Europe Cheese Market

Market Size in USD Billion

CAGR :

%

USD

73.42 Billion

USD

104.41 Billion

2024

2032

USD

73.42 Billion

USD

104.41 Billion

2024

2032

| 2025 –2032 | |

| USD 73.42 Billion | |

| USD 104.41 Billion | |

|

|

|

|

Europe Cheese Market Size

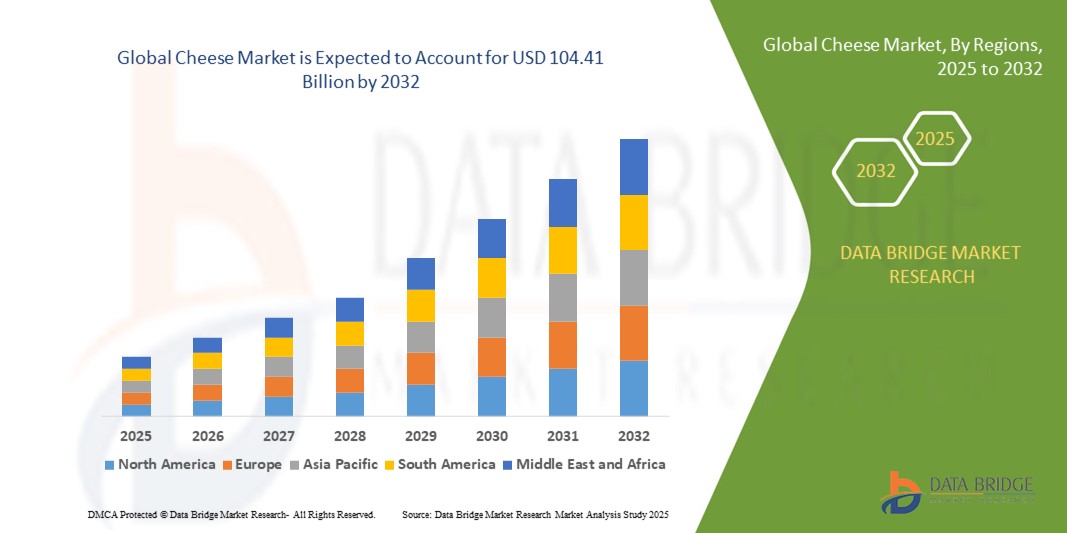

- The Europe cheese market size was valued at USD 73.42 billion in 2024 and is expected to reach USD 104.41 billion by 2032, at a CAGR of 4.5% during the forecast period

- The market growth is primarily driven by increasing consumer demand for diverse cheese varieties, growing popularity of plant-based cheese alternatives, and rising culinary applications in the food service sector

- Rising health consciousness, demand for organic and artisanal cheeses, and growing awareness of cheese as a protein-rich food source are further propelling market demand across retail and food service channels

Europe Cheese Market Analysis

- The Europe cheese market is experiencing robust growth due to increasing consumer preference for premium and specialty cheeses, coupled with rising demand for plant-based cheese alternatives driven by vegan and lactose-intolerant consumers

- Growing consumption in both household and food service sectors, particularly in fast-casual dining and gourmet cuisine, is encouraging manufacturers to innovate with new flavors, textures, and sustainable production methods

- The U.K. dominated the Europe cheese market with the largest revenue share of 28.5% in 2024, driven by a strong tradition of cheese consumption, a mature dairy industry, and high demand for both traditional and innovative cheese products

- Germany is expected to be the fastest-growing country in the Europe cheese market during the forecast period, fueled by increasing adoption of plant-based and organic cheeses, rising disposable incomes, and growing culinary tourism

- The animal-based cheese segment dominated the largest market revenue share of 85.2% in 2024, driven by the strong tradition of dairy consumption in Europe, particularly in countries such as the U.K., France, and Italy, where cheese is a staple in culinary culture

Report Scope and Europe Cheese Market Segmentation

|

Attributes |

Europe Cheese Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Cheese Market Trends

Increasing Integration of Plant-Based and Specialty Cheese Innovations

- The Europe cheese market is experiencing a significant trend toward the integration of plant-based cheese alternatives and specialty cheese innovations

