Europe Colour Cosmetics Market

Market Size in USD Billion

CAGR :

%

USD

12.83 Billion

USD

21.56 Billion

2024

2032

USD

12.83 Billion

USD

21.56 Billion

2024

2032

| 2025 –2032 | |

| USD 12.83 Billion | |

| USD 21.56 Billion | |

|

|

|

|

Europe Colour Cosmetics Market Size

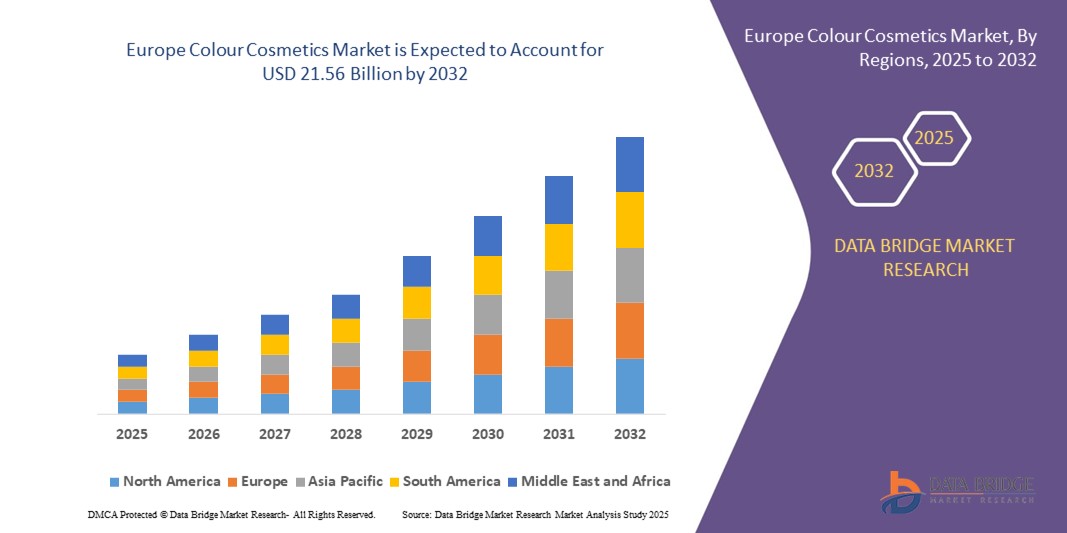

- The Europe colour cosmetics market size was valued at USD 12.83 billion in 2024 and is expected to reach USD 21.56 billion by 2032, at a CAGR of 6.70% during the forecast period

- The market growth is largely fuelled by increasing consumer awareness about personal grooming, rising disposable incomes, and the growing influence of social media and beauty influencers

- Demand for innovative and premium cosmetic products, coupled with the popularity of sustainable and cruelty-free formulations, is further boosting market expansion

Europe Colour Cosmetics Market Analysis

- The Europe colour cosmetics market is witnessing steady growth, driven by increasing consumer awareness about personal grooming, rising disposable incomes, and the influence of social media and beauty influencers

- The demand for innovative, premium, and sustainable cosmetic products, including cruelty-free and eco-friendly formulations, is further fueling market expansion

- Germany colour cosmetics market held the largest market revenue share in 2024, fueled by growing demand for high-quality, eco-friendly, and dermatologically tested products

- U.K. is expected to witness the highest compound annual growth rate (CAGR) in the Europe colour cosmetics market due to increasing consumer awareness of beauty and skincare trends, rising e-commerce penetration, and strong influence of social media and influencer-led marketing. The growing demand for clean, ethical, and multi-functional cosmetic products also contributes to rapid market expansion

- The facial makeup segment held the largest market revenue share in 2024, driven by the high daily usage of foundations, compact powders, and blushes across diverse age groups. Facial makeup products are popular due to their ability to provide smooth coverage, enhance skin tone, and combine multiple benefits such as SPF protection and moisturizing effects, making them a preferred choice among both individual consumers and professional makeup artists

Report Scope and Europe Colour Cosmetics Market Segmentation

|

Attributes |

Europe Colour Cosmetics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

• L’Oréal (France) • Coty Inc. (France/Europe Operations) |

|

Market Opportunities |

• Rising Demand for Sustainable and Cruelty-Free Cosmetics |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Colour Cosmetics Market Trends

Rise of Premium And Natural Formulations in Colour Cosmetics

• The growing shift toward premium and natural formulations is transforming the European colour cosmetics market by catering to consumers’ demand for chemical-free, sustainable, and high-quality products. These products offer multifunctional benefits, such as skincare integration, long-lasting coverage, and eco-friendly packaging, which are increasingly influencing purchasing decisions.

