Europe Construction Management Software Market

Market Size in USD Billion

CAGR :

%

USD

1.34 Billion

USD

2.33 Billion

2024

2032

USD

1.34 Billion

USD

2.33 Billion

2024

2032

| 2025 –2032 | |

| USD 1.34 Billion | |

| USD 2.33 Billion | |

|

|

|

|

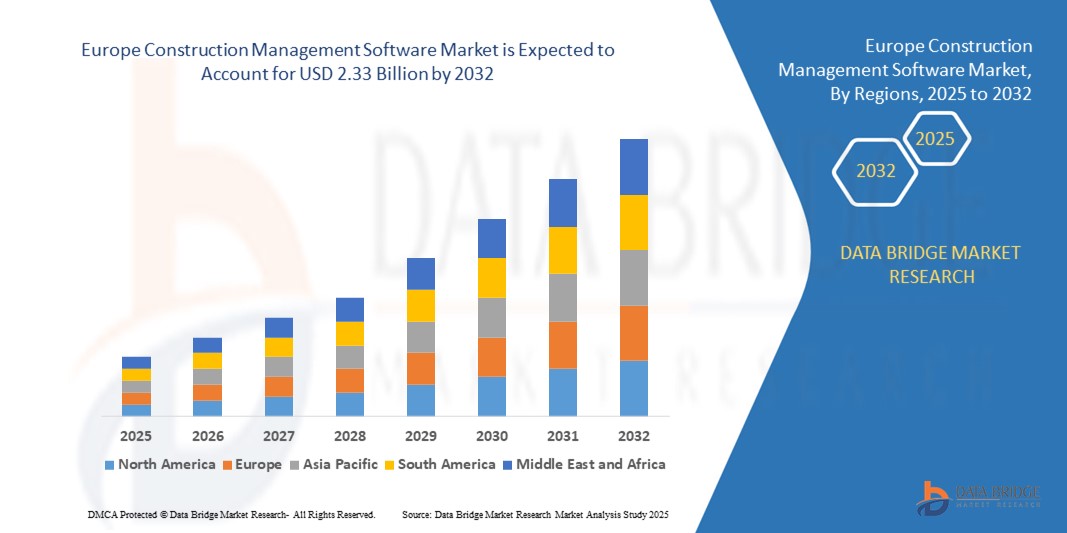

Europe Construction Management Software Market Size

- The Europe construction management software market size was valued at USD 1.34 billion in 2024 and is expected to reach USD 2.33 billion by 2032, at a CAGR of 7.10% during the forecast period

- The market growth is largely fuelled by the increasing adoption of digital technologies in construction workflows, rising demand for real-time project tracking and cost control, and the need for improved collaboration among stakeholders across construction projects

- The expansion of commercial and residential infrastructure projects, coupled with stringent building regulations and compliance requirements, is also driving the demand for construction management software across the region

Europe Construction Management Software Market Analysis

- Increasing adoption of digital construction solutions is driving demand for construction management software across Europe

- Building Information Modeling (BIM) integration and cloud-based project management tools are enhancing collaboration, project visibility, and operational efficiency

- Germany dominated the Europe construction management software market in 2024 and is expected to maintain its leadership throughout the forecast period, supported by its strong construction sector, advanced digital infrastructure, and early adoption of smart building technologies

- U.K. is expected to witness the highest compound annual growth rate (CAGR) in the Europe construction management software market due to rising investments in residential and commercial construction, a rapidly growing smart building ecosystem, and increasing demand for integrated software solutions that enhance project transparency and efficiency

- The cloud segment dominated the market with the largest revenue share in 2024, driven by growing demand for flexible and scalable solutions. Cloud-based construction software offers real-time data access, enhances team collaboration, and reduces upfront infrastructure costs, which is particularly attractive for contractors and project managers seeking operational efficiency. The segment continues to gain momentum due to the ease of system updates, improved security features, and integration with mobile platforms

Report Scope and Europe Construction Management Software Market Segmentation

|

Attributes |

Europe Construction Management Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Europe Construction Management Software Market Trends

Rise of Point-of-Care Testing in Livestock Diagnostics

- The growing shift toward point-of-care (POC) testing is transforming the livestock diagnostics landscape by enabling real-time, on-site disease detection. The portability and speed of these devices allow for immediate treatment decisions, especially in large farms where early isolation of infected animals is critical. This results in improved productivity and lower disease-related losses

- The high demand for rapid diagnostics in remote and under-resourced regions is accelerating the adoption of handheld test kits and mobile diagnostic platforms. These tools are particularly effective where veterinary lab access is limited, helping reduce diagnostic delays and ensuring timely interventions. The trend is further supported by governments and NGOs focusing on animal health in rural settings

- The affordability and ease of use of modern POC devices are making them attractive for routine herd screening, leading to improved disease surveillance. Farmers benefit from more frequent testing without incurring excessive costs or logistical hurdles, which ultimately improves overall herd health management