- These advancements cater to evolving consumer preferences, particularly the growing demand for vegan, lactose-free, and artisanal cheese products

- Plant-based cheeses, made from ingredients such as soy, almond, cashew, and coconut, are gaining traction due to rising veganism and lactose intolerance awareness, with approximately 25% of the European population affected by lactose intolerance

- Specialty cheeses, such as truffle-infused, herb-infused, or regionally crafted varieties, are appealing to consumers seeking unique flavors and premium products

- For instance, companies such as Daiya Foods and PlantWise are leveraging fermentation technologies to produce plant-based cheeses that mimic the taste and texture of dairy-based cheese, while brands such as Bergader have introduced innovative products such as edelblu Blue Cheese for younger audiences

- This trend enhances the appeal of cheese products, making them more attractive to both health-conscious consumers and gourmet enthusiasts across retail and food service sectors

Europe Cheese Market Dynamics

Driver

Rising Demand for Artisanal and Health-Conscious Cheese Products

- The increasing consumer preference for artisanal, organic, and health-conscious cheese products is a major driver for the Europe cheese market

- Cheese enhances culinary experiences through its versatility in dishes such as pizzas, burgers, and gourmet recipes, driving demand in both retail/household and food service sectors

- Government initiatives promoting sustainable and local food production, particularly in countries such as the U.K. and Germany, are supporting the adoption of premium and regional cheese varieties

- The proliferation of e-commerce and advanced packaging solutions, such as sustainable pouches and tubs, enables faster distribution and longer shelf life, further boosting market growth

- Manufacturers are increasingly offering plant-based and lactose-free cheese options as standard or premium products to meet consumer expectations for dietary inclusivity and sustainability

Restraint/Challenge

High Production Costs and Regulatory Compliance Issues

- The substantial costs associated with producing specialty and plant-based cheeses, including raw materials, advanced fermentation technologies, and sustainable packaging, can be a significant barrier to adoption, particularly for smaller producers in emerging markets

- Developing plant-based cheeses that replicate the sensory qualities of dairy cheese is complex and resource-intensive

- In addition, compliance with stringent European regulations, such as protected geographical indications (PGI) and food safety standards, poses a major challenge. Cheese producers must navigate complex rules regarding labeling, production methods, and environmental impact

- The fragmented regulatory landscape across European countries concerning sustainability, animal welfare, and food safety further complicates operations for manufacturers and distributors

- These factors can deter smaller producers and limit market expansion, particularly in regions with high cost sensitivity or strict regulatory oversight

Europe Cheese market Scope

The market is segmented on the basis of product type, cheese type, end user, method of preparation, flavors, form, brand, packaging type, and distribution channel.

- By Product Type

On the basis of product type, the Europe cheese market is segmented into animal-based cheese and plant-based cheese. The animal-based cheese segment dominated the largest market revenue share of 85.2% in 2024, driven by the strong tradition of dairy consumption in Europe, particularly in countries such as the U.K., France, and Italy, where cheese is a staple in culinary culture.

The plant-based cheese segment is anticipated to witness the fastest growth rate of 12.8% from 2025 to 2032, fueled by rising consumer demand for vegan and lactose-free alternatives. Germany is expected to lead this growth, driven by increasing adoption of plant-based diets and innovations in dairy-free cheese products.

- By Cheese Type

On the basis of cheese type, the Europe cheese market is segmented into fresh, hard, and soft cheese. The hard cheese segment is expected to dominate with a market revenue share of 42.7% in 2024, driven by the popularity of varieties such as cheddar and parmesan, particularly in the U.K., which leads due to its strong cheddar production and consumption culture.

The soft cheese segment is projected to experience the fastest growth rate from 2025 to 2032, particularly in Germany, where demand for creamy and spreadable cheeses such as brie and camembert is rising due to evolving consumer preferences and culinary trends.

- By End User

On the basis of end user, the Europe cheese market is segmented into retail/household and food service sector. The retail/household segment is expected to hold the largest market revenue share of 68.3% in 2024, driven by widespread consumer purchasing through supermarkets and hypermarkets, with the U.K. leading due to its robust retail infrastructure.