• The high demand for cruelty-free and vegan cosmetic products is accelerating the adoption of ethically sourced ingredients and clean-label formulations. Consumers are particularly drawn to brands that emphasize sustainability, transparency, and responsible production practices. The trend is further reinforced by growing social media influence and beauty influencers promoting conscious consumption

• The availability and accessibility of mid-range and luxury products across online and offline channels are making premium cosmetics more attainable, enhancing consumer loyalty and repeat purchases. Shoppers benefit from wider product choices, personalized recommendations, and seamless e-commerce experiences, supporting consistent market growth

• For instance, in 2023, several European beauty brands reported a surge in sales of plant-based foundations and lipsticks, driven by younger demographics who prioritize natural ingredients and sustainability alongside aesthetics. This trend has encouraged brands to expand their product lines and invest in innovative formulations

• While premium and natural cosmetics are driving market expansion, their growth depends on continuous product innovation, marketing, and accessibility. Companies must focus on localized trends, consumer education, and omnichannel strategies to maximize adoption and engagement

Europe Colour Cosmetics Market Dynamics

Driver

Rising Consumer Awareness and Growing Influence of Social Media

• Increasing consumer awareness about skincare and cosmetic benefits is pushing brands to innovate and offer products that address specific needs such as anti-aging, hydration, and long-lasting coverage. Awareness campaigns and beauty tutorials are encouraging informed purchases

• Social media platforms and influencer-led marketing are shaping consumer preferences, boosting the visibility of new launches, and fostering brand loyalty. Trends such as “clean beauty” and “ethical cosmetics” are gaining traction among millennials and Gen Z consumers

• Retailers and online marketplaces are supporting growth by offering personalized experiences, virtual try-on tools, and subscription-based models that improve accessibility and engagement. Loyalty programs, AI-driven product recommendations, and curated beauty boxes are enhancing customer retention

• For instance, in 2022, several European brands leveraged Instagram and TikTok campaigns to launch limited-edition eco-friendly makeup collections, resulting in significant increases in online sales and brand recognition. These campaigns also included influencer collaborations, giveaways, and interactive challenges, which helped expand reach across younger demographics

• While awareness and digital marketing are driving growth, brands must continue to adapt to evolving consumer preferences and ensure authenticity, sustainability, and product efficacy to sustain long-term adoption. Consumers are increasingly scrutinizing ingredient lists, packaging claims, and corporate social responsibility initiatives

Restraint/Challenge

High Cost of Premium Products and Regulatory Compliance

• The higher price point of premium and natural cosmetics limits accessibility for price-sensitive consumers, particularly in emerging European markets. Luxury formulations are often concentrated in urban and metropolitan areas, restricting widespread adoption

• Strict regulations on ingredient safety, labelling, and advertising increase operational costs for manufacturers and limit the speed of new product launches. Compliance with EU cosmetic regulations requires rigorous testing and certification, which can be time-consuming and expensive

• Supply chain challenges, such as sourcing sustainable raw materials and eco-friendly packaging, may further increase costs and reduce profitability. Consumers may be deterred by high prices or limited availability of ethical and organic products

• For instance, in 2023, several small European cosmetic brands reported delays in product launches due to the stringent EU compliance requirements for plant-based and vegan-certified makeup lines

• While product innovation continues, overcoming cost barriers and regulatory challenges remains crucial. Market stakeholders must focus on scalable production, strategic sourcing, and targeted marketing to enhance accessibility and long-term market potential

Europe Colour Cosmetics Market Scope

The market is segmented on the basis of product, pigment type, target market, packaging, form, distribution channel, and end-user.

