Europe Coagulationhemostasis Analyzer Market

Market Size in USD Billion

CAGR :

%

USD

2.87 Billion

USD

6.10 Billion

2025

2033

USD

2.87 Billion

USD

6.10 Billion

2025

2033

| 2026 –2033 | |

| USD 2.87 Billion | |

| USD 6.10 Billion | |

|

|

|

|

Europe Coagulation/Haemostasis Analyser Market Size

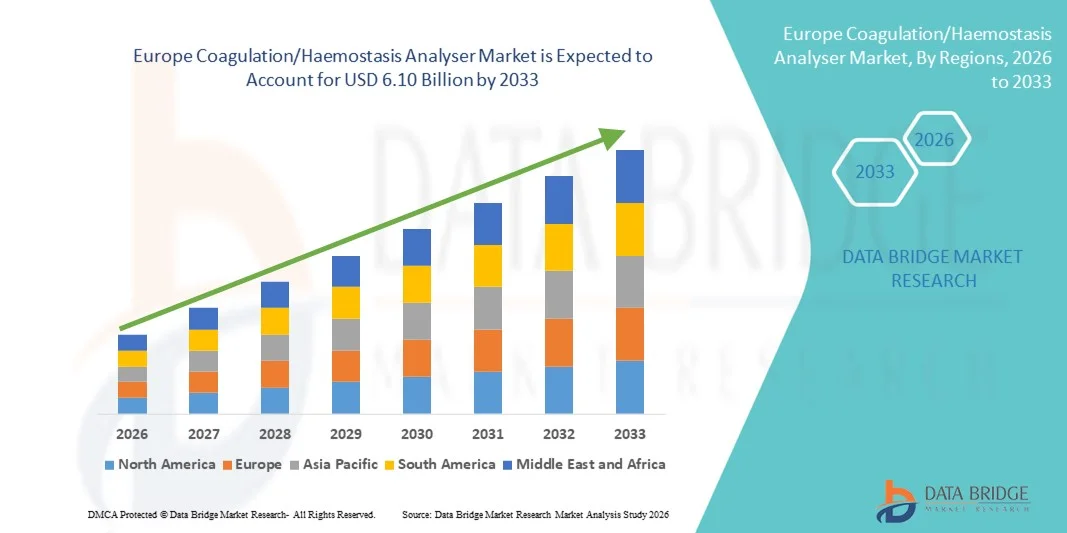

- The Europe coagulation/haemostasis analyser market size was valued at USD 2.87 billion in 2025 and is expected to reach USD 6.10 billion by 2033, at a CAGR of 9.90% during the forecast period

- The market growth is largely driven by rising prevalence of cardiovascular and blood disorders, an ageing population, and ongoing technological advancements in diagnostic analyzers factors that are boosting adoption of sophisticated coagulation and hemostasis testing across clinical laboratories and hospital networks in countries such as Germany, the UK and France

- Furthermore, increasing demand for rapid, accurate, and automated coagulation testing solutions, together with strong healthcare infrastructure and regulatory support within Europe, is establishing advanced analyzers as essential tools in diagnostic workflows thereby significantly accelerating market growth across the region

Europe Coagulation/Haemostasis Analyser Market Analysis

- Coagulation/haemostasis analyzers, providing automated testing for blood clotting and related disorders, are increasingly critical components of modern diagnostic laboratories and hospital workflows in Europe due to their enhanced accuracy, rapid turnaround times, and seamless integration with laboratory information systems

- The rising demand for coagulation analyzers is primarily fueled by the growing prevalence of cardiovascular and blood-related disorders, increasing geriatric population, and a preference for automated, reliable, and high-throughput diagnostic solutions

- Germany dominated the market with the largest revenue share of 28.5% in 2025, supported by advanced healthcare infrastructure, strong regulatory frameworks, and early adoption of automated laboratory systems, with hospitals and clinical laboratories leading in analyzer installations driven by innovations from established medical device manufacturers

- Poland is expected to be the fastest-growing country during the forecast period due to rising healthcare spending, expanding hospital networks, and increasing investments in modern diagnostic technologies

