Europe Computed Tomography Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.37 Billion

USD

9.29 Billion

2023

2031

USD

2.37 Billion

USD

9.29 Billion

2023

2031

| 2024 –2031 | |

| USD 2.37 Billion | |

| USD 9.29 Billion | |

|

|

|

|

Europe Computed Tomography Devices Market Size

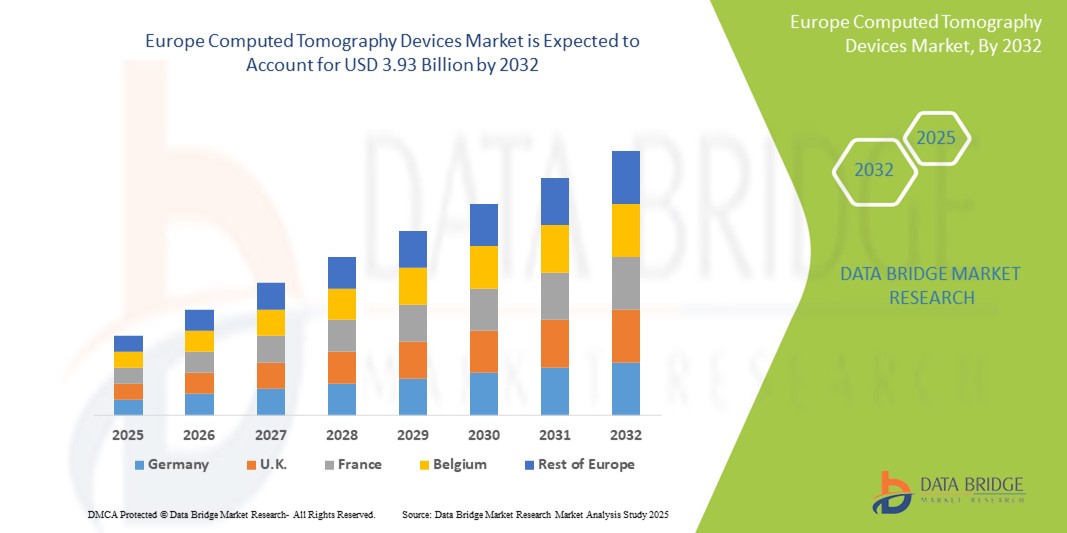

- The Europe computed tomography devices market size was valued at USD 2.50 billion in 2024 and is expected to reach USD 3.93 billion by 2032, at a CAGR of 5.80% during the forecast period

- This growth is driven by factors such as the increasing prevalence of chronic diseases, rising demand for advanced diagnostic imaging, technological advancements in CT systems, and the growing geriatric population across Europe

Europe Computed Tomography Devices Market Analysis

- The Europe computed tomography devices market currently reflects a strong focus on product innovation, with companies investing in advanced imaging technologies that enhance scan accuracy and reduce patient exposure time

- Increasing adoption of artificial intelligence integration in computed tomography systems is shaping purchasing decisions, as healthcare providers seek smarter diagnostics with faster image reconstruction

- Germany is expected to dominate the market with 6.75% market share due to well-established healthcare infrastructure and a high demand for advanced diagnostic

- France is expected to be the fastest growing region in the market during the forecast period with 6.48% market share due to increased healthcare investments and an aging population that requires advanced diagnostic solutions

- The High-Slice CT segment is expected to dominate the market with the largest share of 35.05% in 2025 due to its ability to provide faster and more detailed imaging. High-Slice CT scanners can capture multiple slices in a single rotation, significantly reducing scan time while maintaining high image resolution. This feature is particularly beneficial in emergency and critical care settings where rapid diagnosis is essential. The demand for high-slice systems is also driven by advancements in multi-slice technology, which offers improved visualization of soft tissues, bones, and blood vessels

Report Scope and Europe Computed Tomography Devices Market Segmentation

|

Attributes |

Europe Computed Tomography Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Computed Tomography Devices Market Trends

“Advancements in Imaging Software”

- The computed tomography devices market is currently witnessing a clear trend toward the integration of advanced imaging software to support real-time diagnostics and enhanced image clarity