- By Product

On the basis of product, the Europe colour cosmetics market is segmented into Facial Makeup, Eye Makeup, Lip Products, Nail Products, Hair Products, and Others. The Facial Makeup segment held the largest market revenue share in 2024, driven by the high daily usage of foundations, compact powders, and blushes across diverse age groups. Facial makeup products are popular due to their ability to provide smooth coverage, enhance skin tone, and combine multiple benefits such as SPF protection and moisturizing effects, making them a preferred choice among both individual consumers and professional makeup artists.

The eye makeup segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for mascaras, eyeliners, and eyeshadows that enable creative expression. Eye makeup products are gaining traction among younger consumers and social-media-savvy users due to trend-driven usage and influencer promotions, supporting continuous market expansion.

- By Pigment Type

On the basis of pigment type, the Europe colour cosmetics market is segmented into Inorganic Pigments and Organic Pigments. The Inorganic Pigments segment held the largest market revenue share in 2024, driven by their stability, long-lasting performance, and widespread use in both mass and prestige products. Inorganic pigments are preferred for consistent color payoff and compatibility with various formulations, making them ideal for both professional makeup artists and daily consumers.

The organic pigments segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for natural, eco-friendly, and skin-safe ingredients. Organic pigments are particularly gaining popularity in vegan and cruelty-free products, attracting environmentally conscious and younger consumers, and supporting continuous market expansion.

- By Target Market

On the basis of target market, the market is segmented into Mass Products and Prestige Products. The Mass Products segment held the largest market revenue share in 2024, driven by affordability, easy availability in supermarkets and online platforms, and widespread daily use. Mass products cater to a broad consumer base and provide basic functionality while maintaining cost-effectiveness.

The prestige products segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising disposable incomes, increasing demand for luxury cosmetics, and preference for multi-functional formulations that combine makeup and skincare benefits. Prestige products are favored for premium quality, innovative textures, and brand value, driving higher adoption in urban and professional markets.

- By Packaging

On the basis of packaging, the market is segmented into Bottles & Jars, Tubes, Containers, Pouches, Dispenser, Sticks, and Others. The Bottles & Jars segment held the largest market revenue share in 2024, owing to ease of storage, reusability, and suitability for liquid and cream-based formulations. Bottles and jars provide convenience for both household and professional users, supporting repeat usage and brand loyalty.

The tubes and dispenser segment is expected to witness the fastest growth rate from 2025 to 2032, driven by hygiene advantages, portability, and suitability for travel-friendly and premium cosmetic products. These formats are increasingly preferred for liquid foundations, creams, and gels, enabling precise application and controlled dispensing.

- By Form

On the basis of form, the market is segmented into Liquid, Powder, and Spray. The Liquid segment held the largest market revenue share in 2024, driven by smooth application, blendability, and versatility across skin types. Liquid formulations are widely used in foundations, lip glosses, and liquid eyeshadows, making them popular among both consumers and professionals.

The powder and spray segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by long-lasting coverage, ease of use, and quick application benefits. Powder-based products are ideal for mattifying and setting makeup, while sprays are gaining popularity for refreshing and multifunctional use.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into E-Commerce, Supermarket/Hypermarkets, Direct Sales/B2B, Specialty Stores, and Others. The Supermarket/Hypermarkets segment held the largest market revenue share in 2024, driven by easy accessibility, promotional campaigns, and in-store product trials. Consumers prefer these channels for the convenience of comparing multiple brands and products at one location.

The e-commerce segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing online penetration, influencer-led promotions, virtual try-on tools, and doorstep delivery. Online channels allow personalized experiences, subscription models, and access to niche brands, driving higher adoption among younger and tech-savvy consumers.

- By End-User

On the basis of end-user, the market is segmented into Parlour, Household, Modelling & Fashion Industries, Media Houses, and Others. The Household segment held the largest market revenue share in 2024, driven by routine personal use, product accessibility, and affordability. Household users account for consistent demand across diverse age groups and preferences.

The Modelling & Fashion Industries segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by demand for professional-grade products for photoshoots, runway shows, and media productions. Professional end-users prefer high-performance formulations that ensure durability, color payoff, and aesthetic appeal, supporting continuous market expansion.

