Europe Child Safety Seats Market

Market Size in USD Billion

CAGR :

%

USD

1.23 Billion

USD

2.13 Billion

2024

2032

USD

1.23 Billion

USD

2.13 Billion

2024

2032

| 2025 –2032 | |

| USD 1.23 Billion | |

| USD 2.13 Billion | |

|

|

|

|

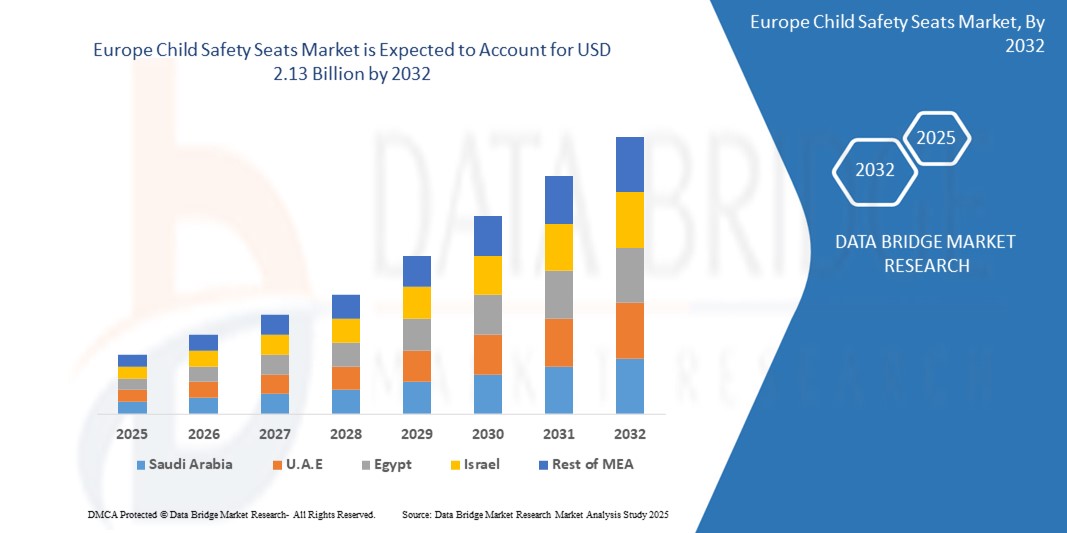

Europe Child Safety Seats Market Size

- The Europe child safety seats market size was valued at USD 1.23 billion in 2024 and is expected to reach USD 2.13 billion by 2032, at a CAGR of 7.1% during the forecast period

- The market growth is largely fueled by the increasing enforcement of child passenger safety regulations and rising awareness among parents regarding the importance of secure travel solutions, which is driving strong demand for certified child safety seats worldwide

- Furthermore, growing parental preference for multifunctional, easy-to-install, and comfort-enhancing designs is accelerating adoption across both developed and emerging markets. These converging factors are significantly boosting the uptake of child safety seats, thereby strengthening the industry’s growth trajectory

Europe Child Safety Seats Market Analysis

- Child safety seats are specially designed restraints that protect infants and children during vehicle travel by ensuring proper positioning and minimizing injury risks in case of collisions. They are available in multiple forms such as infant, convertible, booster, and all-in-one seats, each catering to different age groups and safety requirements

- The escalating demand for child safety seats is primarily driven by stringent government regulations, technological advancements in seat design, and rising consumer awareness of travel safety, coupled with increasing vehicle ownership among young families across the globe

- Germany dominated the child safety seats market in 2024, due to its stringent child passenger safety regulations, high vehicle ownership among families, and strong consumer awareness regarding road safety

- U.K. is expected to be the fastest growing country in the child safety seats market during the forecast period due to growing parental preference for advanced child safety products and strong regulatory enforcement for child passenger safety

- Plastic segment dominated the market with a market share of 56.1% in 2024, due to its lightweight design, affordability, and practicality. Parents value plastic-based seats for their ease of installation and portability, especially for daily commutes. Manufacturers prefer plastic for its moldability, allowing ergonomic and stylish designs that appeal to consumers. Despite being affordable, plastic seats meet safety standards, building consumer trust. Their availability across all price ranges ensures accessibility for a wide audience. The blend of cost efficiency, convenience, and safety keeps plastic in the lead