- Clinical laboratory analyzers segment dominated the market in 2025 with a share of 61.4%, driven by their ability to perform multiple tests such as Activated Partial Thromboplastin Time, Prothrombin Time, D-Dimer, and Platelet Function tests efficiently, meeting the high throughput demands of hospitals and diagnostic laboratories across Europe

Report Scope and Europe Coagulation/Haemostasis Analyser Market Segmentation

|

Attributes |

Europe Coagulation/Haemostasis Analyser Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Coagulation/Haemostasis Analyser Market Trends

Automation and Integration with Laboratory Information Systems

- A key and accelerating trend in the European coagulation/haemostasis analyzer market is the increasing automation of testing workflows and integration with laboratory information systems (LIS) to enhance operational efficiency, reduce human error, and streamline diagnostic reporting

- For instance, Sysmex CS-2500 analyzers integrate seamlessly with LIS platforms, allowing automatic test result transfer and real-time quality control monitoring, significantly improving laboratory throughput and reliability

- Automation in analyzers enables features such as multi-test capabilities in a single run, predictive maintenance alerts, and real-time sample tracking, which enhance laboratory productivity and reduce turnaround times

- The integration of analyzers with LIS facilitates centralized management of patient data, automated reporting, and improved data analytics, allowing clinical laboratories to optimize resource allocation and enhance diagnostic decision-making

- This trend towards intelligent, automated, and connected coagulation testing is reshaping expectations for laboratory diagnostics, with companies such as Instrumentation Laboratory developing analyzers with automated sample handling and advanced connectivity features

- The demand for analyzers with automated and integrated capabilities is rising rapidly across hospitals and clinical laboratories, as institutions increasingly prioritize efficiency, accuracy, and seamless digital workflows

- Integration with cloud-based platforms is gaining traction, allowing laboratories to monitor analyzer performance remotely and perform predictive maintenance for uninterrupted operation

Europe Coagulation/Haemostasis Analyser Market Dynamics

Driver

Rising Prevalence of Blood Disorders and Need for Accurate Diagnostics

- The increasing prevalence of cardiovascular diseases, hemophilia, and other blood disorders, along with growing awareness about clotting risks, is a significant driver of coagulation analyzer demand

- For instance, in March 2025, Siemens Healthineers launched the Atellica COAG 360 System to address high-throughput laboratory needs for accurate coagulation and hemostasis testing, highlighting technological advancement as a growth factor

- As hospitals and diagnostic centers seek more reliable and high-throughput testing solutions, coagulation analyzers provide rapid, accurate, and reproducible results, improving patient care and clinical decision-making

- Furthermore, adoption of modern laboratory automation and demand for integrated diagnostic workflows are making analyzers essential tools in clinical laboratories across Germany, France, and the UK

- The ability to perform multiple test types such as Activated Partial Thromboplastin Time, Prothrombin Time, D-Dimer, and Platelet Function assays with minimal manual intervention is driving analyzer adoption across Europe

- For instance, the growing number of cardiovascular and orthopedic surgeries requiring perioperative coagulation monitoring is boosting demand for analyzers in hospital settings

- Increasing awareness of personalized medicine and anticoagulant therapy monitoring is driving demand for analyzers capable of precise and rapid test results to optimize patient treatment

Restraint/Challenge

High Equipment Cost and Technical Expertise Requirements

- The relatively high cost of advanced coagulation analyzers, especially automated and multi-test systems, can limit adoption in smaller laboratories or budget-constrained healthcare settings across Europe

- For instance, high acquisition and maintenance costs of systems such as the ACL TOP Family analyzers make some laboratories hesitant to upgrade from legacy testing equipment despite performance advantages

- The requirement for trained technical personnel to operate, calibrate, and maintain complex analyzers adds to operational challenges and can slow adoption in hospitals with limited staff resources

- Furthermore, ongoing software updates, quality control management, and troubleshooting necessitate continuous investment in staff training, which may be a barrier for some clinical laboratories

- Overcoming these challenges through cost-effective solutions, simplified operation protocols, and staff training programs will be crucial to sustain market growth and broader analyzer adoption in Europe

- For instance, some laboratories in Eastern Europe continue to rely on manual coagulation testing due to budget constraints, limiting the market penetration of automated analyzers

- The need for compliance with stringent European regulatory standards for medical devices adds complexity and can delay product launches, particularly for newer or smaller market entrants

Europe Coagulation/Haemostasis Analyser Market Scope

The market is segmented on the basis of type of test, product, technology, and end use.

