Europe Confectionery Processing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

7.40 Billion

USD

10.70 Billion

2024

2032

USD

7.40 Billion

USD

10.70 Billion

2024

2032

| 2025 –2032 | |

| USD 7.40 Billion | |

| USD 10.70 Billion | |

|

|

|

|

Confectionery Processing Equipment Market Size

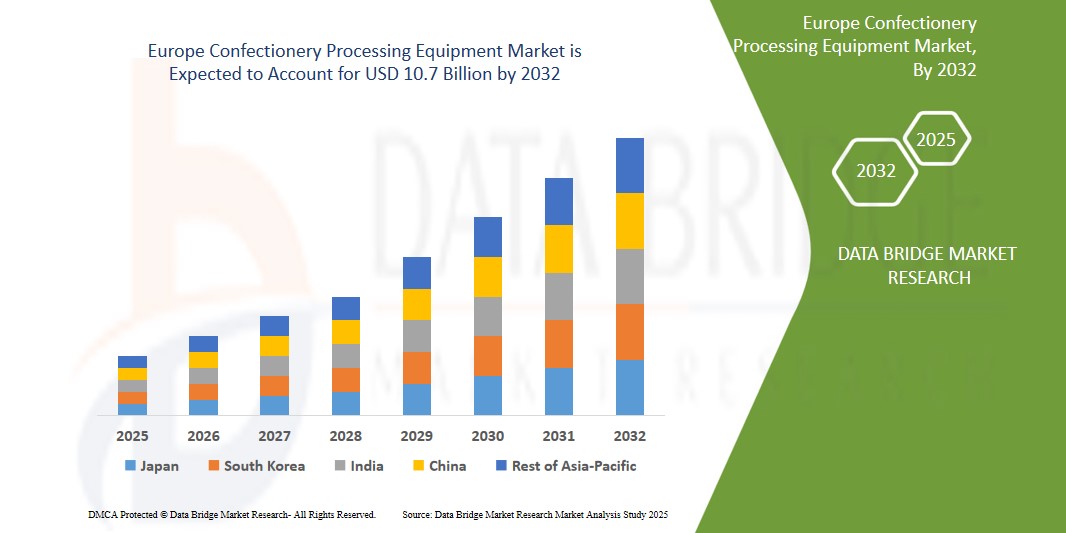

- The Europe Confectionery Processing Equipment Market size was valued at USD 7.4 billion in 2024 and is expected to reach USD 10.7 billion by 2032, at a CAGR of 7.5% during the forecast period

- Market growth is fueled by rising demand for packaged and innovative confectionery products, increasing consumption among youth, and the integration of automation and smart technologies in food manufacturing across developing economies.

- Moreover, growing investments in food processing infrastructure and favorable government initiatives in countries such as U.K., Germany further support market expansion.

Confectionery Processing Equipment Market Analysis

- Europe Confectionery Processing Equipment is increasingly adopted for producing chocolates, candies, gums, and jellies. Rising consumer demand for hygienic, high-quality, and customized sweets is driving strong growth across both local and multinational manufacturers.

- Innovative equipment for molding, tempering, coating, and cooling is crucial for efficient production. Automation and digital monitoring systems help reduce manual labor, enhance food safety, and improve production speed, especially in high-demand markets like Germany and U.K.

- Germany leads the Europe Confectionery Processing Equipment Market, holding approximately 38% market share in 2024. Its dominance is driven by large-scale confectionery production, a strong export network, and increasing adoption of automation in the food processing sector.

- U.K. witnessing the fastest growth, with the Europe region projected to grow at a CAGR of 7.5% from 2025 to 2032. Growth is supported by rising disposable incomes, urbanization, and expansion of retail and e-commerce channels offering diverse confectionery options.

- The chocolate processing equipment segment is expected to dominate the market with a significant share, accounting for over 40% of the total market in 2025, driven by strong Europe demand for chocolate products and continuous innovation in chocolate formulations, textures, and premium offerings.

Report Scope and Confectionery Processing Equipment Market Segmentation

|

Attributes |

Confectionery Processing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Confectionery Processing Equipment Market Trends

“Advancements in Operating Microscopes & 3D Visualization for Intraocular Surgery”

- One prominent trend in the Confectionery Processing Equipment Market is the increasing integration of automation and customization capabilities to meet evolving consumer demands and enhance manufacturing efficiency.