Report Scope and Child Safety Seats Market Segmentation

|

Attributes |

Child Safety Seats Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Europe Child Safety Seats Market Trends

Smart and Tech-Enabled Child Safety Seats

- The child safety seats market is evolving rapidly with the introduction of smart and tech-enabled solutions designed to provide improved protection, comfort, and monitoring. Features such as real-time alerts, connectivity with mobile apps, and built-in sensors are redefining child passenger safety

- For instance, Goodbaby International and CYBEX have developed smart child safety seats with integrated sensors that notify parents of unsafe conditions, such as unfastened straps or a child being left unattended. These innovations highlight how technology is reshaping child safety standards

- The rising importance of connected mobility is impacting child safety products, with smart seats integrating collision detection, posture monitoring, and temperature regulation for enhanced user confidence. These advanced functions strengthen both practicality and parental peace of mind

- In addition, growing adoption in developed regions underscores consumer demand for both premium quality and convenience. Tech-enabled safety seats are becoming a differentiator for manufacturers as parents seek cutting-edge solutions for child welfare

- The expansion of IoT and smart mobility ecosystems provides further opportunities for integrating safety seats into connected car technologies, aligning with broader automotive safety trends. This synergy reflects the future direction of child passenger protection in smart vehicles

- Altogether, the trend toward smart child safety seats highlights the merging of technology with safety essentials. This transformation is likely to accelerate adoption, particularly in markets where consumer awareness and disposable incomes support premium child safety solutions

Europe Child Safety Seats Market Dynamics

Driver

Technological Advancements in Safety Features

- Advancements in safety design and technology are driving the child safety seats market, making products more effective in preventing injuries and promoting compliance with safety standards. Enhanced features are increasing consumer confidence and boosting adoption rates

- For instance, Britax Römer has launched seats with advanced side-impact protection systems and energy-absorbing materials. These innovations increase protection during collisions and illustrate how continuous technological improvements raise the performance threshold within the industry

- Smart harness systems, ISOFIX anchorage, and enhanced adjustability functions are also becoming increasingly widespread. These features enhance child safety and also focus on ease of use, encouraging greater adoption by reducing installation errors

- In addition, stricter automotive safety regulations in regions such as Europe and North America are encouraging companies to innovate continuously. Compliance with evolving standards positions technologically advanced products as essential investments for parents emphasizing safety

- These technological advancements show how innovation remains central to long-term market growth. By aligning with safety regulations and consumer trust requirements, manufacturers are building competitive advantages in an evolving child passenger safety sector

Restraint/Challenge

High Cost in Price-Sensitive Markets

- Despite growing interest, the high cost of advanced child safety seats remains a major barrier in price-sensitive markets. Premium smart-enabled models with advanced features often exceed affordability for middle- and low-income households, restricting wider adoption

- For instance, leading manufacturers such as Maxi-Cosi face difficulties expanding their premium product lines in emerging economies due to cost constraints. Many consumers in these regions prefer low-cost alternatives or may avoid buying dedicated safety seats altogether

- Limited awareness around the importance of safety seats also compounds cost-related barriers in developing nations. Without regulatory enforcement and consumer education, higher-priced products often fail to penetrate beyond affluent urban segments

- In addition, the presence of counterfeit or substandard low-cost alternatives in the market further discourages investment in high-quality seats. Price disparities widen the adoption gap, especially in markets lacking subsidy or incentive programs for child safety products

- Overcoming these challenges will require strategies such as introducing affordable models, increasing consumer awareness through campaigns, and encouraging government-backed subsidy schemes. Addressing price sensitivity will be crucial in expanding global adoption and ensuring improved child passenger safety outcomes

Europe Child Safety Seats Market Scope

The market is segmented on the basis of product, pricing, functionality, material, age group, end use, and sales channel.