- By Type of Test

On the basis of type of test, the Europe coagulation/haemostasis analyser market is segmented into activated clotting time, activated partial thromboplastin time, d-dimer testing, platelet function test, prothrombin time testing, anti-factor XA test, heparin, protamine dose-response test, fibrinogen testing, and others. The Activated Partial Thromboplastin Time (aPTT) segment dominated the market with the largest revenue share in 2025, driven by its widespread use in monitoring anticoagulant therapy and assessing intrinsic pathway clotting disorders. Clinical laboratories across Germany, France, and the UK prioritize aPTT testing due to its accuracy, rapid turnaround, and integration into automated analyzers, enabling high-throughput sample processing. Hospitals and diagnostic centers frequently rely on aPTT assays to optimize patient treatment plans, particularly for those on heparin therapy. The strong regulatory approvals and standardized testing protocols across Europe further support the segment’s dominance. In addition, the demand for comprehensive patient monitoring in perioperative and critical care settings reinforces the preference for aPTT testing. Instrumentation Laboratory, Siemens Healthineers, and Roche Diagnostics are key players offering analyzers with high aPTT throughput and automation capabilities.

The D-Dimer testing segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing incidence of thromboembolic disorders such as deep vein thrombosis and pulmonary embolism. Growing awareness of rapid diagnostic needs in emergency departments and critical care units is driving demand for D-Dimer tests. The integration of D-Dimer assays into automated coagulation analyzers provides real-time results, enabling faster clinical decision-making. Moreover, D-Dimer testing is increasingly used in combination with imaging to reduce unnecessary diagnostic procedures. The growth is further supported by rising adoption of point-of-care (POC) D-Dimer analyzers for bedside testing. Manufacturers are developing sensitive and rapid D-Dimer assays compatible with both hospital and outpatient laboratory settings.

- By Product

On the basis of product, the Europe coagulation/haemostasis analyser market is segmented into Point-of-Care (POC) testing analysers and clinical laboratory analysers. The Clinical Laboratory Analyser segment dominated the market in 2025 with the largest revenue share of 61.4%, driven by high-throughput testing requirements in hospitals and diagnostic labs. These analyzers perform multiple tests simultaneously, including PT, aPTT, D-Dimer, and Platelet Function tests, reducing manual intervention and improving accuracy. Clinical laboratory analyzers are preferred for centralized testing workflows, enabling integration with laboratory information systems for automated data reporting and quality control. Countries such as Germany, the UK, and France have well-established clinical labs equipped with such analyzers, further reinforcing market dominance. The segment benefits from continuous technological upgrades, including automation, multi-test platforms, and predictive maintenance alerts. Leading players, such as Roche Diagnostics and Siemens Healthineers, offer systems tailored to handle high patient volumes efficiently.

The POC Testing Analyser segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing demand for rapid bedside diagnostics in emergency rooms, intensive care units, and outpatient settings. POC analyzers offer real-time coagulation monitoring, enabling immediate clinical decision-making for critical patients. Rising awareness about thromboembolic disorders and the need for prompt diagnosis is accelerating adoption. Portability, ease of use, and integration with hospital networks are key features attracting hospitals and clinics to POC solutions. The segment’s growth is further propelled by miniaturization of analyzers and improved accuracy in small sample testing. Companies such as Instrumentation Laboratory are developing advanced POC analyzers to meet rising European demand.

