Europe Cocoa Market

Market Size in USD Billion

CAGR :

%

USD

10.89 Billion

USD

16.24 Billion

2024

2032

USD

10.89 Billion

USD

16.24 Billion

2024

2032

| 2025 –2032 | |

| USD 10.89 Billion | |

| USD 16.24 Billion | |

|

|

|

|

Europe Cocoa Market Size

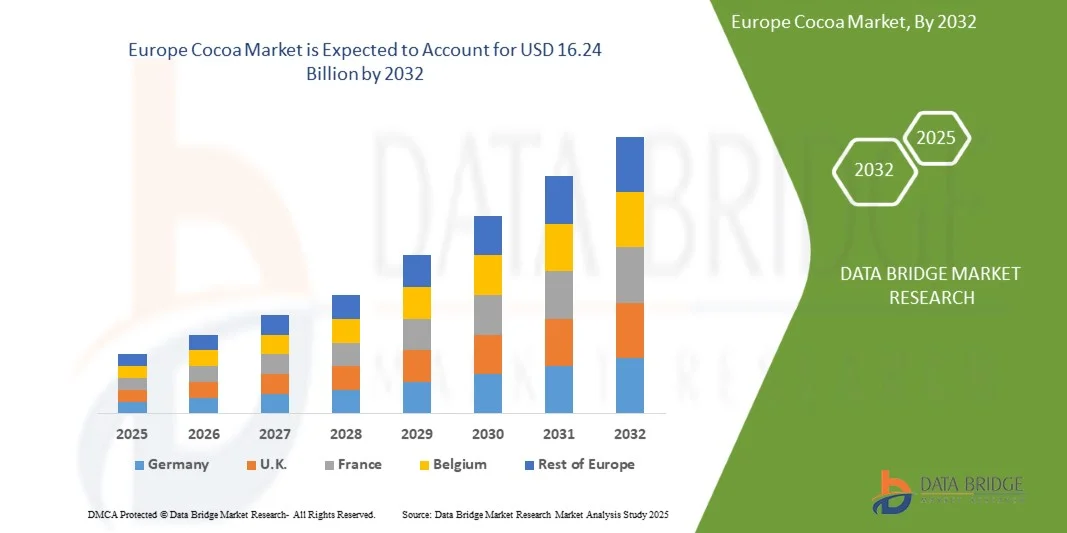

- The Europe Cocoa Market was valued at USD 10.89 billion in 2024 and is expected to reach USD 16.24 billion by 2032, at a CAGR of 5.2% during the forecast period

- The market growth is largely fueled by the rising consumer demand for premium, organic, and sustainably sourced cocoa products, driven by increasing awareness of health benefits associated with dark chocolate and flavonoid-rich cocoa. The growing preference for clean-label and ethically produced ingredients is encouraging manufacturers to adopt transparent and traceable supply chains, thereby enhancing consumer trust and brand value

- Furthermore, expanding applications of cocoa across confectionery, beverages, cosmetics, and nutraceuticals, coupled with ongoing innovations in product formulations such as plant-based and low-sugar chocolate variants, are accelerating market adoption. These converging factors are significantly boosting the cocoa industry's growth and positioning it as a key segment within the food and beverage domain

Europe Cocoa Market Analysis

- The Europe Cocoa Market is significantly driven by the rising demand for chocolate and confectionery products across diverse consumer segments. Chocolate remains one of the most popular indulgence products worldwide, with consumption steadily increasing in both developed and emerging economies. Cocoa, being the primary raw material for chocolate production, experiences a direct surge in demand in line with the growing chocolate industry. Factors such as evolving consumer lifestyles, increasing disposable incomes, and the expansion of premium and artisanal chocolate segments are further fuelling this trend

- Emerging trends include the rising demand for vegan and plant-based cocoa-based products, innovation in cocoa-based functional and fortified food products, and increasing popularity of single-origin and specialty cocoa varieties

- Germany is expected to dominate the Europe Cocoa Market, holding the largest market share of 24.63%% in 2025, attributed to increasing demand for vegan and plant-based cocoa-based products presents

- Germany is projected to be the fastest-growing country in the Europe Cocoa Market during the forecast period with a CAGR of 5.7%, driven by its rising popularity of cocoa-based beverages and wide range of beverage products, including traditional hot chocolate, ready-to-drink cocoa beverages, flavored milk, protein shakes, and functional wellness drinks

- The cocoa powder & cake segment is expected to dominate the Europe Cocoa Market, with a market share of 35.06% in 2025, owing to the expanding application of cocoa in cosmetics and personal care products

Report Scope and Europe Cocoa Market Segmentation

|

Attributes |

Cocoa Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Cocoa Market Trends

“Rising Demand for Chocolate and Confectionery Products”

- One prominent trend in the Europe Cocoa Market is significantly driven by the rising demand for chocolate and confectionery products across diverse consumer segments.

- Cocoa, being the primary raw material for chocolate production, experiences a direct surge in demand in line with the growing chocolate industry. Factors such as evolving consumer lifestyles, increasing disposable incomes, and the expansion of premium and artisanal chocolate segments are further fueling this trend.

- Product innovation by confectionery manufacturers, including the introduction of exotic flavors, functional chocolates with health benefits, and sustainable sourcing claims, has broadened consumer appeal.