- These innovations enable manufacturers to streamline production, reduce manual labor, and offer flexible processing systems that can handle diverse product varieties, shapes, and textures with minimal changeover time.

- For instance, modern depositing systems now feature programmable controls and modular designs, allowing seamless customization of product fillings, sizes, and layering—catering to niche demands such as sugar-free, fortified, or artisanal sweets.

- These advancements are redefining confectionery production, empowering producers to innovate rapidly, reduce waste, and respond to trends such as clean-label ingredients, premium offerings, and healthier confectionery alternatives.

Confectionery Processing Equipment Market Dynamics

Driver

“Rising Demand for Automation and Product Innovation in Confectionery Manufacturing”

- The increasing demand for automated and efficient production lines in the confectionery industry is a major driver for the market. As manufacturers face rising labor costs and higher production volumes, automation helps improve consistency, reduce human error, and lower operational costs.

- Consumers are also seeking novel confectionery products—including filled, layered, and shaped sweets—prompting manufacturers to invest in flexible and innovative equipment capable of producing a wide range of product types

- Additionally, regulatory requirements for food safety and hygiene are pushing companies to upgrade to equipment that supports clean-in-place (CIP) systems and minimizes contamination risks

- For instance, In March 2024, Baker Perkins launched a new modular starch-free depositing system tailored for functional and medicated confectionery, enabling manufacturers to meet both innovation and compliance goals efficiently.

- As a Europe appetite for personalized and healthier treats grows, confectionery manufacturers are increasingly turning to advanced processing equipment to keep pace with market trends.

Restraint/Challenge

“High Capital Investment and Maintenance Costs Limiting Adoption”

- The significant upfront cost of Confectionery Processing Equipment, especially advanced, automated systems, is a key barrier for small and medium-sized enterprises (SMEs) in the industry.

- Many of these machines require custom installations, regular maintenance, and skilled technicians, further increasing operational costs over time.

- Smaller producers, particularly in emerging economies, may struggle to secure the necessary financing or justify the investment, which can hinder market penetration and technological advancement.

- Consequently, This cost constraint often leads smaller companies to rely on older or semi-automatic equipment, restricting their capacity to scale, comply with hygiene standards, or offer product variety—ultimately impacting their competitiveness

Confectionery Processing Equipment Market Scope

The market is segmented on the basis End Products, product type, Mode of Operation, Application.

- By End Products

On the basis of end product, the Europe Confectionery Processing Equipment Market is segmented into hard candies, chocolates, soft confectionery, chewing gums, gummies and jellies, and others. Chocolate-based products dominate the segment in 2025 with over 42% market share, supported by rising consumption of molded and filled chocolates across Germany, U.K., and Southeast Asia. Growing consumer preference for premium, artisanal, and sugar-free chocolate also propels demand for advanced processing lines.

Gummies and jellies are the fastest growing segment, projected to expand at a CAGR of 8.1% from 2025 to 2032, driven by their popularity among children and adults and the increasing availability of fortified and vegan-friendly gummy options.

- By product type

On the basis of type, the Europe Confectionery Processing Equipment Market is segmented into weighing and dissolving equipment, mixers, blenders, cutters, thermal equipment, tempering equipment, forming and depositing equipment, cooling equipment, extrusion equipment, coating equipment, rolling equipment, and others. driven by rising demand for filled and molded confections, efficient production lines, and innovations in candy designs across high-volume facilities in Germany and U.K.

Tempering equipment is the fastest-growing segment, as regional chocolate manufacturers increasingly invest in advanced tempering systems to enhance gloss, shelf life, and structural integrity of artisanal and mass-produced chocolates.

- By Mode of Operation

On the basis of mode of operation, the Europe Confectionery Processing Equipment Market is segmented into semi-automatic and automatic. The automatic segment leads in 2025, owing to rising investments in smart manufacturing and Industry 4.0 adoption across confectionery factories in developed Europe economies such as Spain and South Korea. Automation reduces labor costs and enhances productivity in high-volume production environments.