- By Product

On the basis of product, the child safety seats market is segmented into convertible, combination seats, booster, all-in-one seat, and infant seats. The convertible segment dominated the largest market revenue share in 2024, supported by its adaptability and cost-effectiveness. These seats can be used as both rear-facing and forward-facing, making them suitable for multiple child growth stages. Parents prefer them because they reduce the need to buy several products over time, providing long-term savings. Compliance with international safety standards enhances trust and adoption. Rising awareness of extended rear-facing travel for safety and the easy availability of convertible seats across offline and online channels strengthen their dominance.

The all-in-one seat segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising consumer demand for versatile solutions. These seats combine the functions of infant, convertible, and booster seats into one product, minimizing replacement costs as the child grows. Parents find them appealing for convenience, value, and compatibility with a wide variety of vehicles. Enhanced safety certifications and innovative designs add to their attractiveness. Rising disposable incomes and the trend toward multifunctional, long-term products are fueling adoption. The increasing popularity of premium and durable solutions ensures rapid growth for this category.

- By Pricing

On the basis of pricing, the child safety seats market is segmented into medium, high, and low. The medium pricing segment held the largest revenue share in 2024, as it balances affordability with trusted quality and safety. Parents often choose mid-range seats because they comply with safety regulations while avoiding the high costs of premium models. Availability across retail outlets and online platforms enhances accessibility. Leading brands offer practical features such as washable covers and adjustable harnesses in this category, boosting consumer confidence. Strong visibility and reliability in this price range further strengthen dominance. Parents view medium-priced seats as offering the best value for money, driving sustained demand.

The high pricing segment is expected to record the fastest growth from 2025 to 2032, supported by growing preference for advanced and premium child safety solutions. Parents in developed markets prioritize features such as side-impact protection, ergonomic designs, and enhanced cushioning. Luxury options, including smart connectivity and stylish designs, appeal strongly to affluent families. Rising disposable incomes in emerging economies are also expanding this segment. Strong brand positioning and active promotion by premium companies increase consumer trust. The emphasis on superior safety and comfort is accelerating growth for high-end products in the coming years.

- By Functionality

On the basis of functionality, the child safety seats market is segmented into 2-stage, 1-stage, and 3-stage. The 2-stage segment dominated the market in 2024, as it offers a practical balance of safety and affordability. Covering both rear-facing and forward-facing stages, these seats match the critical safety requirements for early childhood travel. Parents prefer them because they reduce frequent replacements and provide longer usability. Pediatricians and child safety organizations often recommend extended use of 2-stage seats, enhancing consumer trust. Widespread availability and compliance with key safety standards further support adoption. This practical and versatile design sustains its strong leadership in the market.

The 3-stage segment is projected to grow at the fastest rate from 2025 to 2032, as multifunctional solutions gain popularity among modern parents. These seats adapt from infant carriers to forward-facing and then to booster mode, covering nearly all stages of childhood. Parents are attracted to the convenience of purchasing one product that grows with their child, reducing overall costs. Innovative safety features, such as adjustable harnesses and headrests, enhance their appeal. The growing trend toward value-added and long-lasting products supports adoption across both developed and emerging economies. The rising emphasis on complete child safety solutions fuels strong growth for this segment.

- By Material

On the basis of material, the child safety seats market is segmented into plastic, steel, foam, and others. The plastic segment dominated the market with a share of 56.1% in 2024, driven by its lightweight design, affordability, and practicality. Parents value plastic-based seats for their ease of installation and portability, especially for daily commutes. Manufacturers prefer plastic for its moldability, allowing ergonomic and stylish designs that appeal to consumers. Despite being affordable, plastic seats meet safety standards, building consumer trust. Their availability across all price ranges ensures accessibility for a wide audience. The blend of cost efficiency, convenience, and safety keeps plastic in the lead.

The steel segment is anticipated to grow at the fastest rate from 2025 to 2032, as safety-conscious parents increasingly favor reinforced frames. Steel-based seats offer superior crash protection and structural durability, which resonates strongly with parents prioritizing safety. Though heavier and more expensive, they are gaining traction in premium categories. Automakers and premium brands are actively promoting steel-reinforced models, boosting awareness and demand. The growing emphasis on reliability and long-term use is also driving interest in this category. Rising adoption in developed markets positions steel as the fastest-growing material segment.