Europe Cocoa Market Dynamics

Driver

“Growing Awareness of Cocoa’s Health and Antioxidant Benefits”

- One of the key trends propelling the Europe Cocoa Market is the increasing awareness of cocoa’s health-promoting properties has emerged as a strong driver for the market

- Cocoa is naturally rich in flavonoids, polyphenols, and other antioxidants that are linked to various health benefits, including improved cardiovascular health, better blood circulation, and reduced risk of chronic diseases.

- For instance, in November 2024, University of Birmingham researchers revealed that consuming high-flavanol cocoa after a high-fat meal greatly enhanced blood flow and vascular performance for up to 90 minutes, even during mental stress, suggesting a protective role for cardiovascular health in challenging dietary conditions

- The wellness trend, coupled with the rise of preventive healthcare, is expanding cocoa’s applications into categories such as cocoa-based beverages, protein powders, and beauty-from-within products. As consumers become more informed about the nutritional value of cocoa, the market is expected to benefit from sustained demand, creating new growth avenues across multiple industries beyond traditional chocolate manufacturing.

- Manufacturers are capitalizing on this awareness by promoting “dark chocolate” and “high cocoa content” products, which contain higher levels of beneficial compounds compared to milk chocolate

Opportunities

“Rising Demand for Vegan and Plant-Based Cocoa-Based Products”

- Growing adoption of vegan and plant-based lifestyles, driven by ethical, environmental, and health factors, is boosting demand for dairy-free cocoa-based products.

- Cocoa, being naturally plant-derived, aligns well with vegan trends in confectionery, bakery, and beverage industries.

- Product innovations such as dairy-free dark chocolates, plant-based cocoa beverages, and vegan-friendly cocoa spreads are gaining popularity.

- The rise of plant-based milk alternatives (almond, oat, and soy milk) supports the development of creamy, indulgent cocoa-based drinks without dairy.

- In 2023, Barry Callebaut reported strong traction for vegan chocolate brands using cocoa butter and plant milks, appealing to health- and sustainability-conscious consumers.

- Premium brands are offering ethically sourced, organic, and sustainably packaged vegan cocoa products, particularly thriving in Europe

Restraint/Challenge

“Growing Competition from Alternative Ingredients in Confectionery Production”

- One of the key restraints impacting the Europe Cocoa Market is the growing competition from alternative ingredients used in confectionery production. Rising cocoa prices, coupled with supply uncertainties caused by climate change and crop diseases, have encouraged manufacturers to explore cost-effective substitutes.

- Ingredients such as carob, synthetic cocoa flavors, and other plant-based alternatives are increasingly being adopted to partially or completely replace cocoa in chocolate, bakery, and beverage applications.

- Advanced food technology has enabled the development of cocoa flavor mimetics and blends that use less cocoa while maintaining taste and texture. This shift is particularly noticeable among mass-market confectionery brands seeking to maintain competitive pricing without compromising consumer appeal.

- While these alternatives may not fully replicate the premium qualities of cocoa, their increasing acceptance in certain consumer segments poses a challenge for cocoa demand.

Europe Cocoa Market Scope

The Europe Cocoa Market is segmented into product type, nature, types of cocoa, distribution channel, and application.

- Product Type

On the basis of product type, the market is segmented into cocoa powder & cake, cocoa butter, cocoa beans, cocoa liquor & paste, cocoa nibs, others. In 2025, the cocoa powder & cake segment is expected to dominate the market with a market share of 35.06%. The dominance of the cocoa powder & cake segment can be attributed to its widespread use in chocolate manufacturing, bakery applications, and beverage formulations. Its ease of storage, long shelf life, and compatibility with large-scale production processes make it highly preferred among food processors.

The cocoa beans segment is projected to grow with the highest CAGR of 6.1% during the forecast period due to rising demand for premium and single-origin chocolates, increasing use of raw cocoa in artisanal and craft applications, and growing consumer preference for minimally processed, natural ingredients.

- Nature

On the basis of nature, the market is segmented into conventional, organic. In 2025, the conventional segment is expected to dominate the market with a share of 93.07%. The dominance of the conventional segment is primarily driven by its cost efficiency, established supply chains, and large-scale production capabilities. Conventional cocoa offers consistent quality, making it ideal for manufacturers targeting mass-market applications.

The organic segment is anticipated to grow with the highest CAGR of 5.9% during the forecast period, owing to increasing consumer awareness of health and wellness.

- Type of Cocoa

On the basis of type of cocoa, the market is segmented into forastero cocoa, trinitario cocoa, criollo cocoa. In 2025, the forastero cocoa segment is expected to dominate with a market share of 82.91%. The dominance of the forastero cocoa segment can be attributed to its resilience, consistent quality, and suitability for mass production. Its regional cultivation footprint, supports economies of scale and meets the demands of large-scale chocolate producers. Its robustness also makes it less susceptible to disease, ensuring steady supply and affordability, driving their rapid adoption and consistent market growth

Forastero cocoa growing at the highest CAGR of 5.3% during the forecast period, due to its high yield, lower cost of production, and widespread cultivation.

- Distribution Channel

On the basis of distribution channel, the market is segmented into indirect, direct. In 2025, the Indirect segment is expected to dominate with a market share of 77.34%. The dominance of the Indirect segment is supported by the presence of established retail, wholesale, and distribution networks that facilitate access to cocoa products across both developed and emerging markets. Indirect channels offer better logistics, wider geographic coverage, and economies of scale especially for manufacturers distributing through supermarkets, wholesalers, and foodservice providers, driving their rapid adoption and consistent market growth.