- Manufacturers are prioritizing software upgrades that allow for faster image processing and seamless data sharing across multiple healthcare platforms

- There is a growing demand for computed tomography systems with customizable scanning protocols that can be tailored to specific clinical needs and patient profiles

- Healthcare facilities are increasingly selecting systems that offer high-resolution imaging with minimal scanning time to optimize workflow and improve patient throughput

- Investment in research and development is driving continuous improvements in post-processing tools that assist radiologists in interpreting complex scans more efficiently

- For instance, some computed tomography devices now come with built-in analytics tools that help in detecting subtle abnormalities, improving diagnostic confidence among clinicians

- In conclusion, the market is steadily evolving with a strong focus on advanced imaging software that enhances diagnostic precision and clinical workflow.

Europe Computed Tomography Devices Market Dynamics

Driver

“Rising Burden of Chronic Diseases”

- The increasing prevalence of chronic diseases such as cancer and cardiovascular disorders is driving higher demand for computed tomography devices across European healthcare facilities

- With a growing aging population, hospitals are prioritizing faster and more accurate diagnostics to manage long-term health conditions and reduce time to treatment

- For instance, computed tomography is commonly used in Germany’s oncology units to monitor tumor progression and guide treatment decisions

- Investments from public health bodies like the UK's National Health Service have enabled the replacement of outdated scanners with advanced computed tomography systems in multiple hospitals

- For instance, Spain's Ministry of Health funded upgrades in regional hospitals to include multi-slice scanners for improved cardiovascular diagnostics

- In conclusion, the rise in chronic disease cases combined with infrastructure improvements is strengthening the role of computed tomography in early diagnosis and long-term care across Europe

Opportunity

“Rise in Artificial Intelligence Integration in Imaging”

- The integration of artificial intelligence into computed tomography devices is creating new possibilities for faster, more accurate image interpretation across European hospitals

- For instance, tools like Aidoc’s AI software are already helping radiologists in the Netherlands flag urgent brain hemorrhages within minutes of a scan

- Artificial intelligence enhances workflow by automating case prioritization and providing real-time insights, which is crucial in emergency and critical care settings

- Automated scan planning and dose control enabled by artificial intelligence improve patient safety while ensuring high diagnostic accuracy

- Collaborations between tech companies and healthcare providers, such as Siemens Healthineers and University College London Hospitals, are accelerating the adoption of intelligent imaging solutions

- In conclusion, the increasing acceptance of artificial intelligence-based diagnostics is opening a valuable opportunity to modernize computed tomography applications and improve clinical outcomes across Europe

Restraint/Challenge

“High Installation and Maintenance Costs”

- The high initial investment required for computed tomography devices including installation, infrastructure, and staff training makes it difficult for small and mid-sized hospitals to adopt new systems

- For instance, several rural clinics in Eastern Europe have delayed equipment upgrades due to limited budget allocations and lack of long-term financial support

- Ongoing maintenance expenses such as software updates, technical servicing, and skilled personnel add to the financial burden over time

- Older devices still in use due to funding gaps often lack advanced safety features like dose optimization, increasing radiation risk to patients

- Facilities are often dependent on expensive service contracts to prevent downtime, which can disrupt patient care and delay critical diagnoses

- In conclusion, the substantial cost of ownership continues to challenge equitable adoption of computed tomography technology across both urban and underserved healthcare settings in Europe

Europe Computed Tomography Devices Market Scope

The market is segmented on the basis of architecture, technology, type, slice, modality, application, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Architecture |

|

|

By Technology |

|

|

By Type |

|

|

By Slice

|

|

|

By Modality |

|

|

By Application

|

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, the High-Slice CT segment is projected to dominate the market with a largest share in technology segment

The High-Slice CT segment is expected to dominate the market with the largest share of 35.05% in 2025 due to its ability to provide faster and more detailed imaging. High-Slice CT scanners can capture multiple slices in a single rotation, significantly reducing scan time while maintaining high image resolution. This feature is particularly beneficial in emergency and critical care settings where rapid diagnosis is essential. The demand for high-slice systems is also driven by advancements in multi-slice technology, which offers improved visualization of soft tissues, bones, and blood vessels

The oncology segment is expected to account for the largest share during the forecast period in application segment

In 2025, the oncology segment is expected to dominate the market with the largest market share of 27.29% due to the increasing prevalence of cancer and the critical role of computed tomography in early detection, staging, and monitoring of tumors. CT imaging provides high-resolution images that are essential for identifying and assessing cancerous growths, helping oncologists plan precise treatment strategies.