- For instance, in 2023, several dairy cooperatives across rural India reported a reduction in milk contamination rates after implementing on-farm mastitis testing kits developed by local biotechnology firms. These kits allowed early detection and treatment, improving milk quality and animal welfare while reducing treatment expenses

- While POC diagnostics are accelerating early detection and supporting biosecurity, their impact depends on continued innovation, user training, and affordability. Manufacturers must focus on localized product development and deployment strategies to fully capitalize on this growing demand

Europe Construction Management Software Market Dynamics

Driver

Growing Prevalence of Zoonotic Diseases and Rising Awareness Among Farmers

• The rise in zoonotic diseases is pushing both governments and livestock producers to prioritize diagnostics as a frontline defense. Diseases such as brucellosis, leptospirosis, and bovine tuberculosis have cross-species implications, prompting a strong focus on early identification and control. This has accelerated investment in veterinary diagnostics

• Farmers are increasingly aware of the financial risks associated with undiagnosed infections, including reduced productivity, increased mortality, and restricted access to export markets. This awareness has led to the regular use of diagnostic kits, even among small and mid-sized operators. The shift is supported by evolving consumer demands for safe animal-derived products

• Public sector efforts and international agencies have strengthened diagnostic infrastructure and surveillance protocols. From subsidized testing programs to nationwide disease control initiatives, supportive frameworks are helping farmers detect threats early and act decisively to prevent spread

• For instance, in 2022, the European Union implemented a mandatory testing protocol for select zoonotic diseases across commercial farms, boosting demand for rapid diagnostics and portable analyzers across the region

• While awareness and institutional support are driving the market, there is still a need to enhance last-mile connectivity, ensure diagnostic affordability, and integrate technology into routine livestock management practices to ensure sustained adoption

Restraint/Challenge

High Cost of Advanced Diagnostic Equipment and Limited Access in Rural Regions

• The high price point of advanced diagnostic equipment such as PCR analyzers and ELISA systems makes them inaccessible for smallholder farmers and underfunded veterinary centers. These systems are often reserved for large commercial operations or research institutes. Cost remains a major limiting factor for widespread usage

• In many rural areas, there is a lack of trained personnel capable of using or maintaining complex diagnostic tools. The absence of supporting infrastructure and logistical barriers further reduce access to timely and accurate testing. This leads to underreporting and delayed disease responses in high-risk zones

• Market penetration is also restricted by supply chain challenges in remote areas, where consistent availability of diagnostic kits and reagents is not guaranteed. These regions often rely on symptomatic treatment, which is less effective and can lead to increased animal mortality and productivity losses

• For instance, in 2023, livestock agencies in Sub-Saharan Africa revealed that over 70% of small-scale farmers had no access to formal diagnostic services, citing equipment cost and infrastructure gaps as the primary barriers

• While diagnostic technologies continue to evolve, solving cost and access challenges remains crucial. Market stakeholders must focus on decentralized solutions, mobile testing units, and scalable tools to bridge the rural diagnostic divide and unlock long-term market potential

Europe Construction Management Software Market Scope

The market is segmented on the basis of deployment, organization size, device type, pricing model, application, and vertical.

- By Deployment

On the basis of deployment, the Europe construction management software market is segmented into cloud and on-premise. The cloud segment dominated the market with the largest revenue share in 2024, driven by growing demand for flexible and scalable solutions. Cloud-based construction software offers real-time data access, enhances team collaboration, and reduces upfront infrastructure costs, which is particularly attractive for contractors and project managers seeking operational efficiency. The segment continues to gain momentum due to the ease of system updates, improved security features, and integration with mobile platforms.

The on-premise segment is expected to witness the fastest growth from 2025 to 2032, remains relevant among enterprises prioritizing greater control over data and legacy infrastructure compatibility, especially in regions or sectors with strict data compliance mandates.

- By Organization Size

On the basis of organization size, the Europe construction management software market is segmented into large enterprises and small and medium-sized enterprises (SMEs). The large enterprises segment held the largest market share in 2024 due to their extensive project portfolios, which demand sophisticated tools for budget control, scheduling, and resource allocation. These organizations often invest in comprehensive software platforms that integrate multiple functions for end-to-end project visibility.

The SMEs segment is expected to witness the fastest growth from 2025 to 2032, propelled by increasing awareness of digital tools and the availability of affordable cloud-based subscription models. These solutions help SMEs enhance productivity, reduce manual errors, and remain competitive in a highly fragmented construction market.

- By Device Type

On the basis of device type, the Europe construction management software market is segmented into smartphone and computer. The computer segment held the highest revenue share in 2024, as desktop-based software remains the preferred tool for detailed project design, reporting, and financial management among office-based professionals.

