strong presence of leading ceramic manufacturers, high export volumes, and growing demand for premium tiles and sanitary ware in both residential and commercial construction sectors.

Italy Europe Ceramic Market Insight

Italy is expected to register a notable CAGR from 2025 to 2032, driven by rising investments in sustainable construction, increasing demand for high-performance ceramics in the automotive and aerospace sectors, and supportive government policies promoting energy-efficient and eco-friendly building materials.

Europe Ceramic Market Share

The Ceramic industry is primarily led by well-established companies, including:

- Saint‑Gobain Ceramic Materials (France)

- 3M (U.S.)

- Mohawk Industries Inc. (U.S.)

- Corning Incorporated (U.S.)

- Villeroy & Boch (Germany)

- Kyocera Corporation (Japan)

- Morgan Advanced Materials (U.K.)

- PORCELANOSA Grupo A.I.E. (Spain)

- CoorsTek Inc. (U.S.)

- Florim Ceramiche S.p.A (Italy)

- Grupo Lamosa (Mexico)

- Gruppo Ceramiche Ricchetti SpA (Italy)

- CeramTec GmbH (Germany)

- Johnson Tiles Limited (U.K.)

- AGC Inc. (Japan)

- IRIS CERAMICA GROUP (Italy)

- Applied Ceramics Inc. (U.S.)

- BCE Special Ceramics GmbH (Germany)

- Ceramiche Refin Spa (Italy)

- International Syalons (Newcastle) Limited (U.K.)

- RAK Ceramics (U.A.E.)

- Pamesa Ceramica (Spain)

- Kajaria Ceramics Limited (India)

- Ceramiche Atlas Concorde S.p.A (Italy)

- Saloni (Spain)

- Ceramica Sant’Agostino S.p.A (Italy)

- EPC Stone & Ceramics Ltd (U.K.)

- NANOKER (Spain)

- Ceramic Workshop Schaedler AG (Switzerland)

- ETI TK (Slovenia)

Latest Developments in Europe Ceramic Market

- In January 2025, Pure Lithium and Saint‑Gobain Ceramics signed a joint development agreement to accelerate the production of lithium‑selective, water‑blocking membranes for both lithium extraction and next-generation lithium‑metal battery applications

- In May 2025, Saint‑Gobain Ceramic Materials showcased its zirconia grinding beads, zirconia powders, and engineering ceramics at the China International Battery Fair (CIBF 2025) in Shenzhen.

- In 2022, Mohawk Industries announced the acquisition of Vitromex, a leading Mexican ceramic tile company, from Grupo Industrial Saltillo for USD 293 million. The deal, expected to close in the second half of 2022, will expand Mohawk’s footprint in Mexico and enhance its product offerings and logistics. Vitromex generated USD 204 million in revenue in 2021 and holds a strong position in the USD 1.7 billion Mexican tile market.

- In March 2025, Corning introduced Corning ® Gorilla ® Glass Ceramic, a groundbreaking transparent glass-ceramic cover material engineered to offer significantly enhanced drop resistance on rough surfaces—surviving over ten one-meter drops on asphalt compared to standard aluminosilicate glass fragility.

- In May 2025, Corning and Samsung unveiled Corning ® Gorilla ® Glass Ceramic 2, designed specifically for the new Galaxy S25 Edge smartphone. This next-gen material achieves an exceptional combination of thinness, optical clarity, and durability through embedded crystals and ion exchange strengthening.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Ceramic Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Ceramic Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Ceramic Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.