The indirect segment is forecasted to grow with the highest CAGR of 5.7% during the forecast period, driven by the rapid expansion of e-commerce platforms and increasing demand for convenience.

- Application

On the basis of application, the market is segmented into dietary supplements, food and beverage, beverage, pharmaceuticals, personal care and cosmetics. In 2025, the dietary supplements segment is anticipated to dominate with a share of 37.53%. The dominance of the dietary supplements segment is attributed to the growing recognition of cocoa’s health benefits, including its antioxidant properties, mood-enhancing effects, and cardiovascular support. Cocoa-based supplements are increasingly integrated into health-conscious diets and functional nutrition products, particularly in developed markets where preventive wellness is a major trend, driving their rapid adoption and consistent market growth.

The food and beverage segment is expected to grow with the highest CAGR of 5.9% during the forecast period, driven by increasing demand for cocoa-based snacks, bakery products, and dairy alternatives.

Europe Cocoa Market Regional Analysis

- Germany is expected to dominate the Europe Cocoa Market, holding the largest revenue share of 24.63% in 2025, attributed to increasing demand for vegan and plant-based cocoa-based products presents.

- Germany is projected to be the fastest-growing country in the market during the forecast period with a CAGR of 5.7%, driven by its rising popularity of cocoa-based beverages and wide range of beverage products, including traditional hot chocolate, ready-to-drink cocoa beverages, flavored milk, protein shakes, and functional wellness drinks.

- The Europe Cocoa Market in the Europe region is experiencing steady growth due to several key factors. One of the primary drivers is the rising demand for cocoa-based products such as chocolate, confectionery, and bakery items, fueled by a growing urban population and increasing disposable incomes. As consumer preferences shift toward Western-style diets and indulgent foods, the consumption of chocolate and cocoa-infused products is becoming more widespread, particularly in urban centers across the region. Additionally, the expanding food and beverage industry, along with a growing interest in functional foods and dietary supplements, is further boosting cocoa usage in diverse applications. The region is also witnessing a rise in organic and ethically sourced cocoa, driven by growing health awareness and sustainability concerns among consumers. Moreover, advancements in supply chain infrastructure and increased investments in local cocoa processing facilities are supporting market growth by improving product availability and reducing dependency on imports.

Europe Cocoa Market Insight

Europe is expected to grow at a CAGR of 5.2% from 2025 to 2032, primarily driven by its high and consistent consumer demand for chocolate and cocoa-based products, supported by a deeply rooted chocolate culture and a highly developed food processing industry.

Germany Europe Cocoa Market Insights

Germany, remains to dominate the market by its high per capita chocolate consumption and well-established confectionery industry. Germany is home to some of the largest chocolate manufacturers in Europe and acts as a major processing and distribution hub. Germany is expected to be the fastest growing with CAGR 5.7% from 2025 to 2032, the surging demand for organic, fair-trade, and sustainably sourced cocoa products. German consumers are increasingly concerned about ethical sourcing, environmental sustainability, and the social impact of cocoa farming.

Netherlands Europe Cocoa Market Insights

Netherlands remains a key player in the Europe Cocoa Market due to its position as the largest cocoa bean importer and processor in the world. The Port of Amsterdam serves as a critical gateway for cocoa imports into Europe, making the country a major hub for cocoa trade, storage, and processing. The Netherlands is expected to register steady growth with a CAGR of 5.5% from 2025 to 2032, driven by increasing investments in sustainable cocoa sourcing, innovation in cocoa-based ingredients, and strong demand from food and beverage manufacturers across Europe. Dutch companies are leading global efforts in traceability and ethical sourcing, aligning with consumer preferences for transparency, fair trade, and environmental responsibility.

Europe Cocoa Market Share

The cocoa industry is primarily led by well-established companies, including:

- Neogric Limited (U.K.)

- Macofa Chocolate factory (India)

- Toutan S.A (France)

- Olam International Limited (Singapore)

- Blommer Chocolate Company (U.S.)

- Deprama Cocoa (Indonesia)

- PT GRAND KAKAO INDONESIA (Indonesia)

- Jaya Saliem Industri (Indonesia)

- INDCRE S.A (Spain)

- PT ANDOW NGENSOWIDJAJA (Indonesia)

- INDOCOCOA (PT KENDO AGRI NUSANTARA) (Indonesia)

- Guan Chong Berhad (Malaysia)

- ECUAKAO GROUP LTD (Ecuador)

- CocoaCraft (India)

- Sucden (France)

- Cargill, Incorporated (U.S.)

- Cocoa Processing Company Limited (CPC) (Ghana)

- Uncommon Cacao (U.S.)

- Puratos (Belgium)

- ECOM Agroindustrial Corp. Limited (Switzerland)

- Kokoa Kamili (Tanzania)

- Barry Callebaut (Switzerland)

- JB Cocoa (Malaysia)

- Cocoa Hub (U.K.)

- Duc d’O (Part of the Baronie.com group) (Belgium)

- Natra (Spain)

- MONER COCOA, S.A. (Spain)

- Pacari Chocolate (Ecuador)

- Icam Spa (Italy)

- ALTINMARKA (Turkey)

Latest Developments in Europe Cocoa Market

- In October 2024, ICAM Cioccolato has launched a redesigned e-shop built on Shopify, offering a mobile-friendly, intuitive, and secure shopping experience. The platform showcases ICAM, Vanini, and Otto products while emphasizing sustainability and inclusivity. Featuring customer profiling for personalized marketing, the project was developed with Ecommerce School and supported by promotional campaigns to boost visibility and online sales.