The smartphone segment is expected to witness the fastest growth from 2025 to 2032, driven by the growing use of mobile apps among on-site supervisors, engineers, and contractors. Mobile-accessible solutions support real-time updates, field data collection, and enhanced communication between teams, improving project timelines and decision-making.

- By Pricing Model

On the basis of pricing model, the Europe construction management software market is segmented into license based and subscription based. The subscription-based segment dominated the market in 2024, owing to its lower upfront costs, automatic updates, and flexible billing options that appeal to both SMEs and large contractors. The trend toward Software-as-a-Service (SaaS) is reshaping how construction firms access and use project management solutions.

The license-based segment is expected to witness the fastest growth from 2025 to 2032, demand from traditional firms that prefer one-time purchases and have internal IT capabilities to manage updates and security in-house, particularly for long-term infrastructure projects.

- By Application

On the basis of application, the Europe construction management software market is segmented into pre-construction, project management, financial management, resource management, customer relationship management, and others. The project management segment held the largest market share in 2024, driven by increasing demand for tools that support task scheduling, real-time collaboration, and milestone tracking across dispersed teams.

The financial management segment is expected to witness the fastest growth from 2025 to 2032, supported by rising awareness of cost control and compliance. Integration of budgeting tools, invoicing systems, and procurement modules within construction software is gaining traction to minimize financial risks and improve return on investment.

- By Vertical

On the basis of vertical, the Europe construction management software market is segmented into residential construction contractors, commercial construction contractors, landscaping contractors, construction managers, engineers, architects, and others. The commercial construction contractors segment led the market in 2024, supported by rising commercial infrastructure development and the need for integrated platforms to manage complex, multi-phase projects.

The residential construction contractors segment is expected to witness the fastest growth from 2025 to 2032, driven by increased housing demand and the rise of small-scale developers using digital tools for cost estimation, project planning, and customer engagement. Vertical-specific solutions are becoming essential to address the unique workflows and regulatory needs of each category.

Europe Construction Management Software Market Regional Analysis

- Germany dominated the Europe construction management software market in 2024 and is expected to maintain its leadership throughout the forecast period, supported by its strong construction sector, advanced digital infrastructure, and early adoption of smart building technologies

- The country’s focus on sustainability, strict compliance regulations, and large-scale infrastructure investments are driving the integration of digital solutions across both public and private construction projects

- Leading construction firms are increasingly leveraging cloud-based tools and Building Information Modeling (BIM) platforms to improve cost control and project timelines

- Government initiatives promoting energy-efficient construction and smart city development further fuel software adoption. However, small contractors may still face challenges related to high implementation costs and legacy system integration

U.K. Construction Management Software Market Insights

The U.K. is expected to witness the fastest growth from 2025 to 2032, driven by the rising adoption of homebuilding automation, modular construction practices, and post-Brexit infrastructure investments. A robust regulatory framework for digital compliance and increasing demand for real-time data access across project sites are accelerating digital transformation in the sector. The U.K.'s strong fintech and proptech ecosystem also supports innovation in construction technology, leading to wider deployment of cloud-based management tools. Increased investments in transport and housing, along with strong public-private partnerships, are expected to further strengthen market growth. Despite promising prospects, ongoing economic uncertainties and skills shortages may present short-term challenges for broader adoption.

Europe Construction Management Software Market Share

The Europe Construction Management Software industry is primarily led by well-established companies, including:

- Nemetschek Group (Germany)

- Bentley Systems, Incorporated (U.K.)

- Sage Group plc (U.K.)

- Trimble Inc. (Germany)

- RIB Software GmbH (Germany)

- Asite Solutions Limited (U.K.)

- PlanRadar GmbH (Austria)

- Thinkproject Deutschland GmbH (Germany)

- Bricsys NV (Belgium)

- Elecosoft plc (U.K.)

Latest Developments in Europe Construction Management Software Market

- In July 2023, Nemetschek Group announced a pre-seed investment in Stylib, aiming to simplify architectural product discovery across Europe. This move supports Nemetschek’s broader mission to drive digital transformation within the European construction and design sectors. By enhancing access to digital building materials and design tools, the investment strengthens its software ecosystem and positions the company as a key innovator in the European construction tech landscape

- In March 2023, Bentley Systems partnered with WSB to promote the adoption of infrastructure digital twins among civil infrastructure stakeholders. The collaboration introduced a digital construction management solution built on Bentley’s SYNCHRO platform, enhancing project visibility and efficiency. This is particularly impactful in Europe, where infrastructure modernization and smart city initiatives are creating demand for advanced project management technologies

- In May 2023, Sage completed the acquisition of Corecon, expanding its construction management capabilities beyond accounting software. While based in the United Kingdom, Sage now offers integrated cloud-based preconstruction and project management tools. This development enhances its competitiveness in the European construction software market and supports a more holistic approach to digital construction workflows across the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.