The food service sector is anticipated to witness rapid growth from 2025 to 2032, particularly in Germany, where the increasing use of cheese in restaurants, cafes, and fast-food chains is driven by the growing popularity of cheese-centric dishes and convenience foods.

- By Method of Preparation

On the basis of method of preparation, the Europe cheese market is segmented into bacteria-ripened, mold-ripened, and un-ripened cheese. The bacteria-ripened segment is expected to hold the largest market revenue share of 55.4% in 2024, driven by the popularity of cheeses such as cheddar and gouda, with the U.K. dominating due to its strong heritage in producing these varieties.

The mold-ripened segment is projected to grow at the fastest rate from 2025 to 2032, particularly in Germany, where consumer interest in artisanal and specialty cheeses such as blue cheese and camembert is increasing due to premiumization trends.

- By Flavors

On the basis of flavors, the Europe cheese market is segmented into regular/unflavored and flavored cheese. The regular/unflavored segment is expected to dominate with a market revenue share of 70.1% in 2024, driven by the widespread consumption of traditional cheeses such as cheddar and mozzarella, with the U.K. leading due to its established cheese culture.

The flavored cheese segment is anticipated to witness the fastest growth from 2025 to 2032, particularly in Germany, where demand for innovative flavors such as herb-infused and spicy cheeses is growing, driven by younger consumers seeking unique taste experiences.

- By Form

On the basis of form, the Europe cheese market is segmented into shred, slices, grated, wheels, cubes, block and wedges, and spread. The block and wedges segment is expected to hold the largest market revenue share of 38.6% in 2024, driven by its versatility in retail and food service applications, with the U.K. dominating due to high demand for cheddar blocks.

The spread segment is projected to experience the fastest growth from 2025 to 2032, particularly in Germany, where convenience-driven products such as cream cheese spreads are gaining popularity in both household and food service settings.

- By Brand

On the basis of brand, the Europe cheese market is segmented into branded and private label cheese. The branded segment is expected to hold the largest market revenue share of 62.8% in 2024, driven by consumer trust in established brands such as Cathedral City and Leerdammer, with the U.K. leading due to its strong branded cheese market.

The private label segment is anticipated to witness rapid growth from 2025 to 2032, particularly in Germany, where retailers are increasingly offering high-quality private label cheeses at competitive prices, appealing to cost-conscious consumers.

- By Packaging Type

On the basis of packaging type, the Europe cheese market is segmented into pouches, tubs, bottles, and others. The pouches segment is expected to dominate with a market revenue share of 45.3% in 2024, driven by their convenience for shredded and grated cheese, with the U.K. leading due to strong retail demand.

The tubs segment is projected to grow at the fastest rate from 2025 to 2032, particularly in Germany, where demand for spreadable and soft cheeses in resealable tubs is rising due to convenience and longer shelf life.

- By Distribution Channel

On the basis of distribution channel, the Europe cheese market is segmented into store-based retailing and non-store retailing. The store-based retailing segment is expected to hold the largest market revenue share of 78.6% in 2024, driven by the dominance of supermarkets and hypermarkets, with the U.K. leading due to its well-developed retail network.

The non-store retailing segment, including online sales, is anticipated to witness the fastest growth rate of 15.4% from 2025 to 2032, particularly in Germany, where e-commerce platforms are gaining traction for cheese purchases due to convenience and a growing digital consumer base.

Europe Cheese Market Regional Analysis

- The U.K. dominates the Europe cheese market with the largest revenue share of 28.5% in 2024, driven by a strong tradition of cheese consumption, a mature dairy industry, and high demand for both traditional and innovative cheese products

- The trend toward premium and flavored cheese varieties, coupled with widespread retail distribution through store-based and non-store retailing, boosts market expansion. Increasing adoption in the food service sector, particularly in urban areas, further complements market growth

Germany Cheese Market Insight

Germany is expected to witness the fastest growth rate in the Europe cheese market, attributed to its advanced dairy processing industry and rising consumer focus on health-conscious and sustainable cheese options. German consumers prefer innovative products such as plant-based and bacteria-ripened cheeses that align with environmental concerns and dietary trends. The integration of these products in both branded and private label segments, along with diverse packaging formats such as pouches and tubs, supports sustained market growth.