Europe Computed Tomography Devices Market Regional Analysis

“Germany Holds the Largest Share in the Europe Computed Tomography Devices Market”

- Germany is the largest market for computed tomography devices in Europe with a market share of 6.75%, driven by a well-established healthcare infrastructure and a high demand for advanced diagnostic technologies

- The country's healthcare system focuses heavily on early detection and effective treatment planning, increasing the reliance on high-quality imaging tools like computed tomography

- Major companies such as Siemens Healthineers and Philips have a strong presence in Germany, contributing to the continuous adoption of state-of-the-art imaging systems

- Germany’s healthcare policies support significant investments in diagnostic technologies, making it a key player in the European computed tomography market

- The consistent innovation and development of new technologies in Germany ensure that the country remains a dominant force in the computed tomography market across Europe

“France is Projected to Register the Highest CAGR in the Europe Computed Tomography Devices Market”

- France is experiencing rapid growth in the computed tomography market, with 6.48% market share driven by increased healthcare investments and an aging population that requires advanced diagnostic solutions

- The French healthcare system is modernizing its infrastructure, leading to an accelerated adoption of high-performance computed tomography systems to meet rising demand for accurate diagnostics

- Artificial intelligence integration into computed tomography machines in France is improving diagnostic efficiency, supporting the country’s rapid growth in this market

- As chronic diseases become more prevalent, healthcare providers in France are increasingly utilizing computed tomography for early detection and treatment planning

- France's commitment to healthcare modernization and technological innovation is positioning it as the fastest-growing country in the European computed tomography market

Europe Computed Tomography Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- CANON MEDICAL SYSTEMS CORPORATION (U.S.)

- Medtronic (Ireland)

- FUJIFILM Holdings Corporation (Japan)

- SternMed GmbH (Germany)

- Esaote SPA (Italy)

- MinFound Medical Systems Co., Ltd. (China)

- Neusoft Corporation (China)

- Brainlab AG (Germany)

- Hologic, Inc. (U.S.)

- SAMSUNG (South Korea)

- PLANMED OY (Finland)

- Shimadzu Corporation (Japan)

- SCANCO Medical AG (Switzerland)

- Shenzhen Anke High-tech Co., Ltd. (China)

- Accuray Incorporated (U.S.)

- AB-CT – Advanced Breast-CT GmbH (Germany)

- Koning Health (U.S.)

Latest Developments in Europe Computed Tomography Devices Market

- In June 2022, Trivitron Healthcare launched plans to introduce domestically manufactured CT-Scan and MRI systems in fiscal year 2022-23, catering to both Indian and markets. The initiative aims to enhance diagnostic capabilities in remote areas, leveraging smart features, cost-effectiveness, and portability for improved healthcare access

- In April 2022, Wipro GE Healthcare launched the Revolution Aspire CT scanner, a next-generation imaging solution entirely designed and produced in India. Aligned with the "Atmanirbhar Bharat" initiative, it signifies a significant step towards self-reliance in medical device manufacturing, contributing to technological advancements in the healthcare sector

- In April 2022, Siemens inaugurated a new production line in Bengaluru, India, dedicated to manufacturing CT scanners. This strategic move underscores Siemens' commitment to local production, supporting healthcare infrastructure growth and accessibility to advanced medical imaging technologies

- In November 2021, Siemens Healthineers launched the Naeotom Alpha, a photon-counting CT scanner cleared for clinical use in the U.S. and Europe. This cutting-edge system signifies advancements in diagnostic imaging technology, offering precision and reliability for medical professionals

- In May 2021, Royal Philips launched the Spectral Computed Tomography (CT) 7500, featuring a spectral detector for precision diagnostics. This innovation enhances imaging capabilities, reinforcing Philips' commitment to delivering state-of-the-art solutions for improved patient care and diagnostic accuracy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.