- In June 2025, Kokoa Kamili, operating in Tanzania’s Kilombero Valley since 2013, reaffirmed its mission to position the country as a Europe leader in fine-flavor cocoa. Co-founder Siman Bindra emphasized that while Tanzania produces only about 14,000 tons annually—far below major producers like Ivory Coast and Ghana—the nation’s strength lies in its genetics, climate, and quality. Kokoa Kamili partners with 1,500 organic-certified farmers, has distributed over 600,000 seedlings, and is developing grafting programs from top-yielding, high-flavor trees. The company has won the Cocoa of Excellence award three times and seeks International Cocoa Organization recognition for its fine-flavor status to secure higher prices for all Tanzanian cocoa. Facing climate change challenges, Kokoa Kamili explores solar-powered irrigation and calls for national irrigation strategies to include cocoa. Bindra also aims to break the misconception that Africa produces only bulk, low-quality cocoa, stressing Tanzania’s proven excellence in premium markets.

- In March 2025, Natra Cacao S.L. launched a project, supported by the European Regional Development Fund (FEDER) and the Valencian Agency of Innovation, to develop fermented products analogous to cocoa for chocolate production. The initiative explores alternative plant-based raw materials with the same organoleptic profile and functionality as fermented cocoa, aiming to create value-added products with health benefits, shorter and more resilient supply chains, and reduced dependence on volatile Europe Cocoa Markets. The project also seeks to lower carbon footprint, mitigate deforestation risks, and drive innovation across the Natra group’s value chain.

- In June 2025, Touton showcases how collaboration, operational intelligence, and targeted innovation have driven meaningful results in forest protection, sustainable production, and community engagement in the 2023-2024 crop year. The report highlights achievements such as the distribution of hundreds of thousands of improved cocoa and multi-purpose trees in Ghana and Côte d'Ivoire, and the training of over 112,000 farmers in climate-smart practices.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES

4.2 IMPORT EXPORT SCENARIO

4.3 PRICING ANALYSIS

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.6 VALUE CHAIN ANALYSIS

4.7 VENDOR SELECTION CRITERIA

4.7.1 SOURCE: DBMR ANALYSIS

4.7.2 PRODUCT QUALITY AND CERTIFICATION

4.7.3 SOURCING AND TRACEABILITY

4.7.4 PRICING AND COST COMPETITIVENESS

4.7.5 SUSTAINABILITY AND ETHICAL PRACTICES

4.7.6 PRODUCTION CAPACITY AND RELIABILITY

4.7.7 COMPLIANCE WITH REGULATIONS

4.7.8 LOGISTICS AND SUPPLY CHAIN EFFICIENCY

4.7.9 REPUTATION AND REFERENCES

4.8 BRAND OUTLOOK

4.8.1 MARKET ROLES & POSITIONING (WHO PLAYS WHICH ROLE?)

4.8.2 PRODUCT & PACKAGING DIFFERENCES

4.8.3 SUSTAINABILITY & FARMER PROGRAMS (CRITICAL FOR REPUTATION & SUPPLY SECURITY)

4.8.4 STRENGTHS, COMPETITIVE EDGES, AND CUSTOMER FIT

4.8.5 RISKS & MARKET PRESSURES (INDUSTRY-WIDE)

4.8.6 STRATEGIC TAKEAWAYS FOR REPORT READERS

4.8.7 WHY THIS LAYOUT?

4.8.8 BARRY CALLEBAUT — FULL-SPECTRUM CHOCOLATE LEADER

4.8.9 CARGILL — CUSTOM SOLUTIONS + INDUSTRY SCALE

4.8.10 OLAM — ORIGINATION & PROCESSING BACKBONE

4.8.11 GUAN CHONG (GCB) — EFFICIENT PROCESSOR

4.8.12 BLOMMER — NORTH AMERICA PROCESSOR & SERVICE

4.9 CONSUMER BUYING BEHAVIOUR

4.9.1 PROBLEM RECOGNITION AND AWARENESS

4.9.2 INFORMATION SEARCH

4.9.3 EVALUATION OF ALTERNATIVES

4.9.4 PURCHASE DECISION

4.9.5 POST-PURCHASE BEHAVIOUR

4.9.6 DEMOGRAPHIC INSIGHTS

4.9.7 CONCLUSION

4.1 COST ANALYSIS BREAKDOWN

4.10.1 INITIAL INVESTMENT AND CAPITAL EXPENDITURE (CAPEX)

4.10.2 INSTALLATION AND INFRASTRUCTURE ADAPTATION

4.10.3 ENERGY CONSUMPTION AND OPERATIONAL COST (OPEX)

4.10.4 MAINTENANCE AND SERVICING

4.10.5 OVERHEAD AND INDIRECT COSTS

4.10.6 STRATEGIC INVESTMENT CONSIDERATIONS

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.1.1 JOINT VENTURES

4.11.1.2 MERGERS AND ACQUISITIONS

4.11.1.3 LICENSING AND PARTNERSHIP

4.11.1.4 TECHNOLOGY COLLABORATIONS

4.11.1.5 STRATEGIC DIVESTMENTS

4.11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.11.3 STAGE OF DEVELOPMENT

4.11.4 TIMELINES AND MILESTONES

4.11.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.11.6 RISK ASSESSMENT AND MITIGATION