- By Technology

On the basis of technology, the Europe coagulation/haemostasis analyser market is segmented into electrochemical, optical, and mechanical analyzers. The Optical segment dominated the market in 2025 with the largest revenue share, driven by its precise detection of clot formation and reliable automation for various coagulation tests. Optical analyzers are widely adopted in hospital laboratories due to their high sensitivity, reproducibility, and ability to process multiple sample types. European laboratories prefer optical systems for routine PT, aPTT, and fibrinogen testing due to standardized protocols and regulatory compliance. Integration with LIS and automated quality control makes optical analyzers suitable for high-throughput testing. Major players such as Siemens Healthineers and Roche Diagnostics have invested in optical technology to enhance accuracy and workflow efficiency. The segment also benefits from continuous software upgrades and connectivity features for better lab management.

The Electrochemical segment is expected to witness the fastest growth from 2026 to 2033, fueled by innovations in biosensor technology and miniaturized platforms suitable for point-of-care testing. Electrochemical analyzers offer rapid results with high specificity for coagulation markers. Rising adoption in POC settings, emergency care, and smaller diagnostic labs is driving demand. These analyzers are gaining traction for their low sample volume requirements and portability. The ability to integrate with digital health platforms and enable remote monitoring further accelerates adoption. Leading manufacturers are focusing on electrochemical platforms to expand access to bedside testing in hospitals and clinics.

- By End Use

On the basis of end use, the Europe coagulation/haemostasis analyser market is segmented into clinical laboratories and Point-of-Care (POC) settings. The Clinical Laboratory segment dominated the market in 2025 with the largest revenue share, driven by the growing number of hospitals, diagnostic centers, and specialized hematology labs across Europe. These laboratories rely on high-throughput, automated analyzers to perform comprehensive testing for PT, aPTT, D-Dimer, and platelet function, ensuring accurate diagnosis and patient monitoring. Strong healthcare infrastructure in countries such as Germany, the UK, and France supports continued dominance of clinical laboratories. Integration with LIS, multi-test capabilities, and advanced automation make clinical labs the preferred choice for large-scale coagulation testing. Leading players invest in clinical laboratory solutions to meet high-volume testing demands efficiently. The segment also benefits from regulatory approvals and standardized quality protocols.

The POC segment is expected to witness the fastest growth from 2026 to 2033, driven by rising demand for bedside coagulation testing in critical care, emergency, and outpatient settings. Rapid result generation enables timely clinical decisions, improving patient outcomes. Increasing awareness of thromboembolic and cardiovascular disorders encourages adoption of POC analyzers in hospitals and smaller clinics. Portability, user-friendly design, and integration with digital platforms enhance adoption across Europe. Manufacturers are developing innovative POC analyzers that provide accurate results with minimal operator intervention. Growing interest in decentralized diagnostics and emergency care applications further accelerates segment growth.

Europe Coagulation/Haemostasis Analyser Market Regional Analysis

- Germany dominated the market with the largest revenue share of 28.5% in 2025, supported by advanced healthcare infrastructure, strong regulatory frameworks, and early adoption of automated laboratory systems, with hospitals and clinical laboratories leading in analyzer installations driven by innovations from established medical device manufacturers

- Clinical laboratories and hospitals in the country highly prioritize accuracy, high-throughput testing, and integration with laboratory information systems (LIS), making coagulation analyzers a critical component of routine diagnostic workflows

- This widespread adoption is further supported by strong regulatory standards, availability of skilled laboratory personnel, and ongoing investment in modern diagnostic equipment, establishing Germany as the leading market for coagulation and hemostasis analyzers in Europe

The Germany Coagulation/Haemostasis Analyser Market Insight

The Germany coagulation/haemostasis analyser market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare infrastructure, well-established hospital networks, and high investment in modern diagnostic technologies. German hospitals and laboratories prioritize accuracy, automation, and multi-test throughput, making coagulation analyzers critical for routine patient care. Increasing awareness of anticoagulant therapy monitoring and perioperative coagulation management is driving the adoption of automated analyzers. Integration with LIS and clinical decision support systems further enhances workflow efficiency and regulatory compliance. Moreover, Germany’s emphasis on innovation and precision medicine supports market growth, with hospitals and diagnostic centers seeking reliable, high-performance analyzers.