- By Age Group

On the basis of age group, the child safety seats market is segmented into above 24 months, 12 to 23 months, 8 to 11 months, 4 to 7 months, and below 3 months. The above 24 months segment dominated the market in 2024, as parents continue using safety seats for toddlers and preschoolers. Regulations and awareness campaigns highlight the importance of child seats beyond infancy, encouraging extended use. Seats in this category support higher weight and height capacities, making them practical for older children. Parents rely on them for both long commutes and occasional travel. Their availability across all price tiers expands adoption. Consistent reliance on toddler safety seats underpins their strong revenue share.

The below 3 months segment is forecasted to grow at the fastest rate from 2025 to 2032, driven by rising awareness of neonatal travel safety. Parents are becoming more cautious about protecting newborns during the first months of life. Specialized infant seats offer cushioned inserts, reclining positions, and breathable fabrics, making them suitable for delicate care. Hospitals and child safety organizations are actively promoting the use of infant-specific seats. Increasing rates of first-time parents in urban areas add momentum to adoption. Growing awareness of neonatal safety ensures rapid expansion of this segment.

- By End Use

On the basis of end use, the child safety seats market is segmented into original equipment manufacturers (OEM) and aftermarket. The aftermarket segment dominated the largest revenue share in 2024, due to its accessibility, affordability, and wide product range. Parents often prefer aftermarket purchases because of the availability of diverse designs and price categories. The expansion of e-commerce has further boosted aftermarket sales, allowing parents to compare products and read reviews before buying. Retail stores and online platforms frequently offer discounts, increasing affordability. Strong brand presence in this channel reinforces consumer trust. These advantages ensure aftermarket’s sustained dominance in the market.

The OEM segment is expected to grow at the fastest rate from 2025 to 2032, as automakers integrate child safety features into vehicles. Collaborations between car manufacturers and safety seat brands are leading to vehicle-specific solutions. Parents trust OEM products for strict compliance with safety regulations and compatibility with car models. Growing demand for premium vehicles with built-in safety features further supports OEM adoption. Rising consumer awareness of child travel safety reinforces this trend. This integration of safety seats into vehicle design drives the strong growth of OEM offerings.

- By Sales Channel

On the basis of sales channel, the child safety seats market is segmented into offline and online. The offline segment dominated the market in 2024, as parents often prefer physically inspecting safety seats before purchasing. Retail outlets, specialty baby stores, and supermarkets provide the opportunity to test product quality and installation. Expert sales support builds consumer trust and confidence. Offline channels also offer after-sales services such as installation guidance and warranties. The assurance of physical inspection and customer service keeps offline sales ahead. Strong reliance on traditional shopping sustains this segment’s leadership.

The online segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by the rapid growth of digital platforms. Parents are increasingly turning to online channels for convenience, wider product choices, and attractive discounts. Reviews, ratings, and influencer marketing strongly shape consumer decisions. Doorstep delivery and hassle-free return policies enhance customer experience. Expanding internet penetration in emerging economies is accelerating online adoption. The preference for digital shopping trends ensures online sales grow at the fastest pace.

Europe Child Safety Seats Market Regional Analysis

- Germany dominated the child safety seats market with the largest revenue share in 2024, driven by its stringent child passenger safety regulations, high vehicle ownership among families, and strong consumer awareness regarding road safety

- The country’s leadership is reinforced by continuous product innovations, widespread adoption of premium and technologically advanced seats, and active support from government campaigns promoting child restraint systems

- Growing demand for multifunctional and easy-to-install seats, coupled with collaborations between leading global brands and domestic distributors, further strengthens Germany’s position. The integration of safety technologies and compliance with European standards continues to consolidate Germany’s dominant status in the regional market

U.K. Child Safety Seats Market Insight

The U.K. market is projected to register the fastest CAGR in Europe during 2025–2032, fueled by growing parental preference for advanced child safety products and strong regulatory enforcement for child passenger safety. Rising adoption of premium multifunctional seats, coupled with the trend toward sustainable and comfort-oriented materials, is accelerating growth. Government initiatives, retail expansion, and collaborations with global brands are enhancing product accessibility. The U.K.’s emphasis on safety innovation, consumer education, and smart technologies is expanding market penetration and driving adoption across families nationwide.