4.11.7 FUTURE OUTLOOK

4.12 PROFIT MARGINS SCENARIO

4.12.1 FACTORS INFLUENCING PROFITABILITY

4.12.2 VALUE ADDITION:

4.12.3 QUALITY & CERTIFICATION:

4.12.4 MARKET DEMAND:

4.12.5 BUSINESS MODEL:

4.13 RAW MATERIAL COVERAGE

4.13.1 COCOA BEANS (PRIMARY RAW MATERIAL)

4.13.2 SUGAR (SWEETENING AGENT)

4.13.3 COCOA BUTTER (FAT COMPONENT)

4.13.4 MILK POWDER (DAIRY INGREDIENT)

4.13.5 LECITHIN (EMULSIFIER)

4.14 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURER

4.14.1 ADVANCED COCOA BEAN ROASTING TECHNOLOGIES

4.14.2 AUTOMATED COCOA PROCESSING AND PRODUCTION SYSTEMS

4.14.3 AI-DRIVEN QUALITY CONTROL AND DEFECT DETECTION

4.14.4 ENERGY-EFFICIENT GRINDING AND CONCHING EQUIPMENT

4.14.5 SMART PACKAGING AND SHELF-LIFE EXTENSION SOLUTIONS

4.14.6 DIGITAL SUPPLY CHAIN AND TRACEABILITY INTEGRATION

4.15 PATENT ANALYSIS –

4.15.1 PATENT QUALITY AND STRENGTH

4.15.2 PATENT FAMILIES

4.15.3 NUMBER OF INTERNATIONAL PATENT FAMILIES BY PUBLICATION YEAR

4.15.4 REGION PATENT LANDSCAPE

4.15.5 IP STRATEGY AND MANAGEMENT

4.15.6 PATENT ANALYSIS – TOP APPLICANTS

5 TARIFFS & IMPACT ON THE EUROPE COCOA MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCE ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATION COVERAGE

7 BEANS AND RATIOS FOR HISTORY AND FORECAST AND WITH CONCRETE DATA

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING DEMAND FOR CHOCOLATE AND CONFECTIONERY PRODUCTS

8.1.2 GROWING AWARENESS OF COCOA’S HEALTH AND ANTIOXIDANT BENEFITS

8.1.3 EXPANDING USE OF COCOA IN COSMETICS AND PERSONAL CARE

8.1.4 GROWTH IN COCOA-BASED BEVERAGES

8.2 RESTRAINTS

8.2.1 GROWING COMPETITION FROM ALTERNATIVE INGREDIENTS IN CONFECTIONERY PRODUCTION

8.2.2 STRINGENT REGULATORY STANDARDS FOR COCOA QUALITY AND SAFETY COMPLIANCE

8.3 OPPORTUNITIES

8.3.1 RISING DEMAND FOR VEGAN AND PLANT-BASED COCOA-BASED PRODUCTS

8.3.2 INNOVATION IN COCOA-BASED FUNCTIONAL AND FORTIFIED FOOD PRODUCTS

8.3.3 INCREASING POPULARITY OF SINGLE-ORIGIN AND SPECIALTY COCOA VARIETIES

8.4 CHALLENGE

8.5 CLIMATE CHANGE REDUCING COCOA YIELDS AND AFFECTING QUALITY

8.5.1 LIMITED FARMER ACCESS TO MODERN FARMING TOOLS AND TRAINING

9 EUROPE COCOA MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 COCOA POWDER & CAKE

9.3 COCOA BUTTER

9.4 COCOA BEANS

9.5 COCOA LIQUOR & PASTE

9.6 COCOA NIBS

9.7 OTHERS

10 EUROPE COCOA MARKET, BY NATURE

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 EUROPE COCOA MARKET, BY TYPE OF COCOA

11.1 OVERVIEW

11.2 FORASTERO COCOA

11.3 TRINITARIO COCOA

11.4 CRIOLLO COCOA

12 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 INDIRECT

12.3 DIRECT

13 EUROPE COCOA MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 DIETARY SUPPLEMENTS

13.3 FOOD AND BEVERAGE

13.4 BEVERAGE

13.5 PHARMACEUTICALS

13.6 PERSONAL CARE AND COSMETICS

14 EUROPE COCOA MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 NETHERLANDS

14.1.3 FRANCE

14.1.4 U.K.

14.1.5 BELGIUM

14.1.6 ITALY

14.1.7 SWITZERLAND

14.1.8 SPAIN

14.1.9 POLAND

14.1.10 RUSSIA

14.1.11 TURKEY

14.1.12 SWEDEN

14.1.13 DENMARK

14.1.14 NORWAY

14.1.15 FINLAND

14.1.16 REST OF EUROPE

15 EUROPE COCOA MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 OLAM GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 RECENT FINANCIALS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT UPDATES

17.2 BARRY CALLEBAUT

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 ECOM AGROINDUSTRIAL CORP. LIMITED.