Europe Colour Cosmetics Market Regional Analysis

- Germany colour cosmetics market held the largest market revenue share in 2024, fueled by growing demand for high-quality, eco-friendly, and dermatologically tested products

- Consumers are increasingly seeking safe, multifunctional, and performance-oriented cosmetics, reflecting strong adoption in both individual and professional settings

- Germany’s well-established retail network, combined with a focus on innovation, sustainability, and premium brand offerings, promotes continued growth in facial, eye, lip, and nail product segments

U.K. Colour Cosmetics Market Insight

The U.K. colour cosmetics market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising interest in luxury and prestige products alongside mass-market offerings. Increasing awareness about ethical, clean, and sustainable beauty, coupled with a strong e-commerce and retail infrastructure, is encouraging both household and professional users to adopt innovative products. The trend toward personalization, virtual try-on tools, and influencer marketing is further supporting market growth.

Europe Colour Cosmetics Market Share

The Europe Colour Cosmetics industry is primarily led by well-established companies, including:

• L’Oréal (France)

• Essence Cosmetics (Germany)

• Beiersdorf AG (Germany)

• Intercos Group (Italy)

• KIKO Milano (Italy)

• Coty Inc. (France/Europe Operations)

• Oriflame Cosmetics (Sweden)

• Deborah Group (Italy)

• Dr. Hauschka (Germany)

• Bourjois (France)

Latest Developments in Europe Colour Cosmetics Market

- In June 2023, L'Oréal GROUP showcased Beauty Tech innovations at Viva Technology Paris, emphasizing their commitment to "beauty for all and beauty for each." The technologies include smart and sustainable beauty solutions, digital services, and data-powered diagnostic devices for inclusive, personalized, and virtual beauty experiences. These innovations contribute to the company's technological development and improve its dedication to making beauty accessible and personalized for consumers

- In June 2022, Henkel AG & Co. KGaA inked a deal to acquire the Asia-Pacific Hair Professional business of Shiseido, a move that significantly strengthens its presence in the professional haircare market. This strategic acquisition encompasses popular brands such as Sublimic and Primience, which fall under the Shiseido Professional umbrella. Shiseido Professional is known for its salon-exclusive offerings, including top-tier products for hair care, coloring, styling, and perm solutions. The collaboration is set to propel Henkel's business growth in the region. Notably, Shiseido will maintain a 20 percent stake in the Japanese legal entity, solidifying a lasting partnership between the two companies. This move is poised to bring enhanced capabilities and a broader product portfolio to Henkel, reinforcing its position in the competitive haircare industry

- In November 2023, The Estée Lauder Companies Inc. announced the recipients of its Beauty & You incubator awards for Indian beauty businesses, in collaboration with Nykaa, a Indian beauty retailer. The second edition of these awards, unveiled earlier this year, recognized outstanding achievements in various sectors of the beauty industry, spanning active ingredients, perfumery, sustainability, and brand communities. This initiative spotlighted the innovative contributions of Indian beauty brands and creators and fostered a collaborative platform for the industry to thrive. By considering the diverse aspects of the beauty sector, the Beauty & You incubator awards have played a crucial role in nurturing and promoting the growth of the Indian beauty business ecosystem

- In December 2023, Amorepacific Corporation introduced Dr. Amore an innovative artificial intelligence (AI)-powered skin diagnosis system. The company's recent breakthrough was documented in a paper published in the International Journal of Cosmetic Science. The system utilizes advanced AI algorithms to provide accurate and personalized skin analyses. This technological advancement is expected to enhance the company's product development and formulation processes, enabling a more targeted approach to skincare solutions. By leveraging AI, Amorepacific aims to better understand individual skin needs, ensuring that its cosmetic products are tailored to meet diverse customer requirements. This scientific leap reinforces Amorepacific's commitment to staying at the forefront of skincare research and development

- In September 2022, BBIA launched the signature soft MLBB colours, reflecting a notable progression in the field. This development signified a contemporary shift towards enhanced and refined colour options. This helped the company to diversify the product portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.