The semi-automatic segment is the fastest growing due to increasing demand from small and medium enterprises (SMEs) in emerging markets like U.K., Germany, Spain where cost-effective and flexible equipment is preferred.

- By Application

On the basis of application, the Europe Confectionery Processing Equipment Market is segmented into weighing and dosing, mixing and refining, conching, tempering, enrobing, moulding, cooling, and decorating. The mixing and refining segment dominates in 2025, supported by expanding production of chocolates and sugar confectioneries requiring precise ingredient blending to meet quality standards.

The enrobing segment is the fastest growing, driven by the rising popularity of coated confectionery products in urban markets and increasing exports from the region to Europe and North America.

Confectionery Processing Equipment Market Regional Analysis

- Germany leads the Europe Confectionery Processing Equipment Market, holding approximately 38% market share in 2024. Its dominance is driven by large-scale confectionery production, a strong export network, and increasing adoption of automation in the food processing sector.

- Its vast confectionery manufacturing base and strong export capabilities leads Germany. Large-scale production facilities leverage automation to boost efficiency, meeting both domestic demand and growing international orders.

- The country’s rapid industrialization and government support for smart manufacturing fuel advanced equipment adoption. Additionally, expanding consumer markets and investments in R&D enhance Germany’s competitive edge in producing innovative, high-quality confectionery processing solutions.

U.K. Confectionery Processing Equipment Market Insight

U.K. witnessing the fastest growth, with the Europe region projected to grow at a CAGR of 7.5% from 2025 to 2032. Growth is supported by rising disposable incomes, urbanization, and expansion of retail and e-commerce channels offering diverse confectionery options.

Spain Confectionery Processing Equipment Market Insight

Spain maintains a steady growth trajectory due to its advanced electronics, automotive, and medical device industries. Strong R&D focus on high-precision, medical-grade Confectionery Processing Equipment supports innovation and quality improvements. Government policies promoting technology advancement and export competitiveness bolster Spain’s market position in the Europe region.

Confectionery Processing Equipment Market Share

The Confectionery Processing Equipment industry is primarily led by well-established companies, including:

- Bühler AG (Switzerland)

- ALFA LAVAL (Sweden)

- JBT (John Bean Technologies Corporation) (U.S.)

- Robert Bosch GmbH (Germany)

- GEA Group Aktiengesellschaft (Germany)

- Candy Worx (U.S.)

- Tanis Confectionery (Netherlands)

- Caotech Grinding Technology (Netherlands)

- SELMI GROUP (Italy)

- Royal Duyvis Wiener B.V. (Netherlands)

- Baker Perkins (U.K.)

- Loynds (U.K.)

- Latini - Hohberger Dhimantec (U.S.)

- Hacos NV (Belgium)

- Heat and Control, Inc. (U.S.)

- SOLLICH KG (Germany)

- Aasted ApS (Denmark)

- BCH LTD (U.K.)

Latest Developments in Europe Confectionery Processing Equipment Market

- In April 2025, Bühler AG announced the launch of its next-generation DoMiReCo (Dosing, Mixing, Refiner, and Conche) system, aimed at improving energy efficiency and product consistency in chocolate processing. The upgraded solution integrates smart sensors and automation capabilities to streamline production and reduce energy consumption by up to 20%, catering to sustainability goals in the confectionery industry.

- In February 2025, GEA Group Aktiengesellschaft unveiled its new hygienic rotary depositor for starch-free confectionery production, designed to process functional and nutraceutical candies. The depositor supports flexible changeovers between recipes and ingredient types, helping manufacturers meet rising consumer demand for sugar-reduced and vitamin-enriched confections.

- In January 2025, Tanis Confectionery introduced a compact jellies and gummies processing line designed for mid-size manufacturers looking to scale operations. The line incorporates integrated cooking, depositing, and drying technologies, with real-time monitoring to optimize quality control and minimize waste during production.

- In December 2024, Heat and Control, Inc. announced a strategic partnership with a leading Asian food producer to expand its snack and confectionery processing footprint in Southeast Asia. The collaboration includes the deployment of modular systems for candy coating and seasoning, enabling high throughput with consistent taste and texture

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Confectionery Processing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Confectionery Processing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Confectionery Processing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.