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS/NEWS

17.4 PURATOS

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 GUAN CHONG BERHAD (GCB)

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS/NEWS

17.6 JB COCOA

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 RECENT DEVELOPMENT

17.7 ALTINMARKA

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT UPDATES

17.8 BLOMMER CHOCOLATE COMPANY

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 CARGILL, INCORPORATED.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 COCOA HUB

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS/NEWS

17.11 COCOA PROCESSING COMPANY LIMITED (CPC)

17.11.1 COMPANY SNAPSHOT

17.11.2 RECENT FINANCIALS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT UPDATES

17.12 COCOACRAFT

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS/NEWS

17.13 DEPRAMA COCOA

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATES

17.14 DUC D’O

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS/NEWS

17.15 ECUAKAO GROUP LTD

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS/NEWS

17.16 ICAM SPA

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT UPDATES

17.17 INDCRE S.A

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT UPDATES

17.18 INDOCOCOA

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS/NEWS

17.19 JAYA SALIEM INDUSTRI

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 KOKOA KAMILI

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS/NEWS

17.21 MACOFA CHOCOLATE FACTORY

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 MONER COCOA, S.A.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT UPDATES

17.23 NATRA

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENTS/NEWS

17.24 NEOGRIC LIMITED

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 PACARI

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT UPDATES

17.26 PT ANDOW NGENSOWIDJAJA

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS/NEWS

17.27 PT GRAND KAKAO INDONESIA

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 TOUTON S.A.

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 UNCOMMON CACOA .

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT UPDATES

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 FIGURE 2. COMPANY VS BRAND OVERVIEW

TABLE 3 NUMBER OF PATENTS PER YEAR

TABLE 4 NUMBER OF PATENTS PER REGION/COUNTRY

TABLE 5 TOP PATENT APPLICANTS.

TABLE 6 REGULATORY COVERAGE

TABLE 7 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 9 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 10 EUROPE COCOA BUTTER IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE COCOA MARKET, BY NATURE, 2025-2032 (USD THOUSAND)

TABLE 12 EUROPE COCOA MARKET, BY NATURE, 2025-2032 (TONS)

TABLE 13 EUROPE COCOA MARKET, BY NATURE, 2025-2032 (PRICE USD/KG)

TABLE 14 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2025-2032 (USD THOUSAND)

TABLE 15 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2025-2032 (TONS)

TABLE 16 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2025-2032 (PRICE USD/KG)

TABLE 17 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

TABLE 18 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (TONS)

TABLE 19 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (PRICE USD/KG)

TABLE 20 EUROPE INDIRECT IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 21 EUROPE OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 22 EUROPE COCOA MARKET, BY APPLICATION, 2025-2032 (USD THOUSAND)

TABLE 23 EUROPE FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 24 EUROPE BAKERY IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 25 EUROPE CONFECTIONERY IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 26 EUROPE CHOCOLATE IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 27 EUROPE CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2025-2032 (USD THOUSAND)

TABLE 28 EUROPE WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 29 EUROPE DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 30 EUROPE PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 31 EUROPE BEVERAGES IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 32 EUROPE DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 33 EUROPE PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 34 EUROPE COCOA MARKET, BY APPLICATION, 2025-2032 (TONS)

TABLE 35 EUROPE COCOA MARKET, BY APPLICATION, 2025-2032 (PRICE USD/KG)