France Child Safety Seats Market Insight

France is expected to witness steady growth during 2025–2032, supported by increasing awareness of child safety regulations, growing vehicle ownership, and demand for reliable travel solutions. The adoption of convertible and all-in-one seats is rising due to their multifunctionality and long-term use benefits. Supportive government policies, retailer promotions, and rising consumer interest in certified safety products are driving market expansion. Collaborations between international manufacturers and local distributors continue to enhance product availability and awareness. France’s focus on safety compliance, design innovation, and parental confidence is shaping its long-term market outlook.

Europe Child Safety Seats Market Share

The child safety seats industry is primarily led by well-established companies, including:

- Newell Brands (U.S.)

- Britax (U.K.)

- Orbit Baby (U.S.)

- Artsana S.p.A. (Italy)

- Goodbaby Internationl Holdings Ltd. (China)

- Diono, LLC (U.S.)

- Dorel Industries (Canada)

- Graco Children’s Products Inc. (U.S.)

- Evenflo Company, Inc. (U.S.)

- Aprica Healthcare Limited (India)

- Stokke AS (Norway)

- Beloved Baby (Malaysia)

- Peg Perego (Italy)

- BELLELLI (Italy)

- Combi Hong Kong Limited (Taiwan)

- Doona (U.K.)

- Jané Group (Spain)

- Nuna Intl BV (Netherlands)

Latest Developments in Europe Child Safety Seats Market

- In May 2024, Newell Brands introduced the SmartSense Soothing Bassinet and SmartSense Soothing Swing under its Graco brand, reinforcing its leadership in baby care innovation. Featuring patented cry-detection technology and over 1,000 soothing combinations, these products elevate parental convenience by simulating comforting motions and enhancing infant comfort with organic fabrics and gentle vibrations. Their launch on Amazon with a broader release scheduled for June highlights Graco’s strong e-commerce presence and ability to meet rising demand for smart, responsive baby gear. This innovation strengthens Graco’s competitive positioning by addressing the evolving needs of tech-savvy, safety-conscious parents

- In January 2024, Diono upgraded its flagship Radian line with the Radian 3RXT SafePlus Max, incorporating enhanced safety elements such as a 2-in-1 anti-rebound bar and calf support system. By integrating multi-mode versatility with travel-friendly design, Diono has improved its product appeal to modern families seeking both safety and convenience. This development enhances customer retention through product loyalty and also positions Diono to capture greater market share within the premium child safety seat segment. The upgrade demonstrates the brand’s strategy of continuous innovation to remain competitive in a crowded market

- In December 2023, Dorel Industries secured a USD 88 million senior secured term loan facility to bolster its financial standing and operational flexibility. This strategic funding provides the company with essential capital to support growth initiatives within its juvenile and home products divisions. For the child safety seat market, the strengthened financial position enables Dorel to enhance product development, expand distribution networks, and improve competitive resilience against global players. This financial move demonstrates Dorel’s commitment to sustaining long-term growth and innovation despite challenging market conditions

- In June 2023, Evenflo expanded its Revolve360 product line by launching the Revolve360 Extend Rotational All-In-One Convertible Car Seat and the Revolve360 Slim 2-in-1 Rotational Car Seat with SensorSafe technology. These additions respond to consumer demand for advanced safety features and convenience, including extended rear-facing support up to 50 lbs and compact design compatibility. The inclusion of SensorSafe technology caters to modern parents seeking tech-enabled safety solutions. This expansion reinforces Evenflo’s leadership in the rotational seat segment, broadening its consumer base and strengthening its competitive advantage in advanced child safety solutions

- In January 2023, babyark introduced its convertible car seat at CES 2023, showcasing cutting-edge integration of advanced materials and IoT-driven safety technology. Designed by aeronautical engineer Shy Mindel, the product provides real-time alerts and ensures proper installation, addressing a critical parental concern. This innovation positions babyark as a disruptive entrant in the child safety seat market, appealing to tech-savvy parents seeking superior protection and user assurance. By merging aerospace engineering with child safety, babyark establishes a distinctive market identity, likely to influence future product development trends across the industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.