Europe Cheese Market Share

The cheese industry is primarily led by well-established companies, including:

- Caseifico F.lli Oioli (Italy)

- SAVENCIA SA (France)

- Santangiolina Milk (Italy)

- Garda Latte (Italy)

- Grand'Or (France)

- RENY PICOT (Spain)

- Alpenhain (Germany)

- Loicq (Belgium)

- Pâturages Comtois (France)

- Quesera Napoli S.L. (Spain)

- violife (Greece)

- Byelovezhskije Syry (Belarus)

- JAY and JOY (Germany)

- Mondarella (Germany)

- Dr. Mannahs (Germany)

- Yogan (Greece)

- Rosie and Riffy (U.K.)

- New Roots (Switzerland)

- Winterdale Cheesemaker (U.K.)

What are the Recent Developments in Europe Cheese Market?

- In July 2025, Hellenic Dairies significantly expanded its operations by acquiring Dodoni, a renowned Greek dairy brand previously owned by Vivartia Group. Valued at approximately USD 239.4 million, this acquisition marks the largest M&A transaction in the Greek dairy sector in recent years. The deal, pending regulatory approval, positions Hellenic Dairies as Greece’s largest dairy company, enhancing its domestic footprint and international reach. Dodoni is well known for its feta cheese, yogurts, and halloumi, and the acquisition strengthens Hellenic Dairies’ product portfolio and competitiveness in the European dairy market

- In June 2025, Lactalis, the French multinational and global dairy leader, completed its acquisition of Ambrosi Spa, an Italian specialist in Parmesan and other hard cheeses. This strategic move strengthens Lactalis’s position in the European cheese market, particularly within the premium hard cheese segment such as Grana Padano PDO and Parmigiano Reggiano PDO. The acquisition also includes the transfer of a 25% stake previously held by Emmi Group, consolidating full ownership under Lactalis. The deal is expected to reshape market dynamics, expand Lactalis’s product portfolio, and enhance its international distribution capabilities

- In March 2025, Yeo Valley Production, a leading UK dairy company, acquired The Collective UK, a premium yogurt brand formerly owned by Epicurean Dairy. This strategic move strengthens Yeo Valley’s position in the gourmet and high-protein dairy segment, expanding its product portfolio and manufacturing capabilities. The acquisition reflects a shared commitment to sustainability, quality, and taste-led innovation, aligning with growing consumer demand for natural and functional dairy products. It also highlights ongoing consolidation in the UK dairy market, positioning Yeo Valley as a formidable competitor in the premium category

- In March 2025, Sargento has unveiled a series of innovative product launches, many developed in collaboration with well-known food brands, reinforcing its commitment to flavor innovation and convenient snacking solutions. Among the highlights is the introduction of Sargento’s sliced Natural American Cheese, a cleaner-label product made with just five ingredients, marking a significant shift toward more natural and transparent food offerings.

- In December 2024, Belgian dairy companies Vache Bleue Group and Flanders Food Production (FFP) merged to form the European Dairy Company, marking a significant consolidation in the European dairy sector. With a combined turnover, the new entity aims to strengthen its position in both private label and branded cheese products. The merger brings together Vache Bleue’s expertise in grated and packaged cheeses with FFP’s specialization in slicing and portioning, enabling broader market reach, operational synergies, and enhanced production capabilities across Belgium, France, and Germany

- In October 2024, the UK’s Competition and Markets Authority (CMA) officially approved Müller’s acquisition of Yew Tree Dairy, a family-owned dairy based in Skelmersdale, Lancashire. The strategic merger enables Müller to expand its milk powder production capabilities, strengthen supply chain resilience, and boost its export business. The acquisition marks a significant step in the consolidation of the UK dairy sector, aligning with Müller’s long-term goal to build a flagship facility for milk drying and enhance its role in the British dairy industry. The deal reflects Müller’s commitment to sustainability, quality, and growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Cheese Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Cheese Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Cheese Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.