UK Coagulation/Haemostasis Analyser Market Insight

The UK coagulation/haemostasis analyser market is anticipated to grow at a noteworthy CAGR, driven by rising prevalence of blood disorders and the increasing adoption of automated laboratory solutions in hospitals and diagnostic centers. Concerns regarding timely diagnosis and accurate monitoring of thromboembolic events encourage healthcare providers to invest in high-throughput coagulation analyzers. The integration of analyzers with digital laboratory networks and LIS enhances efficiency and patient management. Increasing government support for modern healthcare infrastructure, alongside strong clinical research initiatives, is stimulating market growth. Furthermore, the UK’s adoption of point-of-care (POC) testing solutions is expanding rapidly in emergency and critical care settings.

France Coagulation/Haemostasis Analyser Market Insight

The France coagulation/haemostasis analyser market is expected to expand steadily during the forecast period, driven by growing demand for automated and reliable coagulation testing in hospitals and diagnostic labs. Rising awareness of cardiovascular and thromboembolic disorders is increasing the need for accurate monitoring, particularly for patients on anticoagulant therapy. French healthcare providers are investing in advanced multi-test analyzers to improve diagnostic turnaround time and laboratory efficiency. Integration with LIS and data management platforms enables streamlined reporting and quality control. Moreover, government initiatives promoting modernization of clinical laboratories and adherence to strict regulatory standards further support market adoption.

Poland Coagulation/Haemostasis Analyser Market Insight

The Poland coagulation/haemostasis analyser market is anticipated to witness the fastest growth during the forecast period, fueled by expanding hospital networks, increasing healthcare expenditure, and modernization of diagnostic laboratory infrastructure. Rising awareness of cardiovascular and blood disorders is driving demand for automated analyzers with rapid, reliable test results. The adoption of multi-test analyzers capable of PT, aPTT, D-Dimer, and platelet function testing is increasing in both public and private hospitals. Integration with laboratory information systems and training of technical staff are contributing to efficient workflow adoption. Moreover, growing government support for diagnostic equipment upgrades and investment in point-of-care testing is boosting market expansion in Poland.

Europe Coagulation/Haemostasis Analyser Market Share

The Europe Coagulation/Haemostasis Analyser industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- Sysmex Corporation (Japan)

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Diagnostica Stago SAS (France)

- Werfen (Spain)

- NIHON KOHDEN CORPORATION (Japan)

- Helena Laboratories Corporation (U.S.)

- Beckman Coulter, Inc. (U.S.)

- Grifols, S.A. (Spain)

- HORIBA, Ltd. (Japan)

- Mindray Medical International Limited (China)

- Rayto Life and Analytical Sciences (China)

- International Technidyne Corporation (U.S.)

- EKF Diagnostics Holdings plc (U.K.)

- Microvisk Ltd (U.K.)

- Medtronic (Ireland)

- Randox Laboratories Ltd (U.K.)

- Diasorin S.p.A. (Italy)

What are the Recent Developments in Europe Coagulation/Haemostasis Analyser Market?

- In September 2025, CoaguSense received European approval for its Coag‑Sense PT/INR Monitoring System, expanding patient self‑testing access (including in Europe) and intensifying competition in point‑of‑care coagulation monitoring beyond traditional lab setting

- In July 2025, Werfen unveiled next‑generation ACL TOP hemostasis testing systems at the ADLM Annual Meeting 2025, reinforcing its innovation leadership in specialized coagulation diagnostics with enhanced workflow automation and expanded commercialization of advanced systems in Europe

- In April 2024, Siemens Healthineers integrated its hemostasis product offerings in Europe, enabling independent distribution of hemostasis analyzers (such as CS‑2500, CS‑5100, CA‑600 series, CN‑3000/CN‑6000) under its own brand to streamline access for laboratories and improve workflow efficiency across EU countries

- In April 2024, Sysmex Corporation began independently selling its hemostasis instruments and reagents under the Sysmex brand in EU countries, transitioning from a long-standing OEM supply relationship with Siemens Healthineers to drive broader distribution and tailored solutions across European laboratories

- In February 2024, Roche Diagnostics launched three new Factor Xa inhibitor coagulation tests for direct oral anticoagulants such as apixaban, edoxaban, and rivaroxaban in CE‑marked European markets, enhancing clinical decision support for anticoagulant therapy monitoring

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.