TABLE 36 EUROPE COCOA MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE COCOA MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 38 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 40 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 41 EUROPE COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 44 EUROPE COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 45 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 47 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 48 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 50 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 51 EUROPE INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 55 EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 56 EUROPE FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 GERMANY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 GERMANY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 69 GERMANY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 70 GERMANY COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 GERMANY COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 72 GERMANY COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 73 GERMANY COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 74 GERMANY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 75 GERMANY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 76 GERMANY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 77 GERMANY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 78 GERMANY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 79 GERMANY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 80 GERMANY INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 GERMANY OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 GERMANY COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 GERMANY COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 84 GERMANY COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 85 GERMANY FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 GERMANY BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 GERMANY CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 GERMANY CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 GERMANY CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 90 GERMANY WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 GERMANY DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 NETHERLANDS COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 NETHERLANDS COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 98 NETHERLANDS COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 99 NETHERLANDS COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NETHERLANDS COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 101 NETHERLANDS COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 102 NETHERLANDS COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 103 NETHERLANDS COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 104 NETHERLANDS COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 105 NETHERLANDS COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 106 NETHERLANDS COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 107 NETHERLANDS COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 108 NETHERLANDS COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 109 NETHERLANDS INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NETHERLANDS OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NETHERLANDS COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 NETHERLANDS COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 113 NETHERLANDS COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 114 NETHERLANDS FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 NETHERLANDS BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 NETHERLANDS CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 NETHERLANDS CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 NETHERLANDS CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 119 NETHERLANDS WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NETHERLANDS DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 NETHERLANDS PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 NETHERLANDS BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 NETHERLANDS DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 NETHERLANDS PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 FRANCE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 FRANCE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 127 FRANCE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 128 FRANCE COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 FRANCE COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 130 FRANCE COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 131 FRANCE COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 132 FRANCE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 133 FRANCE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 134 FRANCE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 135 FRANCE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 136 FRANCE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 137 FRANCE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 138 FRANCE INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 FRANCE OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 FRANCE COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 141 FRANCE COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 142 FRANCE COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 143 FRANCE FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 FRANCE BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 FRANCE CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 FRANCE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 FRANCE CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 148 FRANCE WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 FRANCE DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 FRANCE PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 FRANCE BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 FRANCE DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 FRANCE PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.K. COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.K. COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 156 U.K. COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 157 U.K. COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 U.K. COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 159 U.K. COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 160 U.K. COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 161 U.K. COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 162 U.K. COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 163 U.K. COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 164 U.K. COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 165 U.K. COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 166 U.K. COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 167 U.K. INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 U.K. OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 U.K. COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 U.K. COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 171 U.K. COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 172 U.K. FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 U.K. BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 U.K. CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 U.K. CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 U.K. CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 177 U.K. WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 U.K. DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 U.K. PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 U.K. BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 U.K. DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 U.K. PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 BELGIUM COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 BELGIUM COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 185 BELGIUM COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 186 BELGIUM COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 BELGIUM COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 188 BELGIUM COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 189 BELGIUM COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 190 BELGIUM COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 191 BELGIUM COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 192 BELGIUM COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 193 BELGIUM COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 194 BELGIUM COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 195 BELGIUM COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 196 BELGIUM INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 BELGIUM OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 BELGIUM COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 199 BELGIUM COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 200 BELGIUM COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 201 BELGIUM FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 BELGIUM BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 BELGIUM CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 BELGIUM CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 BELGIUM CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 206 BELGIUM WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 BELGIUM DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 BELGIUM PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 BELGIUM BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 BELGIUM DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 BELGIUM PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 ITALY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 ITALY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 214 ITALY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 215 ITALY COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 ITALY COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 217 ITALY COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 218 ITALY COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 219 ITALY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 220 ITALY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 221 ITALY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 222 ITALY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 223 ITALY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 224 ITALY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 225 ITALY INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 ITALY OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 ITALY COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 228 ITALY COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 229 ITALY COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 230 ITALY FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 ITALY BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 ITALY CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 ITALY CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 ITALY CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 235 ITALY WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 ITALY DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 ITALY PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 ITALY BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 ITALY DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 ITALY PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 SWITZERLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 SWITZERLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 243 SWITZERLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 244 SWITZERLAND COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 SWITZERLAND COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 246 SWITZERLAND COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 247 SWITZERLAND COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 248 SWITZERLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 249 SWITZERLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 250 SWITZERLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 251 SWITZERLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 252 SWITZERLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 253 SWITZERLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 254 SWITZERLAND INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 SWITZERLAND OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 SWITZERLAND COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 257 SWITZERLAND COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 258 SWITZERLAND COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 259 SWITZERLAND FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 SWITZERLAND BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 SWITZERLAND CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 SWITZERLAND CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 SWITZERLAND CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 264 SWITZERLAND WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 SWITZERLAND DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 SWITZERLAND PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 SWITZERLAND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 SWITZERLAND DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 SWITZERLAND PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 SPAIN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 SPAIN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 272 SPAIN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 273 SPAIN COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 SPAIN COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 275 SPAIN COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 276 SPAIN COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 277 SPAIN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 278 SPAIN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 279 SPAIN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 280 SPAIN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 281 SPAIN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 282 SPAIN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 283 SPAIN INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 SPAIN OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 SPAIN COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 286 SPAIN COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 287 SPAIN COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 288 SPAIN FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 SPAIN BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 SPAIN CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 SPAIN CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 SPAIN CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 293 SPAIN WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 SPAIN DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SPAIN PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SPAIN BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 SPAIN DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SPAIN PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 POLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 POLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 301 POLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 302 POLAND COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 POLAND COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 304 POLAND COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 305 POLAND COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 306 POLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 307 POLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 308 POLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 309 POLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 310 POLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 311 POLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 312 POLAND INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 POLAND OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 POLAND COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 315 POLAND COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 316 POLAND COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 317 POLAND FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 POLAND BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 POLAND CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 POLAND CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 POLAND CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 322 POLAND WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 POLAND DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 POLAND PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 POLAND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 POLAND DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 POLAND PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 RUSSIA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 RUSSIA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 330 RUSSIA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 331 RUSSIA COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 RUSSIA COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 333 RUSSIA COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 334 RUSSIA COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 335 RUSSIA COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 336 RUSSIA COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 337 RUSSIA COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 338 RUSSIA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 339 RUSSIA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 340 RUSSIA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 341 RUSSIA INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 RUSSIA OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 RUSSIA COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 344 RUSSIA COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 345 RUSSIA COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 346 RUSSIA FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 RUSSIA BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 RUSSIA CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 RUSSIA CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 RUSSIA CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 351 RUSSIA WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 RUSSIA DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 RUSSIA PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 RUSSIA BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 RUSSIA DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 RUSSIA PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 TURKEY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 TURKEY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 359 TURKEY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 360 TURKEY COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 TURKEY COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 362 TURKEY COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 363 TURKEY COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 364 TURKEY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 365 TURKEY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 366 TURKEY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 367 TURKEY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 368 TURKEY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 369 TURKEY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 370 TURKEY INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 TURKEY OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 TURKEY COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 373 TURKEY COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 374 TURKEY COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 375 TURKEY FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 376 TURKEY BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 TURKEY CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 TURKEY CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 TURKEY CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 380 TURKEY WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 TURKEY DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 382 TURKEY PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 TURKEY BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 TURKEY DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 TURKEY PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 SWEDEN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 387 SWEDEN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 388 SWEDEN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 389 SWEDEN COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 SWEDEN COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 391 SWEDEN COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 392 SWEDEN COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 393 SWEDEN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 394 SWEDEN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 395 SWEDEN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 396 SWEDEN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 397 SWEDEN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 398 SWEDEN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 399 SWEDEN INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 SWEDEN OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 401 SWEDEN COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 402 SWEDEN COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 403 SWEDEN COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 404 SWEDEN FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 405 SWEDEN BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 406 SWEDEN CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 407 SWEDEN CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 408 SWEDEN CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 409 SWEDEN WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 SWEDEN DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 411 SWEDEN PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 412 SWEDEN BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 413 SWEDEN DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 414 SWEDEN PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 415 DENMARK COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 416 DENMARK COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 417 DENMARK COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 418 DENMARK COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 419 DENMARK COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 420 DENMARK COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 421 DENMARK COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 422 DENMARK COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 423 DENMARK COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 424 DENMARK COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 425 DENMARK COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 426 DENMARK COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 427 DENMARK COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 428 DENMARK INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 429 DENMARK OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 430 DENMARK COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 431 DENMARK COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 432 DENMARK COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 433 DENMARK FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 434 DENMARK BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 435 DENMARK CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 436 DENMARK CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 437 DENMARK CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 438 DENMARK WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 439 DENMARK DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 440 DENMARK PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 441 DENMARK BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 442 DENMARK DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 443 DENMARK PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 444 NORWAY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 445 NORWAY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 446 NORWAY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 447 NORWAY COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 448 NORWAY COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 449 NORWAY COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 450 NORWAY COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 451 NORWAY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 452 NORWAY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 453 NORWAY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 454 NORWAY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 455 NORWAY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 456 NORWAY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 457 NORWAY INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 458 NORWAY OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 459 NORWAY COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 460 NORWAY COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 461 NORWAY COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 462 NORWAY FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 463 NORWAY BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 464 NORWAY CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 465 NORWAY CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 466 NORWAY CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 467 NORWAY WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 468 NORWAY DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 469 NORWAY PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 470 NORWAY BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 471 NORWAY DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 472 NORWAY PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 473 FINLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 474 FINLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 475 FINLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 476 FINLAND COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 477 FINLAND COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 478 FINLAND COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 479 FINLAND COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 480 FINLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 481 FINLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 482 FINLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 483 FINLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 484 FINLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 485 FINLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 486 FINLAND INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 487 FINLAND OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 488 FINLAND COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 489 FINLAND COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 490 FINLAND COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 491 FINLAND FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 492 FINLAND BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 493 FINLAND CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 494 FINLAND CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 495 FINLAND CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 496 FINLAND WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 497 FINLAND DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 498 FINLAND PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 499 FINLAND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 500 FINLAND DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 501 FINLAND PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 502 REST OF EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 503 REST OF EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 504 REST OF EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 505 REST OF EUROPE COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 506 REST OF EUROPE COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 507 REST OF EUROPE COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 508 REST OF EUROPE COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 509 REST OF EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 510 REST OF EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 511 REST OF EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 512 REST OF EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 513 REST OF EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 514 REST OF EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 515 REST OF EUROPE INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 516 REST OF EUROPE OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 517 REST OF EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 518 REST OF EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 519 REST OF EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 520 REST OF EUROPE FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 521 REST OF EUROPE BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 522 REST OF EUROPE CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 523 REST OF EUROPE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 524 REST OF EUROPE CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 525 REST OF EUROPE WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 526 REST OF EUROPE DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 527 REST OF EUROPE PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 528 REST OF EUROPE BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 529 REST OF EUROPE DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 530 REST OF EUROPE PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 EUROPE COCOA MARKET

FIGURE 2 EUROPE COCOA MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE COCOA MARKET: DROC ANALYSIS

FIGURE 4 EUROPE COCOA MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE COCOA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE COCOA MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE COCOA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE COCOA MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE COCOA MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE COCOA MARKET: SEGMENTATION

FIGURE 11 EUROPE IS EXPECTED TO DOMINATE THE EUROPE COCOA MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 SIX SEGMENTS COMPRISE THE EUROPE COCOA MARKET, BY PRODUCT TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING DEMAND FOR CHOCOLATE AND CONFECTIONERY PRODUCTS IS EXPECTED TO DRIVE THE EUROPE COCOA MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 16 THE COCOA POWDER & CAKE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE COCOA MARKET IN 2025 AND 2032

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 EUROPE COCOA MARKET, 2022-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 19 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 20 VENDOR SELECTION CRITERIA

FIGURE 21 IPC CODE V/S NUMBER OF PATENTS

FIGURE 22 NUMBER OF PATENTS PER YEAR

FIGURE 23 NUMBER OF PATENTS PER REGION/COUNTRY

FIGURE 24 TOP PATENT APPLICANTS.

FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE COCOA MARKET

FIGURE 26 EUROPE COCOA MARKET: BY PRODUCT TYPE, 2024

FIGURE 27 EUROPE COCOA MARKET: BY NATURE, 2024

FIGURE 28 EUROPE COCOA MARKET: BY TYPE OF COCOA, 2024

FIGURE 29 EUROPE COCOA MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 30 EUROPE COCOA MARKET: BY APPLICATION, 2024

FIGURE 31 EUROPE COCOA MARKET: SNAPSHOT (2024)

FIGURE 32 EUROPE COCOA MARKET: COMPANY SHARE 2024 (%)

Europe Cocoa Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Cocoa Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Cocoa Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.